Professional Documents

Culture Documents

Gender Based Income Tax - HW

Gender Based Income Tax - HW

Uploaded by

wonderingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gender Based Income Tax - HW

Gender Based Income Tax - HW

Uploaded by

wonderingCopyright:

Available Formats

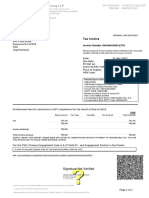

GENDER BASED INCOME TAX

ID Code

C001

C002

C003

C004

C005

C006

C007

C008

C009

C010

Status

SNo

Sex &

Category

SnCNo

R

R

NR

D

D

R

R

NR

D

D

1

1

2

4

4

1

1

2

4

4

MN

MS

MM

FS

FN

MN

FM

MM

MN

FN

1

3

2

6

4

1

5

2

1

4

Gross Income Standard

(Rs.)

Deduction

100,000

200,000

60,000

75,000

600,000

900,500

1,100,000

545,000

456,000

347,000

100000

200000

0

120000

60000

100000

170000

0

50000

60000

Taxable

Income

0

0

60000

0

540000

800500

930000

545000

406000

287000

Standard Deduction Norms

R

NR

N

D

Tax

Rate

1

3

2

6

4

1

5

2

1

4

Tax Payable

0

0

20

0

20

30

10

20

30

20

Rs. '000

Normal (N)

100

0

0

50

Male (M)

Minority (M)

150

0

0

70

Normal (N)

0

5

25

30

Male (M)

Minority (M)

0

3

10

20

Female (F)

Senior (S)

Normal (N) Minority (M)

200

120

170

0

50

70

0

50

70

150

60

80

Senior (S)

200

100

100

120

Female (F)

Normal (N) Minority (M)

0

0

3

2

10

5

20

10

Senior (S)

0

0

2

5

Tax Rate Norms

<=50000

>50000 & <=100000

>100000 & <=500000

>500000

Tno

Per Cent

Senior (S)

0

2

5

8

Max tax payer n ID

240150

Tax Payable

0 C006

0

12000

0

108000

240150

93000

109000

121800

57400

ID Code

0 C001

0 C002

12000 C003

0 C004

108000 C005

240150 C006

93000 C007

109000 C008

121800 C009

57400 C010

Standard Deduction Norms

Rs. '000

MN

R

NR

N

D

100

0

0

50

Male (M)

MM

150

0

0

70

MS

FN

200

0

0

150

120

50

50

60

Female (F)

FM

170

70

70

80

FS

200

100

100

120

Tax Rate Norms

Per Cent

MN

<=50000

>50000 & <=100000

>100000 & <=500000

>500000

MM

0

5

25

30

0

3

10

20

Male (M)

MS

0

2

5

8

Female (F)

FN

FM

0

3

10

20

FS

0

2

5

10

0

0

2

5

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chandan Salary SlipDocument5 pagesChandan Salary SlipSumit BhardwajNo ratings yet

- Tax Invoice Cum Delivery ChallanDocument2 pagesTax Invoice Cum Delivery ChallanLazzieey RahulNo ratings yet

- Zudio Bill28 NovDocument4 pagesZudio Bill28 Novsachin gautamNo ratings yet

- Ferrer V Bautista (2015)Document4 pagesFerrer V Bautista (2015)Ralph Deric EspirituNo ratings yet

- Id-Jkt-Txz: C-DTPDocument8 pagesId-Jkt-Txz: C-DTPms. Nissa FourtaNo ratings yet

- Cir Vs Mirant Pagbilao CorporationDocument2 pagesCir Vs Mirant Pagbilao CorporationPeanutButter 'n Jelly100% (1)

- 2017 Transfer Pricing Overview For SlovakiaDocument12 pages2017 Transfer Pricing Overview For SlovakiaAccaceNo ratings yet

- Payment Payment: Colorado Individual Income Tax Filing GuideDocument40 pagesPayment Payment: Colorado Individual Income Tax Filing Guidestop recordsNo ratings yet

- Muster Roll Cum Wage RegisterDocument6 pagesMuster Roll Cum Wage Registervickyr070% (1)

- Tally - ERP 9 ContentDocument6 pagesTally - ERP 9 ContentRK & SONS PRODUCTIONNo ratings yet

- Partnership AllocationDocument63 pagesPartnership AllocationMitchelGramaticaNo ratings yet

- Final Exam TaxDocument3 pagesFinal Exam TaxMulugeta Akalu50% (4)

- Salary Slip (31692490 April, 2017)Document1 pageSalary Slip (31692490 April, 2017)Muhamm Jamshed Zarrar50% (2)

- DHYANIDocument2 pagesDHYANIVinodeshwar GandlaNo ratings yet

- OCTOBER 2021: PT. Shopee Internasional IndonesiaDocument1 pageOCTOBER 2021: PT. Shopee Internasional IndonesiaRifka FitrotuzzakiaNo ratings yet

- EY Invoice - ORG - IN91MH3M011376Document1 pageEY Invoice - ORG - IN91MH3M011376AltafNo ratings yet

- Boat InvoiceDocument1 pageBoat Invoiceadityashah0803No ratings yet

- Business and Transfer Taxes SylabusDocument13 pagesBusiness and Transfer Taxes SylabusagentnicNo ratings yet

- 07 - CLWTAXN Notes On Income TaxationDocument10 pages07 - CLWTAXN Notes On Income TaxationMichael Allen RodrigoNo ratings yet

- Philippine Tax CasesDocument10 pagesPhilippine Tax CasesCelineAbbeyMangalindanNo ratings yet

- View SyllabusDocument9 pagesView SyllabusMadhu kumarNo ratings yet

- Gepco Online BillDocument2 pagesGepco Online BillhamzaNo ratings yet

- GSTDocument59 pagesGSTkeval Chavan88% (8)

- Types of AssessmentDocument9 pagesTypes of AssessmentRasel AshrafulNo ratings yet

- Assignment For Tally PrimeDocument12 pagesAssignment For Tally PrimeSagarNo ratings yet

- S C Test Bank Income TaxationDocument135 pagesS C Test Bank Income Taxationthenikkitr50% (6)

- Highlighted in Re Zialcita, AM No. 90-6-015-SC, Oct. 18, 1990.htmlDocument4 pagesHighlighted in Re Zialcita, AM No. 90-6-015-SC, Oct. 18, 1990.htmlCharity RomagaNo ratings yet

- Tax Sale ListingsDocument18 pagesTax Sale ListingsmmelhamNo ratings yet

- Principles of Taxation Question Bank 2021Document243 pagesPrinciples of Taxation Question Bank 2021Khadeeza ShammeeNo ratings yet

- 693-2010 Income Tax Amendment ProclamationDocument3 pages693-2010 Income Tax Amendment ProclamationKassahunNo ratings yet