Professional Documents

Culture Documents

Revenue and Expenditure

Uploaded by

Yusuf HusseinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revenue and Expenditure

Uploaded by

Yusuf HusseinCopyright:

Available Formats

Revenue

1. REVENUE RECEIPTS

A. Tax Revenue

Tax revenue includes all the revenues earned through various kinds of taxes.taxes are broadly

divided into direct & indirect taxes.

Direct Tax Corporation Tax , Income Tax, Interest Tax, Wealth Tax, Gift Tax, Div.

Distribution Tax, Personal Income Tax, Fringe Benefit taxes, Banking Cash Transaction

Tax

indirect tax custom duties , excise duties, sales tax, service tax

B. Non tax

It includes the revenue accruing to the government from sources other than tax, these are; ,

interest receipts, dividends, grants, fines

2. CAPITAL RECEIPTs

These include borrowing of the government, since these receipts have to be repaid by the

government, the capital receipts are liabilities, capital receipts include public borrowing,

recovery of loans and resale of shares and bonds held by the government.

Expenditure

1. Revenue Expenditure

It is the expenditure incurred for the day-to-day functioning of the government departments and

various services offered to the people, etc. Revenue expenditure will not result in the creation

of assets

2. Capital Expenditure

capital expenditure is the expenditure incurred on creating permanent assets, such

expenditure is incurred on items like construction of buildings ,roads, bridges, canals

,power plants, capital equipments

You might also like

- GOVERNMENT BUDGET GUIDEDocument7 pagesGOVERNMENT BUDGET GUIDEDope 90No ratings yet

- Sources of Public RevenueDocument2 pagesSources of Public RevenueDipak Nalang75% (4)

- F018 How To Read A BudgetDocument3 pagesF018 How To Read A BudgetSanjana SinghNo ratings yet

- Sources of Public Revenue and Classification of TaxesDocument3 pagesSources of Public Revenue and Classification of TaxesSiddhuNo ratings yet

- Govt Budget Part 2Document17 pagesGovt Budget Part 2Devarsh :DNo ratings yet

- Chapter-8 Bbs 2 NDDocument32 pagesChapter-8 Bbs 2 NDmagardiwakar11No ratings yet

- Classnote 1 - IPF - Module 3 - 23 Oct 2023Document117 pagesClassnote 1 - IPF - Module 3 - 23 Oct 2023Hope LessNo ratings yet

- SYJC Public EconomicsDocument16 pagesSYJC Public EconomicsAagam NanduNo ratings yet

- Public Revenue Sources and ClassificationDocument37 pagesPublic Revenue Sources and ClassificationApon MajumderNo ratings yet

- Topic 4 Roles of Government PolicyDocument9 pagesTopic 4 Roles of Government PolicyTIRANo ratings yet

- Calculate Tax First DraftDocument12 pagesCalculate Tax First DraftTegene TesfayeNo ratings yet

- Government Budget ExplainedDocument6 pagesGovernment Budget ExplainedGoursankar RajNo ratings yet

- Eco With Atm: Government Budget and The EconomyDocument11 pagesEco With Atm: Government Budget and The EconomyKeshav KhandelwalNo ratings yet

- Public Revenue Sources DefinedDocument11 pagesPublic Revenue Sources DefinedIfaz Mohammed Islam 1921237030No ratings yet

- General Concepts What Is Public Finance?Document13 pagesGeneral Concepts What Is Public Finance?Black boxNo ratings yet

- Government Budget and BOP-1Document97 pagesGovernment Budget and BOP-1Sahil Raj RavenerNo ratings yet

- Government BudgetDocument28 pagesGovernment Budgetshauryakumar421100% (1)

- Economics Project WorkDocument27 pagesEconomics Project WorkBashar Ahmed100% (4)

- Government Budget and The EconomyDocument10 pagesGovernment Budget and The EconomyFathimaNo ratings yet

- Wa0002.Document6 pagesWa0002.ayushsingh7173No ratings yet

- Calculate Administer, Taxes, Fee and Other ChargesDocument39 pagesCalculate Administer, Taxes, Fee and Other ChargesGena HamdaNo ratings yet

- Public Economics: Budget & Its TypesDocument24 pagesPublic Economics: Budget & Its TypesMahesh Rasal0% (1)

- Fiscal IndicatorsDocument21 pagesFiscal IndicatorsBhanu UpadhyayNo ratings yet

- Budget-Terminologies and Concepts: Classification of Expenditure of GovernmentDocument3 pagesBudget-Terminologies and Concepts: Classification of Expenditure of GovernmentdassreerenjiniNo ratings yet

- Understanding Public Finance: Revenues, Expenditures, Budgets and BorrowingsDocument66 pagesUnderstanding Public Finance: Revenues, Expenditures, Budgets and BorrowingsLovely Rizziah Dajao CimafrancaNo ratings yet

- Public RevenueDocument17 pagesPublic RevenueNamrata More100% (1)

- The Revenues From Different Sources Received by The Government Are Called Public RevenuesDocument2 pagesThe Revenues From Different Sources Received by The Government Are Called Public Revenuessohan shresthaNo ratings yet

- Public Finance PolyDocument65 pagesPublic Finance PolyNeelabh KumarNo ratings yet

- Public Financ and Taxation-Chapter TwoDocument19 pagesPublic Financ and Taxation-Chapter TwoEyuel SintayehuNo ratings yet

- Government Budget Guide: Key Types and ObjectivesDocument15 pagesGovernment Budget Guide: Key Types and ObjectivesSaja FarsanaNo ratings yet

- Government Budget and The EconomyDocument8 pagesGovernment Budget and The EconomyAryan Rawat100% (1)

- UNIT-2 Public Revenue: An Overview of PRDocument67 pagesUNIT-2 Public Revenue: An Overview of PRmelaNo ratings yet

- Govt BudgetDocument38 pagesGovt BudgetRishab JainNo ratings yet

- Government Budget and Its ComponentsDocument7 pagesGovernment Budget and Its ComponentsRitesh Kumar SharmaNo ratings yet

- Government Budget Notes PDFDocument22 pagesGovernment Budget Notes PDFShivam MutkuleNo ratings yet

- Economic Glossary: Union BudgetDocument3 pagesEconomic Glossary: Union BudgetSanjay kumarNo ratings yet

- Budget Concepts and Terminologies Yojana March 2013Document3 pagesBudget Concepts and Terminologies Yojana March 2013gowsikhNo ratings yet

- 3taxation Cha 3Document15 pages3taxation Cha 3Lakachew GetasewNo ratings yet

- Public Finance-PARANADA, Diana, QUEJADO, Narcisa TAGLE, EugeneDocument54 pagesPublic Finance-PARANADA, Diana, QUEJADO, Narcisa TAGLE, EugeneJERRALYN ALVANo ratings yet

- Government Budget Objectives and ComponentsDocument11 pagesGovernment Budget Objectives and ComponentsBhagya aggarwalNo ratings yet

- Government's Three Key Economic FunctionsDocument10 pagesGovernment's Three Key Economic FunctionsNeel ChaurushiNo ratings yet

- Union Budget 2022-23 PDFDocument25 pagesUnion Budget 2022-23 PDFabhi JhaNo ratings yet

- economicproject-220513142118-58e4c686Document37 pageseconomicproject-220513142118-58e4c686Chandrima MannaNo ratings yet

- Ch1 TaxDocument96 pagesCh1 Taxnatnaelsleshi3No ratings yet

- Public Finance & IT Law 222Document29 pagesPublic Finance & IT Law 222Arun ANNo ratings yet

- EconomyDocument19 pagesEconomymirgasha10No ratings yet

- 4 T KHV DEzt 3 Yffbr Q8 Rce UKT2 U QW R3 V SYYo HP Ii CMDocument19 pages4 T KHV DEzt 3 Yffbr Q8 Rce UKT2 U QW R3 V SYYo HP Ii CManiket singhNo ratings yet

- Indian Union Budget: Sameer Bakshi AlakanandaDocument14 pagesIndian Union Budget: Sameer Bakshi Alakanandasameer bakshiNo ratings yet

- Module - 2 Public RevenueDocument11 pagesModule - 2 Public RevenueGargstudy PointNo ratings yet

- Union Budget 2022-23 - PrintableDocument18 pagesUnion Budget 2022-23 - Printablesum ranjan patraNo ratings yet

- Government Budget Objectives and ImpactDocument21 pagesGovernment Budget Objectives and ImpactSireen IqbalNo ratings yet

- Public SectorDocument2 pagesPublic SectorDarlyn CarelNo ratings yet

- Public Finance NoteDocument6 pagesPublic Finance NotenarrNo ratings yet

- Understanding the Federal BudgetDocument4 pagesUnderstanding the Federal BudgetClevin CkNo ratings yet

- Hugh Dalton's Classification of Public Expenditure and Non-Tax Revenue SourcesDocument1 pageHugh Dalton's Classification of Public Expenditure and Non-Tax Revenue SourcesshababNo ratings yet

- Budget Glossary: Appropriation BillDocument4 pagesBudget Glossary: Appropriation BillNandan RathoreNo ratings yet

- Government Budget and The EconomyDocument7 pagesGovernment Budget and The EconomyChinmay AgarwalNo ratings yet

- Fiscal PolicyDocument26 pagesFiscal PolicyLourdes Anne ManapatNo ratings yet

- Government Budget and The Economy-STDocument14 pagesGovernment Budget and The Economy-STSafwa KhasimNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Ch02 LeadershipDocument60 pagesCh02 LeadershipYusuf HusseinNo ratings yet

- Final Exam Research Methods ANTH 410/510Document7 pagesFinal Exam Research Methods ANTH 410/510Yusuf HusseinNo ratings yet

- Linear Regression Is An Important Concept in Finance and Practically All Forms of ResearchDocument10 pagesLinear Regression Is An Important Concept in Finance and Practically All Forms of ResearchYusuf HusseinNo ratings yet

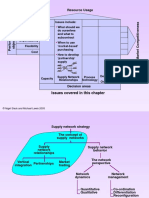

- Resource Usage: Issues Covered in This ChapterDocument21 pagesResource Usage: Issues Covered in This ChapterYusuf HusseinNo ratings yet

- Statistics and Research MethodsDocument5 pagesStatistics and Research MethodsYusuf HusseinNo ratings yet

- Lec 1 - Introduction To Wireless CommunicationDocument60 pagesLec 1 - Introduction To Wireless CommunicationYusuf HusseinNo ratings yet

- Abdc Journal Quality List 2013Document32 pagesAbdc Journal Quality List 2013PratikJainNo ratings yet

- Lesson ThreeDocument14 pagesLesson ThreeYusuf HusseinNo ratings yet

- Acc 255 Final Exam Review Packet (New Material)Document6 pagesAcc 255 Final Exam Review Packet (New Material)Tajalli FatimaNo ratings yet

- Yaaqshiid: 1 Xaafadaha, Laamaha Iyo Waax-AhaDocument4 pagesYaaqshiid: 1 Xaafadaha, Laamaha Iyo Waax-AhaYusuf HusseinNo ratings yet

- Format of The ResearchDocument2 pagesFormat of The ResearchYusuf HusseinNo ratings yet

- Except The: Income Sharing RatioDocument1 pageExcept The: Income Sharing RatioYusuf HusseinNo ratings yet

- Chapter Four: Entering Beginning BalancesDocument4 pagesChapter Four: Entering Beginning BalancesYusuf HusseinNo ratings yet

- BankingDocument20 pagesBankingYusuf HusseinNo ratings yet

- Exam 2 Sample SolutionDocument6 pagesExam 2 Sample SolutionYusuf HusseinNo ratings yet

- RSH - Qam11 - Excel and Excel QM Explsm2010Document153 pagesRSH - Qam11 - Excel and Excel QM Explsm2010Yusuf HusseinNo ratings yet

- QuizzDocument1 pageQuizzYusuf HusseinNo ratings yet

- Ackoff's Management Misinformation SystemsDocument5 pagesAckoff's Management Misinformation SystemsAnna KarousiotiNo ratings yet

- Example DVDDocument17 pagesExample DVDYusuf HusseinNo ratings yet

- Chapter EightDocument11 pagesChapter EightYusuf HusseinNo ratings yet

- Data and Process Modeling: Husein OsmanDocument17 pagesData and Process Modeling: Husein OsmanYusuf HusseinNo ratings yet

- Key Concepts: Week 5 Lesson 3: Economic Order Quantity (EOQ) ExtensionsDocument5 pagesKey Concepts: Week 5 Lesson 3: Economic Order Quantity (EOQ) ExtensionsYusuf HusseinNo ratings yet

- Test OneDocument8 pagesTest OneYusuf HusseinNo ratings yet

- 6 - 2 - Lectures NotesDocument103 pages6 - 2 - Lectures NotesYusuf HusseinNo ratings yet

- Chapter 1Document29 pagesChapter 1Yusuf Hussein100% (2)

- Accounting for Islamic Banks: Mudharabah FinancingDocument32 pagesAccounting for Islamic Banks: Mudharabah FinancingYusuf Hussein40% (5)

- Islamic Banking Ideal N RealityDocument19 pagesIslamic Banking Ideal N RealityIbnu TaimiyyahNo ratings yet

- Capital BudgetDocument124 pagesCapital BudgetYusuf HusseinNo ratings yet

- Simplex Method Solves Linear Programming ProblemsDocument34 pagesSimplex Method Solves Linear Programming ProblemsYusuf HusseinNo ratings yet

- Mcom Ac Paper IIDocument282 pagesMcom Ac Paper IIAmar Kant Pandey100% (1)