Professional Documents

Culture Documents

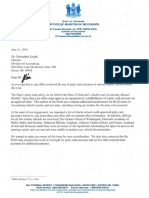

Delaware Academy of Public Safety and Security Inspection Letter

Uploaded by

Anonymous duPuriqX0I0 ratings0% found this document useful (0 votes)

1K views3 pagesLetter

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLetter

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views3 pagesDelaware Academy of Public Safety and Security Inspection Letter

Uploaded by

Anonymous duPuriqX0ILetter

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

STATE OF DsLAWARE

OFFICE OF AUDITOR OF ACCOUNTS

R. THOMAS WAGNER, JR., CFE, CGFM, CICA

"AUDITOR OF ACCOUNTS

"302-739-5055

R-THOMAS. WAGNER@STATE.DE.US

June 29, 2016

Mr, Herbert Sheldon

School Lead

Delaware Academy of Public Safety and Security

801 N. DuPont Road

New Castle, DE 19720

Dear Mr. Sheldon,

‘As you know, my office began reviewing the use of petty cash accounts at various charter schools earlier

this year. Overall, we found that these charter schools were not following the State’s petty cash policy

as set forth in the State of Delaware’s Budget and Accounting Manual (BAM).

Petty Cash Account Approvals

‘The Division of Accounting must approve the establishment of petty cash fund and the Off

the State Treasurer must approve the opening of the bank account used.' ‘The names and signatures

of the authorized petty cash check signers must be on record with the Secretary of Finance.

We found no evidence that Delaware Academy of Public Safety and Security's petty cash account

‘was properly approved by any of these enti

Petty Cash Account Management Compliance

Petty cash, by definition, is a small amount of money kept in an office to pay for small value items.”

Itcan be maintained in the form of cash or a checking account, Petty cash allows the processing and

payment of expenditures to occur outside the normal accounting environment. However, while the

use of such an account is convenient, it is important to recognize that the overuse of petty cash

minimizes public transparency and increases the risk of control overrides, inaccurate accounting, and

misappropriation of funds.

Per the BAM, organizations‘ may use petty cash when acquiring and paying for small value

purchases. Generally, the maximum authorization is not greater than $2,000; however, amounts not

BAM, Section 7.12.1, v.4.26

2 BAM, Section 7.12.2, v.4.26 (5)

> Per http://www. merriam-webster.com/dictionary/Petty%20cash, on March 2, 2016.

“The BAM defines “organization” as State of Delaware agencies (both merit and non-merit), school distriets, charter schools,

and higher education. BAM, Section 1.7, v.29

401 FEDERAL STREET » TOWNSEND BUILDING ¢ SUITE ONE * DOVER, DE 19901

MAIN OFFICE: 3027304241 FRAUD HOTLINE: 1-800.55-FRAUD

\Visrr UR WERSITETO VIEW, DOWNLOAD. OR PRINT AUDIT REPORTS AND OTHER INFORMATION

HUTP:/ /AUDITOR.DELAWARE.GOV

Mr. Sheldon

Page 2

June 29, 2016

exceeding $5,000 may be requested where exceptional circumstances exist.’ Section 7.12 of the

BAM also sets forth additional guidelines for the operation of petty cash accounts within the State,

including that all petty cash receipts and supporting documentation must be kept by the organization

for audit purposes.°

The following table summarizes Delaware Academy of Public Safety and Security’s compliance

with these requirements during the Fiscal Year ended June 30, 2015 (Fiscal Year 2015),

Delaware Academy of Public Safety and Security

Petty Cash Account Management Compliance

Written Policies and Procedures for Petty Cash

Checks were drawn in consecutive numerical order

(BAM, Section 7.12.2.1, 4.26)

We identified three months where the checks were not written in sequential

order. We also found one check that was written out of sequence by

approximately two months.

‘Account reconciliations were performed by the Account Custox

(BAM, Section 7.12.2.4, v4.20)

The school did not perform reconciliations

Checks were signed by two employees

(the Account Custodian may not be a check signer)

(BAM, Section 7.12.2.2, v4.26)

Only the Chief Financial Officer signed each check

No petty cash checks were drawn in exeess of $500.00.

(BAM, Section 7.12.28, v4.26)

The school processed 8 checks, totaling $6,440.11, that were in excess of the

$500.00 threshold.

Maintained a Petty Cash account within the $5,000 limit throughout the period

(BAM, Section 7.12, v4.26)

The average monthly balance was $1,433.57, with an ending balance of

$467.80 on June 30, 2015.

\ |X) x xX xX xX

Further, the school lacked support to demonstrate that any of the expenditures from this account

were for a valid school purpose.

5 BAM, Section 7.12, v4.26

® BAM, Section 7.12.3, v.4.26

Mr. Sheldon

Page 3

June 29, 2016

In previous communications with my office, you stated the account was indeed a petty cash account.

We agreed since it was used for ongoing operational items, such as field trip costs and cadet graduation

expenses, for the school during Fiscal Year 2015.

As stated above, we caution the school’s overuse of a petty cash account since these accounts may be

viewed as a way of transferring funds from the State into external bank accounts that lack continual

State oversight. The petty cash restrictions in the BAM are meant to reduce the various risks associated

with the use of petty cash, and users of the State’s accounting system must abide by these restrictions, in

addition to developing and implementing entity-specifie petty cash controls.

While AOA recognizes that some charter school accounts may have been operating prior to the

implementation of these BAM guidelines, we encourage all charter schools to periodically review the

BAM to ensure compliance with all of its financial processes. We also recommend using a State-issued

procurement card (PCard) or direct claim through First State Financials when possible. Regardless of

the method of payment, supporting documentation must be maintained for all transactions.

Please feel free to contact me at (302) 739-5055 with any further questions you may have,

av

R. Thomas Wagner, Jr., CGFM, CICA, CFE

State Auditor

Sincerely,

ce: Dr. Steven H. Godowsky, Secretary, Department of Education

Mr. Charles Copeland, President of the Board of Directors

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- MEMO - Executive Authority Over COVID-19 Response in Public SchoolsDocument3 pagesMEMO - Executive Authority Over COVID-19 Response in Public SchoolsAnonymous duPuriqX0INo ratings yet

- HB 47 LetterDocument2 pagesHB 47 LetterAnonymous duPuriqX0INo ratings yet

- FSCC Discussion On Wilmington 11-13-17Document1 pageFSCC Discussion On Wilmington 11-13-17Anonymous duPuriqX0INo ratings yet

- MEMO - Executive Authority Over COVID-19 Response in Public SchoolsDocument3 pagesMEMO - Executive Authority Over COVID-19 Response in Public SchoolsAnonymous duPuriqX0INo ratings yet

- HB 47 LetterDocument2 pagesHB 47 LetterAnonymous duPuriqX0INo ratings yet

- Balance 8 DayDocument11 pagesBalance 8 DayAnonymous duPuriqX0INo ratings yet

- Balance 8 DayDocument11 pagesBalance 8 DayAnonymous duPuriqX0INo ratings yet

- Balance 8 DayDocument11 pagesBalance 8 DayAnonymous duPuriqX0INo ratings yet

- DOE Match Tax LetterDocument2 pagesDOE Match Tax LetterKevinOhlandtNo ratings yet

- Signed Letter MWDocument1 pageSigned Letter MWAnonymous duPuriqX0INo ratings yet

- Balance 8 DayDocument11 pagesBalance 8 DayAnonymous duPuriqX0INo ratings yet

- Balance 8 DayDocument11 pagesBalance 8 DayAnonymous duPuriqX0INo ratings yet

- Jim Startzman: Yesterday at 8:54amDocument5 pagesJim Startzman: Yesterday at 8:54amAnonymous duPuriqX0INo ratings yet

- Balance 8 DayDocument11 pagesBalance 8 DayAnonymous duPuriqX0INo ratings yet

- Executive Director JobDescriptionDocument2 pagesExecutive Director JobDescriptionAnonymous duPuriqX0INo ratings yet

- 2017 Joint Sunset Committee Performance Review QuestionnaireDocument63 pages2017 Joint Sunset Committee Performance Review QuestionnaireKevinOhlandt100% (1)

- Balance 8 DayDocument11 pagesBalance 8 DayAnonymous duPuriqX0INo ratings yet

- Teacher PrepDocument129 pagesTeacher PrepAnonymous duPuriqX0INo ratings yet

- Jim Startzman: Yesterday at 8:54amDocument5 pagesJim Startzman: Yesterday at 8:54amAnonymous duPuriqX0INo ratings yet

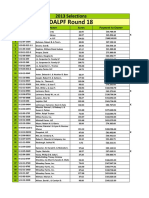

- Round18 Selections 2013Document2 pagesRound18 Selections 2013Anonymous duPuriqX0INo ratings yet

- De House Dems - Opposing Betsy DeVosDocument3 pagesDe House Dems - Opposing Betsy DeVosAnonymous duPuriqX0INo ratings yet

- BAM Compliance - Office of The State TreasurerDocument2 pagesBAM Compliance - Office of The State TreasurerAnonymous duPuriqX0INo ratings yet

- State Elected Leaders Supporting Betsy DeVosDocument9 pagesState Elected Leaders Supporting Betsy DeVoszPolitics.comNo ratings yet

- Sussex Academy Inspection LetterDocument3 pagesSussex Academy Inspection LetterAnonymous duPuriqX0INo ratings yet

- Email To Wagner Re Indian RiverDocument1 pageEmail To Wagner Re Indian RiverAnonymous duPuriqX0INo ratings yet

- Who Controls Our Schools PDF Ebook 1 1Document47 pagesWho Controls Our Schools PDF Ebook 1 1Anonymous duPuriqX0INo ratings yet

- Odyssey Charter School Inspection LetterDocument3 pagesOdyssey Charter School Inspection LetterAnonymous duPuriqX0INo ratings yet

- BAM Compliance - Division of RevenueDocument2 pagesBAM Compliance - Division of RevenueAnonymous duPuriqX0INo ratings yet

- BAM Compliance - Department of FinanceDocument2 pagesBAM Compliance - Department of FinanceAnonymous duPuriqX0INo ratings yet