Professional Documents

Culture Documents

Top NCD Picks - April (4) : Retail Research

Uploaded by

arun_algoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Top NCD Picks - April (4) : Retail Research

Uploaded by

arun_algoCopyright:

Available Formats

April 25, 2014

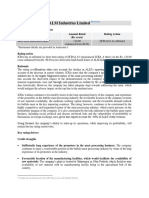

Top NCD Picks April (4)

RETAIL RESEARCH

Issuer

Series

HSL Scrip code

Last traded

Price (Rs)

Coupon

Rate

(%)

Tenor

Residual

Maturity

(Year)

Interest

payment

frequency

Latest

Record

Date

Call / Put

Date

Tenor to

Call / Put

(Yrs)

YTC

(%)

Daily

Avg

Volume

(Nos)

YTM (%)

Tax Free Bonds

AAA Rated

IIFCL

875IIFCL33 Indiv

IIF875NBNR

1061

8.75%

20 Years

19.57 Yrs

Yearly

526

8.52%

NHAI

N6 Indiv

NHA875N6NR

1035.84

8.75%

15 Years

14.80 Yrs

Yearly

28Feb14

25255

8.44%

NHB

NHBTF2014 N6 Ind

NHB901N6NR

5403.82

9.01%

20 Years

19.74 Yrs

Yearly

1968

8.44%

PFC

843PFC23 Indiv

PFC843B1NR

1035

8.43%

10 Years

9.57 Yrs

Yearly

158

8.44%

AA+ Rated

HUDCO

839HUDCO23 Indiv

HUD839B1NR

1013.11

8.39%

10 Years

9.51 Yrs

Yearly

163

8.84%

HUDCO

851HUDCO28

HUD851A2NR

1020

8.51%

15 Years

14.52 Yrs

Yearly

376

8.80%

SBI

N2

STABANN2NR

10049

9.50%

15 Years

11.54 Yrs

Yearly

16Mar14

5Nov20

6.54 Yrs

9.51%

116

9.51%

SBI

N5

STABANN5NR

10359

9.95%

15 Years

11.90 Yrs

Yearly

16Mar14

17Mar21

6.90 Yrs

9.35%

961

9.51%

Taxable Bonds

AAA Rated

AA+ Rated

Residual Maturity Below 24 months

Shriram Transport

STFC NC

SRTRANNCNR

596.25

10.50%

5 Years

1.11 Yrs

Yearly

12Mar14

145

13.79%

Shriram Transport

STFC NR Individual

SRTRANNRNR

997

11.15%

3 Years

1.30 Yrs

Yearly

12Mar14

105

12.10%

Residual Maturity Above 24 months

Shriram Transport

STFC NU Individual

SRTRANNUNR

1170

5 Years

3.30 Yrs

Comulative

120

12.35%

Shriram Transport

STFC NW Individual

SRTRANNWNR

982

11.15%

5 Years

4.27 Yrs

Yearly

12Mar14

519

12.02%

AA and AA Rated

Residual Maturity Below 24 months

Muthoot Finance

1150MFL15

M1150M2SNR

980.01

11.50%

2 Years

1.42 Yrs

Monthly

16Apr14

155

13.58%

Religare Finvest Li

15B

RELFINN2NR

1175

0.00%

3 Years

1.47 Yrs

Comulative

130

13.50%

Residual Maturity Above 24 months

India Infoline Fina

IIFLFIN N7

INDINFN7NR

1160.1

6 Years

4.41 Yrs

Comulative

162

13.87%

Muthoot Finance

1225MFL16

M1225Y3SNR

1046.45

12.25%

3 Years

2.43 Yrs

Yearly

151

13.38%

Note:

Credit Rating (as per latest data): For STFC NCDs CARE AA+ / Crisil AA (Stable). For TATA Cap NCDs CARE AA+ / ICRA LAA+. For L&T Fin NCDs CARE AA+ / ICRA LAA+. For SBI Bonds CARE AAA / AAA/ Stable by CRISIL. For

IndiaInfoline NCDs issued on Aug 2011 and Sep 2012 CARE AA' by CARE & ICRA AA by ICRA. For IndiaInfoline NCDs issued on Sep 2013 CARE AA[Double A] by CARE & BWR AA (Outlook:Stable)' by Brickwork. For

SHRIRAMCITI NCDs Crisil AA/Stable Care AA'. For Muthoot NCDs CRISIL AA/Stable by CRISIL and [ICRA] AA(stable) by ICRA. For Manappuram NCDs A+/Negative by CRISIL. For Religare Finvest NCDs [ICRA] AA

(Stable) from ICRA Ltd. &[CARE] AA from CARE. For NHAI NCDs CRISIL AAA/Stable by CRISIL CARE AAA by CARE and "Fitch AAA(ind) with Stable Outlook by FITCH. For PFC NCDs "CRISIL AAA/Stable by CRISIL and ICRA

AAA by ICRA. For IRFC CRISIL AAA/Stable by CRISIL, [ICRA] AAA by ICRA and CARE AAA by CARE ". For HUDCO CARE AA+ from CARE and Fitch AA+ (ind) from Fitch. For REC CRISIL AAA/Stableby CRISIL,CARE AAAby

CARE, Fitch AAA(ind)by FITCH and [ICRA]AAAby ICRA. For Tata Capital Financial Service Ltd AA+/Stable from ICRA Limited and CARE AA from CARE. For IIFCL, ICRA AAA/Stable by ICRA,BWR AAA by Brickworks and CARE

AAA by CARE. For NHB, CRISIL AAA/Stable and CARE AAA". For Ennore Port, BWR AA+ (SO), CRISIL AA/Stable and CARE AA. For Dredging Corporation of India, BWR AA+ (SO) and CARE AA. For Jawaharlal Nehru Port Trust,

CRISIL AAA/Stable, "BWR AAA". For NHPC, [ICRA] AAA by ICRA IND AAA by India Rating & Research Private Limited and CARE AAA by CARE. For NTPC, CRISIL AAA from CRISIL and ICRA AAA from ICRA. For ECL CARE AA

by CARE and BWR AA by Brickwork. For SREI "CARE AA (Double A Minus) by CARE and BWR AA (BWR Double A) by BRICKWORK.

YTM is yield to maturity Annualized yield that would be realized on a bond if the bond is held until the maturity date. Yield to call (YTC) is the annualized rate of return that an investor would earn if he bought a callable bond at

its current market price and held until the call is first exercisable by the issuer.

Religare, PFC, REC, DCI, Ennore Port, IIFCL NCDs are listed only on BSE, while the rest are listed on NSE and (in some cases Muthoot finance, IIFL, HUDCO and some series of Shriram Citi, Muthoot Fin & Religare Fin) also on BSE. In

case where the NCD are listed on both the exchanges, the price on the exchange where it is traded more (average daily volumes) is considered.

FV of NCDs in all cases is Rs.1000, except Rs.10,000 for SBI, Rs.1,00,000 for TATA Cap N1 and Rs. 200 for STFC N1 and STFC N2. For NHB, the FV of Series NHBTF2023 is Rs 10,000, while the FV for Series N1,N2,N3,N4,N5,N6 is Rs

5000.

Last traded date means date of last trade (not beyond the previous month). Further freak trades are not considered for YTM calculations. While short listing the top picks, enough weightage is given to frequency of trade and

average volumes. Unexpected cut in credit rating could result in bond prices going down and resultant MTM loss.

As mentioned, the series named 'NHPC Individual', 'REC Individual', 'HUDCO Individual' and 'NTPC Individual' are available only for Retail investors. To avail of 25 bps higher coupon rates, retailers have to hold the bonds for

the face value amount of not more than Rs. 10 lakh as on record dates. If they hold the bonds for the face value amount of more than Rs. 10 lakh on the record date (based on demat account or PAN), then they will lose out 25

bps in the coupon rates.

The series mentioned as individual in taxable NCDs of Shriram Transport and Shriram Citi are eligible for retail investments (and higher coupon) irrespective of investment amount. The only criterion for higher interest is that the

holder should be an individual as on the record date.

RETAIL RESEARCH Fax: (022) 3075 3435

Corporate Office: HDFC Securities Limited, I Think Techno Campus, Building B, Alpha, Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Fax: (022) 30753435 Website:

www.hdfcsec.com

Disclaimer: Debt investments are subject to risk. Past performance is no guarantee for future performance. This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation.

This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable.

We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or

perform investment banking, or other services for, any company mentioned in this document. This report is intended for nonInstitutional Clients.

RETAIL RESEARCH

You might also like

- ReportDocument1 pageReportumaganNo ratings yet

- Top Tax-Free and Taxable NCD Picks for May 2014Document1 pageTop Tax-Free and Taxable NCD Picks for May 2014arun_algoNo ratings yet

- Top NCD Picks and Analysis for May 2014Document1 pageTop NCD Picks and Analysis for May 2014shobhaNo ratings yet

- ReportDocument3 pagesReportshobhaNo ratings yet

- ReportDocument2 pagesReportumaganNo ratings yet

- Report PDFDocument2 pagesReport PDFGauriGanNo ratings yet

- 3013618Document2 pages3013618GauriGanNo ratings yet

- 3013734Document2 pages3013734GauriGanNo ratings yet

- TAX-FREE AND TAXABLE BONDS RESEARCHDocument3 pagesTAX-FREE AND TAXABLE BONDS RESEARCHumaganNo ratings yet

- ReportDocument3 pagesReportumaganNo ratings yet

- Top NCD Picks for September 2013Document1 pageTop NCD Picks for September 2013vivekrajbhilai5850No ratings yet

- Top AA+ rated tax-free bonds under 15 yearsDocument3 pagesTop AA+ rated tax-free bonds under 15 yearsumaganNo ratings yet

- ReportDocument3 pagesReportumaganNo ratings yet

- Nhai NCD Note - 27122011Document7 pagesNhai NCD Note - 27122011Akchat JainNo ratings yet

- Range Bound Markets With A Positive Bias Seen Today: Top Nifty GainersDocument5 pagesRange Bound Markets With A Positive Bias Seen Today: Top Nifty GainersDynamic LevelsNo ratings yet

- Live Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Document15 pagesLive Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Shakthi ShankaranNo ratings yet

- Investment Analysis & Portfolio MGTDocument104 pagesInvestment Analysis & Portfolio MGTkhusbuNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- Daily Derivatives: December 23, 2016Document3 pagesDaily Derivatives: December 23, 2016choni singhNo ratings yet

- Brigade-Enterprises-Ltd IER FirstCut INE791I01019Document2 pagesBrigade-Enterprises-Ltd IER FirstCut INE791I01019Bhavan BarhateNo ratings yet

- Global Dis Trip Arks ProspectusDocument250 pagesGlobal Dis Trip Arks ProspectusSandeepan ChaudhuriNo ratings yet

- Script Code: 531179 ISIN: INE109C01017 Symbol: ARMANFIN Series: EQDocument42 pagesScript Code: 531179 ISIN: INE109C01017 Symbol: ARMANFIN Series: EQvermaanuradha823No ratings yet

- Equity Report by Ways2capital 19 May 2014Document6 pagesEquity Report by Ways2capital 19 May 2014Ways2CapitalNo ratings yet

- Shriram Transport Financ NCDDocument2 pagesShriram Transport Financ NCDRajib LayekNo ratings yet

- Ipo FinalDocument34 pagesIpo FinalAteet AgarwalNo ratings yet

- Triveni TurbineDocument6 pagesTriveni TurbinevikasNo ratings yet

- Module1-Investments & Risk & DerivativesDocument169 pagesModule1-Investments & Risk & DerivativesLMT indiaNo ratings yet

- MOStMarketOutlook3rdMay2023 PDFDocument10 pagesMOStMarketOutlook3rdMay2023 PDFLakhan SharmaNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Bulls Say Happy Weekend: Punter's CallDocument5 pagesBulls Say Happy Weekend: Punter's CallGauriGanNo ratings yet

- PC Jeweller LTD IER InitiationReport 2Document28 pagesPC Jeweller LTD IER InitiationReport 2Himanshu JainNo ratings yet

- MOSt Market Outlook 15 TH February 2024Document10 pagesMOSt Market Outlook 15 TH February 2024Sandeep JaiswalNo ratings yet

- Crisil HeroDocument28 pagesCrisil HeroSachin GuptaNo ratings yet

- Sharekhan Top Mutual Fund Picks May 2015Document14 pagesSharekhan Top Mutual Fund Picks May 2015Siddhant PardeshiNo ratings yet

- Impact of M&A in Indian Banking SectorDocument29 pagesImpact of M&A in Indian Banking SectorAbhishek SinghNo ratings yet

- Top SIP fund picks for disciplined long-term investingDocument4 pagesTop SIP fund picks for disciplined long-term investingLaharii MerugumallaNo ratings yet

- MOStMarketOutlook2ndApril2024Document10 pagesMOStMarketOutlook2ndApril2024Sandeep JaiswalNo ratings yet

- TTK Report - 2011 and 2012Document2 pagesTTK Report - 2011 and 2012sgNo ratings yet

- Morning Market Outlook and Investment IdeasDocument10 pagesMorning Market Outlook and Investment IdeasLakhan SharmaNo ratings yet

- BeyondMarket Issue 114Document52 pagesBeyondMarket Issue 114ektapatelbmsNo ratings yet

- AXIS Mutual FundDocument68 pagesAXIS Mutual Fundallsbri600No ratings yet

- Babula (Anagram)Document43 pagesBabula (Anagram)Venkates ReddyNo ratings yet

- SAME Deutz-Fahr India Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesSAME Deutz-Fahr India Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionABHISHEK BHAGATNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- Larsen& Toubro LTD Initiating Coverage 15062020Document8 pagesLarsen& Toubro LTD Initiating Coverage 15062020Aparna JRNo ratings yet

- MOStMarketOutlook3rdApril2024Document10 pagesMOStMarketOutlook3rdApril2024Sandeep JaiswalNo ratings yet

- Retail Research: Cues From Derivative Sentiment and Volatility IndicatorsDocument2 pagesRetail Research: Cues From Derivative Sentiment and Volatility IndicatorsjaimaaganNo ratings yet

- Quant Consumption Fund One Pager-01Document2 pagesQuant Consumption Fund One Pager-01Priyanka GandhiNo ratings yet

- Crisil Report Sep 2013Document32 pagesCrisil Report Sep 2013MLastTryNo ratings yet

- 9th Nov, 2023Document11 pages9th Nov, 2023Pushpendra KushwahaNo ratings yet

- Head and Shoulders Broken: Punter's CallDocument5 pagesHead and Shoulders Broken: Punter's CallRajasekhar Reddy AnekalluNo ratings yet

- MOStMarketOutlook4thApril2024Document10 pagesMOStMarketOutlook4thApril2024Sandeep JaiswalNo ratings yet

- List of Important Abbreviations in NEWS 2014Document2 pagesList of Important Abbreviations in NEWS 2014Govind GautamNo ratings yet

- CRISIL Research Ier Report Sterlite Technologies 2012Document28 pagesCRISIL Research Ier Report Sterlite Technologies 2012J Shyam SwaroopNo ratings yet

- Most Market Out Look 27 Th February 24Document12 pagesMost Market Out Look 27 Th February 24Realm PhangchoNo ratings yet

- ALM Industries Limited: Summary of Rated Instruments Instruments Amount Rated (Rs. Crore) Rating ActionDocument6 pagesALM Industries Limited: Summary of Rated Instruments Instruments Amount Rated (Rs. Crore) Rating Actionsgr_kansagraNo ratings yet

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKFrom EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKNo ratings yet

- SERIES 6 EXAM STUDY GUIDE 2023+ TEST BANKFrom EverandSERIES 6 EXAM STUDY GUIDE 2023+ TEST BANKNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- En Bloc,: No.l 34IRGIDHC/2021Document2 pagesEn Bloc,: No.l 34IRGIDHC/2021arun_algoNo ratings yet

- ChangePro software reviewDocument6 pagesChangePro software reviewarun_algoNo ratings yet

- 08add - Edit - Search With Highlighting Pattern Dialog - ReSharperDocument9 pages08add - Edit - Search With Highlighting Pattern Dialog - ReSharperarun_algoNo ratings yet

- 14fast Native Structure Reading in C# Using Dynamic Assemblies - CodeProjectDocument6 pages14fast Native Structure Reading in C# Using Dynamic Assemblies - CodeProjectarun_algoNo ratings yet

- 0.1 New in ZUP From Version 151 Onwards. Im... Onix-TradeDocument18 pages0.1 New in ZUP From Version 151 Onwards. Im... Onix-Tradearun_algoNo ratings yet

- 08add - Edit - Search With Highlighting Pattern Dialog - ReSharperDocument9 pages08add - Edit - Search With Highlighting Pattern Dialog - ReSharperarun_algoNo ratings yet

- 14fast Native Structure Reading in C# Using Dynamic Assemblies - CodeProjectDocument6 pages14fast Native Structure Reading in C# Using Dynamic Assemblies - CodeProjectarun_algoNo ratings yet

- Hands-On Lab: Linq Project: Unified Language Features For Object and Relational QueriesDocument24 pagesHands-On Lab: Linq Project: Unified Language Features For Object and Relational Queriesarun_algoNo ratings yet

- HSL PCG "Currency Daily": 11 January, 2017Document6 pagesHSL PCG "Currency Daily": 11 January, 2017arun_algoNo ratings yet

- OIDocument13 pagesOIarun_algoNo ratings yet

- Indian Rupee Currency Market Technical Analysis and Hedging StrategiesDocument6 pagesIndian Rupee Currency Market Technical Analysis and Hedging Strategiesarun_algoNo ratings yet

- HSL PCG “CURRENCY DAILYDocument6 pagesHSL PCG “CURRENCY DAILYarun_algoNo ratings yet

- 08add - Edit - Search With Highlighting Pattern Dialog - ReSharperDocument9 pages08add - Edit - Search With Highlighting Pattern Dialog - ReSharperarun_algoNo ratings yet

- ChangePro software reviewDocument6 pagesChangePro software reviewarun_algoNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail Researcharun_algoNo ratings yet

- HSL PCG "Currency Daily": 05 January, 2017Document6 pagesHSL PCG "Currency Daily": 05 January, 2017arun_algoNo ratings yet

- Reset A MySQL Root Password PDFDocument3 pagesReset A MySQL Root Password PDFarun_algoNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoNo ratings yet

- Indian Rupee Currency Market Moves and Hedging StrategiesDocument6 pagesIndian Rupee Currency Market Moves and Hedging Strategiesarun_algoNo ratings yet

- HSL PCG "Currency Daily": 06 January, 2017Document6 pagesHSL PCG "Currency Daily": 06 January, 2017arun_algoNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail Researcharun_algoNo ratings yet

- HSL PCG "Currency Daily": 19 January, 2017Document6 pagesHSL PCG "Currency Daily": 19 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 18 January, 2017Document6 pagesHSL PCG "Currency Daily": 18 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 17 January, 2017Document6 pagesHSL PCG "Currency Daily": 17 January, 2017arun_algoNo ratings yet

- ReportDocument6 pagesReportarun_algoNo ratings yet

- HSL PCG "Currency Daily": 18 January, 2017Document6 pagesHSL PCG "Currency Daily": 18 January, 2017arun_algoNo ratings yet

- ReportDocument6 pagesReportarun_algoNo ratings yet

- HSL PCG "Currency Daily": 31 January, 2017Document6 pagesHSL PCG "Currency Daily": 31 January, 2017arun_algoNo ratings yet

- HSL PCG Currency Daily OutlookDocument6 pagesHSL PCG Currency Daily Outlookarun_algoNo ratings yet

- HSL PCG "Currency Daily": 25 January, 2017Document6 pagesHSL PCG "Currency Daily": 25 January, 2017arun_algoNo ratings yet