Professional Documents

Culture Documents

Merriman Four Fund Solution Table

Uploaded by

aballard11Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Merriman Four Fund Solution Table

Uploaded by

aballard11Copyright:

Available Formats

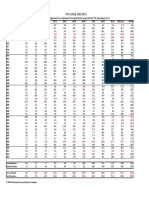

Summary of 1 Yr Period Results (1928-2014)

$100 grows to

LCB

LCV

SCB

SCV

4-Fund

$346,261

$971,683

$2,223,809

$6,563,730

$1,793,238

CRR

9.8%

11.1%

12.2%

13.6%

11.9%

CRR SD

20.1%

23.6%

28.9%

32.1%

25.2%

Avg annual return

11.8%

13.9%

16.0%

18.2%

14.9%

Best 1 year return

54.0%

92.7%

110.0%

125.2%

96.0%

1933

1933

1933

1933

1933

-43.3%

-62.0%

-48.0%

-54.7%

-51.8%

Best year

Worst 1 year return

1931

1931

1937

1931

1931

# years up 0%

Worst year

63

65

59

59

62

# years up <0%

24

22

28

28

25

Avg of 'up 0%' years

21.5%

23.8%

31.2%

34.6%

26.8%

Avg of 'up <0%' years

-13.6%

-15.4%

-16.0%

-16.6%

-14.8%

4-Fund

Summary of 15 Yr Period Results (1928-2014)

LCB

LCV

SCB

SCV

$474

$641

$699

$943

$686

Average 15 year CRR

10.9%

13.2%

13.8%

16.1%

13.7%

Best 15 year CRR

On average, $100 grows to:

18.9%

21.7%

23.1%

26.4%

22.1%

Start of Best 15 year CRR

1985

1975

1975

1975

1975

Worst 15 year CRR

0.6%

-1.4%

1.6%

-1.6%

0.5%

Start of Worst 15 year CRR

1929

1928

1928

1928

1928

Avg 15 year SD

18.2%

20.4%

26.4%

29.1%

22.5%

Lowest 15 year SD

12.4%

12.9%

16.2%

19.0%

14.9%

1982

1979

1992

1992

1975

30.7%

39.1%

45.5%

51.8%

40.7%

Start of Lowest 15 year SD

Highest 15 year SD

1928

1930

1929

1929

1929

# 15 year periods 10% CRR

Start of Highest 15 year SD

43

57

64

68

61

# 15 year periods <10% CRR

30

16

12

Avg 'up 10%' 15 yr period CRR

14.1%

15.0%

14.9%

17.0%

15.0%

Avg 'up <10%' 15 yr period CRR

6.4%

6.6%

6.2%

4.2%

7.1%

Summary of 40 Yr Period Results (1928-2014)

LCB

LCV

SCB

SCV

4-Fund

On average, $100 grows to:

$6,287

$15,621

$17,072

$40,413

$17,275

Average 40 year CRR

10.9%

13.5%

13.7%

16.2%

13.7%

Best 40 year CRR

12.5%

15.8%

16.7%

18.9%

15.9%

Start of Best 40 year CRR

1950

1958

1975

1975

1975

Worst 40 year CRR

8.9%

8.3%

10.7%

11.8%

10.7%

Start of Worst 40 year CRR

1930

1930

1969

1928

1930

Avg 40 year SD

17.9%

19.8%

26.8%

28.8%

22.2%

Lowest 40 year SD

15.6%

16.2%

20.7%

23.3%

18.5%

Start of Lowest 40 year SD

Highest 40 year SD

Start of Highest 40 year SD

1959

1961

1975

1975

1975

23.2%

28.9%

34.6%

39.3%

30.5%

1928

1930

1928

1929

1928

# 40 year periods 10% CRR

36

44

48

48

48

# 40 year periods <10% CRR

12

Avg 'up 10%' 40 yr period CRR

11.4%

13.9%

13.7%

16.2%

13.7%

Avg 'up <10%' 40 yr period CRR

9.6%

9.0%

N/A

N/A

N/A

Abbreviations: Avg - average, CRR - Compound Rate of Return, LCB - Large Cap Blend, LCV - Large Cap Value, SCB Small Cap Blend, SCV - Small Cap Value, SD - Standard Deviation

Merriman Financial Education Foundation

Page 1 of 2

4-Fund Portfolio Analysis (R10).xlsm, Summary Output

Small Cap Blend, SCV - Small Cap Value, SD - Standard Deviation

Data sources

The following data sources were used. All performance data are total returns including interest and dividends. No

expense ratio or management fees have been applied.

Stocks

Large Cap Blend (LCB)

S&P 500 Index 1/1928 12/2014.

(Provided by Standard & Poors Index Services Group, through DFA)

Large Cap Value (LCV)

Dimensional US Large Cap Value Index 1/1928 12/2014

Small Cap Blend (SCB)

Dimensional US Small Cap Index 1/1928 12/2014

Small Cap Value (SCV)

Dimensional US Small Cap Value Index 1/1928 12/2014

4-Fund Combo

25% LCB, 25% LCV, 25% SCB, 25% SCV 1/1928 12/2014

Yearly rebalancing is used.

Merriman Financial Education Foundation

Page 2 of 2

4-Fund Portfolio Analysis (R10).xlsm, Summary Output

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Paulmerriman Com 4 Fund Combo Wallops SP 500 IndexDocument3 pagesPaulmerriman Com 4 Fund Combo Wallops SP 500 Indexaballard11No ratings yet

- Merriman 2014 Fine Tuning Asset AllocationDocument1 pageMerriman 2014 Fine Tuning Asset Allocationaballard11No ratings yet

- OFC368 - Jeff Mealiffe - Office 365 Internet Connection Planning and TroubleshootingDocument38 pagesOFC368 - Jeff Mealiffe - Office 365 Internet Connection Planning and Troubleshootingaballard11No ratings yet

- BSF Lessson 22Document2 pagesBSF Lessson 22aballard11No ratings yet

- Matriculated Student Status Certification FormDocument2 pagesMatriculated Student Status Certification Formaballard11No ratings yet

- Teaching Philosophy Statement Example #1Document5 pagesTeaching Philosophy Statement Example #1Dilruk GallageNo ratings yet

- Bult MannDocument1 pageBult Mannaballard11No ratings yet

- Highest Return Vanguard FUndsDocument2 pagesHighest Return Vanguard FUndsaballard11No ratings yet

- Fairfiled LibraryDocument1 pageFairfiled Libraryaballard11No ratings yet

- Coptic Instruction at FordhamDocument1 pageCoptic Instruction at Fordhamaballard11No ratings yet

- Coffee Table For Sale: Call 334-300-4542 6/21/13Document1 pageCoffee Table For Sale: Call 334-300-4542 6/21/13aballard11No ratings yet

- 2cor 5 InterlinearDocument4 pages2cor 5 InterlinearJackson TraceNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)