Professional Documents

Culture Documents

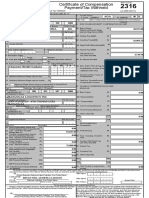

2316 JAKE

Uploaded by

JM HernandezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2316 JAKE

Uploaded by

JM HernandezCopyright:

Available Formats

DLN:

Certificate of Compensation

Payment/Tax Withheld

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

For Compensation Payment With or Without Tax Withheld

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

1

For the Year

( YYYY )

2015

Part I

Employee Information

3 Taxpayer

Identification No.

242

17

211

4 Employee's Name (Last Name, First Name,

8 Middle Name)

53A

6A Zip Code

B32 L43 OZAITA ST., BF RESORT, LAS

6B Local

Home Address

PINAS

6C Zip Code

6D Foreign Address

6E Zip Code

7 Date of Birth (MM/DD/YYYY)

10

06

8 Telephone Number

1981

9 Exemption Status

Single

For the Period

From (MM/DD)

12

01

To (MM/DD)

Amount

A. NON-TAXABLE/EXEMPT COMPENSATION INCOME

32 Basic Salary/

Statutory Minimum Wage

32

Minimum Wage Earner (MWE)

33 Holiday Pay (MWE)

33

34 Overtime Pay (MWE)

34

35 Night Shift Differential (MWE)

35

36 Hazard Pay (MWE)

36

37 13th Month Pay

and Other Benefits

37

38 De Minimis Benefits

38

39 SSS, GSIS, PHIC & Pag-ibig

Contributions, & Union Dues

39

Married

9A Is the wife claiming the additional exemption for qualified dependent children?

Yes

10 Name of Qualified Dependent Children

12

31

Details of Compensation Income and Tax Withheld from Present Employer

5 RDO Code

SANTOS, ARISTOTLE G.

6 Registered Address

2316

July 2008 (ENCS)

Part IV-B

000

BIR Form No.

30,000.00

No

11 Date of Birth (MM/DD/YYYY)

ARIANE JOSETTE C. SANTOS

ARESON JAMES C. SANTOS

02

14

12

28

2007

12 Statutory Minimum Wage rate per day

12

13 Statutory Minimum Wage rate per month

13

2004

Minimum Wage Earner whose compensation is exempt from

withholding tax and not subject to income tax

Part II

Employer Information (Present)

15 Taxpayer

Identification No.

006

51

687

000

16 Employer's Name

6

16,480.64

(Employee share only)

40 Salaries & Other Forms of

Compensation

40

41 Total Non-Taxable/Exempt

Compensation Income

41

14

O & S TRADING AND CONSTRCTION SUPPLY

17 Registered

17A Zip Code

INC. Address

NAGA RD., PULANG LUPA 2, LAS

1740

Secondary Employer

PINASMain Employer

Part III

Employer Information (Previous)

18 Taxpayer

Identification No.

19 Employer's Name

20 Registered Address

20A Zip Code

Part IV-A

21 Gross Compensation Income from

Summary

21

B. TAXABLE COMPENSATION INCOME

REGULAR

42 Basic Salary

42

43

43 Representation

44 Transportation

44

45 Cost of Living Allowance

45

46 Fixed Housing Allowance

46

47 Others (Specify)

47A

47A

47B

47B

SUPPLEMENTARY

48 Commission

48

49 Profit Sharing

49

50 Fees Including Director's

Fees

50

51 Taxable 13th Month Pay

and Other Benefits

51

52 Hazard Pay

52

53 Overtime Pay

53

4,200,000.00

Present Employer (Item 41 plus Item 55)

22 Less: Total Non-Taxable/

22

4,246,480.64

23

46,480.64

24 Add: Taxable Compensation

Income from Previous Employer

25 Gross Taxable

Compensation Income

26 Less: Total Exemptions

24

4,200,000.00

26

4,200,000.00

27 Less: Premium Paid on Health

27

50,000.00

Exempt (Item 41)

23 Taxable Compensation Income

from Present Employer (Item 55)

25

and/or Hospital Insurance (If applicable)

28 Net Taxable

Compensation Income

29 Tax Due

28

29

30 Amount of Taxes Withheld

30A Present Employer

30A

30B Previous Employer

30B

31 Total Amount of Taxes Withheld

As adjusted

31

0.00

0.00

4,155,000.00

54 Others (Specify)

1,277,164.38

54A

54A

54B

54B

1,277,164.38

55 Total Taxable Compensation

Income

0.00

55

4,200,000.00

We declare, under the penalties of perjury,1,277,164.38

that this certificate has been made in good faith, verified by us, and to the best of our knowledge

and belief, is true and correct

pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

Date Signed

56

SAMSON SERVIDAD

Present Employer/ Authorized Agent Signature Over Printed Name

CONFORME:

57

CTC No.

of Employee

ARISTOTLE G. SANTOS

Employee Signature Over Printed Name

Place of Issue

Date Signed

Amount Paid

Date of Issue

To be accomplished under substituted filing

I declare, under the penalties of perjury, that the information herein stated are reported

under BIR Form No. 1604CF which has been filed with the Bureau of Internal Revenue.

58

SAMSON SERVIDAD

Present Employer/ Authorized Agent Signature Over Printed Name

(Head of Accounting/ Human Resource or Authorized Representative)

I declare,under the penalties of perjury that I am qualified under substituted filing of

Income Tax Returns(BIR Form No. 1700), since I received purely compensation income

from only one employer in the Phils. for the calendar year; that taxes have been

correctly withheld by my employer (tax due equals tax withheld); that the BIR Form

No. 1604CF filed by my employer to the BIR shall constitute as my income tax return;

and that BIR Form No. 2316 shall serve the same purpose as if BIR Form No. 1700

had been filed pursuant to the provisions of RR No. 3-2002, as amended.

59

ARISTOTLE G. SANTOS

Employee Signature Over Printed Name

You might also like

- IT Certificate 622197149Document1 pageIT Certificate 622197149karimshiekNo ratings yet

- Beer Duty Return by Keyconsulting UKDocument2 pagesBeer Duty Return by Keyconsulting UKKeyconsulting UKNo ratings yet

- Sana MabagoDocument1 pageSana MabagojoystambaNo ratings yet

- PD851Document1 pagePD851jenNo ratings yet

- New Application Form Importer Non-Individual RMO 56-2016 - CopyDocument1 pageNew Application Form Importer Non-Individual RMO 56-2016 - CopyKhay-Ar PagdilaoNo ratings yet

- San Pablo City Water District Laguna Executive Summary 2021 PDFDocument8 pagesSan Pablo City Water District Laguna Executive Summary 2021 PDFJohn Archie SerranoNo ratings yet

- Chapter 5 - Employee Benefits Part 1Document7 pagesChapter 5 - Employee Benefits Part 1XienaNo ratings yet

- Handling BIR Tax Examination For COOPS EVR PDFDocument133 pagesHandling BIR Tax Examination For COOPS EVR PDFGracel Joy Galeno100% (1)

- How To Use BIR FormsDocument52 pagesHow To Use BIR Formsbalinghoy#hotmail_com2147No ratings yet

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- Certification Statement of Management's Responsibility (Itr)Document1 pageCertification Statement of Management's Responsibility (Itr)Earl Jhune Amoranto100% (1)

- Notes To Financial StatementsDocument9 pagesNotes To Financial StatementsCheryl FuentesNo ratings yet

- Afar MCQ PracticeDocument79 pagesAfar MCQ PracticeAlysa dawn CabrestanteNo ratings yet

- BIR Form 1701QDocument2 pagesBIR Form 1701QfileksNo ratings yet

- Philhealth Schedule of FeesDocument6 pagesPhilhealth Schedule of FeesNina Rhose OcsoNo ratings yet

- Practice Test - Financial ManagementDocument6 pagesPractice Test - Financial Managementelongoria278100% (1)

- Guidelines and Instruction For BIR Form No 1702 RTDocument2 pagesGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- Estate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andDocument6 pagesEstate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andAngelyn SamandeNo ratings yet

- SSS R-5 Employer Payment ReturnDocument2 pagesSSS R-5 Employer Payment ReturnJimzon Kristian JimenezNo ratings yet

- Alpha ListDocument22 pagesAlpha ListArnold BaladjayNo ratings yet

- Oregon Public Employees Retirement (PERS) 2001Document74 pagesOregon Public Employees Retirement (PERS) 2001BiloxiMarxNo ratings yet

- Manual Payroll Processing System - Flowchart: WALLIS, Franchelle P. Ae 111 Ais Coa Blk2A WSAT 1:30-5:30Document3 pagesManual Payroll Processing System - Flowchart: WALLIS, Franchelle P. Ae 111 Ais Coa Blk2A WSAT 1:30-5:30FranchNo ratings yet

- Bir Ruling 044-10Document4 pagesBir Ruling 044-10Jason CertezaNo ratings yet

- Tax 1 Cases - Government Remedies Batch 2Document24 pagesTax 1 Cases - Government Remedies Batch 2Krissie GuevaraNo ratings yet

- Oregon Public Employees Retirement (PERS) 2007Document108 pagesOregon Public Employees Retirement (PERS) 2007BiloxiMarxNo ratings yet

- Republic of The Philippines) ) S.S.Document4 pagesRepublic of The Philippines) ) S.S.Noan SimanNo ratings yet

- Intermediate Accounting 3 PDFDocument86 pagesIntermediate Accounting 3 PDFChelsy SantosNo ratings yet

- Withholding Tax 101Document82 pagesWithholding Tax 101Maria GinalynNo ratings yet

- 82202BIR Form 1702-MXDocument9 pages82202BIR Form 1702-MXRen A EleponioNo ratings yet

- 62983rmo 5-2012Document14 pages62983rmo 5-2012Mark Dennis JovenNo ratings yet

- Annual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 2 I I 0 1 3Document9 pagesAnnual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 2 I I 0 1 3albertNo ratings yet

- 5 Features of Economic Zones Under PEZA in The Philippines - Tax and Accounting Center, IncDocument7 pages5 Features of Economic Zones Under PEZA in The Philippines - Tax and Accounting Center, IncMartin MartelNo ratings yet

- Basic Concepts of TaxationDocument5 pagesBasic Concepts of TaxationRhea Javed100% (1)

- 267731702final PDFDocument5 pages267731702final PDFelmarcomonal100% (1)

- Total Rewards For Civil Servants - WB - MukherjeeDocument6 pagesTotal Rewards For Civil Servants - WB - MukherjeeAngel Tejeda MorenoNo ratings yet

- Salient Points of TRAIN LawDocument21 pagesSalient Points of TRAIN LawNani kore100% (1)

- FM LR 005 DO18 A Application FormDocument2 pagesFM LR 005 DO18 A Application FormNatura ManilaNo ratings yet

- Case Sample 1Document3 pagesCase Sample 1Shivam AroraNo ratings yet

- Withholding Taxes 2Document20 pagesWithholding Taxes 2hildaNo ratings yet

- Design and Construction of An Automatic Emergency - Lighting - SystemDocument9 pagesDesign and Construction of An Automatic Emergency - Lighting - SystemSadiq ShittuNo ratings yet

- BIR Ruling DA-648-04Document2 pagesBIR Ruling DA-648-04Phoebe SpaurekNo ratings yet

- Final Withholding Tax FWT and CapitalDocument39 pagesFinal Withholding Tax FWT and CapitalJessa HerreraNo ratings yet

- Steps For EfpsDocument3 pagesSteps For EfpsMarites Domingo - PaquibulanNo ratings yet

- 1601E - August 2008Document3 pages1601E - August 2008lovesresearchNo ratings yet

- Diagnostic in Basic AccountingDocument5 pagesDiagnostic in Basic Accountingjapvivi cece100% (2)

- 2.1. Property Plant and Equipment IAS 16Document7 pages2.1. Property Plant and Equipment IAS 16Priya Satheesh100% (1)

- Estate Tax PDFDocument13 pagesEstate Tax PDFAlexis Jaina TinaanNo ratings yet

- ACC-553 Federal Taxation Midterm Exam (Keller)Document9 pagesACC-553 Federal Taxation Midterm Exam (Keller)robertmoreno0% (1)

- Valencia FBT Chapter 6 5th EditionDocument8 pagesValencia FBT Chapter 6 5th EditionJacob AcostaNo ratings yet

- Bir Forms PDFDocument4 pagesBir Forms PDFgaryNo ratings yet

- Mastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresDocument66 pagesMastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresClarine Kyla Bautista100% (1)

- Cta 2D CV 09224 M 2019feb12 AssDocument17 pagesCta 2D CV 09224 M 2019feb12 AssMelan YapNo ratings yet

- Vat Audit ManualDocument47 pagesVat Audit ManualViswanadham ChallaNo ratings yet

- Annex C-1 - Summary of System DescriptionDocument4 pagesAnnex C-1 - Summary of System DescriptionChristian Albert HerreraNo ratings yet

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Document7 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)rain06021992No ratings yet

- RR 16 2008Document8 pagesRR 16 2008Ruby ReyesNo ratings yet

- CTA - 2D - CV - 09618 - M - 2022SEP21 - ASS - Motion To Release Cash BondDocument11 pagesCTA - 2D - CV - 09618 - M - 2022SEP21 - ASS - Motion To Release Cash BondFirenze PHNo ratings yet

- Grade ReportDocument1 pageGrade ReportRalph Gregor PadolinaNo ratings yet

- Objective Type Questions and Answers On Central ExciseDocument5 pagesObjective Type Questions and Answers On Central ExciseGayathri Prasad Gayathri0% (2)

- Documentary Stamp TaxDocument7 pagesDocumentary Stamp TaxJenny KimmeyNo ratings yet

- Gadiano 2316Document2 pagesGadiano 2316Jypy Torrejos100% (1)

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldRoger BernasorNo ratings yet

- RBC Rate Sheet For Region 4A (As of July 01 2016)Document7 pagesRBC Rate Sheet For Region 4A (As of July 01 2016)JM HernandezNo ratings yet

- RBC DirectoryDocument1 pageRBC DirectoryJM HernandezNo ratings yet

- Atm RequestDocument2 pagesAtm RequestJM HernandezNo ratings yet

- Lorenzo Oliver Hernandez Iv: Email AddDocument2 pagesLorenzo Oliver Hernandez Iv: Email AddJM HernandezNo ratings yet

- YPI Rpan Supp TemplateDocument75 pagesYPI Rpan Supp TemplateJM HernandezNo ratings yet

- RBC Filing August 1 Period RBC Filing August 1 Period RBC FilingDocument2 pagesRBC Filing August 1 Period RBC Filing August 1 Period RBC FilingJM HernandezNo ratings yet

- Minimum Wage Matrix Shee (29) NEW (10-04-2016)Document13 pagesMinimum Wage Matrix Shee (29) NEW (10-04-2016)JM HernandezNo ratings yet

- Clarence N. Gonzales: ObjectiveDocument2 pagesClarence N. Gonzales: ObjectiveJM HernandezNo ratings yet

- English 1 Directions. Color The Soft Sounds Yellow. Color The Loud Sounds RedDocument1 pageEnglish 1 Directions. Color The Soft Sounds Yellow. Color The Loud Sounds RedJM HernandezNo ratings yet

- United States Court of Appeals, Second Circuit.: Docket Nos. 94-1161, 94-1192Document16 pagesUnited States Court of Appeals, Second Circuit.: Docket Nos. 94-1161, 94-1192Scribd Government DocsNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)priyanka priyadarsini singhNo ratings yet

- Indicative Taxnet Profile: Personal InformationDocument4 pagesIndicative Taxnet Profile: Personal InformationAbdul WadoodNo ratings yet

- Morpheus Proposal PoLL 2Document12 pagesMorpheus Proposal PoLL 2Papers of the Libertarian LeftNo ratings yet

- Maruti Suzuki Financial StatementDocument5 pagesMaruti Suzuki Financial StatementMasoud AfzaliNo ratings yet

- AP Micro Syllabus - 20222023Document11 pagesAP Micro Syllabus - 20222023Sarah SeeharNo ratings yet

- Chapter 5 DDR A231Document14 pagesChapter 5 DDR A231Patricia TangNo ratings yet

- Case 3 - Andy 2015Document14 pagesCase 3 - Andy 2015api-306226330No ratings yet

- Exercixe1-Consultant PO 1Document6 pagesExercixe1-Consultant PO 1Saima SharifNo ratings yet

- Henry Has The Following Data For The YeaDocument3 pagesHenry Has The Following Data For The YeaQueen ValleNo ratings yet

- BestBari - Marketing Agreement - Property Sales (MARC Holdings LTD)Document4 pagesBestBari - Marketing Agreement - Property Sales (MARC Holdings LTD)Abdullah HridoyNo ratings yet

- Gurughasidas Central University, Bilaspur: "Power and Duties of Income-Tax Authorities"Document20 pagesGurughasidas Central University, Bilaspur: "Power and Duties of Income-Tax Authorities"Kishori PatelNo ratings yet

- Basyiruddin & Wildan: Company ProfileDocument18 pagesBasyiruddin & Wildan: Company ProfileAnggun SomariiNo ratings yet

- R R MarblesDocument9 pagesR R Marblessri sai digital careNo ratings yet

- The Church and The Tax Law: Keeping Church and State SeparateDocument19 pagesThe Church and The Tax Law: Keeping Church and State SeparateAlbertoNo ratings yet

- 7 City of Davao V RTC BR XIIDocument6 pages7 City of Davao V RTC BR XIIUlyung DiamanteNo ratings yet

- Ontario Production Services TAX Credit (Opstc) : Ontario Media Development Corporation (OMDC)Document46 pagesOntario Production Services TAX Credit (Opstc) : Ontario Media Development Corporation (OMDC)efex66No ratings yet

- Civil Law Review 2 Midterms FinalDocument44 pagesCivil Law Review 2 Midterms FinalTapix-Jr TapiaNo ratings yet

- Law On Charity and Sponsorship LithuaniaDocument4 pagesLaw On Charity and Sponsorship LithuaniaRosa Martin HuelvesNo ratings yet

- BUSN 6020 - Midterm - Moodle - REVIEW PDFDocument24 pagesBUSN 6020 - Midterm - Moodle - REVIEW PDFAmit GuptaNo ratings yet

- Final Project Sasti Roti SchemeDocument28 pagesFinal Project Sasti Roti SchemeRahat Ul Aain50% (2)

- Indiana University of Pennsylvania Affidavit of Financial SupportDocument1 pageIndiana University of Pennsylvania Affidavit of Financial Supportadani9No ratings yet

- ENC 3250 Exercise by Samantha OuimetteDocument10 pagesENC 3250 Exercise by Samantha OuimetteouimetteNo ratings yet

- Summer Training Project Report On Real EstateDocument61 pagesSummer Training Project Report On Real EstateKajal Heer100% (4)

- Botswana-Training For Inspectors On Iso-Iec 17020Document30 pagesBotswana-Training For Inspectors On Iso-Iec 17020SankaranarayananNo ratings yet

- Tax - Talusan Vs TayagDocument1 pageTax - Talusan Vs TayagthedoodlbotNo ratings yet

- Investment Law: Assignment On Dividends and Capital GainsDocument8 pagesInvestment Law: Assignment On Dividends and Capital GainsAmirZargarNo ratings yet

- 3-Statement CompactDocument4 pages3-Statement CompactJames BondNo ratings yet