Professional Documents

Culture Documents

Ratio Analysis

Uploaded by

Nurdina KamaliaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis

Uploaded by

Nurdina KamaliaCopyright:

Available Formats

Gross Profit margin

For The Store Corperation Berhad, the gross profit margin which shows the

percentage of sales price is increasing. While for Aeon Co. Berhad, the gross profit

margin which shows the percentage of sales price is decrease. So to recover the

sales price has been falling, perhaps due to discounting to retain market share over

new or more aggressive competition. The best way to assess performance is

company The Store Corperation Berhad.

Net Profit Margin

For The Store Corperation Berhad, the net profit margin which shows the percentage

of sales price is increasing. While for Aeon Co. Berhad, the net profit margin which

shows the percentage of sales price are decrease. So reflects the return on sales

from the normal operations of the organisation, without the effects of taxation policy

and the cost of debt financing. The store sells fewer units but it expects to earn a

higher profit margin on each unit sold, while the supermarket sells many units with a

small profit margin.

Asset Turnover

For The Store Corperation Berhad, the asset turnover which shows the number of

times per year that inventory is turned over into sales is increasing while the Aeon

Co. Berhad, the assets turnover also increase. So to assess operating efficiency

refer to the ability of the entity to manage its assets so that the maximum return is

achieved for the lowest possible level of assets is company the Aeon Co. Berhad.

You might also like

- Invoice Invoice: NO Name I/C No PT Num Total Com (RM) Total Amount 5,000.00Document1 pageInvoice Invoice: NO Name I/C No PT Num Total Com (RM) Total Amount 5,000.00Nurdina KamaliaNo ratings yet

- Pending Disbursed BBS BBSCDocument2 pagesPending Disbursed BBS BBSCNurdina KamaliaNo ratings yet

- Invoice - Disbursed BBS - Semi D 160420Document1 pageInvoice - Disbursed BBS - Semi D 160420Nurdina KamaliaNo ratings yet

- Invoice Invoice: NO Name I/C No PT Num Total Com (RM) Total Amount 10,000.00Document1 pageInvoice Invoice: NO Name I/C No PT Num Total Com (RM) Total Amount 10,000.00Nurdina KamaliaNo ratings yet

- Resit NZ Network Management Services SDN BHD Rm1130Document1 pageResit NZ Network Management Services SDN BHD Rm1130Nurdina KamaliaNo ratings yet

- Invoice - Disbursed BBS - Semi D 160420Document1 pageInvoice - Disbursed BBS - Semi D 160420Nurdina KamaliaNo ratings yet

- Qt-01885 Gates Ventures SDN BHD Rm60Document1 pageQt-01885 Gates Ventures SDN BHD Rm60Nurdina KamaliaNo ratings yet

- T6 GroupsDocument16 pagesT6 GroupsNurdina KamaliaNo ratings yet

- Quiz 3 - Output 1Document1 pageQuiz 3 - Output 1Nurdina KamaliaNo ratings yet

- Object Clause 1Document17 pagesObject Clause 1Nurdina KamaliaNo ratings yet

- Quiz 3 - Output 2Document1 pageQuiz 3 - Output 2Nurdina KamaliaNo ratings yet

- Question TEst 1 MGTDocument9 pagesQuestion TEst 1 MGTNurdina KamaliaNo ratings yet

- Principle of EntrepreneurshipDocument1 pagePrinciple of EntrepreneurshipNurdina KamaliaNo ratings yet

- Quiz 3 - Output 2Document1 pageQuiz 3 - Output 2Nurdina KamaliaNo ratings yet

- Study of Students' Preference About Different Mobile Service ProviderDocument34 pagesStudy of Students' Preference About Different Mobile Service ProviderDinesh Kumar SelvarajNo ratings yet

- Quiz 3 - Output 2Document1 pageQuiz 3 - Output 2Nurdina KamaliaNo ratings yet

- Quiz 3 - Output 2Document1 pageQuiz 3 - Output 2Nurdina KamaliaNo ratings yet

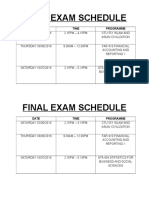

- Final Exam Schedule: Date Time ProgrammeDocument1 pageFinal Exam Schedule: Date Time ProgrammeNurdina KamaliaNo ratings yet

- Quiz 3 - Output 2Document1 pageQuiz 3 - Output 2Nurdina KamaliaNo ratings yet

- Question 3 ADocument3 pagesQuestion 3 ANurdina KamaliaNo ratings yet

- Outstanding ClientsDocument7 pagesOutstanding ClientsNurdina KamaliaNo ratings yet

- Sales Quotation 1Document1 pageSales Quotation 1Nurdina KamaliaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)