Professional Documents

Culture Documents

A STUDY ON CUSTOMER New

Uploaded by

Martin MathewOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A STUDY ON CUSTOMER New

Uploaded by

Martin MathewCopyright:

Available Formats

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS

CASH DEPOSITING MACHINE IN KOLLAM

Abstract:This paper shows a study on customers attitude and usage in using cash deposit

machines at Kollam Disrrict. Banking sector plays an active role in the economic development of

a country. The new technologies help the banks to reduce the work load. The green channel

counters help the customers to have convenient and comfortable banking transactions The study

has been formulated based on the following objectives.

To identify the factors that influences the customers satisfaction of green channel

counter

To identify the factors leading to Green Channel Counter

To offer suggestion to satisfy and retain the customers.

TKM INSTITUTE OF MANAGEMENT

Page 1

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

INTRODUCTION

Banking sector plays an active role in the economic development of a country. Their ability to

make a positive contribution in igniting the process of growth depends to a great extent on the

way the banking policies are pursued and the banking structure is evolved. It is, therefore, no

exaggeration to say that an effective, efficient and disciplined banking system greatly helps the

growth of economic development. It functions as a catalytic agent in bringing about economical,

industrial and agricultural growth and prosperity of the country.In kerala ,the cash deposit

machine was first indroduced by SBI at the Kanhangad branch on march 2014..

Banking in India in the modern sense originated in the last decades of the 18th century. Among

the first banks were the Bank of Hindustan, which was established in 1770 and liquidated in

1829-32; and the General Bank of India, established 1786 but failed in 1791.

The largest bank, and the oldest still in existence, is the State Bank of India. It originated as

the Bank of Calcutta in June 1806. In 1809, it was renamed as the Bank of Bengal. This was one

of the three banks funded by a presidency government, the other two were the Bank of

Bombay and the Bank of Madras. The three banks were merged in 1921 to form the Imperial

Bank of India, which upon India's independence, became the State Bank of India in 1955. For

many years the presidency banks had acted as quasi-central banks, as did their successors, until

the Reserve Bank of India was established in 1935, under the Reserve Bank of India Act, 1934.

In 1960, the State Banks of India was given control of eight state-associated banks under the

State Bank of India (Subsidiary Banks) Act, 1959. These are now called its associate banks. In

1969 the Indian government nationalised 14 major private banks. In 1980, 6 more private banks

were nationalized. These nationalised banks are the majority of lenders in the Indian economy.

They dominate the banking sector because of their large size and widespread networks.

The Indian banking sector is broadly classified into scheduled banks and non-scheduled banks.

The scheduled banks are those which are included under the 2nd Schedule of the Reserve Bank

of India Act, 1934. The scheduled banks are further classified into: nationalised banks; State

Bank of India and its associates; Regional Rural Banks (RRBs); foreign banks; and other Indian

TKM INSTITUTE OF MANAGEMENT

Page 2

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

private sector banks.[6] The term commercial banks refers to both scheduled and non-scheduled

commercial banks which are regulated under the Banking Regulation Act, 1949.

Banking was one of the more preferred lines of business in Kerala - as well as in the princel

states of Travancore and Cochin and the Malabar Province of British India that originally

comprised it - in the twentieth century. A list of some of the Banks that operated in that territory

during that period are given below. Due to various reasons most of them were either closed or

amalgamated with other banks, leaving only a handful now.

The Kerala bank sector operates three types of banks

Nationalized banks: The list of nationalized banks includes the State Bank Group, Bank of

India, Central Bank, Canara Bank and Corporation Bank.

Private banks: Major private players in the Kerala bank industry are ICICI bank, HDFC, Axis

bank and The Karur Vysya Bank.

Foreign banks: Several foreign-based banks also play key role in Kerala, such as Citibank,

HSBC and ABM AMRO

Trends in services offered by banks

Traditionally, retail banks have used branches, ATM, call centers, mobile, and Internet to interact

with their customers, though newer direct channels such as social media have emerged recently.

Branches have always played an important role and remain a key banking channel. However the

changing needs and preferences of customers, coupled with growing technological innovations,

has led to the increased popularity and adoption of direct channels over the last decade. Because

of their growing popularity, direct channels are expected to hold the highest share of global

banking transaction volume by 2012, though traditional channels are still expected to command

the highest share of the sales volume1 . As branch networks typically constitute around 75% of a

banks total distribution costs, the key challenge banks face today is to justify the high branch-

TKM INSTITUTE OF MANAGEMENT

Page 3

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

operating costs at a time of lower branch-driven revenue growth. The current economic scenario

gives banks an opportunity to identify channels that are most important to their customers, and

provide a positive experience across them. Banks are shifting their customers from high-cost to

lower-cost channels, thus reducing their total cost-to-serve. There is a growing trend to achieve a

seamless multi-channel integration by banks who want to make their customer interactions

channel-agnostic. This will help banks leverage their distribution networks by offering the right

products to the right customer segment through a desired channel, resulting in overall cost

savings and an enhanced customer experience. Banks also face highly saturated markets where

product and price no longer remain the key differentiators, thus pushing up retention costs.

Innovations around better and faster delivery of the right products to a customer will help banks

provide a differentiated customer experience, thus supporting better customer retention. Global

IT spending on retail banking channels remained stagnant in 2009, but is expected to grow to

$45.8bn at a compound annual growth rate of 4.2% through 20122 . Key trends are emerging

which are expected to drive future growth and transform the key customer touch points for

delivering better and more costeffective client service. Banks globally are investing in enterprise

mobile financial service solutions to deliver more mobile-based banking services and reduce the

overall cost of operations. As the adoption rate of online banking continues to increase globally,

banks are expected to increase their online marketing presence by leveraging technologies such

as Web 2.0 and social networks, which have evolved as an integral part of the banking channel

mix. Banks are also increasingly spending on customer-centric analytical tools to better

understand client buying and channelusage patterns, which can help build and improve customer

relationships.

Customer attitude towards banking services in India

Liberalisation trends in the emerging economies have led the banking sector devise

marketing strategies to accommodate the changing needs of their customers (Krishnan

et al., 1999). The Indian industry has witnessed sweeping reforms in the banking and

financial sector in the last decade. The first banks in India were established by the British

East India Company in the first half of the 19th century the Bank of Bengal in 1809, the

Bank of Bombay in 1840 and the Bank of Madras in 1843. Later, these banks were

TKM INSTITUTE OF MANAGEMENT

Page 4

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

amalgamated to a new bank called Imperial Bank which was renamed as the State Bank

of India in 1955. In 1969, 14 major banks were nationalised and in 1980, six major

private sector banks were taken over by the government (Indiaonline, 2009). In recent

years, the Central Bank of India (RBI) initiated a number of liberalisation measures to

encourage commercial banks to move towards market driven system (Kumbhakar and

Sarkar, 2003). The banking sector reforms have focused on customer-satisfaction,

asset-liability management, investments, training of human resource and use of

technology to make banking convenient (Bedi, 2010). These reforms had a positive

impact on the banking sector. The highly regulated market pre-deregulation had stifled

the growth of the public sector banks, and they had become inefficient and were losing

productivity (Kumar and Gulati, 2009). The earlier banking system crippled the

operations of banking sector and made it incompetent (Mohan, 2007). Kumar and Gulati

(2009) state: In order to impart more vitality and autonomy to banks in their operations,

the policy makers successfully adopted the route of partial privatisation of public sector

banks, interest rate deregulation, relaxing entry norms for domestic private and foreign

banks, and removal of financial repression through reduction in statutory

pre-emptions. There have been consistent efforts by the government to improve the

banking structure and allow more autonomy to the public sector banks (Roland, 2008).

Liberalisation policies pursued by the government have made it easy for multinational

banks to make investments into Indian banking industry. The multinational banks with

their advanced technologies and superior service portfolios have revolutionarised the

banking services. The Indian banks with their inefficient services are faced with the

challenge to improve their facilities. Indian Banking Sector Forecast (2009) posits that

the Indian banking industry is well poised as compared to their banking industries in the

western countries which have been affected by the financial crisis. The strong economic

growth, low defaulter ratio, absence of complex financial products, regular intervention

by central bank and, proactive adjustment of monetary policy provided the right mix for

investments in Indian banking sector. The multinational banks are eyeing the Indian

banking sector as it promises steady growth and opportunity to serve Indian customers

with better product/service portfolios. The predominant factors which have been

responsible for steady growth are strong economic cycle. The foreign and private banks

TKM INSTITUTE OF MANAGEMENT

Page 5

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

have grown at 50%, while public sector banks have improved their growth rate to 15%.

The share of the private sector banks has increased by 35% and that of foreign banks

increased to 20% of total sector assets (McKinsey, 2010).

Increasing competition and variety in banking services have acted as a catalyst for the

growing inclination of Indian customers towards multinational banks (Moodys Banking

Sector Report, 2008; Business Wire, 2009). The key focus of banking sector reforms was

on technology upgradation and improvement of human resource (Bhaumik and

Mukherjee, 2001). The competition presented by private and multinational banks forced

the public sector banks to adopt aggressive strategies, increase their presence in rural

India and expand their customer base (Sureshchandar et al., 2003; Reddy, 2007; Bedi,

2010). They are focusing on innovative marketing strategies like cross selling, packaged

selling of retail products, and technology based banking (Business Wire, 2009;

McKinsey, 2010).

Banks that provide good quality service to their customers definitely would be able to

increase their profits and revenues by being paid in terms of customer retention (Bennett

and Higgins, 1988) and loyalty. The difference in the perception of the customer related

to the quality of the services provided by different banks is dependent upon customers

perceptual construct and their earlier experiences with the banks. To be able to serve

customers, it becomes imperative for banks to combine promptness with convenience,

and mixing technology with human element. The research adapted the SERVQUAL scale

to understand the customers perceptions and attitude regarding service quality of

multinational banks in India. The results would enable multinational banks to define their

strategies for capturing Indian market according to customers perspective.

Green Channel Counter

The Green Channel Counter is functioning in most of the banks in India. The Customer has to

swipe their ATM card for withdrawal or has to deposit the money in the counter. The customer

has to select the transaction type and enter their pin number to complete the transaction within

time. The information will be displayed to the counter clerk who in turn would issue a slip to the

customer after completion of the transaction. This new system would enable the customer to

TKM INSTITUTE OF MANAGEMENT

Page 6

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

complete the transactions without paper work. Each customer would be allowed to either deposit

or withdraw amount up to Rs.40, 000 per transaction.

Cash Deposit Machine

It is a 24*7 self-service banking terminal, which accepts cash deposits using ATM. Customers

account will be instantly credited with the cash deposited. A receipt will be issued to you for each

successful deposit. Deposit service is available 24 hours a day, 7 days a week. For the

convenience of the customers, the customers can deposit cash without the need for a card or

passbook. They can simply touch the screen and follow the step by step guide. This machine

accepts cash deposits only and does not dispense cash. Only Indian currency is accepted. The

accepted denominations are 5rs, 10rs, 20rs, 50rs, 100rs, 500rs and 1000rs. The fake currencies

are also detected. Rs 49999 are the cash limit that can be withdrawn at a time. It is set so to avoid

income tax issues. The bundle of notes can comprise of mixed denominations place in any order.

The respective account is credited immediately after detecting the fake currencies. One possible

reason could be your notes are crumpled, soiled, defaced or folded. Please ensure that your notes

are properly straightened i.e. without folds, dogged-ears etc before depositing.

TKM INSTITUTE OF MANAGEMENT

Page 7

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

LITERATURE REVIEW

Walfried,

(2000) defined service as a set of characteristics that meet the clients' needs,

strengthen the links between the organization and them, and enhance the clients' value as well

As per Section 5(b) of the Banking Regulation Act, 1949 , "banking" means the accepting, for

the purpose of lending or investment, of deposits of money from the public, repayable on

demand or otherwise, and withdraw able by cheque, draft, order or otherwise.

Kolter and Armstrong (1999) defended the customer satisfaction as the customer's. Perception

that compare their pre-purchase expectations with post purchase

perception

Dr. Arvind A. Dhond (2013) conducted study tiled An empirical study on Green Channel

Counter in Banks. The researcher identified some problem faced by the customers and banks,

he given solution that the green channel counter helps to solve the problems. The objectives are

to provide insight into Green Banking initiative of State Bank of India by introducing Green

Channel Counter, to determine the level of awareness about Green Banking and Green Channel

Counter among the public in general SBI customers and to draw conclusions based on the

primary data survey results. He concludes that the future banks will be customer friendly

banking approach and the customers will welcome these types of green innovations in banking

sector. There was no study conducted in SBI Green Channel Counter except the above study.

Based on the above study and related publications the researcher designed the following

objectives.

Frascati Manual defiant Technological innovations comprise new products and processes and

significant technological changes of products and processes. An innovation has been

implemented if it has been introduced on the market (product innovation

TKM INSTITUTE OF MANAGEMENT

Page 8

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

Kasper et al state: Quality is an ambiguous term. On the one hand, everyone knows (or thinks

they know) what quality is. On the other hand, formulating a comprehensive and uniform

definition is a big if not insurmountable problem

Scheduled Bank is defined by Section 5(1) (m) of the Banking Companies Act, 1949 as a bank

for the time being included in the Second Schedule to the Reserve Bank of India Act, 1934

Nonscheduled bank in India means a banking company as defined in clause (c) of section 5 of

the Banking Regulation Act,1949 (10 of 1949), which is not a scheduled bank"

Dhiraj Vasant Kapare ,etc) conducted study tiled - Automatic Cash Deposite Machine With

Currency Detection Using Fluorescent And UV Light(2013),Department of E&TC Engineering

Imperial College of engineering, Pune, India Cash Deposit Machines (CDM) has altered the

relationship between banks and their depositors, as well as the competitive relationships among

banks. In this paper, I survey the literature to describe the ways have influenced these aspects of

banking markets. The project is designed to provide fully automatic cash deposit machine. It is

combination of Embedded, DIP & Automation. In Mat lab every data image of note is compared

with ideal stored image of every appropriate type of note. Every note is passed through UV light

to detect the originality of note which consequently results in acceptance and rejection of faulty

notes.

Arpita Khare(2011) ) conducted study tiled Customers perception and attitude towards service

quality in multinational banks in India

STATEMENT OF THE PROBLEM

A Study on Attitude and usage of customers towards Cash Depositing machine at Kollam

District.

TKM INSTITUTE OF MANAGEMENT

Page 9

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

OBJECTIVES OF THE STUDY

To find out the attitude of customers towards Cash Depositing Machine

To find out customers satisfaction towards Cash Depositing Machine

To know the factors influencing the use of CDM

To find out the problems usually faced by the customers while using CDM in a bank

Methodology and Tools used

The study is based on primary data. Structured questionnaire was used to collect data from

300 customers those who are using Green Channel Counter in various banks in Kollam.

Convenient sampling method was used to collect the data from the respondents.conclusive

case study method is used. Likert point scale technique was used to measure the customers

satisfaction. The factors influence Customer satisfaction were identified and mean score were

calculated to find out the factor which highly influence the satisfaction.

Convenience sampling

Convenience sampling is a non-probability sampling technique where subjects are selected

because of their convenient accessibility and proximity to the researcher.The subjects are

selected just because they are easiest to recruit for the study and the researcher did not consider

selecting subjects that are representative of the entire population.In all forms of research, it

would be ideal to test the entire population, but in most cases, the population is just too large that

it is impossible to include every individual. This is the reason why most researchers rely on

TKM INSTITUTE OF MANAGEMENT

Page 10

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

sampling techniques like convenience sampling, the most common of all sampling techniques.

Many researchers prefer this sampling technique because it is fast, inexpensive, easy and

the subjects are readily available.

DATA ANALYSIS AND FINDINGS

The objective of the study is to identify and analyse the Customer satisfaction in Cash

Deposit Machine services in Kollam,the impact of technology on banking operations and

comparative analysis between Public and Private sector banks.

Survey isconducted by Chandu sajeevan,Akshay.P,Amalesh Chandran.S,Safar Ali

S2(TKM institute of management,Kollam) under the guidance of Dr.Santhosh V.A (Associate

Professor TKM Institute of management,kerala university). Please be assured that your responses

will be strictly confidential. Please put a ( ) mark to indicate your preference

TKM INSTITUTE OF MANAGEMENT

Page 11

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

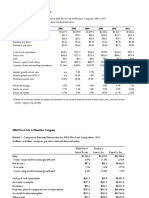

STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH

DEPOSITING MACHINE IN KOLLAM

Gender

Age

Education

Occupation

Income

Male

Female

Below 20

20-30

Above 40

Under Graduate

Graduate

Post-Graduate

Others

Business

Profession

Govt. Sector Employee

Pvt. Sector Employee

Others

Less than 50,000

50,000 1,00,000

1,00,000 2,00000

More than 2,00,000

TKM INSTITUTE OF MANAGEMENT

No. of Respondents

32

28

11

30

9

11

17

9

3

16

6

5

9

4

45

3

1

1

Page 12

Total

50

50

50

50

50

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

FINDINGS

1. Gender

Male

Female

2. Age

TKM INSTITUTE OF MANAGEMENT

Page 13

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

18 - 25

26 - 30

31 40

41 50

51 60

Above 60

3.Educational Qualification

Under Graduate

Graduate

Post-Graduate

Others

TKM INSTITUTE OF MANAGEMENT

Page 14

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

4.Marital Status

Married

Un married

5.Profession

Govt Employee

Private Employee

Business

Self Employee

Student

House Wife

TKM INSTITUTE OF MANAGEMENT

Page 15

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

6.Monthly Income

Upto 10,000

10,000- 15,000

15,001-20,000

20,001-25,000

25,001-30,000

Above 30,000

7.Status of usage

Less than 1 year

1 5 years

5 10 years

10 15 yeas

Above 15 years

TKM INSTITUTE OF MANAGEMENT

Page 16

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

8. Do you know about CDM(cash deposit machine) ?

50

45

40

35

30

25

20

15

10

5

0

Yes

No

9.Is it easy to use?

40

35

30

25

20

15

10

5

0

Yes

No

TKM INSTITUTE OF MANAGEMENT

Page 17

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

10.Are you able to deposit cash with CDM(cash deposit machine) ?

35

30

25

20

15

10

5

0

Less than 5 minutes

5-10 minutes

More than 10 minutes

11.Are you satisfied with the speed ?

45

40

35

30

25

20

15

10

5

0

Yes

TKM INSTITUTE OF MANAGEMENT

No

Page 18

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

12.Do you want the menu in your language ?

45

40

35

30

25

20

15

10

5

0

Yes

No

13.How much time it will take to reflect in your account

after depositing in CDM(is it real time)

TKM INSTITUTE OF MANAGEMENT

Page 19

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

60

50

40

30

20

10

0

Less than 5 minutes

5-10 minutes

More than 10 minutes

14.Is good notes you are putting in get rejected ?

45

40

35

30

25

20

15

10

5

0

Yes

No

15.Does the machine identifies counter feet notes?

TKM INSTITUTE OF MANAGEMENT

Page 20

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

50

45

40

35

30

25

20

15

10

5

0

Yes

No

16.Does your note get stucks in the machine often?

60

50

40

30

20

10

0

Yes

TKM INSTITUTE OF MANAGEMENT

No

Page 21

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

17.Do You want to associate ATM with the CDM ?

45

40

35

30

25

20

15

10

5

0

Yes

No

18.Do you think it is reliable to send money for emergency proposes?

60

50

40

30

20

10

0

Yes

TKM INSTITUTE OF MANAGEMENT

No

Page 22

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

19.Which category of the banks do you consider as most

technologically advanced?

40

35

30

25

20

15

10

5

0

Public sector bank

Private sector bank

20.How familiar are you with computer usage level of your

bank?

Ex

pe

rt

kn

ow

le

dg

e

Av

er

ag

e

kn

ow

le

dg

e

of

co

m

pu

te

r

18

16

14

12

10

8

6

4

2

0

TKM INSTITUTE OF MANAGEMENT

Page 23

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

21.Which factor promotes you to use the new cash deposit

machine?

20

15

10

5

0

1

22.Which attribute of the bank do you value the most?

TKM INSTITUTE OF MANAGEMENT

ba

nk

of

th

e

Ty

pe

Lo

ca

tio

n

Tr

us

t

us

ed

Te

ch

no

lo

gy

Q

ua

lit

y

of

S

er

vi

ce

35

30

25

20

15

10

5

0

Page 24

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

23. How satisfied are you with Working through green

channels?

35

30

25

20

15

10

5

at

is

fe

d

H

ig

hl

y

D

is

s

fe

d

eu

tr

al

N

D

is

sa

tis

H

ig

hl

y

Sa

tis

fe

d

Sa

tis

fe

d

24.How much money do you usually deposit?

16

14

12

10

8

6

4

2

10

,0

00

-1

5,

00

0

15

,0

01

-2

0,

00

0

20

,0

01

-2

5,

00

0

25

,0

01

-3

0,

00

0

30

,0

01

35

,0

00

pt

o

10

,0

00

TKM INSTITUTE OF MANAGEMENT

Page 25

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

25. How frequently do you use the following banking

services per month?

18

16

14

12

10

8

6

4

2

0

Nil

1 to 3

3 to 8

8 to 12

TKM INSTITUTE OF MANAGEMENT

Over 12

Page 26

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

CONCLUSION AND SUGGESTIONS

Majority of the respondents in the banks satisfied with the cash depositing machine. Hence it is

suggested the banks to developed and improvise the proper mechanism to resolve the grievance

settlement, as it leads to customer comfort and satisfaction. Comfort and convenience is very

important in any business.Majority of the customers are dissatisfied with the sufficient number of

CDMs. Complaint book is most important at the CDMs, it is found respondents stated that no

compliant book is available at ATM counter hence, it is suggested the banks to put the complaint

book in ATM counter, then the customers utilize and make the complaint and also suggestions to

the banks for effective functioning. The most important issue the bank administration should

concentrate on proper mechanism on Grievances settlement; besides that, customers data is

increasing day by day correspondingly the number of CDMs should be increased, so it leads to

customers satisfaction.

REFERENCES

TKM INSTITUTE OF MANAGEMENT

Page 27

A STUDY ON ATTITUDE AND USAGE OF CUSTOMERS TOWARDS CASH DEPOSITING MACHINE IN KOLLAM

1. Bishnoi Sunita (2013), An Empirical Study of Customers' Perception Regarding Automated

Teller Machine in Delhi and NCR, Integral Review- A Journal of Management, Vol.6 No.1 pp

47- 60

2. Chattopadhyay P. and Saralelimath S. (2012) customer preferences towards use of CDM

services in pune city, international journal of marketing, financial services and management

research, Vol.1, issue-7, July 2012 (ISSN: 2277 3622)

3. Kumbhar Vijay M (2011), Customer satisfaction in CDM service: an empirical evidences

from public and private sector banks in India, Management research practice, Vol. 3, issue-2, pp

24-35.

4. Kaur Manpreet (2013), Customer Satisfaction in CDM Service: An Empirical Study of Banks

in Chandigarh International Journal of Research in Commerce & Management, Vol. 4, No. 6.

5. Kumar Jayant, E-Banking: Some Economic Implications, The ICFAI University, Vol. 10,

Issue 1, pp. 42-43

TKM INSTITUTE OF MANAGEMENT

Page 28

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Supply Side Channel Analysis Channel Flows Ch#3 AnsaryDocument8 pagesSupply Side Channel Analysis Channel Flows Ch#3 Ansarybakedcaked100% (1)

- Turnaround - Vermont Aerospace - ProofedDocument2 pagesTurnaround - Vermont Aerospace - ProofedJojnNo ratings yet

- Accounting Cycle WorksheetDocument11 pagesAccounting Cycle Worksheettarikuabdisa0No ratings yet

- CVS OTIF Program Webinar-Reporting, Charge Investigation, Disputes - 0Document58 pagesCVS OTIF Program Webinar-Reporting, Charge Investigation, Disputes - 0Elite Cleaning ProductsNo ratings yet

- Monitor Risk and Evaluate Processes: Submission DetailsDocument5 pagesMonitor Risk and Evaluate Processes: Submission DetailsFair StudentNo ratings yet

- US Internal Revenue Service: Irb07-20Document44 pagesUS Internal Revenue Service: Irb07-20IRSNo ratings yet

- English Technical Writing SamplesDocument27 pagesEnglish Technical Writing Samplesabaine20% (2)

- How To Get Skilled by Valeri ChukhlominDocument2 pagesHow To Get Skilled by Valeri ChukhlominYazid Rasid0% (3)

- Vikas TyagiDocument3 pagesVikas TyagiVicki jonesNo ratings yet

- What Is Auditor IndependenceDocument6 pagesWhat Is Auditor IndependenceNeriza PonceNo ratings yet

- Indian Contract Act, 1872Document111 pagesIndian Contract Act, 1872bhishamshah70No ratings yet

- Discussionquestions: Making Research DecisionsDocument2 pagesDiscussionquestions: Making Research DecisionsRodolfo Mapada Jr.No ratings yet

- Evaluation of Extension ProgrammeDocument10 pagesEvaluation of Extension Programmenuralom mithunNo ratings yet

- Business Excellence Model in Indian Context: A Select Study: Sushil Kumar AgrawalDocument13 pagesBusiness Excellence Model in Indian Context: A Select Study: Sushil Kumar Agrawaldebo001No ratings yet

- Lect 5B (Comp Chall)Document10 pagesLect 5B (Comp Chall)azharzebNo ratings yet

- International Financial Management 8th Edition Madura Test BankDocument40 pagesInternational Financial Management 8th Edition Madura Test Bankvioletciara4zr6100% (33)

- Wild Wood Case StudyDocument6 pagesWild Wood Case Studyaudrey gadayNo ratings yet

- Full Report - SMA TechniquesDocument3 pagesFull Report - SMA TechniquesAirane ChanNo ratings yet

- Jurnal Internasional 3Document9 pagesJurnal Internasional 3Bella Nur anggrainiNo ratings yet

- Nielsen - Market Research For PanteneDocument21 pagesNielsen - Market Research For Panteneveerapratapreddy509No ratings yet

- The Change Leader's Roadmap: How To Navigate Your Organization's TransformationDocument21 pagesThe Change Leader's Roadmap: How To Navigate Your Organization's TransformationakimNo ratings yet

- Li & Fung - Final PresentationDocument26 pagesLi & Fung - Final PresentationapoorvsinghalNo ratings yet

- BPML SampleDocument2,745 pagesBPML SampleSheikh Usman Saleem100% (1)

- Consumer Behavior - Week 3Document7 pagesConsumer Behavior - Week 3Jowjie TVNo ratings yet

- TBCH 06Document12 pagesTBCH 06Bill BennttNo ratings yet

- Standard Form of Contract For Engg Consultancy Services (Lump Sum Assignment)Document45 pagesStandard Form of Contract For Engg Consultancy Services (Lump Sum Assignment)euthan100% (3)

- Lse TPCL 2017Document384 pagesLse TPCL 2017Vinayak BagayaNo ratings yet

- Salomon V A Salomon and Co LTD (1897) AC 22 Case Summary The Requirements of Correctly Constituting A Limited CompanyDocument5 pagesSalomon V A Salomon and Co LTD (1897) AC 22 Case Summary The Requirements of Correctly Constituting A Limited CompanyDAVID SOWAH ADDO0% (1)

- Emerging Trends in Banking SectorDocument35 pagesEmerging Trends in Banking SectorThyagarajan MuthiyanNo ratings yet

- NikeDocument27 pagesNikeKrishna KinkerNo ratings yet