Professional Documents

Culture Documents

Beispiel Sonderabschreibung en

Uploaded by

kimhoang_169275740 ratings0% found this document useful (0 votes)

5 views1 pageSonderabschreibung

Original Title

Beispiel Sonderabschreibung En

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSonderabschreibung

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageBeispiel Sonderabschreibung en

Uploaded by

kimhoang_16927574Sonderabschreibung

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

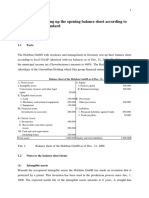

Example of special depreciation allowances

for small and medium sized enterprises

In the year of purchase or manufacture of movable assets is special depreciation of 20 %

possible. In the years before is due to the investment allowance a reduction of profit possible.

Liquidity is preserved and investment is abetted.

A company decides in 2009 to buy an excavator on 2/1/2012. The estimated cost of

acquisition is 100.000 Euro (without VAT). The useful life of the excavator is 10

years.

Reduction of profit

2009 -- 2011

Investment allowance

(at maximum)

Purchase 2/1/2012

Investment allowance

2009 -- 2011

Adjusted

cost of acquisition

Special depreciation

20 % of 60,000

Straight-line

depreciation

10 % of 60,000

Reduction of profit

2012

40,000

100,000

40,000

60,000

12,000

6,000

Stand: Juni 2010

www.germantaxes.info - Zentrale Anlaufstelle fr auslndische Investoren

You might also like

- This Paper Is Not To Be Removed From The Examination HallsDocument82 pagesThis Paper Is Not To Be Removed From The Examination HallsPutin PhyNo ratings yet

- Bank of Scotland Ireland 2009Document75 pagesBank of Scotland Ireland 2009grumpyfeckerNo ratings yet

- Sap TablesDocument29 pagesSap Tableslucaslu100% (14)

- Advanced Corporate Reporting: Professional 2 Examination - November 2020Document16 pagesAdvanced Corporate Reporting: Professional 2 Examination - November 2020Issa BoyNo ratings yet

- Sa Mar11 F6UK Cgtpart1Document13 pagesSa Mar11 F6UK Cgtpart1Shahid KamarNo ratings yet

- Corp Tax Revision Q4 AnswerDocument2 pagesCorp Tax Revision Q4 Answerqmwdb2k27kNo ratings yet

- Block 3 Adjustments To Company AccountsDocument49 pagesBlock 3 Adjustments To Company AccountsNguyễn Hạnh Linh100% (1)

- Things You Must NoticeDocument2 pagesThings You Must NoticeKezia N. ApriliaNo ratings yet

- Accounting Treatment of DepreciationDocument5 pagesAccounting Treatment of Depreciationwebsurfer755100% (3)

- Class 1Document4 pagesClass 1skjacobpoolNo ratings yet

- Irish Air Travel TaxDocument31 pagesIrish Air Travel TaxbizyrenNo ratings yet

- Technopolis Online Report - Finnish Venture Capital Market in Q3 2010Document5 pagesTechnopolis Online Report - Finnish Venture Capital Market in Q3 2010TechnopolisOnlineNo ratings yet

- Finaccurate Advisory PresentationDocument14 pagesFinaccurate Advisory PresentationJARRYNo ratings yet

- Contoh Soal Dan Kunci Jawaban Financial Accounting Akun Jessica - Compressed 1Document9 pagesContoh Soal Dan Kunci Jawaban Financial Accounting Akun Jessica - Compressed 1Mega LengkongNo ratings yet

- IAS12 - Examples - SolutionDocument9 pagesIAS12 - Examples - SolutionTrần Nguyễn Tuệ MinhNo ratings yet

- PR - Update To The Icade Reference DocumentDocument1 pagePR - Update To The Icade Reference DocumentIcadeNo ratings yet

- AC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and CommentariesDocument59 pagesAC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and Commentaries전민건No ratings yet

- Case Exercise 1 - DPRADocument2 pagesCase Exercise 1 - DPRALadipo AilaraNo ratings yet

- Management Accounting Exam Paper August 2012Document23 pagesManagement Accounting Exam Paper August 2012MahmozNo ratings yet

- Evca Yearbook 2011Document420 pagesEvca Yearbook 2011astefan1No ratings yet

- Financial Accounting Sample Paper 21Document31 pagesFinancial Accounting Sample Paper 21Jayasankar SankarNo ratings yet

- The EVCA Yearbook 2011Document7 pagesThe EVCA Yearbook 2011Justyna GudaszewskaNo ratings yet

- 11.4. Final Exam ReviewDocument2 pages11.4. Final Exam Reviewlibe.lasaNo ratings yet

- Taxation (United Kingdom) : Tuesday 12 June 2012Document12 pagesTaxation (United Kingdom) : Tuesday 12 June 2012Iftekhar IfteNo ratings yet

- Case Study 1: Setting Up The Opening Balance Sheet According To The IFRS-SME-StandardDocument4 pagesCase Study 1: Setting Up The Opening Balance Sheet According To The IFRS-SME-StandardDipen ShahNo ratings yet

- MCQs PPEDocument10 pagesMCQs PPEfrieda20093835100% (1)

- PR - 2014 Half-Year Results Resilient Cash-Flows in A Still-Strained MarketDocument11 pagesPR - 2014 Half-Year Results Resilient Cash-Flows in A Still-Strained MarketIcadeNo ratings yet

- Sa Feb12 f6 GainsDocument14 pagesSa Feb12 f6 GainsShuja Muhammad LaghariNo ratings yet

- F6UK 2012 Dec AnsDocument9 pagesF6UK 2012 Dec AnsamirahimiNo ratings yet

- Capital AllowanceDocument6 pagesCapital AllowanceAbhiraj RNo ratings yet

- AC1025 ZA d1Document12 pagesAC1025 ZA d1Amna AnwarNo ratings yet

- P1 - Corporate Reporting April 11Document20 pagesP1 - Corporate Reporting April 11Abdurrazaq PanhwarNo ratings yet

- Wienerberger AR 11 EngDocument172 pagesWienerberger AR 11 Eng0730118008No ratings yet

- Hou Mba51 Wa1 2013 - 14Document4 pagesHou Mba51 Wa1 2013 - 14Eleni KaragiannidouNo ratings yet

- Avolta Partners VC MA Tech Trends France Q2 2022Document21 pagesAvolta Partners VC MA Tech Trends France Q2 2022David GoubetNo ratings yet

- Anility - OutlayDocument1 pageAnility - OutlaySava KosanovicNo ratings yet

- IFA 2 - Group 5 - BE13.7&P13.2Document1 pageIFA 2 - Group 5 - BE13.7&P13.2AFIFAH KHAIRUNNISA SUBIYANTORO 1No ratings yet

- CFAB Accounting QB Chapter 10 C601Document14 pagesCFAB Accounting QB Chapter 10 C601VânAnh NguyễnNo ratings yet

- Helpful PDFDocument23 pagesHelpful PDFMahrukh ChohanNo ratings yet

- Chargeable Gains, Part 1: Scope of Capital Gains Tax (CGT)Document12 pagesChargeable Gains, Part 1: Scope of Capital Gains Tax (CGT)Ishmail A. kargboNo ratings yet

- Taxation Trends in The European Union - 2012 91Document1 pageTaxation Trends in The European Union - 2012 91d05registerNo ratings yet

- All Amounts Include VAT and Are in Zimbabwean Dollars (ZWL) Unless Otherwise StatedDocument6 pagesAll Amounts Include VAT and Are in Zimbabwean Dollars (ZWL) Unless Otherwise StatedMoses Nhlanhla MasekoNo ratings yet

- Unique Tax Incentives in Belgium'Document42 pagesUnique Tax Incentives in Belgium'De StandaardNo ratings yet

- Taxation: DFA 2104YDocument16 pagesTaxation: DFA 2104YFhawez KodoruthNo ratings yet

- Ex-Ante Contribution To The National Resolution Fund - 2020 Contribution PeriodDocument10 pagesEx-Ante Contribution To The National Resolution Fund - 2020 Contribution PeriodgrobbebolNo ratings yet

- AME - 2022 - Tutorial 6 - SolutionsDocument17 pagesAME - 2022 - Tutorial 6 - SolutionsjjpasemperNo ratings yet

- Ir q2 2009 Results Highlights tcm82-184522Document1 pageIr q2 2009 Results Highlights tcm82-184522Salita SangarunNo ratings yet

- ST Answers PDFDocument32 pagesST Answers PDFcatwalktoiimNo ratings yet

- MG 3027 TAXATION - Week 19 Introduction To Capital Gains Tax, Computation of Gains and LossesDocument39 pagesMG 3027 TAXATION - Week 19 Introduction To Capital Gains Tax, Computation of Gains and LossesSyed SafdarNo ratings yet

- Finance Lease Sales Type Lease: Leased Equipment UnderDocument5 pagesFinance Lease Sales Type Lease: Leased Equipment UnderM Nur FahmiNo ratings yet

- Sa Mar12 f6 CorpDocument5 pagesSa Mar12 f6 CorpShuja Muhammad LaghariNo ratings yet

- UntitledDocument52 pagesUntitledHải NguyễnNo ratings yet

- Company Accounts F6.1: Additional InformationDocument4 pagesCompany Accounts F6.1: Additional InformationYogesh PanwarNo ratings yet

- CSF Annual Report 2011Document60 pagesCSF Annual Report 2011red cornerNo ratings yet

- Tax Card 2018: Paralimni PaphosDocument12 pagesTax Card 2018: Paralimni PaphosJade ViguillaNo ratings yet

- 2014 CommentaryDocument46 pages2014 Commentaryduong duongNo ratings yet

- Acc 2112: Accounting Theory and Practice Assignment (February 2021)Document6 pagesAcc 2112: Accounting Theory and Practice Assignment (February 2021)Ranson MerciecaNo ratings yet

- Merger and Acquisition: Presentation OnDocument20 pagesMerger and Acquisition: Presentation OnShankar DhondwadNo ratings yet

- Capital AllowanceDocument9 pagesCapital AllowanceAlfred MphandeNo ratings yet

- Lecture 2 Macro Environment - Measuring GDPDocument28 pagesLecture 2 Macro Environment - Measuring GDPRex HowNo ratings yet

- FIORI Apps in Simple FinanceDocument13 pagesFIORI Apps in Simple FinancesaavbNo ratings yet

- Month End Closing ActivitiesDocument201 pagesMonth End Closing Activitiesudayredekar50% (2)

- SAP Training - ALE-LSMW (Idocs)Document42 pagesSAP Training - ALE-LSMW (Idocs)kimhoang_16927574No ratings yet

- CM8197 - Three Ways SAP Cloud Platform Could Enable Real-Time Credit ManagementDocument49 pagesCM8197 - Three Ways SAP Cloud Platform Could Enable Real-Time Credit Managementkimhoang_16927574No ratings yet

- SAPTransactionCodes Jan29 0004Document10 pagesSAPTransactionCodes Jan29 0004kimhoang_16927574No ratings yet

- Chee4367 HW051231Document2 pagesChee4367 HW051231kimhoang_16927574No ratings yet

- U2K2 Project and SAP ExecutionDocument43 pagesU2K2 Project and SAP Executiong_usreddyNo ratings yet

- CA District TaxDocument5 pagesCA District Taxkimhoang_16927574No ratings yet

- U2K2 Project and SAP ExecutionDocument43 pagesU2K2 Project and SAP Executiong_usreddyNo ratings yet

- European Value Added TaxDocument52 pagesEuropean Value Added TaxneelsterNo ratings yet