Professional Documents

Culture Documents

2014 Vol 1 CH 9 Answers

2014 Vol 1 CH 9 Answers

Uploaded by

Jea BalagtasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2014 Vol 1 CH 9 Answers

2014 Vol 1 CH 9 Answers

Uploaded by

Jea BalagtasCopyright:

Available Formats

Chapter 9 Biological Assets

CHAPTER 9

BIOLOGICAL ASSETS

9-1.

(ABC Farms)

(a)

Carrying value of Biological Assets, 12/31/12

Cost of biological assets purchased during 2013

Fair valuation loss on initial recognition

Change in fair value due to biological transformation and

price fluctuations

Decrease in fair value due to harvest

Biological Assets, 12/31/13

(b)

9-2.

Loss on initial recognition at FV less cost to sell

Increase in FV less costs to sell

(Ranchero Corporation)

(a) Balance of Biological Assets at December 31, 2012

3 years old = 2,000 x P44,000

P88,000,000

2 years old = 1,500 x P35,000

52,500,000

Increase in fair value

2,000 x (P55,000 P44,000)

P22,000,000

1,500 x (P47,000 P35,000)

18,000,000

Balance, December 31, 2013 (at FV less cost to sell)

P2,800,000

3,200,000

( 150,000)

2,000,000

(1,000,000)

P6,850,000

P 150,000

P2,000,000

P140,500,000

40,000,000

P180,500,000

(b) Increase in FV less cost to sell due to

(1) Price Change :

3 year old cows 2,000 x (P47,000 P44,000)

2 year old heifers 1,500 x (P37,500 P35,000)

Increase in FV due to Price Change

(2) Physical Change

4 year old cows 2,000 x (P55,000 P47,000)

3 year old cows 1,500 x (47,000 P37,500)

Increase in FV due to Physical Change

(c) FV less costs to sell at December 31, 2013

4 year old cows 2,000 x P55,000

3 year old cows 1,500 x P47,000

FV less cost to sell at December 31, 2013

P6,000,000

3,750,000

P9,750,000

P16,000,000

14,250,000

P30,250,000

P110,000,000

70,500,000

P180,500,000

(d) Entry at yearend

Biological Assets

40,000,000

Gain Increase in FV less CTS due to Price Change

9,750,000

Gain Increase in FV less CTS due to Physical Change

30,250,000

9-3.

(a)

Price Change

2 year-old animals on Jan. 1

10 x (P10,500 P10,000)

2.5 year-old animal on July 1 1 x (P11,100 P10,800)

Animal born on July 1

1 x (P7,200 P7,000)

Change in FV less CTS due to Price Change

88

P5,000

300

200

P5,500

Chapter 9 Biological Assets

Physical Change

3 year-old animals on 12/31 10 x (P12,000 P10,500)

3 year old animal on 12/31 1 x (P12,000 P11,100)

Born on July 1 (upon birth)

On December 31 P8,000 P7,200

Change in FV less CTS due to Physical Change

(b) Entries for the Year

2013

July 1 Biological Assets

Cash

Purchased one animal.

P15,000

900

7,000

800

P23,700

10,800

1 Biological Assets

7,000

Increase in FV less CTS due to Physical Change

10,800

7,000

Dec 31 Biological Assets

22,200

Increase in FV less CTS due to Price Change

5,500

Increase in FV less CTS due to Physical Change

(23,700 7,000)

16,700

31 Cash {2 x (13,500 1,500)

Biological Assets

(c)

24,000

Balance, 1/1/13 10 animals x P10,000

Purchase

Change in FV less CTS due to Price Change

Change in FV less CTS due to Physical Change

(including the birth of one animal)

Sale at FV less CTS

Balance, December 31, 2013

(d)

24,000

P100,000

10,800

5,500

23,700

(24,000)

P116,000

The balance at December 31, 2013 is composed of the following:

3 year old animals 9 animals x P12,000

P108,000

1 year old animal

1 animal x P8,000

8,000

Total

P116,000

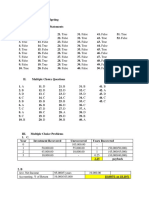

MC1

MC2

MC3

MC4

MC5

MC6

MC7

B

D

C

D

D

B

B

MC15

MC16

MC17

MC18

C

C

C

A

MULTIPLE

MC8

MC9

MC10

MC11

MC12

MC13

MC14

CHOICE

B

A

B

B

B

C

A

450,000 + 250,000 + 220,000 + 64,000 290,000 = 694,000

220,000 + 64,000 = 284,000

{(15,000-13,000) x 25} +{ (7,000-5,000) x 5 } + (4,000 x 5) = 80,000

{13,000 12,000) 25 + (5,000 4,000) x 5 = 30,000

89

Chapter 9 Biological Assets

MC19

MC20

MC21

MC22

MC23

MC24

MC25

D

B

B

A

C

A

(25 x 15,000) + (5 x 7,000) = 410,000

30,000 + 80,000 = 110,000

5,000,000 50,000 = 4,950,000

10M + 4M + 800,000 + 1.5M 2M 0.5M =

350,000-10,000 = 340,000

330,000 10,000 = 320,000

345,000 9,500 = 335,500; 335,500 320,000 = 15,500

90

You might also like

- VALLEJOS ACCTG 301 Biological Assets Answer KeyDocument4 pagesVALLEJOS ACCTG 301 Biological Assets Answer KeyEllah Rah78% (9)

- CHAPTER 34 - Biological Assets: Problem 34-1 (IFRS)Document13 pagesCHAPTER 34 - Biological Assets: Problem 34-1 (IFRS)Kimberly Claire Atienza100% (3)

- #3 Financial Accounting and Reporting Test BankDocument32 pages#3 Financial Accounting and Reporting Test BankPatOcampo100% (5)

- Intermediate Accounting Volume 2 Robles Solution Manual: Click Here Read/DownloadDocument2 pagesIntermediate Accounting Volume 2 Robles Solution Manual: Click Here Read/DownloadmaxsNo ratings yet

- Cost Accounting Reviewer by GuerreroDocument25 pagesCost Accounting Reviewer by GuerreroJaneth NavalesNo ratings yet

- Investments in Equity Securities Problems (Victoria Corporation) Year 1Document12 pagesInvestments in Equity Securities Problems (Victoria Corporation) Year 1Xyza Faye Regalado100% (2)

- Intermediate Accounting CH 8 Vol 1 2012 AnswersDocument6 pagesIntermediate Accounting CH 8 Vol 1 2012 AnswersPrincessAngelaDeLeon100% (5)

- PLM LECTURES COST ACCOUNTING-GLORIA RANTE - Doc1Document13 pagesPLM LECTURES COST ACCOUNTING-GLORIA RANTE - Doc1Angelita Alonzo57% (7)

- Cost Acctg Chapter-3Document11 pagesCost Acctg Chapter-3Renzo Ramos100% (1)

- Cost Ac Rante Chap 7Document24 pagesCost Ac Rante Chap 7Charlene BalderaNo ratings yet

- Biological Assets: SAMPLE PROBLEMS With AnswersDocument1 pageBiological Assets: SAMPLE PROBLEMS With AnswersMary Yvonne AresNo ratings yet

- CH 6 Answers Vol 1Document6 pagesCH 6 Answers Vol 1Jully GonzalesNo ratings yet

- ANSWERS - MODULE 5 For TeamsDocument4 pagesANSWERS - MODULE 5 For Teamsbhettyna noayNo ratings yet

- Rante 2019 SolmanDocument128 pagesRante 2019 SolmanGillian Cristel Samiano100% (1)

- CH 9 Capital Budgeting PayongayongDocument5 pagesCH 9 Capital Budgeting PayongayongNadi Hood100% (1)

- Chapter 12 1Document8 pagesChapter 12 1Princess Via Ira EstacioNo ratings yet

- Fin Ac Robles Empleo CH 5 Vol 1 Answers2012Document18 pagesFin Ac Robles Empleo CH 5 Vol 1 Answers2012Engel Ken Castro71% (7)

- Temporarily Shut Down Operations or ContinueDocument2 pagesTemporarily Shut Down Operations or ContinueAira Jaimee GonzalesNo ratings yet

- Solution Prelim ExamDocument30 pagesSolution Prelim ExamMedalla NikkoNo ratings yet

- CH 4 AnswersDocument9 pagesCH 4 AnswersElaineSmith83% (6)

- Assignment 2 - Practice 2 - CVP AnalysisDocument2 pagesAssignment 2 - Practice 2 - CVP Analysisjoint accountNo ratings yet

- Cost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Document7 pagesCost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Saarah KylueNo ratings yet

- Non-Current Assets Held For Sale: CA51016 - 2MA1Document21 pagesNon-Current Assets Held For Sale: CA51016 - 2MA1The Brain Dump PHNo ratings yet

- Intermediate Accounting Volume by Empleo Robles Solution Manual Chapter 1 PDFDocument1 pageIntermediate Accounting Volume by Empleo Robles Solution Manual Chapter 1 PDFthe Real Thugyum0% (1)

- Requirement 1:: Sales Cost of Goods Sold) Cost of Goods Sold X 100 X 100 X 100Document1 pageRequirement 1:: Sales Cost of Goods Sold) Cost of Goods Sold X 100 X 100 X 100KHAkadsbdhsgNo ratings yet

- 2016 Vol 1 CH 4 AnswersDocument15 pages2016 Vol 1 CH 4 Answersbebe_cute06XDNo ratings yet

- Chapter 4 Job Order CostingDocument9 pagesChapter 4 Job Order CostingSteffany RoqueNo ratings yet

- 2014 Vol 1 CH 4 AnswersDocument11 pages2014 Vol 1 CH 4 AnswersSimoun Torres100% (2)

- Income Tax On Individual TaxpayersDocument7 pagesIncome Tax On Individual TaxpayersYoite MiharuNo ratings yet

- Acctg 13 - Midterm ExamDocument8 pagesAcctg 13 - Midterm ExamMary Grace Castillo AlmonedaNo ratings yet

- Final Term Quiz 2 On Cost of Production Report - Average CostingDocument4 pagesFinal Term Quiz 2 On Cost of Production Report - Average CostingYhenuel Josh LucasNo ratings yet

- Acctg201 PCLossesLectureNotesDocument17 pagesAcctg201 PCLossesLectureNotesSophia Marie Eredia FerolinoNo ratings yet

- Assignment 7 Prepare A Cost of Goods Sold Budget KarununganDocument2 pagesAssignment 7 Prepare A Cost of Goods Sold Budget KarununganRenzo KarununganNo ratings yet

- Chapter 20 - Answer PDFDocument6 pagesChapter 20 - Answer PDFCarmila BaltazarNo ratings yet

- Biological Assets Problems 9-1Document3 pagesBiological Assets Problems 9-1Elvin BauiNo ratings yet

- 2016 Vol 1 CH 9 AnswersDocument3 pages2016 Vol 1 CH 9 Answersma quenaNo ratings yet

- Answers - Module 5 For TeamsDocument4 pagesAnswers - Module 5 For Teamsbhettyna noayNo ratings yet

- Answers - Module 5 For TeamsDocument4 pagesAnswers - Module 5 For Teamsbhettyna noayNo ratings yet

- Solution To Biological Assets ProblemsDocument9 pagesSolution To Biological Assets ProblemsBella De LiañoNo ratings yet

- BIOLOGICAL ASSETS (5 Cows X P20,000 Fair Value) CashDocument2 pagesBIOLOGICAL ASSETS (5 Cows X P20,000 Fair Value) CashAnj HwanNo ratings yet

- CHAPTER 8 - Agriculture Problem 8-1: True or False: Loss 30Document3 pagesCHAPTER 8 - Agriculture Problem 8-1: True or False: Loss 30Stefanie FerminNo ratings yet

- VALLEJOS ACCTG 301 Biological Assets Answer KeyDocument3 pagesVALLEJOS ACCTG 301 Biological Assets Answer Keyyes yesnoNo ratings yet

- Bio AssetDocument8 pagesBio AssetJessie jorgeNo ratings yet

- AP Solutions 2012Document13 pagesAP Solutions 2012Jake ManansalaNo ratings yet

- Material Cost VarianceDocument2 pagesMaterial Cost VarianceGoodluck SumariNo ratings yet

- Biological Assets Quizzer Problem 1Document5 pagesBiological Assets Quizzer Problem 1GooJaeRiNo ratings yet

- Answers Biological AssetsDocument4 pagesAnswers Biological AssetsJanella Gail ArenasNo ratings yet

- AP Solutions 2013Document7 pagesAP Solutions 2013Rod Lester de GuzmanNo ratings yet

- DEC 2019 Solution 4 A.: Price ChangesDocument3 pagesDEC 2019 Solution 4 A.: Price ChangesNurNabilah YasminNo ratings yet

- Biological AssetsDocument4 pagesBiological AssetsAlizeyy100% (1)

- Bio Assets AssignmentDocument3 pagesBio Assets AssignmentJuliet Leron MediloNo ratings yet

- Ppe Bio AssetDocument2 pagesPpe Bio AssetEvita Faith LeongNo ratings yet

- Solution Manual For Module 2 AgricultureDocument5 pagesSolution Manual For Module 2 AgricultureYves Kim YangNo ratings yet

- Costs To Sell. (Refer To Page 314)Document2 pagesCosts To Sell. (Refer To Page 314)Kyle John DonNo ratings yet

- Answer: A Forest Asset 6,000,000.00 Less: Land Under Trees 600,000.00 Roads in Forest 300,000.00 Free Standing TreesDocument6 pagesAnswer: A Forest Asset 6,000,000.00 Less: Land Under Trees 600,000.00 Roads in Forest 300,000.00 Free Standing TreesNikki GarciaNo ratings yet

- Key Answer To Acc 107 P1 ExamDocument3 pagesKey Answer To Acc 107 P1 ExamRachel VillamorNo ratings yet

- Financial Accounting and Reporting Test Bank 80102016 - 3: - Investment in AssociateDocument10 pagesFinancial Accounting and Reporting Test Bank 80102016 - 3: - Investment in AssociateFery AnnNo ratings yet

- Chicken Poultry Business PlanDocument10 pagesChicken Poultry Business PlanDianne Montabon PariñaNo ratings yet

- Ralph Christian Balista Eddie Roger P. SaluntaoDocument10 pagesRalph Christian Balista Eddie Roger P. SaluntaoEddie Roger SaluntaoNo ratings yet

- Advacc - Plant AssetsDocument4 pagesAdvacc - Plant AssetsJohn JackNo ratings yet