Professional Documents

Culture Documents

Review of Portfolio Analysis

Uploaded by

Santu EstradaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Review of Portfolio Analysis

Uploaded by

Santu EstradaCopyright:

Available Formats

Dr.

Kiseok Nam

Sawyer Business School

Suffolk University

Sample Questions for Portfolio Analysis

1. Which one of the following is a collection of possible risk-return combinations available from

portfolios consisting of individual assets?

A) minimum variance set

C) financial frontier

B) efficient portfolio

D) investment opportunity set

2. An efficient portfolio is a portfolio that does which one of the following?

A) offers the highest return for the lowest possible cost

B) provides an evenly weighted portfolio of diverse assets

C) eliminates all risk while providing an expected positive rate of return

D) lies on the vertical axis when graphing expected returns against standard deviation

E) offers the highest return for a given level of risk

3. Which one of the following is the locus of portfolios that provides the maximum return for a given

standard deviation?

A) minimum variance portfolio

C) correlated market frontier

B) efficient frontier

D) diversified portfolio line

4. You own a stock which is expected to return 14 percent in a booming economy and 9 percent in a

normal economy. If the probability of a booming economy decreases, your expected return will:

A) decrease.

C) increase.

B) remain constant.

D) either remain constant or increase.

5. Where does the minimum variance portfolio lie in respect to the investment opportunity set?

A) lowest point

C) highest point

B) most leftward point

D) most rightward point

6. Which one of the following statements about efficient portfolios is correct?

A) Any efficient portfolio will lie below the minimum variance portfolio when the expected portfolio

return is plotted against the portfolio standard deviation.

B) An efficient portfolio will have the lowest standard deviation of any portfolio consisting of the

same two securities.

C) There are multiple efficient portfolios that can be constructed using the same two securities.

D) Any portfolio mix consisting of only two securities will be an efficient portfolio.

E) There is only one efficient portfolio that can be constructed using two securities.

7. You are graphing the portfolio expected return against the portfolio standard deviation for a portfolio

consisting of two securities. Which one of the following statements is correct regarding this graph?

A) Risk-taking investors should select the minimum variance portfolio.

B) Risk-averse investors should select the portfolio with the lowest rate of return.

C) Some portfolios will be efficient while others will not.

D) The minimum variance portfolio will have the lowest portfolio expected return of any of the

possible portfolios.

E) All possible portfolios will graph as efficient portfolios.

Dr. Kiseok Nam

Sawyer Business School

Suffolk University

8. You are graphing the investment opportunity set for a portfolio of two securities with the expected

return on the vertical axis and the standard deviation on the horizontal axis. If the correlation

coefficient of the two securities is +1, the opportunity set will appear as ________.

A) conical shape

C) hyperbole

B) linear with an upward slope

D) horizontal line

9. A portfolio that belongs to the efficient portfolios will have which one of the following

characteristics? Assume the portfolios are comprised of five individual securities.

A) the lowest return for any given level of risk

B) the largest number of potential portfolios that can achieve a specific rate of return

C) the largest number of potential portfolios that can achieve a specific level of risk

D) a positive rate of return and a zero standard deviation

E) the lowest risk for any given rate of return

E (rP ) r f

P

10. The formula

A) Sharpe ratio

B) Treynor measure

is used to calculate the _____________.

C) Coefficient of variation

D) Real rate of return

11. For purposes of maximum portfolio diversification, which for the following would provide the

greatest diversification?

A) Security A with a correlation coefficient of -0.0

B) Security B with a correlation coefficient of 0.0

C) Security C with a correlation coefficient of -0.50

D) Security D with a correlation coefficient of 0.50

12. The primary benefit of diversification is:

A) an increase in expected return.

B) a reduction in risk.

C) an equal reduction in risk and return.

D) diversification has no real benefit.

13. The type of risk that can be diversified away is called ________.

A) unsystematic risk

C) systematic risk

B) nondiversifiable risk

D) system-wide risk

14. Unsystematic risk

A) is also known as nondiversifiable risk.

B) is system-wide risk.

C) can be diversified away.

D) is equal to 2 times the systematic risk.

15. ________ is risk that cannot be diversified away.

A) Unsystematic risk

B) Firm-specific risk

C) Systematic risk

D) Diversifiable risk

16. The terms ________ and ________ mean the same thing.

A) nondiversifiable risk, unsystematic risk

C) diversifiable risk, systematic risk

B) diversifiable risk, unsystematic risk

D) total risk, unique risk

2

Dr. Kiseok Nam

Sawyer Business School

17. The measure of systematic risk is called ________.

A) correlation

B) covariance

C) variance

Suffolk University

D) beta

18. A portfolio with a 25% standard deviation generated a return of 15% last year when T-bills were

paying 4.5%. This portfolio had a Sharpe ratio of ____.

A) 0.22

B) 0.60

C) 0.42

D) 0.25

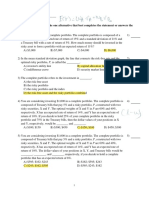

19. You combine a set of assets using different weights such that you produce the following results.

Which one of these portfolios CANNOT be a Markowitz efficient portfolio?

A) A

B) B

C) C

D) D

E) E

20. What is the expected return on this stock given the following information?

A) -8.07%

B) -7.69%

E(R) = (.40 16) + (.60 -22) = -6.80%

C) -6.80%

D) -5.70%

E) -5.22%

21. The risk-free rate is 4.15 percent. What is the expected risk premium on this stock given the following

information?

A) 5.88%

B) 5.95%

E(R) = (.35 14) + (.65 8) = 10.10

C) 6.10%

D) 6.23%

Risk premium = 10.10 - 4.15 = 5.95 percent

22. What is the variance of the expected returns on this stock?

A) 1.21

B) 1.56

C) 3.84

E(R) = (.40 15) + (.60 19) = 17.4

Var = .40(15 - 17.4)2 + .60(19 - 17.4)2 = 3.84

3

D) 4.03

Dr. Kiseok Nam

Sawyer Business School

Suffolk University

Dr. Kiseok Nam

Sawyer Business School

Suffolk University

23. What is the standard deviation of the returns on this stock?

A) 3.33%

B) 4.62%

C) 5.01%

E(R) = (.27 6) + (.73 19) = 15.49

Var = .27(6 - 15.49)2 + .73(19 - 15.49)2 = 33.31

Std Dev = 33.31 = 5.77 percent

D) 5.77%

24. A portfolio consists of the following securities. What is the portfolio weight of stock B?

A) 0.226

B) 0.239

C) 0.245

D) 0.257

WB = (150 $33)/[(200 $48) + (150 $33) + (350 $21)] = .2260

25. Travis has a portfolio consisting of two stocks, A and B, which is valued at $53,800. Stock A is worth

$23,900. What is the portfolio weight of stock B?

A) 0.528

B) 0.543

C) 0.551

D) 0.556

WB = ($53,800 - $23,900)/$53,800 = .5558

26. You have a portfolio which is comprised of 60 percent of stock A and 40 percent of stock B. What is

the expected rate of return on this portfolio?

A) 12.76%

B) 12.98%

C) 13.44%

D) 13.85%

E(RP-Boom) = .60(15%) + .40(9%) = 12.6%

E(RP-Normal) = .60(8%) + .40(20%) = 12.8%

E(RP-Portfolio) = (.20)(12.6%) + (.80)(12.8%) = 12.76%

27. You have a portfolio which is comprised of 55 percent of stock A and 45 percent of stock B. What is

the expected rate of return on this portfolio?

A) 9.67%

B) 9.88%

C) 10.03%

E(RP-Boom) = (.55 22) + (.45 14) = 18.4

E(RP-Normal) = (.55 14) + (.45 8) = 11.3

E(RP-Recession) = (.55 -10) + (.45 5) = -3.25

5

D) 11.79%

Dr. Kiseok Nam

Sawyer Business School

Suffolk University

E(RP-Portfolio) = (.18 18.4) + (.62 11.3) + (.20 -3.25) = 9.67%

28. You have a portfolio which is comprised of 72% of stock A and 28% of stock B. What is the variance

of this portfolio?

A) 203.8

B) 268.1

C) 290.9

D) 306.9

E(RP-Boom) = (.72 12%) + (.28 22%) = 14.8%

E(RP-Normal) = (.72 -12%) + (.28 -44%) = -20.96%

E(RP-Portfolio) = (.60 14.8) + (.40 -20.96) = 0.50%

Var(Portfolio) = .60(14.8 - .50)2 + .40(-21.0 - .50)2 = 306.91

29. Roger has a portfolio comprised of $8,000 of stock A and $12,000 of stock B. What is the standard

deviation of this portfolio?

A) 4.67%

B) 9.97%

C) 7.23%

D) 8.83%

30. Stock A has a standard deviation of 15% per year and stock B has a standard deviation of 8% per

year. The correlation between stock A and stock B is .40. You have a portfolio of these two stocks

wherein stock B has a portfolio weight of 40%. What is your portfolio variance?

A) 0.01143

B) 0.01214

C) 0.01329

D) 0.01437

Var_Port = [(1 - .40)2 .152] + [.402 .082] + [2 (1 - .40) .40 .15 .08 .40] = .011428

31. Stock A has a standard deviation of 15% per year and stock B has a standard deviation of 21% per

year. The correlation between stock A and stock B is .30. You have a portfolio of these two stocks

wherein stock B has a portfolio weight of 60%. What is your portfolio standard deviation?

A) 14.87%

B) 15.50%

C) 16.91%

D) 17.45%

Var_Port = [(1 - .60)2 .152] + [.602 .212] + [2 (1 - .60) .60 .15 .21 .30] = .024314

Std Dev_Port = .024012 = 15.50%

32. A stock fund has a standard deviation of 17% and a bond fund has a standard deviation of 8%. The

correlation of the two funds is .24. What is the approximate weight of the stock fund in the minimum

variance portfolio?

A) 11%

B) 15%

C) 21%

D) 24%

Dr. Kiseok Nam

Sawyer Business School

Suffolk University

33. The standard deviation of return on investment A is .10, while the standard deviation of return on

investment B is .05. If the covariance of returns on A and B is .0030, the correlation coefficient

between the returns on A and B is _________.

A) 0.12

B) 0.36

C) 0.60

D) 0.77

Corr = 0.0030/(0.1)(0.05)=0.60

34. The standard deviation of return on investment A is .10, while the standard deviation of return on

investment B is .04. If the correlation coefficient between the returns on A and B is -.50, the

covariance of returns on A and B is _________.

A) -0.0447

B) -0.0020

C) 0.0020

D) 0.0447

Cov = -(0.5)(0.1)(0.04)=-0.0020

35. An investor can design a risky portfolio based on two stocks, A and B. The standard deviation of

return on stock A is 20%, while the standard deviation on stock B is 15%. The correlation coefficient

between the returns on A and B is 0%. The expected return on the minimum-variance portfolio is

approximately _________.

A) 10%

B) 13.6%

C) 15%

D) 19.41%

36. An investor can design a risky portfolio based on stocks A & B. The standard deviation of return is

20% for stock A and 15% for stock B. The correlation coefficient between the returns on A and B is 0.

Compute the standard deviation of return on the minimum-variance portfolio.

A) 0%

B) 6%

C) 12%

D) 17%

You might also like

- FIN352 FALL17Exam2Document6 pagesFIN352 FALL17Exam2Hiếu Nguyễn Minh Hoàng0% (1)

- AF335 Midterm ExamDocument7 pagesAF335 Midterm ExamKunhong ZhouNo ratings yet

- Corporate Financial Management 5th Edition Glen Arnold Test Bank DownloadDocument564 pagesCorporate Financial Management 5th Edition Glen Arnold Test Bank DownloadRichard Hunter100% (25)

- HW01Document5 pagesHW01lhbhcjlyhNo ratings yet

- Homework3 With AnsDocument14 pagesHomework3 With AnsLiangWei KhoNo ratings yet

- RR Problems SolutionsDocument5 pagesRR Problems SolutionsShaikh FarazNo ratings yet

- Finance MCQsDocument12 pagesFinance MCQsrajendraeNo ratings yet

- TB 11Document7 pagesTB 11trevorsum123No ratings yet

- HW02Document7 pagesHW02lhbhcjlyhNo ratings yet

- Mt2 PracticeDocument8 pagesMt2 PracticemehdiNo ratings yet

- FRM Quantitative Analysis Test 1 PDFDocument11 pagesFRM Quantitative Analysis Test 1 PDFConradoCantoIIINo ratings yet

- Practice Questions Final Exam-Financial ManagementDocument8 pagesPractice Questions Final Exam-Financial ManagementNilotpal Chakma100% (8)

- Capital MarketDocument27 pagesCapital MarketJoebet DebuyanNo ratings yet

- Markowitz Portfolio TheoryDocument13 pagesMarkowitz Portfolio TheoryManisha BhoiNo ratings yet

- CH 08Document11 pagesCH 08kmarisseeNo ratings yet

- FIN 335 Exam III Spring 2008 For Dr. Graham's Class: (With An Addendum Including Some Additional Practice Questions.)Document13 pagesFIN 335 Exam III Spring 2008 For Dr. Graham's Class: (With An Addendum Including Some Additional Practice Questions.)An HoàiNo ratings yet

- Chapter 11Document7 pagesChapter 11NguyenThiTuOanhNo ratings yet

- Soal Chapter 5Document5 pagesSoal Chapter 5Cherry BlasoomNo ratings yet

- Tutorial-2 212 Mba 680 SolutionsDocument9 pagesTutorial-2 212 Mba 680 SolutionsbillyNo ratings yet

- Practice Questions For Final ExamDocument8 pagesPractice Questions For Final ExamChivajeetNo ratings yet

- Midterm 2010 DanielandreiinfoDocument11 pagesMidterm 2010 DanielandreiinfoCindy MaNo ratings yet

- Homework 5Document9 pagesHomework 5mas888No ratings yet

- Foundations of Financial Markets and InstitutionsDocument8 pagesFoundations of Financial Markets and InstitutionsMichiOSTNo ratings yet

- Chapter8Risk and ReturnDocument19 pagesChapter8Risk and ReturnAnonymous VnNZmOo6Z100% (2)

- Ce 11Document8 pagesCe 11Christine AltamarinoNo ratings yet

- Corporate Finance TutorialDocument2 pagesCorporate Finance TutorialAlan DaiNo ratings yet

- Risk Return QuizDocument10 pagesRisk Return QuizalyNo ratings yet

- Chapter 06 - Risk & ReturnDocument42 pagesChapter 06 - Risk & Returnmnr81No ratings yet

- RISK AND RETURNS PLUS OBJsDocument7 pagesRISK AND RETURNS PLUS OBJsEmmmanuel ArthurNo ratings yet

- Caiib Financialmgt A MCQDocument15 pagesCaiib Financialmgt A MCQsilyyjay121No ratings yet

- Prob Set 4Document3 pagesProb Set 4ebrahimnejad64No ratings yet

- DTU406 - Mock ExamDocument8 pagesDTU406 - Mock ExamXuân MaiNo ratings yet

- Investment (Index Model)Document29 pagesInvestment (Index Model)Quoc Anh NguyenNo ratings yet

- Mock Test SolutionsDocument13 pagesMock Test SolutionsMyraNo ratings yet

- CVDocument4 pagesCVShiv Shakti SinghNo ratings yet

- Chap 08Document36 pagesChap 08George MartinNo ratings yet

- Quantitative Analysis Sectional TestDocument11 pagesQuantitative Analysis Sectional Testgeeths207No ratings yet

- Sample ProbsDocument27 pagesSample Probsals7No ratings yet

- FIN322 Week 3 HomeworkDocument5 pagesFIN322 Week 3 HomeworkamalNo ratings yet

- Tutorial 5 - SolutionsDocument8 pagesTutorial 5 - SolutionsstoryNo ratings yet

- Answer 3Document7 pagesAnswer 3Quân LêNo ratings yet

- Chapter 5Document5 pagesChapter 5Khue NgoNo ratings yet

- Risk and ReturnDocument166 pagesRisk and ReturnShailendra ShresthaNo ratings yet

- FRM Part I - Full Length Test 3Document37 pagesFRM Part I - Full Length Test 3pradeep johnNo ratings yet

- Assig 2Document7 pagesAssig 2Katie CookNo ratings yet

- Exam2 FIN4504 Spring2022Document10 pagesExam2 FIN4504 Spring2022Eduardo VillarrealNo ratings yet

- Econ 252 Spring 2011 Problem Set 2Document5 pagesEcon 252 Spring 2011 Problem Set 2Tu ShirotaNo ratings yet

- Essentials of Corporate Finance Australian 3rd Edition Ross Test BankDocument43 pagesEssentials of Corporate Finance Australian 3rd Edition Ross Test Banksarahhant7t86100% (30)

- Cov (R, R) = β β σ Cov (R, R) = 0.8 *0.9*0.35^2 Cov (R, R) =0.07717Document5 pagesCov (R, R) = β β σ Cov (R, R) = 0.8 *0.9*0.35^2 Cov (R, R) =0.07717killerNo ratings yet

- HomeworkDocument6 pagesHomeworkHayden Rutledge EarleNo ratings yet

- Chap 008Document26 pagesChap 008Ken WhiteNo ratings yet

- Sapm - Solution, Assignment 2Document5 pagesSapm - Solution, Assignment 2nikhilchatNo ratings yet

- HW 6 - AkDocument6 pagesHW 6 - AkSuvaid KcNo ratings yet

- Chapter 7 - Portfolio TheoryDocument10 pagesChapter 7 - Portfolio TheorySinpaoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Solutions Manual to accompany Introduction to Linear Regression AnalysisFrom EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisRating: 1 out of 5 stars1/5 (1)

- AP Computer Science Principles: Student-Crafted Practice Tests For ExcellenceFrom EverandAP Computer Science Principles: Student-Crafted Practice Tests For ExcellenceNo ratings yet

- CFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyFrom EverandCFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyRating: 3 out of 5 stars3/5 (2)