Professional Documents

Culture Documents

Treasury Audit Summary

Uploaded by

Eric Ashalley Tetteh0 ratings0% found this document useful (0 votes)

4 views6 pagesSummary information on treasury operation.

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSummary information on treasury operation.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views6 pagesTreasury Audit Summary

Uploaded by

Eric Ashalley TettehSummary information on treasury operation.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

You are on page 1of 6

+ The treasury department of a bank is responsible for

balancing and managing the daily cash flow and liquidity

of funds within the bank. The department also handles the

bank's investments in securities, foreign

exchange, asset/liability management and cash

instruments.

What Does Treasury

Department Do in a Bank?

Treasury Management

+ Treasury generally refers to the funds and revenue at the disposal

of the bank and day-to-day management of the same.

* The treasury acts as the custodian of cash and other liquid assets.

* The art of managing, within the acceptable level of risk, the

consolidated fund of the bank optimally and profitably is called

Treasury Management.

+ Iris the window through which banks raise funds or place funds

{for its operations.

——EEEEay

=

Functions of an integrated treasury

+ Reserve Management and Investment

* Liquidity and Funds Management

- Asset-Liability Management

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Controller Typically Reports To The Chief Financial Officer (CFO) or May Even Be The CFODocument1 pageThe Controller Typically Reports To The Chief Financial Officer (CFO) or May Even Be The CFOEric Ashalley TettehNo ratings yet

- Basel Three Liquidity MonitoringDocument1 pageBasel Three Liquidity MonitoringEric Ashalley TettehNo ratings yet

- Basel Three Liquidity MonitoringDocument1 pageBasel Three Liquidity MonitoringEric Ashalley TettehNo ratings yet

- Samsung Mission and VisionDocument7 pagesSamsung Mission and VisionEric Ashalley TettehNo ratings yet

- Effective Fraud HandlingDocument1 pageEffective Fraud HandlingEric Ashalley TettehNo ratings yet

- FM of Bank Question 3 Q and ADocument3 pagesFM of Bank Question 3 Q and AEric Ashalley TettehNo ratings yet

- Early Fraud DetectionDocument1 pageEarly Fraud DetectionEric Ashalley TettehNo ratings yet

- FM of Bank Question 3 Q and ADocument3 pagesFM of Bank Question 3 Q and AEric Ashalley TettehNo ratings yet

- Early Fraud DetectionDocument1 pageEarly Fraud DetectionEric Ashalley TettehNo ratings yet

- Money Had and ReceivedDocument10 pagesMoney Had and ReceivedEric Ashalley TettehNo ratings yet

- 29Document141 pages29Anandbabu RadhakrishnanNo ratings yet

- Study TYBCom Accountancy Auditing-IIDocument396 pagesStudy TYBCom Accountancy Auditing-IIRani Naik Dhuri100% (2)

- Objectives and Risks for Payroll ManagementDocument2 pagesObjectives and Risks for Payroll ManagementEric Ashalley Tetteh100% (3)

- Financial Institutions ManagementDocument8 pagesFinancial Institutions ManagementJesmon RajNo ratings yet

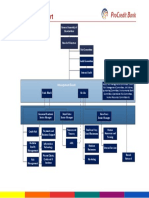

- Organizational Chart November 2014Document1 pageOrganizational Chart November 2014Eric Ashalley TettehNo ratings yet

- TEMENOS Product Brochure PDFDocument28 pagesTEMENOS Product Brochure PDFHa Thanh HungNo ratings yet

- Audit Committee Checklist 2009Document3 pagesAudit Committee Checklist 2009Eric Ashalley TettehNo ratings yet

- Overview of Enterprise Risk ManagementDocument34 pagesOverview of Enterprise Risk ManagementEric Ashalley TettehNo ratings yet

- Cape Coast Metro Budget 2012Document78 pagesCape Coast Metro Budget 2012Eric Ashalley TettehNo ratings yet

- Proforma-Invoice 1Document4 pagesProforma-Invoice 1Eric Ashalley TettehNo ratings yet

- Cash Count SheetDocument3 pagesCash Count SheetEric Ashalley TettehNo ratings yet

- Proforma-Invoice 1Document4 pagesProforma-Invoice 1Eric Ashalley TettehNo ratings yet

- Table of Contents Audit Program SectionsDocument2 pagesTable of Contents Audit Program SectionsEric Ashalley TettehNo ratings yet

- Abitech Consult: Pro Forma InvoiceDocument4 pagesAbitech Consult: Pro Forma InvoiceEric Ashalley TettehNo ratings yet

- Vehicle TransferDocument1 pageVehicle TransferEric Ashalley TettehNo ratings yet

- Table of Contents Audit Program SectionsDocument2 pagesTable of Contents Audit Program SectionsEric Ashalley TettehNo ratings yet

- Group Audit & Assurance Division Certificate of Cash Count YEAR ENDED 31st December 2012Document1 pageGroup Audit & Assurance Division Certificate of Cash Count YEAR ENDED 31st December 2012Eric Ashalley TettehNo ratings yet

- Table of Contents Audit Program SectionsDocument2 pagesTable of Contents Audit Program SectionsEric Ashalley TettehNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)