Professional Documents

Culture Documents

INAF - PP (Des 09-Des 13) PDF

INAF - PP (Des 09-Des 13) PDF

Uploaded by

Rolan MardaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

INAF - PP (Des 09-Des 13) PDF

INAF - PP (Des 09-Des 13) PDF

Uploaded by

Rolan MardaniCopyright:

Available Formats

INAF Indofarma (Persero) Tbk.

[S]

COMPANY REPORT : JULY 2014

As of 25 July 2014

Main Board

Industry Sector : Consumer Goods Industry (5)

Industry Sub Sector : Pharmaceuticals (53)

Individual Index

:

Listed Shares

:

Market Capitalization :

71.200

3,099,267,500

551,669,615,000

334 | 0.55T | 0.01% | 99.23%

250 | 0.06T | 0.007% | 99.66%

COMPANY HISTORY

Established Date

: 02-Jan-1996

Listing Date

: 17-Apr-2001

Under Writer IPO :

PT Bahana Securities

Securities Administration Bureau :

PT Datindo Entrycom

Puri Datindo - Wisma Sudirman

Jln. Jend. Sudirman Kav. 34 - 35, Jakarta 10220

Phone : (021) 570-9009

Fax

: (021) 570-9026

SHAREHOLDERS (July 2014)

1. Negara Republik Indonesia

2. Public (<5%)

2,500,000,000 :

599,267,500 :

DIVIDEND ANNOUNCEMENT

Bonus

Cash

Year

2000

2001

2012

Shares

Dividend

12.46

19.77

1.37

Cum Date

29-Nov-01

18-Nov-02

02-May-13

Ex Date

30-Nov-01

19-Nov-02

03-May-13

Recording

Date

05-Dec-01

21-Nov-02

07-May-13

80.66%

19.34%

Payment

Date

20-Dec-01

04-Dec-02

22-May-13

F/I

F

F

F

ISSUED HISTORY

BOARD OF COMMISSIONERS

1. Akmal Taher

2. Fajar Rahmat Zulkarnaen *)

3. Kustantinah *)

4. Rina Moreta

*) Independent Commissioners

BOARD OF DIRECTORS

1. Elfiano Rizaldi

2. Bambang Solihin Irianto

3. John Guntar Sebayang

4. Kosasih

AUDIT COMMITTEE

1. Akmal Taher

2. Darul Dimasqy Kramawiredja

3. Fajar Rahmat Zulkarnaen

4. Warga Murad

CORPORATE SECRETARY

Yasser Arafat

HEAD OFFICE

Jln. Indofarma No. 1

Cikarang Barat

Bekasi - 17530

Phone : (021) 883-23975, 859-08350

Fax

: (021) 883-23972, 883-23973

Homepage

Email

: www.indofarmagroup.com

: yasser@indofarma.co.id

No.

1.

2.

3.

4.

Type of Listing

Negara RI (Seri A)

First Issue

Company Listing

Option Conversion

Shares

1

596,875,000

2,499,999,999

2,392,500

Listing

Date

17-Apr-01

17-Apr-01

17-Apr-01

26-Aug-02

Trading

Date

00-Jan-00

17-Apr-01

17-Apr-01

26-Aug-02

INAF Indofarma (Persero) Tbk. [S]

Closing

Price*

Volume

(Mill. Sh)

360

320

315

280

270

240

225

200

180

160

135

120

90

80

45

40

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

Closing Price*, Jakarta Composite Index (IHSG) and

Consumer Goods Industry Index

January 2010 - July 2014

350%

300%

250%

207.4%

200%

150%

114.5%

97.6%

100%

50%

-50%

Jan 10

Jan 11

Jan 12

Jan 13

Jan 14

SHARES TRADED

2010

2011

2012

2013

Jul-14

Volume (Million Sh.)

Value (Billion Rp)

Frequency (Thou. X)

Days

2,534

226

67

244

3,256

399

105

246

3,546

779

91

246

1,767

523

72

244

315

58

22

137

110

73

80

80

197

67

163

163

340

158

330

330

370

145

153

153

202

151

178

178

13.66

16.22

0.83

24.13

19.75

1.57

-5.81

19.15

0.81

-5.42

20.27

1.02

Price (Rupiah)

High

Low

Close

Close*

19.76

PER (X)

16.41

PER Industry (X)

0.80

PBV (X)

* Adjusted price after corporate action

Closing Price

Freq.

Volume

Value

Day

TRADING ACTIVITIES

Closing Price* and Trading Volume

Indofarma (Persero) Tbk. [S]

January 2010 - July 2014

Month

Jan-10

Feb-10

Mar-10

Apr-10

May-10

Jun-10

Jul-10

Aug-10

Sep-10

Oct-10

Nov-10

Dec-10

High

95

82

83

110

107

102

95

90

99

97

85

82

Low

79

73

75

78

76

83

87

83

82

82

78

79

Close

80

78

79

107

87

92

87

84

83

84

81

80

(X)

20,111

2,397

5,675

9,253

1,122

3,093

3,183

4,893

5,435

8,978

2,200

783

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Jul-11

Aug-11

Sep-11

Oct-11

Nov-11

Dec-11

82

77

82

85

99

99

96

91

86

129

143

197

70

70

71

77

80

80

89

75

69

67

114

130

72

73

79

80

87

92

90

83

74

127

129

163

626

749

1,043

2,718

15,321

8,531

2,421

949

491

20,950

27,981

22,790

19,915

15,276

25,482

80,536

351,728

355,321

93,568

23,804

18,240

646,157

738,087

888,348

1,515

1,125

1,947

6,554

31,719

33,168

8,616

2,023

1,257

73,913

93,649

143,816

21

17

23

20

21

20

21

19

20

21

22

21

Jan-12

Feb-12

Mar-12

Apr-12

May-12

Jun-12

Jul-12

Aug-12

Sep-12

Oct-12

Nov-12

Dec-12

205

225

205

260

250

205

225

250

225

245

280

340

158

183

173

187

196

177

193

192

200

200

197

240

205

188

190

220

196

196

215

205

215

200

265

330

25,363

6,548

7,005

11,251

4,989

2,497

2,116

3,169

2,017

4,454

13,696

8,211

960,199

237,728

197,853

504,651

177,002

56,407

68,842

128,580

77,247

134,171

674,878

328,090

176,675

48,949

37,981

110,639

38,997

10,956

14,100

29,502

16,408

29,020

165,966

99,883

21

21

21

20

21

21

22

19

20

22

20

18

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

370

355

345

340

345

310

265

215

195

192

179

175

290

315

305

280

260

245

200

145

158

168

159

152

350

340

315

295

310

260

200

168

170

176

163

153

8,982

5,477

8,076

16,071

7,826

2,983

5,052

5,181

4,664

5,495

1,481

1,075

310,631

190,078

246,199

267,121

274,865

93,228

91,381

80,020

60,780

114,482

20,257

18,069

104,787

64,487

81,157

84,710

87,373

25,462

21,909

14,320

11,104

20,770

3,403

3,688

21

20

19

22

22

19

23

17

21

21

20

19

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

174

181

202

202

192

186

187

151

161

164

180

179

166

169

164

172

196

185

182

168

178

3,945

2,797

6,020

3,753

1,999

1,250

1,929

40,259

34,989

101,260

70,489

24,807

16,591

26,741

7,217

6,042

18,874

13,626

4,571

2,965

4,788

20

20

20

20

18

21

18

(Thou. Sh.) (Million Rp)

702,651

62,514

50,099

3,855

148,097

11,793

448,199

41,283

62,418

6,028

51,804

5,009

52,380

4,715

72,182

6,230

378,689

34,768

476,186

41,896

69,574

5,647

22,116

1,783

20

19

22

21

19

21

22

21

17

21

21

20

INAF Indofarma (Persero) Tbk. [S]

Financial Data and Ratios

Book End : December

Public Accountant : Hendrawinata Eddy & Siddharta (Member of Kreston International)

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

Cash & Cash Equivalents

110,875

120,918

133,417

194,903

121,432

Receivables

180,351

132,470

161,953

248,475

285,853

Inventories

141,953

159,253

193,442

161,342

236,417

Current Assets

581,222

582,662

706,558

777,629

848,840

Fixed Assets

100,991

96,937

342,984

339,196

367,913

BALANCE SHEET

TOTAL ASSETS AND LIABILITIES (Bill. Rp)

(Million Rp except Par Value)

Assets

1,100

825

Other Assets

22,296

27,316

9,009

8,582

Total Assets

728,035

733,958

1,114,902

1,188,619

1,294,511

0.81%

51.90%

6.61%

8.91%

275

376,912

375,536

459,404

369,864

670,903

52,402

47,154

46,304

168,653

32,815

429,313

422,690

505,708

538,517

703,717

-1.54%

19.64%

6.49%

30.68%

1,000,000

1,000,000

1,000,000

1,000,000

1,000,000

309,927

309,927

309,927

309,927

309,927

3,099

3,099

3,099

3,099

3,099

100

100

100

100

100

Growth (%)

Current Liabilities

Long Term Liabilities

Total Liabilities

Growth (%)

Liabilities

1,375

550

2009

2010

2011

2012

2013

TOTAL EQUITY (Bill. Rp)

Authorized Capital

Paid up Capital

Paid up Capital (Shares)

Par Value

Retained Earnings

-86,307

-75,760

20,821

61,729

2,420

Total Equity

298,720

311,267

609,194

650,102

590,793

4.20%

95.71%

6.72%

-9.12%

Growth (%)

INCOME STATEMENTS

Total Revenues

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

1,125,055

1,047,918

1,203,467

1,156,050

1,337,498

-6.86%

14.84%

-3.94%

15.70%

Growth (%)

Cost of Revenues

820,420

729,454

807,283

788,155

999,931

Gross Profit

304,636

318,464

396,184

367,896

337,567

Expenses (Income)

258,727

262,017

304,226

284,587

369,873

45,909

56,448

91,959

83,309

-32,306

22.96%

62.91%

-9.41%

N/A

Operating Profit

Growth (%)

609

650

650

591

517

385

299

311

2009

2010

252

120

-13

2011

2012

2013

TOTAL REVENUES (Bill. Rp)

1,337

1,203

1,337

1,125

1,048

1,156

1,065

-33,243

-36,039

-36,756

-21,577

-30,727

Income before Tax

12,666

20,409

55,203

61,732

-63,033

Tax

10,540

7,862

18,283

19,347

-8,810

Other Income (Expenses)

Profit for the period

2,126

Growth (%)

12,547

36,919

42,385

-54,223

490.23%

194.26%

14.80%

N/A

792

519

246

Period Attributable

Comprehensive Income

Comprehensive Attributable

RATIOS

Current Ratio (%)

Dividend (Rp)

42,385

-54,222

2,126

12,547

36,970

42,385

-54,223

-54,222

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

154.21

155.15

153.80

210.25

126.52

1.37

13.68

-17.50

BV (Rp)

96.38

100.43

196.56

209.76

190.62

DAR (X)

0.59

0.58

0.45

0.45

0.54

DER(X)

1.44

1.36

0.83

0.83

1.19

ROA (%)

0.29

1.71

3.31

3.57

-4.19

ROE (%)

0.71

4.03

6.06

6.52

-9.18

GPM (%)

27.08

30.39

32.92

31.82

25.24

OPM (%)

4.08

5.39

7.64

7.21

-2.42

NPM (%)

0.19

1.20

3.07

3.67

-4.05

10.02

0.42

EPS (Rp)

Payout Ratio (%)

Yield (%)

-27

2009

2010

2011

2012

2013

PROFIT FOR THE PERIOD (Bill. Rp)

37

42

42

13

23

2.1

2013

2009

2010

2011

2012

-16

-35

-54

-54

You might also like

- Ultrajaya Milk Industry & Trading Co. Tbk. (S) : Company Report: July 2014 As of 25 July 2014Document3 pagesUltrajaya Milk Industry & Trading Co. Tbk. (S) : Company Report: July 2014 As of 25 July 2014Ladies90No ratings yet

- MYORDocument3 pagesMYORTubagusPayungNo ratings yet

- Ades-Akasha Wira InternationalDocument3 pagesAdes-Akasha Wira InternationalBima Arif OktiantoNo ratings yet

- Mas Murni Indonesia Tbk. (S) : Company Report: July 2015 As of 31 July 2015Document3 pagesMas Murni Indonesia Tbk. (S) : Company Report: July 2015 As of 31 July 2015Fransisca Angelica Atika SisiliaNo ratings yet

- Hero Supermarket Tbk. (S) : Company Report: July 2016 As of 29 July 2016Document3 pagesHero Supermarket Tbk. (S) : Company Report: July 2016 As of 29 July 2016FiqriNo ratings yet

- Ricky Putra Globalindo Tbk. (S) : Company Report: July 2014 As of 25 July 2014Document3 pagesRicky Putra Globalindo Tbk. (S) : Company Report: July 2014 As of 25 July 2014Nianatus PusantoNo ratings yet

- BJBRDocument3 pagesBJBRdavidwijaya1986No ratings yet

- Sampoerna Agro Tbk. (S) : Company Report: January 2014 As of 30 January 2014Document3 pagesSampoerna Agro Tbk. (S) : Company Report: January 2014 As of 30 January 2014Yasir Hadi SatriaNo ratings yet

- AKKUDocument3 pagesAKKUdavidwijaya1986No ratings yet

- Bukit Darmo Property Tbk. (S) : Company Report: July 2014 As of 25 July 2014Document3 pagesBukit Darmo Property Tbk. (S) : Company Report: July 2014 As of 25 July 2014davidwijaya1986No ratings yet

- BISIDocument3 pagesBISIDjohan HarijonoNo ratings yet

- FKS Multi Agro Tbk. (S) : Company Report: July 2014 As of 25 July 2014Document3 pagesFKS Multi Agro Tbk. (S) : Company Report: July 2014 As of 25 July 2014Rochmatul UmmahNo ratings yet

- Indah Kiat Pulp & Paper TBK.: Company Report: July 2014 As of 25 July 2014Document3 pagesIndah Kiat Pulp & Paper TBK.: Company Report: July 2014 As of 25 July 2014btishidbNo ratings yet

- JKSWDocument3 pagesJKSWAprilia Surya Setya WidayuNo ratings yet

- JAPFA Comfeed Indonesia TBK.: Company Report: January 2016 As of 29 January 2016Document3 pagesJAPFA Comfeed Indonesia TBK.: Company Report: January 2016 As of 29 January 2016Gema Putra PratamaNo ratings yet

- First Media Tbk. (S) : Company Report: February 2013 As of 28 February 2013Document3 pagesFirst Media Tbk. (S) : Company Report: February 2013 As of 28 February 2013Bayu Adhytia ShenzeiNo ratings yet

- Argo Pantes TBK.: Company Report: July 2014 As of 25 July 2014Document3 pagesArgo Pantes TBK.: Company Report: July 2014 As of 25 July 2014Natasha AlhabsyiNo ratings yet

- 47 BACA Bank Capital Indonesia TBKDocument3 pages47 BACA Bank Capital Indonesia TBKDjohan HarijonoNo ratings yet

- Mayora Indah Tbk. (S) : Company Report: July 2015 As of 31 July 2015Document3 pagesMayora Indah Tbk. (S) : Company Report: July 2015 As of 31 July 2015Julio RendyNo ratings yet

- Akasha Wira International Tbk. (S) : Company Report: February 2013 As of 28 February 2013Document3 pagesAkasha Wira International Tbk. (S) : Company Report: February 2013 As of 28 February 2013luvzaelNo ratings yet

- MYRXDocument3 pagesMYRXriaminunyuNo ratings yet

- Bank Rakyat Indonesia (Persero) TBK.: Company Report: July 2014 As of 25 July 2014Document3 pagesBank Rakyat Indonesia (Persero) TBK.: Company Report: July 2014 As of 25 July 2014Itie WirataNo ratings yet

- ArnaDocument3 pagesArnaLuhh SukarhyniNo ratings yet

- Ckra Citra Kebun Raya Agri TBK.: Company Report: January 2012Document3 pagesCkra Citra Kebun Raya Agri TBK.: Company Report: January 2012Djohan HarijonoNo ratings yet

- Ringkasan Kinerja Perusahaan TercatatDocument3 pagesRingkasan Kinerja Perusahaan TercatatDian PrasetyoNo ratings yet

- Bank Mandiri (Persero) TBK.: Company History SHAREHOLDERS (July 2012)Document3 pagesBank Mandiri (Persero) TBK.: Company History SHAREHOLDERS (July 2012)Agus Wibowo PurnomoNo ratings yet

- TLKM Telekomunikasi Indonesia Tbk. (S) : Company Report: July 2010Document3 pagesTLKM Telekomunikasi Indonesia Tbk. (S) : Company Report: July 2010Rere 'Hyuniest' ErlisaNo ratings yet

- Tiga Pilar Sejahtera Food Tbk. (S) : Company Report: February 2013 As of 28 February 2013Document3 pagesTiga Pilar Sejahtera Food Tbk. (S) : Company Report: February 2013 As of 28 February 2013luvzaelNo ratings yet

- 57 BBNP Bank Nusantara Parahyangan TBKDocument3 pages57 BBNP Bank Nusantara Parahyangan TBKDjohan HarijonoNo ratings yet

- Alam Karya Unggul TBK.: Company Report: February 2013 As of 28 February 2013Document3 pagesAlam Karya Unggul TBK.: Company Report: February 2013 As of 28 February 2013luvzaelNo ratings yet

- EPF Quarterly InvestmentDocument4 pagesEPF Quarterly InvestmentcsiewmayNo ratings yet

- Adro 2010-2013Document3 pagesAdro 2010-2013pradika179No ratings yet

- Budi Acid Jaya Tbk. (S) : Company Report: February 2013 As of 28 February 2013Document3 pagesBudi Acid Jaya Tbk. (S) : Company Report: February 2013 As of 28 February 2013Eggy BlaZeNo ratings yet

- AutoDocument3 pagesAutoleadyourlifeNo ratings yet

- Agung Podomoro Land Tbk. (S) : Company Report: January 2014 As of 30 January 2014Document3 pagesAgung Podomoro Land Tbk. (S) : Company Report: January 2014 As of 30 January 2014Budi Santoso PangaribuanNo ratings yet

- ZBRA - PDF Indonesian Capital Market DirectoryDocument3 pagesZBRA - PDF Indonesian Capital Market DirectorysientamiNo ratings yet

- Indo Kordsa Tbk. (S) : Company Report: July 2015 As of 31 July 2015Document3 pagesIndo Kordsa Tbk. (S) : Company Report: July 2015 As of 31 July 2015ChOirul AnWarNo ratings yet

- Admf PDFDocument3 pagesAdmf PDFGeorgekastanyaNo ratings yet

- Multi Bintang Indonesia TBK.: Company Report: July 2015 As of 31 July 2015Document3 pagesMulti Bintang Indonesia TBK.: Company Report: July 2015 As of 31 July 2015Anton SocoNo ratings yet

- 48 BAEK Bank Ekonomi Raharja TBKDocument3 pages48 BAEK Bank Ekonomi Raharja TBKDjohan HarijonoNo ratings yet

- Mahaka Media Tbk. (S) : Company Report: February 2013 As of 28 February 2013Document3 pagesMahaka Media Tbk. (S) : Company Report: February 2013 As of 28 February 2013luvzaelNo ratings yet

- ADHIDocument3 pagesADHIluvzaelNo ratings yet

- BNBADocument3 pagesBNBAluvzaelNo ratings yet

- Weekly Market Outlook 11.03.13Document5 pagesWeekly Market Outlook 11.03.13Mansukh Investment & Trading SolutionsNo ratings yet

- Titan Kimia Nusantara Tbk. (S) : Company Report: February 2013 As of 28 February 2013Document3 pagesTitan Kimia Nusantara Tbk. (S) : Company Report: February 2013 As of 28 February 2013Hendra Gun DulNo ratings yet

- Voks Voksel Electric Tbk. (S) : Company Report: January 2012Document3 pagesVoks Voksel Electric Tbk. (S) : Company Report: January 2012Andres CiayadiNo ratings yet

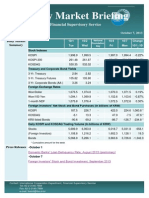

- Weekly Market Briefing (October 7, 2013)Document1 pageWeekly Market Briefing (October 7, 2013)jaymidas_320416395No ratings yet

- Weekly Market Outlook 08.10.11Document5 pagesWeekly Market Outlook 08.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- PlantationDocument3 pagesPlantationDjohan HarijonoNo ratings yet

- Akbar Indo Makmur Stimec Tbk. (S) : Company Report: February 2013 As of 28 February 2013Document3 pagesAkbar Indo Makmur Stimec Tbk. (S) : Company Report: February 2013 As of 28 February 2013luvzaelNo ratings yet

- Index Flat Deals in JKH Boost Turnover : Tuesday, July 30, 2013Document6 pagesIndex Flat Deals in JKH Boost Turnover : Tuesday, July 30, 2013Randora LkNo ratings yet

- Daily Note: Market UpdateDocument3 pagesDaily Note: Market UpdateAyush JainNo ratings yet

- Bakrieland Development Tbk. (S) : Company Report: February 2013 As of 28 February 2013Document3 pagesBakrieland Development Tbk. (S) : Company Report: February 2013 As of 28 February 2013luvzaelNo ratings yet

- WEEKLY MARKET OUTLOOK For 30 July CAUTIOUSLY OPTIMISTIC..Document6 pagesWEEKLY MARKET OUTLOOK For 30 July CAUTIOUSLY OPTIMISTIC..Mansukh Investment & Trading SolutionsNo ratings yet

- Alumindo Light Metal Industry Tbk. (S) : Company History SHAREHOLDERS (July 2012)Document3 pagesAlumindo Light Metal Industry Tbk. (S) : Company History SHAREHOLDERS (July 2012)Reny YustinaNo ratings yet

- Thailand Stocks Div ETFDocument1 pageThailand Stocks Div ETFMartinNo ratings yet

- Adira Dinamika Multi Finance TBK.: Company Report: February 2013 As of 28 February 2013Document3 pagesAdira Dinamika Multi Finance TBK.: Company Report: February 2013 As of 28 February 2013luvzaelNo ratings yet

- Astra Agro Lestari Tbk. (S) : Company Report: July 2015 As of 31 July 2015Document3 pagesAstra Agro Lestari Tbk. (S) : Company Report: July 2015 As of 31 July 2015Ladies90No ratings yet

- TODAY Tourism & Business Magazine, Volume 22, October , 2015From EverandTODAY Tourism & Business Magazine, Volume 22, October , 2015No ratings yet