Professional Documents

Culture Documents

Total Information Bird

Uploaded by

Ganesh KaleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Total Information Bird

Uploaded by

Ganesh KaleCopyright:

Available Formats

Causes of Inflation

A sustained rise in the prices of commodities that leads to a fall in the

purchasing power of a nation is called inflation. Although inflation is part of

the normal economic phenomena of any country, any increase in inflation

above a predetermined level is a cause of concern.

High levels of inflation distort economic performance, making it mandatory to identify

the causing factors. Several internal and external factors, such as the printing of more

money by the government, a rise in production and labor costs, high lending levels, a

drop in the exchange rate, increased taxes or wars, can cause inflation.

Different schools of thought provide different views on what actually causes inflation.

However, there is a general agreement amongst economists that economic inflation may

be caused by either an increase in the money supply or a decrease in the quantity of

goods being supplied.The proponents of the Demand Pull theory attribute a rise in prices

to an increase in demand in excess of the supplies available. An increase in the quantity

of money in circulation relative to the ability of the economy to supply leads to increased

demand, thereby fuelling prices. The case is of too much money chasing too few goods.

An increase in demand could also be a result of declining interest rates, a cut in tax rates

or increased consumer confidence.

The Cost Push theory, on the other hand, states that inflation occurs when the cost of

producing rises and the increase is passed on to consumers. The cost of production can

rise because of rising labor costs or when the producing firm is a monopoly or oligopoly

and raises prices, cost of imported raw material rises due to exchange rate changes, and

external factors, such as natural calamities or an increase in the economic power of a

certain country.

An increase in indirect taxes can also lead to increased production costs. A classic

example of cost-push or supply-shock inflation is the oil crisis that occurred in the 1970s,

after the OPEC raised oil prices. The US saw double digit inflation levels during this

period. Since oil is used in every industry, a sharp rise in the price of oil leads to an

increase in the prices of all commodities.

While money growth is considered to be a principal long-term determinant of inflation,

non-monetary sources, such as an increase in commodity prices, have played a key role

in triggering inflation in the past four decades.

Inflation has become a major concern worldwide in 2008, with global prices rises in oil,

food, steel and other commodities being the culprit.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Monetary EconomicsDocument14 pagesMonetary EconomicsMarco Antonio Tumiri López0% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Quantity Theory of Money A RestatementDocument20 pagesThe Quantity Theory of Money A RestatementErnesto MoriartyNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sem-II Book INTRODUCTORY MACROECONOMICSDocument68 pagesSem-II Book INTRODUCTORY MACROECONOMICSanushkaNo ratings yet

- Fiscal Policy in IslamDocument343 pagesFiscal Policy in Islamzafir_123No ratings yet

- Display Raj PatraDocument2 pagesDisplay Raj PatraŚáńtőśh MőkáśhíNo ratings yet

- MCGM PF SlipDocument2 pagesMCGM PF SlipŚáńtőśh Mőkáśhí100% (3)

- Badminton: Cleanliness SloganDocument3 pagesBadminton: Cleanliness SloganŚáńtőśh MőkáśhíNo ratings yet

- Maharashtra Rain Ahawal + 2 PhotosDocument2 pagesMaharashtra Rain Ahawal + 2 PhotosŚáńtőśh MőkáśhíNo ratings yet

- Daily tasks and responsibilities of McCafe staffDocument1 pageDaily tasks and responsibilities of McCafe staffŚáńtőśh MőkáśhíNo ratings yet

- At Home + School + PlaygroundDocument1 pageAt Home + School + PlaygroundŚáńtőśh MőkáśhíNo ratings yet

- Where Do Roses GrowDocument3 pagesWhere Do Roses GrowŚáńtőśh MőkáśhíNo ratings yet

- Corruption's Big Threat to Societal Well-BeingDocument2 pagesCorruption's Big Threat to Societal Well-BeingŚáńtőśh MőkáśhíNo ratings yet

- Group 4Document34 pagesGroup 4Śáńtőśh MőkáśhíNo ratings yet

- The India of My DreamsDocument1 pageThe India of My DreamsŚáńtőśh MőkáśhíNo ratings yet

- Corvus (genus) - Characteristics of Crows and RavensDocument5 pagesCorvus (genus) - Characteristics of Crows and RavensŚáńtőśh MőkáśhíNo ratings yet

- Front PageDocument4 pagesFront PageŚáńtőśh MőkáśhíNo ratings yet

- IndiaDocument3 pagesIndiaGanesh KaleNo ratings yet

- 10 Common Plants in EuropeDocument7 pages10 Common Plants in EuropeŚáńtőśh MőkáśhíNo ratings yet

- Car Reverse Horn Circuit GuideDocument8 pagesCar Reverse Horn Circuit GuideŚáńtőśh MőkáśhíNo ratings yet

- Curriculum Vitae: Personal ProfileDocument2 pagesCurriculum Vitae: Personal ProfileŚáńtőśh MőkáśhíNo ratings yet

- Lec5 6Document35 pagesLec5 6priyasanthakumaranNo ratings yet

- Swami Vivekananda: Bengali: BengaliDocument1 pageSwami Vivekananda: Bengali: BengaliŚáńtőśh MőkáśhíNo ratings yet

- Instituteinformation2011 Engg PDFDocument113 pagesInstituteinformation2011 Engg PDFŚáńtőśh MőkáśhíNo ratings yet

- Curriculum Vitae: Sushant Suresh VajeDocument3 pagesCurriculum Vitae: Sushant Suresh VajeŚáńtőśh MőkáśhíNo ratings yet

- Curriculum Vitae: Personal ProfileDocument2 pagesCurriculum Vitae: Personal ProfileŚáńtőśh MőkáśhíNo ratings yet

- Water Supply and Sanitation: Railway Advantages: 1. DependableDocument2 pagesWater Supply and Sanitation: Railway Advantages: 1. DependableŚáńtőśh MőkáśhíNo ratings yet

- Rohan Dilip Milkhe: Residential & Permanent AddressDocument2 pagesRohan Dilip Milkhe: Residential & Permanent AddressŚáńtőśh MőkáśhíNo ratings yet

- App 27802794462079Document2 pagesApp 27802794462079Śáńtőśh MőkáśhíNo ratings yet

- Curriculum Vitae: Personal ProfileDocument2 pagesCurriculum Vitae: Personal ProfileŚáńtőśh MőkáśhíNo ratings yet

- Baithe KhelDocument1 pageBaithe KhelŚáńtőśh MőkáśhíNo ratings yet

- No 2-Part2-4 India PDFDocument27 pagesNo 2-Part2-4 India PDFŚáńtőśh MőkáśhíNo ratings yet

- Curriculum Vitae: Personal ProfileDocument2 pagesCurriculum Vitae: Personal ProfileŚáńtőśh MőkáśhíNo ratings yet

- Curriculum Vitae: Personal ProfileDocument2 pagesCurriculum Vitae: Personal ProfileŚáńtőśh MőkáśhíNo ratings yet

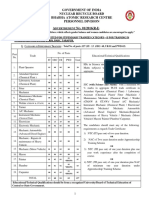

- Government of India Nuclear Recycle Board Bhabha Atomic Research Centre Personnel Division A N - 01/2016 (R-I)Document7 pagesGovernment of India Nuclear Recycle Board Bhabha Atomic Research Centre Personnel Division A N - 01/2016 (R-I)Śáńtőśh MőkáśhíNo ratings yet

- The Bretton Woods Committee: The Russian Capital MarketDocument30 pagesThe Bretton Woods Committee: The Russian Capital MarketDevhuti Nandan Sharan MishraNo ratings yet

- Teaching Money Creation and Monetary PolicyDocument21 pagesTeaching Money Creation and Monetary PolicyJuan Diego González Bustillo100% (1)

- Monetary and Fiscal PolicyDocument31 pagesMonetary and Fiscal PolicyprasadzinjurdeNo ratings yet

- Monetary policy components and objectivesDocument18 pagesMonetary policy components and objectivesrenisha gargNo ratings yet

- EconomicsDocument241 pagesEconomicsSumit Dhall100% (2)

- Macrohw1spring20 SolDocument6 pagesMacrohw1spring20 SolFarishta MuradNo ratings yet

- BAM Quiz 6Document15 pagesBAM Quiz 6Nads MemerNo ratings yet

- ECB monetary analysis enhances understanding of money and pricesDocument64 pagesECB monetary analysis enhances understanding of money and pricesGuido TrovatoNo ratings yet

- Mankiw Skeptics Guide To Modern Monetary Theory PDFDocument9 pagesMankiw Skeptics Guide To Modern Monetary Theory PDFFiel Aldous EvidenteNo ratings yet

- ECOTAXA PrefinalsDocument5 pagesECOTAXA PrefinalsandyNo ratings yet

- Money and Banking: Chapter - 8Document32 pagesMoney and Banking: Chapter - 8Kaushik NarayananNo ratings yet

- Monetary Policy and The Federal Reserve: Current Policy and ConditionsDocument25 pagesMonetary Policy and The Federal Reserve: Current Policy and ConditionsJithinNo ratings yet

- w10 112 v1Document22 pagesw10 112 v1Rusty ButlerNo ratings yet

- Money Supply, Components and MeasurementsDocument6 pagesMoney Supply, Components and MeasurementsTaariniNo ratings yet

- Pakistan Economic Survey 2010-11Document392 pagesPakistan Economic Survey 2010-11raza9871No ratings yet

- Determination of Value of MoneyDocument17 pagesDetermination of Value of Moneymuhammad farhan100% (1)

- IS LM CurveDocument29 pagesIS LM CurveutsavNo ratings yet

- State Bank of Pakistan Central Bank Role, Functions & Monetary Policy ToolsDocument25 pagesState Bank of Pakistan Central Bank Role, Functions & Monetary Policy ToolsTariq Abbasi50% (2)

- Main WordDocument25 pagesMain Wordvipul sutharNo ratings yet

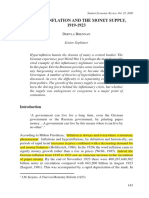

- German Inflation and The Money Supply, 1919-1923: Ervla RennanDocument9 pagesGerman Inflation and The Money Supply, 1919-1923: Ervla RennanBhargavNo ratings yet

- 2 History of Philippine Currency & Philippine Monetary Standards PDFDocument86 pages2 History of Philippine Currency & Philippine Monetary Standards PDFRodel Novesteras ClausNo ratings yet

- Economic 100B Macroeconomic Analysis Professor Steven Wood: Exam #2 ANSWERSDocument10 pagesEconomic 100B Macroeconomic Analysis Professor Steven Wood: Exam #2 ANSWERSEmmanuel MbonaNo ratings yet

- Hayek Vs Keynes - A ComparisonDocument4 pagesHayek Vs Keynes - A ComparisonIttisha SarahNo ratings yet

- The Nature and Functions of MoneyDocument18 pagesThe Nature and Functions of MoneyCafe MusicNo ratings yet

- 1.banking Theory and Practice Notes-1Document435 pages1.banking Theory and Practice Notes-1JOSIANENo ratings yet

- Summary Ch.9 MankiwDocument3 pagesSummary Ch.9 MankiwExza XNo ratings yet