Professional Documents

Culture Documents

Ivan Incisor 2014 Tax Return CHAPTER 2 - T14 - For - Filing

Ivan Incisor 2014 Tax Return CHAPTER 2 - T14 - For - Filing

Uploaded by

mirandaCopyright:

Available Formats

You might also like

- Pet Kingdom Tax ReturnDocument26 pagesPet Kingdom Tax ReturnRaychael Ross100% (2)

- 1 2 3 4 5 6 7 8 9 10Document57 pages1 2 3 4 5 6 7 8 9 10gschmidtkeNo ratings yet

- 1779 & 928 American States Assembly Document Check ListDocument6 pages1779 & 928 American States Assembly Document Check ListLaLa Banks100% (2)

- NATH f1040Document2 pagesNATH f1040Spencer NathNo ratings yet

- Windward Fund's 2018 Tax FormsDocument49 pagesWindward Fund's 2018 Tax FormsJoe SchoffstallNo ratings yet

- Complete Return President Obama 2012 PDFDocument38 pagesComplete Return President Obama 2012 PDFTyler DeiesoNo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- TaxDocument9 pagesTaxKuan ChenNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument3 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetLabNo ratings yet

- Tax Certificate 2022-2023Document1 pageTax Certificate 2022-2023marco.kozilekgoweNo ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- Tax ReturnsDocument1 pageTax Returnshuss eynNo ratings yet

- 2020 Donnarumma SH Form 1040 Individual Tax Return - RecordsDocument19 pages2020 Donnarumma SH Form 1040 Individual Tax Return - RecordsandyNo ratings yet

- 2023 Tax Return: Prepared ByDocument14 pages2023 Tax Return: Prepared BypatovoidNo ratings yet

- 2023 Tax Return ZaireDocument14 pages2023 Tax Return ZairepatovoidNo ratings yet

- 1098T17Document2 pages1098T17RegrubdiupsNo ratings yet

- A218 DocumentDocument9 pagesA218 DocumentJose AlmonteNo ratings yet

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- State District of ColumbiaDocument20 pagesState District of ColumbiaRoger federerNo ratings yet

- 2014 Alabama Possible 990Document39 pages2014 Alabama Possible 990Alabama PossibleNo ratings yet

- Return 2019 BOY FIRST MAKEDocument6 pagesReturn 2019 BOY FIRST MAKEshahabNo ratings yet

- TurboTax Print Preview 02-14-2013T20.10.08.460Document13 pagesTurboTax Print Preview 02-14-2013T20.10.08.460glenncannon1973No ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyNo ratings yet

- 2009 Balderas Puentes S Form 1040 Individual Tax ReturnDocument9 pages2009 Balderas Puentes S Form 1040 Individual Tax ReturnJaqueline LeslieNo ratings yet

- TaxReturn JoderamerDocument19 pagesTaxReturn JoderamerTujuh AnginNo ratings yet

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Document17 pagesRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Moysés Isper NetoNo ratings yet

- 2016 540 California Resident Income Tax ReturnDocument5 pages2016 540 California Resident Income Tax Returnapi-351213976No ratings yet

- 2021-2022 Tax ReturnDocument3 pages2021-2022 Tax ReturnMmmmmmmNo ratings yet

- 2023 Tax Return: Prepared ByDocument11 pages2023 Tax Return: Prepared ByopreciousekugbereNo ratings yet

- Will Frost 2013 Tax Return - T13 - For - RecordsDocument146 pagesWill Frost 2013 Tax Return - T13 - For - RecordsjessicaNo ratings yet

- CLR 2020 Tax ReturnDocument14 pagesCLR 2020 Tax ReturnAlexander Barno AlexNo ratings yet

- Advia Credit Union 2Document1 pageAdvia Credit Union 2kathyNo ratings yet

- Tax Return 2018-19Document18 pagesTax Return 2018-19Kasam ANo ratings yet

- 1 5136803172601299942 PDFDocument3 pages1 5136803172601299942 PDFnurulamin00023No ratings yet

- Rhonda TX RTNDocument18 pagesRhonda TX RTNobriens05No ratings yet

- Real 1040 1Document2 pagesReal 1040 1paul100% (1)

- 2023 Form 1040-SR. U.S. Tax Return For SeniorsDocument4 pages2023 Form 1040-SR. U.S. Tax Return For SeniorspatovoidNo ratings yet

- TB US TaxRefund 2009 ENG PackDocument8 pagesTB US TaxRefund 2009 ENG Packabsolute_absurdNo ratings yet

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocument72 pagesInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001No ratings yet

- U.S. Individual Income Tax Return: Standard DeductionDocument3 pagesU.S. Individual Income Tax Return: Standard DeductionAkNo ratings yet

- LG FFDocument1 pageLG FFfeem743No ratings yet

- Tax Return 2023Document2 pagesTax Return 2023jacksonleah313No ratings yet

- Tax Return SummaryDocument14 pagesTax Return Summaryevalle13No ratings yet

- 2011 Income Tax ReturnDocument4 pages2011 Income Tax Returnsalazar17No ratings yet

- 2021 TaxReturnDocument11 pages2021 TaxReturnHa AlNo ratings yet

- Main - Form Pa 8453 2018 Pennsylvania Individual Income Tax Declaration Electronic Filing PennsylvaniaDocument4 pagesMain - Form Pa 8453 2018 Pennsylvania Individual Income Tax Declaration Electronic Filing PennsylvaniaDiana JuanNo ratings yet

- UnknownDocument24 pagesUnknownanyanwuchigozie560No ratings yet

- 2009 Gibbs D Form 1040 Individual Tax Return Tax2009Document23 pages2009 Gibbs D Form 1040 Individual Tax Return Tax2009Jaqueline LeslieNo ratings yet

- 2021 - TaxReturn 2pagessignedDocument3 pages2021 - TaxReturn 2pagessignedDedrick RiversNo ratings yet

- Income Tax Return Ay 2019-20Document1 pageIncome Tax Return Ay 2019-20ramanNo ratings yet

- 2020 TaxReturnDocument17 pages2020 TaxReturnOscar Alexander Rodríguez MogollónNo ratings yet

- Tax Return 2017Document23 pagesTax Return 2017jbanuelosv73No ratings yet

- ApplicationDocument2 pagesApplicationFabian SandovalNo ratings yet

- MLFA Form 990 - 2016Document25 pagesMLFA Form 990 - 2016MLFANo ratings yet

- FTF 2024-05-11 1715453284246Document4 pagesFTF 2024-05-11 1715453284246Brad Dorsey100% (1)

- Tax Return - Mr. X - AY 2022-23Document12 pagesTax Return - Mr. X - AY 2022-23Rasel AshrafulNo ratings yet

- HPK3PZDocument7 pagesHPK3PZDiane LeeNo ratings yet

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDocument2 pagesEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNo ratings yet

- Kia Lopez Form 1040Document2 pagesKia Lopez Form 1040Stephanie RobinsonNo ratings yet

- Tax Return 2021Document3 pagesTax Return 2021Mark ThomasNo ratings yet

- 2019 Tax Return Documents (CLEAN LIVING LLC)Document28 pages2019 Tax Return Documents (CLEAN LIVING LLC)JuniorNo ratings yet

- Tax File 2106 Ss FileingDocument5 pagesTax File 2106 Ss FileingWALLAUERNo ratings yet

- Chapter 4 For FilingDocument9 pagesChapter 4 For Filinglagurr100% (1)

- Nucor Corporation Case16Document1 pageNucor Corporation Case16ShakilaMissz-KyutieJenkinsNo ratings yet

- Exercise 1 SolutionDocument15 pagesExercise 1 SolutionShakilaMissz-KyutieJenkinsNo ratings yet

- Bul4421-10868 WillsDocument4 pagesBul4421-10868 WillsShakilaMissz-KyutieJenkinsNo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- 09 8 6 SCDocument12 pages09 8 6 SCRanger Rodz TennysonNo ratings yet

- 1 Ca Irs 3176CDocument3 pages1 Ca Irs 3176CStephen Monaghan100% (1)

- GROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanDocument4 pagesGROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanJoatham GenovisNo ratings yet

- Bar+Q+ (Domondon) +TAX (1) PrintedDocument47 pagesBar+Q+ (Domondon) +TAX (1) PrintedJoyce Noreen BagyonNo ratings yet

- TAX CODAL As Per SyllabusDocument5 pagesTAX CODAL As Per SyllabusCarmela WenceslaoNo ratings yet

- Steag State Power v. CIRDocument2 pagesSteag State Power v. CIRSab Amantillo BorromeoNo ratings yet

- Rmo 1985Document58 pagesRmo 1985Mary graceNo ratings yet

- VAT 5 CIR-v-CHEVRONDocument4 pagesVAT 5 CIR-v-CHEVRONSherry Jane GaspayNo ratings yet

- Ebook PDF Fundamentals of Taxation 2018 Edition 11th Edition by Ana CruzDocument41 pagesEbook PDF Fundamentals of Taxation 2018 Edition 11th Edition by Ana Cruzfrank.kuan506No ratings yet

- Tax Review Cases (Digested)Document41 pagesTax Review Cases (Digested)Tokie TokiNo ratings yet

- Rule: Steel Import Monitoring and Analysis SystemDocument4 pagesRule: Steel Import Monitoring and Analysis SystemJustia.comNo ratings yet

- Commissioner V AlgueDocument2 pagesCommissioner V AlgueRyan Vic AbadayanNo ratings yet

- JV1Document3 pagesJV1Yakup AVCINo ratings yet

- Philippine Guaranty Co Vs CIRDocument4 pagesPhilippine Guaranty Co Vs CIRJarvin David ResusNo ratings yet

- CS Garment Inc. v. CIR, G.R. No. 182399, 2014Document11 pagesCS Garment Inc. v. CIR, G.R. No. 182399, 2014JMae MagatNo ratings yet

- CIR Vs GJMDocument4 pagesCIR Vs GJMiamchurkyNo ratings yet

- Cir vs. TMX Sales and CtaDocument3 pagesCir vs. TMX Sales and CtaD De LeonNo ratings yet

- September 2010 Philippine Supreme Court Decisions On TaxDocument2 pagesSeptember 2010 Philippine Supreme Court Decisions On TaxNgan TuyNo ratings yet

- Due Process Cases - CompleteDocument275 pagesDue Process Cases - CompleteJustin Columba AgraviadorNo ratings yet

- 1120 Single MemberDocument16 pages1120 Single MemberA.F. GRANADANo ratings yet

- Butuan Sawmill vs. CTADocument2 pagesButuan Sawmill vs. CTARhea CagueteNo ratings yet

- Sjahss 96 240-249Document10 pagesSjahss 96 240-249Mahamood FaisalNo ratings yet

- HW 4Document9 pagesHW 4piya67kNo ratings yet

- 1902 January 2018 ENCS FinalDocument2 pages1902 January 2018 ENCS FinalrbelduaNo ratings yet

- CIR vs. Isabela Cultural Corporation 135210Document1 pageCIR vs. Isabela Cultural Corporation 135210magenNo ratings yet

- 211-CIR v. Li Yao G.R. No. L-11875 December 28, 1963Document12 pages211-CIR v. Li Yao G.R. No. L-11875 December 28, 1963Jopan SJNo ratings yet

- Tax ReviewerDocument14 pagesTax ReviewerRey Victor GarinNo ratings yet

Ivan Incisor 2014 Tax Return CHAPTER 2 - T14 - For - Filing

Ivan Incisor 2014 Tax Return CHAPTER 2 - T14 - For - Filing

Uploaded by

mirandaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ivan Incisor 2014 Tax Return CHAPTER 2 - T14 - For - Filing

Ivan Incisor 2014 Tax Return CHAPTER 2 - T14 - For - Filing

Uploaded by

mirandaCopyright:

Available Formats

COVER PAGE

Filing Checklist for 2014 Tax Return Filed On Standard Forms

Prepared on: 09/06/2016 10:19:58 pm

Return: C:\Users\Miranda\Documents\HRBlock\Ivan Incisor 2014 Tax Return.T14

To file your 2014 tax return, simply follow these instructions:

Step 1. Sign and date the return

Because you're filing a joint return, IVAN and IRENE both need to sign the tax return.

If your return is signed by a representative for you, you must have a power of attorney attached that specifically authorizes the representative to

sign your return. To do this, you can use Form 2848, Power of Attorney and Declaration of Representative.

Step 2. Assemble the return

These forms should be assembled behind Form 1040 --U.S. Individual Income Tax Return

Staple these documents to the front of the first page of the return:

Form W-2: Wage and Tax Statement

1st (Bitewing Dental Clinic, Inc.)

Step 3. Mail the return

Mail the return to this address:

Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0002

We recommend that you use one of these IRS-approved methods to send your return. Retain the proof of mailing to avoid a late filing penalty:

- U.S. Postal Service certified mail.

- FedEx Priority Overnight, Standard Overnight, 2Day, International Priority, or International First.

- United Parcel Service Next Day Air, Next Day Air Saver, 2nd Day Air, 2nd Day Air A.M., Worldwide Express Plus, or Worldwide Express.

Step 4. Keep a copy

Print a second copy of the return for your records. We recommend that you also print and retain these supporting forms, which don't need to be

sent to the IRS:

- - Background Worksheet

- - Dependents Worksheet

- - Last Year's Data Worksheet

- - Form 1099-INT/OID

- - Form 1099-DIV

- - Form 1099-G

- - Non-W2 Wages

2014 return information - Keep this for your records

Here is some additional information about your 2014 return. Keep this information with your records.

You will need your 2014 AGI to electronically sign your return next year.

Quick Summary

Income

Adjustments

Adjusted gross income

Deductions

Exemption(s)

Taxable income

Tax withheld or paid already

Actual tax due

Refund applied to next year

Refund

* Your long-term capital gains and

qualifying dividends are taxed at a

lower rate than your other income.

As a result, your total federal tax is

$77,245

$13,000

$64,245

$12,400

$11,850

$39,995

$6,000

$4,894

$0

$1,106

less than the tax shown on the IRS's

Tax Table.

(99)

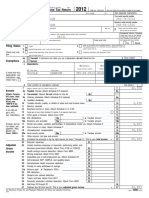

Department of the TreasuryInternal Revenue Service

F

o

r

m

For the year Jan. 1Dec. 31, 2014, or other tax year beginning

1040 U.S. Individual Income Tax Return 2014

Your first name and initial

OMB No. 1545-0074

, 2014, ending

IRS Use OnlyDo not write or staple in this space.

See separate instructions.

Your social security number

,20

Last name

IVAN

INCISOR

If a joint return, spouse's first name and initial

IRENE

477-34-4321

Last name

Spouse's social security number

INCISOR

637-34-4927

Apt. no.

Home address (number and street). If you have a P.O. box, see instructions.

Make sure the SSN(s) above

and on line 6c are correct.

468 MULE DEER LANE

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

SPOKANE

WA

Foreign country name

Filing Status

Foreign province/state/county

Single

2

3

Exemptions

6a

b

c

X

X

IRA

Check here if you, or your spouse if filing

jointly, want $3 to go to this fund. Checking

a box below will not change your tax

or refund

You

Spouse

Head of household (with qualifying person). (See instr.) If the

qualifying person is a child but not your dependent, enter this

child's name here.

Qualifying widow(er) with dependent child

Yourself. If someone can claim you as a dependent, do not check box 6a

Boxes checked

on 6a and 6b

. . . . . . .

social security number

Last name

INCISOR

relationship to you

lived with you

did not live with

you due to divorce

or separation

(see instructions)

(see instructions)

690-99-9999 Son

Attach Form(s)

W-2 here. Also

attach Forms

W-2G and

1099-R if tax

was withheld.

If you did not

get a W-2,

see instructions.

Adjusted

Gross

Income

KIA

Dependents on 6c

not entered above

Add numbers on

lines above

d Total number of exemptions claimed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Income

No. of children

on 6c who:

Spouse . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(4) X if child under age 17

(2) Dependent's

(3) Dependent's

Dependents:

qualifying for child tax credit

(1) First name

If more than four

dependents, see

instructions and

check here

Foreign postal code

Married filing jointly (even if only one had income)

Married filing separately. Enter spouse's SSN above

and full name here.

Check only one

box.

Presidential Election Campaign

99206

7

Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . . . . . . . . . . . . . . .

8a

Taxable interest. Attach Schedule B if required . . . . . . . . . . . . . . . . . . . . . . . . . .

650

Tax-exempt interest. Do not include on line 8a . . . . . . . . . . . . . .

8b

Ordinary dividends. Attach Schedule B if required . . . . . . . . . . . . . . . . . . . . . . . . .

9a

1,320

Qualified dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9b

10

10

Taxable refunds, credits, or offsets of state and local income taxes . . . . . . . . . . . . . . . .

11

11

Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

Business income or (loss). Attach Schedule C or C-EZ . . . . . . . . . . . . . . . . . . . . . .

12

13

13

Capital gain or (loss). Attach Schedule D if required. If not required, check here . . . . . . . . . . . . . . . . . .

14

14

Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15b

15a IRA distributions . . . . . . . . . . . . . . 15a

b Taxable amount . . .

16b

16a Pensions and annuities . . . . . . . . . . . 16a

b Taxable amount . . .

17

17

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E . . . . .

18

18

Farm income or (loss). Attach Schedule F . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

19

Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20a

20a Social security benefits

b Taxable amount . . . . . . . . 20b

21

21

Other income. List type and amount _ _ _ _ _ _ _ _ _ _ _ _GAMBLING

_____________________

22

22

Combine the amounts in the far right column for lines 7 through 21. This is your total income

7

8a

b

9a

b

23

Educator expenses

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25

26

27

28

29

30

31a

32

Certain business expenses of reservists, performing artists, and

fee-basis government officials. Attach Form 2106 or 2106-EZ . .

Health savings account deduction. Attach Form 8889 . . . . . .

Moving expenses. Attach Form 3903 . . . . . . . . . . . . . .

Deductible part of self-employment tax. Attach Schedule SE . .

Self-employed SEP, SIMPLE, and qualified plans . . . . . . . .

Self-employed health insurance deduction . . . . . . . . . . . .

Penalty on early withdrawal of savings . . . . . . . . . . . . . .

667-34-9224

Alimony paid b Recipient's SSN

IRA deduction . . . . . . . . . . . . . . . . . . . . . . . . . .

33

34

Student loan interest deduction . . . . . . . . . . . . . . . . . . . . . .

Tuition and fees. Attach Form 8917 . . . . . . . . . . . . . . . . . . . .

35

Domestic production activities deduction. Attach Form 8903

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. . . . .

. . . . . . .

23

24

25

26

27

28

29

30

31a

32

33

34

35

0

0

0

0

0

0

0

13,000

0

65,000

1,030

1,465

0

0

0

0

0

0

3,750

6,000

77,245

36

Add lines 23 through 35 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37

Subtract line 36 from line 22. This is your adjusted gross income . . . . . . . . . . . . . . . .

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

36

37

13,000

64,245

Form 1040 (2014)

IVAN

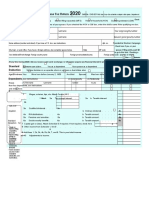

Form 1040 (2014)

Tax and

Credits

Standard

Deduction

for

People who

check any

box on line

39a or 39b or

who can be

claimed as a

dependent,

see

instructions.

All others:

Single or

Married filing

separately,

$6,200

Married filing

jointly or

Qualifying

widow(er),

$12,400

Head of

household,

$9,100

Other

Taxes

Payments

If you have a

qualifying

child, attach

Schedule EIC.

Joint return? See

instructions.

Keep a copy for

your records.

Paid

Preparer

Use Only

KIA

. . . . . .

40

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

41

12,400

51,845

11,850

39,995

4,894

0

41

Subtract line 40 from line 38

42

Exemptions. If line 38 is $152,525 or less, multiply $3,950 by the number on line 6d. Otherwise, see instructions

43

Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0-

44

Tax (see instructions). Check if any from:

45

46

Alternative minimum tax (see instructions). Attach Form 6251 . . . . . . . . . . . . . . . . . . . . . . . . . .

45

Excess advance premium tax credit repayment. Attach Form 8962 . . . . . . . . . . . . . . . . .

46

47

Add lines 44, 45, and 46 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

47

4,894

48

Foreign tax credit. Attach Form 1116 if required . . . . . . . . . . . . .

48

49

Credit for child and dependent care expenses. Attach Form 2441 . . . .

49

50

Education credits from Form 8863, line 19

. . . . . . . . . . . . . . .

50

51

Retirement savings contributions credit. Attach Form 8880 . . . . . . .

51

52

53

Child tax credit. Attach Schedule 8812, if required . . . . . . . . . . .

Residential energy credits. Attach Form 5695 . . . . . . . . . . . . . .

52

54

Other credits from Form: a

55

56

Add lines 48 through 54. These are your total credits . . . . . . . . . . . . . . . . . . . . . . .

Subtract line 55 from line 47. If line 55 is more than line 47, enter -0- . . . . . . . . . . . . . .

55

57

Self-employment tax. Attach Schedule SE

57

0

4,894

0

0

0

0

0

58

Form(s) 8814

3800 b

Form 4972

42

. . . . . . . . . . . . . . .

43

44

53

54

8801 c

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Unreported social security and Medicare tax from Form:

4137

8919 . . . . . . . .

59

Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required . . . . .

60 a Household employment taxes from Schedule H . . . . . . . . . . . . . . . . . . . . . . . . . . .

b First-time homebuyer credit repayment. Attach Form 5405 if required . . . . . . . . . . . . . . . .

61

Health care: individual responsibility (see instructions)

62

Taxes from: a

63

Add lines 56 through 62. This is your total tax

64

65

Form 8959 b

Form 8960 c

Full-year coverage X

. . . . . . . . . .

56

58

59

60a

60b

61

0

4,894

62

Instructions; enter code(s)

. . . . . . . . . . . . . . . . . . . . . . . . .

6,000

64

Federal income tax withheld from Forms W-2 and 1099 . . . . . . . . .

0

2014 estimated tax payments and amount applied from 2013 return . .

65

63

66a

66a Earned income credit (EIC) . . . . . . . . . . . . . . . . . . . . . .

66b

b Nontaxable combat pay election . . . . .

67

Additional child tax credit. Attach Schedule 8812 . . . . . . . . . . . .

68

American opportunity credit from Form 8863, line 8 . . . . . . . . . . .

67

Net premium tax credit. Attach Form 8962 . . . . . . . . . . . . . . . .

68

69

70

Amount paid with request for extension to file . . . . . . . . . . . . . .

70

71

Excess social security and tier 1 RRTA tax withheld . . . . . . . . . . .

71

72

73

Credit for federal tax on fuels. Attach Form 4136 . . . . . . . . . . . .

72

Credits from Form:

Reserved c

Reserved d

a

2439 b

73

Add lines 64, 65, 66a, and 67 through 73. These are your total payments . . . . . . . . . . .

0

6,000

1,106

1,106

74

75

If line 74 is more than line 63, subtract line 63 from line 74. This is the amount you overpaid . . .

76a Amount of line 75 you want refunded to you. If Form 8888 is attached, check here . . . .

b Routing number XXXXXXXXX

c Type: X Checking

Savings

d Account number XXXXXXXXXXXXXXXXX

75

76a

0

77

78

Amount you owe. Subtract line 74 from line 63. For details on how to pay, see instructions . .

78

79

Estimated tax penalty (see instructions) . . . . . . . . . . . . . . . . .

79

Do you want to allow another person to discuss this return with the IRS (see instructions)?

Yes. Complete below

77

Amount

You Owe

Third Party

Designee

Sign

Here

38

Itemized deductions (from Schedule A) or your standard deduction (see left margin)

74

Direct deposit?

See

instructions.

Page 2

64,245

477-34-4321

40

69

Refund

I INCISOR

Amount from line 37 (adjusted gross income) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Blind.

You were born before January 2, 1950,

39a Check

Total boxes

0

checked

39a

if:

Spouse was born before January 2, 1950,

Blind.

39b

b If your spouse itemizes on a separate return or you were a dual-status alien, check here

38

Amount of line 75 you want applied to your 2015 estimated tax

Designee's

name

Phone

no.

No

Personal identification

number (PIN)

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature

Date

Your occupation

Daytime phone number

DENTIST

Spouse's signature. If a joint return, both must sign.

Date

214-555-7890

Spouse's occupation

If the IRS sent you an Identity Protection

PIN, enter it

here (see inst.)

HOMEMAKER

Print/Type preparer's name

Preparer's signature

Date

Firm's name

Firm's EIN

Firm's address

Phone no.

www.irs.gov/form1040

Check

if

self-employed

PTIN

Form 1040 (2014)

You might also like

- Pet Kingdom Tax ReturnDocument26 pagesPet Kingdom Tax ReturnRaychael Ross100% (2)

- 1 2 3 4 5 6 7 8 9 10Document57 pages1 2 3 4 5 6 7 8 9 10gschmidtkeNo ratings yet

- 1779 & 928 American States Assembly Document Check ListDocument6 pages1779 & 928 American States Assembly Document Check ListLaLa Banks100% (2)

- NATH f1040Document2 pagesNATH f1040Spencer NathNo ratings yet

- Windward Fund's 2018 Tax FormsDocument49 pagesWindward Fund's 2018 Tax FormsJoe SchoffstallNo ratings yet

- Complete Return President Obama 2012 PDFDocument38 pagesComplete Return President Obama 2012 PDFTyler DeiesoNo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- TaxDocument9 pagesTaxKuan ChenNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument3 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetLabNo ratings yet

- Tax Certificate 2022-2023Document1 pageTax Certificate 2022-2023marco.kozilekgoweNo ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- Tax ReturnsDocument1 pageTax Returnshuss eynNo ratings yet

- 2020 Donnarumma SH Form 1040 Individual Tax Return - RecordsDocument19 pages2020 Donnarumma SH Form 1040 Individual Tax Return - RecordsandyNo ratings yet

- 2023 Tax Return: Prepared ByDocument14 pages2023 Tax Return: Prepared BypatovoidNo ratings yet

- 2023 Tax Return ZaireDocument14 pages2023 Tax Return ZairepatovoidNo ratings yet

- 1098T17Document2 pages1098T17RegrubdiupsNo ratings yet

- A218 DocumentDocument9 pagesA218 DocumentJose AlmonteNo ratings yet

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- State District of ColumbiaDocument20 pagesState District of ColumbiaRoger federerNo ratings yet

- 2014 Alabama Possible 990Document39 pages2014 Alabama Possible 990Alabama PossibleNo ratings yet

- Return 2019 BOY FIRST MAKEDocument6 pagesReturn 2019 BOY FIRST MAKEshahabNo ratings yet

- TurboTax Print Preview 02-14-2013T20.10.08.460Document13 pagesTurboTax Print Preview 02-14-2013T20.10.08.460glenncannon1973No ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyNo ratings yet

- 2009 Balderas Puentes S Form 1040 Individual Tax ReturnDocument9 pages2009 Balderas Puentes S Form 1040 Individual Tax ReturnJaqueline LeslieNo ratings yet

- TaxReturn JoderamerDocument19 pagesTaxReturn JoderamerTujuh AnginNo ratings yet

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Document17 pagesRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Moysés Isper NetoNo ratings yet

- 2016 540 California Resident Income Tax ReturnDocument5 pages2016 540 California Resident Income Tax Returnapi-351213976No ratings yet

- 2021-2022 Tax ReturnDocument3 pages2021-2022 Tax ReturnMmmmmmmNo ratings yet

- 2023 Tax Return: Prepared ByDocument11 pages2023 Tax Return: Prepared ByopreciousekugbereNo ratings yet

- Will Frost 2013 Tax Return - T13 - For - RecordsDocument146 pagesWill Frost 2013 Tax Return - T13 - For - RecordsjessicaNo ratings yet

- CLR 2020 Tax ReturnDocument14 pagesCLR 2020 Tax ReturnAlexander Barno AlexNo ratings yet

- Advia Credit Union 2Document1 pageAdvia Credit Union 2kathyNo ratings yet

- Tax Return 2018-19Document18 pagesTax Return 2018-19Kasam ANo ratings yet

- 1 5136803172601299942 PDFDocument3 pages1 5136803172601299942 PDFnurulamin00023No ratings yet

- Rhonda TX RTNDocument18 pagesRhonda TX RTNobriens05No ratings yet

- Real 1040 1Document2 pagesReal 1040 1paul100% (1)

- 2023 Form 1040-SR. U.S. Tax Return For SeniorsDocument4 pages2023 Form 1040-SR. U.S. Tax Return For SeniorspatovoidNo ratings yet

- TB US TaxRefund 2009 ENG PackDocument8 pagesTB US TaxRefund 2009 ENG Packabsolute_absurdNo ratings yet

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocument72 pagesInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001No ratings yet

- U.S. Individual Income Tax Return: Standard DeductionDocument3 pagesU.S. Individual Income Tax Return: Standard DeductionAkNo ratings yet

- LG FFDocument1 pageLG FFfeem743No ratings yet

- Tax Return 2023Document2 pagesTax Return 2023jacksonleah313No ratings yet

- Tax Return SummaryDocument14 pagesTax Return Summaryevalle13No ratings yet

- 2011 Income Tax ReturnDocument4 pages2011 Income Tax Returnsalazar17No ratings yet

- 2021 TaxReturnDocument11 pages2021 TaxReturnHa AlNo ratings yet

- Main - Form Pa 8453 2018 Pennsylvania Individual Income Tax Declaration Electronic Filing PennsylvaniaDocument4 pagesMain - Form Pa 8453 2018 Pennsylvania Individual Income Tax Declaration Electronic Filing PennsylvaniaDiana JuanNo ratings yet

- UnknownDocument24 pagesUnknownanyanwuchigozie560No ratings yet

- 2009 Gibbs D Form 1040 Individual Tax Return Tax2009Document23 pages2009 Gibbs D Form 1040 Individual Tax Return Tax2009Jaqueline LeslieNo ratings yet

- 2021 - TaxReturn 2pagessignedDocument3 pages2021 - TaxReturn 2pagessignedDedrick RiversNo ratings yet

- Income Tax Return Ay 2019-20Document1 pageIncome Tax Return Ay 2019-20ramanNo ratings yet

- 2020 TaxReturnDocument17 pages2020 TaxReturnOscar Alexander Rodríguez MogollónNo ratings yet

- Tax Return 2017Document23 pagesTax Return 2017jbanuelosv73No ratings yet

- ApplicationDocument2 pagesApplicationFabian SandovalNo ratings yet

- MLFA Form 990 - 2016Document25 pagesMLFA Form 990 - 2016MLFANo ratings yet

- FTF 2024-05-11 1715453284246Document4 pagesFTF 2024-05-11 1715453284246Brad Dorsey100% (1)

- Tax Return - Mr. X - AY 2022-23Document12 pagesTax Return - Mr. X - AY 2022-23Rasel AshrafulNo ratings yet

- HPK3PZDocument7 pagesHPK3PZDiane LeeNo ratings yet

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDocument2 pagesEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNo ratings yet

- Kia Lopez Form 1040Document2 pagesKia Lopez Form 1040Stephanie RobinsonNo ratings yet

- Tax Return 2021Document3 pagesTax Return 2021Mark ThomasNo ratings yet

- 2019 Tax Return Documents (CLEAN LIVING LLC)Document28 pages2019 Tax Return Documents (CLEAN LIVING LLC)JuniorNo ratings yet

- Tax File 2106 Ss FileingDocument5 pagesTax File 2106 Ss FileingWALLAUERNo ratings yet

- Chapter 4 For FilingDocument9 pagesChapter 4 For Filinglagurr100% (1)

- Nucor Corporation Case16Document1 pageNucor Corporation Case16ShakilaMissz-KyutieJenkinsNo ratings yet

- Exercise 1 SolutionDocument15 pagesExercise 1 SolutionShakilaMissz-KyutieJenkinsNo ratings yet

- Bul4421-10868 WillsDocument4 pagesBul4421-10868 WillsShakilaMissz-KyutieJenkinsNo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- 09 8 6 SCDocument12 pages09 8 6 SCRanger Rodz TennysonNo ratings yet

- 1 Ca Irs 3176CDocument3 pages1 Ca Irs 3176CStephen Monaghan100% (1)

- GROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanDocument4 pagesGROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanJoatham GenovisNo ratings yet

- Bar+Q+ (Domondon) +TAX (1) PrintedDocument47 pagesBar+Q+ (Domondon) +TAX (1) PrintedJoyce Noreen BagyonNo ratings yet

- TAX CODAL As Per SyllabusDocument5 pagesTAX CODAL As Per SyllabusCarmela WenceslaoNo ratings yet

- Steag State Power v. CIRDocument2 pagesSteag State Power v. CIRSab Amantillo BorromeoNo ratings yet

- Rmo 1985Document58 pagesRmo 1985Mary graceNo ratings yet

- VAT 5 CIR-v-CHEVRONDocument4 pagesVAT 5 CIR-v-CHEVRONSherry Jane GaspayNo ratings yet

- Ebook PDF Fundamentals of Taxation 2018 Edition 11th Edition by Ana CruzDocument41 pagesEbook PDF Fundamentals of Taxation 2018 Edition 11th Edition by Ana Cruzfrank.kuan506No ratings yet

- Tax Review Cases (Digested)Document41 pagesTax Review Cases (Digested)Tokie TokiNo ratings yet

- Rule: Steel Import Monitoring and Analysis SystemDocument4 pagesRule: Steel Import Monitoring and Analysis SystemJustia.comNo ratings yet

- Commissioner V AlgueDocument2 pagesCommissioner V AlgueRyan Vic AbadayanNo ratings yet

- JV1Document3 pagesJV1Yakup AVCINo ratings yet

- Philippine Guaranty Co Vs CIRDocument4 pagesPhilippine Guaranty Co Vs CIRJarvin David ResusNo ratings yet

- CS Garment Inc. v. CIR, G.R. No. 182399, 2014Document11 pagesCS Garment Inc. v. CIR, G.R. No. 182399, 2014JMae MagatNo ratings yet

- CIR Vs GJMDocument4 pagesCIR Vs GJMiamchurkyNo ratings yet

- Cir vs. TMX Sales and CtaDocument3 pagesCir vs. TMX Sales and CtaD De LeonNo ratings yet

- September 2010 Philippine Supreme Court Decisions On TaxDocument2 pagesSeptember 2010 Philippine Supreme Court Decisions On TaxNgan TuyNo ratings yet

- Due Process Cases - CompleteDocument275 pagesDue Process Cases - CompleteJustin Columba AgraviadorNo ratings yet

- 1120 Single MemberDocument16 pages1120 Single MemberA.F. GRANADANo ratings yet

- Butuan Sawmill vs. CTADocument2 pagesButuan Sawmill vs. CTARhea CagueteNo ratings yet

- Sjahss 96 240-249Document10 pagesSjahss 96 240-249Mahamood FaisalNo ratings yet

- HW 4Document9 pagesHW 4piya67kNo ratings yet

- 1902 January 2018 ENCS FinalDocument2 pages1902 January 2018 ENCS FinalrbelduaNo ratings yet

- CIR vs. Isabela Cultural Corporation 135210Document1 pageCIR vs. Isabela Cultural Corporation 135210magenNo ratings yet

- 211-CIR v. Li Yao G.R. No. L-11875 December 28, 1963Document12 pages211-CIR v. Li Yao G.R. No. L-11875 December 28, 1963Jopan SJNo ratings yet

- Tax ReviewerDocument14 pagesTax ReviewerRey Victor GarinNo ratings yet