Professional Documents

Culture Documents

B3summarytable PDF

B3summarytable PDF

Uploaded by

Jasvinder TanejaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B3summarytable PDF

B3summarytable PDF

Uploaded by

Jasvinder TanejaCopyright:

Available Formats

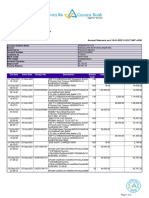

Basel Committee on Banking Supervision reforms - Basel III

Strengthens microprudential regulation and supervision, and adds a macroprudential overlay that includes capital buffers.

Liquidity

Capital

All Banks

Pillar 1

Pillar 3

Capital

Risk coverage

Containing

leverage

Risk management

and supervision

Market

discipline

Quality and level of capital

Greater focus on common equity. The

minimum will be raised to 4.5% of riskweighted assets, after deductions.

Securitisations

Strengthens the capital

treatment for certain complex

securitisations. Requires banks to

conduct more rigorous credit

analyses of externally rated

securitisation exposures.

Leverage ratio

A non-risk-based

leverage ratio that

includes off-balance

sheet exposures will

serve as a backstop to

the risk-based capital

requirement. Also

helps contain system

wide build up of

leverage.

Supplemental Pillar

2 requirements.

Address firm-wide

governance and risk

management;

capturing the risk of

off-balance sheet

exposures and

securitisation

activities; managing

risk concentrations;

providing incentives

for banks to better

manage risk and

returns over the long

term; sound

compensation

practices; valuation

practices; stress

testing; accounting

standards for financial

instruments; corporate

governance; and

supervisory colleges.

Revised Pillar 3

disclosures

requirements

The requirements

introduced relate

to securitisation

exposures and

sponsorship of offbalance sheet

vehicles. Enhanced

disclosures on the

detail of the

components of

regulatory capital

and their

reconciliation to

the reported

accounts will be

required, including

a comprehensive

explanation of

how a bank

calculates its

regulatory capital

ratios.

"Gone concern" contingent capital

"gone concern" capital proposal would

requires contractual terms of capital

instruments to include a clause allowing

at the discretion of the relevant authority

write-off or conversion to common

shares if the bank is judged to be nonviable. "Gone concern" contingent capital

increases the contribution of the private

sector to resolving future banking crises

and thereby reduces moral hazard.

Capital conservation buffer

Comprising common equity of 2.5% of

risk-weighted assets, bringing the total

common equity standard to 7%.

Constraint on a bank's discretionary

distributions will be imposed when banks

fall into the buffer range.

Countercyclical buffer

Imposed within a range of 0-2.5%

comprising common equity, when

authorities judge credit growth is

resulting in an unacceptable build up of

systematic risk.

SIFIs

Pillar 2

Trading book

Significantly higher capital for

trading and derivatives activities,

as well as complex securitisations

held in the trading book.

Introduction of a stressed valueat-risk framework to help

mitigate procyclicality.

Counterparty credit risk

Substantial strengthening of the

counterparty credit risk

framework. Includes: more

stringent requirements for

measuring exposure; capital

incentives for banks to use

central counterparties for

derivatives; and higher capital for

inter-financial sector exposures.

In addition to meeting the Basel III requirements, global systemically important financial institutions (SIFIs) must have higher loss absorbency capacity to reflect

the greater risks that they pose to the financial system. The Committee has developed a methodology that includes both quantitative indicators and qualitative

elements to identify global SIFIs. The additional loss absorbency requirements are to be met with a progressive Common Equity Tier 1 (CET1) capital requirement

ranging from 1% to 2.5%, depending on a bank's systemic importance. A consultative document was submitted to the Financial Stability Board (FSB), which is

coordinating the overall set of measures to reduce the moral hazard posed by global systemically important financial institutions.

Global liquidity

standard and

supervisory monitoring

Liquidity coverage ratio

The liquidity coverage ratio (LCR)

will require banks to have sufficient

high-quality liquid assets to

withstand a 30-day stressed funding

scenario that is specified by

supervisors.

Net stable funding ratio

The net stable funding ratio (NSFR)

is a longer-term structural ratio

designed to address liquidity

mismatches. It covers the entire

balance sheet and provides

incentives for banks to use stable

sources of funding.

Principles for Sound Liquidity

Risk Management and

Supervision

The Committee's 2008 guidance

entitled Principles takes account of

lessons learned during the crisis and

are based on a fundamental review

of sound practices for managing

liquidity risk in banking

organisations.

Supervisory monitoring

The liquidity framework includes a

common set of monitoring metrics

to assist supervisors in identifying

and analysing liquidity risk trends at

both the bank and system-wide

level.

You might also like

- Go4itCreditCardTermsConditions PDFDocument29 pagesGo4itCreditCardTermsConditions PDFJismin JosephNo ratings yet

- FHFA Lawsuits (1 File)Document1,943 pagesFHFA Lawsuits (1 File)A. Campbell100% (1)

- Zarro Inference 1 Report of The Special Master Concerning Jpmorgan Chase Bank and Chase Home Finance - Aug 15, 2011Document30 pagesZarro Inference 1 Report of The Special Master Concerning Jpmorgan Chase Bank and Chase Home Finance - Aug 15, 2011DeontosNo ratings yet

- Fannie MaeDocument6 pagesFannie MaeChahnaz KobeissiNo ratings yet

- Credorax DM (Mar 2021)Document29 pagesCredorax DM (Mar 2021)csh011235No ratings yet

- Transfer Pricing in One Lesson: A Practical Guide to Applying the Arm’s Length Principle in Intercompany TransactionsFrom EverandTransfer Pricing in One Lesson: A Practical Guide to Applying the Arm’s Length Principle in Intercompany TransactionsNo ratings yet

- Too Many Jobs - Linda Green, Tywanna Thomas, Korell Harp and Shelly ScheffeyDocument8 pagesToo Many Jobs - Linda Green, Tywanna Thomas, Korell Harp and Shelly ScheffeyForeclosure FraudNo ratings yet

- Banking Awareness - A Complete B - N K GuptaDocument458 pagesBanking Awareness - A Complete B - N K GuptaAbhi Saha100% (2)

- ExhibitsDocument901 pagesExhibitstonystarks21100% (1)

- BOA - American Home Mortgage Servicing PlatformDocument4 pagesBOA - American Home Mortgage Servicing Platform83jjmackNo ratings yet

- Gundlach Nov 2018Document54 pagesGundlach Nov 2018Zerohedge100% (5)

- Carrington Mortgage Flyer - 12 25 15Document1 pageCarrington Mortgage Flyer - 12 25 15reyes500No ratings yet

- Goldman Exhibits - Hearing On Wall Street and Financial CrisisDocument901 pagesGoldman Exhibits - Hearing On Wall Street and Financial CrisisFOXBusiness.com100% (1)

- Fivecoat Foreclosures & FraudDocument429 pagesFivecoat Foreclosures & FraudAlbertelli_Law100% (1)

- FundraiserDocument1 pageFundraiserSunlight FoundationNo ratings yet

- MERS Tips & Hints 2011-07Document1 pageMERS Tips & Hints 2011-07WARWICKJNo ratings yet

- EXHIBITS 1-99 For July 17 2012 HSBC HearingUR7 PDFDocument530 pagesEXHIBITS 1-99 For July 17 2012 HSBC HearingUR7 PDFseymourwardNo ratings yet

- More On MERSDocument3 pagesMore On MERSBill GeorgeNo ratings yet

- Basel IiiDocument44 pagesBasel IiiƦƛj Thålèswäř100% (2)

- 11-02-18 US Drops Criminal Probe of Former Country Wide Chief Angelo Mozilo - LATimesDocument4 pages11-02-18 US Drops Criminal Probe of Former Country Wide Chief Angelo Mozilo - LATimesHuman Rights Alert - NGO (RA)No ratings yet

- Intro To FX SlidesDocument81 pagesIntro To FX Slidessbrownv100% (1)

- Note On Credit Credit Analysis ProcessDocument26 pagesNote On Credit Credit Analysis Processaankur aaggarwalNo ratings yet

- Bank of America: 4Q11 Financial ResultsDocument40 pagesBank of America: 4Q11 Financial ResultsBing LiNo ratings yet

- Basel 3 PPT OfficialDocument32 pagesBasel 3 PPT OfficialNEERAJA N JNo ratings yet

- Overview of The Federal Sentencing Guidelines For Organizations and Corporate Compliance Programslawrence D. Finderhaynes and Boone, Llpa. Michael Warneckehaynes and Boone, LLPDocument45 pagesOverview of The Federal Sentencing Guidelines For Organizations and Corporate Compliance Programslawrence D. Finderhaynes and Boone, Llpa. Michael Warneckehaynes and Boone, LLPLisa Stinocher OHanlonNo ratings yet

- Active Inactive DataDocument889 pagesActive Inactive Datapallavi chaddhaNo ratings yet

- World Logistics Center Settlement AgreementDocument53 pagesWorld Logistics Center Settlement AgreementBeau YarbroughNo ratings yet

- Kyle Bass - Subprime Credit Strategies Fund Power PointDocument53 pagesKyle Bass - Subprime Credit Strategies Fund Power PointbrmadragonNo ratings yet

- 2021 Trent Graduate ListDocument68 pages2021 Trent Graduate ListGradListNo ratings yet

- Agard - US Bankruptcy Court New YorkDocument37 pagesAgard - US Bankruptcy Court New YorkMortgage Compliance Investigators100% (1)

- GF&Co: JPM - Out of ControlDocument45 pagesGF&Co: JPM - Out of Controldavid_dayen3823100% (1)

- New Century Capital Corporation Secondary Marketing PoliciesDocument86 pagesNew Century Capital Corporation Secondary Marketing Policies83jjmack100% (1)

- FinalASFInvestorReportingStandards PDFDocument6 pagesFinalASFInvestorReportingStandards PDFdeeNo ratings yet

- AIG Offer To Buy Maiden Lane II SecuritiesDocument43 pagesAIG Offer To Buy Maiden Lane II Securities83jjmackNo ratings yet

- Zarro Inference 4 Memorandum of Respondents Jpmorgan Chase Bank, N.A. and Chase Home Finance LLC in Response To Order To Show Cause - January 5, 2011Document51 pagesZarro Inference 4 Memorandum of Respondents Jpmorgan Chase Bank, N.A. and Chase Home Finance LLC in Response To Order To Show Cause - January 5, 2011DeontosNo ratings yet

- Lending Regulation TableDocument5 pagesLending Regulation TableThaddeus J. CulpepperNo ratings yet

- American Home Mortgage Investment Corp, Chapter 11 Plan, LIQUITIDATIONDocument111 pagesAmerican Home Mortgage Investment Corp, Chapter 11 Plan, LIQUITIDATIONwicholacayo100% (1)

- Federal V StateDocument2 pagesFederal V StateMortgage Compliance Investigators100% (1)

- AttachmentDocument49 pagesAttachmentAlhaji Mamah Sesay0% (1)

- Senate Hearing, 111TH Congress - Wall Street and The Financial Crisis: The Role of High Risk Home LoansDocument935 pagesSenate Hearing, 111TH Congress - Wall Street and The Financial Crisis: The Role of High Risk Home LoansScribd Government DocsNo ratings yet

- Acquisition of Merrill Lynch by Bank of AmericaDocument26 pagesAcquisition of Merrill Lynch by Bank of AmericaNancy AggarwalNo ratings yet

- Subprime Mortgage Crisis 2008Document37 pagesSubprime Mortgage Crisis 2008Robin Thieu100% (16)

- 12 in Re CYNTHIA CARRSOW FRANKLIN C O M M E N T A R Y New Lawsuit Alleges That Wells Has A Manual For Mass Fabrication of Foreclosure Documents - Naked CapitalismDocument38 pages12 in Re CYNTHIA CARRSOW FRANKLIN C O M M E N T A R Y New Lawsuit Alleges That Wells Has A Manual For Mass Fabrication of Foreclosure Documents - Naked CapitalismDeontosNo ratings yet

- Deutsche MemoDocument16 pagesDeutsche Memochunga85No ratings yet

- Washington Mutual (WMI) - Objection of The TPS Consortium To Confirmation PlanDocument100 pagesWashington Mutual (WMI) - Objection of The TPS Consortium To Confirmation PlanmeischerNo ratings yet

- Complete KYTC Standard Specifications - 2004Document618 pagesComplete KYTC Standard Specifications - 2004MuhammadIqbalMughalNo ratings yet

- Washington Mutual (WMI) - Declaration of Thomas M. Blake (Counsel For JPMorgan Chase)Document49 pagesWashington Mutual (WMI) - Declaration of Thomas M. Blake (Counsel For JPMorgan Chase)meischerNo ratings yet

- Mrs V JPMC Doc 151-17, Amended RICO Statement, March 6, 2017Document48 pagesMrs V JPMC Doc 151-17, Amended RICO Statement, March 6, 2017FraudInvestigationBureau100% (2)

- Washington Mutual (WMI) - Attachments/Exhibits To The Final Report of The Examiner (Part 7/10)Document427 pagesWashington Mutual (WMI) - Attachments/Exhibits To The Final Report of The Examiner (Part 7/10)meischerNo ratings yet

- m3 JP Morgan Chase Stated in A Fed m3 CT It Is Not Successor in Interest To Wamu Loans and Lawerence Nardi Confirms 10-30-2017Document4 pagesm3 JP Morgan Chase Stated in A Fed m3 CT It Is Not Successor in Interest To Wamu Loans and Lawerence Nardi Confirms 10-30-2017api-321082827No ratings yet

- QL KZKFKCFMDocument377 pagesQL KZKFKCFMDeadlyClearNo ratings yet

- LB RepoDocument71 pagesLB RepoCarl D'Amour-BelizarioNo ratings yet

- ProvestDocument14 pagesProvestForeclosure FraudNo ratings yet

- Net Proceeds of Bond Sale Market Price NP I (Pvifa: KD, N N KD, NDocument3 pagesNet Proceeds of Bond Sale Market Price NP I (Pvifa: KD, N N KD, NMich Elle CabNo ratings yet

- Kim V JP Morgan Chase Bank, N.A. - 3.75 Billion of Chase-WAMU Mortgages Are Voidable!!Document38 pagesKim V JP Morgan Chase Bank, N.A. - 3.75 Billion of Chase-WAMU Mortgages Are Voidable!!83jjmackNo ratings yet

- Generally Accepted Auditing Standards A Complete Guide - 2020 EditionFrom EverandGenerally Accepted Auditing Standards A Complete Guide - 2020 EditionNo ratings yet

- Responsibility Assignment Matrix A Complete Guide - 2020 EditionFrom EverandResponsibility Assignment Matrix A Complete Guide - 2020 EditionNo ratings yet

- Basel 3 Summary TableDocument1 pageBasel 3 Summary TableIzian SherwaniNo ratings yet

- B 3 Summary TableDocument1 pageB 3 Summary Tablecarlosito_lauraNo ratings yet

- Basel 2 NormsDocument11 pagesBasel 2 NormsAbhishek RajputNo ratings yet

- Risk Management Framework: by Prof Santosh KumarDocument30 pagesRisk Management Framework: by Prof Santosh KumarAYUSH RAVINo ratings yet

- Basel I I I Presentation 1Document32 pagesBasel I I I Presentation 1madhusudhananNo ratings yet

- Basel 3Document8 pagesBasel 3Shuvo SDNo ratings yet

- Insights - A Journey From Basel II To Basel IVDocument12 pagesInsights - A Journey From Basel II To Basel IV0399shubhankarNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- Information SessionDocument2 pagesInformation SessionSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- LuncheonDocument4 pagesLuncheonSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- #PromoteOpenData: How Cities Can Use Social Media To Publicize Open Data PolicyDocument14 pages#PromoteOpenData: How Cities Can Use Social Media To Publicize Open Data PolicySunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- History of Money: Theories of Money Technologies Prehistory: Predecessors of Money and Its EmergenceDocument22 pagesHistory of Money: Theories of Money Technologies Prehistory: Predecessors of Money and Its Emergencehasan jamiNo ratings yet

- DDDDDDDDDocument24 pagesDDDDDDDDdenekew lesemiNo ratings yet

- Customer Satisfaction: Punjab National BankDocument59 pagesCustomer Satisfaction: Punjab National BankvivekNo ratings yet

- Time Value of MoneyDocument35 pagesTime Value of MoneysandhurstalabNo ratings yet

- Academic Roundtable Discussion Discussion Outline Format Discussion FacilitatorDocument4 pagesAcademic Roundtable Discussion Discussion Outline Format Discussion FacilitatorKatelynNo ratings yet

- Determination of Interest RateDocument35 pagesDetermination of Interest Rateznz17_78248No ratings yet

- Microfinance Paper PresentationDocument8 pagesMicrofinance Paper Presentationtulasinad123No ratings yet

- 13account-Pricelist-En 1.8 PDFDocument7 pages13account-Pricelist-En 1.8 PDFTheodoorNo ratings yet

- Power of CompoundingDocument9 pagesPower of CompoundingSuresh IndiaNo ratings yet

- Comparing Home Loan Quotes From Different Banks/NbfcsDocument2 pagesComparing Home Loan Quotes From Different Banks/NbfcsUpasana SahniNo ratings yet

- Grade11 Business Math - Module 4Document6 pagesGrade11 Business Math - Module 4Erickson SongcalNo ratings yet

- Vault Guide Asia Pacific Banking EmployeesDocument339 pagesVault Guide Asia Pacific Banking EmployeesmcarimNo ratings yet

- Account Statement As of 18-01-2022 21:02:27 GMT +0530Document2 pagesAccount Statement As of 18-01-2022 21:02:27 GMT +0530Goutham HNo ratings yet

- Atm / Debit Card Application Form: Khumneicha G A O NG NDocument2 pagesAtm / Debit Card Application Form: Khumneicha G A O NG NLalrinpuii Joute0% (1)

- Bank Reconciliation: Kevin E. Paz Business MathematicsDocument14 pagesBank Reconciliation: Kevin E. Paz Business MathematicsJonard TejonesNo ratings yet

- Ar Rahnu ThesisDocument7 pagesAr Rahnu ThesisWriteMyPaperForMoneySingapore100% (4)

- Danamon No More: DBS GroupDocument6 pagesDanamon No More: DBS GroupphuawlNo ratings yet

- Marsha Sompayrac SunTrust Helps Exporters - How To Get PaidDocument21 pagesMarsha Sompayrac SunTrust Helps Exporters - How To Get PaidMarsha SompayracNo ratings yet

- Revathy Assg Ratio CalculationDocument2 pagesRevathy Assg Ratio CalculationAishvini ShanNo ratings yet

- CH 14Document6 pagesCH 14Saleh RaoufNo ratings yet

- A Presentation On Internet Banking: Prepared byDocument17 pagesA Presentation On Internet Banking: Prepared byTrivedi OmNo ratings yet

- Fin533 Ivve Sherlyn Palitus 2021123981 PDFDocument11 pagesFin533 Ivve Sherlyn Palitus 2021123981 PDFNatasya JescorinNo ratings yet

- Consumer Satisfaction IciciDocument55 pagesConsumer Satisfaction IciciAkshay TullyNo ratings yet

- Khushi Enterprise: Customer Registration FormDocument7 pagesKhushi Enterprise: Customer Registration Formkage laxmiNo ratings yet

- BIDA Application Front PageDocument1 pageBIDA Application Front PageZahed IbrahimNo ratings yet

- Loi Landbank TeachersDocument1 pageLoi Landbank Teachersmark san andres100% (1)