Professional Documents

Culture Documents

DGT 1716

Uploaded by

Venugopal Honavanapalli0 ratings0% found this document useful (0 votes)

21 views2 pagestrade notice

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttrade notice

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views2 pagesDGT 1716

Uploaded by

Venugopal Honavanapallitrade notice

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

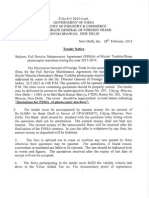

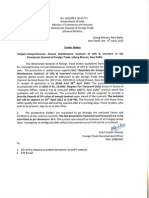

Goverment of Inia

Minis of Commerce Indy

Department of Commerce

Directorate Genera of Frcign Trade

Udyog Bhawan, New Deli

‘Trade Notice No 172016

Due: 22nd sep 2010

To

All Regional Authorities

Members of Trade

‘Sub: _ Refund of Teominal Excise Duty (TED) under Deemed Exports where Duty has been

paid fom CENVAT Credit andab-nito waver isnot availabe

Si

The Para 703 (@) of ETP 2015-20 provides for refund of Terminal Excise Duty if

cxemption isnot avalble. The Para 7.05 i) of FTP 2015-20 that supply of goods which

rc cacmied ant fom payment of Terminal Excise Duty woul be ineligible 0 get rind

ot TED.

2 The Policy Creu No. 16 (RE-201272009-14) dated 153.2013 also while specifying the

categories where ab-initio exemption is there, specified thit no refund of TED should be

provided by RAS of DGFTIOMTce of Development Commissioners, because such supplies are

b.nito exempted fom payment of excise dt.

3. Eventhough there as avin exemption from payment of TED for supplies to EOUs,

some fis were trying to get refund of TED, pad in many cases with accumullted CENVAT

roi. This amounted to encashmont ofthe accumulated CENVAT credit by way of TED rend

under deemed expots, wherein no TED was requited to be pid in the fs instance.

4. This lead to cerisin position being taken also regarding the refund of TED in deemed

export cases where no sich ab initio waiver existed and the duty had teen paid using the

CENVAT credit, on grounds related t0 the permisibility of refunds of TED paid though

CENVAT Credit. Some RAS had also denied the refund of TED in such cases. There were

representations from trade and industry on this arguing tha they have al along been geting such

eit

5. Inligh of representations the issue has been examined in consultation with Department of|

Revenue and it is accordingly clarified thatthe refund of TED as per FTP, subject tall other

conditions, shall continue tobe avilable where the ab-ntio exemption was not provided and

uty had been pid using CENVATT credit. However DOR has advised that necessary safeguards

should be adopted to ensure that the TED isnot already claimed (or shall not be otherwise

limes) as refund in any other manne, suc as area based exemptions.

6, isreterted that no refund of TED shall be allowed where ab-intio exemption was there,

as already specified inthe FTP.

‘This iesves withthe approval of DGFT,

defeat

(8. SUDHA)

Dy, Director General of Foreign Trade

“Tel. 23061562232 (Ext)

Email. ssthe28dniein

(ss fom fle number 01/92/1$02/AM-17/PC-V1)

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- AtmaBodha (Self-Knowledge) and Other Stotras by Sri ShankaracharyaDocument345 pagesAtmaBodha (Self-Knowledge) and Other Stotras by Sri ShankaracharyaEstudante da Vedanta88% (8)

- DGT 1616Document4 pagesDGT 1616Venugopal HonavanapalliNo ratings yet

- India-Contract Law Lawcommission ReportDocument98 pagesIndia-Contract Law Lawcommission ReportVenugopal HonavanapalliNo ratings yet

- DGFT Tender For Electrical AppliancesDocument8 pagesDGFT Tender For Electrical AppliancesVenugopal HonavanapalliNo ratings yet

- DGT 18116Document1 pageDGT 18116Venugopal HonavanapalliNo ratings yet

- Circular RbiDocument20 pagesCircular RbiVenugopal HonavanapalliNo ratings yet

- Carnatic MusicDocument41 pagesCarnatic Musicanu_bluNo ratings yet

- DGFT Tender For Electrical AppliancesDocument8 pagesDGFT Tender For Electrical AppliancesVenugopal HonavanapalliNo ratings yet

- Tender EnquiryDocument2 pagesTender EnquiryVenugopal HonavanapalliNo ratings yet

- Water Charges PetitionDocument9 pagesWater Charges PetitionVenugopal HonavanapalliNo ratings yet

- Shipment of Spare Parts To Tunis Port On LCL Basis (11.12.2014)Document1 pageShipment of Spare Parts To Tunis Port On LCL Basis (11.12.2014)Venugopal HonavanapalliNo ratings yet

- NTPC Water Charges - Affidavit Dated 30.4.2014Document31 pagesNTPC Water Charges - Affidavit Dated 30.4.2014Venugopal HonavanapalliNo ratings yet

- Carnatic MusicDocument41 pagesCarnatic Musicanu_bluNo ratings yet

- Any Tune User Guide3.0-V1Document32 pagesAny Tune User Guide3.0-V1Venugopal HonavanapalliNo ratings yet

- Ecs-Direct Debit Mandate FormDocument2 pagesEcs-Direct Debit Mandate Formrndsoft100% (1)

- Shipment of Spare Parts To Tunis Port On LCL Basis (11.12.2014)Document1 pageShipment of Spare Parts To Tunis Port On LCL Basis (11.12.2014)Venugopal HonavanapalliNo ratings yet

- Form 15CA Under IT ActDocument5 pagesForm 15CA Under IT ActVenugopal HonavanapalliNo ratings yet

- Tender Number 02Document7 pagesTender Number 02Venugopal HonavanapalliNo ratings yet

- Tender Notice: Subject:-Calling of Quotation For Purchase of 9 Nos - 2 GB RAM of HP Make For Laptop / Notebook IntelDocument2 pagesTender Notice: Subject:-Calling of Quotation For Purchase of 9 Nos - 2 GB RAM of HP Make For Laptop / Notebook IntelVenugopal HonavanapalliNo ratings yet

- Ecs-Direct Debit Mandate FormDocument2 pagesEcs-Direct Debit Mandate Formrndsoft100% (1)

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- Tender Number 05Document8 pagesTender Number 05Venugopal HonavanapalliNo ratings yet

- Tender Number 09Document7 pagesTender Number 09Venugopal HonavanapalliNo ratings yet

- Sanskrit Alphabet BookDocument15 pagesSanskrit Alphabet BookVenugopal HonavanapalliNo ratings yet

- Tender Number 10Document5 pagesTender Number 10Venugopal HonavanapalliNo ratings yet

- Devanagari ScriptDocument2 pagesDevanagari ScriptVenugopal HonavanapalliNo ratings yet

- Tender Number 04Document4 pagesTender Number 04Venugopal HonavanapalliNo ratings yet

- Tender Number-03Document4 pagesTender Number-03Venugopal HonavanapalliNo ratings yet

- Tender Number-03Document4 pagesTender Number-03Venugopal HonavanapalliNo ratings yet