Professional Documents

Culture Documents

Taxation Trends in The European Union - 2011 - Booklet 33

Uploaded by

Dimitris ArgyriouOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Trends in The European Union - 2011 - Booklet 33

Uploaded by

Dimitris ArgyriouCopyright:

Available Formats

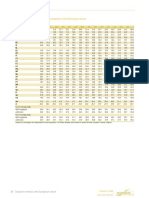

Annex A

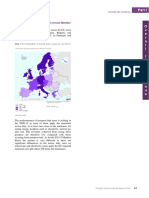

Table 3: Top statutory tax rate on personal income

1995-2011, in %

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

BE

60.6

60.6

60.6

60.6

60.6

60.6

60.1

56.4

53.7

53.7

53.7

53.7

53.7

53.7

53.7

53.7

53.7

BG

50.0

50.0

40.0

40.0

40.0

40.0

38.0

29.0

29.0

29.0

24.0

24.0

24.0

10.0

10.0

10.0

10.0

CZ

43.0

40.0

40.0

40.0

40.0

32.0

32.0

32.0

32.0

32.0

32.0

32.0

32.0

15.0

15.0

15.0

15.0

DK

63.5

62.0

62.9

61.4

61.1

59.7

59.6

59.8

59.8

59.0

59.0

59.0

59.0

59.0

59.0

51.5

51.5

DE

57.0

57.0

57.0

55.9

55.9

53.8

51.2

51.2

51.2

47.5

44.3

44.3

47.5

47.5

47.5

47.5

47.5

EE

26.0

26.0

26.0

26.0

26.0

26.0

26.0

26.0

26.0

26.0

24.0

23.0

22.0

21.0

21.0

21.0

21.0

IE

48.0

48.0

48.0

46.0

46.0

44.0

42.0

42.0

42.0

42.0

42.0

42.0

41.0

41.0

41.0

41.0

41.0

EL

45.0

45.0

45.0

45.0

45.0

45.0

42.5

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

45.0

45.0

ES

56.0

56.0

56.0

56.0

48.0

48.0

48.0

48.0

45.0

45.0

45.0

45.0

43.0

43.0

43.0

43.0

45.0

FR

59.1

59.6

57.7

59.0

59.0

59.0

58.3

57.8

54.8

53.4

53.5

45.8

45.8

45.8

45.8

45.8

46.7

IT

51.0

51.0

51.0

46.0

46.0

45.9

45.9

46.1

46.1

46.1

44.1

44.1

44.9

44.9

44.9

45.2

45.6

CY

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

30.0

30.0

30.0

30.0

30.0

30.0

30.0

30.0

30.0

LV

25.0

25.0

25.0

25.0

25.0

25.0

25.0

25.0

25.0

25.0

25.0

25.0

25.0

25.0

23.0

26.0

25.0

LT

33.0

33.0

33.0

33.0

33.0

33.0

33.0

33.0

33.0

33.0

33.0

27.0

27.0

24.0

15.0

15.0

15.0

LU

51.3

51.3

51.3

47.2

47.2

47.2

43.1

39.0

39.0

39.0

39.0

39.0

39.0

39.0

39.0

39.0

42.1

HU

44.0

44.0

44.0

44.0

44.0

44.0

40.0

40.0

40.0

38.0

38.0

36.0

40.0

40.0

40.0

40.6

20.3

MT

35.0

35.0

35.0

35.0

35.0

35.0

35.0

35.0

35.0

35.0

35.0

35.0

35.0

35.0

35.0

35.0

35.0

NL

60.0

60.0

60.0

60.0

60.0

60.0

52.0

52.0

52.0

52.0

52.0

52.0

52.0

52.0

52.0

52.0

52.0

AT

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

PL

45.0

45.0

44.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

32.0

32.0

32.0

PT

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

42.0

42.0

42.0

42.0

45.9

46.5

RO

40.0

40.0

40.0

48.0

40.0

40.0

40.0

40.0

40.0

40.0

16.0

16.0

16.0

16.0

16.0

16.0

16.0

SI

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

50.0

41.0

41.0

41.0

41.0

41.0

SK

42.0

42.0

42.0

42.0

42.0

42.0

42.0

38.0

38.0

19.0

19.0

19.0

19.0

19.0

19.0

19.0

19.0

FI

62.2

61.2

59.5

57.8

55.6

54.0

53.5

52.5

52.2

52.1

51.0

50.9

50.5

50.1

49.1

49.0

49.2

SE

61.3

61.4

54.4

56.7

53.6

51.5

53.1

55.5

54.7

56.5

56.6

56.6

56.6

56.4

56.4

56.4

56.4

UK

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

40.0

50.0

50.0

NO

41.7

41.7

41.7

41.7

41.5

47.5

47.5

47.5

47.5

47.5

43.5

40.0

40.0

40.0

40.0

40.0

40.0

46.1

46.1

EU-27

47.3

47.1

46.4

46.1

45.3

44.7

43.7

42.9

42.2

41.2

39.9

39.3

39.1

37.8

37.1

37.6

37.1

EA-17

49.0

49.0

48.8

48.0

47.4

47.1

45.9

44.9

43.8

42.4

41.9

41.5

41.0

40.9

40.8

41.4

41.8

IS

Note: Figures in italics represent flat-rate tax; Please refer to endnote 6 for details on the calculation of the rates.

32 Taxation trends in the European Union

2011

You might also like

- Taxation Trends in The European Union - 2011 - Booklet 34Document1 pageTaxation Trends in The European Union - 2011 - Booklet 34Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 36Document1 pageTaxation Trends in The European Union - 2011 - Booklet 36Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 37Document1 pageTaxation Trends in The European Union - 2011 - Booklet 37Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 34Document1 pageTaxation Trends in The European Union - 2012 34Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 31Document1 pageTaxation Trends in The European Union - 2011 - Booklet 31Dimitris ArgyriouNo ratings yet

- New RHB Loan Table 3.88%Document10 pagesNew RHB Loan Table 3.88%Adrian SaniNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 35Document1 pageTaxation Trends in The European Union - 2011 - Booklet 35Dimitris ArgyriouNo ratings yet

- Bank Islam Kadar Yg TerkiniDocument18 pagesBank Islam Kadar Yg TerkiniMfairuz HassanNo ratings yet

- World at GlanceDocument9 pagesWorld at GlancebharatNo ratings yet

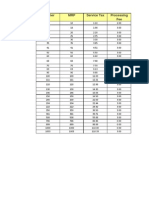

- Voucher MRP Service Tax Processing FeeDocument2 pagesVoucher MRP Service Tax Processing FeeRaj PatelNo ratings yet

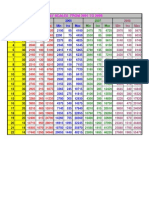

- Standar Biaya Perencanaan Dan Pengawasan Konsultan: Dalam RibuanDocument34 pagesStandar Biaya Perencanaan Dan Pengawasan Konsultan: Dalam RibuanArif Rahman SetiawanNo ratings yet

- Table 5: Pay Matrix (Civilian Employees) : Report of The Seventh CPCDocument2 pagesTable 5: Pay Matrix (Civilian Employees) : Report of The Seventh CPCLokesh ParganihaNo ratings yet

- Tarifhist Estbel STDocument1 pageTarifhist Estbel STAnonymous Yrx9mKmiNo ratings yet

- Lampiran A Data VariabelDocument11 pagesLampiran A Data Variabeltimetable27No ratings yet

- Phase 4 2Document5 pagesPhase 4 2api-257250995No ratings yet

- Taxation Trends in The European Union - 2012 42Document1 pageTaxation Trends in The European Union - 2012 42Dimitris ArgyriouNo ratings yet

- Combined Pay ScalesDocument1 pageCombined Pay ScalesFayaz KhanNo ratings yet

- Frequency Distribution - Quantitative: Salary - MilDocument12 pagesFrequency Distribution - Quantitative: Salary - MilMichael JohnsonNo ratings yet

- Report Retrieve ControllerDocument13 pagesReport Retrieve ControllerPetra FaheyNo ratings yet

- Voucher MRP Service Tax Processing Fee TalktimeDocument10 pagesVoucher MRP Service Tax Processing Fee TalktimeAkhil VermaNo ratings yet

- Employment Rate 2010Document1 pageEmployment Rate 2010joancuteverNo ratings yet

- C5 Column Ast and Rebar % Stories M20 M18 AST AST: O/S Over Stressed Steel More Than 6%Document6 pagesC5 Column Ast and Rebar % Stories M20 M18 AST AST: O/S Over Stressed Steel More Than 6%Noor MohdNo ratings yet

- DBM LBP SSL3Document12 pagesDBM LBP SSL3Nening Gina B JordanNo ratings yet

- Results of Monte Carlo SimulationDocument19 pagesResults of Monte Carlo Simulationjodi setya pratamaNo ratings yet

- 2019 Military Basic Pay TableDocument1 page2019 Military Basic Pay TableJuanCarlosMarrufoNo ratings yet

- Screen Mesh ChartDocument2 pagesScreen Mesh ChartClaudio O'nell GóngoraNo ratings yet

- Stewart Rate SchedDocument5 pagesStewart Rate SchedComConDevNo ratings yet

- The True Potential Impact of Recent Pension ChangesDocument1 pageThe True Potential Impact of Recent Pension ChangesEmily BaldwinNo ratings yet

- Bars & Rods: All Dimensions in Mm. Cat L - 2008 Jindal Aluminium Ltd. I - 1 All Dimensions in MMDocument8 pagesBars & Rods: All Dimensions in Mm. Cat L - 2008 Jindal Aluminium Ltd. I - 1 All Dimensions in MMnadaf2No ratings yet

- CCL Tax RecordsDocument2 pagesCCL Tax Recordsstan rawlNo ratings yet

- Benford's LawDocument4 pagesBenford's LawNakkolopNo ratings yet

- 2021 Pay Table 3 Percent - FINALDocument1 page2021 Pay Table 3 Percent - FINALRachit SinghalNo ratings yet

- AmortizationDocument1 pageAmortizationelizabeth_w_ctNo ratings yet

- Tabella Slu Ca (DM2008)Document2 pagesTabella Slu Ca (DM2008)SerCik SettantaseiNo ratings yet

- Drainkot KLPDocument22 pagesDrainkot KLPRidho Septian RahmanNo ratings yet

- Philippines: Page 1 of 10Document10 pagesPhilippines: Page 1 of 10Ferdinand AguilaNo ratings yet

- English Life Table 12-MALES: Basis of The TableDocument7 pagesEnglish Life Table 12-MALES: Basis of The TablecamhutchNo ratings yet

- Monthly Basic Pay Table: Effective 1 January 2021Document3 pagesMonthly Basic Pay Table: Effective 1 January 2021Pedro MoralesNo ratings yet

- AppendixDocument1 pageAppendixChika AlbertNo ratings yet

- Lista 2002 Rep. Mic EurosDocument364 pagesLista 2002 Rep. Mic EurosGegeAltNo ratings yet

- BNCM - JM L UhlnygkfDocument28 pagesBNCM - JM L UhlnygkfReckon IndepthNo ratings yet

- Crane Load CalculationDocument42 pagesCrane Load CalculationObul Reddy50% (2)

- PA RACP Grant Awards Thru 2012Document43 pagesPA RACP Grant Awards Thru 2012sokil_dan100% (1)

- Transport As IDocument1 pageTransport As IKajidoarichikitoki ZirikatojiNo ratings yet

- 10th Bipartite Settlement - Bank Officers Revised Pay Scales (Expected) From November 2012Document2 pages10th Bipartite Settlement - Bank Officers Revised Pay Scales (Expected) From November 2012Yogesh Choudhary100% (1)

- Source: MWCOG Round 6.3 Forecasts, Prepared by The Research & Technology Center, M-NCPPCDocument11 pagesSource: MWCOG Round 6.3 Forecasts, Prepared by The Research & Technology Center, M-NCPPCM-NCPPCNo ratings yet

- Baûng Tính Coát Theùp Taàng 4: Ñoà Aùn Toát Nghieäp KSXD GVHD: Ts Ñoã Kieán QuoácDocument8 pagesBaûng Tính Coát Theùp Taàng 4: Ñoà Aùn Toát Nghieäp KSXD GVHD: Ts Ñoã Kieán Quoácshinji_naviNo ratings yet

- Case 001Document9 pagesCase 001MMNo ratings yet

- Classwork Macro KeyDocument32 pagesClasswork Macro KeyMohamed Al-aNo ratings yet

- Airthread Connections Case (Work Sheet)Document66 pagesAirthread Connections Case (Work Sheet)bachandas75% (4)

- Cash OutflowDocument2 pagesCash Outflowharshtalia99No ratings yet

- Umts Performance ReportDocument34 pagesUmts Performance ReportPrasad KaleNo ratings yet

- PASIG REVENUE CODE of 1992 As Amended (LBT of Dealers, Contractors and Services)Document4 pagesPASIG REVENUE CODE of 1992 As Amended (LBT of Dealers, Contractors and Services)Bobby Olavides Sebastian33% (3)

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Hunting Cyber Criminals: A Hacker's Guide to Online Intelligence Gathering Tools and TechniquesFrom EverandHunting Cyber Criminals: A Hacker's Guide to Online Intelligence Gathering Tools and TechniquesRating: 5 out of 5 stars5/5 (1)

- J.K. Lasser's Guide to Self-Employment: Taxes, Strategies, and Money-Saving Tips for Schedule C FilersFrom EverandJ.K. Lasser's Guide to Self-Employment: Taxes, Strategies, and Money-Saving Tips for Schedule C FilersNo ratings yet

- The Second Leg Down: Strategies for Profiting after a Market Sell-OffFrom EverandThe Second Leg Down: Strategies for Profiting after a Market Sell-OffRating: 5 out of 5 stars5/5 (1)

- Taxation Trends in The European Union - 2012 44Document1 pageTaxation Trends in The European Union - 2012 44Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 41Document1 pageTaxation Trends in The European Union - 2012 41Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 39Document1 pageTaxation Trends in The European Union - 2012 39Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 40Document1 pageTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 40Document1 pageTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 42Document1 pageTaxation Trends in The European Union - 2012 42Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 45Document1 pageTaxation Trends in The European Union - 2012 45Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 38Document1 pageTaxation Trends in The European Union - 2012 38Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 35Document1 pageTaxation Trends in The European Union - 2012 35Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 33Document1 pageTaxation Trends in The European Union - 2012 33Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 37Document1 pageTaxation Trends in The European Union - 2012 37Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 37Document1 pageTaxation Trends in The European Union - 2012 37Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 30Document1 pageTaxation Trends in The European Union - 2012 30Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 24Document1 pageTaxation Trends in The European Union - 2012 24Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 31Document1 pageTaxation Trends in The European Union - 2012 31Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 28Document1 pageTaxation Trends in The European Union - 2012 28Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 27Document1 pageTaxation Trends in The European Union - 2012 27Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 29Document1 pageTaxation Trends in The European Union - 2012 29Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 26Document1 pageTaxation Trends in The European Union - 2012 26Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 23Document1 pageTaxation Trends in The European Union - 2012 23Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 25Document1 pageTaxation Trends in The European Union - 2012 25Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 10Document1 pageTaxation Trends in The European Union - 2012 10Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 6Document1 pageTaxation Trends in The European Union - 2012 6Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 4Document1 pageTaxation Trends in The European Union - 2012 4Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 7Document1 pageTaxation Trends in The European Union - 2012 7Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 8Document1 pageTaxation Trends in The European Union - 2012 8Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 5Document1 pageTaxation Trends in The European Union - 2012 5Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 3Document1 pageTaxation Trends in The European Union - 2012 3Dimitris ArgyriouNo ratings yet