Professional Documents

Culture Documents

NCR Retail 4q15

Uploaded by

pandhi2000Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NCR Retail 4q15

Uploaded by

pandhi2000Copyright:

Available Formats

MARKETBEAT

Retail Snapshot Q4 2015

DELHI-NCR, INDIA

Economy

ECONOMIC INDICATORS

National

2014

2015

2016F

GDP Growth

6.9%

7.3%

7.5%

CPI Growth

6.7%

6.0%

5.9%

Private Final Expenditure Growth

6.2%

6.3%

7.0%

Govt. Final Expenditure Growth

8.2%

6.6%

7.9%

Source: CSO, RBI, Oxford Economics

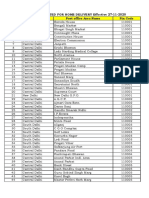

PRIME RETAIL RENTS DECEMBER 2015

Main Streets

INR

SF/MTH

EURO

SF/YR

US$

SF/YR

Q-O-Q

Change

Y-O-Y

Change

India's GDP growth for the second quarter of FY2015-16 was

recorded at 7.4%, as compared to 7.0% in the April-June 2015

quarter on the back of higher manufacturing output.

Manufacturing sector grew by 9.3% during the July-September

quarter, against 7.25% that was recorded in the April-June

quarter. India's retail inflation accelerated to a 14-month high in

November to 5.4%, from 5.0% in the preceding month. This was

driven by food inflation that rose to 6.07% in November from

5.25% in the preceding month. The government, in November,

relaxed foreign direct investment (FDI) norms of construction

development by removing two major conditions related to

minimum built up area and capital requirement.

1,250

208

227

0.0%

0.0%

Market Overview

South Extension I

& II

750

125

136

0.0%

0.0%

Lajpat Nagar

225

37

41

0.0%

0.0%

Connaught Place

850

142

154

0.0%

6.3%

Greater Kailash I,

M Block

550

92

100

0.0%

0.0%

Rajouri Garden

200

33

36

0.0%

0.0%

Punjabi Bagh

200

33

36

0.0%

0.0%

Karol Bagh

375

62

68

0.0%

0.0%

Kamla Nagar

400

67

73

0.0%

0.0%

Dwarka

425

71

77

0.0%

0.0%

Vikas Marg

200

33

36

0.0%

0.0%

750

125

136

0.0%

7.1%

190

32

35

0.0%

0.0%

225

37

41

0.0%

0.0%

INR

SF/MTH

EURO

SF/YR

US$

SF/YR

Q-O-Q

Change

Y-O-Y

Change

South Delhi

500

83

91

0.0%

0.0%

West Delhi

325

54

59

0.0%

0.0%

Gurgaon

375

62

68

0.0%

0.0%

Noida

380

63

69

0.0%

0.0%

Greater Noida

125

21

23

0.0%

0.0%

Ghaziabad

200

33

36

0.0%

0.0%

Deferred mall supply; marginal increase in mall vacancy

levels. Delhi-NCR witnessed no new mall supply due to

deferment of malls to the beginning of next year. Overall mall

vacancy levels increased marginally compared to the previous

quarter primarily due to exit by retailers in malls in West and

North Delhi submarkets.

Mall rentals remain stable across submarkets in the city.

During the fourth quarter of 2015, mall rentals remained stable in

most malls with stable demand. Brands from the food and

beverage (F&B) and lifestyle segment such as Wendys, Central,

Aeropostale and H&M took up mall space during the quarter.

Rentals in main street locations maintain status quo. The

main street locations also witnessed rental maintaining status

quo during the quarter as both retailers and landlords exhibited

sensitivity to any rental change. Demand for space in main street

locations during the quarter was mainly from apparel and food

and beverage (F&B) segment. Main street locations in South

Delhi, namely Greater Kailash, South Extension, Defence Colony

and Lajpat Nagar witnessed take-up primarily from the apparel

sector. Few brands that took up space in main street locations of

South Delhi include Flying Machine, US Polo Assn., Anju Modi

and Vibe to name a few. Prominent main street locations of

Central Delhi, Khan Market and Connaught Place attracted

brands from the F&B along with apparel segment with brands

such as Caf Coffee Day, Summer House Caf, Begin Human

and AM:PM opening stores. Kamla Nagar in North Delhi

witnessed demand from apparel and F&B segment with brands

including Pepe Jeans and Chocolate Room taking up space.

Khan Market

DLF Galleria

(Gurgaon)

Sector 29

(Gurgaon)

Sector 18 (Noida)

Malls

Note: Asking rent (INR/sf/month) on carpet area of ground floor Vanilla stores is quoted

Conversion Rate: US$1= INR 66.05 and Euro 1 = INR 72.05

*Newly Added in 2015

www.cushmanwakefield.com

MARKETBEAT

Retail Snapshot Q4 2015

DELHI-NCR, INDIA

Outlook

SIGNIFICANT LEASING TRANSACTIONS

Property

Location

Tenant

Square Feet

Select City Walk

South Delhi

Aeropostale

2,500

Standalone

Connaught Place

Summer House Caf

2,200

SIGNIFICANT PROJECT UNDER CONSTRUCTION

Completion

Date

Property

Location

Square Feet

Mall of India

Noida

1,900,000

Q1 2016

Reliance Mall

West Delhi

500,000

Q1 2016

Significant new mall supply expected in the next quarter.

Several malls, aggregating 3.3 million square feet, are scheduled

to commence operations from the next quarter. Most of these

malls have witnessed healthy retailers interest and are expected

to begin operations with healthy occupancy levels.

Rentals expected to remain stable across submarkets. With

stable demand, rentals across submarkets is expected to

maintain status quo during the next quarter in both malls and

main street locations.

About Cushman & Wakefield

Cushman & Wakefield is a global leader in commercial real estate services, helping clients transform the way

people work, shop, and live. The firms 43,000 employees in more than 60 countries provide deep local and

global insights that create significant value for occupiers and investors around the world. Cushman & Wakefield

is among the largest commercial real estate services firms in the world with revenues of $5 billion across core

services of agency leasing, asset services, capital markets, facilities services (branded C&W Services), global

occupier services, investment management (branded DTZ Investors), tenant representation and valuations &

advisory. To learn more, visit www.cushmanwakefield.com or follow @Cushwake on Twitter.

Copyright 2016 Cushman & Wakefield. All rights reserved. The information contained within this report is gathered from multiple sources considered

to be reliable. The information may contain errors or omissions and is presented without any warranty or representations as to its accuracy.

Somy Thomas

Managing Director

Valuation & Advisory Services, India

Tel: +91 80 40465555

somy.thomas@ap.cushwake.com

www.cushmanwakefield.com

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Builders in Delhi: Address-1Document13 pagesBuilders in Delhi: Address-1Dadheech VikasNo ratings yet

- Brokers List As On 23-10-2020Document60 pagesBrokers List As On 23-10-2020Green Valley100% (2)

- DASMESH, DMB Meters and KONARAK- KBM G+ Ultra-G Meters Suppliers ListDocument8 pagesDASMESH, DMB Meters and KONARAK- KBM G+ Ultra-G Meters Suppliers Listvikas yadavNo ratings yet

- MR Diwali GiftDocument10 pagesMR Diwali Giftjennifer271No ratings yet

- Delhi Property Dealers, Real Estate Agents in Delhi: Home Buy Delhi Properties Delhi Rent Delhi ArchitectsDocument16 pagesDelhi Property Dealers, Real Estate Agents in Delhi: Home Buy Delhi Properties Delhi Rent Delhi ArchitectsSameen Ayesha50% (2)

- Sample To SoniDocument5 pagesSample To SoniShakya DeepakNo ratings yet

- RainbowDocument22 pagesRainbowVikrant ChauhanNo ratings yet

- Network Hospital List MaxDocument546 pagesNetwork Hospital List MaxDeepak GuptaNo ratings yet

- Policy 9bDocument4 pagesPolicy 9bpandhi2000No ratings yet

- Policy9 PDFDocument1 pagePolicy9 PDFpandhi2000No ratings yet

- Headquarters, Faridabad Planning & Coordination UnitDocument3 pagesHeadquarters, Faridabad Planning & Coordination Unitpandhi2000No ratings yet

- Sector 31Document3 pagesSector 31pandhi2000No ratings yet

- McDonalds Opens Its First Gold Standard Drive-Thru Restaurant in Nadiad (Company Update)Document3 pagesMcDonalds Opens Its First Gold Standard Drive-Thru Restaurant in Nadiad (Company Update)Shyam SunderNo ratings yet

- Tender NoticeDocument1 pageTender Noticepandhi2000No ratings yet

- RKVY (Zero Till Drill) : List of Beneficiaries Under Agri Mechanisation Schemes DISTT. FARIDABAD (2013-14)Document11 pagesRKVY (Zero Till Drill) : List of Beneficiaries Under Agri Mechanisation Schemes DISTT. FARIDABAD (2013-14)pandhi2000No ratings yet

- Press Release Feb2014Document2 pagesPress Release Feb2014pandhi2000No ratings yet

- Press Release Feb2014Document2 pagesPress Release Feb2014pandhi2000No ratings yet

- Day 1 1. Hindi Declamation Iii-VDocument6 pagesDay 1 1. Hindi Declamation Iii-Vpandhi2000No ratings yet

- UploadtenderDocument3 pagesUploadtenderpandhi2000No ratings yet

- Joint Pastoral Lette6Document5 pagesJoint Pastoral Lette6pandhi2000No ratings yet

- Raj Rashmi Darshna - My Smart FaridabadDocument1 pageRaj Rashmi Darshna - My Smart Faridabadpandhi2000No ratings yet

- Online Bids Are Hereby Invited On Behalf of Commissioner MCF For The Work Mentioned BelowDocument2 pagesOnline Bids Are Hereby Invited On Behalf of Commissioner MCF For The Work Mentioned Belowpandhi2000No ratings yet

- RYAN INTERNATIONAL SCHOOL MOCK TEST SYLLABUSDocument3 pagesRYAN INTERNATIONAL SCHOOL MOCK TEST SYLLABUSpandhi2000No ratings yet

- 1Document1 page1pandhi2000No ratings yet

- Ryan International School, Faridabad Mock Test Syllabus Class Ix EnglishDocument3 pagesRyan International School, Faridabad Mock Test Syllabus Class Ix Englishpandhi2000No ratings yet

- Banks On StrikeDocument1 pageBanks On Strikepandhi2000No ratings yet

- OSK DMG - Market Outlook For The YearDocument87 pagesOSK DMG - Market Outlook For The YearChan Weng HongNo ratings yet

- Ansal Royal Heritage 2 BHKDocument1 pageAnsal Royal Heritage 2 BHKpandhi2000No ratings yet

- Icop WorldDocument2 pagesIcop Worldpandhi2000No ratings yet

- Costing HingeDocument1 pageCosting Hingepandhi2000No ratings yet

- HSI Report PDFDocument4 pagesHSI Report PDFpandhi2000No ratings yet

- Art1 242Document83 pagesArt1 242pandhi2000No ratings yet

- Beauty ListingsDocument79 pagesBeauty Listingspandhi2000No ratings yet

- This If Google TipsDocument2 pagesThis If Google TipstwmailinatorNo ratings yet

- Manual 16 1Document14 pagesManual 16 1pandhi2000No ratings yet

- Banks On StrikeDocument1 pageBanks On Strikepandhi2000No ratings yet

- Holiday Homework M-II (Final)Document10 pagesHoliday Homework M-II (Final)pandhi2000No ratings yet

- TIFR Question PaperDocument14 pagesTIFR Question PaperAbhrajit MahapatraNo ratings yet

- Buy farm land to improve air qualityDocument1 pageBuy farm land to improve air qualitysandeeparora007.com6204No ratings yet

- Directories ListDocument34 pagesDirectories Listnearmeplus comNo ratings yet

- Jest Physics 2018 Paper PDFDocument9 pagesJest Physics 2018 Paper PDFSatyaki ChowdhuryNo ratings yet

- S.No. Zone Post Office Area Name Pin Code Pin Codes Activated For Home Delivery Effective 27-11-2020Document12 pagesS.No. Zone Post Office Area Name Pin Code Pin Codes Activated For Home Delivery Effective 27-11-2020abhinav007_007100% (1)

- LISTDocument12 pagesLISTSabhanathan SadasivamNo ratings yet

- Delhi Security ServicesDocument63 pagesDelhi Security ServicesSandiip SrivastavNo ratings yet

- Offline Doubt Clearing Classes Schedule South Delhi (Panini) (Venue: DCC Floor, New Admission Building, Kalu Sarai)Document14 pagesOffline Doubt Clearing Classes Schedule South Delhi (Panini) (Venue: DCC Floor, New Admission Building, Kalu Sarai)SakshiNo ratings yet

- Reaching college was never so easy thanks to Delhi MetroDocument3 pagesReaching college was never so easy thanks to Delhi MetroChetan PrakashNo ratings yet

- Csir-Ugc-Net/Jrf - Gate - Physics: Unit Test-3Document4 pagesCsir-Ugc-Net/Jrf - Gate - Physics: Unit Test-3Abhrajit MahapatraNo ratings yet

- Marketonline - in Online Market Yellow Pages in South Delhi, Excel Media Services 5Document2 pagesMarketonline - in Online Market Yellow Pages in South Delhi, Excel Media Services 5kamini0% (1)

- DelhiNCR PDFDocument27 pagesDelhiNCR PDFBassam QureshiNo ratings yet

- Development of Urban Villages in Delhi - 2013Document144 pagesDevelopment of Urban Villages in Delhi - 2013piinkaNo ratings yet

- SEO-Optimized Title for Property Dealer DocumentDocument2 pagesSEO-Optimized Title for Property Dealer DocumentkaminiNo ratings yet

- Home TuitionDocument5 pagesHome TuitionswastiktutorsNo ratings yet

- Branch Master January 2022 OutDocument642 pagesBranch Master January 2022 OutArt PlatformNo ratings yet

- Iit Jam Physics Test Series 3Document12 pagesIit Jam Physics Test Series 3shreya debnathNo ratings yet

- Unique Hospital Id Master Ver.2.0 (20.11.2014)Document454 pagesUnique Hospital Id Master Ver.2.0 (20.11.2014)mydearbhava1No ratings yet

- HCU Chemistry 2011-2017 - Career EndeavourDocument78 pagesHCU Chemistry 2011-2017 - Career EndeavourSankar AdhikariNo ratings yet

- Top Delhi Schools by DistrictDocument6 pagesTop Delhi Schools by DistrictNTI AcademyNo ratings yet

- BrochureDocument2 pagesBrochureShreyas MehtaNo ratings yet

- Hyderabad Central University (Hcu) M.Sc. Physics Entrance - 2015Document12 pagesHyderabad Central University (Hcu) M.Sc. Physics Entrance - 2015Aaloka GautamaNo ratings yet