Professional Documents

Culture Documents

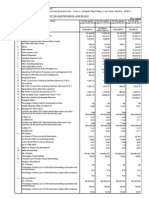

Table 4 Total Losses On Disposal of Non-Performing Loans of All Banks

Table 4 Total Losses On Disposal of Non-Performing Loans of All Banks

Uploaded by

EnricoCarusoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Table 4 Total Losses On Disposal of Non-Performing Loans of All Banks

Table 4 Total Losses On Disposal of Non-Performing Loans of All Banks

Uploaded by

EnricoCarusoCopyright:

Available Formats

Table 4 Total Losses on Disposal of Non-Performing Loans of All Banks

(100 million yen)

Mar-93

Total Losses on Disposal of Non-Performing Loans

16,398

Mar-94

38,722

Mar-95

52,322

Net Transfer to provisions for Loan Losses

9,449

11,461

14,021

Direct Write-offs

4,235

20,900

28,085

Write-offs of Loans

Losses on Sales through Bulk Sales, etc.

Others

Cumulative Total since end-March 1993

Cumulative Total of Direct Write-offs

Risk Management Loans

Provisions for Loan Losses

2,044

2,354

7,060

2,191

18,546

21,025

2,714

6,361

10,216

16,398

55,120

107,442

4,235

25,135

53,220

127,746

135,759

125,462

36,983

45,468

55,364

Mar-96

Mar-97

Mar-98

Mar-99

Mar-00

Mar-01

Mar-02

Mar-03

Mar-04

Mar-05

133,692

77,634

132,583

136,309

69,441

61,076

97,221

66,584

53,742

28,475

(110,669)

(62,099)

(108,188)

(104,403)

(53,975)

(42,898)

(77,212)

(51,048)

(34,607)

(19,621)

70,873

34,473

84,025

81,181

25,313

27,319

51,959

31,011

16,157

940

(55,758)

(25,342)

(65,522)

(54,901)

(13,388)

(13,706)

(38,062)

(20,418)

(4,202)

(4,262)

59,802

43,158

39,927

47,093

38,646

30,717

39,745

35,201

37,335

27,536

(54,901)

(36,756)

(35,005)

(42,677)

(36,094)

(26,500)

(34,136)

(30,376)

(30,472)

(23,862)

17,213

9,730

8,506

23,772

18,807

25,202

32,042

21,627

25,166

17,114

(15,676)

(8,495)

(7,912)

(22,549)

(17,335)

(22,014)

(27,183)

(17,737)

(19,852)

(14,743)

42,589

33,428

31,421

23,321

19,839

5,516

7,703

13,574

12,169

10,422

(39,225)

(28,261)

(27,093)

(20,128)

(18,759)

(4,486)

(6,953)

(12,640)

(10,621)

(9,119)

3,017

8,631

8,035

5,482

3,040

5,517

372

250

(10)

(1)

(7,661)

(6,825)

(4,493)

(2,691)

(5,013)

(253)

(68)

(21)

241,134

318,768

451,351

587,660

657,101

718,177

815,398

881,982

935,724

964,199

(218,111)

(280,210)

(388,398)

(492,801)

(546,776)

(589,674)

(666,886)

(717,934)

(752,541)

(772,162)

113,022

156,180

196,107

243,200

281,846

312,563

352,308

387,509

424,844

452,380

(108,121)

(144,877)

(179,882)

(222,559)

(258,653)

(285,153)

(319,289)

(349,665)

(380,137)

(403,999)

285,043

217,890

297,580

296,270

303,660

325,150

420,280

348,490

262,040

175,390

(218,682)

(164,406)

(219,780)

(202,500)

(197,720)

(192,810)

(276,260)

(204,330)

(135,670)

(72,900)

132,930

123,340

178,150

147,970

122,300

115,550

133,530

125,850

114,300

85,350

(103,450)

(93,880)

(136,010)

(92,580)

(76,780)

(69,390)

(86,570)

(78,970)

(69,030)

(47,390)

Note:

1. From March 1993 to March 1995, figures are composed of City Banks, Long-term Credit Banks and Trust Banks.

2. From March 1996 onward, figures are composed of City Banks, Long-term Credit Banks (including Shinsei Bank, which changed its status to an Ordinary Bank Charter in April 2004, for March 2005), Trust Banks and Regional Banks (including Saitama Resona

Bank from March 2003 onward). Figures in parentheses refer to the total amounts of City Banks, Long-term Credit Banks and Trust Banks, and do not include Regional Banks.

3. Hokkaido Takushoku Bank, Tokuyo City Bank, Kyoto Kyoei Bank, Naniwa Bank, Fukutoku Bank, and Midori Bank are excluded from March 1998 onward. Kokumin Bank, Kofuku Bank and Tokyo Sowa Bank are excluded from March 1999 onward. Namihaya

Bank and Niigata Chuo Bank are excluded from March 2000 onward. Ishikawa Bank and Chubu Bank are excluded from March 2002 onward. Long-term Credit Bank of Japan (Shinsei Bank at present) is excluded for March 1999. Nippon Credit Bank (Aozora Bank

at present) is excluded for March 1999 and for March 2000.

4. Figures in the above table for Mizuho Group, UFJ Bank, NISHI-NIPPON Bank and Fukuoka City Bank (as of March 2004, NISHI-NIPPON Bank and Fukuoka City Bank merged to become NISHI-NIPPON City Bank) include those of subsidiary companies for

corporate revitalization.

FY2004, the figures for Hokuriku Bank include those which are transferred to subsidiary companies for corporate revitalization.

Figures of "Risk Management Loans" include those figures of UFJ Bank's subsidiary company for corporate revitalization from March 03 onward and Mizuho Group's subsidiary companies for corporate revitalization from September 03 onward.

5. The figure of "Total Losses on Disposal of Non-Performing Loans" of March 2002 includes Tokai Bank (merged in January 2002), and that of March 2003 includes Asahi Bank (merged in March 2003).

6. "Provisions for Loan Losses" refers to the total amount of specific provisions for loan losses and general provisions for loan losses.

7. "Losses on Sales through Bulk Sales etc." refers to the total amount of losses on sales through bulk sales, losses on supports to subsidiaries and losses on sales to the RCC (Resolution and Collection Corporation) etc.

8. "Others" in "Total Losses on Disposal of Non-Performing Loans" refer to the total amount of provisions for expected losses brought by supports to subsidiaries etc.

9. Figures of "Risk Management Loans" are composed of "Loans to Borrowers in Legal Bankruptcy" [LBB] and "Past Due Loans" [PDL] before March 1995.

For March 1996 and March 1997, the figures are composed of LBB, PDL and loans for which banks have reduced their interest rates.

You might also like

- Toy World - ExhibitsDocument9 pagesToy World - Exhibitsakhilkrishnan007No ratings yet

- Student Number (UWL Registration Number) : 21452742 Assignment Name: Consolidation and Analysis On The MusicalDocument19 pagesStudent Number (UWL Registration Number) : 21452742 Assignment Name: Consolidation and Analysis On The MusicalSavithri NandadasaNo ratings yet

- Chapter III - Developments in Commercial Banking: (Amount in Rs. Crore)Document59 pagesChapter III - Developments in Commercial Banking: (Amount in Rs. Crore)Modi SinghNo ratings yet

- Press Release: Onetary Developments in The Euro Area EbruaryDocument6 pagesPress Release: Onetary Developments in The Euro Area Ebruaryse99No ratings yet

- India External Debt March 2013Document7 pagesIndia External Debt March 2013Jhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- EMSCFIN-FARDocument37 pagesEMSCFIN-FARPuwanachandran KaniegahNo ratings yet

- Non-Banking Financial InstitutionsDocument23 pagesNon-Banking Financial InstitutionsSuresh RVNo ratings yet

- Summary of Consolidated Financial Results For The Year Ended March 31, 2014 (U.S. GAAP)Document34 pagesSummary of Consolidated Financial Results For The Year Ended March 31, 2014 (U.S. GAAP)pathanfor786No ratings yet

- Chapter - 5 Regional Rural BanksDocument11 pagesChapter - 5 Regional Rural Banksbaby0310No ratings yet

- 2023 Annual Financial Report EDocument94 pages2023 Annual Financial Report Ehimanshuchikiboy05No ratings yet

- Bank of MaharashtraDocument5 pagesBank of MaharashtraShivesh KumarNo ratings yet

- Miggros - CaseDocument4 pagesMiggros - CasefineksusgroupNo ratings yet

- Horizontal and Vertical Dis AllowanceDocument12 pagesHorizontal and Vertical Dis Allowancesuhaspujari93No ratings yet

- Bank of Tokyo LTD 2010Document45 pagesBank of Tokyo LTD 2010Mahmood KhanNo ratings yet

- A Profile of Banks 2005-06: Reserve Bank of IndiaDocument96 pagesA Profile of Banks 2005-06: Reserve Bank of IndialakshmimanipalNo ratings yet

- Micro Finance in India - 2007-08Document193 pagesMicro Finance in India - 2007-08Yedukondalu Vaddeboina100% (1)

- Chapter-5: Aggregated Balance Sheet 5.4 Assets: Aggregate Industry Assets in 2004Document13 pagesChapter-5: Aggregated Balance Sheet 5.4 Assets: Aggregate Industry Assets in 2004Zena FondaNo ratings yet

- Monetary Developments Euro Area Feb 2012Document5 pagesMonetary Developments Euro Area Feb 2012economicdelusionNo ratings yet

- Kotak Mahindra BankDocument22 pagesKotak Mahindra BankAbideez PaNo ratings yet

- 2023 q1 Consolidated Audit Report enDocument61 pages2023 q1 Consolidated Audit Report enduyhuynhworkkNo ratings yet

- Indian Oil Corporation Project 2Document30 pagesIndian Oil Corporation Project 2Rishika GoelNo ratings yet

- Wipro Financial StatementsDocument37 pagesWipro Financial StatementssumitpankajNo ratings yet

- Samsung Electronics Co., LTD.: Index December 31, 2009 and 2008Document74 pagesSamsung Electronics Co., LTD.: Index December 31, 2009 and 2008Akshay JainNo ratings yet

- Debt MarDocument44 pagesDebt MardrtaintuNo ratings yet

- Financial Statement AnalysisDocument12 pagesFinancial Statement AnalysisYousuf khanNo ratings yet

- Auditors' Report To The MembersDocument59 pagesAuditors' Report To The MembersAleem BayarNo ratings yet

- Sbi Analyst PPT Fy16Document49 pagesSbi Analyst PPT Fy16tamirisaarNo ratings yet

- SL& C Study 9Document37 pagesSL& C Study 9abhibth151No ratings yet

- HDFC Consolidate Q3Document5 pagesHDFC Consolidate Q3Satish MehtaNo ratings yet

- Analysis On The Financial Performance of The Musical MuseumDocument19 pagesAnalysis On The Financial Performance of The Musical MuseumDaniel AjanthanNo ratings yet

- India External DebtDocument9 pagesIndia External Debtasingh0001No ratings yet

- Financial Performance: Profits and ProvisionsDocument6 pagesFinancial Performance: Profits and ProvisionsSwaroop KrishnaNo ratings yet

- ZTBL 2008Document62 pagesZTBL 2008Mahmood KhanNo ratings yet

- Final Exam Financial ManagementDocument2 pagesFinal Exam Financial ManagementAnonymous 0PsfK9wKNo ratings yet

- ECB Monetary Policy Developments Dec 2012Document6 pagesECB Monetary Policy Developments Dec 2012economicdelusionNo ratings yet

- Assignment - Due, Friday, 24 March 2023Document4 pagesAssignment - Due, Friday, 24 March 2023mwazi simbeyeNo ratings yet

- Appendix Table IV.1 (A) : Consolidated Balance Sheet of Public Sector BanksDocument2 pagesAppendix Table IV.1 (A) : Consolidated Balance Sheet of Public Sector Banksnisarg_No ratings yet

- TRM 231.01 Financial Statements of Migros Assignment 1Document6 pagesTRM 231.01 Financial Statements of Migros Assignment 1Neşe RomanNo ratings yet

- Private Sector Banks in India - A SWOT Analysis 2004Document23 pagesPrivate Sector Banks in India - A SWOT Analysis 2004Prof Dr Chowdari Prasad67% (3)

- Selected Financial Summary (U.S. GAAP) : For The YearDocument82 pagesSelected Financial Summary (U.S. GAAP) : For The YearshanzarapunzleNo ratings yet

- Budget at A GlanceDocument2 pagesBudget at A Glancefaysal_duNo ratings yet

- Monthly Portfolio - July 2019Document17 pagesMonthly Portfolio - July 2019TunirNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- Bulletin Oct Dec 2023Document26 pagesBulletin Oct Dec 2023muhammad.umar14781No ratings yet

- Monetary Devs Feb 2012Document5 pagesMonetary Devs Feb 2012economicdelusionNo ratings yet

- Regional Rural BanksDocument13 pagesRegional Rural Banksshivakumar N100% (1)

- Fundamental Analysis Case Study of ICICI BankDocument61 pagesFundamental Analysis Case Study of ICICI BankNirojini Bhat BhanNo ratings yet

- EU Transparency ExerciseDocument39 pagesEU Transparency ExerciseAlexander LueNo ratings yet

- AR2006 Volume2Document181 pagesAR2006 Volume2Mgn SanNo ratings yet

- Bharti AirtelDocument3 pagesBharti AirtelAditya JainNo ratings yet

- 2021 Con Quarter01 AllDocument61 pages2021 Con Quarter01 AllMohammadNo ratings yet

- Israel Corp Q2 2023 Financial Report EnglishDocument71 pagesIsrael Corp Q2 2023 Financial Report Englisha.belgherrasNo ratings yet

- Nissan Motor Co., LTD.: Financial Information As of March 31, 2021Document156 pagesNissan Motor Co., LTD.: Financial Information As of March 31, 2021Noura KakiNo ratings yet

- Case Study - ACI and Marico BDDocument9 pagesCase Study - ACI and Marico BDsadekjakeNo ratings yet

- Consolidated Business Results For The Fiscal Year Ended March 31, 2012 (U.S. GAAP)Document25 pagesConsolidated Business Results For The Fiscal Year Ended March 31, 2012 (U.S. GAAP)jonzthNo ratings yet

- Appendix Table IV.1: Indian Banking Sector at A GlanceDocument1 pageAppendix Table IV.1: Indian Banking Sector at A GlancePankaj PrabhaNo ratings yet

- TFR 2023 eDocument69 pagesTFR 2023 eAntwanNo ratings yet

- Saurabh Jain 08 BS 000 3005 Ibs, ChennaiDocument16 pagesSaurabh Jain 08 BS 000 3005 Ibs, Chennaisaurabh698100% (1)

- Asset-backed Securitization and the Financial Crisis: The Product and Market Functions of Asset-backed Securitization: Retrospect and ProspectFrom EverandAsset-backed Securitization and the Financial Crisis: The Product and Market Functions of Asset-backed Securitization: Retrospect and ProspectNo ratings yet

- Guide to Management Accounting CCC for managers 2020 EditionFrom EverandGuide to Management Accounting CCC for managers 2020 EditionNo ratings yet

- Bank and Financial RevDocument8 pagesBank and Financial RevMutiara Agnes TaliaNo ratings yet

- Union Bank of IndiaDocument10 pagesUnion Bank of IndiaRakesh Prabhakar ShrivastavaNo ratings yet

- The Board of Commissioners ProfileDocument3 pagesThe Board of Commissioners Profilemartin ibrahim saputraNo ratings yet

- 2016E 00 Full PDFDocument168 pages2016E 00 Full PDFFitra VertikalNo ratings yet

- Mizuho India ProfileDocument15 pagesMizuho India ProfileKirti SethiNo ratings yet

- 20230405spemem eDocument4 pages20230405spemem eReka IsalNo ratings yet