Professional Documents

Culture Documents

SGV Report On Use of IPO Proceeds 2Q

Uploaded by

xnUdn4eN0 ratings0% found this document useful (0 votes)

2 views3 pagesT

Original Title

SGV Report on Use of IPO Proceeds 2Q

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentT

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views3 pagesSGV Report On Use of IPO Proceeds 2Q

Uploaded by

xnUdn4eNT

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

—_

SGV Skee keene

226 Makati City

Building a better Phiigones

‘working world

restation No, O012-FR°3 (Grou,

November 15, 2022, valid unt November 16, 2015,

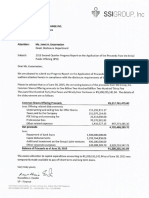

REPORT OF FACTUAL FINDINGS

The Stockholders and the Board of Directors

SSI Group, Inc.

6th Floor, Midland Buendia Building

403 Sen. Gil Puyat Avenue

Makati City

We have performed the procedures agreed with you and enumerated below with respect to the

attached Quarterly Progress Report ended June 30, 2015 on the application of proceeds from the

Initial Public Offering (IPO) of SSI Group, Ine. (the Company) on November 7. 2014. ‘the

procedures were performed solely to enable the Company to comply with the Philippine Stock

Exchange, Inc.’s (PSE) requirement to submit an external auditor's certification on the information

being presented by the Company relating to the application of procecds from the IPO. Our

engagement was undertaken in accordance with the Philippine Standards on Related Services 4400.

“Engagements to Perform Agreed-Upon Procedures Regarding Financial Information” applicable to

agreed-upon procedures engagements. These agreed-upon procedures sind results thereo! are

summarized as follows

1. We obtained a copy of the Planned Use of Proceeds from the offering of the Company’s

common shares.

2. We obtained the Quarterly Progress on the Application of Proceeds from the IPO (ihe

“Progress Report”) for the quarter ended June 30. 2015 and checked its mathematical

accuracy. We also agreed the amounts of repayment of bank loans, capital expenditure

disbursements, additional investment on the Group’s joint ventures and other corporate

purposes to the related schedules,

sd the

3. We obtained the supporting documents of the repayment of bank loans and aj

amounts to the accounting records and supporting documems,

4. We obtained the schedule of capital expenditure disbursements, additional investments to the

Group’s joint ventures and other corporate purposes and check the mathematical accuracy’ ol

the schedules. On a test basis, we traced certain items to the accounting records and

supporting documents,

We report our findings below:

¢ of Proceeds from the offering

1. With respect to item 1, we obtained a copy of the Planned U

‘of the common shares (the Plan) of the Company. We noted from the Plan that the net

proceeds from the offering will be used by the Company for store development mainly

consisting of the construction of new stores, equity investments in the joint ventures,

consisting of capital injection pursuant to the obligation under the joint venture agreements.

repayment of existing debts and other corporate purposes,

2. With respect to item 2, we found the Progress Report to be mathematically accurate and the

amounts are in agreement with the respective schedules provided by management supporting

the use of the IPO Proceeds. We also noted that the amounts in the schedules consist of

acquisitions and/or payments recognized in the Company’s records for the period April 2015

to June 2015,

With respect to item 3, we checked the accounting records for the entry made on the

repayment of bank loans and noted no exceptions. We also obtained the authority to debit

issued by Stores Specialists, Inc. (SSI), a wholly-owned subsidiary of the Company. to

Metropolitan Bank & Trust Co, and traced the corresponding withdrawals 10 passbook. We

noted that the total amount of loan paid by Stores Specialists. Inc. for the quarter was

P2,859,057.42. Of this amount, P2,500,000.00 was sourced from the IPO proceeds while

359,057.42 was sourced from SSI’s operations.

4. With respect to item 4, we found the schedules to be in order and mathematically accurate

‘On a test basis, we traced capital expenditures and disbursements made for other corporate

purposes and noted no exceptions, We noted that the additional investments to SIAL. CVS

Retailers, Inc. and SIAL Specialty Retailers, Ine., the Group's joint ventures, for the quarter

amounted to P66,900,000,00 and #100,000,000.00. respectively. Of the total amount,

P79,000,000.00 was sourced from the IPO proceeds while P87.900,000.00 was sourced from

SSI’s operations.

5. The Company also disclosed in the Progress Report that P!.200.235,141.94 of the total net

proceeds allocated to capital expenditures but have not yet been applied was made available

to pay off its short-term and long-term loans. ‘This represents the excess of the allocation tor

capital expenditures amounting to P2,500,000,000.00 and the actual capital expenditure:

June 30, 2015 amounting to PL,299,764.858.06.

Because the above procedures do not constitute either an audit or a review made in accordance with

Philippine Standards on Auditing or Philippine Standards on Review Fngagements, respecti

do not express any assurance on the use of proceeds from the IPO based on the said standards,

Had we performed additional procedures or had we performed an audit or review of the Financial

statements in accordance with Philippine Standards on Auditing or Philippine Standards on Review

Engagements, other matters might have come to our attention that would have been reported to you

We have no responsibility to update this report for events or circumstances occurring after the date of

this report

‘Our report is solely for the purpose set forth in the first paragraph of this report and for your

information and is not to be used for any other purpose or to be distributed to any other parties. ‘This

report relates only to the updated report on the Company’s use of proceeds from the IPO and items

specified above and do not extend to any financial statements of SS} Group. Inc.. taken as a whole.

SYCIP GORRES VELAYO & CO.

Ladliden Airy

Ladistao Z. Avila.)

Partner

CPA Certificate No. 69099

SEC Accreditation No, O111-AR-3 (Group A),

January 18, 2013, valid until January 17, 2016

‘Tax Identification No, 109-247-891

BIR Accreditation No. 08-001998-43-2015,

February 27, 2015, valid until February 26, 2018

PTR No. 4751254, January 5, 2015, Makati

July 14, 2015

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- SSI Group 2014 17A 2015 0414 1900H (Execution-Signed) With Annexes ACGRDocument190 pagesSSI Group 2014 17A 2015 0414 1900H (Execution-Signed) With Annexes ACGRxnUdn4eNNo ratings yet

- FORM 23-B: Huang Anthony Tantoco SSI Group, Inc. (SSI)Document4 pagesFORM 23-B: Huang Anthony Tantoco SSI Group, Inc. (SSI)xnUdn4eNNo ratings yet

- SEC Form 23B - JTL - 02-11-2015Document4 pagesSEC Form 23B - JTL - 02-11-2015xnUdn4eNNo ratings yet

- SEC Form 23B - MTV - 04-08-2015Document4 pagesSEC Form 23B - MTV - 04-08-2015xnUdn4eNNo ratings yet

- SEC+Form+23B - Wellborn - 02 12 2015 2Document4 pagesSEC+Form+23B - Wellborn - 02 12 2015 2xnUdn4eNNo ratings yet

- Report On IPO ProceedsDocument1 pageReport On IPO ProceedsxnUdn4eNNo ratings yet

- SSI Group Inc. - GIS 2015 (PSE Disclosure)Document10 pagesSSI Group Inc. - GIS 2015 (PSE Disclosure)xnUdn4eNNo ratings yet

- PSE - SSI Top 100 Shareholders (Registry and Depository Participants)Document4 pagesPSE - SSI Top 100 Shareholders (Registry and Depository Participants)xnUdn4eNNo ratings yet

- SGV Report On IPO Proceeds of SGI - 31march2015Document2 pagesSGV Report On IPO Proceeds of SGI - 31march2015xnUdn4eNNo ratings yet

- 17Q Sept 2015 Final - SignedDocument55 pages17Q Sept 2015 Final - SignedxnUdn4eNNo ratings yet

- 2015 03 26 SSI-PSE CG Guidelines Disclosure Survey (2014)Document8 pages2015 03 26 SSI-PSE CG Guidelines Disclosure Survey (2014)xnUdn4eNNo ratings yet

- SSI Group, Inc. Quarterly Report For June 30, 2015Document55 pagesSSI Group, Inc. Quarterly Report For June 30, 2015xnUdn4eNNo ratings yet

- 3Q - SGI - AUP IPO Proceeds ReportDocument2 pages3Q - SGI - AUP IPO Proceeds ReportxnUdn4eNNo ratings yet

- Ssi Group Net Income Up 63% To Php998.7 MillionDocument1 pageSsi Group Net Income Up 63% To Php998.7 MillionBusinessWorldNo ratings yet

- 23-B ATH 20150820 (Signed)Document4 pages23-B ATH 20150820 (Signed)xnUdn4eNNo ratings yet

- SSI TOP 100 09302015 Registry & DepositoryDocument7 pagesSSI TOP 100 09302015 Registry & DepositoryxnUdn4eNNo ratings yet

- ATH - Oct 2Document3 pagesATH - Oct 2xnUdn4eNNo ratings yet

- SSI TOP100 063015 (Registry and PCD)Document7 pagesSSI TOP100 063015 (Registry and PCD)xnUdn4eNNo ratings yet

- Travel Retail Press ReleaseDocument1 pageTravel Retail Press ReleasexnUdn4eNNo ratings yet

- 2Q - Report On IPO ProceedsDocument1 page2Q - Report On IPO ProceedsxnUdn4eNNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ch05 12edDocument39 pagesCh05 12edpenusilaNo ratings yet

- CH 21 Answer To in Class Diiscussion ProblemsDocument20 pagesCH 21 Answer To in Class Diiscussion ProblemsJakeChavezNo ratings yet

- Developing Marketing Strategies and PlansDocument43 pagesDeveloping Marketing Strategies and PlansThaer Abu Odeh100% (1)

- Iimjobs Abhishek KaulDocument2 pagesIimjobs Abhishek KaulRam Krishna JaladiNo ratings yet

- Beta Management Company r2Document17 pagesBeta Management Company r2Yash AgarwalNo ratings yet

- TATA MotorsDocument16 pagesTATA MotorsShweta Gupta0% (1)

- Pinnacle Far Preweek May 2022Document32 pagesPinnacle Far Preweek May 2022Miguel ManagoNo ratings yet

- JNPT Final Volume2v2Document311 pagesJNPT Final Volume2v2Samir DhrangdhariyaNo ratings yet

- VP Marketing Brand Strategy in New York City Resume Meryl AltuchDocument3 pagesVP Marketing Brand Strategy in New York City Resume Meryl AltuchMeryl AltuchNo ratings yet

- ONGC India: in Search of A New Growth StrategyDocument13 pagesONGC India: in Search of A New Growth StrategyRonak MotaNo ratings yet

- Kuala Lumpur Industries Holdings Berhad (165126 - M) (Special Administrators Appointed) (Incorporated in Malaysia)Document54 pagesKuala Lumpur Industries Holdings Berhad (165126 - M) (Special Administrators Appointed) (Incorporated in Malaysia)chairkp 2015No ratings yet

- Mobile Money International Sdn Bhd Company ProfileDocument1 pageMobile Money International Sdn Bhd Company ProfileLee Chee SoonNo ratings yet

- Foreign ExchangeDocument35 pagesForeign ExchangeHafiz Ahmed33% (3)

- John Ervin Bonilla Bsba Fm2B 1. Admission by Purchase of InterestDocument8 pagesJohn Ervin Bonilla Bsba Fm2B 1. Admission by Purchase of InterestJohn Ervin Bonilla100% (4)

- Demo-Cpsm Exam 1Document20 pagesDemo-Cpsm Exam 1examkiller25% (4)

- RTM7Document7 pagesRTM7Sanchit ShresthaNo ratings yet

- Fathoming FEMA (Overview of Provisions of Foreign Exchange Management Act, 1999 (FEMA) and Rules and Regulations There Under) by Rajkumar S Adukia 4Document16 pagesFathoming FEMA (Overview of Provisions of Foreign Exchange Management Act, 1999 (FEMA) and Rules and Regulations There Under) by Rajkumar S Adukia 4Apoorv GogarNo ratings yet

- Perceptions of Grade 12 ABM Students on TRAIN LawDocument6 pagesPerceptions of Grade 12 ABM Students on TRAIN LawJennieca TablarinNo ratings yet

- Asahi Glass CompanyDocument14 pagesAsahi Glass CompanyMohit Manaktala100% (2)

- Accounting For Shares NewDocument24 pagesAccounting For Shares NewSteve NtefulNo ratings yet

- Apply for credit cardDocument1 pageApply for credit cardandrewqwertyNo ratings yet

- PSB Education LoanDocument71 pagesPSB Education LoanGanesh JoshiNo ratings yet

- Finance 4610T1V2Sp18Document5 pagesFinance 4610T1V2Sp18jl123123No ratings yet

- 2010 Form 990 For President and Fellows of Harvard CollegeDocument254 pages2010 Form 990 For President and Fellows of Harvard CollegeresponsibleharvardNo ratings yet

- HARLEY-DAVIDSON STRATEGIC PLAN ANALYSISDocument28 pagesHARLEY-DAVIDSON STRATEGIC PLAN ANALYSISRasydi Rashid67% (3)

- Nature of ManagementDocument5 pagesNature of ManagementDennis FalaminianoNo ratings yet

- 2015 Saln Form-From CSCDocument3 pages2015 Saln Form-From CSCRowel Magsino GonzalesNo ratings yet

- Chapter 23 Hedging With Financial DerivativesDocument15 pagesChapter 23 Hedging With Financial DerivativesGiang Dandelion100% (1)

- Executive Compensation at AquilaDocument8 pagesExecutive Compensation at AquilaSai VishnuNo ratings yet

- DM21A24 - Hitakshi ThakkarDocument8 pagesDM21A24 - Hitakshi ThakkarRAHUL DUTTANo ratings yet