Professional Documents

Culture Documents

Income-Tax Rules, 1962: Form No. 10A

Uploaded by

Karanam RaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income-Tax Rules, 1962: Form No. 10A

Uploaded by

Karanam RaoCopyright:

Available Formats

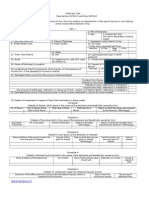

INCOME-TAX RULES, 1962

FORM NO. 10A

[See rule 17A]

Application for registration of charitable or religious trust or institution

under clause (aa) of sub-section (1) of section 12A of the Income-tax Act, 1961

To

The Commissioner of Income-tax,

Sir,

I,

on behalf of

[name

of the trust or institution] hereby apply for the registration of the said trust/institution under section 12A of the

Income-tax Act, 1961. The following particulars are furnished herewith:

1.

Name

of the

* trust/institution

in full

block

letters]

1. Name

of the

*trust/institution

in full

(in[in

block

letters]

2. Permanent

2.

Address Account Number

3. Address

3.

Name(s)

and

address(es) of author(s)/founder(s)

4. Details

of the

author(s)/founder(s):

--

Sl.No.Date

Name

Address

Permanent Account Number (PAN)

4.

of creation of the trust

or establishment of the institution

5. Date of creation of the trust or establishment of the institution

6. Details of the trustee(s)/manager(s): -Sl.No. Name

Address

Permanent Account Number (PAN)

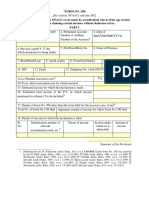

I also enclose the following documents:

1. (a)

* Original/Certified copy of the instrument under which the trust/institution was created/established,

together with a copy thereof.

(b) * Original/Certified copy of document evidencing the creation of the trust or the establishment of the

institution, together with a copy thereof. [The originals, if enclosed, will be returned].

2. Two copies of the accounts of the * trust/institution for the latest * one/two/three years.

I undertake to communicate forthwith any alteration in the terms of the trust, or in the rules governing the

institution, made at any time hereafter.

Date

Signature

Designation

Address

*Strike out whichever is not applicable.

You might also like

- Form - 10ADocument1 pageForm - 10AveersainikNo ratings yet

- Sr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidDocument7 pagesSr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidKartikey RanaNo ratings yet

- FCRA - Application For Change in Name and AddressDocument2 pagesFCRA - Application For Change in Name and Addresstgpackia82No ratings yet

- Income Tax Form 10A For 12A RegistrationDocument1 pageIncome Tax Form 10A For 12A RegistrationAbu Afaq ZaidiNo ratings yet

- Form10A 2016Document1 pageForm10A 2016Dinesh KhandelwalNo ratings yet

- New Form 15H For Fixed Deposits Editable in PDFDocument2 pagesNew Form 15H For Fixed Deposits Editable in PDFMutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- To The Secretary To The Government of India, Ministry of Home Affairs, Jaisalmer House, 26, Mansingh Road, New Delhi - 110011Document5 pagesTo The Secretary To The Government of India, Ministry of Home Affairs, Jaisalmer House, 26, Mansingh Road, New Delhi - 110011Anurag Kumar SinghNo ratings yet

- 80G FormatDocument23 pages80G FormatPadmanabha NarayanNo ratings yet

- OBC Bank Form - 15H PDFDocument2 pagesOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- NOTIFICATION NO. 294/2004 Dated: December 8, 2004Document5 pagesNOTIFICATION NO. 294/2004 Dated: December 8, 2004reetsdoshiNo ratings yet

- PT Challan MTR 6Document1 pagePT Challan MTR 6mak_palkar772No ratings yet

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocument3 pages"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanNo ratings yet

- Statutory Declaration To CourtDocument3 pagesStatutory Declaration To CourtKelz Youknowmyname100% (1)

- Charitable TrustDocument2 pagesCharitable TrustvipingplNo ratings yet

- PF Forms FormatsDocument10 pagesPF Forms FormatsSnehal ChauhanNo ratings yet

- Fss 4Document2 pagesFss 4craz8gtNo ratings yet

- (Class of Assets) Under Section 34AB of The Wealth-Tax Act, 1957. The Following Particulars Are Furnished HerewithDocument2 pages(Class of Assets) Under Section 34AB of The Wealth-Tax Act, 1957. The Following Particulars Are Furnished Herewithrohit mathurNo ratings yet

- ss4 PDFDocument4 pagesss4 PDFKeith Muhammad: Bey100% (2)

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocument3 pages"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanNo ratings yet

- Form No 15HDocument3 pagesForm No 15HsaymtrNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- All FormsDocument27 pagesAll FormsSathyanarayana Reddy Antham100% (1)

- Form No. 15H: Part - IDocument2 pagesForm No. 15H: Part - Itoton33No ratings yet

- New FORM 15H Applicable PY 2016-17Document2 pagesNew FORM 15H Applicable PY 2016-17addsingh100% (1)

- Business Ownership Form 1639467252Document12 pagesBusiness Ownership Form 1639467252lwere isufuhNo ratings yet

- Australian Tax Return: Power of Attorney and Declaration of RepresentativeDocument1 pageAustralian Tax Return: Power of Attorney and Declaration of RepresentativeOmar FuentesNo ratings yet

- PDFDocument4 pagesPDFushapadminivadivelswamyNo ratings yet

- Schedule 1Document29 pagesSchedule 1Quinn EllaNo ratings yet

- Annual Return 10-11 ShekhawatiDocument9 pagesAnnual Return 10-11 ShekhawatitomNo ratings yet

- Tax Form 15H PDFDocument4 pagesTax Form 15H PDFraviNo ratings yet

- "Form No. 15GDocument2 pages"Form No. 15GJayvin ShiluNo ratings yet

- 1 CWF Application FormDocument5 pages1 CWF Application FormShubham Jain ModiNo ratings yet

- EMP101 eDocument7 pagesEMP101 eNozipho MpofuNo ratings yet

- Ucc 1Document6 pagesUcc 1Li'on Benammi Bey100% (1)

- 15G FormDocument2 pages15G Formsurendar147No ratings yet

- (Form 1) 1994: (Surname) (First Name) (M. I.)Document3 pages(Form 1) 1994: (Surname) (First Name) (M. I.)Miko Arianne Cruz MajaraisNo ratings yet

- BIR Form 1901Document2 pagesBIR Form 1901Jap Algabre40% (5)

- Saln 2016 FormDocument3 pagesSaln 2016 FormJOHN100% (3)

- Form FC - 8Document4 pagesForm FC - 8rajesh kumar yadavNo ratings yet

- Application Format - Dda Instl LandDocument11 pagesApplication Format - Dda Instl Landsourabhmunjal0112No ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- Connecticut Articles of OrganizationDocument3 pagesConnecticut Articles of OrganizationhowtoformanllcNo ratings yet

- IT Declaration Form 2014 15 - KreplDocument2 pagesIT Declaration Form 2014 15 - KreplGoyal AbhijeetNo ratings yet

- Certificate For NRO To NRE Account TransferDocument1 pageCertificate For NRO To NRE Account Transferkannan associatesNo ratings yet

- Form 15 HDocument2 pagesForm 15 Hsingh ramanpreetNo ratings yet

- Form 1: Application and Declaration For Incorporation of A CompanyDocument9 pagesForm 1: Application and Declaration For Incorporation of A Companyஷங்கர் ஷங்கர்No ratings yet

- Icici Form 15GDocument2 pagesIcici Form 15Grajanikant_singhNo ratings yet

- Articles of Incorporation Template 04Document2 pagesArticles of Incorporation Template 04張 雲No ratings yet

- Sample Income Tax FormDocument8 pagesSample Income Tax FormSadav ImtiazNo ratings yet

- ANNEXURE - I BORROWER'S BASIC FACT SHEET - FOR SMEs OTHER THAN INDIVIDUALSDocument3 pagesANNEXURE - I BORROWER'S BASIC FACT SHEET - FOR SMEs OTHER THAN INDIVIDUALSHusnainShahid100% (1)

- Form 2 - PF NominationDocument2 pagesForm 2 - PF NominationKishore BellamNo ratings yet

- Guidelines in Filling Up Reg FormsDocument5 pagesGuidelines in Filling Up Reg FormschatNo ratings yet

- Subscription To Shares LetterDocument1 pageSubscription To Shares LetterVigho AbuNo ratings yet

- Annual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxDocument2 pagesAnnual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxAngela ArleneNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet