Professional Documents

Culture Documents

Effects of Economic Crisis

Effects of Economic Crisis

Uploaded by

leonns1Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Effects of Economic Crisis

Effects of Economic Crisis

Uploaded by

leonns1Copyright:

Available Formats

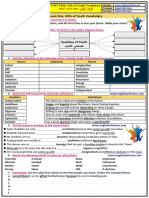

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Background

There has been much news about the current state of the economy and the

fundamental challenges that all organizations now face. As companies make

changes to survive the economic downturn, management often chooses marketing

as the first candidate for cost cuts. To keep marketers current during these

turbulent times, MarketingProfs conducted a survey of members in companies of

all industries and sizes to determine how this economic crisis is impacting

marketing plans and projections for 2009.

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Methodology

On October 10, 2008, MarketingProfs distributed a web-based survey concerning

this economic crisis, and received responses from 684 marketing and business

professionals in four days. Respondents reflected a wide variety of business

circumstances, as represented by the following:

Company Size

Small

Medium

Large

57%

29%

14%

Sector*

Primarily Business-to-Business (B2B)

Primarily Business-to-Consumer (B2C)

57%

17%

Core Business

Manufacturing /Product

Marketing

Provision of

Service /Service Marketing

Other

23%

59%

18%

*Other respondents included marketers who described their companies as either a combination of B2B/B2C, government, or non-profit.

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Summary

Two-thirds of respondents (68%) believe the current economic crisis will have a

negative impact on their business, with detrimental effects anticipated more often

by marketers in large organizations (75%) than those in medium (70%) or small

(65%). Already, 30% claim to have made spending cuts (43% of marketers in

large companies), and 22% have made budget reallocations.

A fourth predict they will have to make cuts in marketing spending next year, and

a third anticipate that their 2009 budgets will remain steady but spending will be

reallocated to different vehicles. Business-to-consumer and product

marketing/manufacturing companies indicate a greater likelihood to make future

budget cuts or reallocations than those in either business-to-business organizations

or those engaged in businesses with a service-marketing orientation.

Plans for product/line extensions are currently forecasted to remain unchanged by

56%, with an additional 21% being undecided; only 8% said they plan to delay

new product development. Manufacturing/product marketers and B2B

organizations are more likely to maintain their current product/line extension plans

than service marketers or those with a B2C focus.

Marketers overwhelmingly are planning for spending reductions on traditional

vehicles, and are increasing the importance of online marketing in their projected

budgets. Marketers who have a pessimistic outlook are more likely than those

with an optimistic outlook to report that they expect to increase spending on

online vehicles and decrease spending on traditional vehicles. Although there has

3

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Summary (cont.)

been a general trend toward online marketing and away from traditional vehicles,

those who are pessimistic may be increasing the speed of their transition.

Although conditions like this may often be exaggerated by the media, most

marketers (71%) report that the effects on their industry have not been

exaggerated. A proportion slightly larger (77%) does not anticipate staff layoffs,

with B2B marketers being somewhat more likely to anticipate staff layoffs than

those in a B2C environment.

Marketers are split as to their predictions for the duration of the current climate,

with nearly half (47%) believing it will continue through all or most of 2009, and

25% believing it will last into 2010 or beyond. 22% believe the current climate

will end by the middle of 2009.

While respondents believe that their own careers will not be impacted as much as

that of their colleagues, they are equally likely to think that their compensation

and their colleagues compensation will be affected.

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Conclusions

In general, marketers are taking a largely negative view of the impact of this

current economic crisis, and are altering their current actions and future plans

accordingly. Many have likely expected that marketing is the first expense to be

cut when the economy slows and management is looking to cut costs.

However, this crisis also has the potential to create an opportunity for savvy

business management to carefully consider their marketing budgets and allocations

in order to capitalize on the chance to snag a greater share of voice in certain

vehicles. When the competition cuts their spending, there will be potential to gain a

competitive advantage.

Digital marketing vehicles may provide an opportunity to stretch a marketing

budget. Those marketers who can best position themselves vis--vis the

competition and can capitalize on creative and innovative use of online marketing

tactics may be able to reap the greatest return on the shift in allocation to this new

media.

Overall, it is important to keep various tools in your marketing arsenal, and not

become too heavily focused or reliant on any one tactic or media. Each tool can

have a pay-off for organizations that use it effectively to target the needs and

benefits sought by their target audiences. Regardless of what tools marketers

employ, it is essential that results be measured over time to determine which

vehicles are most effective for each strategy.

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Conclusions (cont.)

Finally, it is also worth noting that while marketing may be viewed as an expense

by senior management, the more savvy companies understand that it is an

investment. History has shown that during economic downturns, reductions in

marketing spending may have the effect of prolonging or creating permanent loss

in market share or profitability for a company after the economy improves.

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Expected Impact of Current Economic Crisis

on Company Business

Total and Company Size

Over two-thirds of respondents (68%) anticipate that the current economic crisis will have a negative effect on their

business, of which 11% believe the effect will be seriously negative. 19% predict minimal impact, while the remaining 12%

think there may be some positive effect for their business. Overall, the tendency to anticipate a negative impact increases by

company size, with 75% of large business anticipating a negative effect on their business. Differences between marketers in

business-to-business (B2B) versus business-to-consumer (B2C) organizations are not notable.

Expected Impact of Current Economic Crisis on Company Business

Total

(N= 671)

11%

Small

(N= 384)

11%

57%

19%

54%

11%

19%

14%

1%

2%

Seriously negative

Negative, but not sure

how much

Minimal effect overall

Medium

(N= 191)

7%

63%

19%

8%

2%

Could be positive

Will definitely be positive

Large

(N= 96)

16%

59%

20%

5% 0%

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Up-to-date Adjustments to Marketing Plans/Budgets

Total and Company Size

30% have already made cut-backs and an additional 22% have shifted spending to alternative tactics from what they had

originally planned; 41% of respondents have yet to make any changes to their marketing budgets or marketing plans.

Marketers in large organizations are more likely to have already made cuts (43%) when compared with their cohorts in

medium/small companies.

Up-to-Date Adjustments to Marketing Plans/Budgets

Total

(N= 668)

30%

Small

(N= 383)

29%

22%

21%

7%

41%

9%

41%

Yes, cut back on spending

Yes, reallocated among

alternatives

Yes, increased budget

Medium

(N= 191)

Large

(N= 94)

27%

43%

26%

4%

16%

42%

3%

38%

No/No change

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Expected Modifications to 2009 Marketing Plans

Total and Company Size

About a fourth (24%) of marketers say they will probably make reductions in their 2009 marketing budgets; approximately

one-third of respondents anticipate holding budgets steady for 2009 but will reallocate their resources. 29% expect to

maintain their current course of action. 40% of marketers in large organizations expect to reduce their budgets, a

proportion nearly twice as large as those in small-medium enterprises.

Expected Modifications to 2009 Marketing Plans

Total

(N= 669)

Small

(N= 383)

24%

34%

21%

29%

14%

29%

17%

32%

Will probably reduce

Hold total budget but

reallocate

Medium

(N= 190)

22%

46%

9%

23%

Will probably increase

Will probably stay the course

Large

(N= 96)

40%

27%

7%

26%

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Expected Modifications to 2009 Marketing Plans

By Primary Sector

Marketers in organizations with a consumer focus are slightly more likely to plan on reductions or allocations than those

with a business focus (29% vs. 24%).

Expected Modifications to 2009 Marketing Plans

B2C

(N= 112)

29%

40%

5%

25%

Will probably reduce

Hold total budget but reallocate

Will probably increase

Will probably stay the course

B2B

(N= 384)

24%

30%

15%

10

31%

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Expected Modifications to 2009 Marketing Plans

By Company Type

Marketers in manufacturing organizations are more likely to expect budget reductions (34%) than those in either servicebased (20%) or other (non-profit or government) organizations (22%).

Expected Modifications to 2009 Marketing Plans

Manufacturing

(N= 155)

28%

34%

9%

28%

Will probably reduce

Service

(N= 391)

Hold total budget but

reallocate

20%

34%

16%

29%

Will probably increase

Will probably stay the

course

Other

(N= 124)

22%

40%

11%

11

27%

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Plans For Product/Line Extension as A Result of Financial Situation

By Company Type

Overall, 56% of marketers plan to continue with current plans for product or line extensions. While 21% are considering

their options, 16% plan on accelerating these plans and 8% say they expect a delay. Marketers in manufacturing companies

are more likely to remain committed to these current plans than those in other organizations.

Plans for Product/Line Extension as a Result of Financial Situation

Total

(N= 619)

Manufa cturing

(N= 152)

16%

8%

21%

56%

12%

70%

11% 7%

Accelerate

Delay

Stay the course

Still considering options

Service

(N= 356)

17%

8%

Other

(N= 111)

16%

11%

22%

53%

27%

46%

12

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Plans For Product/Line Extension as A Result of Financial Situation

By Primary Sector

B2B marketers are more likely to maintain their planned course of action for product or line extensions than are B2C

marketers (59% vs. 44%).

Plans for Product/Line Extension as A Result of Financial Situation

B2C

(N= 100)

15%

14%

44%

27%

Accelerate

Delay

Stay the course

Still considering options

B2B

(N= 361)

16%

7%

59%

17%

13

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Areas for Projected Budget Increase/Decrease

By Company Type

Most marketers (62%) expect to increase their budgets for online marketing while widely expecting to make spending cuts

to traditional vehicles (83%). While just 18% of marketers in manufacturing organizations expect to make increases in

traditional areas, this is still double the proportion observed in other types of organizations. In general, marketers are also

more likely to increase resources devoted to strategy and planning than they are to make decreases in these areas.

Manufacturing marketers are less likely to plan on dedicating additional resources to strategy and planning than other

marketing professionals.

Areas for Projected Budget Increase/Decrease

Areas for Projected Budget Increase

Other

(N= 108)

Service

(N= 355)

64%

60%

29%

31%

Areas for Projected Budget Decrease

7%

Other

5% 9%

(N= 92)

86%

9%

Service

10% 6%

(N= 306)

84%

Online marketing

Strategy and planning

Traditional vehicles

Manufacturing

(N= 136)

Total

(N= 599)

64%

62%

18%

28%

Manufacturing

(N= 121)

18%

Total

(N= 519)

11%

14

11% 11%

9% 8%

79%

83%

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Areas for Projected Budget Increase/Decrease

By Primary Sector

B2B marketers are more likely to expect to increase spending on strategy and planning than those in B2C organizations, and

also appear to be somewhat more likely to cut spending on traditional vehicles.

Areas for Projected Budget Increase/Decrease

Areas for Projected Budget Increase

B 2C

(N = 1 01)

B2B

(N= 341)

67%

60%

19%

29%

Areas for Projected Budget Decrease

14%

B2C

(N= 87)

10% 11%

12%

B2B

(N= 298)

11% 6%

Online marketing

Strategy and planning

Traditional vehicles

15

78%

83%

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Expected Duration That Current Climate Will Persist

Marketers are most likely to anticipate that the current climate will persist through all or most of 2009 (47%), and an

additional 25% believe the timeframe could well extend into 2010 or beyond. Just 6% predict a quick recovery (by the first

quarter of next year). Differences by primary sector, company size or company type are not significant.

Expected Duration That Current Climate Will Persist

Could be behind us in

1st Quarter 2009, 6%

Could well extend into

2010 or beyond, 25%

Will probably be over by

mid-year 2009, 22%

Will probably extend

through all or most of

2009, 47%

16

Total = 679 Respondents

Marketing in the Economic Crisis

Survey of Marketers, October 2008

General Feeling of Optimism/Pessimism

Just over half of respondents (52%) have mixed feelings about what they believe is likely to happen. 30% are optimistic,

and 18% have a general feeling of pessimism.

General Feelings about Whats Likely to Happen

Optimistic, 30%

Mixed feelings, 52%

Pessimistic, 18%

Total = 681 Respondents

17

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Optimism/Pessimism

By Company Size

The pervasive feeling, regardless of company size, is ambiguity. However, marketers in large companies are far less likely to

feel optimistic than marketers in medium or small companies, and are more likely to have mixed feelings. There are no

substantial differences in outlook by sector or company type.

General Feelings about Whats Likely to Happen

Total

(N= 668)

52%

30%

Small

(N= 382)

49%

33%

18%

19%

Optimistic

Mixed feelings

Pessimistic

Medium

(N= 191)

Large

(N= 95)

53%

30%

19%

61%

18

16%

20%

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Expected Modifications to 2009 Marketing Plans

By Optimistic/Pessimistic Outlook

Not surprisingly, marketers with a pessimistic outlook are far more likely to anticipate budget reductions than those who are

either optimistic or feel ambivalent.

Expected Modifications to 2009 Marketing Plans

Total

(N= 679)

23%

34%

13%

29%

Will probably reduce

Optimistic

(N= 207)

14%

36%

20%

31%

Hold total budget but

reallocate

Will probably increase

Will probably stay the

course

Pessimistic

(N= 121)

Mixed feelings

(N= 351)

43%

23%

23%

37%

12%

10%

19

22%

30%

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Areas for Projected Budget Increase/Decrease

By Optimistic/Pessimistic Outlook

Marketers who have a pessimistic outlook are more likely than those with an optimistic outlook to report that they expect to

increase spending on online vehicles and decrease spending on traditional vehicles. Although there has been a general trend

toward online marketing and away from traditional vehicles, those who are pessimistic may be increasing the speed of their

transition.

Areas for Projected Budget Increase/Decrease

Areas for Projected Budget Increase

Total

(N= 607)

Optimistic

(N= 186)

Pessimistic

(N= 99)

Mixed feelings

(N= 322)

62%

28%

Areas for Projected Budget Decrease

Total

(N = 530)

11%

Online marketing

58%

30%

13%

Strategy and planning

Traditional vehicles

67%

62%

26%

27%

Optimistic

(N = 160)

15%

Pessimistic 5% 6%

(N = 94)

7%

Mixed feelings

(N = 276)

10%

20

83%

9% 8%

7% 8%

8%

78%

88%

85%

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Belief in Exaggeration of Crisis Effects

Most respondents (71%) do not believe that the effects of the current crisis on their industry have been exaggerated. Results

are similar regardless of company size, type or sector.

Belief in Exaggeration of Crisis Effects

Yes, effects have

been exaggerated,

29%

No, effects have not

been exaggerated,

71%

Total = 670 Respondents

21

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Expectation of Staff Layoffs

Almost a fourth of marketers already anticipate staff layoffs in their department over the next year.

Expectation of Staff Layoffs

Yes, believe there

will be staff layoffs,

23%

No, do not believe

there will be staff

layoffs, 77%

Total = 673 Respondents

22

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Expectation of Staff Layoffs

By Primary Sector

Expectations for departmental layoffs are somewhat higher among B2B marketers than B2C.

Percentage Expecting Staff Layoffs

B2C

(N= 110)

17%

B2B

(N= 378)

25%

23

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Expected Impact on Career/Compensation

By Company Size

Respondents believe that their own careers (20%) will be impacted by the economic crisis to a far less degree than that of

their colleagues (38%). However, they tend to have a higher expectation that compensation, for both themselves and their

colleagues, will be affected (43% and 44%, respectively). Marketers in mid-sized companies are less likely to believe any of

these areas will be affected than their cohorts at either end of the company size spectrum.

Percentage Expecting Impact On...

50%

Colleagues'

compensation

35%

47%

44%

41%

Large

30%

Colleagues' careers

41%

38%

Medium

48%

32%

Your compensation

47%

43%

23%

Your career

12%

23%

20%

24

Small

Total

Marketing in the Economic Crisis

Survey of Marketers, October 2008

Contact Information

MarketingProfs Research Insights

MarketingProfs, LLC

research@MarketingProfs.com

Copyright 2008. MarketingProfs Research Insights,

MarketingProfs, LLC. All rights reserved.

25

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Complete These Sentences To Express Your Real Feelings. Try To Do Every One. Be Sure To Make Complete SentencesDocument5 pagesComplete These Sentences To Express Your Real Feelings. Try To Do Every One. Be Sure To Make Complete SentencesSarah Noor100% (1)

- Leisure in Later LifeDocument43 pagesLeisure in Later Lifekokopile15No ratings yet

- Sol3e Adv U4 Progress Test BDocument6 pagesSol3e Adv U4 Progress Test BAylana Halova100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Miroslav Holub - Selected PoemsDocument102 pagesMiroslav Holub - Selected PoemsArtNonart75% (4)

- Case Study: The Bill and Melinda Gates FoundationDocument9 pagesCase Study: The Bill and Melinda Gates FoundationPhuong Linh Nguyen50% (2)

- Nielsen Global E Commerce Report August 2014Document21 pagesNielsen Global E Commerce Report August 2014leonns1No ratings yet

- Vestax Pmc-250 (Manual)Document12 pagesVestax Pmc-250 (Manual)leonns1No ratings yet

- The Princess, The Dragon, and The Very Bad Knight PDFDocument14 pagesThe Princess, The Dragon, and The Very Bad Knight PDFleonns1No ratings yet

- Behringer - DDM4000 PDFDocument1 pageBehringer - DDM4000 PDFleonns1No ratings yet

- FireBox Owners Manual enDocument29 pagesFireBox Owners Manual enleonns1No ratings yet

- Life Is What You Make It PDFDocument7 pagesLife Is What You Make It PDFAbhishek Sharma0% (1)

- UTT Tarot Card Reference GuideDocument87 pagesUTT Tarot Card Reference Guideroyshubhadeep93% (14)

- 13 Dedap An Thi Chuyen Anh Vao 10 THPTDocument315 pages13 Dedap An Thi Chuyen Anh Vao 10 THPTthanhnguyendac.08No ratings yet

- JupiterDocument17 pagesJupiterAnand ChineyNo ratings yet

- Final ManuscriptDocument136 pagesFinal ManuscriptPakisend Po DitoNo ratings yet

- Habits For Life 9 Steps For Building Habi - Akash KariaDocument58 pagesHabits For Life 9 Steps For Building Habi - Akash KariaHARSH CHOUDHARINo ratings yet

- Psychology of Sales - 2014Document78 pagesPsychology of Sales - 2014Pavel ChirițăNo ratings yet

- PrimalworldbeliefscliftonDocument18 pagesPrimalworldbeliefscliftonGabriela BorsosNo ratings yet

- Stay PositiveDocument4 pagesStay PositiveSaira Zafar100% (1)

- Cec 30 EcDocument2 pagesCec 30 EcSA NANo ratings yet

- Exploring OptimismDocument3 pagesExploring OptimismJanet LeDesmaNo ratings yet

- Small Is Beautiful - E F SchumacherDocument210 pagesSmall Is Beautiful - E F Schumachercdwsg254100% (9)

- كتاب العلوم الصحيةDocument194 pagesكتاب العلوم الصحيةNuriddin JehadNo ratings yet

- Positive Psychology S Fascinating FactsDocument37 pagesPositive Psychology S Fascinating FactsHammad Ahmad100% (1)

- Compilation of Some VK TweetsDocument81 pagesCompilation of Some VK Tweetsxefedoy533No ratings yet

- Or FinalDocument34 pagesOr FinalmanagementboyNo ratings yet

- Exercises For Grade 9 StudentsDocument6 pagesExercises For Grade 9 StudentsMinh La0% (1)

- Positive Thinking Among Internet Users in Saudi Arabia and Its Relationship With The Subjective Feeling of Well BeingDocument10 pagesPositive Thinking Among Internet Users in Saudi Arabia and Its Relationship With The Subjective Feeling of Well BeingSEP-PublisherNo ratings yet

- Power, Optimism, and Risk-Taking: Cameron Anderson and Adam D. GalinskyDocument26 pagesPower, Optimism, and Risk-Taking: Cameron Anderson and Adam D. GalinskyRAul Bunicu'No ratings yet

- Work Related Flow, Psychological Capital, and Creativity Among Employees of Software HousesDocument11 pagesWork Related Flow, Psychological Capital, and Creativity Among Employees of Software HousesLazain ZulhamNo ratings yet

- Marketing & SalesDocument5 pagesMarketing & SalesPratipal SinghNo ratings yet

- Antiblackness Answers Compiled - Wake 2018Document119 pagesAntiblackness Answers Compiled - Wake 2018Evan JackNo ratings yet

- Positive Thinking: Powerpoint Slides by Megha SahayDocument18 pagesPositive Thinking: Powerpoint Slides by Megha SahaySachin Methree100% (1)

- Six Thinking HatsDocument6 pagesSix Thinking HatsAngeline SalesNo ratings yet

- Unit One Vocabulary Gifts of Youth VOCABULARY by English With SimoDocument2 pagesUnit One Vocabulary Gifts of Youth VOCABULARY by English With Simomalak bnaniNo ratings yet