Professional Documents

Culture Documents

Business Combi - Acquisition

Business Combi - Acquisition

Uploaded by

naserCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Combi - Acquisition

Business Combi - Acquisition

Uploaded by

naserCopyright:

Available Formats

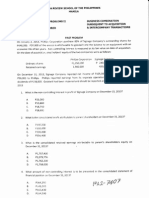

BUSINESS COMBINATION DATE OF ACQUISITION

#0012

ACQUISITION OF NET ASSETS AND ACQUISITION OF STOCKS

PROBLEM 1.

STAR Corporation is a company involved in manufacturing cars. On January 1, 2013,

the board of directors of the said company has decided to acquire the net assets of

NOVA Corporation and RISE Corporation, suppliers of materials they use in

production. The merger is expected to result in producing higher quality cars with

lower total cost.

The deal was closed on February 29, 2013 and the following information was

gathered from the books of the entities:

Current Assets

Noncurrent Assets

Total Assets

STAR

P1,375,000

3,125,000

P4,500,000

NOVA

P390,000

2,550,000

P2,940,000

RISE

P260,000

1,700,000

P1,960,000

Liabilities

Common stock, P100 par

Additional Paid-in capital

Retained earnings

Total equity & liability

P325,000

2,748,500

176,500

1,250,000

P4,500,000

P210,000

1,780,200

169,800

780,000

P2,940,000

P140,000

1,186,800

113,200

520,000

P1,960,000

Star will issue 22,500 of its common stock in exchange for the net assets of Nova

and 11,200 of its common stock in exchange for the net assets of Rise. The fair

value of Stars shares is P150. In addition, the following adjustments should be

made:

Current assets of Nova and Rise have a fair value of P450,000 and P230,000

respectively.

Noncurrent assets have a fair value of P2,150,000 and P1,975,000 for Nova and

Rise, respectively.

Compute for the following balances of Star Company on the date of acquisition:

Stockholders equity

A. P6,118,500

B. P7,980,000

C. P3,496,500

D. P9,615,000

Assets

A. P10,290,000

B. P9,240,000

C. P10,500,000

D. P9,840,000

PROBLEM 2.

Denim Co. merged into Kraft Corp. on July 1, 2013. In exchange for the net assets at

fair market value of Denim Co. amounting to P696,450, Kraft issued 68,000 common

shares at P9 par value with a market price of P12 per share.

Out of pocket costs of the combination were as follows:

Legal fees for the contract of business

combination

Audit fee for SEC registration of stock issue

Printing costs of stock certificates

Brokers fee

Accountants fee for pre-acquisition audit

Other direct cost of acquisition

General and allocated expenses

Listing fees in issuing new shares

BUSINESS COMBINATION DATE OF ACQUISITION

#0012

P35,600

90,000

14,500

23,600

80,000

75,000

43,000

36,000

BUSINESS COMBINATION DATE OF ACQUISITION

#0012

Denim will pay an additional cash consideration of P455,000 in the event that

Krafts net income will be equal or greater than P950,000 for the period ended

December 31, 2013. At acquisition date, there is a high probability of reaching the

target net income and the fair value of the additional consideration was determined

to be P195,000.

Actual net income for the period ended December 31, 2013 amounted to

P1,250,000. The additional cash consideration was paid.

What is the amount of goodwill to be recognized in the statement of financial

position as of December 31, 2013?

A. P295,450

B. P308,500

C. P314,550

D. P326,550

What is the amount of expense to be recognized in the statement of comprehensive

income for the year ended December 31, 2013?

A. P257,200

B. P517,200

C. P307,400

D. P412,500

PROBLEM 3.

On October 1, 2013, Winner Corporation acquired all the assets and assumed all the

liabilities of Getter Company by issuing 20,000 shares with a fair value of P67.5 per

share and an obligation to pay a contingent consideration with a fair value of

P750,000.

In addition, Winner paid the following acquisition related costs:

Legal fees

Audit fee for SEC registration of stock

issue

Costs of stock certificates

Brokers fee

Other direct cost of acquisition

General and allocated expenses

P 105,600

320,400

35,000

49,000

50,000

14,000

The Statement of Financial Position as of September 30, 2013 of Winner and Getter,

together with the fair market value of the assets and liabilities are presented below:

Winner

Book value

Fair value

Cash

Accounts Receivable

Inventories

Prepaid expenses

Land

Building

Equipment

Goodwill

Total Assets

P640,000

360,000

475,000

25,000

2,000,000

800,000

700,000

5,000,000

P640,000

335,000

390,000

2,900,000

900,000

585,000

5,750,000

Accounts Payable

Notes payable

Capital stock, P50 par

Additional paid in

capital

Retained earnings

312,500

937,500

2,000,000

1,000,000

312,500

980,000

750,000

BUSINESS COMBINATION DATE OF ACQUISITION

#0012

Getter

Book

Fair value

value

P45,000

P45,000

70,000

54,000

87,000

78,000

13,500

5,000

900,000 1,550,000

723,000

768,000

361,500

360,000

300,000

2,500,000 2,860,000

200,000

700,000

850,000

400,000

350,000

200,000

765,000

BUSINESS COMBINATION DATE OF ACQUISITION

#0012

Total Liability & Equity

5,000,000

2,500,000

Compute for the balances that will be shown on the October 1, 2013 statement of

financial position of the surviving company:

Retained earnings

A. P480,000

B. P540,000

C. P526,000

D. P475,000

Total Assets

A. P7,015,000

B. P6,980,000

C. P7,118,000

D. P7,491,000

PROBLEM 4.

The Statement of Financial Position of Luster Corporation on June 30, 2013 is

presented below:

Current assets

P32,500

Land

220,000

Building

110,000

Equipment

87,500

Total Assets

P450,000

Liabilities

Capital stock, P5 par

Additional paid in capital

Retained earnings

Total equities

87,500

150,000

137,500

75,000

P450,000

All the assets and liabilities of Luster assumed to approximate their fair values

except for land and building. It is estimated that the land have a fair value of

P350,000 and the fair value of the building increased by P80,000.

Kernel Corporation acquired 80% of Lusters capital stock for P500,000.

Assuming the consideration paid includes control premium of P142,000, how much

is the goodwill/(gain on acquisition) on the consolidated financial statement?

A. P60,000

B. P48,000

C. P42,000

D. P50,000

Assuming the consideration paid excludes control premium of P23,000, and the fair

value of the noncontrolling interest is P122,750, how much is the goodwill/(gain on

acquisition) on the consolidated financial statement?

A. P78,250

B. P73,250

C. P69,500

D. P74,750

Assuming the consideration paid includes control premium of P37,000, how much is

the goodwill/(gain on acquisition) on the consolidated financial statement?

A. P43,250

B. P73,250

C. P56,750

D. P68,350

BUSINESS COMBINATION DATE OF ACQUISITION

#0012

BUSINESS COMBINATION DATE OF ACQUISITION

#0012

PROBLEM 5.

Better Company has gained control over the operations of Calm Corporation by

acquiring 85% of its outstanding capital stock for P2,580,000. This amount includes

a control premium of P30,000. Acquisition expenses, direct and indirect, amounted

to P83,000 and P42,000 respectively.

Better

Calm

Book Value

Book Value

Fair Value

Cash

P3,541,500

P128,000

Accounts receivable

300,000

325,000

Inventories

550,000

360,000

Prepaid expenses

148,500

125,000

Land

2,350,000

879,000

Building

1,560,000

558,000

Equipment

300,000

185,000

Goodwill

0

300,000

Total Assets

P8,750,000

P2,860,000

Accounts Payable

Notes payable

Capital stock, 50 par

Additional paid in capital

Retained earnings

Total equities

675,000

1,400,000

3,400,000

1,575,000

1,700,000

P8,750,000

253,000

730,000

800,000

600,000

477,000

P2,860,000

The following was ascertained on the date of acquisition for Calm Corporation:

The value of receivables and equipment has decreased by P25,000 and P14,000

respectively.

The fair value of inventories is now P436,000 whereas the value of land and

building has increased by P471,000 and P107,000 respectively.

There was an unrecorded accounts payable amounting to P27,000 and the fair

value of notes is P738,000.

Compute for the following balances to be presented in the consolidated statement

of financial position at the date of business combination:

Total Assets

A. P9,875,000

B. P10,093,000

C. P10,112,000

D. P9,215,000

Total Shareholders Equity

A. P7,000,000

B. P7,500,000

C. P8,200,000

D. P8,000,000

PROBLEM 6.

On January 2, 2013, the Statement of Financial Position of Pepper and Steak

Company prior to the combination are:

Pepper Co.

Steak Co.

Cash

P450,000

P 15,000

Inventories

300,000

30,000

PPE, net

750,000

105,000

Total Assets

P1,500,000

P150,000

Current Liabilities

Common stock, P100 par

Additional Paid in capital

BUSINESS COMBINATION DATE OF ACQUISITION

#0012

P 90,000

150,000

450,000

P 15,000

15,000

30,000

BUSINESS COMBINATION DATE OF ACQUISITION

#0012

Retained earnings

Total Liabilities and Stockholders equity

810,000

P1,500,000

90,000

P150,000

The fair value of Steak Companys equipment is P153,000.

Assume the following independent cases:

1. Assuming Pepper Company acquired 70% of the outstanding common stock of

Steak Company for P105,000 and Non-controlling interest is measured at fair

value of P61,000, how much is the goodwill (gain on acquisition)?

A. P(17,000)

B. P17,000

C. P23,100

D. P(23,100)

2. Assuming Pepper Company acquired 80% of the outstanding common stock of

Steak Company for P136,800 and non-controlling interest is measured at noncontrolling interests proportionate share of Steak Companys identifiable net

assets, how much is the consolidated stockholders equity on the date of

acquisition?

A. P1,410,000

B. P1,419,600

C. P1,446,600

D. P1,456,200

3. Assuming Pepper Company acquired 90% of the outstanding common stock of

Steak Company for P243,000 and Non-controlling interest is measured at fair

value, how much is the total consolidated assets on the date of acquisition?

A. P1,542,000

B. P1,785,000

C. P1,737,000

D. P1,494,000

PROBLEM 7.

Acquirer Company acquires 25% of Acquired Companys common stock for

P190,000 cash and carries the investment using the cost method. After three

months, Parent purchases another 60% of Subsidiarys common stock for P540,000.

On this date, acquired company reports identifiable net assets with carrying value of

P720,000 and fair value of P920,000. The liabilities of the acquired company has a

book value and a fair value of P280,000. The fair value of the 15% non-controlling

interest is P125,000.

How much is the goodwill or (gain on acquisition)?

A. P(17,000)

B. P250,000

C. P(30,000)

D. P263,000

PROBLEM 8.

Condensed statements of financial position of Care Corp. and Charm Corp. as of

December 31, 2012 are as follows:

Current Assets

Noncurrent assets

Total assets

Liabilities

Common stocks, P20 par

Additional paid in capital

Retained earnings

Care

P 43,750

181,250

P225,000

Charm

P 16,250

106,250

P122,500

P 16,250

137,500

8,750

62,500

P8,750

75,000

6,250

32,500

BUSINESS COMBINATION DATE OF ACQUISITION

#0012

BUSINESS COMBINATION DATE OF ACQUISITION

#0012

On January 1, 2013, Care Corp. issued 8,750 stocks with a market value of

P25/share for the assets and liabilities of Charm Corp. The book value reflects the

fair value of the assets and liabilities, except that the noncurrent assets of Charm

has a temporary appraisal of P157,500 and the noncurrent assets of Care are

overstated by P7,500. Contingent consideration, which is determinable, is equal to

P3,750. Care also paid for the stock issuance costs worth P8,500 and other

acquisition costs amounting to P4,750.

On March 1, 2013, the contingent consideration has a determinable amount of

P5,000. On June 1, 2013, the provisional fair value of the noncurrent assets of

Charm increased by P2,250.

How much is the combined total assets at the end of 2013?

A.

B.

C.

D.

P435,500

P443,000

P442,000

P444,250

*** END ***

BUSINESS COMBINATION DATE OF ACQUISITION

#0012

You might also like

- PDFDocument35 pagesPDFFrancheska NadurataNo ratings yet

- Partnership Additional ProbsDocument9 pagesPartnership Additional ProbsJoy LagtoNo ratings yet

- Advanced Accounting 2Document9 pagesAdvanced Accounting 2Elmin ValdezNo ratings yet

- Consolidated Problems TestbankDocument6 pagesConsolidated Problems TestbankIvy Salise0% (1)

- CPAR - P2 - 7407 - Business Combination Subsequent To Acquisition PDFDocument5 pagesCPAR - P2 - 7407 - Business Combination Subsequent To Acquisition PDFAngelo Villadores100% (3)

- PB DifficultDocument20 pagesPB DifficultPaulo MiguelNo ratings yet

- Accounting MidTermDocument16 pagesAccounting MidTermPrincess Claris Araucto33% (3)

- Advanced AccountingDocument14 pagesAdvanced AccountingBehbehlynn67% (3)

- Afar ToaDocument19 pagesAfar ToaRicamae Mendiola100% (1)

- 02 - Business Combination Date of AcquisitionDocument5 pages02 - Business Combination Date of AcquisitionMelody Gumba100% (1)

- 2019 TaxReturn PDFDocument6 pages2019 TaxReturn PDFdavid barrow100% (2)

- Quiz - 3 ABC Problem SolvingDocument6 pagesQuiz - 3 ABC Problem SolvingAngelito Mamersonal0% (1)

- CPA Board Examination Operation - Advance Accounting: Page 1 of 11Document11 pagesCPA Board Examination Operation - Advance Accounting: Page 1 of 11Janella Patrizia0% (1)

- Nfjpia Nmbe Afar 2017 AnsDocument10 pagesNfjpia Nmbe Afar 2017 AnshyosungloverNo ratings yet

- Business Combi - SubsequentDocument5 pagesBusiness Combi - Subsequentnaser100% (2)

- Audit TheoryDocument8 pagesAudit TheoryJekNo ratings yet

- CPAR P2 7406 Business Combination at Date of Acquisition With Answer PDFDocument6 pagesCPAR P2 7406 Business Combination at Date of Acquisition With Answer PDFRose Vee0% (2)

- Business Combination (Statutory Merger) ReviewerDocument1 pageBusiness Combination (Statutory Merger) ReviewerErika100% (2)

- Afar QuestionsDocument16 pagesAfar Questionspopsie tulalianNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Chapter 1 - Accounting For Business CombinationsDocument6 pagesChapter 1 - Accounting For Business CombinationsLyaNo ratings yet

- Home Office BranchDocument5 pagesHome Office BranchRodNo ratings yet

- AFAR.2906 - SEPARATE and CONSOLIDATED STATEMENTSDocument7 pagesAFAR.2906 - SEPARATE and CONSOLIDATED STATEMENTSRonna Mae Mendoza100% (1)

- Exercise-Receivables-Block BDocument2 pagesExercise-Receivables-Block BSittieAyeeshaMacapundagDicaliNo ratings yet

- Handout Audit of InventoriesDocument4 pagesHandout Audit of InventoriesJAY AUBREY PINEDA0% (2)

- CPAR - P2 - 7406 - Business Combination at Date of Acquisition With Answer PDFDocument6 pagesCPAR - P2 - 7406 - Business Combination at Date of Acquisition With Answer PDFAngelo Villadores100% (4)

- AFAR Self Test - 9001Document5 pagesAFAR Self Test - 9001King MercadoNo ratings yet

- Consolidation Objectives: PAS 27 Objective of Setting The Standard To Be AppliedDocument11 pagesConsolidation Objectives: PAS 27 Objective of Setting The Standard To Be AppliedAdam SmithNo ratings yet

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobNo ratings yet

- All The Assets and Liabilities of LusterDocument2 pagesAll The Assets and Liabilities of LusterVannesaNo ratings yet

- Lecture Notes: National University Ellery de Leon Advac 1-Partnerships 1 Semester SY 2016-2017Document10 pagesLecture Notes: National University Ellery de Leon Advac 1-Partnerships 1 Semester SY 2016-2017sunflowerNo ratings yet

- AfarDocument3 pagesAfarDanielle Nicole MarquezNo ratings yet

- Vdocuments - MX - Advanced Financial Accounting 1Document11 pagesVdocuments - MX - Advanced Financial Accounting 1Sweet EmmeNo ratings yet

- Multiple Choice Problems 9Document15 pagesMultiple Choice Problems 9Dieter LudwigNo ratings yet

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- Practical Accounting Problem 2Document18 pagesPractical Accounting Problem 2JimmyChao100% (2)

- OfficeDocument12 pagesOffice123r12f1100% (1)

- ACC401 Quiz2Document7 pagesACC401 Quiz287StudentNo ratings yet

- Instruction: Show Your Solution. No Solution Incorrect AnswerDocument1 pageInstruction: Show Your Solution. No Solution Incorrect AnswerRian ChiseiNo ratings yet

- Cpar - P2 09.15.13Document22 pagesCpar - P2 09.15.13Leo Mark Ramos100% (1)

- CPAR AP - Audit of ReceivablesDocument3 pagesCPAR AP - Audit of ReceivablesJohn Carlo CruzNo ratings yet

- Classification of InventoriesDocument10 pagesClassification of InventoriesExcelsior Business Support ServicesNo ratings yet

- FL AfarDocument20 pagesFL AfarKenneth Robledo50% (2)

- AA MIDTERMS - With AnswerDocument9 pagesAA MIDTERMS - With AnswerChristopher NogotNo ratings yet

- Home Office and BranchDocument4 pagesHome Office and BranchRed YuNo ratings yet

- AP 59 1stPB - 5.06Document9 pagesAP 59 1stPB - 5.06Loren Lordwell MoyaniNo ratings yet

- AFAR Quizzer 3 SolutionsDocument12 pagesAFAR Quizzer 3 SolutionsHazel Mae Lasay100% (1)

- Partnership & Business CombinationDocument32 pagesPartnership & Business CombinationJason Bautista100% (1)

- Business Combination - Comprehensive ExamDocument4 pagesBusiness Combination - Comprehensive ExamJulie Ann Canlas100% (1)

- Business Com Chapter 23Document5 pagesBusiness Com Chapter 23Nino Joycelee TuboNo ratings yet

- Practical Accounting 2Document4 pagesPractical Accounting 2Steph BorinagaNo ratings yet

- 11 Business CombinationDocument2 pages11 Business CombinationShara VidalNo ratings yet

- M 203Document3 pagesM 203Rafael Capunpon VallejosNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- Business Combination Practical Accounting 2 Date of AcquisitionDocument6 pagesBusiness Combination Practical Accounting 2 Date of AcquisitionEdi wow WowNo ratings yet

- Quiz BeeDocument58 pagesQuiz BeeShane Almoguera100% (1)

- AttDocument8 pagesAttKath LeynesNo ratings yet

- Advac2 MidtermDocument5 pagesAdvac2 MidtermgeminailnaNo ratings yet

- Business Combi - AcquisitionDocument6 pagesBusiness Combi - Acquisitionnaser20% (5)

- Business Combi - SubsequentDocument5 pagesBusiness Combi - Subsequentnaser100% (2)

- Week 1 Problem Solving Assignment Solutions PDFDocument4 pagesWeek 1 Problem Solving Assignment Solutions PDFnaser100% (1)

- Ap 59 PW - 5 06 PDFDocument18 pagesAp 59 PW - 5 06 PDFJasmin NgNo ratings yet

- Revenue RecognitionDocument6 pagesRevenue RecognitionnaserNo ratings yet

- Ch15 Tool KitDocument55 pagesCh15 Tool KitAdamNo ratings yet

- Iapm NotesDocument8 pagesIapm NotesRuchaNo ratings yet

- Property Risk ManagementDocument18 pagesProperty Risk ManagementImran NarejoNo ratings yet

- Stock Holding Corporation of India LTD, BangaloreDocument17 pagesStock Holding Corporation of India LTD, Bangalore9986212378No ratings yet

- Module10 1Document22 pagesModule10 1Colleen Mae San DiegoNo ratings yet

- Madsen PedersenDocument23 pagesMadsen PedersenWong XianyangNo ratings yet

- An.1 83Document98 pagesAn.1 83Berlinschi DinuNo ratings yet

- 1stpreboard Oct 2013-2014Document19 pages1stpreboard Oct 2013-2014Michael BongalontaNo ratings yet

- Annual Return Gstr-9 Case StudyDocument40 pagesAnnual Return Gstr-9 Case StudyGST SPECIALIST PALANISAMY MADURAINo ratings yet

- Efx-Creditreport 20231203Document20 pagesEfx-Creditreport 20231203jordanmoonmanNo ratings yet

- Pay Slip Dipankar Mondal 05Document1 pagePay Slip Dipankar Mondal 05Pritam GoswamiNo ratings yet

- Financial Management MCQsDocument18 pagesFinancial Management MCQsAnkit BaranwalNo ratings yet

- Value Area Trading StrategyDocument14 pagesValue Area Trading Strategykevin tamayoNo ratings yet

- 04c Receivables (Part 3) With AnswersDocument3 pages04c Receivables (Part 3) With Answershelaihjs100% (1)

- Branding & Promotional Article On 'Bank of Ceylon'.Document3 pagesBranding & Promotional Article On 'Bank of Ceylon'.Umi MariamNo ratings yet

- Working Capital Management - 309306319Document41 pagesWorking Capital Management - 309306319Srikant BasaNo ratings yet

- Project On Strategic Marketing: Saintgits Institute of Management KottayamDocument4 pagesProject On Strategic Marketing: Saintgits Institute of Management KottayamKAILAS S NATH MBA19-21No ratings yet

- Sample Problems - DerivativesDocument4 pagesSample Problems - DerivativesMary Yvonne AresNo ratings yet

- Employees' Provident Funds & Misc. Provisions Act. 1952Document21 pagesEmployees' Provident Funds & Misc. Provisions Act. 1952Harshit Kumar SinghNo ratings yet

- Min ZoDocument3 pagesMin ZoaniclazarNo ratings yet

- Chapter - 16 Investors' Protection FundDocument7 pagesChapter - 16 Investors' Protection FundNikhil JoharNo ratings yet

- PitchBook PE Breakdown 3Q2010Document6 pagesPitchBook PE Breakdown 3Q2010ddavidson55142No ratings yet

- ProjectDocument52 pagesProjectChithra ChithuNo ratings yet

- FABM1 Lesson8-1 Five Major Accounts-LIABILITIESDocument13 pagesFABM1 Lesson8-1 Five Major Accounts-LIABILITIESWalter MataNo ratings yet

- Cancelled Check of Nice Corporation Returned With The Sept. Bank Statement of Nile Corporation and Recorded Thereon: Br. 98Document2 pagesCancelled Check of Nice Corporation Returned With The Sept. Bank Statement of Nile Corporation and Recorded Thereon: Br. 98zemen tadesseNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Business Administration)Document9 pagesAllama Iqbal Open University, Islamabad: (Department of Business Administration)sajid bhattiNo ratings yet

- Research Paper On Corporate Debt RestructuringDocument5 pagesResearch Paper On Corporate Debt Restructuringefj02jba100% (1)

- Risk Management BlackbookDocument80 pagesRisk Management Blackbookjaueshmahale1234No ratings yet