Professional Documents

Culture Documents

pms-2015-1 Paper Objectives of Feasibility Studies PDF

pms-2015-1 Paper Objectives of Feasibility Studies PDF

Uploaded by

JoseMiguelVargasRojasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

pms-2015-1 Paper Objectives of Feasibility Studies PDF

pms-2015-1 Paper Objectives of Feasibility Studies PDF

Uploaded by

JoseMiguelVargasRojasCopyright:

Available Formats

McCarthy P L, Internal AMC Paper

Objectives of Feasibility Studies

By P L McCarthy 1

Objectives of Feasibility Studies

The life cycle of a mining project includes:

Exploration

Discovery

Assessment

Development

Production

Closure

Feasibility studies are required in the pre-production stages to

justify the continued investment of money. Usually a scoping

study is followed by one or more prefeasibility studies which

reflect the increasing level of technical and economic

knowledge gained at the various earlier stages. These culminate

in a final feasibility study which demonstrates the economic

feasibility of the project with sufficient certainty to allow a

decision to mine. The level of engineering which has been

attained in the feasibility study is usually well short of that

required for construction, so a further period of detailed

engineering follows. This usually continues during construction

and only tapers off when production is imminent.

The first evaluations of the property occur well before the

scoping study, and form the basis of a decision to commence

exploration. These may involve considering likely costs and

revenues for conceptual targets, or sometimes look at the

economics of discovering a similar orebody to one which was

mined on or near the property in the past. Many times such

analyses are not done prior to exploration. This procedure sets

minimum targets for grade and tonnages against which the

progress of exploration can be reviewed or considered.

If the initial drill intercepts give some indication of potential

economic size and grade, the scoping study is carried out to

justify further exploration. Exploration including preliminary

metallurgical assessment, geotechnical investigations and so on

will continue until sufficient data has been gathered to permit a

prefeasibility study to be carried out.

The prefeasibility study usually considers a range of mining and

processing alternatives and varying production rates. Usually

the options are narrowed down to one or two in each area. At

this stage it is usually possible to detail the additional work

including further definition drilling, metallurgical test work and

site investigation which will be needed to support a feasibility

study. The results of the prefeasibility study are used to justify

expenditure on gathering this additional information and the

considerable expenditure needed to carry out the final feasibility

1.

Managing Director, AMC Consultants Pty Ltd, 19/114 William Street,

Melbourne Vic 3000. E-mail: pmccarthy@amcconsultants.com.au

study on a substantial project. The final feasibility study

provides a basis for a commitment to proceed with project

development, detailed design and construction.

While it is convenient to refer to scoping studies, prefeasibility

studies, and final feasibility studies, in reality the study process

is iterative and several increasingly detailed prefeasibility

studies may be undertaken before committing to the final

feasibility study. Regardless of the level of study the areas

addressed will include:

geology and resources,

mining and ore reserves,

processing and transportation,

market and price expectations,

infrastructure,

the various "soft" implications of location - political

risks, skills, recruitment, logistics and environment,

economic evaluation including consideration of

capital and operating costs, revenues, taxes and

royalties,

an assessment of whether the project is sufficiently

attractive to proceed to the next stage.

Types of Feasibility Studies

Scoping Studies

A scoping study may be carried out very early in the project

life. For example it may be used as a basis for acquiring

exploration areas or making a commitment for exploration

funding. At this stage the investment risk may be relatively

small but it is obviously undesirable to expend further funds on

something that has no chance of being economic.

The major risk is that a viable mining project is relinquished

due to an inadequate assessment. When it is considered that

there is a very low probability of an exploration project

proceeding to a mine it is evident that this risk is quite a serious

one at the scoping study stage. For this reason it is essential that

experienced people are involved in the scoping study. Due to

organisational structures, there is a risk that this may be left to

exploration departments and geologists who may have only

limited expertise in the areas of mining and mineral processing.

It should be noted that exploration companies usually employ

only geologists.

It is acceptable for scoping studies to be based on very limited

information or speculative assumptions in the absence of hard

Objective of Feasibility Studies

data. The study is directed at the potential of the property rather

than a conservative view based on limited information.

1)

To demonstrate within a reasonable confidence that

the project can be constructed and operated in a

technically sound and economically viable manner.

2)

To provide a basis for detailed design and

construction.

3)

To enable the raising of finance for the project from

banks or other sources.

Prefeasibility Studies

There are three common reasons for carrying out prefeasibility

studies as follows:

1)

As a basis for committing to a major exploration

program following a successful preliminary program.

It is possible for commitments of $10 to 20M for

ongoing exploration and development to be made on

the basis of a prefeasibility study. For example, where

reserves cannot be proven by surface drilling a

decline may be developed for exploration at an early

stage of the project. This happened at Stawell in

Victoria, and is planned for Ballarat.

2)

To attract a buyer to the project or to attract a joint

venture partner or as a basis for a major underwriting

to raise the required risk capital. A prefeasibility study

may also be prepared in full or in part by potential

purchasers as part of the due diligence process.

3)

To provide a justification for proceeding to a final

feasibility study.

The results of a prefeasibility study may be the first hard project

information which is seen by corporate decision makers. There

is a risk that the findings are committed to memory so that it

becomes difficult to dislodge them with subsequent

information. In such cases, the prefeasibility study is the real

decision point, with the subsequent feasibility study being seen

by management as a necessary step along the path which has

already been irrevocably committed.

For these reasons the prefeasibility study must be prepared with

great care by experienced people, and its conclusions heavily

qualified wherever necessary. Assumptions should be realistic

rather than optimistic because it is very difficult to bring

management and markets back to reality in the event that the

final feasibility study is significantly less favourable.

The main features of the prefeasibility study are;

Mine design based on a resource model.

Best alternative selected from a range of alternatives.

Preliminary studies completed on geotechnical, environmental,

and infrastructure requirements.

Bench scale metallurgical tests and preliminary process design

completed.

Cost estimates based on factored or comparative prices.

Terminology

A range of sometimes conflicting titles are used for studies,

including the following;

Scoping study

Class 1 Study

Preliminary Evaluation

"Order-of-Magnitude Estimate"

"Capacity Factor Estimate"

Screening study

Prefeasibility Study

Class 2 Study

Intermediate Economic Study

Preliminary Feasibility Study

"Equipment Factor Estimate"

Final Feasibility Study

Class 3 Study

Bankable Feasibility Study

"Forced Detailed Estimate"

Detailed Engineering Study

Class 4 Study

Project Control Estimate

Definitive Cost Estimate

"Fall-out Detailed Estimate"

Thompson (1993) reports that "he discovered that if 10 people

were discussing preliminary engineering or that old standby

definitive estimate, there were 10 different opinions" (as to the

meaning of these terms). Some of the above terms are not

widely used in Australia.

The terminology used in these notes is that usually used by the

authors, and we believe it to be widely used in the Australian

mining industry.

Accuracy of Feasibility Studies

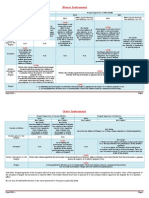

The probable accuracy achieved by each phase of the

study/design process is illustrated in Figure 1. The engineering

requirements for each type of study are listed in Table 1 The

overall study accuracy cannot readily be calculated, and is

usually a matter for judgement based on experience.

Study accuracy 15% to 25%.

Ready to proceed to final feasibility study.

Final Feasibility Studies

The final feasibility study is usually based on the most attractive

alternative for the project as previously determined. The aim of

the study is to remove all significant uncertainties and to present

the relevant information with back up material in a concise and

accessible way. The final feasibility study has three objectives;

AMC Reference Library www.amcconsultants.com.au

Contingency Allowance

The contingency allowance is intended to make provision for:

Items which have not been covered because of oversight.

Unpredictable external changes, such as changes in

legislation, taxation and royalties, or provision or

discontinuation of external infrastructure services.

Objective of Feasibility Studies

Changes arising from a greater knowledge with time, from

poor initial appreciation, or simply the limited depth of

engineering analysis during the feasibility stage. Examples

include more rock in foundations, alternative equipment,

bid rates different to assumptions, need for wet explosives,

refinement of metallurgical process, design errors,

accidents.

The key to the assessment is the manner in which the

contingency level is derived. There should be different levels

for different considered circumstances for various components

of the project. These can then be summed to show the overall

contingency allowance.

stops short of analysing overall project viability or profitability.

This analysis and sometimes the marketing component of the

study may be carried out by the project sponsor. In this case the

technical reports would be considered bankable by the

engineers but perhaps not by the bank or the sponsor.

A bank may be satisfied with the technical work and economics

sufficient to lend 60% of future development cost where the

sponsors are seeking 80%. Despite the accuracy of the

engineering, in this case the sponsors have not got what they

require of a bankable study. Daley (1990) argues that the term

"Bankable" should be avoided by engineers and project

sponsors.

The discipline of a measured consideration is important. For

example, with a firm quote for standard equipment e.g. a truck,

little contingency allowance is required. On the other hand there

may have been no foundation drilling in which case excavation

costs may be more and more concrete will be required. There

may also be the effect of subsequent construction being

delayed.

From a lender's view point the following information is

required:

There has been a trend recently to estimate the probability of

not exceeding the estimate, including the contingency. This can

be difficult to justify if the contingency is intended to allow for

the unpredictable. The main thing is to convey to the owner a

feel for the levels of uncertainties upon which the estimates are

based. It might also be possible to account for some of these

"contingencies" using risk analysis.

Independently prepared or reviewed ore reserve and

resource reports. A bank will usually be prepared to

provide a loan facility which can be fully repaid within the

period of depletion of the proved ore reserve defined at the

time of final feasibility. A mine life (proved and probable

reserves) at least twice the projected loan life is usually

required.

The project manager, in assessing contingencies, needs to guard

against the human nature self- interest/self- justification of the

engineers undertaking the design and compiling the contingency

estimate.

Final Feasibility Study engineering with capital and

operating cost estimates to an accuracy of 10 to 15%

including realistic contingency allowances.

An Engineering Feasibility Study by an independent

engineer of high reputation. Alternatively, where an

established resource company has carried out the feasibility

study in-house, a review by an independent engineer.

A monthly project development plan containing a full

description of the project with a detail schedule of planned

activities and expenditures in monthly periods until project

commissioning. This may be prepared subsequent to the

final feasibility study during the loan negotiation.

The "Bankable" Study

The meaning of the term bankable will vary depending on when

it is used. To the engineers preparing a feasibility study, the

term bankable only refers to the technical completeness and the

level of detail contained in the report which they are preparing.

Their scope of work is usually not broad enough to fully satisfy

a bank's requirements. The engineers' feasibility study often

Identification of risks in the operational phase with

sensitivity analyses of likely or possible downsides.

35

(Without contingency)

% Likely Accuracy

Figure 1 Probable accuracy of each study/design phase

Scoping Study

30

Prefeasibility Study

25

20

Final Feasibility

Study

15

Detailed

Mechanical

Engineering

Completion

10

5

0

Project

Completion

20

40

60

80

100

120

% Project Status

AMC Reference Library www.amcconsultants.com.au

Objective of Feasibility Studies

Table 1 Engineering requirements by type of study

After Thompson 1993

Item

Scoping Study

Preliminary Feasibility

Study

Final Feasibility Study

Detailed Design

Site

Geographical location

Assumed

General

Approximate

Maps and surveys

None

If Available

Available

Specific

Detailed

Soil and Foundations Test

None

None

Preliminary

Final

Site visits by project team

Possibly

Recommended

Essential

Essential

Basis for Schedule

Indicated/Inferred Resources

Measured/Indicated Resources Proven/Probable Reserve

Proven/Probable

Reserve

Mining Method

Assumed

Preliminary

Finalised

Mining Rate

By Analogy

Geotechnical

Assumed

Equipment Selection

Mining

Preliminary

Optimised

Optimised by Detailed

Scheduling

Finalised

Preliminary

Detailed

Finalised

Not Essential

Preliminary

Type and Capacity

Make and Model

Process Flowsheets

Assumed

Preliminary

Optimised

Finalised

Bench-scale Tests

If Available

Recommended

Essential

Essential

Pilot Plant Tests

Not Needed

Recommended

Recommended

Essential

Preliminary

Optimised

Finalised

Treatment Process

Energy and Material Balances Not Essential

Facilities Design

Nature of Facilities

Conceptual

Possible

Probable

Actual

Equipment Selection

General Arrangements,

Mechanical

General Arrangements,

Structural

Hypothetical

Preliminary

Optimised

Finalised

Sometimes

Minimum

Preliminary

Complete

None

Outline

Outline

Preliminary

General Arrangements, Other None

None

Single-line

Some Detail

Piping Drawings

None

Single-line

Some Detail

None

Electrical Drawings

None

None

Single-line

Some Detail

Specifications

None

Performance

General/Major Equipment

Detailed

Basis for Capital Cost Estimating

Estimates Prepared by

Project Staff

Specialist Engineer

Specialist Engineer

Estimators

Quotations From Suppliers

Existing Files

Single Source

Multiple

Competitive

Civil Work

Rough Sketch

Drawing Estimate

Drawing Estimate

Take-offs

Mechanical Work

% of Machinery

% of Machinery

Manhours/Tonne

Manhours/Tonne

Structural Work

Rough Sketch

Preliminary Drawings

Take-off/Tonne

Take-off/Tonne

Piping and Instrumentation

% of Machinery

% of Machinery

Take-off

Take-off

Electrical Work

$ per Kw

$ per Kw

Take-off

Take-off

Indirect Costs

Accuracy (Based on

Experience)

% of Total

% of Total

Calculated

Calculated

20-25%

15-20%

15%

10%

Operating Cost Determination

Labour Costs

Assumed

Investigative

Investigative

Negotiate

On-costs

Assumed

Calculated

Calculated

Calculated

Power Costs

Assumed

Actual

Actual

Contract

Fuel Costs

Assumed

Verbal Quote

Letter Quote

Contract

Consumable Supplies

Assumed

Verbal Quote

Letter Quote

Contract

Reagents

Assumed

Verbal Quote

Letter Quote

Contract

Maintenance Supplies

Assumed

Verbal Quote

Letter Quote

Contract

Economic Analysis

If Meaningful

Comparison/ Rejection

Preliminary Evaluation

If Required

Commitment to Final

Feasibility Study

Required

If Requested

Commitment to Project

Project Control

Use of Estimates

AMC Reference Library www.amcconsultants.com.au

Objective of Feasibility Studies

Working capital requirements.

Production schedules, cost and revenue estimates, quarterly for

the first two years, half yearly to the end of year five and

annually thereafter.

A market assessment including the depth of market for the

product and the commodity price.

A detailed description of the sponsors including;

previous experience in this type of project,

experience in the geographical area,

present operations and their financial performance,

current management strengths,

specific form of association of sponsors (joint venture,

partnership, etc.).

A brief checklist includes;

industry structure and competition

historical and projected supply- demand curves

consumption outlook

technological changes or potential substitutions,

project competitiveness in relation to operating mines and

other proposed developments,

specific marketing advantages or disadvantages including

product differentiation.

Environmental considerations, usually involving a full

environmental impact study by experienced consultants.

Political considerations, depending on the country concerned.

Analysis of management and employee skills.

A preliminary financing plan showing the major sources of

finance including;

equity contribution from each partner,

disbursement schedules,

loans from governmental agencies, international or

commercial banks,

overrun financing,

completion guarantees and completion test proposal.

Risk categories for a mining project are;

Under Company Control

Operating:

Technical Costs

Resource/reserve assessment

Participant, i.e., joint venture partners

Completion

Outside Company Control

Reserve realisation

Market

Political

Force majeure type risks including strikes, natural

disasters and wars

Foreign exchange

Under Bank Control

Syndication

Funding

Ideally a bank or financing/lending institution would

like to see a clear and concise review of the project

risks associated with any proposed mining project.

When preparing the Feasibility Study it is very useful to have a

clear statement from the proposed financiers of what they

require. For example, the International Finance Corporation has

a 10-page document setting out its requirements.

AMC Reference Library www.amcconsultants.com.au

You might also like

- Reply To Motion To Dismiss CH 13 Bankruptcy: Benjamin Levi Jones-NormanDocument5 pagesReply To Motion To Dismiss CH 13 Bankruptcy: Benjamin Levi Jones-Normangw9300No ratings yet

- Negotiable InstrumentDocument316 pagesNegotiable InstrumentJosiah Rodolfo Santiago100% (1)

- Bankable Feasibility Study (BFS) For Mining ProjectDocument22 pagesBankable Feasibility Study (BFS) For Mining ProjectSalli Marindha100% (2)

- Use and Abuse of Feasibility StudiesDocument12 pagesUse and Abuse of Feasibility Studiesntvf100% (1)

- Feasibility Studies Made EasyDocument110 pagesFeasibility Studies Made EasyUmer AzharNo ratings yet

- Feasibility StudiesDocument60 pagesFeasibility Studiesice100% (2)

- Agi Dagi - Kirazli PFS - Technical Report (2012)Document448 pagesAgi Dagi - Kirazli PFS - Technical Report (2012)Mutlu ZenginNo ratings yet

- Feasibility StudyDocument53 pagesFeasibility StudyKei Samson88% (48)

- 09 - Civil Engineering Project FeasibilityDocument20 pages09 - Civil Engineering Project FeasibilityQaiser Khan88% (8)

- Fundamentals Feasibility StudyDocument78 pagesFundamentals Feasibility StudyMohamed Mubarak100% (4)

- Philippine Mineral Reporting CodeDocument50 pagesPhilippine Mineral Reporting CodeBelle Estal Palajos100% (6)

- Feasibility Studies - Scope and AccuracyDocument8 pagesFeasibility Studies - Scope and Accuracyminerito2211No ratings yet

- Feasibility Study: A Practical Diy Guide for Sme Projects with a Detailed Case StudyFrom EverandFeasibility Study: A Practical Diy Guide for Sme Projects with a Detailed Case StudyRating: 5 out of 5 stars5/5 (2)

- Feasibility Study Outline PDFDocument3 pagesFeasibility Study Outline PDFgabinuang100% (1)

- Feasibility Study QuestionsDocument1 pageFeasibility Study QuestionsPat Hadji AliNo ratings yet

- !portfolio Optimization With Trade Paring ConstraintsDocument14 pages!portfolio Optimization With Trade Paring ConstraintsivostefanovNo ratings yet

- Project Management Lecture Note 3 - Feasibility StudyDocument22 pagesProject Management Lecture Note 3 - Feasibility StudySixd Waznine100% (1)

- Feasibility StudyDocument4 pagesFeasibility StudytomarifianNo ratings yet

- Technical Economic Feasibility Study PDFDocument125 pagesTechnical Economic Feasibility Study PDFMardi RahardjoNo ratings yet

- The Investment Feasibility StudyDocument9 pagesThe Investment Feasibility StudyBiodun AhmedNo ratings yet

- Feasibility SamplesDocument21 pagesFeasibility Samplesbongmagana50% (2)

- FeasibilityDocument122 pagesFeasibilityparul vyasNo ratings yet

- Feasibility Study SAMPLEDocument106 pagesFeasibility Study SAMPLERia Dumapias60% (5)

- Feasibility Study-FinalDocument137 pagesFeasibility Study-FinalKathleen PardoNo ratings yet

- Feasibility Study BookDocument34 pagesFeasibility Study BookBoboy AzanilNo ratings yet

- Effects of ForgeryDocument2 pagesEffects of ForgeryShine Billones100% (2)

- Feasibility Study and Business PlanDocument37 pagesFeasibility Study and Business PlanRadu Dimana82% (11)

- Hyperloop Feasibility StudyDocument19 pagesHyperloop Feasibility StudyBarbara Geller100% (1)

- 18 Project Feasibility StudyDocument9 pages18 Project Feasibility StudyJemNo ratings yet

- Optimizing Mining Feasibility Studies The 100 Billion OpportunityDocument8 pagesOptimizing Mining Feasibility Studies The 100 Billion OpportunityPatricia GarciaNo ratings yet

- Feasibility StudiesDocument34 pagesFeasibility StudiesVipul TopareNo ratings yet

- Mine Project Life Cycle - Massmin 2004 - Cap04-01Document6 pagesMine Project Life Cycle - Massmin 2004 - Cap04-01Cristian Reyes IlicNo ratings yet

- Pre-Feasibility Study ReportDocument63 pagesPre-Feasibility Study ReportWill Edwardio100% (2)

- Feasibility StudyDocument21 pagesFeasibility StudySerge Olivier Atchu Yudom67% (3)

- What Is A Project Feasibility StudyDocument22 pagesWhat Is A Project Feasibility StudyDaleKevinAmagsilaRoqueNo ratings yet

- Imam Hassan Furnitures and Fixtures: Pre-Feasibility Study (Furniture Manufacturing Unit)Document7 pagesImam Hassan Furnitures and Fixtures: Pre-Feasibility Study (Furniture Manufacturing Unit)jibranNo ratings yet

- Steps in A Feasibility StudyDocument7 pagesSteps in A Feasibility Studybereket worede100% (1)

- CHAPTER 2 - Lifecycle of A Project ManagementDocument35 pagesCHAPTER 2 - Lifecycle of A Project ManagementhalinaNo ratings yet

- San Ramon Feasibility StudyDocument467 pagesSan Ramon Feasibility StudyPabsepulvNo ratings yet

- Aspects of Evaluating Mining ProjectsDocument12 pagesAspects of Evaluating Mining ProjectsIury VazNo ratings yet

- Fire Protection For StorageDocument4 pagesFire Protection For StorageAnonymous wtK1AZBiNo ratings yet

- Hospital Equipments PrecurmentDocument10 pagesHospital Equipments PrecurmentRashid UmerNo ratings yet

- Feasibility Study - SamplesDocument14 pagesFeasibility Study - SamplesAi Zy67% (3)

- 243 Rupprecht PDFDocument6 pages243 Rupprecht PDFdonnypsNo ratings yet

- Sample Feasibility StudyDocument39 pagesSample Feasibility StudyMycha P. EncarnacionNo ratings yet

- Individual Project Feasibility AnalysisDocument14 pagesIndividual Project Feasibility AnalysislpelessNo ratings yet

- 5 Initial Study Inputs RSR Feasibility Project StudyDocument4 pages5 Initial Study Inputs RSR Feasibility Project StudyGinny MontalbanNo ratings yet

- Feasibility Study (Compatibility Mode)Document35 pagesFeasibility Study (Compatibility Mode)Deep ShahNo ratings yet

- Feasibility Studies (Building Surveying UiTM)Document11 pagesFeasibility Studies (Building Surveying UiTM)Muzzammil AyobNo ratings yet

- SAAD Tutorial - Feasibility StudyDocument3 pagesSAAD Tutorial - Feasibility Studyflowerpot321No ratings yet

- Feasibility ReportDocument29 pagesFeasibility ReportArya AnujNo ratings yet

- Feasibility StudyDocument17 pagesFeasibility StudyHazelle CarmeloNo ratings yet

- Progress Report of Nepal Electricity Authority 2013Document120 pagesProgress Report of Nepal Electricity Authority 2013Vijay TamrakarNo ratings yet

- Stages of MININGDocument6 pagesStages of MININGRonipet II LopezNo ratings yet

- AP Feasibility StudyDocument176 pagesAP Feasibility Studyghkashyap1No ratings yet

- Project Feasibility Study For The Establishment of Footwear and Accessory ProductsDocument13 pagesProject Feasibility Study For The Establishment of Footwear and Accessory ProductsEphremNo ratings yet

- Economic and Market AnalysisDocument5 pagesEconomic and Market AnalysisAlba PeaceNo ratings yet

- Project Cycle Model IPPMC and DEPSADocument12 pagesProject Cycle Model IPPMC and DEPSAyetmNo ratings yet

- Am Tris Resume Update-1Document6 pagesAm Tris Resume Update-1AMTRISNo ratings yet

- McDonald Case StudyDocument9 pagesMcDonald Case StudyAnuranjanSinhaNo ratings yet

- Introduction Feasibility Study Hotel ConstructionDocument4 pagesIntroduction Feasibility Study Hotel ConstructionEckae Valiente100% (2)

- Bytex FeasibilityDocument1 pageBytex FeasibilityjimdougNo ratings yet

- Aneela Riaz Shabana Parveen: Feasibility Report Restaurant in JeddahDocument25 pagesAneela Riaz Shabana Parveen: Feasibility Report Restaurant in Jeddahmalik NajibullahNo ratings yet

- Intro Mining First AssignmnetDocument10 pagesIntro Mining First AssignmnetTemesgen SilabatNo ratings yet

- Processing Fatal Flaws in Due Diligences - Newell - Key Note PaperDocument22 pagesProcessing Fatal Flaws in Due Diligences - Newell - Key Note PaperanewellNo ratings yet

- Feasibility Studies For Deep Mines PDFDocument6 pagesFeasibility Studies For Deep Mines PDFgzapasNo ratings yet

- Loredana Bleiziffer - CV GeneralDocument2 pagesLoredana Bleiziffer - CV GeneralLoredana BleizifferNo ratings yet

- Product Development and Key ConceptsDocument11 pagesProduct Development and Key ConceptsNoah Ras LobitañaNo ratings yet

- BHS InggrisDocument27 pagesBHS InggrisJatmikoNo ratings yet

- Mattel Recalls 2007: Communication Implications For Quality Control, Outsourcing, and Consumer RelationsDocument28 pagesMattel Recalls 2007: Communication Implications For Quality Control, Outsourcing, and Consumer RelationsSasha KhalishahNo ratings yet

- FRM Syllabus With Topic-Wise Weightage and Sub TopicsDocument8 pagesFRM Syllabus With Topic-Wise Weightage and Sub TopicsSushil MundelNo ratings yet

- Tradewise Policy SummaryDocument2 pagesTradewise Policy SummaryadrianxtrnNo ratings yet

- IATF Rules 5th Edition - FAQs 1 3 - 23jan2017 - FINAL PDFDocument6 pagesIATF Rules 5th Edition - FAQs 1 3 - 23jan2017 - FINAL PDFsathyabalaramanNo ratings yet

- Chapter 04Document5 pagesChapter 04Madina SuleimenovaNo ratings yet

- What Is Hypothesis Testing Procedure - Business JargonsDocument8 pagesWhat Is Hypothesis Testing Procedure - Business JargonsSivaNo ratings yet

- 5SDocument5 pages5SRamakant PandeyNo ratings yet

- Adjustment of Claim For Collision Liability and Division of RecoveryDocument8 pagesAdjustment of Claim For Collision Liability and Division of RecoveryKelvin KessyNo ratings yet

- Brother Printers Advertising PlanDocument52 pagesBrother Printers Advertising PlanMohamed Mourad75% (4)

- Heizer 17-1Document33 pagesHeizer 17-1Ahmad ArdiansyahNo ratings yet

- Certificate of Calibration: Global ServicesDocument10 pagesCertificate of Calibration: Global ServicesAhmed Shaban KotbNo ratings yet

- Executive Administrative Professional or Executive AdministrativDocument3 pagesExecutive Administrative Professional or Executive Administrativapi-77797201No ratings yet

- BTAX1 Group Assignment PDFDocument2 pagesBTAX1 Group Assignment PDFkasad jdnfrnas0% (1)

- A Project Report On "Recruitment & Selection Procedure": Andromeda Marketing Pvt. LTDDocument91 pagesA Project Report On "Recruitment & Selection Procedure": Andromeda Marketing Pvt. LTDManjeet Singh0% (1)

- Architect Shyam SinghDocument29 pagesArchitect Shyam SinghShyam SinghNo ratings yet

- Banty DocumentsDocument82 pagesBanty DocumentsPandu TiruveedhulaNo ratings yet

- PP1Document7 pagesPP1yaminiNo ratings yet

- Just in Time Manufacturing SEMINARDocument15 pagesJust in Time Manufacturing SEMINARpavithra222No ratings yet

- What WHY AND: Business Problems Solved Through Desi Network-Bouncing BoardsDocument4 pagesWhat WHY AND: Business Problems Solved Through Desi Network-Bouncing BoardsMotivational ExpeditiousNo ratings yet

- Tirumala Tirupati DevasthanamsDocument1 pageTirumala Tirupati DevasthanamsKKVSANTOSHNo ratings yet

- L & D Module 1Document83 pagesL & D Module 1surbhiNo ratings yet