Professional Documents

Culture Documents

Nestle India - Axis Direct - 25 August

Uploaded by

anjugaduCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nestle India - Axis Direct - 25 August

Uploaded by

anjugaduCopyright:

Available Formats

Analyst Meet Update

25 AUG 2016

NESTLE INDIA

SELL

FMCG

Target Price: Rs 6,000

Getting its act together; valuations rich

Nestle India is eyeing volume-driven double digit topline growth in the

medium term led by increasing penetration and higher frequency (aided

by innovation and renovations across portfolio). Innovation is largely

focused on uptrading the consumer and new category incubation.

ItsH1CY16 analyst meet emphasized on new product launches and

recovery in Maggi sales as the key focus areas. In the last three months,

Nestlewas able to launch 25 new products due to significant ramp-up in

operational parameters.

The companys aggression on topline growth has generated excitement

but new launches are niche in nature and would be a dragon earnings

even in medium term. The stock trades at CY19 P/E of 33x onour

somewhat optimistic earnings. Maintain SELL with TP of Rs 6,000

(36x 1-year forward PE).

CMP

Potential Upside

: Rs 6,825

: -12%

MARKET DATA

No. of Shares

Free Float

Market Cap

52-week High / Low

Avg. Daily vol. (6mth)

Bloomberg Code

Promoters Holding

FII / DII

: 96 mn

: 37%

: Rs 658 bn

: Rs 7,390 / Rs 4,990

: 45,219 shares

: NEST IB Equity

: 63%

: 0% / 6%

Way forward: Nestle aims to achieve its growth objective through (a) penetration and frequency, (b) consumer-focused

innovation and renovation, and (c) capturing potential of many Indias within India. Seven identified trends influencing

the companys way forward are(i) increasing urbanization, (ii) technology tide (~345 mn population is tech enabled),

(iii) increasing women power (decision making on the rise), (iv) premiumization, (v) valorizing value, (vi) quest for

goodness and (vii) balance between taste, indulgence and health.

Our view: Nestle delivered 18% EPS CAGR over CY01-11 led by 15% sales growth and margin gains. In the past five

years, volume growth slowed down with sales and EPS CAGR of 5% and 4% over CY11-16E (despite full Maggi sales

in CY16). We believe Nestle might deliver on growth expectations (~15% growth) over CY16-18E but it would be

mainly achieved due to lower base. It would be difficult to sustain this rate as baby food category(high contribution to

sales) is growing at a slower pace.

Financial summary (Standalone)

Key drivers

Y/E December

CY15

CY16E

CY17E

Sales (Rs mn)

81,233

96,361

110,678

126,714

9,800

12,223

14,189

16,695

123.3

148.5

170.5

EPS (Rs)

101.6

126.8

147.2

173.2

Change YOY (%)

(20.1)

24.7

16.1

17.7

P/E (x)

67.1

53.8

46.4

39.4

Price performance

RoE (%)

34.7

41.0

42.7

45.3

140

RoCE (%)

46.6

58.2

60.1

63.1

120

EV/E (x)

38.6

30.9

26.7

23.2

100

DPS (Rs)

48.5

75.0

90.0

110.0

80

Adj PAT (Rs mn)

Con. EPS* (Rs)

Source: *Consensus broker estimates, Company, Axis Capital

CY18E

(%)

CY15E

CY16E

CY17E

(17.8)

20.2

15.5

(1.3)

0.8

7.8

Gross margin

57.3

57.5

57.2

EBITDA margin

20.3

21.3

21.3

Domestic Revenue

Growth

Exports Growth

Sensex

Nestle India

60

Jul-15

Oct-15

Jan-16

Apr-16

Jul-16

01

Analyst Meet Update

25 AUG 2016

NESTLE INDIA

FMCG

Analyst meet takeaways

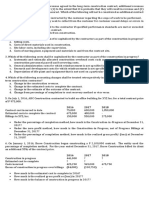

Maggi gaining back share, though category is still 2/3rd of pre-controversy levels

In 2014, when noodles market was sized at ~Rs33bn, Maggi sales were

~Rs26bn with ~80% market share. Post Maggi re-launch in Nov-15, Nestle was

quick to regain 57% market share in the Rs22bn noodle category. Management

expects category recovery(to 2014 level) to be gradual, as noodle consumption is

still an area of concern for some consumers (especially Mothers, who have migrated

to other food options). Management observations on Maggi re-launch:

Rebound and reloaded While there was concern over revival of noodles

category due to Maggi controversy (from Jun-15 to Nov-15), Nestle India has

not lost any distributor, saw no industrial disputes and no supplier left

Accelerate to market - Maggi controversy helped Nestle significantly revamp its

operations. It has able to reduce the lead time considerably like packing

material procurement days reduced to 9(normal 42), raw material to 5 days

(from 21 days), system readiness to 5 days (from 21 days), campaign to

20 days(from 45 days)

GalvanizingtroopsMaggi is now present in ~900 towns across India. Total

outlet reach is ~2.4 mn (vs. 3.8 mn in 2014). Management highlighted that

while it has completely recovered supplies to urban market, there is still short

supply in rural markets.

170

171

44%

148

136

129

131

54% 56%

57%

35%

138

100

Source: Company, Axis Capital Note: Sales indexed to Nov-15 (100)

Apr-16

Mar-16

Feb-16

Jan-16

Dec-15

Nov-15

Jun-16

May-16

Apr-16

Mar-16

Feb-16

Jan-16

11%

Dec-15

Nov-15

48%

51%

Jun-16

Exhibit 2: Maggi market share in noodles (post controversy)

May-16

Exhibit 1: Maggi sales (post controversy)

Source: Company, Axis Capital

02

25 AUG 2016

Analyst Meet Update

NESTLE INDIA

FMCG

Way forward for the company

What is the new reality: Management is hopeful that urbanization can help

urban-biased companies. It highlighted sevenimportant trends for Nestle:

Urbanization:is at an all-time high, with ~51% increase in cities in India

Technology tide: ~345 mn population tech-enabled, hence digital has high

influence on consumers

Women worth improving: Buying decisions by women today account for

90%of Nestle Indiassales (of house product categories)

Propensity to premiumize:

premium products

Valorizing value: Indian consumer is looking for value-add and price is not

the only criteria for buying decisions

Quest for goodness: Huge opportunities exist in health and nutrition space.

Nestle Health Science business has strong prospects. Eg. ~63 mn peoplein

India arediabetic and the number has been rising through the years

Shifting the sweet spot: There is a need to balance Taste, Indulgence

and Health

Overall

market

is

moving

towards

Where does Nestle want to go: Company vision is to remain a leading and

trusted health and wellness company.Of the 1.28bn (in 2015) Indian

population, Nestle India is targeting urban-centric 315 mn population.

Management highlighted its key ambitions and growth drivers:

Consumer-led growth: (a) focusing on volume-led double digit growth,

(b) launchof new products in each category, and (c) consumer

insight-led growth

Winning edge: (a) fast, focused and flexible in thought and action,

(b) embrace powerful way of working and(c) enable, empower, engage,

and energize colleagues

Simplification of processes: (a) process reduction of 30-40%, (b) reduction

in meetings by 50% and(c) zero tolerance for non-compliance

Howwill the company get there: Management emphasized goals to be

achieved through:

Driving penetration and frequency:Management highlighted that ~50% of

growth in the next couple of years will come from penetration improvement

and increased frequency of usage. Penetration in some of the categories

are still relatively low

Consumer-centric innovations and renovations across categories:

Five criteria for innovation highlighted by management are (a) consumer

insight around nutrition, health and wellness (differentiated offering;Eg: it

has launched a+ PRO-GROWTH as protein intake is less among kids),

(b) value up and premiumize (more initiatives in this space), (c) size of

opportunity and companys competency, (d) sustainability and innovation

of an accretive nature (should be a building block for something else as

well) and(e) building capabilities to expand in new categories (Noodles in

the past and currently with Nestle Ceregrow for 3-5year old kids)

03

25 AUG 2016

Analyst Meet Update

NESTLE INDIA

FMCG

Capture potential of many Indias within India: (a) Calibrated launches

based on geography, brand, category and channel potential, (b) Resources

to be placed behind national and regional winners and (c) Organization

capabilities to be fast, focused and flexible helping to excel in execution.

Launch and assessment time reduced from couple of months to couple

of weeks

25 new product launches in last three months

Prepared dishes and cooking aidsThe company has expanded the Maggi

franchise with new launches like (a) Maggi Cuppanoodles (4 variants),

(b) Maggi Hot Heads (4 variants) and (c) Maggi no garlic and no onion. It is

focusing to uptradethrough these launches. Response has been good so far

Chocolate and confectioneryIts new launches in the segment include NESTLE

BARONE charge, NESTLE Munch nuts, gift packs and premium chocolates

Milk products and Nutrition New launches in the segment includeNESTLE a+

GREKYO (4 variants, launched only in five to six states), NESTLE a+

PRO- GROWTH, NESTLE EVERYDAY masala fusion (tastes better than

homemade masala tea, as per management) and NESTLE CEREGROW (entry

into 3-5 year kids segment;in-between food with nutrition)

Beverages New launches include NESCAF SUNRISE Insta-Filter, NESCAF 3in-1, NESCAF RTD 3 variants, NESTEA 3 variants

Nestle categories more impacted in a slowing FMCG market

FMCG category (including infant formula and infant cereal segments) sized at

~US$ 40 bn (as per AC Nielson) has grown ~5.8% in H1CY16, with ~7.2%

growth in Q1 and ~4.4% in Q2. Of this, Foods and Beverage category sized at

US$ 21 bn has grown 6.3% in H1CY16. Nestle specific category sized at

US$ 4 bn has been highly impacted from slowdown (1.2% growth in H1CY16, Q1

1.3% and Q2 1%).

Exhibit 3: Category-wise market share and leadership position

Source: Company, Axis Capital

04

Analyst Meet Update

25 AUG 2016

NESTLE INDIA

FMCG

H1FY16 performance review

Nestle Indias H1CY16 domestic sales volume grew 7.3% YoY to 172,000 tons.

Volume growth adjusted for Noodles, Surplus fat & product portfolio optimization

initiatives was 0.5%. Reported domestic sales value growth was 2.6%, while

comparable growth was -0.7%.

Raw material indexed bottomed out

The company has benefitedfrom benign raw material prices during the last

18 months. However, management indicated inflation in some of the food raw

materialswould move index up in coming quarters. Inflationary trend seen for key

raw materials like Sugar (up 40%), Palm oil (14%), and Wheat flour (14%).

Exhibit 4: Nestl Indias Commodity Price Index

122

125

120

115

112

115

114

107

110

105

100

100

95

1HCY16

2015

2014

2013

2011

2012

90

Source: Company, Axis Capital Note: Indexed with base year 2011

Exhibit 5: Milk fat price trends

Exhibit 6: Palm oil price trends

150

160

Index - Q1 CY10 = 100

170

150

140

140

130

130

120

120

110

110

100

100

Source: Company, Axis CapitalNote: Indexed 1QCY10=100

Current

Q1CY16

Q3CY15

Q1CY15

Q3CY14

Q1CY14

Q3CY13

Q1CY13

Q3CY12

Q1CY12

Q3CY11

Q1CY11

90

Q3CY10

Current

Q1CY16

Q3CY15

Q1CY15

Q3CY14

Q1CY14

Q3CY13

Q1CY13

Q3CY12

Q1CY12

Q3CY11

Q1CY11

Q3CY10

Q1CY10

90

Q1CY10

Index - Q1 CY10 = 100

160

Source: Company, Axis CapitalNote: Indexed 1QCY10=100

05

Analyst Meet Update

25 AUG 2016

NESTLE INDIA

FMCG

Exhibit 7: Sugar price trends

Exhibit 8: Wheat flour price trends

140

90

Q1CY16

Current

Current

Q3CY15

Q1CY15

Q3CY14

Q1CY14

Q3CY13

Q1CY13

Q3CY12

Q1CY12

80

Q1CY16

Source: Company, Axis CapitalNote: Indexed 1QCY10=100

Source: Company, Axis CapitalNote: Indexed 1QCY10=100

Exhibit 9: Skimmed milk price trends

Exhibit 10: Green coffee price trends

200

200

180

Index - Q1 CY10 = 100

220

180

160

160

140

140

120

120

100

Source: Company, Axis CapitalNote: Indexed 1QCY10=100

Q3CY15

Q1CY15

Q3CY14

Q1CY14

Q3CY13

Q1CY13

Q3CY12

Q1CY12

Q3CY11

Q1CY11

80

Q3CY10

Current

Q1CY16

Q3CY15

Q1CY15

Q3CY14

Q1CY14

Q3CY13

Q1CY13

Q3CY12

Q1CY12

Q3CY11

Q1CY11

Q3CY10

80

Q1CY10

100

Q1CY10

Index - Q1 CY10 = 100

100

Current

Q1CY16

Q3CY15

Q1CY15

Q3CY14

Q1CY14

Q3CY13

Q1CY13

Q3CY12

Q1CY12

Q3CY11

Q1CY11

Q3CY10

Q1CY10

70

110

Q3CY11

80

120

Q1CY11

90

130

Q3CY10

100

Q1CY10

Index - Q1 CY10 = 100

Index - Q1 CY10 = 100

110

Source: Company, Axis CapitalNote: Indexed 1QCY10=100

24X7 consumer engagement services

The company has significantly improved consumer engagement program along with

Maggi re-launch. It now has 24X7 consumer engagement services across channels

in India. Number of contactsrose to 450,000 from 2,500 in 2012. Call response

time has significantly reduced to 30 minutes nowfrom 24 hours in 2012.

Other highlights

Effective tax rate for H1CY16 increased 550 bps YoY to 36%(vs. 30.5% in

H1CY15). Management highlighted that lower tax rate in H1CY15 was due to

(a) investment allowance received was for couple of years and (b) profit from

tax holiday period was high. Management highlighted that tax benefit from

Pantnagar facility has been phased out effective 1st Apr 2016

With no capacity expansion plans, management expects only maintenance

capex in CY16. Utilization is 50-60% for current Maggi capacity

06

25 AUG 2016

Analyst Meet Update

NESTLE INDIA

FMCG

Exhibit 11: 1-year forward PE (on consensus EPS)

PE (x)

60

10 yr median

50

40

30

20

Aug-16

Aug-15

Aug-14

Aug-13

Aug-12

Aug-11

Aug-10

Aug-09

Aug-08

Aug-07

Aug-06

10

Source: Bloomberg, Axis Capital

07

Analyst Meet Update

25 AUG 2016

NESTLE INDIA

FMCG

Financial summary (Standalone)

Profit &loss (Rs mn)

Y/E December

Net sales

Other operating income

Total operating income

Cost of goods sold

Gross profit

Gross margin (%)

Total operating expenses

EBITDA

EBITDA margin (%)

Cash flow (Rs mn)

CY15

CY16E

CY17E

CY18E

Y/E December

CY15

CY16E

CY17E

CY18E

81,233

96,361

110,678

126,714

Profit before tax

14,155

18,380

21,021

24,361

520

617

682

754

Depreciation & Amortisation

(3,473)

(3,627)

(4,099)

(4,508)

81,753

96,978

111,360

127,468

Chg in working capital

(34,689)

(40,954)

(47,339)

(54,487)

Cash flow from operations

47,064

56,025

64,021

72,981

57.9

58.1

57.8

57.6

(30,504)

(35,347)

(40,270)

(45,711)

16,560

20,678

23,751

27,271

20.4

21.5

21.5

21.5

Capital expenditure

Cash flow from investing

Equity raised/ (repaid)

Debt raised/ (repaid)

1,665

1,797

18,795

21,606

(944)

(5,692)

(6,000)

(6,250)

(4,974)

(1,075)

(6,631)

(6,652)

(18)

(177)

(8,533)

(10,239)

(12,515)

(12,362)

(9,310)

(10,889)

(13,165)

532

4,515

1,275

1,789

CY15

CY16E

CY17E

CY18E

101.6

126.8

147.2

173.2

CEPS (Rs)

94.4

160.3

185.1

215.3

48.5

75.0

90.0

110.0

83.0

61.2

63.1

65.3

(3,473)

(3,627)

(4,099)

(4,508)

Cash flow from financing

EBIT

13,087

17,051

19,652

22,763

Net chg in cash

(33)

(39)

Other income

216

14,899

(5,633)

Dividend paid

Depreciation

Net interest

3,445

17,868

Key ratios

1,101

1,368

1,369

1,598

Profit before tax

14,155

18,380

21,021

24,361

Y/E December

Total taxation

(4,356)

(6,157)

(6,832)

(7,666)

OPERATIONAL

Tax rate (%)

30.8

33.5

32.5

31.5

Profit after tax

9,800

12,223

14,189

16,695

FDEPS (Rs)

Minorities

DPS (Rs)

Profit/ Loss associate co(s)

Dividend payout ratio (%)

9,800

12,223

14,189

16,695

12.1

12.7

12.8

13.2

Net sales (%)

(17.2)

18.6

14.9

14.5

(4,167)

(399)

(439)

(445)

EBITDA (%)

(21.2)

24.9

14.9

14.8

Adj net profit (%)

(20.1)

24.7

16.1

17.7

FDEPS (%)

(20.1)

24.7

16.1

17.7

RoE (%)

34.7

41.0

42.7

45.3

RoCE (%)

46.6

58.2

60.1

63.1

6.2

8.8

9.2

10.5

Adjusted net profit

Adj. PAT margin (%)

Net non-recurring items

Reported net profit

5,633

11,824

13,750

16,249

Balance sheet (Rs mn)

Y/E December

Paid-up capital

GROWTH

PERFORMANCE

CY15

CY16E

CY17E

CY18E

964

964

964

964

Reserves & surplus

27,214

30,505

34,017

37,751

EFFICIENCY

Net worth

28,178

31,470

34,981

38,715

Asset turnover (x)

Borrowing

177

1,729

1,729

1,729

1,729

Total liabilities

60,804

65,383

72,335

79,918

Receivable days

3.5

4.0

3.6

3.6

Gross fixed assets

51,174

56,674

62,674

68,924

Inventory days

46.0

42.0

43.3

43.4

Less: Depreciation

(22,195)

(25,822)

(29,921)

(34,429)

Payable days

41.6

30.1

30.3

30.5

28,979

30,851

32,753

34,495

2,308

2,500

2,500

2,500

Total fixed assets

31,286

33,351

35,253

36,995

Net debt/ equity (x)

(0.6)

(0.7)

(0.7)

(0.7)

Total Investment

13,249

10,000

12,000

14,000

Current ratio (x)

0.5

0.7

0.7

0.7

8,208

8,773

10,402

11,909

Interest cover (x)

397.8

437.2

784

1,069

1,103

1,263

4,995

9,557

10,832

12,621

PE (x)

67.1

53.8

46.4

39.4

EV/ EBITDA (x)

38.6

30.9

26.7

23.2

7.9

6.6

5.7

5.0

23.4

20.9

18.8

17.0

Dividend yield (%)

0.7

1.1

1.3

1.6

Free cash flow yield (%)

2.6

1.4

1.9

2.3

Other non-current liabilities

Net fixed assets

Add: Capital WIP

Inventory

Debtors

Cash & bank

Loans & advances

2,134

2,533

2,646

3,030

Current liabilities

30,719

32,184

35,625

39,473

Net current assets

(14,451)

(10,153)

(10,543)

(10,550)

Other non-current assets

Total assets

Source: Company, Axis Capital

60,804

65,383

72,335

79,918

Sales/ total assets (x)

Working capital/ sales (x)

1.4

1.5

1.6

1.7

(0.2)

(0.2)

(0.2)

(0.2)

FINANCIAL STABILITY

Total debt/ equity (x)

VALUATION

EV/ Net sales (x)

PB (x)

Source: Company, Axis Capital

08

25 AUG 2016

Analyst Meet Update

NESTLE INDIA

FMCG

Disclosures:

The following Disclosures are being made in compliance with the SEBI Research Analyst Regulations 2014 (herein after referred to as the Regulations).

1. Axis Securities Ltd. (ASL) is a SEBI Registered Research Analyst having registration no. INH000000297. ASL, the Research Entity (RE) as defined in the

Regulations, is engaged in the business of providing Stock broking services, Depository participant services & distribution of various financial

products. ASL is a subsidiary company of Axis Bank Ltd. Axis Bank Ltd. is a listed public company and one of Indias largest private sector bank and

has its various subsidiaries engaged in businesses of Asset management, NBFC, Merchant Banking, Trusteeship, Venture Capital, Stock Broking, the

details in respect of which are available on www.axisbank.com.

2. ASL is registered with the Securities & Exchange Board of India (SEBI) for its stock broking & Depository participant business activities and with the

Association of Mutual Funds of India (AMFI) for distribution of financial products and also registered with IRDA as a corporate agent for insurance

business activity.

3. ASL has no material adverse disciplinary history as on the date of publication of this report.

4. I/We, authors (Research team) and the name/s subscribed to this report, hereby certify that all of the views expressed in this research report accurately

reflect my/our views about the subject issuer(s) or securities. I/We also certify that no part of my/our compensation was, is, or will be directly or

indirectly related to the specific recommendation(s) or view(s) in this report. I/we or my/our relative or ASL does not have any financial interest in the

subject company. Also I/we or my/our relative or ASL or its Associates may have beneficial ownership of 1% or more in the subject company at the

end of the month immediately preceding the date of publication of the Research Report. Since associates of ASL are engaged in various financial

service businesses, they might have financial interests or beneficial ownership in various companies including the subject company/companies

mentioned in this report. I/we or my/our relative or ASL or its associate does not have any material conflict of interest. I/we have not served as director

/ officer, etc. in the subject company in the last 12-month period.

Research Team

Sr. No

Name

Designation

Sunil Shah

Head of Research

sunil.shah@axissecurities.in

PankajBobade

Research Analyst

pankaj.bobade@axissecurities.in

Priyakant Dave

Research Analyst

priyakant.dave@axissecurities.in

Akhand Singh

Research Analyst

akhand.singh@axissecurities.in

BuntyChawla

Research Analyst

bunty.chawla@axissecurities.in

Hiren Trivedi

Research Associate

hiren.trivedi@axissecurities.in

Kiran Gawle

Associate

kiran.gawle@axissecurities.in

5. ASL has not received any compensation from the subject company in the past twelve months. ASL has not been engaged in market making activity for

the subject company.

6. In the last 12-month period ending on the last day of the month immediately preceding the date of publication of this research report, ASL or any of

its associates may have:

i.

ii.

iii.

Received compensation for investment banking, merchant banking or stock broking services or for any other services from the subject

company of this research report and / or;

Managed or co-managed public offering of the securities from the subject company of this research report and / or;

Received compensation for products or services other than investment banking, merchant banking or stock broking services from the subject

company of this research report;

ASL or any of its associates have not received compensation or other benefits from the subject company of this research report or any other third-party

in connection with this report

Term& Conditions:

This report has been prepared by ASL and is meant for sole use by the recipient and not for circulation. The report and information contained herein is

strictly confidential and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or

reproduced in any form, without prior written consent of ASL. The report is based on the facts, figures and information that are considered true, correct,

reliable and accurate. The intent of this report is not recommendatory in nature. The information is obtained from publicly available media or other

sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is

made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. The report is prepared

solely for informational purpose and does not constitute an offer document or solicitation of offer to buy or sell or subscribe for securities or other

financial instruments for the clients. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same

time. ASL will not treat recipients as customers by virtue of their receiving this report.

09

25 AUG 2016

Analyst Meet Update

NESTLE INDIA

FMCG

Disclaimer:

Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate

to the recipients specific circumstances. The securities and strategies discussed and opinions expressed, if any, in this report may not be suitable for all

investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient.

This report may not be taken in substitution for the exercise of independent judgment by any recipient. Each recipient of this report should make such

investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this report

(including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. Certain transactions,

including those involving futures, options and other derivatives as well as non-investment grade securities involve substantial risk and are not suitable for

all investors. ASL, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to

the investments made or any action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the

currency rates, diminution in the NAVs, reduction in the dividend or income, etc. Past performance is not necessarily a guide to future performance.

Investors are advise necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated

before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not

predictions and may be subject to change without notice.

ASL and its affiliated companies, their directors and employees may; (a) from time to time, have long or short position(s) in, and buy or sell the securities of

the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities or earn brokerage or other compensation or act as a

market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or investment banker, lender/borrower to such

company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions. Each of

these entities functions as a separate, distinct and independent of each other. The recipient should take this into account before interpreting this document.

ASL and / or its affiliates do and seek to do business including investment banking with companies covered in its research reports. As a result, the

recipients of this report should be aware that ASL may have a potential conflict of interest that may affect the objectivity of this report. Compensation of

Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. ASL may have issued other reports

that are inconsistent with and reach different conclusion from the information presented in this report.

Neither this report nor any copy of it may be taken or transmitted into the United State (to U.S. Persons), Canada, or Japan or distributed, directly or

indirectly, in the United States or Canada or distributed or redistributed in Japan or to any resident thereof. If this report is inadvertently sent or has

reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This report is not directed or

intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction,

where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ASL to any registration or licensing

requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of

investors.

The Disclosures of Interest Statement incorporated in this document is provided solely to enhance the transparency and should not be treated as

endorsement of the views expressed in the report. The Company reserves the right to make modifications and alternations to this document as may be

required from time to time without any prior notice. The views expressed are those of the analyst(s) and the Company may or may not subscribe to all the

views expressed therein.

Copyright in this document vests with Axis Securities Limited.

Axis Securities Limited, Corporate office: Unit No. 2, Phoenix Market City, 15, LBS Road, Near Kamani Junction, Kurla (west), Mumbai-400070, Tel No.

18002100808/022-61480808, Regd. off.- Axis House, 8th Floor, Wadia International Centre, PandurangBudhkarMarg, Worli, Mumbai 400 025. Compliance

Officer: AnandShaha, Email: compliance.officer@axisdirect.in, Tel No: 022-42671582.

010

You might also like

- Apollo Hospitals: Numbers Continue To StrengthenDocument13 pagesApollo Hospitals: Numbers Continue To StrengthenanjugaduNo ratings yet

- Shree Cement: Treading Smoothly On The Growth PathDocument6 pagesShree Cement: Treading Smoothly On The Growth Pathanjugadu100% (1)

- Divis-Laboratories 24022020Document6 pagesDivis-Laboratories 24022020anjugaduNo ratings yet

- Indian Railway Catering and Tourism Corporation (IRCTC IN) : Q3FY20 Result UpdateDocument7 pagesIndian Railway Catering and Tourism Corporation (IRCTC IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- Ipca Laboratories Limited: Promising OutlookDocument8 pagesIpca Laboratories Limited: Promising OutlookanjugaduNo ratings yet

- Dhanuka Agritech (DAGRI IN) : Q3FY20 Result UpdateDocument7 pagesDhanuka Agritech (DAGRI IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- P.I. Industries (PI IN) : Q3FY20 Result UpdateDocument8 pagesP.I. Industries (PI IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- 9th April 2020 Equity 360: Nifty LevelDocument6 pages9th April 2020 Equity 360: Nifty LevelanjugaduNo ratings yet

- Godrej Consumer Products Limited: Recovery Likely by Q1FY2021Document5 pagesGodrej Consumer Products Limited: Recovery Likely by Q1FY2021anjugaduNo ratings yet

- Ambuja Cement: Volume Push Drives Topline Maintain HOLDDocument9 pagesAmbuja Cement: Volume Push Drives Topline Maintain HOLDanjugaduNo ratings yet

- Essel Propack LTD: Blackstone Acquires Promoter's StakeDocument4 pagesEssel Propack LTD: Blackstone Acquires Promoter's StakeanjugaduNo ratings yet

- S Chand and Company (SCHAND IN) : Q3FY20 Result UpdateDocument6 pagesS Chand and Company (SCHAND IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- Heidelberg Cement India (HEIM IN) : Q3FY20 Result UpdateDocument6 pagesHeidelberg Cement India (HEIM IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- Infosys: Digital Trajectory Intact, Revises Guidance UpwardsDocument11 pagesInfosys: Digital Trajectory Intact, Revises Guidance UpwardsanjugaduNo ratings yet

- Inox Leisure: Growth Outlook Healthy Despite Short-Term HiccupsDocument6 pagesInox Leisure: Growth Outlook Healthy Despite Short-Term HiccupsanjugaduNo ratings yet

- Stock Update: Greaves CottonDocument3 pagesStock Update: Greaves CottonanjugaduNo ratings yet

- Lupin (LPC IN) : Event UpdateDocument6 pagesLupin (LPC IN) : Event UpdateanjugaduNo ratings yet

- Symphony: Back On The Fast LaneDocument18 pagesSymphony: Back On The Fast LaneanjugaduNo ratings yet

- Asian Paints: Volume Led Growth ContinuesDocument9 pagesAsian Paints: Volume Led Growth ContinuesanjugaduNo ratings yet

- DCB Bank: Healthy Growth in Balance Sheet C/I Continues To ImproveDocument4 pagesDCB Bank: Healthy Growth in Balance Sheet C/I Continues To ImproveanjugaduNo ratings yet

- India in Numbers - Oct 2019Document40 pagesIndia in Numbers - Oct 2019anjugaduNo ratings yet

- Voltamp Transformers 26112019Document5 pagesVoltamp Transformers 26112019anjugaduNo ratings yet

- Petronet LNG 281218Document3 pagesPetronet LNG 281218anjugaduNo ratings yet

- Infosys (INFO IN) : Event UpdateDocument7 pagesInfosys (INFO IN) : Event UpdateanjugaduNo ratings yet

- Bajaj Holdings Investment 24042019Document3 pagesBajaj Holdings Investment 24042019anjugaduNo ratings yet

- Supreme Industries LTD Hold: Retail Equity ResearchDocument5 pagesSupreme Industries LTD Hold: Retail Equity ResearchanjugaduNo ratings yet

- CD Equisearchpv PVT LTD: Quarterly HighlightsDocument12 pagesCD Equisearchpv PVT LTD: Quarterly HighlightsanjugaduNo ratings yet

- L&T Technology Services (LTTS IN) : Q3FY19 Result UpdateDocument9 pagesL&T Technology Services (LTTS IN) : Q3FY19 Result UpdateanjugaduNo ratings yet

- KEC International LTD (KEC) : Continued Traction in Railway & Civil Help Post Stable PerformanceDocument4 pagesKEC International LTD (KEC) : Continued Traction in Railway & Civil Help Post Stable PerformanceanjugaduNo ratings yet

- Network Analysis-Two Port Network & Network FunctionsDocument34 pagesNetwork Analysis-Two Port Network & Network Functionsanjugadu100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Business Sample LettersDocument3 pagesBusiness Sample Lettersshaikat1009549No ratings yet

- Basic Concepts in Business Policy and StrategyDocument3 pagesBasic Concepts in Business Policy and Strategylance100% (1)

- Oak University School of Business Bba312: Financial ManagementDocument2 pagesOak University School of Business Bba312: Financial ManagementDanielNo ratings yet

- The Kerala State Co-Operative Bank LTD Customer Rights PolicyDocument14 pagesThe Kerala State Co-Operative Bank LTD Customer Rights PolicyAkhilAkhilNo ratings yet

- Customs Bonded Warehousing SystemDocument28 pagesCustoms Bonded Warehousing SystemJen CastroNo ratings yet

- Office Fit-Out GuideDocument4 pagesOffice Fit-Out Guidebulsemberutu100% (1)

- BBA Project Handbook 2021Document13 pagesBBA Project Handbook 2021alinaNo ratings yet

- S 8-Category Driver Analysis-Dr PlaviniDocument19 pagesS 8-Category Driver Analysis-Dr PlaviniPallav JainNo ratings yet

- Tugas ManPro Group 1Document2 pagesTugas ManPro Group 1Salshadina SundariNo ratings yet

- Mr. Dhaval G. Patadiya: Education Board / University YearDocument4 pagesMr. Dhaval G. Patadiya: Education Board / University YearTEJ_SACHLANo ratings yet

- Gorry Scott-Morton FW 22Document22 pagesGorry Scott-Morton FW 22neerajvijayranjanNo ratings yet

- Fabm 21Document6 pagesFabm 21kristelNo ratings yet

- Ey CSR Report 2020Document60 pagesEy CSR Report 2020azNo ratings yet

- Chapter 8 Segmenting and Targeting MarketsDocument26 pagesChapter 8 Segmenting and Targeting Marketsrizcst9759No ratings yet

- Investing in Banking Sector Mutual Funds - An OverviewDocument5 pagesInvesting in Banking Sector Mutual Funds - An OverviewarcherselevatorsNo ratings yet

- Definition of WagesDocument8 pagesDefinition of WagesCorolla SedanNo ratings yet

- Las-Business-Finance-Q1 Week 4Document22 pagesLas-Business-Finance-Q1 Week 4Kinn JayNo ratings yet

- Axis Long Term Equity Fund - KIMDocument19 pagesAxis Long Term Equity Fund - KIMsurefooted1No ratings yet

- Latido Leather'S: Team Member: Samikshya Khati Chhetri Ria Shrestha Ritu Lama Prasiddha Pradhan Prajwol KatwalDocument19 pagesLatido Leather'S: Team Member: Samikshya Khati Chhetri Ria Shrestha Ritu Lama Prasiddha Pradhan Prajwol KatwalPrasiddha Pradhan100% (1)

- Business Process Reengineering 2Document33 pagesBusiness Process Reengineering 2Rashi VermaNo ratings yet

- ConstructionDocument1 pageConstructionAlexandriteNo ratings yet

- 19llb082 - Banking Law Project - 6th SemDocument25 pages19llb082 - Banking Law Project - 6th Semashirbad sahooNo ratings yet

- India 2023 Agrifood Investment ReportDocument34 pagesIndia 2023 Agrifood Investment ReportANKUSH SINHANo ratings yet

- Human Resources Kpi LibraryDocument6 pagesHuman Resources Kpi Libraryoironet18100% (1)

- 2023 - Mintz Et Al - Marketing LettersDocument16 pages2023 - Mintz Et Al - Marketing LettersYupal ShuklaNo ratings yet

- BTL tài chính doanh nghiệp mớiDocument19 pagesBTL tài chính doanh nghiệp mớiDo Hoang LanNo ratings yet

- 2223-Article Text-10843-1-10-20230721Document17 pages2223-Article Text-10843-1-10-20230721aptvirtualkpknlmksNo ratings yet

- Chapter 8 and 9Document3 pagesChapter 8 and 9Ajith GeorgeNo ratings yet

- Preamble To Bill of QuantitiesDocument1 pagePreamble To Bill of QuantitiesAziz ul HakeemNo ratings yet

- Introduction To Project ManagementDocument58 pagesIntroduction To Project ManagementAnonymous kwi5IqtWJNo ratings yet