Professional Documents

Culture Documents

Chapter 2 PDF

Uploaded by

madhu0 ratings0% found this document useful (0 votes)

79 views42 pagesOriginal Title

Chapter 2.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

79 views42 pagesChapter 2 PDF

Uploaded by

madhuCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 42

-INCOME TAXATION

Taxation of Individuals

Leaming Objectives:

After studying this chapter, you should be able to:

12.

Identify the individual income taxpayers. :

Define the individual taxpayers and the related terms used.

Illustrate the different classification of individual taxpayers.

State the sources of income of individual taxpayers.

Recognize the categories of income and state the tax rates to be used by each

type of individual taxpayer. :

List the sources of passive income and state the final tax rates to be used by

each type of individual taxpayer,

Discuss the treatment of passive income in the computation of taxable income

from compensation or business/professional income.

Define the allowable deductions from gross income.

Identify the kinds of personal exemptions.

Discuss the guidelines on change of status.

Define and compute taxable income and tax due for each type of individual

taxpayer depending on income category. »

Be familiar with individual taxpayers exempt from income tax.

The Code directs that a tax shall be imposed on the taxable income of every individual.

. Our present tax system imposes progressive rates of income taxes on citizens and

resident aliens. This system equitably distributes the tax burden by recognizing the

paying ability of the individual taxpayer.

Likewise, the global treatment in taxing compensation and business income has been

restored from the previous schedular treatment. In a schedular system, the income tax

treatment varies depending on the kind of taxable income of the taxpayer. A schedular

system of taxation provides for a different tax treatment of different types of income so

that a separate tax return is required to be filed for each type of income and the tax Is

computed on a per return or per schedule basis.

33

Global treatment, on the other hand, is a system where the tax treatment views

indifferently the tax base and generally treats in common all categories of taxable

income of the taxpayer. A global system of taxation is one where the taxpayer is

required to lump up all items of income earned during a taxable period and pay under a

single set of income tax rules on these different items of income. Under this system, the

taxable income—which is the aggregate of the gross compensation income and gross

business or professional income less the allowable deductions—is being subjected to a

unitary but progressive, graduated rates.

Unlike financial accounting, tax law does not distinguish between a person and an

unincorporated business. If one person engages in several different business activities,

his or her total taxable Income is determined by aggregating income and losses from the

various sources. If two of more individuals-professionals form a general professional

partnership, there Is no Income tax Imposed on the entity. Rather, the partners must

include their respective shares of the partnership’s income, along with income from any

other sources, in determining their individual taxable incomes.

While all individuals are subject to tax on their respective taxable incomes, they are nat

all taxed at the same rate for two reasons. First, tax rates are generally higher for higher

levels of income. Second, even at the same level of income and with the same basic

personal exemption of P50,000, tax dues will vary depending on an individual's claim for

additional exemptions on dependents.

CLASSIFICATION OF INDIVIDUAL INCOME TAXPAYERS

1. Citizen

a. Resident

b. Non-resident

2. Alien

a. Resident

b. Non-resident

1. Engaged in trade or business in the Philippines _

2. Not engaged in trade or business in the Philippines

3. Employed by

@ Regional or area headquarters (RHQs) and regional operating

headquarters (ROHQs) of multinational entities in the Philippines that

are engaged in international trade with affiliates and subsidiary branch

offices in the Asia-Pacific region.

b. Offshore banking units.

c. Petroleum contractors and sub-contractors,

34

Definition of Terms

1. Citizen. The following shall be considered citizens of the Philippines:

2 Resident ci

3. Nom-resident ci

‘Those who are citizens of the Philippines at the time of the adoption of the Feb. 2, 1987

Constitution;

‘Those whose fathers or mothers are citizens of the Philippines;

‘Those born before Jan. 17, 1973, the date of the adoption of the 1973 Constitution, of

Filipino mothers, who elect Philippine citizenship upon reaching the age of majority; and

‘Those who are naturalized In accordance with law.

en {s a Filipino citizen who permanently resides in the Philippines.

en means:

A citizen of the Philippines who establishes to the satisfaction of the Commissioner the

fact of his physical presence abroad with a definite intention to reside therein.

A citizen of the Philippines who leaves the Philippines during the taxable year to reside

abroad, either as an immigrant or for employment on a permanent basis.

A citizen of the Philippines who works and derives income from abroad and whose

employment thereat requires him to be physically present abroad most of the time

during the taxable year. “Most of the time” is interpreted to mean presence abroad for

at least 183 days during the taxable year (BIR Ruling 128-99, Aug. 18, 1999).

A citizen who has been previously considered as non-resident citizen and who arrives in

the Philippines at any time during the taxable year to reside permanently in the

Philippines shall likewise be treated as a non-resident citizen for the taxable year in

Which he arrives in the Philippines with respect to his income derived from sources

abroad until the date of his arrival in the Philippines.

The taxpayer shall submit proof to the Commissioner to show his intention of leaving,

ippines to reside permanently abroad or to return to and reside in the

Philippines, as the case may be.

Resident alien. Means an individual whose residence is within the Philippines and

who is not a citizen thereof. He Is one who is actually present in the Phi

pines and

who is not a mere transient or sojourner. But residence does not mean mere

physical presence. An alien is considered a resident or a non-resident depending on

his intention with regard to the length and nature of his stay.

Non-resident alien. Means an individual whose residence Is not within the

Philippines and who is not a citizen thereof.

as

10.

Non-resident alien engaged in trade-or business (NRA-ETB). Means that that the -

alien is carrying on a business in the Philippines. It connotes more than a single act

or isolated transactions. It involves some continuity of action.

The term trade, business or profession shall not include performance of services by

the taxpayer as an employee but it includes the performance of the functions of a

public office. A non-resident.alien who has stayed in the Philippines for more than

180 days during any calendar year shall be deemed doing business in the

Philippines. If he stayed for 180 days or less, he is considered a non-resident alien.

not doing business in the Philippines (NRA-NETB).

OCWs or OFWs refer to Fi ens employed in foreign countries who are

physically present in a foreign country as 2 consequence of their employment

thereat. Their salaries and wages are paid by an employer abroad and:are not

borne by any entity or person in the Philippines. To be considered as an OCW or

OFW, they must be duly registered as such with the Philippine Overseas

Employment Administration (POEA), with a valid Overseas Employment Certificate

(OEC)

Seafarers or seamen are Filipino citizens who receive compensation for services

rendered abroad as a member of the complement of a vessel engaged exclusively in

international trade. They must be duly registered as such with the POEA with a valid

OEC and Seafarers Identification Record Book (SIRB) or Seaman’s Book issued by the

Maritime Industry Authority (MARINA) (Revenue Regulations 1-2011, Feb. 24, 2011).

Foreign currency deposit system (FCDS) shall refer to the conduct of banking

transactions whereby any person, whether natural or juridical, may deposit foreign

currencies forming part of the Philippine international reserves, in accordance with

the provisions of R.A. 6426 entitled “An Act Instituting a Foreign Currency Deposit

System in the Philippines, and For Other Purposes.”

Foreign currency deposit unit (FCDU) shall refer to that unit of a local bank or a

local branch of a foreign bank authorized by the Bangko Sentral ng Pilipinas (BSP) to

‘engage In foreign currency-denominated transactions, pursuant to the provisions of

R.A. 6426, as amended. Local bank shall refer to a thrift bank or a commercial bank

organized under the laws of the Republic of the Philippines. Local branch of a

foreign bank shall refer to a branch of a foreign bank doing business in the

Philippines, pursuant to the provisions of R.A. 337, as amended.

Offshore banking system shall refer to the conduct of banking transactions in

foreign currencies involving the receipt of funds principally from external and

internal sources and the utilization of such fund pursuant to Presidential Decree

1034 as implemented by Central Bank (now Bangko Sentral ng Pilipinas (BSP))

Circular 1389, as amended.

36

ot

12.

13.

14.

15.

16.

17.

18.

Offshore banking unit (OBU) shall mean a branch, subsidiary or affiliate of a forelgn

banking corporation which is duly authorized by the BSP to transact offshore

banking business in the Philippines In accordance with the provisions of Presidential

Decree 1034 as implemented by Central Bank (now BSP) Circular 1389, as amended,

Deposits, in connection with offshore banking, shall mean funds in foreign

currencies which are accepted and held by an Offshore Banking Unit or Foreign

Currency Deposit Unit in the regular course of business, with the obligation to

return an equivalent amount to the owner thereof, with or without interest.

Deposit substitutes shall mean an alternative from of obtaining funds from the

public (the term ‘public’ means borrowing from twenty (20) or more individual or

corporate lenders at any one time] other than deposits, through the issuance,

endorsement, or acceptance of debt instruments for the borrowers own account,

for the purpose of relending or purchasing of receivables and other obligations, or

financing their own needs or the needs of their agent or dealer. These instruments

may include, but need not be limited to bankers’ acceptances, promissory notes,

repurchase agreements, including reverse repurchase agreements entered into by

and between the Bangko Sentral ng Pilipinas (BSP) and any authorized agent bank,

certificates of assignment or participation and similar instruments with recourse:

Provided, however, That debt instruments issued for interbank call loans with

maturity of not more than five (5) days to cover deficiency in reserves against

deposit liabilities, including those between or among banks and quasi-banks, shall

not be considered as deposit substitute debt instruments.

Mixed income earner refers to a compensation-earner who at the same time is

‘engaged In business or practice of profession.

Marginal income earner refers to an individual whose business does not realize

gross sales or recelpts exceeding P100,000 in any 12-month period.

Self-employed individual is one who may either be a single proprietor engaged in

business or in the practice of his profession.

Regional’ or area headquarters (RHQs) shall mean a branch established in the

Philippines by multinational companies and which headquarters do not earn or

derive income from the Phillppines and which act as supervisory, communications

and coordinating center for their affiliates, subsidiaries, or branches in the Asia-

Pacific Region and other foreign markets.

Regional operating headquarters (ROHQs) shell mean a branch established in the

Philippines by multinational companies which are engaged in any of the following

services: general administration and planning; business planning and coordination;

sourcing and procurement of raw materials and components; corporate finance

advisory services; marketing control and sales promotion; training and personnel

37

management; logistic services; research ‘and development services and product

development; technical support and maintenance; data processing and

communications; and business development.

‘The following definitions are used in relation to R.A. 10165, the Foster Care Act of 2012:

19. Agency refers to any child-caring or child-placing institution licensed and accredited

by the Department of Social Welfare and Development (DSWD) to iniplement the

Foster Care Program.

20. Child. refers to a person below eighteen (18) years of age, or one who is over

eighteen (18) but is unable to fully take care of, or protect, himself or herself from

abuse, neglect, cruelty, exploitation or discrimination because of a physical or

mental disability or condition.

21. Child with Special Needs refers to a child with developmental or physical disability.

22. Foster Care refers to the provision of planned temporary substitute parental care to

a child by a Foster Parent or a Foster Family.

23. Foster Child refers to a child placed under Foster Care.

24. Foster Family refers to a Foster Parent(s) and his/her immediate family members.

25. Foster Family Care License refers to the document issued by the DSWD authorizing

the Foster Parent(s) to provide Foster Care.

26. Foster Parent refers to a person duly licensed by the DSWD to provide Foster Care.

27. Social Worker refers to a registered and licensed Social Worker of the DSWD, LGU

‘or Agency.

According to Rule 5 of the Implementing Rules and Regulations of R.A. 10165, the

following may be placed under Foster Care:

'@. Achild who is abandoned, surrendered, neglected, dependent or orphaned;

b. A child who is a victim of sexual, physical, or any other form of abuse or

exploitation;

©. Achild with special needs;

d. A child whose family members are temporarily or permanently unable or unwilling

to provide the child with adequate cai

fe. Achild awaiting adoptive placement and who would have to be prepared for family

life, including a child who has already been matched for adoption but continues to

receive institutional care;

f. A child who needs long-term care and close fa!

for domestic adoption;

8: Achild whose adoption has been disrupted;

ly ties but who cannot be placed

38

h. A child who is under socially difficut circumstances such as, but not limited to, a

street child, a child in armed conflict or a victim of child labor or trafficking;

‘A child who committed a minor offense but has been released on recognizance, or

who is in custody supervision, or whose case has been dismissed; and

j. A child who is In need of special protection as assessed by @ Social Worker, an

Agency, or the DSWD. Provided, that in the case of (b}, (c), (f), (h), {i) and Qj), the

child must have no family willing and capable of caring and providing for him/her.

Rule 6 of the IRR states, to qualify as a Foster Parent, an applicant must meet all of

the following:

a. Must'be of legal age;

b. Must be at /east sixteen (16) years older than the Foster Child unless the applicant

Isa relative of the Foster Child;

c. Must have a genuine Interest, capacity and commitment in parenting the Foster

Child and able to provide the Foster Child with a familial atmosphere;

d, Must have a healthy and harmonious relationship with each family member living

with him/her;

Must be of good moral character;

‘Must be physically and mentally capable and emotionally mature;

Must have sufficient resources to he able to provide for the family’s needs; and

Must be willing to be trained or recelve advice for the purpose of increasing or

Improving his or her knowledge, attitudes and skills in caring for a child.

For an alien to qualify as a Foster Parent, he/she must (i) be legally documented, (ii)

possess all the qualifications above-stated, (iii) have resided in the Philippines for at

least twelve (12) continuous months at the time of the application, and (iv)

undertake to maintain such residence until the termination of placement by the

DSWD or expiration of the Foster Family Care License.

For purposes of determining continuous residence, the alien must not have spent

more than sixty (60) days of the last twelve (12)-month period prior to the filing of

the application outside of the Philippines, and then only for meritorious reasons.

Mlustrations:

1. A British computer expert was hired by a Philippine corporation to assist in its

computer system installation for which he had to stay in the Philippines for 6

months. Is he a resident alien?

‘Answer: One who comes to the Philippines for a definite purpose which in its nature

would require an extended stay and to that end makes:his home temporarily in the

Philippines, becomes a resident, though it may be his intention at all times to return

to his domicile (place of habitual or permanent residence) abroad when the purpose

for which he came has been accomplished.

39

2. A British cultural performer was engaged to perform in the Philippines for two

weeks after which he returned to his country. Is he a resident alien?

Answer: No. One who comes to the Philippines for a definite purpose which in its

nature may bg promptly accomplished isa transient.

3. An alien owns shares of stock in the Philippines. Is he considered as engaged in

business or trade in the Philippines?

Answer: No, mere ownership of shares of stock in the Philippines is not enough to

constitute as engaging in trade or business in the Philippines.

4. An alien temporarily serves as executive manager of an airline in Manila, Is he

considered engaged in trade or business in the Philippines?

Answer

es, because he is performing the functions of a public office,

5. A resident alien left the Philippines and abandoned his residency thereof without

any intention of returning. May he still be considered a resident alien?

‘Answer: No, because he has no intention at all to return to the Philippines.

6. A resident alien left the Philippines with a re-entry permit. Is he, still a resident

alien?

Answer: Yes, his re-entry permit proves that he has not abandoned his residence in

the Philippines.

7. A non-resident citizen went to Manila under the Balikbayan Program. Does his

return to Manila interrupt his residence abroad?

Answer: No, his trip to Manila did not interrupt his residence abroad. The phrase

“uninterrupted period” should not be interpreted literally. His trip to Manila did not

affect the continuity of his residence abroad.

Ilustration. Source: BIR Ruling ITAD 340-14, Dec. 29, 2014

‘An Individual who, at the invitation of a Philippine schoo!, visits the Philippines for a period not exceeding

‘two years solely for the purpose of teaching at such educational institution, and wha Is, or was, Immediately

before that visita resident of the UK, shall be exempt from Philippine income tax on the remuneration from

teaching at such school. This is provided for under Article 20 of the Pallipplnes-United Kingdom Tax Treaty.

“Alustration. Sour

WR Ruling 053-2010, Sept. 14, 2010

‘An alien who holds a Special Retiree Residents Visa is considered # resident lien subject to Philippine

Income tax under Section 24(A) of the Tax Code.

40

ustration. Source: BiR Ruling DA-056-2005, Feb.'16, 2005,

Under the Tax Cade, a non-resident individual who stays in the Philippines for an aggregate perlod of more

than 180 days during any calendar yaar shall be considered a non-resident allen engaged in trade or

business in the Phippines and shall be subject to income tax at 5% to 32% graduated rates.

‘The phrase “any calendar year” should be interpreted to mean that when an expatriate stays In the

Philippines for more than 180 calendar days in any calendar year, he would be taxed at the graduated rate

(Of S% to 32% not only in the year that he exceeds that 180-day period, but also during the other years of

agement, even if his stay did not exceed 180 days,

Miestration. Source: BIR Ruling 0A-290-2008, June 27, 2005

‘An afen is a stockholder of a PEZA-ragistered enterprise. He has been involved in the company since its

incorporation in 1996, has abtained a special non-immigrant visa and was required as company president to

bbe in the Philippines most of the time to manage the.day-to-day operations of the company. This alien

‘quatfies as a resident alien for Philippine income: tax purposes. His dividend income shall be subject to the

‘40% final tax imposed under Section 24(8)(2) of the Tax Code to be withheld by the payor-company..

SOURCES OF INCOME

Source of income is not a place but the property, activity or service that produced the

income. In the case of income derived from labor, it is the place where the labor is

performed; in the case of income derived from the use of capital, it is the place where

the capital is employed; and in the case of profits from the sale or exchange of capital

is the place where the sale or transaction occurs,

important to know the source of income of an individual taxpayer—whether from

within the Philippines or without—because not all individual texpayers are taxed on all

their income. The following rules apply:

1. Resident

without.

ens are taxable on all income derived from sources within and

2. Non-resident citizens and alien individuals—resident and non-resident—are

taxable only on income derived from sources within the Philippines. An overseas

contract worker is taxable only on his Income from sources within.

Individual Source of income

Within the Phils Without the Phils,

1. Resident Citizen az

2. Non-Resident Citizen

3, Resident Allen

4, Non-Resident Alien

wees

a1

CATEGORIES OF INCOME AND TAX RATES *

1. Compensation income. In general, the term “compensation” means all

remuneration for services performed by an employee for his employer under an

employer-employee relationship, unless specifically excluded by the Code. This is

discussed thoroughly in Chapter 7.

If 2 taxpayer is receiving compensation income from two or more employers, he/she

must combine all compensation income received from all employers for 2 particular

calendar year. Taxed at the graduated rates from 5% to 32% (revised Section 24(A)

per R.A. 9504)

Mlustration: Kyla, single and a resident citizen, has'a gross compensation income of

P180,000 in 2015. . How much is her taxable income and tax due for 2015? A

resident citizen, who is single, is allowed basic personal exemption of P50,000 (per

R.A. 9504),

Gross Compensation Income 180,000

Less: Basic Personal Exemption 50,000

Net Taxable Compensation Income 130,000

Tax Due:

(On 70,000 P 8,500

60,000 at 20% 12,000

20,500

2. Business income arises from self-employment or practice of profession. This shall

not include income from performance of services by the taxpayer as an employee.

Taxed at graduated rates. from 5% to 32% (revised Section 24(A) per R.A. 9504).

Note that the same graduated tax schedule is used for individual taxpayers earning

compensation income, business/professional income or both.

Illustration: Katrina, single and a resident citizen, has a gross business income of

350,000 in 2015. Deductions retated to her business is P80,000, How much is, her

taxable income and tax due for 2015?

Gross Income 370,000

Less: Deductions 80,000 *

Basic Personal Exemption 50,000_ _+ 130,000

Taxable Income 240,000

Tax Due:

(On P:140,000, 22,500

100,000 at 25% 25,000

47,500

42

‘An individual receiving a combination of compensation and business income shall

first deduct the allowable basic, personal and additional exemptions from

_ compensation income. The excess, if any, shall then be deducted from business

income.

3. Passive income. Passive income are subject to a separate and final tax. These are

taxed at fixed rates ranging from 5% to 259%. Examples of passive Income are

imerests, royalties, prizes, winnings arid dividends. A table showing the passive

income and the corresponding tax rates is provided in this chapter.

Masstration: Helena, single and a resident citizen, has the following passive income

for the year 2015:

Interest from BPI Savings Deposit 75,000,

Royalty from Invention 80,000

Prize in a Painting Competition 50,000

Dividends Recelved from a Domestic Corporation _—-30,000

Computation of Final Tax:

Interest (P75,000 x 20%) 15,000

Royalty (P80,000 x 20%) 116,000

Prize (P50,000 x 20%) 10,000

Dividends (P30,000 x 10%) 3,000

Total 44,000.

For this illustration, it is assumed that the passive income are all gross of final taxes

(FT) or final withholding taxes (FWT).

Final tax imposed on income or gain shall no longer be included as taxable Income

subject to the graduated rates. The final tax is imposed without any deduction and

is withheld at source. The amount received by passive income earner is net of the

final:tax. The final tax on passive income is remitted by the payor who serves as the

withholding agent? to the BIR. For example, if the prize in a painting comps

50,000, the amount to be received by the winner will only be P40,000.

4. Capital gains from sale of shares of stock, not traded through the local stock

exchange. Texed at.5% and 10% final taxes on a per transaction basis. This is

discussed thoroughly in another chapter.

On the Net Capital Gains:

Not over P100,000 5%

Amount in Excess of 100,000 10%

3 any person required to deduct and withhold any tax under the provistons of Sec. 57 of the Tax Code.

43

The categories of income and the tax rates applicable for each type of individual

taxpayer are presented below, Passive income is discussed in another section of this

chapter.

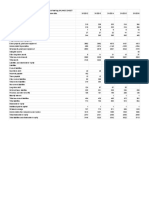

Resident | Non Resident | Resident | Non-Resident Alien

on Cizen Gitizen ‘Alien | Engaged | Not Engaged

TON TAKABLE INCOME as

defined in Sec. 31 the tax

computed under the 59-32% sx-a% | FT 25%

revised Sec. 24(A), except

Zor NRA-NETB.

‘ON PASSIVE INCOME

Za genera, interests,

“oyatties, prizes and other

azings.

20% Fr25%

3, cash and/or property

avidends 20% Fr35%

(ON CAPITAL GAIN.

“Sale of shares of stock not 5% 10%

‘vaded In stock exchange

E Sale of real property

LL. The taxable Income referred to in the table (no. 1} may arise from compensation income,

business income from self-employment and/or practice of profession. The concept of

taxable income is discussed in this chapter. In computing for the tax due, the graduated

individual income tax schedule shall be used (revised Section 24(A) per R.A. 9504). From

hereon, any reference to Section 24(A) means the revised Section 24 (A) per R.A. 9504 for

simplicity.

2. All income received by a non-resident alien not engaged in trade or business in the

Philippines (NRA-NETB) except capital gains (from sales of shares of stock not traded in stock

exchange and of real property) are included as gross income taxed at 25% final tax or final

‘withholding tax (FT or FWT)).

All income received by a non-resident alien employed by:

a. Regional or area headquarters (RHQs) and regional operating headquarters (ROHQs) of

multinational companies in the Philippines, which are engaged in International trade

‘with affiliates and subsidlary branch offices inthe Asia-Pacific region and other foreign

markets (see note 4),

b. Offshore banking units,

Petroleum contractors and sub-contractors,

are Included as gross income taxed at 15% final tax. This same tax treatment shall apply to

2 Filipino employed by such firms. But such Filipinos have the option to be taxed at either

15% or under Section 24(A) subject to the schedular tax rates of 5% to 32%,

4s

‘These alien individuals referred to above are employees occupying managerial, confidential

or highly technical positions or the so-called “expatriate employees.”

‘The test of “managerial status” depends on whether a person possesses the authority to act

in the interest of his employer and whether such authority is not merely routinary or clerical

in nature, but requires the use of independént judgment. Where such recommendatory

power are subject to evaluation, review and final action by the department heads and other

higher executives of the company, the person having such recommendatory powers is not a

managerial employee (Philippine Appliance Corporetion vs. Laguesma, 226 SCRA 730 (1993))

‘The term “technical positions” refers to positions that are highly technical in nature or

where there are no Filipinos who are competent, able and willing to perform the services for

which the aliens are desired. The Labor Code of the Philippines prohibits employment of

aliens when there are Filipinos who are competent, able and willing to perform the services

for which the aliens are desired.

Revenue Memorandum. Circular 41-2009, which defined the term “managerial and/or

technical positions,” has created confusion on the tax treatment of Filipinos employed by

RHQs or ROHQs, as it implied that Filipinos must be employed in a “managerial and technical

position” to enjoy the option to be taxed at elther the 15% preferential final withholding tax

rate on gross compensation income or at the regular income tax rate based on taxable

compensation income,

Revenue Regulations 11-2010 clarifies the term “managerial and technical positions” under

Section 2.57.1(D) of RR 2-1998, as amended, and prescribes the qualifications and

requirements for Filipinos employed by RHQs and ROHQs of multinational companies to

have the option to be taxed at the 15% preferential income tax rate under Section 25(C) of

the Tax Code.

‘The option to be taxed at the 15% preferential rate shall be available to the Filipino

employee of an RHQ or ROHQIf he meets all of the following requirements:

a. Position and Function Test ~ The employee must occupy a managerial position or

technical position, and must actually exercise managerial or technical functions.

b. Compensation Threshold Test — The employee must have received, or is due to receive

under a contract of employment, 3 gross annual taxable compensation of at least

975,000. If there is a change in the compensation resulting in the employee receiving

less than the threshold for the calendar year, the employee shall be subject to the

regular income tax rate.’ The compensation threshold shall be adjusted every three

years using the Philippine Consumer Price Index.

c. Exclusivity Test ~ The employee must be exclusively working for the RHQ. or ROHQ. as a

regular employee and not just a consultant or contractual personnel. Exclusivity means

having Just one employer ata time.

For purposes of determining the compensation threshold of P975,000, gross compensation

shall include both the regular taxable compensation income and supplementary

compensation income of the employee, Regular taxable compensation Includes basic salary,

fixed allowances for representation, transportation and other allowances pald to an

employee per payroll period. Supplementary compensation covers payments in addition to

45

the regular compensation such as commission, overtime pay, taxable bonus and other

taxable benefits, with or without regard to a payroll period.

Gross compensation shall not include retirement or separation benefits (whether or not

taxable) as well as de minimis benefits, although these shall be considered in determining

the income tax due at the time of the employee's retirement or separation.

At the start of the year or at the start of employment, it will be determined whether the

grass annual compensation of an employee is equivalent to or above the compensation

threshold. If the total compensation cannot be determined at the start of the year or

employment, the option to be taxed at 15% cannot be exercised

‘To iustrate, at the start of the year, Mr. Thed, a Filipino employed by an ROHQ, receives a

monthly salary and cost of living allowance in the amount of P65,000 and P5,000

respectively. His employment contract also states that he may receive a performance bonus

‘at the end of the year which amount Is not presently determinable. Since Mr. Thed’s regular

‘compensation income of P905,000 composed of P780,000 (P65,000 x 12 months) basic pay,

65,000 13th month pay and PGO,000 (P5,000 x 12 months) cost of living allowance, is below

the compensation threshold of P975,000 then his employer shall, on every pay period from

the start of the yéar withhold from Mr. Thed income tax at the regular rate of withholding

tax on compensation. However, If at the end of the year Mr. Thed receives a performance

incentive bonus of P'100,000, thus making his annual gross compensation income total

1,005,000 and he opts to be taxed at the rate of 15% of his gross income, his employer shall

make the necessary adjustments to the Income tax rate.

Miustration. Source: B/f Ruling 007-99, Jan. 18, 1999

!watan! International Corporation (ITC) is a corporation formed and organized under the laws of Japan

registered with the Securities and Exchange Commission (SEC) as a Philippine Representative Office.

ITC is authorized to gather Information, disseminate Information on the company and Its products,

liaise with customers but is not authorized to generate income within the Philippines. ITC has an

expatriate resident manager. Is he subject to the 15% income tax rate on his gross income?

‘The BIR ruled in the affirmative citing Section 25(C) of the Tax Code of 1997 which states: "There shall

be levied, collected and pald for each taxable year upon the gross income received by every allen

Individual employed by regional or area headquarters and regional operating headquarters established

In the Philippines by multinational companies as salaries, wages, annuities, compensation,

remuneration and other emoluments, such as honoraria and allowances, a tax equal to 15% of such

{gross Income.”

Mlustration. Source: BIR Ruling DAXITAD 155-04, Dec. 23, 2004

‘A Dutch corporation not registerad with the Securities and Exchange Commission has been éngaged as

contractor since 2000. it has been providing engineering services to support the operation and

maintenance of three geothermal power companies under the General Services Agreements. One of

its employees was present in the Philippines for more than 183 days, and total project revenue derived

‘through said employee was in excess of P720,000 for 2004,

‘The BIR ruled that the company will be considered to have a permanent establishment in the

Philippines pursuant to the RP-Netherlands tax treaty. As such the company shall be subject to

Philippine tax on income received from all sources within the Philippines and to withholding tax at 10%

0 15% on management and technical consultants.

5, The BIR has issued the Revenue Regulations 47-2011 implementing the tax provisions of

Republic Act 9505, Personal Equity and Retirement Account Act of 2008, which provides the

legal and regulatory framework for the establishment of personal equity retirement account

(PERA), This law aims to pramate the development of the capital market by tapping into the

savings of its residents and overseas citizens. PERA is a voluntary retirement account for

individuals which provides tax incentives—like 5% tax credit and exempt investment income

of PERA assets, Details are discussed at the end of this chapter.

Revenue Memorandum Circular 31-2013 prescribes the guidelines on the taxation of

compensation income of Philippine nationals and alien individuals employed by foreign

governments, embassies, diplomatic missions, and international organizations situated in

‘the Philippines. Details are discussed at the end of this chapter.

Revenue Regulations $-2013 prescribes the tax treatment of the sale of jewelry, gold and

other metallic minerals to a non-resident alien individual not engaged in trade or business

within the Philippines, or to a non-resident foreign corporation.

Sellers of jewelry, gold, and other metallic minerals are required to pay business tax (VAT or

percentage tax), income and excise tay, if appiicable, In advance through the assigned

Revenue Collection Officers of the Revenue District Office (RDO) having jurisdiction over the

“place where the subject transaction occurs, regardless of whether the sellers are duly

registered with the BIR:

‘Advance payment of 12% VAT on gross selling price, or percentage tax at the rate of 3%

‘on gross sales, as the case may be;

. Advance payment of income tax at the rate of 5% on gross payment;

c. Actual payment of 2% excise tax based on elther the actual market value of the gross

output at the time of removal, in the case of those locally extracted or produced; or the

value used by the Bureau of Customs (BOC) in computing tariff and duties, in the case of

Importations, Actual market value shall refer to the actual consideration paid by the

buyer to the seller.

‘The advance payments shall be credited against the actual business tax (VAT or percentage

tax, as the case may be) and income tax due from such persons for the taxable period for

which such advance payments were remitted to the BIR.

Non-resident alien individuals not engaged In trade or business within the Philippines or

non-resident foreign corporations shall: (2) Maintain a record of the transactions containing

the date of the transaction, name of the seller, Tax Identification Number (TIN) of the seller,

if available, and amount received by the seller; and (2) Require the seller to sign an order slip

or any similar document as evidence of the amount received by the seller. This document

shall be the basis of the Revenue Officers in recording the transaction and assessing the

correct tax due.

‘Owners and operators of hotels, inns or establishments where the subject transactions are

conducted are required to provide the following information to the ROO having jurisdiction

over them: name of the alien individuals and/or entity; nationality; passport number;

Intended number of days of staying in the hotel, inn or establishment; place, date and time

of the buying event; and TIN of the non-resident alien or non-resident foreign corporation, if

already registered.

48

PASSIVE INCOME

Passive income is subject to a separate and final tax at fixed rates ranging from 5% to

25%. They are not included in the computation of taxable income from compensation

oF business/professional income, the tax due on which is computed in accordance with

the graduated income tax schedule for individuals

Section 24(A).

(ON PASSIVE INCOME

Resident Gkizen—]

Non-Resident Citizen

Resident Alien

Non-Resident Alien

Engaged in Trade

or Business in the

Philippines (waa-ere)

waerests

‘terest from any currency bank

deposit and yield or any other

monetary benefit from deposit

substitutes (see Note 1 below) and 20% 20%

from trust funds and similar

arrangements

‘interest income from a depository 75% Exempt

‘bank under the Expanded Forelgn Non-resident citizen

Currency Deposit System (FCDS) is tax exempt |

interest income from long-term

deposit or investment in the form of

savings, common or individual trust,

funds, deposit substitute, Investment

management accounts {IMA) and

other investments evidenced by :

certificates in such form prescribed Exempt Exempt

bby the 8SP with five-year term or

longer (see Note 2 below).

IF deposit is pre-terminated

before the fifth year, the

corresponding final tax shall be:

4 years to less than S years 5% 5%

3 years to less than 4 years 12% 12%

Less than 3 years 20% 20%

Royalties

Royalties, in general 20% 20%

Royalties on books, literary works and

musical composition 10% 1056

49

Prizes and Wi

Prizes, In general

Prizes amounting to P10,000 or less are

subject to the graduated Income tax

schedule in Sec. 24(A).

20%

20%

Winnings, in general

CSO and lotto winnings are tax

exempt.

20%

20%

Cashand/or Property Dividends

actually or constructively received

from a domestic corporation, joint

stock company, Insurance, mutual

fund companies and regional

operating headquarter of a

multinational company or

Share of an Individual in the

distributable net income after tox of

a taxable partnership or

‘Share of an individual in the net

Income after tax of an association,

joint account or a joint venture or

consortium taxable as a corporat

A.

‘Tax on dividends shall apply only on

income earned on or after Jan. 1,

1998.

6% - 1998

8% - 1999

10% - 2000

20%

Notes:

Interest Income from Government Debts and Securities: Government Debt Instruments

and Securities, including Bureau of Treasury (BTr) issued instruments and securities such as

Treasury bonds (T-bonds), Treasury bills (T-bills) and Treasury notes, are considered as

deposit substitutes, irrespective of the number of lenders at the time of origination, if such

debt instruments and securities are to be traded or exchanged on the secondary market.

‘The mere issuance of government debt instruments and securities is considered as falling

within the coverage of ‘deposit substitutes’ irrespective of the number of lenders at the time

of origination; therefore, interest income derived shall be subject to 20% FWT imposed on

dapostt substitutes (Sec. 2, Revenue Regulations 14-2012, Nov. 7, 2012).

50

{in the case of zero-coupon liistruments and securities, the FWT Is payable upon their original

issuance. In the case of interest-bearing Instruments and securities, the FWT is payable upon

Payment of the interest (RMC 77-2012, Nov. 22, 2012).

Interest income derived from any other debt instrument not within the coverage of deposit

substitutes ~ The 20% Creditable WT shall apply to each Interest payment to be made

beginning on Nov. 23, 2012, irrespective of when the instruments or securities were issued,

This covers interest income from current outstanding instruments, securities, or accounts as

Of Nov. 23, 2012 (Sec. 7, Revenue Regulations 14-2012, Nov. 7, 2012 and RMC 77-2012, Nov.

22, 2012)

Interest Income from Long-Term Deposits or Investment Securities: The depositor or

investor is an individual citizen (resident or non-resident) or resident allen or non-resident

alien engaged in trade or business in the Philippines and not a corporation, The long-term

deposits or investments certificates should be under the name of the individual and not

under the name of the corporation or the bank or the trust department/unit of the bank.

‘The long-term deposits or investments must be Issued by banks only and not by other

financial institutions. Only the Interest income from long-term deposits or investment

certificates is covered by the income tax exemption. The income tax exemption does not

cover any other income such as gains from trading, foreign exchange gain (RR 14-2012, Nov.

22, 2012; RMC 18-2011, Apr. 12, 2011; BIR Ruling 84-2012, Feb. 15, 2012).

Interest income from long-term deposit or Investment shall he subject to 25% FWT if

received by a non-resident alien not engaged In trade or business in the Philippines (NRA-

NETB)

On investments of individuals in long-term trust invested by a bank’s trust department in a

‘five-year corporate bond ~ Even If the Individual does not withdraw his money from the trust

‘agreement for at least five years, his interest income from the trust agreement will not be

exempt from the FWT as the underlying instrument is 2 corporate bond, even If such

corporate bond has @ maturity of five years. Corporate bonds or any other debt instrument

issued by a non-bank corporation as underlying Instrument will not meet the requirements

of Section 22(FF) of the Tax Code since it is not issued by a bank,

‘On Investments of individuals in long-term trust invested in long-term deposits placed under

name of @ bank's trust department ~ if a bank’s trust department Inyests a fund in a long-

term deposit or Investment certificate in its own name without mentioning the particular

Individual for whom the investment is being made, this long-term deposit and Investment

are not exempt from the 20% FWT. Only those made specifically in trust for the name of,

specific qualified individual investors may be exempt from income tax under the Tax Code

(RIAC 81-2012, Dec. 10, 2012).

Income from cinematographic films and similar works ty @ non-resident alien not engaged in

trade or business in the Philippines is taxed at 25% final tax.

Dividend Payments to Philippine Central Depository (PCD) Nominees: If the PCD Nominee

isa Filipino, the income recipient is deémed to be an individual subject to the 10% final tax

Pursuant to Sec. 24(8)(2) of the Tax Code, unless it Is satisfactorily shown that the actual

‘equity investor is a domestic corporation.

51

If the PCD Nominee is not a Filipino, the Income recipient is deemed to be 2 non-resident

foreign corporation subject to the 30% final tax under Sec. 28(8)(1) of the Tax Code, unles:

is satisfactorily shown that the actual equity Investor is a resident alien, non-resident allen

whether engaged or not engaged in trade or business in the Philippines or resident foreign

corporation (Revenue Memorandum Circular 73-2014, Sept. 12, 2014).

Ilustration, Source: BIR Ruling DA-390-2004, July 20, 2004

Interest income derived by @ non-resident Filipino citlzen from foreign currency bank deposit in the

Philippines shall be exempt from the final withholding’tax of 7.5%. But when the account is jointly in the

name of the non-resident and a resident, e.g. spouse or dependent, only 50% of the Interest income shall

be exempt (that pertalning to the non-resident) and 50% shall be subject to the 7.5% final withholding tax.

The non-resideint citizen shall execute a written permission allowing the depository bank to inforrn the BIR

of his exemption. Any of the following shall be sufficient proof of non-residency:

1. Immigration visa Issued by the country of residence;

Certificate of residency issued by the Philippine Embassy or Consulate in the country of residen

Certificate of the overseas worker's employment contract duly registered with the Phillppine Overseas

Employment Agency (POEA) or a Seaman's Certificate (now Seaman's Book).

IMlustration. Source: BIR Ruling DA (EIT-016) 492-2009, Sept. 4, 2009

Interest income from long-term Individual trust or long-term investment management arrangements with a

bank is exempt from the 20% final WT. This BIR ruling is based on the following fact

8 Co., a domestic universal bank, intends to launch new products or accounts namely: B Co. Personal

Retirement Account and 8 Co, Personal Pension Account. These are long-term Individual trust or long-term

investment management arrangements. Under these arrangements, the client, as trustor or principal,

‘contributes funds to an account and & Co., as the trustee or Investment manager, holds and menages the

fund for the future needs of the client/trustor/prineipal, particularly at retirement. The objective of the

accounts is primarily to provide supplemental funds to individuals for their retirement in addition to

‘government or company retirement plans.

‘The pertinent features of thé new products or accounts are:

2. Eligible trustors/prinelpals are limited to individuals who are Filipino citizens or resident

aliens;

1b. The underlying agreements are non-negotiable and nen-transferrabie and will comply with

the BSP requirements for long-term trust and investment management accounts;

c. There will be a five-year holding peried for the amounts contributed into the accounts;

4d. If the principal is withdrawn within the five-year holding period, interest income shall be

subject to a final WT at the applicable rates depending on the holding perlod specified under

Section 24 (8) (1} and 25 (A) (2) of the Tax Code, as follows:

Holding period ‘Applicable tax rate

Four years to ess than five years om

“Three years to less than four years 12%

[[Less than three years 720%

fe. The funds will be Invested In long-term (more than five years) and/or short-term (Five years

cr fess) investment outlets

52

‘The exemption continues ragardless of the terms of the Investment or maturity of the instrument in which

the longterm deposit or Investment is subsequently Invested (see (e) above). The withdrawal of the

principal deposit/investment before the fifth year will subject the entire earnings to a final WT depending

(on the holding period of the instrument in accordance with the above schedule.

ALLOWABLE DEDUCTIONS

Allowable deductions are items or amounts, which the law allows to be deducted fram

gross income in order to arrive at the taxable income. Deductions from gross income

from business are discussed in another chapter.

1. From compensation income

a. Basic personal and/or additional exemptions; and

b. Premium payments on health and/or hospitalization insurance,

2. From business income

a. Ba

b. Premium payments on health and/or hospitalization insurance;

personal and/or additional exemptions;

€. ltemized deductions under the Tax Code (Items A-I, Section 34); and

d. Optional standard deduction. In place of the itemized deductions, the individual

taxpayer may opt for the optional standard deduction (OSD) nat to exceed 40%

{before R.A. 9504, OSD was 10% only) of his gross sales or gross receipts, as the

case maybe.

if the individual is on the accrual basis of accounting for his income and deductions,

the OSD shall be based on the gross sales during the taxable year. On the other

hand, if the individual employs the cash basis of accounting for his income and

deductions, the OSD shall be based on his gross receipts during the taxable year.

Note that cost of sales in case of individual seller of goods, or cost of services in the

«ase of individual seller of services, are not allowed to be deducted for purposes of

of the OSD.

Personal Exemptions

Personal exemptions are arbitrary amounts allowed as deductions fram gross income of

the individual taxpayer from compensation, business (self-employment) or practice of

Profession. Personal exemptions in a sense represent the personal, living or family

‘expenses of the taxpayer,

53

Kinds of Personal Exemptions .

1, Basic personal exemption

2.- Additional exemption; This exemption is further allowed to the taxpayer by reason

of his qualified dependent children

Basic Personal Exemption 7

Republic Act 9504, which amended Republic Act 8424, otherwise known as the National

Interfial Revenue Code, was signed into law on June 17, 2008. This law provides that for

purposes of deterinining the tax provided in Section 24(A), there shall be allowed a basic

personal exemption amounting to P50,000 for each individual taxpayer regardless of

status. In the case of married individuals where only one of the spouses is deriving

gross income, only such spouse shall be allowed the personal exemption.

Addi

nal Exemption

‘An individual, whether single or married, shall be allowed an additional exemption of

P25,000 for each dependent child not exceeding four (4) children. The additional

exemption for dependents shall be claimed by only one of the spouses in the case of

married individuals.

A dependent means a legitimate, illegitimate or legally adopted child chiefly dependent

upon and living with the taxpayer if such dependent is not more than twenty-one (21)

years of age, unmarried and not gainfully employed or if such dependent, regardless of

age, is incapable of self-support because of mental or physical defect.

In the case of legally separated spouses, additional exemptions may be claimed only by

the spouse who has custody of the child or children. The total amount of additional

exemptions that may be claimed by both shall not’ exceed the maximum additional

exeriptions allowed for four (4) children.

The husband shall be deemed the proper claimant of the additional exemption unless

he waives his right in favor of his wife. But if the spouse of the employee is unemployed

or is a non-resident citizen deriving income from foreign sources, the employed spouse

within the Philippines shall be automatically entitled to claim the additional exemptions

for children. The above basic personal and additional exemptions shall apply after the

transitory period.

Ad

ional Exemption for Dependents per R.A. 10165, the Foster Care Act of 2012

The definition of the term “dependent” under Section 35(B) of the National Internal

Revenue Code of 1997 (NIRC), has been amended to include a “Foster Child.”

54.

Parent/s Brother/sor _Chiid/ren

Sister/s

Living with the taxpayer v Vv

Depending upon the taxpayer for

chief support v

Not more than 21 years old

Unmarried

Not gainfully employed

‘Mentally or physically defective

regardless of age

Pena eateda

HSU esi ead

Living with the person giving support does not necessarily mean actual and physical

dwelling together at all times and under all circumstances. Thus, the additional

exemption applies even if a child or other dependent is away at schoo] or on a visit. If,

however, without necessity the dependent continuously makes his home elsewhere, his

benefactor is not the head of a family irrespective of the question of support.

Chief support means principal or main support (such as paying for the rent and spending

for the food of the dependent}. It is more than one half (50%) of the support required

by the dependent,

In the case of married individuals where only one of the spouses is deriving gross

income, only such spouse shall be allowed the basic and additional exemptions.

For each legally married employee, the amount of personal exemption allowed is

32,000, A married individual deriving Income within the Philippines whose spouse is

unemployed or is a non-resident citizen deriving income from foreign sources, shall be

entitled to a personal exemption of P32,000 only.

Transitory Basic Personal and Ad

ional Exemptions

The implementing Revenue Regulations 10-2008 was made effective on July 6, 2008 so

the basic personal and additional exeniptions for calendar year 2008 shall be as follows:

Jan. 1 to July 6 to 2008

_duly5,2008__Dec. 31, 2008 Total

Basic Personal Exemption

Single 10,000 25,000 35,000

Head of the Family 12,500 25,000 37,500

Married 146,000 25,000 41,000

‘Additional Exemption For Every

Qualified Dependent Child 4,000 12,500 16,500

56

Mlustration: On July 16, 2008, Mr. Marriott married his girlfriend who was already four

(4) months pregnant. On Dec. 26, 2008, the wife gave birth to twins. Earnings from Jan.

1 to July 5, 2008 was P150,000 and for the remainder of the year, he earned P200,000

more. The tax due for 2008 is computed as follows:

Compensation Income (Jan. 1 to July 5, 2008)

(Commpensation income (July 6 to Dec. 31, 2008)

‘Total Compensation for 2008

Less Basic Personal Exemption

‘Additional Exemptions (P16,500 x 2)

‘Taxable Compensation Income

‘Tax Due: On P250,000

26,000 x 30%

Total

150,000

200,000

41,000

33,000

350,000"

74,000

276,000

50,000

7,800

P57, B00,

In all of the illustrations that follow, assume that the individual taxpayer is a resident

itizen and is either earning compensation income or business/professional income. In

each illustration, the basic personal and additional exemptions are determined.

Wustrations:

For Taxable Year 2015

1. Leonardo D. Is single, supporting his studies and

living by himself.

2. Jennifer L., single, supports herself and parents

who live with her.

3. Demi M., legally separated who gains custody of

her only child, a minor, by her husband,

4, Michael 0. Is married to Catherine Z. He Is

supporting the education of a younger brother,

still a minor,

5. Bruce W., married, living with his wife and son

who is 22 years old but mentally retarded,

6. Madonna is married with 2 minor children, Her

husband walves his right to claim exemptions.

For Taxable Year 2007

1. Leonardo D. is single, supporting his studies and

living by himself.

2. Jennifer L., single, supports herself and parents

who live with her.

3. Demi M., legally separated who gains custody of

her only child, a minor, by her husband.

4, Michael D. is married to Catherine Z, He is

supporting the education of a younger brother,

still a minor.

37

Basic

Personal

50,000

50,000

50,000

50,000

50,000

50,000

Basic

Personal

20,000

25,000

25,000

32,000

Additional

None

None

25,000

None

25,000

50,090

Additional

None

None

8,000

None

5. Bruce W., married, living with his wife and son

‘who is 22 years old but mentally retarded.

6. Madonna Is married with 2 minor children, Her

husband waives his right to claim exemptions.

32,000 8,000

32,000 116,000,

Illustrations: Assume that the taxpayer is a resident citizen earning compensation or

b

2015:

iness/professional income in the following illustrations. ‘The subject taxable year Is

Circumstances involving change of status

Basic Personal Additional

Britney S., single, has a legally adopted daughter, still a

minor. Her parents live with and depend on her for their

chief support. Before the year 2015 ended, Britney, met

a car accident and died. How much exemption shall her

estate be entitled to? Her estate may still claim her basic

personal exemption as head of the family*. it may also

claim additional exemption for her legally adopted

daughter. It isos If the taxpayer died at the close of the

Russell C, thought he was to remain single forever. But

ast December, he met Jodie F. and afraid to lose her, he

proposed marriage to her right away. His parents are

abroad such that his entire income goes to his pocket.

Eventually they got married on Dec. 13, 2015. Will

Russell's basic personal exemption increase or will

remain the same? Before Russell got married, he was

entitled to P50,000 basic personal exemption being

single* with no qualified dependent. In taxable year

2015, he may claim P50,000 as basic personal exemption,

_the same amount entitled to @ married* Individual.

Kevin C. got married in 2015. He and his wife were

blessed with a baby boy that same year. Before the year

2015 ended, the couple expected their second baby. The

baby was eventually born on December 31. Is Kevin

entitled to additional exemption for the second baby?

Yes, he Is. Hence, his additional exemption now is

_P50,000 (P25,000 x 2) from the previous year’s P25,000.

Michelle P., married, whose hushand is unemployed, has

3 qualified dependent children. The youngest of the

three acquired a serious illness In 2015 and dled, May

Michelle still claim the additionai exemption pertaining

to this child? Yes. It is as ifthe child died at the close of

_the year.

50,000 25,000

50,000 None

50,000 P50,000__

50,000, 75,000

‘Alec B. has a daughter, 20, unmarried who lives with and

is dependent on him for her chief support. She just

passed the board exam for teachers in February 2015

and was immediately hired as pre-school teacher at

Bright Future. May Alec be still entitled to the additional

exemption for his daughter? Yes. It sas if the daughter

got gainfully employed at the clase of the year. 50,000 25,000

“Per RA. 9504, individual taxpayers regardless of status are entitled to basic personal

zemption of P50,000 each. In the old law, the Individual taxpayers were classified into three

types with varying basic personal exemptions allowed,

individual Taxpayers Allowed Personal Exemptions

1. Citizens

2. Resident Alien

3. Non-Resident Alien

Non-resident alien engaged in trade or business in the Philippines (NRA-ETB) is

allowed basic exemptions under certain conditions but is not allowed additional

exemptions. His basic personal exemption shall be the lesser amount between that

allowed by the income tax law of the alien’s country to Fi

therein and that allowed by our Tax Code to Filipino citizens and resident aliens.

On the other hand, non-resident aliens not engaged in trade or business In the

Philippines (NRA-NETB) are not allowed basic and additional exemptions,

4, Estates and trusts, which are, for purposes of personal exempt

single individual.

lustration. Source: BIR Ruling DA-359-2004, June 25, 2004

The Tax Code entities the benefactor of a dependent senlor citizen to the basic personal exemption of a

head of @ family. However, cating for such dependent senior citizen shall not entitle the benefactor to claim

additional exemption allowed a married individual or head of a family with qualified dependent children,

However, In the case Agrifino C. Baybay vs. the Honorable Commissioner of internal Revenue, the Court of

Tex Appeals (CTA) ruled that under the Senior Citizens Law, the term “dependent” extends to senior

ditizens; hence, their benefactors should be allowed to ciaim the additional exemptions for qualified

dependents. The IR appealed the decision to the Court of Appeals (CA), but It was dismissed due to a

technicality. Since the case did not reach the Supreme Court (SC), the decision did not have the force and

effect of a law under the “doctrine of stare decisis.” Hence, the decision applies only to Agrifino Bayabay's

‘ase and only he can invoke the same for his own benefit.

59

Premium Payments on Health and/or Hospitalization Insurance

The following conditions must be met:

1. The insurance shall be taken by the individual taxpayer himself for his family;

2. The amount being claimed shall not exceed P2,400 a year or P200 a month per

family;

3. The family has gross income of P250,000 or less for the taxable year.

Total family income includes primary income and other income from sources received

by all members of the nuclear family, Le. father, mother, unmarried children living

together as one household, or a single parent with children. A single person living alone

is considered as a nuclear family. For married taxpayers, only the spouse entitled to

claim for additional exemption is allowed this deduction.

Mustration: Brigitta, single mother, is a government employee who earns a monthly

gross compensation income of P18,000. Effective Jan. 1, 2015, she took a

hospitalization Insurance for her and her 2-year old son. She right away paid the annual

premium of P2,400. However, had she opted to pay this premium monthly, an

additional P50 pesos per month is charged. Is she entitled to the deduction? If so, how

much? .

The first condition that the Insurance shall be taken by the individual taxpayer himself

for his family has been satisfied. The second condition speaks for the annual limit of

2,400 and monthly limit of P200 for each family. The actual premium paid by Brigitta

for the whole year was 2,400. This qualifies her to claim the maximum P2,400. If the

annual premium were lower than P2,400, the lower amount shall be allowed. Had she

chosen to pay the premium monthly, the total payment would have been P3,000 (P250

x12 months). If this is the case, she can only claim P2,400—the maximum limit.

‘The third condition is likewise satisfied. The family gross income, she being the sole

bread winner, is P216,000 (P18,000 x 12), far lower than the P250,000 maximum annual

gross income limit.

Premium payments on health and/or hospitalization insurance may be deducted from

the gross business/professional income or from the gross compensation income of a

resident citizen, non-resident citizen and resident alien.

‘TAXABLE INCOME AND TAX DUE

Taxable income is defined as the peitinent items of gross income less the deductions

and/or personal and additional exemptions, if any, authorized for such types of income,

by the Tax Code or other special laws. Taxable income is the amount or tax base upon

which tax rate is applied to arrive at the tax due. Note that in the succeeding

60.

illustrations, computations are sequenced and patterned after the actual BIR income tax

return forms. Depending on the taxpayer involved, taxable income may refer to either

one of the following:

1. “Net compensation income. The compensation income arrived at after subtracting

from gross compensation income derived by resident citizens or resident aliens,

basic personal and additional exemptions; and premium payments, if any, on health

and hospitalization insurance under certain conditions.

For resident citizen and resident alien ear

1g purely compensation income:

Gross Compensation Income 200%

Basic Personal Exemption 00

Add: Additional Exemptions 00%

Total Exemptions 700

‘Add: Premium Paid on Health and/or

Hospitalization Insurance 00%

Less: Total Exemptions and

Premium Payment

Net Compensation Income

‘Tax Due (Sec. 24(A))

2. Gross compensation income. The gross compensation income derived by aliens

including Filipinos employed by regional and area headquarters and regional

operating headquarters of multinational companies, by offshore banking units, or by

foreign petroleum service contractors and sub-contractors.

For non-resident alien employed by such firms earning purely compensation

income:

Gross Compensation Income 20K

Muttiply by tax rate 15%

Tax Due 200%

3. Net income. The income arrived at after subtracting from the gross income (from

business or profession including compensation income) of a citizen, resident alien,

‘and non-resident alien if the latter is engaged in trade or business in the Philippines

the deductions of the taxpayer, including the basic personal and additional

exemptions, if any.

For citizen, resident alien and non-resident alien. engaged in trade or business In

the Philippines:

_a. earning purely business or professional

Gross Business Income 20x

Itemized Deduction or 40% OSD 200

Basic Personal Exemption 2001

Add: Additional Exemptions 200

Total Exemptions v0

Premium Paid on Health and/or

Hospitalization Insurance 20x :

Less: Total Allowable Deductions 200%

Net Income 200K

Tax Due (Sec. 24(A)) 20K

b. earning both business/professional and compensation income

Gross Business Income roe

Gross Compensation income roo

Total Gross Income v0

Itemized Deduction of 40% OSD 30K

Basic Personal Exemption 70

‘Add: Additional Exemptions rox

Total Exemptions 00%

Premium Paid on Health and/or

Hospitalization Insurance 200

Less: Total Allowable Deductions roe

Net Income 200

Tax Due (Sec. 24(A)) =

4. Entire or gross income. The entire or gross income (from business or profession,

including compensation income) without any deduction with respect to non-

resident aliens not engaged in trade or business in the Philippines.

- For non-resident alien not engaged in trade or business in the Philippines ear

business or professional income, compensation income or combination of both:

Gross Income 0%

Multiply by final tax rate 25%

Tax Due 20x

62

Notes:

For married individuals, the husband and wife shall compute separately the tax due on their

respective taxable income. if any income cannot be definitely attributed to or identified as,

+ income exclusively earned or realized by either of the spouses, the same shall be divided

equally between the spouses for the purpose of determining their respective taxable

2. The requirement for entering centavos on the income tax return has been eliminated. If the

amount of centavos is 49 or less, drop down centavos (e.g. P100.49 = P100). If the amount is

50 centavos or more, round up to the next peso.

3. Creditable withholding tex withheld from income and/or tax credit is deducted from the tax

due; penalties, if any shall be added to the tax due. (These are dlscussed In later chapters.)

Mlustration 1: Mr. Antonio B., the taxpayer, is married, with 6 qualified dependent

children. Texable year is 2015. The following data are available:

Gross Compensation Income 240,000

Premium Payment on Health insurance 10,000

Compute the taxable income and tax due if Mr. Antonio 8. is a resident citizen,

Gross Compensation Income 240,000

Personal Exemptions P 50,000

Add: Additional Exemptions (P25,000 x 4) 100,000

Total Exemptions 150,000

‘Add: Premium Paid on Health and/or

Hospitalization Insurance 100

Less: Total Exemptions and

Premium Payment 152,400

Net Compensation Income P_ 87,600

Tax Due (Sec. 244(A))

70,000 P 8,500

17,600 © at 20% 3,520

12,020

‘The tax due is the same if Mr. Antonio B. were a resident alien because gross income is

purely within the Philippines. If there were gross income without, the computation of

the taxable income and eventually the tax due of the resident citizen would include such

income.

6

Mlustration 2: Compute the taxable income and tax due if Mr. Antonio B. is a non-

resident alien employed by a regional operating headquarter of a multinational

company.

Gross Compensation Income 240,000

Multiply by tax rate. 15%

Tax Due P 36,000

Illustration 3: Compute the taxable income and tax due if Mr. Antonio B. is a non-

resident alien engaged in trade or business in the Philippines. The alien’s country allows

full reciprocity to Filipino citizens not residing therein, Assume further that he earned

purely business income and that he opted for OSD. Use the following additional data

Gross Business income 600,000

Itemized Deductions 300,600,

Gross Business Income 600,000

40% OSD 240,000

Basic Personal Exemption 50,000

Less: Total Allowable Deductions 290,000

Net Income 310,000

Tax Due (Sec. 24(A)):

250,000 50,000

60,000 st 30% 18,000

68,000

Note that a NRA-ET is not allowed additional exemption and premium payment on

health and/or hospitalization insurance.

Illustration 4: Compute the taxable income and tax due if Mr. Antonio B. is a resident

alien, Assume that he earned both business and compensation income in the

Philippines and he used itemized deductions. . Use figures in previous illustrations if

needed.

Gross Business Income 600,000

Gross Compensation Income 240,000

Total Gross Income : 840,000

Itemized Deductions 300,000

Basic Personal Exemption P 50,000

‘Add: Additional Exemptions 100,000

Total Exemptions 150,000

Less: Total Allowable Deductions 450,000

Net Income 330,000,

64

Tax Due (Sec. 24(A)): :

250,000 50,000

140,000 at 30% 42,000

Premium is not deductible because total gross income exceeded the P250,000 limit.

Mustration 5: Compute the taxable income and tax due if Mr. Antonio B. is a non-

resident alien not engaged in trade or business. Assume that he earned both business

and compensation income. Use figures in previous illustrations if needed.

Gross Compensation Income 240,000

Gross Business Income ____609,000_

Gross Income 840,000 :

Multiply by tax rate 25%

Tax Due 240,000,

GRADUATED INCOME TAX SCHEDULE (revised Section 24(A))

Depending on the individual taxpayer involved, the tax due on compensation income

and business/professional income is computed using the graduated tax schedule.

iftaxable But not ofthe

come is over, ‘over Tax due is Plus excess over

P 10,000 5%

P 10,000 30,000 P 500 10% P 10,000

30,000 70,000 2,500 15% 30,000

70,000 140,000 8,500 20% 70,000

140,000 250,000 22,500 25% 140,000

250,000 500,000, 50,000 30% 250,000

500,000 125,000 32% 500,000

DECLARATION OF-INCOME TAX FOR INDIVIDUALS

Self-employed individuals are required to file a declaration of their estimated income for

the current taxable year on or before April 15 of the same taxable year. Generally, self-

employment income consists of the earnings derived by the individual from the practice

of profession or conduct of trade or business carried on by him asa sole proprietor or by

a general professional partnership of which he is a member. This estimated tax shall be

paid in four instalments as follows:

Instalment Date

First April 15

Second ‘August 15,

Third November 15

Fourth April 15

65.

The final adjusted Income tax return is supposed to be filed and paid in time for the

fourth instalment on or before April 15 of the following calendar year. In the quarterly

and final returns, gross income and deductions shalll be computed on a cumulative basis.

Personal exemptions shall be allowed in the final return only. Financial statements are

not required submissions on the 4st, 2nd and 3rd instalments.

Estimated tax means the amount which the individual declared as income tex in his final

adjusted and annual income tax return for the preceding taxable year minus-the credits

allowed. If, during the taxable year, the taxpayer reasonably expects to pay a bigger

come tax, ‘he shall file an amended declaration during any interval of instalment