Professional Documents

Culture Documents

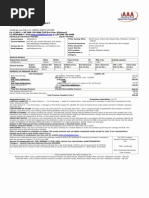

HDFC ERGO General Insurance Company Limited: Policy No. 2312 1000 6143 1100 000

Uploaded by

Satish BojjawarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HDFC ERGO General Insurance Company Limited: Policy No. 2312 1000 6143 1100 000

Uploaded by

Satish BojjawarCopyright:

Available Formats

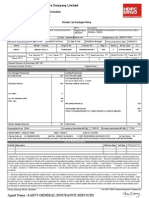

HDFC ERGO General Insurance Company Limited

2312100061431100000

Certificate of Insurance cum Policy Schedule

Policy No. 2312 1000 6143 1100 000

0

Two Wheeler Package Policy

Insured Name

Mr Bitra Janardhanarao

RTO

HYDERABAD

Correspondence

14/251/2 Raghavanagar Colony Meerpet Near Tkr College

Registration 14/251/2 Raghavanagar Colony Meerpet Near Tkr College

Address

HYDERABAD ANDHRA PRADESH 500097

Address

HYDERABAD ANDHRA PRADESH 500097

Mobile

9347452436

Phone

E Mail

venkatakrishnaodugu@gmail.com

Registration No.

AP-29-BV-0082

Period of Insurance

From Date & Time

28/06/2016 00:01 hrs

To Date & Time

27/06/2017 Midnight

Policy Issuance Date

Make

Model - Variant

Engine No

Chassis No

Mfg Yr

HERO MOTOCORP

PASSION PRO-DISC SS

HA10ENDHC17066

MBLHA10AWDHC76884

2013

Vehicle (`)

Insured's Declared

Value (IDV)

Side Car (`)

36,000

Non Electrical Acc. (`)

Electrical Acc. (`)

CNG/LPG Kit (`)

Named Persons & Nominee (IMT-15)

Nominee (Owner Driver) Bitra Koti Lingam , Father

Seats(Incl.

of side car)

2

22/06/2016

Body Type

CC

OPEN

97

Total IDV (`)

36,000

Appointee

Premium Details (`)

Own Damage Premium (a)

Basic Own Damage:

615

Liability Premium (b)

Basic Third Party Liability:

538

PA Cover for Owner Driver of `100000

Total Basic Premium

Less: No Claim Bonus (20%)

Total - Less

615

123

123

50

PA Cover for un-named persons of `100000 each(for 2 Person) (IMT-16)

140

Sub Total Addition

728

Net Liability Premium (b)

728

Total Package Premium (a+b)

1220

Service Tax

Net Own Damage Premium (a)

The total Premium amount is inclusive of NCB 20%

Geographical Area India

492

171

Total Premium

1,391

Compulsory Deductible (IMT-22) ` 100

Voluntary Deductible (IMT-22A) ` 0

Payment Details: Fund Transfer No. TW1506008941

Dated : 22/06/2016

Drawn on

BizDirect

Previous Policy No. 3005/23427872/62890/000 Valid from 28/06/2015 to 27/06/2016 of ICICI LOMBARD GENERAL INSURANCE CO. LTD. No Claim Bonus 0%

If declaration found incorrect, benefits under the present policy in respect of own damage section will stand forfeited.

List of Endorsements

Endt No Description

Effective Date

End Date

Premium (In ` )

LIMITATIONS AS TO USE: The Policy covers use of the vehicle for any purpose other than: a) Hire or Reward b) Carriage of goods (other than samples or personal luggage) c) Organized racing d) Pace making e)

Speed testing f) Reliability Trials g) Any purpose in connection with Motor Trade. Persons or Class of Persons entitled to drive: Any person including the insured, provided that a person driving holds an effective

driving license at the time of the accident and is not disqualified from holding or obtaining such a license. Provided also that the person holding an effective learner`s license may also drive the vehicle when not used

for the transport of passengers at the time of the accident and that such a person satisfies the requirements of Rule 3 of the Central Motor Vehicles Rules, 1989. Limits of Liability 1. Under Section II-1 (i) of the

policy - Death of or bodily injury - Such amount as is necessary to meet the requirements of the Motor Vehicles Act, 1988. 2. Under Section II - 1(ii) of the policy -Damage to Third Party Property` 100000 3.P.A.

Cover under Section III for Owner - Driver(CSI): ` 100000 Terms, Conditions & Exclusions: As per the Indian Motor Tariff. A personal copy of the same is available free of cost on request & the same is also

available at our website.

I / We hereby certify that the policy to which the certificate relates as well as the certificate of insurance are issued in accordance with the provision of chapter X, XI of M. V.Act 1988. "The stamp duty of

` 0.50

paid by Demand Draft, vide Receipt/Challan no 116615201314 dated 31/10/2013 as prescribed in Government Notification Revenue and Forest Department No Mudrank 2004/4125/CR 690/M-1, dated 31/12/2004."

Service Tax Registration No.: AABCH0738EST004. IMPORTANT NOTICE: The Insured is not indemnified if the vehicle is used or driven otherwise than in accordance with this Schedule. Any payment made by the

Company by reason of wider terms appearing in the Certificate in order to comply with the Motor Vehicle Act, 1988 is recoverable from the Insured. See the clause headed "AVOIDANCE OF CERTAIN TERMS AND

RIGHT OF RECOVERY." Disclaimer: The Policy shall be void from inception if the premium cheque is not realized. In the event of misrepresentation, fraud or non-disclosure of material fact, the Company reserves

the right to cancel the Policy from inception.

Policy Issuing Office : LEELA BUSINESS PARK, 6TH FLR, ANDHERI - KURLA RD, MUMBAI, 400059.

Phone No. : +91-22-66383600

Policy Issuing Office: Mumbai

Agent Name: HDFC BANK LTD

Agent Code: 200854080601 Tel No.: 91-22-28561818

For HDFC ERGO General Insurance Company Ltd.

Duly Constituted Attorney

Registered & Corporate Office: 1st Floor, 165-166 Backbay Reclamation, H. T . Parekh Marg, Churchgate, Mumbai - 400020. Customer Service Address: 6th Floor, Leela Business Park, Andheri Kurla Road,

Andheri (E), Mumbai - 400 059. Toll Free : 1800-2-700-700 (Accessible from India only) | Fax : 91 22 6638 3699 | care@hdfcergo.com | www.hdfcergo.com

Frequently Asked Questions (FAQs) - MOTOR INSURANCE

WHAT ARE THE MAJOR COVERS OF THE POLICY?

Loss or Damage to the Insured Vehicle caused due to:

a) Fire, explosion, self ignition or lightning.

b) Burglary, housebreaking or theft

c) All act of God perils like earthquake, flood, cyclone etc

d) Accidental external means, terrorism, riot and strike

Liability to Third Parties:

Provides cover for any legal liability arising out of the

use of the vehicle for:

a) Accidental death / injury to any third party

b) Any damage to property owned by third party

Personal Accident Cover:

The policy provides for mandatory Personal Accident cover for

owner driver and optional cover for passengers covering

accidental death and permanent total disability.

WHAT ARE THE MAJOR EXCLUSIONS IN THE POLICY?

a) General aging, wear & tear, mechanical or electrical breakdown, failure, depreciation,

g) Loss or damage to bonnet side parts, mudguard, bumpers, lamps, tyres, tubes

any consequential loss

headlights, paint work (applicable for all commercial vehicles; unless opted additionally)

b) Damage by a person driving without a valid license

h) Loss or damage resulting from overturning arising out of operation as a tool

c) Damage by a person driving under the influence of liquor or drugs

(applicable for mobile cranes, drilling rigs, mobile plants, navvies, shovels, grabs,

d) Loss/damage attributable to war, mutiny, nuclear risks

rippers unless opted for additionally)

e) Damage to tyres and tubes, unless damaged during an accident

i) Loss of or damage to accessories by burglary housebreaking or theft unless the

f) Usage on hire & reward (applicable for all classes expect public commercial vehicles)

vehicle is stolen at the same time (applicable to all commercial vehicles & two wheelers)

WHAT DO I DO IN CASE OF A CLAIM?

1.

a)

b)

c)

d)

e)

DETAILS TO KEEP HANDY WHILE REGISTERING A CLAIM

Policy No.

Registration details / RC copy

Drivers details at the time of accident including driving license number

FIR on a case to case basis

Repair estimate

2. HOW DO I FILE A CLAIM?

For Accidental Damage to Insured Vehicle (Own Damage Claims):

a) Call our customer care Toll-free 1800-2-700-700 if the vehicle meets with an accident

b) Provide your policy number for reference and register the claim

c) If your vehicle can be driven, take it to the nearest dealer / garage

d) Get a repair estimate,fill up the claim form and attach a copy of the registration

Certificate driving license ofthe person driving at thetimeof the accident

e) If the garage is within our network, you could avail of cashless claim facility. Pay for non

accident related repairs, depreciation and deductible. We would settle the rest.

f) If the garage is outside our network, you would have to get the claim reimbursed

subsequently.

g) Sign the repairers satisfaction voucher and drive off!

4.

a)

b)

c)

d)

e)

f)

CLAIMS DOCUMENTS: IN CASE OF LOSS DUE TO THEFT

Duly filled and signed claim form & discharge voucher ( after loss settlement )

Original Registration Certificate (RC)

Original policy copy

Copy of FIR lodged at the nearest police station

All original keys & vehicle invoice copy

No trace report confirming that the stolen vehicle is not traceable

3. CLAIMS DOCUMENTS - IN CASE OF ACCIDENTAL DAMAGE TO INSURED

VEHICLE

a) Duly filled and signed claim form & satisfaction voucher

b) Registration Certificate (RC)

c) Driving license of the person driving at the time of the accident

d) Policy copy , original repair estimate, repair invoice

e) Payment receipt for non-cashless claims

f) Original repair invoice for cashless claims

g) AML documents for amount more than 1 lac (PAN card, 2 passport size photo,

residence proof).

h) Form 35 & original NOC from financer incase of total loss where payment is made

to insured.

i) A copy of police FIR/panchnama is required for TP injury/death/property damage

Additional documents required for commercial vehicles:

a)

b)

c)

d)

Spot survey

Load challan

Fitness certificate

Route permit

Original NOC from financer incase of hypothecation / HPA

Intimation to RTO for theft of vehicle

Duly signed RTO transfer papers (Form 26, 28,29,30,35)

RC extract with stolen remark from the concerned RTO after the loss

AML documents for amount more than 1 lac (PAN card, 2 passport size photo,

residence proof).

l) Deed of subrogation cum indemnity on judicial stamp paper.

HOW DO I MAKE CHANGES IN MY POLICY (ENDORSEMENTS)?

1. Changes related to registration of vehicle or vehicle details like:

2. For addition of electrical and non electrical accessories/CNG & LPG Kit:

a) Correction in registration number/ location / address

Correction in vehicle make & model / cubic capacity / seating capacity/ engine & chassis

b)

number / year of manufacture

Documents Required:

a) Request letter for the change b) Policy copy c) Registration Certificate copy

3. Documents required to change financier details

(Hypothecation/Lease/Hire-Purchase)

a) Request letter for the change

b) Policy copy

c) Endorsed Registration Certificate copy

d) NOC from financier (not mandatory for deletion if RC is endorsed)

g)

h)

i)

j)

k)

a) Request letter for the change

b) Policy copy

c) Invoice copy (mandatory where value of accessory exceeds ` 20,000/-)

d) Endorsed Registration Certificate Copy (For CNG/LPG kit)

e) Cheque for additional premium

Call us for additional premium details & send relevant documents copy to our corporate

office

4. Changes / Correction in Policy Holder's Name / Correspondence Address /

Contact Numbers / E-mail id / any other changes:

E mail us at : care@hdfcergo.com OR

Call Toll-free: 1800 2 700 700 / 1800 226 226 OR

Fax your request at: 022 6638 3669

HOW DO I RENEW MY POLICY?

HOW DO I RENEW MY POLICY?

a) Visitwww.hdfcergo.com to renew instantly online.

b) SMS"RENEW <POLICY NO> " to 9999 700700

c) Visit our nearest branch / your agent

d) Send a copy of the renewal notice along with premium cheque to our branch office /

Corporate office

e) Call our toll free number 1800 2 700 700 / 1800 226 226.

Manage Your Portfolio

@ hdfcergo.com /

Smartphones*

Call Toll-free

Fax

E-Mail

Write to us at

View your policy details

Link multiple policies of yourself and your loved ones

Change your personal details on the go

:

:

:

:

1800 2 700 700 / 1800 226 226

022 6638 3669

care@hdfcergo.com

HDFC ERGO General Insurance Company Limited

6th floor, Leela Business Park, Andheri Kurla Road,

Andheri(East), Mumbai - 400 059

Track your claims online whenever the need arises

Raise service request / complaints & set renewal reminders

Information about branches, garages and hospitals

* supports smart phones based on Blackberry, iPhone, Android & Symbian platforms

This document is a summary of the benefits offered. The information mentioned above is illustrative and not exhaustive. Information must be read in conjunction with the policy wordings.

In case of any conflict between this document and the policy wordings, the terms and conditions mentioned in the policy wordings shall prevail.

You might also like

- Vehicle Insurance Policy FormatDocument4 pagesVehicle Insurance Policy Formatarunavonline_947835049% (59)

- XCD InsuranceDocument3 pagesXCD Insuranceabhiin4No ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- MOTOR INSURANCE CERTIFICATEDocument3 pagesMOTOR INSURANCE CERTIFICATEJagateeswaran KanagarajNo ratings yet

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument3 pagesIffco-Tokio General Insurance Co - LTD: Servicing Officevijay_sudha50% (2)

- New Bajaj Policies PDFDocument11 pagesNew Bajaj Policies PDFexcel.syed0% (1)

- HDFC ERGO car insurance policy detailsDocument1 pageHDFC ERGO car insurance policy detailsHarsh Sahrawat100% (3)

- Two-wheeler insurance policy detailsDocument3 pagesTwo-wheeler insurance policy detailsSureshNo ratings yet

- Mantra Pushpam Telugu LargeDocument3 pagesMantra Pushpam Telugu Largekotesh13250% (4)

- Bike Insurance PDFDocument2 pagesBike Insurance PDFChaudharyShubhamSachan46% (85)

- 1799 InsuranceDocument1 page1799 InsuranceDeepak SudhakaranNo ratings yet

- Two Wheeler PA ProposalDocument3 pagesTwo Wheeler PA Proposalmurali9026100% (1)

- Icici LombardDocument1 pageIcici LombardTony Jacob33% (3)

- Sunrise Logisticks - 1Document2 pagesSunrise Logisticks - 1niren4u1567100% (2)

- Reliance Private Car Vehicle Certificate Cum Policy ScheduleDocument3 pagesReliance Private Car Vehicle Certificate Cum Policy ScheduleMatthew Smith100% (5)

- Thunderbird Twinspark Insurance2014Document4 pagesThunderbird Twinspark Insurance2014vijaybk73No ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2312 2006 7301 2900 000Document4 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2312 2006 7301 2900 000Ameer SyedNo ratings yet

- mh43x8786 Xylo E6Document4 pagesmh43x8786 Xylo E6Asif ShaikhNo ratings yet

- InsuranceDocument1 pageInsuranceOmkar TrivediNo ratings yet

- Two Wheeler Insurance Policy DetailsDocument2 pagesTwo Wheeler Insurance Policy DetailsAnil Kumar56% (41)

- Harpriti PolicyDocument1 pageHarpriti PolicyIASkanhaNo ratings yet

- Car Insurance RenewalDocument2 pagesCar Insurance Renewalpavnishsharma33% (3)

- 2312100095928100000Document2 pages2312100095928100000Kavin Prakash100% (2)

- AwesomeDocument2 pagesAwesomeAmit BanerjeeNo ratings yet

- HDFC ERGO Two Wheeler Insurance Policy DetailsDocument2 pagesHDFC ERGO Two Wheeler Insurance Policy Detailssachinkulsh_1No ratings yet

- Motor Write Up - ShortDocument3 pagesMotor Write Up - ShortqwertyNo ratings yet

- Gccv-Public Carriers Other Than Three Wheelers Package Policy - Zone C Motor Insurance Certificate Cum Policy ScheduleDocument51 pagesGccv-Public Carriers Other Than Three Wheelers Package Policy - Zone C Motor Insurance Certificate Cum Policy Schedulejpeg143No ratings yet

- Bike PolicyDocument2 pagesBike PolicyAdhwareshBharadwaj100% (2)

- Auto Insurance: What You Need and Why You Need ItDocument44 pagesAuto Insurance: What You Need and Why You Need ItHimanshu KhuranaNo ratings yet

- NgrgnddaDocument15 pagesNgrgnddajustinsitohjsNo ratings yet

- Surendrakumarmishra SulDocument1 pageSurendrakumarmishra SulRavi Kumar33% (3)

- Two Wheeler Insurance CertificateDocument1 pageTwo Wheeler Insurance CertificatesareenckNo ratings yet

- Motorised-Two Wheelers Package Policy - Zone A Motor Insurance Certificate Cum Policy ScheduleDocument3 pagesMotorised-Two Wheelers Package Policy - Zone A Motor Insurance Certificate Cum Policy Schedulekrishna_1238No ratings yet

- Tata AIG General Insurance Co. LTD.: IRDA Registration No: 108 Two Wheeler Package PolicyDocument2 pagesTata AIG General Insurance Co. LTD.: IRDA Registration No: 108 Two Wheeler Package PolicyRapoluSivaNo ratings yet

- Can Insorance SampleDocument19 pagesCan Insorance Samplepradeep singh karkiNo ratings yet

- PolicySchedule 14802939 20230402 144942Document4 pagesPolicySchedule 14802939 20230402 144942Acgleasing ltdNo ratings yet

- Chandrasenan Shine Done Aug 2014Document12 pagesChandrasenan Shine Done Aug 2014chinnuNo ratings yet

- South Arcot policy detailsDocument2 pagesSouth Arcot policy detailsVenkatachalamNo ratings yet

- IRDA Regn No - 137 Motorised Two-Wheeler PolicyDocument1 pageIRDA Regn No - 137 Motorised Two-Wheeler PolicyVimalMalviyaNo ratings yet

- MOTOR INSURANCE CERTIFICATE FOR TWO-WHEELERDocument18 pagesMOTOR INSURANCE CERTIFICATE FOR TWO-WHEELERRaghavendra KNo ratings yet

- Polo 30017392506500000Document1 pagePolo 30017392506500000niren4u1567No ratings yet

- Midnight of 01-1-2015 Cubic Capacity: Issued Through Nsureplus Application SoftwareDocument2 pagesMidnight of 01-1-2015 Cubic Capacity: Issued Through Nsureplus Application Softwareavinash9085No ratings yet

- Motorised-Two Wheelers Package Policy - Zone A Motor Insurance Certificate Cum Policy ScheduleDocument3 pagesMotorised-Two Wheelers Package Policy - Zone A Motor Insurance Certificate Cum Policy ScheduleSelva KumarNo ratings yet

- Shashi Kant Policy PDFDocument1 pageShashi Kant Policy PDFJamie Jordan100% (1)

- Tata AigDocument4 pagesTata AigHarpal Singh MassanNo ratings yet

- Document InsuranceDocument23 pagesDocument InsurancePriti PathakNo ratings yet

- B0512753 V3383925 00000 00000 00001 00130976 FPV Schedule ScheduleDocument1 pageB0512753 V3383925 00000 00000 00001 00130976 FPV Schedule ScheduleshakilNo ratings yet

- Bajaj Two Wheeler Insurance Certificate SummaryDocument2 pagesBajaj Two Wheeler Insurance Certificate SummarySantosh Baratam0% (1)

- Iffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017Document3 pagesIffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017ams20110% (1)

- S M Asloob.Document2 pagesS M Asloob.saikripa1210% (1)

- 4 24 20145 07 53PM PDFDocument2 pages4 24 20145 07 53PM PDFpawarkamal5No ratings yet

- TWO WHEELER PACKAGE POLICY COVER NOTEDocument2 pagesTWO WHEELER PACKAGE POLICY COVER NOTEMIKE4U4No ratings yet

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument3 pagesIffco-Tokio General Insurance Co - LTD: Servicing OfficeAnonymous pKsr5vNo ratings yet

- Motor Insurance Underwriting: in House Training Program On "Basic Course On General Insurance"Document26 pagesMotor Insurance Underwriting: in House Training Program On "Basic Course On General Insurance"Raj HuqeNo ratings yet

- Dublicate InsuranceDocument4 pagesDublicate InsuranceAbubakarsiddiq FruitwalaNo ratings yet

- m4 3fDocument19 pagesm4 3fPraveen KumarNo ratings yet

- RA3550Document1 pageRA3550Patel DipenNo ratings yet

- INSURANCE POLICY SCHEDULE AND CERTIFICATEDocument3 pagesINSURANCE POLICY SCHEDULE AND CERTIFICATESeetha ChimakurthiNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- CDL Study Guide: Guide on hazardous materials, chamber vehicles and basic vehicle control skillsFrom EverandCDL Study Guide: Guide on hazardous materials, chamber vehicles and basic vehicle control skillsNo ratings yet

- CDL Study Guide: Complete manual from A to Z on everything you need to know to pass the commercial driver's license examFrom EverandCDL Study Guide: Complete manual from A to Z on everything you need to know to pass the commercial driver's license examNo ratings yet

- Semaphores in SystemVerilog With ExamplesDocument6 pagesSemaphores in SystemVerilog With ExamplesSatish BojjawarNo ratings yet

- Thumbnails - GATE 2020 YoutubeDocument23 pagesThumbnails - GATE 2020 YoutubeSatish BojjawarNo ratings yet

- Simple Examples Using RandomizationDocument8 pagesSimple Examples Using RandomizationSatish BojjawarNo ratings yet

- Thumbnails - GATE 2020 YoutubeDocument23 pagesThumbnails - GATE 2020 YoutubeSatish BojjawarNo ratings yet

- Simple Examples Using RandomizationDocument8 pagesSimple Examples Using RandomizationSatish BojjawarNo ratings yet

- Problem Set 1 - EDCDocument9 pagesProblem Set 1 - EDCSatish BojjawarNo ratings yet

- Mailbox & Semaphores in SystemVerilog With ExamplesDocument22 pagesMailbox & Semaphores in SystemVerilog With ExamplesSatish BojjawarNo ratings yet

- FDP Certificate for Control Theory ParticipationDocument1 pageFDP Certificate for Control Theory ParticipationSatish BojjawarNo ratings yet

- Satish Bojjawar PDFDocument1 pageSatish Bojjawar PDFSatish BojjawarNo ratings yet

- Claim FormDocument4 pagesClaim FormSatish BojjawarNo ratings yet

- High Frequency Analysis of BJTDocument32 pagesHigh Frequency Analysis of BJTSatish BojjawarNo ratings yet

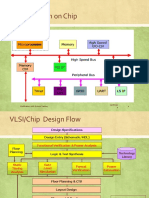

- Soc Verif Udemy Lect 2 SOC Design FlowDocument3 pagesSoc Verif Udemy Lect 2 SOC Design FlowSatish BojjawarNo ratings yet

- Instructions For Course and AssignmentsDocument4 pagesInstructions For Course and AssignmentsSharanyaNo ratings yet

- Chapter 2Document23 pagesChapter 2DrGaurav SinghNo ratings yet

- Sub Threshold Region Modeling and EquationsDocument9 pagesSub Threshold Region Modeling and EquationsSatish BojjawarNo ratings yet

- Cmos InverterDocument32 pagesCmos InverterSatish BojjawarNo ratings yet

- Grade 1 Holiday Home WorkDocument4 pagesGrade 1 Holiday Home WorkSatish BojjawarNo ratings yet

- Low Power Sigma Delta ADC Design for Broadband CommunicationsDocument5 pagesLow Power Sigma Delta ADC Design for Broadband CommunicationsSatish BojjawarNo ratings yet

- Claim FormDocument5 pagesClaim Formwawawa1No ratings yet

- Mantra Pushpam Telugu LargeDocument2 pagesMantra Pushpam Telugu LargeSatish BojjawarNo ratings yet

- LST AssignmentsDocument8 pagesLST AssignmentsSatish BojjawarNo ratings yet

- Freelook Request Format: Date: Policy NumberDocument2 pagesFreelook Request Format: Date: Policy NumberSatish BojjawarNo ratings yet

- 3 - Organization of Intel 8086Document10 pages3 - Organization of Intel 8086linhanumaNo ratings yet

- Weeks 9-10-11 Input/Output Interface Circuits and LSI Peripheral DevicesDocument80 pagesWeeks 9-10-11 Input/Output Interface Circuits and LSI Peripheral Devicesramen4narutoNo ratings yet

- Differential Pair Using MOS TransistorsDocument5 pagesDifferential Pair Using MOS TransistorsSatish BojjawarNo ratings yet

- Mock Gate Offline 5Document14 pagesMock Gate Offline 5Satish BojjawarNo ratings yet

- A Systematic Approach For Preparing The Technical Programmes For Nba Accreditation28!2!2014!18!52 - 27Document19 pagesA Systematic Approach For Preparing The Technical Programmes For Nba Accreditation28!2!2014!18!52 - 27Anburaj JamesNo ratings yet

- T:T-Yuu,: ,.XR Q. Hi Tr,. :,: ,) DH ' TDocument13 pagesT:T-Yuu,: ,.XR Q. Hi Tr,. :,: ,) DH ' TMohammed ThawfeeqNo ratings yet

- Lecture Notes on Mobile Communication SystemsDocument181 pagesLecture Notes on Mobile Communication SystemsUsama LatifNo ratings yet