Professional Documents

Culture Documents

Important Information 1

Uploaded by

Luis Alejandro Serrano0 ratings0% found this document useful (0 votes)

3 views1 pageFormulario

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFormulario

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageImportant Information 1

Uploaded by

Luis Alejandro SerranoFormulario

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

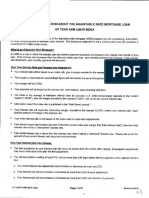

IMPORTANT INFORMATION ABOUT THE ADJUSTABLE RATE MORTGAGE LOAN

5/1 YEAR ARM LIBOR INDEX

This disclosure describes the features of the adjustable-rate mortgage (ARM) program you are considering. information

on other ARM programs is available upon request. This disclosure statement is not a contract and does not constitute @

commitment to make a joan to you,

What is an Adjustable Rato 2

‘An ARM is a foan in which the interest rate and monthly payment (principal and interest) may change over the life of your

foan. ff the interest rate increases from the time you make your loan, your monthly payment will increase. if the interest

Fate decreases, your monthly payment will decrease.

How Your Interest Rate and Payment Are Determined:

* Your interest rate will be based on an index rafé, plus a margin rounded to the nearest 0.125%.

* The margin is expressed as a percentage figure and will remain the same throughout the loan.

* Your margin will be 2.25%,

Your payment will be based on the interest rate, loan balance, and remaining loan term,

* The index is the average of interbank offered rates for one-year U.S. dollar-denominated deposits in the London

‘market ("LIBOR’), plus our margin rounded to the nearest 0.125%, Ask us for our current interest rate

* Information about the index rate is published in the "Wall Street Journal.”

* Your interest rate will equal the index plus margin, rounded fo the nearest 0.125%, unless your interest rate “caps”

limit the amount of change in the interest rate

* Your initial interest rate is not based on the index used to make later adjustments,

* If the initial interest rate is below the sum of the then current index plus margin (the “fully indexed rate"), then the intial

interest rate will be a "discounted" interest rate,

* If the initial interest rate is above the fully indexed rate, then it will be a "premium interest rate, Please ask us for the

‘amount of our current interest rate discounts and premiums,

How Your Interest Rate Can Change:

* The first adjustment to your interest rate will occur no sooner than 60 months after closing. Subsequent adjustments

May occur once each year after the first adjustment.

* You will be notified in writing at least 210, but not more than 240 days before the first payment at the adjusted level is

due.

©. Your inital interest rate adjustment could increase or decrease as much as 2.0%.

© Your interest rate will not increase or decrease by more than 2.0% at each adjustment,

© Your interest rate will not increase or decrease by more than 5.0% over the term of your loan,

5-1 LIBOR ARM (27215 Caps) Page 1 of 2 Revised 0412014

You might also like

- Home RoomsDocument1 pageHome RoomsLuis Alejandro SerranoNo ratings yet

- P InterDocument278 pagesP InterLuis Alejandro SerranoNo ratings yet

- Scan0009 Ilovepdf CompressedDocument24 pagesScan0009 Ilovepdf CompressedLuis Alejandro SerranoNo ratings yet

- Carta Encomienda P.F. 3547Document3 pagesCarta Encomienda P.F. 3547Luis Alejandro SerranoNo ratings yet

- Scoring Rubric For in - Class Cause/Effect EssayDocument2 pagesScoring Rubric For in - Class Cause/Effect EssayLuis Alejandro SerranoNo ratings yet

- Home RoomsDocument1 pageHome RoomsLuis Alejandro SerranoNo ratings yet

- Lesson Plan: Business/Materials Lesson ObjectivesDocument2 pagesLesson Plan: Business/Materials Lesson ObjectivesLuis Alejandro SerranoNo ratings yet

- Presenting Instruction and Modeling SampleDocument3 pagesPresenting Instruction and Modeling SampleAlex VargasNo ratings yet

- Objective Discussion SampleDocument1 pageObjective Discussion SampleLuis Alejandro SerranoNo ratings yet

- Guided Practice SamplesDocument3 pagesGuided Practice SamplesLuis Alejandro SerranoNo ratings yet

- (Free Scores - Com) - Brahms Johannes Hungarian Dance No 5 64563 PDFDocument3 pages(Free Scores - Com) - Brahms Johannes Hungarian Dance No 5 64563 PDFLuis Alejandro SerranoNo ratings yet

- SDL Vendor Tests - Kit 1Document21 pagesSDL Vendor Tests - Kit 1Luis Alejandro SerranoNo ratings yet

- Taxonomy of Language LearningDocument1 pageTaxonomy of Language LearningLuis Alejandro SerranoNo ratings yet

- Common TESOL ActivitiesDocument3 pagesCommon TESOL Activitieschgarcia03No ratings yet

- BB Jazz Blues Soloing Etude PDFDocument6 pagesBB Jazz Blues Soloing Etude PDFChris Brenner100% (4)

- As Told by Levi MendozaDocument1 pageAs Told by Levi MendozaLuis Alejandro SerranoNo ratings yet

- Bonus PM USD PM USDDocument6 pagesBonus PM USD PM USDLuis Alejandro SerranoNo ratings yet

- Abdul LetterDocument1 pageAbdul LetterLuis Alejandro SerranoNo ratings yet

- Chronological Resume ExampleDocument10 pagesChronological Resume ExampleLuis Alejandro SerranoNo ratings yet

- PressedDocument1 pagePressedLuis Alejandro SerranoNo ratings yet

- Blue TrainDocument1 pageBlue TrainEmiliano Pacheco100% (1)

- AA VV Banjo RollsDocument7 pagesAA VV Banjo RollsjuandaleNo ratings yet

- Cheetos Kids Run and FunDocument1 pageCheetos Kids Run and FunLuis Alejandro SerranoNo ratings yet

- Cozolino For EducatorsDocument6 pagesCozolino For EducatorsLuis Alejandro SerranoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)