Professional Documents

Culture Documents

Nifty - Report Equity Research Lab 01 September

Uploaded by

ram sahuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nifty - Report Equity Research Lab 01 September

Uploaded by

ram sahuCopyright:

Available Formats

qwertyuiopasdfghjklzxcvbnmqwerty

uiopasdfghjklzxcvbnmqwertyuiopasd

fghjklzxcvbnmqwertyuiopasdfghjklzx

cvbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

NIFTY OUTLOOK

hjklzxcvbnmqwertyuiopasdfghjklzxc

REPORT

vbnmqwertyuiopasdfghjklzxcvbnmq

1 September 2016

wertyuiopasdfghjklzxcvbnmqwertyui

Prepared by: Meenakshi Pal

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmrtyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyuiopas

st

1st September 2016

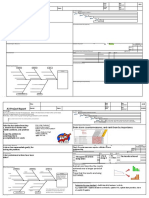

NIFTY FUTURE

NIFTY FUTURE :

PIVOT :8829

R1:8870

S1:8795

R2:8904

S2:8755

R3:8944

S3:8721

NIFTY DAILY CHART

CHART INTERPRETATION

The only strategy for the traders should be to hold long positions or initiate fresh long positions at every

dip in the market. And Expectations of a good monsoon have once again reinforced the confidence

among market participants that the growth may come back on a good note, timely onset of the

monsoons will be a positive for the markets. A strong break below 8600 will increase the downside

pressure and drag it to 8400/8300. Traders can go short on a break below 8600.On the other hand, a

decisive break above 8820 will ease the downside pressure and take the index futures higher to 8900

and8950thereafter.

Mechanical indicator stochastic RSI also showing consolidated trend.

INDEX OUTLOOK

NIFTY FUTURE: Nifty touched psychological 8800-mark intraday for the first time since April 15,

2015 but it failed to hold the same level and closed 41.85 points higher to 8786.20.

equity markets closed higher on account of buying in frontline blue chip counters on Wednesday ahead

of the release of economic growth data later in the day. Market continued its positive momentum and

reached the high P/E valuation of 17x (one year forward) which is similar to the rally of FY15. This is

in expectation of a likely revival in earnings on account of improving domestic fundamentals

The

BSE

Midcap

traded

in

line

with

benchmarks,

rising

0.4

percent.

STRATEGY: Buy Nifty Future

WWW.EQUITYRESEARCHLAB.COM

above 8850 for the target of 8900 -8950 with the stop loss of 8770.

1st September 2016

SECTORAL INDICES

Key Indices Levels to watch out for the day

INDEX (Spot)

RESISTANCE 2

RESISTANCE 1

LTP

SUPPORT 1

SUPPORT 2

SENSEX

28800

28650

28452.17

28150

28000

NIFTY

8850

8800

8786.20

8740

8700

NIFTYBANK

20000

19900

19784.40

19600

19500

NIFTYIT

10700

10625

10533.95

10400

10300

CORPORATE NEWS

Zee Entertainment announced the sale of its loss making sports arm to Sony Pictures for Rs. 2,600 Cr

approximately. The sports business made a net loss of 37.2 Cr in FY16. The deal consists of acquisition of 10

TEN Sports channels operating in various countries. The deal will push up Zees earnings and margins.

Bharat Petroleum Corporations Q1 results showed an 11% rise in net profit Rs. 2,620.5 Cr, as against Rs.

2,360.7 Cr in the corresponding period last fiscal. Revenue declined by 3% to Rs. 57,015.8 Cr in the quarter

compared with Rs. 58,818.4 Cr in same period last year. Operational margin expanded by 37 basis points to

6.87% for the quarter.

The Union Cabinet eased rules for quicker settlements of disputes in the construction sector. In a bid to

activate stranded projects, the cabinet has asked government agencies and public bodies to pay 75% of the

money in cases of such disputes. The construction sector, which contributes 8% of the countrys GDP, will get a

boost as the move will enhance liquidity in the sector. Stocks namely; HCC, Simplex Projects, Gammon India,

ARSS Infrastructure, GVK Power & Infra, Punj Lloyd, IVRCL, Simplex Infrastructure were up 5%-20%.

WWW.EQUITYRESEARCHLAB.COM

1st September 2016

ERL RESEARCH TEAM

Member Name

Designation

E-mail ID

Mr. Tuhinanshu Jain

Mr. Yogesh Subnani

Miss. Meenakshi Pal

Research Head

Sr. Research Analyst

Sr. Research Analyst

Tuhinanshu.jain@equityresearchlab.co.in

Yogesh.subnani@equityresearchlab.co.in

Meenakshi.pal@equityresearchlab.co.in

DISCLAIMER

The information and views in this report, our website & all the service we provide are believed to be

reliable, but we do not accept any responsibility (or liability) for errors of fact or opinion. Users have

the right to choose the product/s that suits them the most. Investment in Stocks has its own risks.

Sincere efforts have been made to present the right investment perspective. The information contained

herein is based on analysis and up on sources that we consider reliable. We, however, do not vouch

for the accuracy or the completeness thereof. This material is for personal information and we are not

responsible for any loss incurred based upon it & takes no responsibility whatsoever for any financial

profit s or loss which may arise from the recommendations above. The stock price projections shown

are not necessarily indicative of future price performance. The information herein, together with all

estimates and forecasts, can change without notice.

Equity Research Lab does not purport to be an invitation or an offer to buy or sell any financial

instrument. Analyst or any person related to Equity Research Lab might be holding positions in the

stocks recommended. It is understood that anyone who is browsing through the site has done so at his

free will and does not read any views expressed as a recommendation for which either the site or its

owners or anyone can be held responsible for. Any surfing and reading of the information is the

acceptance of this disclaimer.

Our Clients (Paid or Unpaid), any third party or anyone else have no rights to forward or share our

calls or SMS or Report or Any Information Provided by us to/with anyone which is received directly

or indirectly by them. If found so then Serious Legal Actions can be taken. Any surfing and reading of

the information is the acceptance of this disclaimer.

ALL RIGHTS RESERVED.

WWW.EQUITYRESEARCHLAB.COM

You might also like

- Trade Like Chuck: How to Create lncome in ANY MARKET!From EverandTrade Like Chuck: How to Create lncome in ANY MARKET!Rating: 3 out of 5 stars3/5 (1)

- Nifty Outlook: 23 August 2016 Prepared By: Meenakshi PalDocument4 pagesNifty Outlook: 23 August 2016 Prepared By: Meenakshi Palram sahuNo ratings yet

- Nifty Outlook: 2 September 2016 Prepared By: Meenakshi PalDocument4 pagesNifty Outlook: 2 September 2016 Prepared By: Meenakshi PalAashika JainNo ratings yet

- Nifty - Report Equity Research Lab 08 SeptemberDocument4 pagesNifty - Report Equity Research Lab 08 Septemberram sahuNo ratings yet

- NIFTY - REPORT - 17 November Equity Research LabDocument4 pagesNIFTY - REPORT - 17 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT - 16 November Equity Research LabDocument4 pagesNIFTY - REPORT - 16 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 18 November Equity Research LabDocument4 pagesNIFTY - REPORT 18 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 23 December Equity Research LabDocument4 pagesNIFTY - REPORT 23 December Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 08 December Equity Research LabDocument4 pagesNIFTY - REPORT 08 December Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 15 December Equity Research LabDocument4 pagesNIFTY - REPORT 15 December Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 06 December Equity Research LabDocument4 pagesNIFTY - REPORT 06 December Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT - 10 November Equity Research LabDocument4 pagesNIFTY - REPORT - 10 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT - 21 November Equity Research LabDocument4 pagesNIFTY - REPORT - 21 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 30 November Equity Research LabDocument4 pagesNIFTY - REPORT 30 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 28 November Equity Research LabDocument4 pagesNIFTY - REPORT 28 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 07 December Equity Research LabDocument4 pagesNIFTY - REPORT 07 December Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT - 09 November Equity Research LabDocument4 pagesNIFTY - REPORT - 09 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 05 December Equity Research LabDocument4 pagesNIFTY - REPORT 05 December Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT - 03 November Equity Research LabDocument5 pagesNIFTY - REPORT - 03 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 21 December Equity Research LabDocument4 pagesNIFTY - REPORT 21 December Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT - 11 November Equity Research LabDocument4 pagesNIFTY - REPORT - 11 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 09 December Equity Research LabDocument4 pagesNIFTY - REPORT 09 December Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 22 December Equity Research LabDocument4 pagesNIFTY - REPORT 22 December Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 29 November Equity Research LabDocument4 pagesNIFTY - REPORT 29 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 13 December Equity Research LabDocument4 pagesNIFTY - REPORT 13 December Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 29 December Equity Research LabDocument4 pagesNIFTY - REPORT 29 December Equity Research Labram sahuNo ratings yet

- Nifty Outlook: 19 December 2016 Prepared By: Meenakshi PalDocument4 pagesNifty Outlook: 19 December 2016 Prepared By: Meenakshi PalAnjali SharmaNo ratings yet

- NIFTY - REPORT 01 December Equity Research LabDocument4 pagesNIFTY - REPORT 01 December Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 12 December Equity Research LabDocument4 pagesNIFTY - REPORT 12 December Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT - 23 November Equity Research LabDocument4 pagesNIFTY - REPORT - 23 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT - 15 November Equity Research LabDocument4 pagesNIFTY - REPORT - 15 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT - 08 November Equity Research LabDocument4 pagesNIFTY - REPORT - 08 November Equity Research Labram sahuNo ratings yet

- NIFTY - REPORT 28 December Equity Research LabDocument4 pagesNIFTY - REPORT 28 December Equity Research Labram sahuNo ratings yet

- Daily Technical Report, 16.08.2013Document4 pagesDaily Technical Report, 16.08.2013Angel BrokingNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- NIFTY - REPORT Equity Research Lab 04 OctoberDocument4 pagesNIFTY - REPORT Equity Research Lab 04 Octoberram sahuNo ratings yet

- Nifty ReportDocument3 pagesNifty Reportram sahuNo ratings yet

- Daily Technical Report: Sensex (18980) / NIFTY (5593)Document4 pagesDaily Technical Report: Sensex (18980) / NIFTY (5593)Angel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Technical Format With Stock 02.11.2012Document4 pagesTechnical Format With Stock 02.11.2012Angel BrokingNo ratings yet

- NIFTY - REPORT 27 December Equity Research LabDocument4 pagesNIFTY - REPORT 27 December Equity Research Labram sahuNo ratings yet

- NIFTY SPOT: 8510.10: Daily Technical OutlookDocument3 pagesNIFTY SPOT: 8510.10: Daily Technical Outlookram sahuNo ratings yet

- Technical Format With Stock 09.11.2012Document4 pagesTechnical Format With Stock 09.11.2012Angel BrokingNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Technical Format With Stock 13.09Document4 pagesTechnical Format With Stock 13.09Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (15948) / NIFTY (4836)Document4 pagesDaily Technical Report: Sensex (15948) / NIFTY (4836)Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (15988) / NIFTY (4848)Document4 pagesDaily Technical Report: Sensex (15988) / NIFTY (4848)Angel BrokingNo ratings yet

- Greaves Cotton: Upgraded To Buy With A PT of Rs160Document3 pagesGreaves Cotton: Upgraded To Buy With A PT of Rs160ajd.nanthakumarNo ratings yet

- Daily Technical Report, 21.06.2013Document4 pagesDaily Technical Report, 21.06.2013Angel BrokingNo ratings yet

- Market Outlook 14th March 2012Document3 pagesMarket Outlook 14th March 2012Angel BrokingNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Rico Auto Industries: Valuations Become Attractive Post-Correction Upgraded To BuyDocument2 pagesRico Auto Industries: Valuations Become Attractive Post-Correction Upgraded To Buyajd.nanthakumarNo ratings yet

- Technical Format With Stock 29.10.2012Document4 pagesTechnical Format With Stock 29.10.2012Angel BrokingNo ratings yet

- Daily Technical Report, 02.08.2013Document4 pagesDaily Technical Report, 02.08.2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (17602) / NIFTY (5337)Document4 pagesDaily Technical Report: Sensex (17602) / NIFTY (5337)Angel BrokingNo ratings yet

- Technical Format With Stock 22.11.2012Document4 pagesTechnical Format With Stock 22.11.2012Angel BrokingNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Daily Technical Report, 18.06.2013Document4 pagesDaily Technical Report, 18.06.2013Angel BrokingNo ratings yet

- Daily Technical Report, 25.06.2013Document4 pagesDaily Technical Report, 25.06.2013Angel BrokingNo ratings yet

- NIFTY SPOT: 8565.85: Daily Technical OutlookDocument3 pagesNIFTY SPOT: 8565.85: Daily Technical OutlookAashika JainNo ratings yet

- UNIBANKDocument9 pagesUNIBANKFidan S.No ratings yet

- Sales and LeasebackDocument8 pagesSales and LeasebackHAZELMAE JEMINEZNo ratings yet

- @magzrock Dalal Street Invest Jour - June - 2017Document69 pages@magzrock Dalal Street Invest Jour - June - 2017Srinivasulu MachavaramNo ratings yet

- Human Resource Management: Prof. Parul Singh Fortune Institute 2010Document30 pagesHuman Resource Management: Prof. Parul Singh Fortune Institute 2010yogimeetNo ratings yet

- BNI Bank StatementDocument1 pageBNI Bank Statementelisio.silvaNo ratings yet

- Marketing 3.0: Dr. (Prof.) Philip KotlerDocument9 pagesMarketing 3.0: Dr. (Prof.) Philip KotleroutkastedNo ratings yet

- 09 Ratio AnalysisDocument16 pages09 Ratio AnalysisHimanshu VermaNo ratings yet

- Explain in Detail All Types of Trademarks With Related Case LawsDocument5 pagesExplain in Detail All Types of Trademarks With Related Case LawsPiku NaikNo ratings yet

- FA GP5 Assignment 1Document4 pagesFA GP5 Assignment 1saurabhNo ratings yet

- Risk Management PolicyDocument2 pagesRisk Management PolicyAkhilesh MehtaNo ratings yet

- Robinhood Case StudyDocument3 pagesRobinhood Case StudyXnort G. XwestNo ratings yet

- Ekonom InggrisDocument2 pagesEkonom InggrisDewi Ayu SaraswatiNo ratings yet

- Traders Mag 2016JANDocument64 pagesTraders Mag 2016JANPrasanna Kalasekar100% (2)

- SAP ComponentsDocument7 pagesSAP ComponentsFahad QuadriNo ratings yet

- Case Study of Satyam ScamDocument21 pagesCase Study of Satyam ScamSyed Sammar Abbas KazmiNo ratings yet

- Configuration Management Process GuideDocument34 pagesConfiguration Management Process GuideRajan100% (4)

- Chapter 6 - International Trade and Factor Mobility TheoryDocument24 pagesChapter 6 - International Trade and Factor Mobility TheoryShakib Ahmed Emon 0389No ratings yet

- Audience Targeting On Facebook: Curt MalyDocument19 pagesAudience Targeting On Facebook: Curt MalyRitsurNo ratings yet

- Buying AlliancesDocument4 pagesBuying AlliancesZubair AhmadNo ratings yet

- Oracle HCM On Cloud NotesDocument9 pagesOracle HCM On Cloud Notesckambara4362No ratings yet

- Supply Chain of Automotive Industry V/S Suplly Chain of FMCG IndustryDocument9 pagesSupply Chain of Automotive Industry V/S Suplly Chain of FMCG IndustryMuhammad Umar KhanNo ratings yet

- RC ColaDocument31 pagesRC ColaMahmud Murtofa Salekin50% (6)

- HR Pepsi CoDocument3 pagesHR Pepsi CookingNo ratings yet

- Rohit Summer ProjectDocument12 pagesRohit Summer ProjectRohit YadavNo ratings yet

- Accounts TestDocument3 pagesAccounts TestAMIN BUHARI ABDUL KHADERNo ratings yet

- Business Hub: National Case Study Challenge 2021Document13 pagesBusiness Hub: National Case Study Challenge 2021HimansuRathiNo ratings yet

- Chapter 7 Intangible Assets Exercises T3AY2021Document4 pagesChapter 7 Intangible Assets Exercises T3AY2021Carl Vincent BarituaNo ratings yet

- Module 5 HRM New PDFDocument16 pagesModule 5 HRM New PDFBim BimNo ratings yet

- Business Intelligence - Data Warehouse ImplementationDocument157 pagesBusiness Intelligence - Data Warehouse ImplementationVijay Thangaraju100% (1)

- A3 Problem-Solving: Title: A3 # Owner: TeamDocument2 pagesA3 Problem-Solving: Title: A3 # Owner: TeamMayra HernándezNo ratings yet