Professional Documents

Culture Documents

Company Law Memo Shashwat Jindal

Uploaded by

Anonymous DCifRxuiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Law Memo Shashwat Jindal

Uploaded by

Anonymous DCifRxuiCopyright:

Available Formats

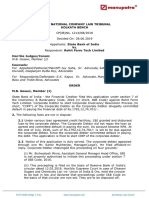

Company Law Memo

Shashwat Jindal

!

!

Memo Problem:!

!

Arvind, Yogi and Manish set up a company called Aap-Apps Private Limited (Company) on

May 15, 2014, with the object of developing mobile applications, for third parties. Arvind is a

graphic designer and Yogi is a computer programmer, and they have been friends from their

years together in school. Over one of their many casual conversations, they struck upon the

idea of setting up a company that would create mobile applications for businesses; and not long

after that conversation, they quit their respective jobs and decided to start their business.

However, they realized that they would not be able to pool together sufficient resources; and

therefore, invited their third friend, Manish, an investment manager, to also join their business.

Manish agreed, and accordingly, the Company was set up. Each of them invested INR

10,00,000, which was divided into 1,00,000 equity shares of INR 10 each. Arvind, Yogi and

Manish appointed themselves as directors on the board of the Company.!

They worked hard to draw clients and the Company was in early 2015, awarded a contract to

develop a mobile application for ICICI Bank. Its clientele grew increasingly impressive from

there and soon, it was drawing more work than they could handle. They realized that the

Company needed to hire more people, which in turn, meant that it would need a bigger space

for its Mumbai office. They also, then discussed the possibility of opening an office in Bangalore,

which is where a lot of their clients were based. Expansion of this scale however, needed

additional funds; and so, Manish proposed that each of them invest an additional INR

20,00,000, to which Arvind immediately agreed. Yogi however, rejected the suggestion because

he did not think he would be able to afford such a huge sum. He suggested instead, that they

seek an institutional investor willing to invest a sum of INR 60,00,000. Arvind and Manish

however, were concerned that it would lead to a dilution in their control over the management of

the Company and were of the opinion that at least for the moment, they should desist from

inviting an institutional investor on board. Thus, despite Yogis objections, Arvind and Manish

passed a board resolution for a rights issue of INR 60,00,000. The resolution authorized Manish

to, on behalf of the Company, send a notice to each of the three shareholders offering each of

them 2,00,000 shares of INR 10, and giving them a time period of 20 days from the date of

receiving the offer, to accept it. Not unexpectedly, Yogi could not accept the offer within this

period, despite his many efforts to arrange the necessary funds to exercise his option to

purchase the shares offered. The Articles of Association of the Company did not permit the

shareholders to renounce their right under Section 62(1)(a) of the Companies Act, 2013 in

favour of another person; and accordingly, it fell upon the Board to decide how to dispose the

additional 2,00,000 shares. !

Arvind and Manish, at the next meeting of the Board, decided on a preferential allotment of the

remaining shares and a resolution was passed that authorized Manish to identify suitable

persons to whom these shares may be issued. This time around, Arvind and Manish were less

concerned, about introducing new members in the Company, because at the end of the

allotment, they would hold more than 66 percent of the shares of the Company, and the shares

that would be allotted to the new member(s) would carry only around 22 percent of the total

voting rights. At the same time, however, Manish was aware that the sum involved was too

small to draw an institutional investor; and therefore, decided to offer these shares to people

among his family and friends. !

Manish then, called some of their friends enquiring whether they would be interested in

investing in the Company. After making around 15 unsuccessful such calls, Manish put up a

status message on Facebook saying, Hoping to expand our office in Mumbai, and set up a new

BALLB 2013

Section D

Company Law Memo

Shashwat Jindal

one in Bangalore; that is, assuming we manage to put together the necessary funds. So, if you

have some loose change lying around the house, send it our way! On a more serious note, if

you (or someone you know) is interested in investing a small sum in our Company, let me know

and Ill be in touch. The post also carried a link to the website of the Company. Of his nearly

500 friends on Facebook, only around 10 responded, and eventually, the Board allotted 20,000

shares of INR 10 to each of these 10 friends of Manish.!

Meanwhile, Yogi was naturally furious at having been reduced to a mere 11% in the Company.

He also thinks that the allotment to Manishs friends compromises on the need to maintain

confidentiality regarding their business. He approaches you and seeks your advice on whether

the allotment to Manishs friends is invalid for being contrary to his and the Companys interest.

He also, wishes to know whether there is ground to argue that the allotment of shares to

Manishs friends was contrary to Section 42 of the Companies Act, 2013 (and Rule 14 of the

Companies (Prospectus and Allotment of Securities) Rules, 2014). !

!

!

!

Facts:!

!

In the present case, the petitioner, Yogi and the respondents, Arvind and Manish, set up a

Private Limited Company, which created mobile based applications for mobile phones. As the

business was growing, they decided that the company needed more funds, so that they could

expand both their present office and open new offices. Contrary to the appellants previous

suggestion to get an institutional investor to invest an additional Rs. 60,00,000, it was decided

through a board resolution that each one of the owners would invest an additional Rs. 20,00,000

each into the company. The appellant was unable to arrange the said amount and thus it was

decided by the board that shares would be allotted through preferential allotment. As they could

not find any suitable investors, Manish finally put up a status on Facebook, which could be

viewed by his 500 friends on Facebook, to invest in the company, it also had a link to the

website of the Company. Out of the 500 friends, only 10 responded, who invested money into

the company. !

!

Issue:!

!

Whether the board was authorized to pass a resolution as to how the shares were to be allotted.!

!

Whether a Private Limited Company, the investment made by the 10 persons is valid on

account of the company being a Private Limited Company. !

!

!

Analysis:!

!

According to Section 107 of the Companies Act, decisions of the Company are to be taken

through voting, which is usually a raise of hands, where the decision of the majority is taken into

consideration. Thus, in this Company of 3 people, the respondents could have taken the

decision to not go for institutional investor. !

According to Section 62(1)(a), the shareholders, i.e. in this case, the appellants and the two

respondents, were given time period of 20 days to accept the offer, which fulfilled the condition

of minimum of 15 days to be given to equity holders in the company, after which the choice of

BALLB 2013

Section D

Company Law Memo

Shashwat Jindal

how the shares are to be disposed off is given to the board (Section 62(1)(c)), thus giving the

board the right to dispose the shares as per their wishes. Also, Section 62 of the Act, which

gives a Pre-emptive right to existing shareholders, was not violated in this case, as an offer had

been made to the appellant.!

According to section 42 of the companies Act, in the case of private placement, not more than

50 people can in one issue be invited to subscribe to the shares of the company through private

placement. Section 2(68)(iii) of the Companies Act 2013, says that a Private Limited Company,

is prohibited from inviting general public to subscribe to the shares of the Company. The only

way for a Private Limited Company to raise share capital is through private placement.

According to the case of Sahara India Real Estate Corporation Limited (SIRECL) vs SEBI, the

learned Supreme Court was of the opinion that as the offer to invest in the company was to

more than 50 persons. In the present case, Manish had made an offer to the 500 people on his

Facebook, to invest in the company, the offer had been made to more than 50 persons, thus

violating the basic principal that a Private Limited Company cannot make a public offer, thus

invalidating the purchase of shares by the ten friends of Manish. !

!

Conclusion:!

!

Thus, it may be concluded that, though the Board of Directors, had the right to allot the

remaining 200000 shares as per their desire, but the method, which was followed by them, was

not right as they had made a Public offer, even though they were a Private Limited Company.

BALLB 2013

Section D

You might also like

- Sahara Failure AnalysisDocument5 pagesSahara Failure Analysisparamvirsingh0802No ratings yet

- Swing Trading ChecklistDocument1 pageSwing Trading ChecklistSanat Mishra50% (2)

- Cir Vs Ca DigestDocument1 pageCir Vs Ca Digestaj salazarNo ratings yet

- Equity Investor HotelsDocument12 pagesEquity Investor HotelsAbhijeet NagraleNo ratings yet

- Tradersworld 63Document161 pagesTradersworld 63anudora100% (1)

- Constitutional & Administrative Law in PakistanDocument24 pagesConstitutional & Administrative Law in PakistanAnonymous DCifRxui100% (4)

- How To Be An Angel InvestorDocument9 pagesHow To Be An Angel Investorcarlyblack2006No ratings yet

- Chapter 8Document30 pagesChapter 8Kad SaadNo ratings yet

- Auditing and Financial ManagementDocument281 pagesAuditing and Financial Managementprashu.darshanam8073100% (2)

- LIC V Escorts PDFDocument6 pagesLIC V Escorts PDFTC003 respondent speaker 02100% (5)

- How To Invest - Raamdeo AgrawalDocument31 pagesHow To Invest - Raamdeo AgrawalAshwinNo ratings yet

- How Quality Growth, Vision and Patience Can Lead to 100x ReturnsDocument6 pagesHow Quality Growth, Vision and Patience Can Lead to 100x Returnsdyadav00No ratings yet

- Chapter 1 Introduction: Risk & ReturnDocument32 pagesChapter 1 Introduction: Risk & ReturnMaridasrajanNo ratings yet

- Mini CaseDocument15 pagesMini CaseSammir Malhotra0% (1)

- Order Against M/s Sai Praksah Properties Development Ltd. and Its Directors/promotersDocument22 pagesOrder Against M/s Sai Praksah Properties Development Ltd. and Its Directors/promotersShyam SunderNo ratings yet

- Blaw CA Notes Test QP With SolutionDocument56 pagesBlaw CA Notes Test QP With SolutionMuhammad WaseemNo ratings yet

- Company LawDocument8 pagesCompany LawAnkur GoyatNo ratings yet

- Banks Liable as Trustees for Refunding Investor FundsDocument3 pagesBanks Liable as Trustees for Refunding Investor FundsNaveen SehrawatNo ratings yet

- WTM/SR/CIS/WRO-ILO/ 45 / 03/2015: Page 1 of 16Document16 pagesWTM/SR/CIS/WRO-ILO/ 45 / 03/2015: Page 1 of 16Shyam SunderNo ratings yet

- 11 BST CH-2 Forms of B.O.Document3 pages11 BST CH-2 Forms of B.O.Saurabh JainNo ratings yet

- Kushi PlaintiffDocument20 pagesKushi PlaintiffJatin TundwalNo ratings yet

- Allotted To: 16043-16046 16048 - 16051 16054 - 16059 16070 - 16073 16081-16082Document2 pagesAllotted To: 16043-16046 16048 - 16051 16054 - 16059 16070 - 16073 16081-16082NavneetNo ratings yet

- Law 580 Written AssignmentDocument15 pagesLaw 580 Written AssignmentSiti Nazatul MurnirahNo ratings yet

- CLDP - Moot Court Case - Soft SolutionsDocument7 pagesCLDP - Moot Court Case - Soft SolutionsBhavik M. VakilNo ratings yet

- g11 SLW CH 2 Forms of Business OrgDocument5 pagesg11 SLW CH 2 Forms of Business OrgShreya KhannaNo ratings yet

- Law346 Group 3Document6 pagesLaw346 Group 3TENGKU ARISSA MAISARAH TENGKU ROSLANNo ratings yet

- Company LawDocument3 pagesCompany LawshivamNo ratings yet

- Case Laws On Company LawDocument5 pagesCase Laws On Company LawPriyanka Dargad0% (1)

- Freshers - Pool Problem 2017.Document3 pagesFreshers - Pool Problem 2017.Mranal MeshramNo ratings yet

- Regulations Governing Nidhi CompaniesDocument13 pagesRegulations Governing Nidhi CompaniesYASHI JAINNo ratings yet

- Paying Bribes SDocument3 pagesPaying Bribes SDorka DormatterinNo ratings yet

- JS Hospitality Services Private LTD - Drafted by SupantaDocument37 pagesJS Hospitality Services Private LTD - Drafted by SupantaPavlov Kumar HandiqueNo ratings yet

- Servcie Agreement 08th Sept PrabhuDocument4 pagesServcie Agreement 08th Sept PrabhuPrabhudatta BhuyanNo ratings yet

- CH 10 Financial Market WsDocument3 pagesCH 10 Financial Market WsqwswhdwindiqwNo ratings yet

- Partnership Letter - BCCLDocument3 pagesPartnership Letter - BCCLpalash ajmeraNo ratings yet

- Auditing RTP of IcaiDocument14 pagesAuditing RTP of IcaitpsbtpsbtpsbNo ratings yet

- UMCS Winter Edition Moot PropositionDocument5 pagesUMCS Winter Edition Moot PropositionRishi SehgalNo ratings yet

- Whether This HonDocument6 pagesWhether This Hongaurav_11No ratings yet

- Law T1Document7 pagesLaw T1Badhrinath ShanmugamNo ratings yet

- Company Law test: Share Capital, Charges, Deposits, Debentures and MembershipDocument26 pagesCompany Law test: Share Capital, Charges, Deposits, Debentures and MembershipShrikant RathodNo ratings yet

- Order in The Matter of Rhine and Raavi Credits and Holding LTDDocument16 pagesOrder in The Matter of Rhine and Raavi Credits and Holding LTDShyam SunderNo ratings yet

- Order in The Matter of ICore E-Services Limited and Its DirectorsDocument11 pagesOrder in The Matter of ICore E-Services Limited and Its DirectorsShyam SunderNo ratings yet

- Tutorial QN LAWS 3320 OCT 22Document5 pagesTutorial QN LAWS 3320 OCT 22Nur AthirahNo ratings yet

- A Project Report ON: Submitted in Partial Fulfillment of The Requirement of Bachelor of BusinessDocument87 pagesA Project Report ON: Submitted in Partial Fulfillment of The Requirement of Bachelor of BusinessAnonymous l5X3VhTNo ratings yet

- SARFAESI Rulings: Prachi Narayan 7 January, 2014Document5 pagesSARFAESI Rulings: Prachi Narayan 7 January, 2014AASHISH GUPTANo ratings yet

- Moot CurtDocument14 pagesMoot Curtलक्ष्य दिवान50% (4)

- Applicability of Consumer Protection Act On Capital Markets in Comparison With Sebi ScoresDocument9 pagesApplicability of Consumer Protection Act On Capital Markets in Comparison With Sebi ScoresAmisha PrakashNo ratings yet

- First Test On Law 5 TopisDocument15 pagesFirst Test On Law 5 TopisShrikant RathodNo ratings yet

- Borrowing Powers of A CompanyDocument2 pagesBorrowing Powers of A CompanyVikash BhattNo ratings yet

- Chapter2 XI AssignmentDocument6 pagesChapter2 XI AssignmentSadhika MathurNo ratings yet

- Bank LoanDocument86 pagesBank LoanDeepak ParwaniNo ratings yet

- Co, Law Case StudiesDocument1 pageCo, Law Case StudiesjaiprakashNo ratings yet

- Amway India Enterprises challenges applicability of Prize Chits ActDocument22 pagesAmway India Enterprises challenges applicability of Prize Chits ActGurupreet AnandNo ratings yet

- Company Law MemoDocument4 pagesCompany Law MemovickydancefloorstudioNo ratings yet

- RTP - CAP - III - Gr-I - Dec - 2022 (2) - 82-105Document24 pagesRTP - CAP - III - Gr-I - Dec - 2022 (2) - 82-105Mahesh PokharelNo ratings yet

- Court Seeks Data Extraction from Devices in MLM Fraud CaseDocument11 pagesCourt Seeks Data Extraction from Devices in MLM Fraud Casefile 1No ratings yet

- Crowdfunding in IndiaDocument6 pagesCrowdfunding in IndiaDipak RanaNo ratings yet

- Juggi - Lal - Kamlapat - Vs - Commissioner - of - Income - Tax - Us680091COM759050Document7 pagesJuggi - Lal - Kamlapat - Vs - Commissioner - of - Income - Tax - Us680091COM759050Abid CoolNo ratings yet

- NDTV Narayan RaoDocument3 pagesNDTV Narayan RaoMoneylife FoundationNo ratings yet

- Devopriya Basu 046 Fiba204 AssignmentDocument11 pagesDevopriya Basu 046 Fiba204 Assignmentbasudevopriya6No ratings yet

- Fraudulent Practices To Finance Family Business in India: A Case Study of Nirav ModiDocument5 pagesFraudulent Practices To Finance Family Business in India: A Case Study of Nirav ModiakshitNo ratings yet

- p3 m2 Different Types of BorrowersDocument4 pagesp3 m2 Different Types of BorrowersMadhavKishore100% (1)

- Siddheswar Co-Operative Bank LTD, BijapurDocument63 pagesSiddheswar Co-Operative Bank LTD, Bijapurarunsavukar100% (2)

- Title: Sahara V/s Sebi Case Analysis: Facts of The CaseDocument5 pagesTitle: Sahara V/s Sebi Case Analysis: Facts of The CaseSpotify tkadNo ratings yet

- NCLT Rejects SBI's Insolvency Application Against Rohit Ferro TechDocument4 pagesNCLT Rejects SBI's Insolvency Application Against Rohit Ferro TechJinu JoseNo ratings yet

- Joint Stock CompanyDocument7 pagesJoint Stock Company198W1A0594-SEC-B LANKE SUMANTH VARMANo ratings yet

- Executive Summary: Project On: Main PointsDocument11 pagesExecutive Summary: Project On: Main PointsMuhammad AfnanNo ratings yet

- Top 100 EFQsDocument13 pagesTop 100 EFQsMudit JainNo ratings yet

- Shareholders MeetingsDocument13 pagesShareholders Meetingspushkal sethiNo ratings yet

- Before The National Company Law Tribunal Mumbai Bench: Per: M. K. Shrawat, Member (J)Document11 pagesBefore The National Company Law Tribunal Mumbai Bench: Per: M. K. Shrawat, Member (J)ajsdkhkljhkjNo ratings yet

- Comparing SBI and HDFC Car Loan SchemesDocument4 pagesComparing SBI and HDFC Car Loan SchemesParasVashishtNo ratings yet

- BPA Report Proforma 2015Document3 pagesBPA Report Proforma 2015Anonymous DCifRxuiNo ratings yet

- Question: Critical Analysis of NJACDocument5 pagesQuestion: Critical Analysis of NJACAnonymous DCifRxuiNo ratings yet

- Comparison Between Administrative Law and Constitutional Law! Abstract!Document3 pagesComparison Between Administrative Law and Constitutional Law! Abstract!Anonymous DCifRxuiNo ratings yet

- BALLB 2013 Shashwat JindalDocument3 pagesBALLB 2013 Shashwat JindalAnonymous DCifRxuiNo ratings yet

- Analysis of Balance Sheet & Working Capital of Hindustan Zinc LimitedDocument67 pagesAnalysis of Balance Sheet & Working Capital of Hindustan Zinc Limitednimbarknimawat100% (1)

- Finance&Accounting Uniseminar112Document354 pagesFinance&Accounting Uniseminar112JohnChiticNo ratings yet

- Deutsche Bank - Sipchem Sukuk Offering CircularDocument209 pagesDeutsche Bank - Sipchem Sukuk Offering CircularcheejustinNo ratings yet

- PPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996Document46 pagesPPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996José Carlos GBNo ratings yet

- Exam40610 Samplemidterm AnswersDocument8 pagesExam40610 Samplemidterm AnswersPRANAV BANSALNo ratings yet

- Circle Advertising Internship ReportDocument35 pagesCircle Advertising Internship ReportTaimoor Ul HassanNo ratings yet

- Book BuildingDocument7 pagesBook BuildingshivathilakNo ratings yet

- Oil Contracts & Production Sharing Agreements ExplainedDocument27 pagesOil Contracts & Production Sharing Agreements ExplainedfrelonfrelonNo ratings yet

- KMV ModelDocument5 pagesKMV ModelVijay BehraNo ratings yet

- B&H CH 3 SolutinsDocument26 pagesB&H CH 3 SolutinsCharmaine de GuzmanNo ratings yet

- Foreign Ownership: Strengths & WeaknessesDocument23 pagesForeign Ownership: Strengths & Weaknessesclama2000No ratings yet

- Acca Paper F3 Financial Accounting Mock Exam Prepared By: MR Yeo Hong AnnDocument23 pagesAcca Paper F3 Financial Accounting Mock Exam Prepared By: MR Yeo Hong AnnRajeshwar Nagaisar50% (2)

- Annexure 2Document13 pagesAnnexure 2Shalini SrivastavNo ratings yet

- Cost of Capital of ITCDocument24 pagesCost of Capital of ITCMadhusudan PartaniNo ratings yet

- DavyDocument8 pagesDavyAhmedRiaz64No ratings yet

- Lountzis Asset Management Annual Letter 2013Document31 pagesLountzis Asset Management Annual Letter 2013CanadianValue100% (1)

- Portfolio Risk and Return: Part I: Presenter Venue DateDocument35 pagesPortfolio Risk and Return: Part I: Presenter Venue DateahmedNo ratings yet

- HedgingDocument15 pagesHedgingAnupam G. RatheeNo ratings yet

- CH 07 ShowDocument37 pagesCH 07 ShowMarselinus Aditya Hartanto TjungadiNo ratings yet