Professional Documents

Culture Documents

Taxation Agreement 2012 Romania

Uploaded by

zinveliu_vasile_florin0 ratings0% found this document useful (0 votes)

8 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageTaxation Agreement 2012 Romania

Uploaded by

zinveliu_vasile_florinCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

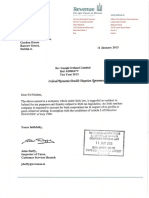

Revenue cl

Cain agus Cutan na hireann

(gn gtoimisin ca ‘fice fhe Revenue Commins

Fem na gsanre Mica Large Cases Dvsion

toa Setata Seana Cee

Sri Taba ral Nassau Stet

Bal ta Ca 2,0 Cin 2, rand

Google Ireland Limited,

Gordon House

Barrow Street,

Dublin 4. 12 January 2012

‘Aug 2011

Re: Google Ireland Limited

Ref: 6388047V

Tax Year 2012

Treland/Romania Double Taxation Agreement

Dear Sir/Madam,

‘The above named is a company which under Irish law, is regarded as resident in

Ireland for tax purposes and thereby subject to Irish tax legislation. An Irish resident

company is required to account for Irish corporation tax in respect of its profits or

gains wherever arising. It complies with the conditions of Article 2 of Directive

90/435/EEC of July 1990.

eh Ft, | cisK ; oa |

12 od

John Duffy,

Inspector of Taxes, et J

Customer Services a

jduffy@revenue.ie

You might also like

- Econ Analysis Report 2016Document340 pagesEcon Analysis Report 2016zinveliu_vasile_florinNo ratings yet

- DTTL Tax Spainhighlights 2017Document5 pagesDTTL Tax Spainhighlights 2017zinveliu_vasile_florinNo ratings yet

- DTTL Tax Romaniahighlights 2016 PDFDocument4 pagesDTTL Tax Romaniahighlights 2016 PDFzinveliu_vasile_florinNo ratings yet

- Deloitte Tax Portugalhighlight 2016Document4 pagesDeloitte Tax Portugalhighlight 2016coyote41No ratings yet

- DTTL Tax Slovakiahighlights 2017 PDFDocument4 pagesDTTL Tax Slovakiahighlights 2017 PDFzinveliu_vasile_florinNo ratings yet

- Deloitte Tax Portugalhighlight 2016Document4 pagesDeloitte Tax Portugalhighlight 2016coyote41No ratings yet

- DTTL Tax Hungaryhighlights 2017Document4 pagesDTTL Tax Hungaryhighlights 2017zinveliu_vasile_florinNo ratings yet

- DTTL Tax Sloveniahighlights 2017 PDFDocument4 pagesDTTL Tax Sloveniahighlights 2017 PDFzinveliu_vasile_florinNo ratings yet

- Taxation Agreement 2013 Romania1 PDFDocument1 pageTaxation Agreement 2013 Romania1 PDFzinveliu_vasile_florinNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)