Professional Documents

Culture Documents

Perfect & Son - Partially Owned Working Paper

Perfect & Son - Partially Owned Working Paper

Uploaded by

Kristine Astorga-NgCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Perfect & Son - Partially Owned Working Paper

Perfect & Son - Partially Owned Working Paper

Uploaded by

Kristine Astorga-NgCopyright:

Available Formats

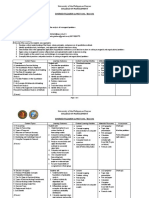

PROBLEM 16-6

Perfect Corporation and Subsidiary

Consolidated Working Paper

Year Ended December 31, 2014 FIRST YEAR

Perfect

Corporation

Statement of CI

Sales

Dividend Income

Total Revenue

COGS

Interest expenses

Depreciation Expense

Other expenses

Goodwill Impairment

Loss

Total cost and

expenses

Net/Consolidated

Income

NCI in CI of subsidiary

CI, carried forward

Statement of R/E

Retained earnings, Jan 1

P

S

CI From above

Dividends declared

P

S

Retained earnings,

Dec 31

Statement of FP

Cash

Accounts Receivable

Inventory

Land

Equipment

Less: Accumulated

Depreciation-Equipment

Building

Less: Accumulated

Depreciation-Building

Goodwill

Investment in Son

Son

Company

400,000

24,000

424,000

200,000

170,000

115,000

50,000

40,000

20,000

15,000

Eliminations & Adjustments

Debit

Credit

Consolidated

600,000

(1)24,000

200,000

600,000

(4)5,000

(4)1,000

(4)5,000

290,000

1,000

75,000

55,000

3,125

(4)3,125

260,000

150,000

424,125

164,000

30,000

175,875

164,000

50,000

(5)7,175

(7,175)

168,700

300,000

300,000

100,000

164,000

(2)100,000

50,000

168,700

(60,000)

(60,000)

404,000

(30,000)

120,000

194,000

75,000

100,000

175,000

200,000

(112,500)

75,000

50,000

75,000

40,000

150,000

(80,000)

600,000

(337,500)

450,000

(240,000)

(1)30,000

408,700

(3)5,000

(3)6,000

(4)5,000

(3)80,000

(4)10,000

(3)160,000

(4)5,000

(3)12,500

310,000

269,000

125,000

175,000

221,000

350,000

(122,500)

(3)180,000

870,000

(412,500)

(4)3,125

(2)240,000

(3)70,000

9,375

-

TOTAL ASSETS

1,204,000

520,000

1.484,375

Accounts Payable

Bonds Payable

Less:Discount on Bonds

Common stock

P

S

Retained Earnings, from

SRE

NCI

100,000

200,000

100,000

100,000

200,000

300,000

(3,000)

TOTAL LIAB & EQUITY

1,204,000

(3)4,000

(4)1000

500,000

404,000

500,000

200,000

120,000

(2)200,000

408,700

(1)6,000

520,000

166,000

(2)60,000

(3)17,500

(5)7,175

166,000

78,675

1,484,375

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Tax On Transfer of Real PropertiesDocument8 pagesTax On Transfer of Real PropertiesKristine Astorga-NgNo ratings yet

- WWF CASE STUDY PAPER Without Proper FormatDocument58 pagesWWF CASE STUDY PAPER Without Proper FormatKristine Astorga-Ng56% (16)

- Term Paper FinanceDocument49 pagesTerm Paper FinanceKristine Astorga-NgNo ratings yet

- Full PFRS Pfrs For Smes: Directly Attributable To TheDocument12 pagesFull PFRS Pfrs For Smes: Directly Attributable To TheKristine Astorga-NgNo ratings yet

- Topic and InstructionDocument3 pagesTopic and InstructionKristine Astorga-NgNo ratings yet

- SPACE NarrativesDocument2 pagesSPACE NarrativesKristine Astorga-Ng100% (1)

- Kristine R. AstorgaDocument1 pageKristine R. AstorgaKristine Astorga-NgNo ratings yet

- Student/Peer Evaluation Form: (Begin With Your Own)Document1 pageStudent/Peer Evaluation Form: (Begin With Your Own)Kristine Astorga-NgNo ratings yet

- Bustillo Wins 2nd Runner Up in Accounting QuizbeeDocument1 pageBustillo Wins 2nd Runner Up in Accounting QuizbeeKristine Astorga-NgNo ratings yet

- Company Study OutlineDocument2 pagesCompany Study OutlineKristine Astorga-NgNo ratings yet

- Charlie Chaplin: Modern Times: A Reaction PaperDocument3 pagesCharlie Chaplin: Modern Times: A Reaction PaperKristine Astorga-NgNo ratings yet

- Weekly InvestmentDocument1 pageWeekly InvestmentKristine Astorga-NgNo ratings yet

- For BegurlDocument3 pagesFor BegurlKristine Astorga-NgNo ratings yet

- Statement of CI: Total Revenue 319,000 150,000 450,000Document2 pagesStatement of CI: Total Revenue 319,000 150,000 450,000Kristine Astorga-NgNo ratings yet

- Audit QuizDocument12 pagesAudit QuizKristine Astorga-NgNo ratings yet

- Strategy Adaptablity Issues For Zest Improved Average Aircraft Utilization RatesDocument1 pageStrategy Adaptablity Issues For Zest Improved Average Aircraft Utilization RatesKristine Astorga-NgNo ratings yet

- Chairman: Donald G. DeeDocument2 pagesChairman: Donald G. DeeKristine Astorga-NgNo ratings yet

- History of Zest Airways The Establishment of AEC and Asian Spirit IncDocument3 pagesHistory of Zest Airways The Establishment of AEC and Asian Spirit IncKristine Astorga-NgNo ratings yet

- MGT 181 Syllabus OBE Jan2016-FDDocument6 pagesMGT 181 Syllabus OBE Jan2016-FDKristine Astorga-NgNo ratings yet