Professional Documents

Culture Documents

Technologies - One Village One World

Uploaded by

Nikhil ToshniwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technologies - One Village One World

Uploaded by

Nikhil ToshniwalCopyright:

Available Formats

4/6/2016

ekgaon technologies | One Village One World

ABOUT

AGRI-SERVICES

SHOP

MICROFINANCE

RECOGINTION

MEDIA

PARTNER WITH US

CONTACT

Mobiletecheasesmicrocredit

http://www.civilsocietyonline.com/pages/Details.aspx?316

AnopensourceapplicationdevelopedbyEkgaonTechnologiesPvtLtdhaseasedaccesstomicrocreditinruralareasandsignificantlybroughtdownthecostoftransactions.

Financialinclusion is the key to sustaining the nations growth story, saysVijay Pratap SinghAditya, CEO of Ekgaon Technologies.The company is all set to launch several

innovationsthisyearinabidtoaddressthechallengesposedtothemicrofinanceindustryunderIndiasrestrictivebankingregime.

Itwasin2002thatAdityaandhisfriend,TapanParikh,hitupontheideaofharnessinginformationandcommunicationtechnologytomeetthefinancialneedsofruralcommunities.

EkgaonsbusinessistodayfocusedontappingmobileandcloudtechnologytobolsterthecapacityofmicrofinanceinstitutionsinruralIndia.

While savings and remittances remain limited to Indias formal banking system, Ekgaon is using technology to bolster the availability and viability of microcredit and other

financialproductsforruralareas.

Webeganfromscratchonmicrofinance.Itwasimportanttounderstandwhatkindoftechnologicalinterventionhadtobemade,saysAditya,anelectricalengineerandalumnusof

theprestigiousIndianInstituteofForestManagement,Bhopal.

In 2002, Ekgaon began implementing CAM, a camera and webbased mobile information services framework for rural areas, and SHG MIS (selfhelp group management

informationsystem)incollaborationwithCovenantCentreforDevelopment,Madurai.Inall,75SHGscovering5,000peopleinDindiguldistrictparticipated.Thefreewebbased

softwareemploysmobiletechnologytoenablemicrofinanceofficerstomonitortransactionsrealtimeinthefield.

Tenyearson,theplatformhasbeenscaledupandabout800,000SHGmembershavebenefittedinTamilNadu,Uttaranchal,UttarPradeshandRajasthan.TheRajasthangovernment

hasplanstobring300,000SHGs,comprisingsixmillionindividuals,undertheSakhDarpanfoldthatusesSHGMIS.Foreachtransaction(loan,mortgage,internalsavings)thathits

theserver,Ekgaonreceivesanominalfeeof4paisefromtheMFIsorNGOs.

Themicrofinanceindustryfacesmanychallenges,thefirstofwhichisthehighcostofdoingbusiness,saysAditya.Thecostisultimatelypassedontotheconsumers.Butwith

freesoftware,MFIscancuttheexpenseofinstallingaserverandhiringstafftorunit.

FinancialinclusionremainsadreamformillionsofruralIndians, saysAditya, because MFIs are barred from taking deposits.They can only grant loans on interest. While the

ReserveBankofIndiaandthefinanceministryareconcernedoverchitfundscams,thegovernmenthasnotallowedusefulproductsorservicestoreachtheaamaadmi,hesays.

Policyconstraintsandabiastowardstheformalbankingsystemforcesunviableproductofferingstoruralcustomers.Firmsengagedasbusinesscorrespondentsfinditextremely

difficulttoserviceruralcustomersandcannotbuildwiderportfoliosduetoregulatoryconstraints.

Moreover,thetenderingprocesstendstofocusonthelowestbidforprovidingservicestoruralcustomerswithoutunderstandingthegroundrealitiesofdeliveringsuchservices.

Lesscompetentbidderswhoareonlyinterestedinenrollingcustomersandnotinservicingthemendupbeingengaged,saysAditya.

MigrantlabourersacrossthecountryspendasmuchasRs150perRs1,000theytransferhome,aMcKinseystudysponsoredbyEkgaonhasrevealed.Thescenarioissettochange

forthebetterwithEkgaonsplanoflaunchingaffordableproductsforlowincomeindividualsandruralcommunities.IthasalreadydevelopedOneFIN,anenterpriseversionofthe

existingMFIsolution.OrganisationsorNGOsneednotbuythesoftwaretheymerelyhavetohostcustomersontheirsites.

Whileregistrationanddatamaintenanceareforfree,atransactionwouldattractanominalfeeofRs3toRs14percustomer,dependingonproductsandtransactions.However,

EkgaonisplanningtochargeMFIsorNGOsaflatfeeofRs2lakhsifthenumberofcustomersismorethan50,000.

OneRemit,tobelaunchedbytheendoftheyear,targetsmigrantlabourerswantingtosendmoneybackhomeindenominationsofRs500andRs1,000.Itisamobilechargecard

whichwillinitiallycostRs10.Weareworkingoutdetailsofthecharges,agentnetwork,etc,saysAditya.Theservicecanbeavailedthroughmobileapplications,IVRSandthe

internet.

Tolaunchtheseproducts,Ekgaonitselfneedsadequatecapital(asregulatedbyRBI,theminimumisRs2crores),whichitisraisingthroughtheprivateequityplayerExhilway

Private Capital Market (EPCM). We have registered with them. We have to raise around Rs 6 crores.Ploughing the profits back into developing new technologies and new

geographies,EkgaonhashadaturnoverofRs1.6croresduring201213andhopestoscaleup.

Aspartofitsglobalfootprint,EkgaonisimplementingasystemfordirectcashtransfersthroughmobilephonesinTanzania.ItalsoplanstoenterotherAfricancountrieslikeKenya

and Uganda. Nearer home, Ekgaon, besides eyeing the Nepal market, is involved in implementing gold mortgage against loans along with Sabaragamuwa Development Bank,

Ratnapura,SriLanka.

AdityareferstothesuccessofKenyasMPesawhichoperatesindependentofthebankingsystemandallowsuserstopaybillsandtransfermoneywithjustafewtapsonamobile

phone.HewonderswhyIndia,despitebeingasoftwaregiant,hasnothingremotelyaseffectiveasMPesa.

Financialinclusionbringsfreedomtoareasnotcoveredbythebankingsystem,Adityaasserts,addingthatitenables greateraccessforruralcustomers,createsawidermarketfor

productsandservices,andspurshighergrossdomesticgrowth.

K.S.Narayanan,NewDelhi

CivilSociety:Business

May,2013

Copyrightekgaononevillageoneworldnetwork.PrivacyPolicyTermsofUse

http://ekgaon.co.in/node/750

1/1

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Granite Industry of Rajasthan, India - LitosonlineDocument3 pagesGranite Industry of Rajasthan, India - LitosonlineNikhil ToshniwalNo ratings yet

- China Pottery AnalysisDocument10 pagesChina Pottery AnalysisNikhil ToshniwalNo ratings yet

- Atif Iqbal, R. K. BaggaDocument16 pagesAtif Iqbal, R. K. BaggaNikhil ToshniwalNo ratings yet

- How To SucceedDocument16 pagesHow To SucceedNikhil ToshniwalNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- RPLI ProposalsDocument8 pagesRPLI ProposalsAbhishek TiwariNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internaskiezer agrudaNo ratings yet

- 6018-P1-LEMBAR KERJA AKUNTANSI. Jawaban Uk 2019Document58 pages6018-P1-LEMBAR KERJA AKUNTANSI. Jawaban Uk 2019adiirwanto80% (5)

- Sandip Voltas ReportDocument43 pagesSandip Voltas ReportsandipNo ratings yet

- CH 21Document86 pagesCH 21Sayed Mashfiq RahmanNo ratings yet

- Elliott Wave Analysis Works Like Magic PDFDocument6 pagesElliott Wave Analysis Works Like Magic PDFpmg3067100% (1)

- Civrev Ii CasesDocument5 pagesCivrev Ii CasesShenilyn MendozaNo ratings yet

- Credit AppraisalDocument14 pagesCredit AppraisalRishabh Jain0% (1)

- Canara BankDocument18 pagesCanara BankparkarmubinNo ratings yet

- PolicySchedule-211200 31 2020 284388-167798016 PDFDocument3 pagesPolicySchedule-211200 31 2020 284388-167798016 PDFKP SinghNo ratings yet

- Organisational Behavior On SBM BANKDocument101 pagesOrganisational Behavior On SBM BANKkeshav_26No ratings yet

- Fee Structure 2022-2023Document2 pagesFee Structure 2022-2023Ayushmaan RawatNo ratings yet

- Life 70 in AS400Document10 pagesLife 70 in AS400krkmff100% (1)

- Date Details Debit Credit: Opening Balance Debits Credit Closing BalanceDocument4 pagesDate Details Debit Credit: Opening Balance Debits Credit Closing BalancealekNo ratings yet

- Know All Men by These Presents:: For Use by Ofws OnlyDocument3 pagesKnow All Men by These Presents:: For Use by Ofws OnlyartemisNo ratings yet

- Functions - Duties of The RBI GovernorDocument4 pagesFunctions - Duties of The RBI GovernorDeepanwita SarNo ratings yet

- Account Statement PDFDocument12 pagesAccount Statement PDFAnkitNo ratings yet

- Analysis On Financial Health of HDFC Bank and Icici BankDocument11 pagesAnalysis On Financial Health of HDFC Bank and Icici Banksaket agarwalNo ratings yet

- Accounts Project FinalDocument18 pagesAccounts Project FinalPulakNo ratings yet

- Souharda ActDocument64 pagesSouharda ActRadhika PriyadarshiniNo ratings yet

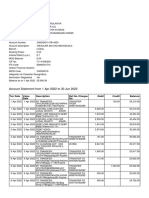

- Account Statement From 1 Apr 2022 To 30 Jun 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument10 pagesAccount Statement From 1 Apr 2022 To 30 Jun 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceParveen SainiNo ratings yet

- Summer Internship Project On BankDocument76 pagesSummer Internship Project On BankReema Negi100% (3)

- Tax Review QuestionsDocument11 pagesTax Review QuestionsAbigail Regondola BonitaNo ratings yet

- Proposal - Fixed Term Deposits Living Word AssemblyDocument5 pagesProposal - Fixed Term Deposits Living Word AssemblySolomon nkusiNo ratings yet

- E Frauds in BankingDocument5 pagesE Frauds in BankingRajivNo ratings yet

- 1538139921616Document6 pages1538139921616Hena SharmaNo ratings yet

- Position Assistant Manager / Sr. Officer - Operations Finance Role & ResponsibilitiesDocument2 pagesPosition Assistant Manager / Sr. Officer - Operations Finance Role & ResponsibilitiesBikram0% (1)

- Central Bank of India: New Business GroupDocument7 pagesCentral Bank of India: New Business GroupAbhishek BoseNo ratings yet

- Methods and Procedures For Risk Profiling ofDocument18 pagesMethods and Procedures For Risk Profiling ofRohith VijayanNo ratings yet

- BibliographyDocument8 pagesBibliographySachin B BarveNo ratings yet