Professional Documents

Culture Documents

J.B. Hunt Transport Pay Stub

Uploaded by

Anonymous w4gxCdLOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

J.B. Hunt Transport Pay Stub

Uploaded by

Anonymous w4gxCdLCopyright:

Available Formats

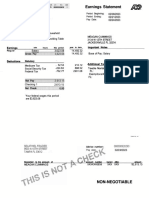

J.B. Hunt Transport, Inc.

615 J B Hunt Corporate Drive

Name

DYLAN DEVILLE

Company

J.B. Hunt Transport, Inc.

Gross Pay

1,165.60

17,867.88

Current

YTD

Earnings

Description

Dates

52 Week Avg Rate

05/15/2016-05/21/2016

Detention

05/15/2016-05/21/2016

Drops

05/15/2016-05/21/2016

Drops

05/15/2016-05/21/2016

Drvr Training Wages

Driver-Hours REG

05/15/2016-05/21/2016

Per Trip Pay

Rate Per Mile

05/15/2016-05/21/2016

Driver Work Hours

05/15/2016-05/21/2016

Personal, Sick, Holiday

Wellness Premium Discount

05/15/2016-05/21/2016

Earnings

Lowell, AR 72745

Employee ID

283896

Reimbursements

8.50

286.54

Hours

1

2.78

3

2

Rate

18.85

20

30

50

Amount

0.00

55.60

90.00

100.00

38.15

0.00

2,200

46.45

0.4

0

880.00

0.00

40.00

1,165.60

Pay Period Begin

05/15/2016

8.50

Employer Paid Benefits

Description

401(k) Match

Basic AD/D Deduction

Basic Life Insurance

Medical - Employer Paid Portion

FUI (Federal)

Details Not Displayed

Employer Paid Benefits

Marital Status

Allowances

Additional Withholding

Bank

Bank Of America

Tulsa Federal Credit Union

Check Date Check Number

05/26/2016

Deductions

216.48

4,540.53

YTD Description

0.00 OASDI

1,043.40 Medicare

Federal Withholding

3,642.50 State Tax - OK

30.00 State Tax - OK

0.00

350.00

11,821.98

0.00

140.00

840.00

17,867.88 Employee Taxes

Net Pay

747.52

10,745.87

Employee Taxes

Amount

63.98

14.97

102.15

29.00

YTD

935.03

218.68

1,351.31

276.00

87.00

210.10

2,868.02

Amount

67.54

9.49

119.57

10.77

9.11

216.48

YTD

1,021.74

412.59

199.29

2,510.97

204.63

191.31

4,540.53

Amount

1,031.87

1,031.87

964.33

YTD

15,081.09

15,081.09

14,059.35

Reduced

0

Available

40

Deductions

Amount

8.50

Reimbursements

Pay Period End

05/21/2016

Employee Taxes

210.10

2,868.02

Reimbursements

Description

Cell Phone Reimbursement

Motel Reimbursement

Repairs/Supply Reim

Scale Reimbursement

+1 (479) 820-0000

Amount

33.77

0.07

0.46

66.75

0.00

78.95

180.00

Federal

Married

0

0

Account Name

Bank Of America ******9890

TFCU

YTD

85.00

128.08

62.96

10.50

Description

401(k) Deduction

Advances

Driver Disability

Medical Deduction

Health Savings Account

Details Not Displayed

286.54 Deductions

YTD

510.90

1.47

9.66

1,401.75

42.00

1,191.97

3,157.75

Taxable Wages

Description

OASDI - Taxable Wages

Medicare - Taxable Wages

Federal Withholding - Taxable Wages

State

Absence Plans

Single Description

Accrued

0 Vacation Time - Time Off Plan - Weekly

0

0

Payment Information

Account Number

******9890

******1203

USD Amount

Payment Amount

627.52

120.00

USD

USD

You might also like

- Earn StatementDocument1 pageEarn StatementKhu RehNo ratings yet

- JournalSheet.com Profit Loss StatementDocument21 pagesJournalSheet.com Profit Loss StatementThird WheelNo ratings yet

- PaystubDocument1 pagePaystubDorothy ShellNo ratings yet

- Statement of Earnings: NON NegotiableDocument1 pageStatement of Earnings: NON NegotiableireneNo ratings yet

- Gina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursDocument4 pagesGina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursGigi EggletonNo ratings yet

- PaycheckDocument2 pagesPaycheckapi-373194232No ratings yet

- Married 0: 401 14Th Street North, Kerkoven, MN 56252Document1 pageMarried 0: 401 14Th Street North, Kerkoven, MN 56252Scott DoeNo ratings yet

- Teaching CertificateDocument1 pageTeaching Certificateapi-359162285No ratings yet

- 4600229175 - CopyDocument2 pages4600229175 - CopyData BaseNo ratings yet

- Screenshot 2021-03-16 at 5.54.57 PMDocument7 pagesScreenshot 2021-03-16 at 5.54.57 PMVictor PorrasNo ratings yet

- Macy's Earnings StatementDocument1 pageMacy's Earnings StatementLiz MatzNo ratings yet

- Pine Ridge Apartment Welcome LetterDocument2 pagesPine Ridge Apartment Welcome LetterKamil KowalskiNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Check Stubs Detail Employee Pay InformationDocument2 pagesCheck Stubs Detail Employee Pay InformationBrianNo ratings yet

- Frazier0224 PDFDocument1 pageFrazier0224 PDFshani ChahalNo ratings yet

- Pay003 2296Document1 pagePay003 2296selvam.kandasamy3297No ratings yet

- Pay StatementDocument1 pagePay Statementjmatos_297262No ratings yet

- EU Digital COVID Certificate Negative TestDocument1 pageEU Digital COVID Certificate Negative TestMarius MateiNo ratings yet

- Equifax Report 0559051909Document4 pagesEquifax Report 0559051909Sony SonyNo ratings yet

- Gary Steger D G2 GRVI-506 19th Avenue - 506 19th Avenue Grubstake Properties VI San Mateo, CA 94401Document6 pagesGary Steger D G2 GRVI-506 19th Avenue - 506 19th Avenue Grubstake Properties VI San Mateo, CA 94401Gary SNo ratings yet

- Cook 4Document1 pageCook 4Renee MillerNo ratings yet

- Carissa Baker: Employee Info Tax DataDocument2 pagesCarissa Baker: Employee Info Tax Datawhat is thisNo ratings yet

- MarDocument1 pageMarDheeraj TippaniNo ratings yet

- Declarations Page for Auto Insurance PolicyDocument2 pagesDeclarations Page for Auto Insurance PolicyLeonardo GutierrezNo ratings yet

- 04 17 2022 Paystub - 1Document1 page04 17 2022 Paystub - 1Destiny SmithNo ratings yet

- Invoice 42010Document1 pageInvoice 42010ragiphani karthikNo ratings yet

- ReportDocument2 pagesReportapi-462242419No ratings yet

- PayStatement D0655147Document1 pagePayStatement D0655147Anonymous O61KvPgNo ratings yet

- Jones Stub 2Document1 pageJones Stub 276xzv4kk5vNo ratings yet

- Apartment Lease Contract: Moving in - General InformationDocument23 pagesApartment Lease Contract: Moving in - General InformationNoel RivasNo ratings yet

- Earnings Statement TitleDocument1 pageEarnings Statement TitleScott DoeNo ratings yet

- File 1831Document1 pageFile 183176xzv4kk5vNo ratings yet

- GeicoDocument2 pagesGeicotfuyuicgufgyu5469No ratings yet

- Attachment 1 4Document1 pageAttachment 1 4Tabbitha CampfieldNo ratings yet

- Direct Deposit AuthorizationDocument1 pageDirect Deposit Authorizationapi-351412138No ratings yet

- JF PaycheckDocument1 pageJF Paycheckapi-285511542No ratings yet

- Paycheck 20201230 001387 Pravallika 202101241910Document1 pagePaycheck 20201230 001387 Pravallika 202101241910Prabhakar AenugaNo ratings yet

- Summit - Print Pay Check Information: InstructionsDocument4 pagesSummit - Print Pay Check Information: Instructionsjr83san100% (2)

- Personal Pay Slip for Diana NguyenDocument1 pagePersonal Pay Slip for Diana NguyenArtemisNo ratings yet

- 2024 12 31 StatementDocument4 pages2024 12 31 StatementAlex NeziNo ratings yet

- Understanding Your PaystubDocument2 pagesUnderstanding Your PaystubmashaNo ratings yet

- Wells Fargo Wire Transfer Confirmation and ReceiptDocument4 pagesWells Fargo Wire Transfer Confirmation and ReceiptvhauamirNo ratings yet

- PsDocument1 pagePsCarrie EvansNo ratings yet

- CertainGovernmentPayments1099G JamesSmith-654202001310815Document4 pagesCertainGovernmentPayments1099G JamesSmith-654202001310815ireaditallNo ratings yet

- Statement For Aug 18, 2023Document1 pageStatement For Aug 18, 2023Hawa KabiaNo ratings yet

- Pay Stub 6.1to6.30Document1 pagePay Stub 6.1to6.30Lorin WagnerNo ratings yet

- Renewal ReceiptDocument1 pageRenewal Receiptalex guzman100% (1)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-Negotiablesivajyothi1973No ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableEvelin De NunezNo ratings yet

- Elite Audit 4Document1 pageElite Audit 4arinzeshedrack30No ratings yet

- CA DMV Receipt: 1 MessageDocument1 pageCA DMV Receipt: 1 MessageJuan MoraNo ratings yet

- Ticket confirmation for Wicked musical on Feb 16Document2 pagesTicket confirmation for Wicked musical on Feb 16xxNo ratings yet

- Manufacturing Company Payroll RegisterDocument4 pagesManufacturing Company Payroll RegisterSurendran LakshmanNo ratings yet

- Harley Davidson InsuranceDocument4 pagesHarley Davidson InsuranceDJ CherryNo ratings yet

- Church Pay Stubs QuarterlyDocument6 pagesChurch Pay Stubs Quarterlydae ChoNo ratings yet

- Paystub For 11-08-2019Document1 pagePaystub For 11-08-2019Roberin SegarNo ratings yet

- December StatementDocument3 pagesDecember StatementNoriely Altagracia Paulino RivasNo ratings yet

- Report PDFDocument2 pagesReport PDFJBStringerNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Cranedge (I) PVT - LTD.: Payslip For The Month of January-2014Document1 pageCranedge (I) PVT - LTD.: Payslip For The Month of January-2014Subham PradhanNo ratings yet

- Solid Investment, The HYIPDocument48 pagesSolid Investment, The HYIPshastaconnect0% (1)

- Benchmarking as a Long-Term Strategy: A Case Study of Xerox CorporationDocument14 pagesBenchmarking as a Long-Term Strategy: A Case Study of Xerox CorporationJenny BascunaNo ratings yet

- COSACC Assignment 2Document3 pagesCOSACC Assignment 2Kenneth Jim HipolitoNo ratings yet

- 04 Meghalaya Industrial Policy 1997Document12 pages04 Meghalaya Industrial Policy 1997Debanjalee ChakravortyNo ratings yet

- Accounting For Managers: Module - 1Document31 pagesAccounting For Managers: Module - 1Madhu RakshaNo ratings yet

- AIS Reviewer PDFDocument20 pagesAIS Reviewer PDFMayNo ratings yet

- Term Paper IN Theories and Practices of Ecological TourismDocument2 pagesTerm Paper IN Theories and Practices of Ecological Tourismkristel jadeNo ratings yet

- Medical Devices Industry in Malaysia PDFDocument28 pagesMedical Devices Industry in Malaysia PDFmangesh224100% (2)

- Capstone Research Paper - Ferrari 2015 Initial Public OfferingDocument9 pagesCapstone Research Paper - Ferrari 2015 Initial Public OfferingJames A. Whitten0% (1)

- Marketing Project On SuzukiDocument96 pagesMarketing Project On SuzukiAsh LayNo ratings yet

- Unit 3 - Strategic Performance Measurement111Document130 pagesUnit 3 - Strategic Performance Measurement111Art IslandNo ratings yet

- CV - Tim SonmezDocument1 pageCV - Tim Sonmezapi-356802988No ratings yet

- The Management of Employee Benefits and ServicesDocument37 pagesThe Management of Employee Benefits and ServicesImy AbrenillaNo ratings yet

- Monopoly Profit MaximizationDocument29 pagesMonopoly Profit MaximizationArmanNo ratings yet

- ProdmixDocument10 pagesProdmixLuisAlfonsoFernándezMorenoNo ratings yet

- Qualitative ResearchDocument3 pagesQualitative ResearchEumy JL JeonNo ratings yet

- Founder Share Purchase and Vesting Agreement SummaryDocument15 pagesFounder Share Purchase and Vesting Agreement SummaryIafrawNo ratings yet

- Communication Strategies For The Asia PacificDocument25 pagesCommunication Strategies For The Asia PacificfahadaijazNo ratings yet

- Honda Balance SheetDocument2 pagesHonda Balance Sheetmeri4uNo ratings yet

- Joint Venture Between Tata and ZaraDocument4 pagesJoint Venture Between Tata and ZaraShrishti Agarwal100% (1)

- CLWTAXN MODULE 5 Income Taxation of Individuals Notes v022023-1-1Document7 pagesCLWTAXN MODULE 5 Income Taxation of Individuals Notes v022023-1-1kdcngan162No ratings yet

- Accounting MemeDocument2 pagesAccounting MemeIan Jay DescutidoNo ratings yet

- Joint VentureDocument2 pagesJoint VentureAries Gonzales CaraganNo ratings yet

- Nuss Company ProfileDocument3 pagesNuss Company ProfiletelecomstuffsNo ratings yet

- An Introduction To Marxism - Its Origins, Key Ideas, and Contemporary RelevanceDocument2 pagesAn Introduction To Marxism - Its Origins, Key Ideas, and Contemporary RelevancemikeNo ratings yet

- Pump Quotation DetailsDocument2 pagesPump Quotation Detailsdhavalesh1No ratings yet

- Franchising: Bruce R. Barringer R. Duane IrelandDocument18 pagesFranchising: Bruce R. Barringer R. Duane IrelandWazeeer AhmadNo ratings yet

- Republic of The PhilippinesDocument7 pagesRepublic of The Philippinesvita feliceNo ratings yet

- Dsr April 2024Document10 pagesDsr April 2024vapatel767No ratings yet

- Contemporary World GE 113 Module 1 PDFDocument19 pagesContemporary World GE 113 Module 1 PDFbojing mendezNo ratings yet