Professional Documents

Culture Documents

Show Distinction Between The Following Terms (Each Will Carry 2 Marks. So

Uploaded by

MohammadHas'sanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Show Distinction Between The Following Terms (Each Will Carry 2 Marks. So

Uploaded by

MohammadHas'sanCopyright:

Available Formats

Short Notes: These type of questions will carry 2 marks for each.

1. CRR

2. T-bills & T-bonds

3. High Powered Money

4. Bangladesh Bank Bill

5. D-SIBs

6. Emergency Liquidity Support (ELA) Program

7. Key Players of Financial System

8. Capital Adequacy Component of CAMELS

9. Fiscal Policy

10.SLR

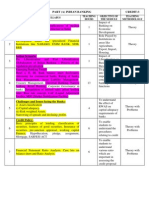

Show distinction between the following terms (Each will carry 2 marks. So,

your answer should focus on core concept, with the support of an example if

possible, but must be in short, otherwise, you cant finish in time. Make your own

notes and then you will not be vacillated in the hall )

1. Bank Note Vs. Currency Note

2. Counter Cyclical Capital Buffer Vs. Dynamic Provisioning

3. Narrow money Vs. Broad money

4. Inflation Targeting Vs. Price Level Targeting

5. Micro prudential supervision Vs. Macro prudential Supervision

6. Intervention Vs. Resolution

7. CAMELS Vs. Basel

8. Repo Vs Reverse Repo

9. Mutilated Note and Mismatched Note

10.Obliterated Note and Charred Note

11.Onsite Examination Vs. offsite monitoring

Questions: Marks vary from 2 to 7 based on their exposure

State and explain the direct and indirect Instruments of Monetary Policy.

Sketch the monetary policy framework of Bangladesh Bank.

Describe the tools used by Bangladesh Bank for Open Market Operation.

What do you mean by monetary policy transmission mechanism? Describe the

interest rate channel of the mechanism.

What is SLR (Statutory Liquidity Ratio)? State the components of SLR.

Discuss the ways through which fiscal policy directly affects monetary policy.

Define Financial Stability

Discuss the role of deposit insurance system in maintaining financial stability.

Discuss the programs effective for monitoring financial stability.

What do you mean by Stress testing? Discuss the techniques used in assessing

individual banks

Why do central banks supervise the commercial banks?

Mention the functions of onsite examination.

Mention the functions of offsite monitoring

What is CAMELS rating? Discuss the measurements used to rate a bank in

accordance with CAMELS.

In recent times, payment system of Bangladesh has optimized a revolutionary

change- Explain the statement in light of Bangladesh Automated Clearing

House (BACH) system

In recent times, need for carrying cash for shopping and other purposes has

become too limited for the revolutionary change in payment system- Explain

the statement in light of National payment Switch of Bangladesh.

What do you mean by RTGS? State the features and outputs of RTGS system.

State and explain the steps of issue and management of currency

Discuss the note refund policy of Bangladesh Bank

You might also like

- A Pragmatist’s Guide to Leveraged Finance: Credit Analysis for Below-Investment-Grade Bonds and LoansFrom EverandA Pragmatist’s Guide to Leveraged Finance: Credit Analysis for Below-Investment-Grade Bonds and LoansRating: 5 out of 5 stars5/5 (1)

- 6 Most Common Password Cracking Methods and Their Countermeasures - Cool Hacking TricksDocument6 pages6 Most Common Password Cracking Methods and Their Countermeasures - Cool Hacking TricksMohammadHas'sanNo ratings yet

- What Is MoneyDocument9 pagesWhat Is MoneyMira Andriani100% (1)

- Bank Treasury FINALDocument20 pagesBank Treasury FINALNguyen Hoai PhuongNo ratings yet

- Tail Risk Management - PIMCO Paper 2008Document9 pagesTail Risk Management - PIMCO Paper 2008Geouz100% (1)

- Ecs2605 - Study Unit 2Document3 pagesEcs2605 - Study Unit 2Rico BartmanNo ratings yet

- Brooks - AQR Drivers of Bond YieldsDocument27 pagesBrooks - AQR Drivers of Bond YieldsStephen LinNo ratings yet

- Alok Rustagi Kaushik Sadhu Paresh Nemade Swapnil DeshapndeDocument48 pagesAlok Rustagi Kaushik Sadhu Paresh Nemade Swapnil DeshapndeSwapnil DeshpandeNo ratings yet

- Money and CreditDocument14 pagesMoney and CreditAbhimanyu Chauhan72% (57)

- Active Balance Sheet Management: A Treasury & Investment PerspectiveFrom EverandActive Balance Sheet Management: A Treasury & Investment PerspectiveNo ratings yet

- Question Bank FMDocument4 pagesQuestion Bank FMN Rakesh100% (3)

- Management of Financial Institution Quiz 1Document2 pagesManagement of Financial Institution Quiz 1shishirk120% (1)

- Asset Liability ManagementDocument8 pagesAsset Liability ManagementAvinash Veerendra TakNo ratings yet

- Liquidity Management of Citi BankDocument8 pagesLiquidity Management of Citi BankGanesh AppNo ratings yet

- MBA Semester-4 MF0007 - Treasury Management Assignment Set-2Document3 pagesMBA Semester-4 MF0007 - Treasury Management Assignment Set-2jaswantmauryaNo ratings yet

- A Short Term Liquidity Forecasting ModelDocument40 pagesA Short Term Liquidity Forecasting ModelNitish SikandNo ratings yet

- MBA Intership Report On Liquidity Management Process of The City Bank Ltd-LibreDocument84 pagesMBA Intership Report On Liquidity Management Process of The City Bank Ltd-LibreGultekin Binte AzadNo ratings yet

- Banking 1Document24 pagesBanking 1deblina sarkarNo ratings yet

- Central Banking SolutionDocument2 pagesCentral Banking SolutionrupalNo ratings yet

- MPRA Paper 38994Document17 pagesMPRA Paper 38994saranyaabhi26No ratings yet

- Financial Liberalisation in India: Interest Rate Deregulation and Related IssuesDocument21 pagesFinancial Liberalisation in India: Interest Rate Deregulation and Related IssuespriyabhavsarNo ratings yet

- 6 Central Bank RoleDocument43 pages6 Central Bank RoleRAUSHAN KUMARNo ratings yet

- Liquidity Management Facility in Inidan Financial SystemDocument20 pagesLiquidity Management Facility in Inidan Financial Systemsantosh kapuNo ratings yet

- Revision Notes For Class 12 Macro Economics Chapter 3 - Free PDF DownloadDocument7 pagesRevision Notes For Class 12 Macro Economics Chapter 3 - Free PDF DownloadVibhuti BatraNo ratings yet

- Subject EconomicsDocument12 pagesSubject Economicsamitava deyNo ratings yet

- Functions of Central BankDocument4 pagesFunctions of Central BankK8suser JNo ratings yet

- IIM Rohtak - Payment Transaction TrackingDocument4 pagesIIM Rohtak - Payment Transaction TrackingAlrick BarwaNo ratings yet

- Central BankDocument35 pagesCentral BankanujNo ratings yet

- A Summer Internship Report: Multistate Scheduled BankDocument23 pagesA Summer Internship Report: Multistate Scheduled BankHetalKachaNo ratings yet

- Coping With Liquidity Management in India: A Practitioner's View Rakesh MohanDocument18 pagesCoping With Liquidity Management in India: A Practitioner's View Rakesh MohanSneha LeeNo ratings yet

- Banking RegulationDocument16 pagesBanking RegulationPst W C PetersNo ratings yet

- Assets & Liabilities Management AT The Union Co-Operative Bank LTDDocument21 pagesAssets & Liabilities Management AT The Union Co-Operative Bank LTDapluNo ratings yet

- Accounting For ManagersDocument8 pagesAccounting For ManagersGlady's DeepzNo ratings yet

- F 309 Group 6 FinalDocument18 pagesF 309 Group 6 FinalMD Alamin 25-125No ratings yet

- Asset Liability Management in BanksDocument5 pagesAsset Liability Management in BanksPooja GuptaNo ratings yet

- Performance Evaluation of Banking Sector in Pakistan: An Application of BankometerDocument6 pagesPerformance Evaluation of Banking Sector in Pakistan: An Application of BankometertafakharhasnainNo ratings yet

- Working Capital MGMTDocument23 pagesWorking Capital MGMTvidushigargeNo ratings yet

- Central BankDocument17 pagesCentral BankWishy KhanNo ratings yet

- CAMELS Analysis - Breaking Down FinanceDocument3 pagesCAMELS Analysis - Breaking Down FinanceOlmedo FarfanNo ratings yet

- Program: MBA Class Of: 2010-2011 Semester: IV Course Title: Treasury Management Credits: 3Document3 pagesProgram: MBA Class Of: 2010-2011 Semester: IV Course Title: Treasury Management Credits: 3Ann DeeNo ratings yet

- Assessing The Value of Asset Liability Management PakistanDocument16 pagesAssessing The Value of Asset Liability Management PakistanVenkat IyerNo ratings yet

- State Bank of PakistanDocument4 pagesState Bank of PakistanNuzrat FatimaNo ratings yet

- Project On UCO Bank FinalDocument69 pagesProject On UCO Bank FinalMilind Singh100% (1)

- Should CRR Be AbolishedDocument12 pagesShould CRR Be AbolishedNimisha JainNo ratings yet

- Monetary Policy NotesDocument13 pagesMonetary Policy NotesMehak joshiNo ratings yet

- Syllabus Central BankingDocument1 pageSyllabus Central BankingRafiul MunirNo ratings yet

- 9 1Document17 pages9 1VikasRoshanNo ratings yet

- Analysis of Credit ControlDocument6 pagesAnalysis of Credit ControlMihir ShahNo ratings yet

- Central BankDocument17 pagesCentral BankGaurav KumarNo ratings yet

- Financial Management Important QuestionsDocument3 pagesFinancial Management Important QuestionsSaba TaherNo ratings yet

- Part (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching MethodologyDocument3 pagesPart (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching Methodologyrajat_177229No ratings yet

- Department of Commerce (PG) Aigs CHAPTER 1: Introduction DefinitionsDocument12 pagesDepartment of Commerce (PG) Aigs CHAPTER 1: Introduction DefinitionsRanjitha NNo ratings yet

- Financial ManagementDocument8 pagesFinancial Managementoptimistic070% (1)

- 1.4 RabbankDocument1 page1.4 RabbankchereNo ratings yet

- Working Capital Management: SSRN Electronic Journal May 2020Document23 pagesWorking Capital Management: SSRN Electronic Journal May 2020Rea Mariz JordanNo ratings yet

- Stress Testing Report of Dhaka Bank Limited 2009Document20 pagesStress Testing Report of Dhaka Bank Limited 2009Amit Roy100% (2)

- Payment System Issues and ChallengesDocument14 pagesPayment System Issues and Challengesray_alokNo ratings yet

- Monetary PolicyDocument3 pagesMonetary PolicyGerome EchanoNo ratings yet

- Financial Statement Analysis of RNSBDocument23 pagesFinancial Statement Analysis of RNSBHetalKacha100% (1)

- Bba Vi Sem Question BankDocument7 pagesBba Vi Sem Question Bankyash soniNo ratings yet

- Asset-Liability Management in Banking SectorDocument7 pagesAsset-Liability Management in Banking SectorsukanyaNo ratings yet

- Asset Liability Management in BanksDocument29 pagesAsset Liability Management in BanksAashima Sharma BhasinNo ratings yet

- Banking Sector Reforms FULL REPORT - 1 - Commerce Seminar TopicsDocument2 pagesBanking Sector Reforms FULL REPORT - 1 - Commerce Seminar TopicsAvishek NandiNo ratings yet

- Asset Liability Management (ALM) / Dynamic Financial Analysis (DFA)Document21 pagesAsset Liability Management (ALM) / Dynamic Financial Analysis (DFA)Prabhat MauryaNo ratings yet

- Liquidity Troops AmericaDocument1 pageLiquidity Troops AmericaMohammadHas'sanNo ratings yet

- STIRPAT ModelDocument29 pagesSTIRPAT ModelMohammadHas'sanNo ratings yet

- This Tesr/tDocument1 pageThis Tesr/tMohammadHas'sanNo ratings yet

- We Can Not Throw Away The USA, Japan, China and UKDocument1 pageWe Can Not Throw Away The USA, Japan, China and UKMohammadHas'sanNo ratings yet

- Waton MethodDocument1 pageWaton MethodMohammadHas'sanNo ratings yet

- Forecasting Longevity Gains For A Population With Short Time Series Using A Structural SUTSE Model: An Application To Brazilian Annuity PlansDocument21 pagesForecasting Longevity Gains For A Population With Short Time Series Using A Structural SUTSE Model: An Application To Brazilian Annuity PlansMohammadHas'sanNo ratings yet

- Durbin WatsonDocument4 pagesDurbin WatsonRafiaZamanNo ratings yet

- BB ReportDocument28 pagesBB ReportMohammadHas'sanNo ratings yet

- DX/CVDocument1 pageDX/CVMohammadHas'sanNo ratings yet

- 4 Public GoodsDocument43 pages4 Public GoodsAli FaycalNo ratings yet

- DX/CVDocument1 pageDX/CVMohammadHas'sanNo ratings yet

- Getting The Standard Deviation From Your Calculator - PDFDocument3 pagesGetting The Standard Deviation From Your Calculator - PDFMohammadHas'sanNo ratings yet

- Important OkDocument1 pageImportant OkMohammadHas'sanNo ratings yet

- Algebra For ISLM ModelDocument9 pagesAlgebra For ISLM ModelMohammadHas'sanNo ratings yet

- The Profite Function ZDocument1 pageThe Profite Function ZMohammadHas'sanNo ratings yet

- Stock Market Capitalization and Economic Growth in GhanaDocument13 pagesStock Market Capitalization and Economic Growth in GhanaAlexander DeckerNo ratings yet

- How Is Inflation Calculated?Document2 pagesHow Is Inflation Calculated?Omkar SheteNo ratings yet

- Managerial EconomicsDocument15 pagesManagerial EconomicsDaniel KerandiNo ratings yet

- Economics - 0455 - Igcse AidDocument1 pageEconomics - 0455 - Igcse AidIvan BatteyNo ratings yet

- Econ 4710 SyllabusDocument5 pagesEcon 4710 Syllabusbilly jeedNo ratings yet

- Coursecontents BbaDocument30 pagesCoursecontents BbaSehar Eiman100% (1)

- Economic Determinants of Household Consumption Expenditures in West Africa: A Case Study of Nigeria and GhanaDocument15 pagesEconomic Determinants of Household Consumption Expenditures in West Africa: A Case Study of Nigeria and Ghanarieke sNo ratings yet

- 248 Multiple Choice Questions in Business EconomicsDocument249 pages248 Multiple Choice Questions in Business EconomicsKiềuMinh VJCCNo ratings yet

- 12th EconomicsDocument79 pages12th EconomicsDhivyaNo ratings yet

- Money and CreditDocument7 pagesMoney and CreditSunil Sharma100% (1)

- LEER PRIMERO Christian Suter - Debt Cycles in The World-Economy - Foreign Loans, Financial Crises, and Debt Settlements, 1820-1990-Westview Press - Routledge (1992)Document247 pagesLEER PRIMERO Christian Suter - Debt Cycles in The World-Economy - Foreign Loans, Financial Crises, and Debt Settlements, 1820-1990-Westview Press - Routledge (1992)Juan José Castro FrancoNo ratings yet

- FIN350 - Solutions Slides 12Document3 pagesFIN350 - Solutions Slides 12David NguyenNo ratings yet

- The Dollar Milkshake TheoryDocument2 pagesThe Dollar Milkshake TheoryHarushika MittalNo ratings yet

- KBC Kinh Bac ReportingDocument41 pagesKBC Kinh Bac Reportingloc1409No ratings yet

- Cbleecpu 12Document8 pagesCbleecpu 12Pubg GokrNo ratings yet

- TNS Beaconhouse (DHA) : Mock Examination DP2 Mar 2021Document3 pagesTNS Beaconhouse (DHA) : Mock Examination DP2 Mar 2021Shamsher IqbalNo ratings yet

- MEBEDocument12 pagesMEBEAnant singhNo ratings yet

- 47- دراسة اقتصادية لبعض العوامل المؤثرة على العجز المالي في الموازنة العراقية 2003-2016 PDFDocument23 pages47- دراسة اقتصادية لبعض العوامل المؤثرة على العجز المالي في الموازنة العراقية 2003-2016 PDFZoheir RABIANo ratings yet

- India Economy, Resi and Office DataDocument20 pagesIndia Economy, Resi and Office Datamahika bellaneyNo ratings yet

- Syllabus Pune University S BcomDocument46 pagesSyllabus Pune University S Bcomsiddhant parkheNo ratings yet

- BlogDocument4 pagesBlogShabih FatimaNo ratings yet

- IE MCQ 75 CompletedDocument15 pagesIE MCQ 75 CompletedRaghuNo ratings yet

- BOI Handbook 2011Document194 pagesBOI Handbook 2011Mainul Izlam50% (2)

- Mock 17 HL Paper 3 MarkscheneDocument12 pagesMock 17 HL Paper 3 MarkscheneSelvy SurjadiNo ratings yet

- Mprdec 2020Document76 pagesMprdec 2020Asora Yasmin snehaNo ratings yet

- MBA - AFM - Inflation AccountingDocument20 pagesMBA - AFM - Inflation AccountingVijayaraj JeyabalanNo ratings yet