Professional Documents

Culture Documents

1st Manipal Ranka National Moot Court Participation Memorial

1st Manipal Ranka National Moot Court Participation Memorial

Uploaded by

Trishna DeviCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1st Manipal Ranka National Moot Court Participation Memorial

1st Manipal Ranka National Moot Court Participation Memorial

Uploaded by

Trishna DeviCopyright:

Available Formats

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

IN THE HONBLE SUPREME COURT OF INDIA

APPEAL NO/2016

(ARTICLE 136 OF THE CONSTITUTION)

JDC LTD. ..APPELLANT

V.

RAMNATH..RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

INDEX

1.

2.

3.

4.

5.

6.

7.

LIST OF ABBREVIATIONS

INDEX OF AUTHORITIES

STATEMENT OF FACTS

STATEMENT OF JURISDICTION

SUMMARY OF ARGUMENTS

ARGUMENTS ADVANCED

PRAYER

LIST OF ABBREVIATIONS

A.I.R--------------------------------------------------------------------------- ALL INDIA REPORTERS

Cal----------------------------------------------------------------------------------------------CALCUTTA

Co. -------------------------------------------------------------------------------------------------COMPANY

GPA----------------------------------------------------------------GENERAL POWER OF ATTORNEY

Sec------------------------------------------------------------------------------------------SECTION

2

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

Ltd------------------------------------------------------------------------------------------LIMITED

BC----------------------------------------------------------------------------------------BANKING CASES

Proviso----------------------------------------------------------------------------PROVISION

SCC---------------------------------------------------------------------------SUPREME COURT CASES

Bom.-------------------------------------------------------------------------------------BOMBAY

INDEX OF AUTHORITIES

List of Statutes:

I.

II.

III.

IV.

V.

VI.

VII.

VIII.

IX.

The Constitution of India,1950

The Transfer of Property Act, 1882

The Indian Contract Act, 1872

The Specific Relief Act, 1963

The Registration Act, 1908

Rajasthan Stamp Law (Adaptation) Act,1998

Indian Stamp Act,1899

The Income Tax Act, 1961

The Power Of Attorney Act, 1882

List of Books Referred:

JAIN, M. P., INDIAN CONSTITUTIONAL LAW,( WADHWA AND COMPANY, 6

NAGPUR) (REP. 2012)

TIWARI, H.N., TRANSFER OF PROPERTY ACT, 1882

SHUKLA, TRANSFER OF PROPERTY, 1882

BANGIA, THE INDIAN CONTRACT ACT, 1872

Dictionaries

AIYAR, RAMANATHA P.: THE LAW LEXICON, WADHWA & COMPANY, 2ND EDN.

NAGPUR(2002).

BLACK, HENRY CAMPBELL: BLACKS LAW DICTIONARY, 6 1991).

CURZON. L. B: DICTIONARY OF LAW, PITMAN PUBLISHING, 4TH EDN. NEW

DELHI (1994).

3

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

GARNER, BRYAN A.: A DICTIONARY OF MODERN LEGAL USAGE, OXFORD

UNIVERSITY PRESS

GREENBERG, DANIEL AND ALEXANDRA, MILLBROOK: STROUDS JUDICIAL

DICTIONARY OF WORD S & PHRASES, VOL. 2, 6 THEDN., CENTENNIAL ED. (1891-

ND EDN. OXFORD (1995). EDN.,

LONDON: SWEET & MAXWELL (2000).

INTERNET SITES

http://www.findlaw.com

http://www.indiankanoon.com

http://www.indlawinfo.org/

http://www.manupatra.

STATEMENT OF FACTS

JDC Ltd., the plaintiff, appellant a company incorporated under the Companies Act,2013 claim

that one Ramanath and his family sold two and half acres of land in Jagatpura village in jaipur to

them my means of an unregistered agreement of sale, General Power of Attorney (GPA) and will

executed on 01.08.2013 for a total consideration of 50 lacs. Of the total amount, 45 lacs were

paid based on which the possessory right of the property was transferred. The remaining amount

which was to be paid before 02.02.2014 was offered to be paid on 10.01.2014 but was not

accepted by Ramanath and his family. Since the agreement of sale, General Power of Attorney

(GPA) and will were unregistered and the plaintiff was not the signatory, so the property was

sold to Mr. Yadav by ramanath and his family for RS 50 lacs and was asked to possession from

JDC Ltd.

Ramanth also pleaded that he enquired about the stamp duty and registration charges and was

informed by the Registering Authority that fair market value on the date of registration and not

4

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

the date of Sale Agreement, would be payable. Thus the stamp duty would be payable on Rs.

1.50 Crore, which should be borne by the plaintiff. The seller further claimed that on account of

Section 50C of the Income-Tax Act, 1961, the seller would be required to pay capital gain tax on

Rs. 1.50 Crore against real sale consideration of Rs. 50 Lacs, which would be additional liability

for no fault on his part.

Shri Dharamvir Yadav claims that earlier General Power of Attorney is having being cancelled

and the second GPA in his name subsists. He has the authority and competence to sell the

property and not Ramnath. Mr Yadav also claims that RS 40 lacs were paid to the plaintiff.

STATEMENT OF JURISDICTION

The honble Supreme Court has the jurisdiction to hear special appeal from decisions of the

Honble high Court of India. Under article 136 (1), the honble supreme court has the power to

take into consideration the present case. However, it is to be taken into consideration that as held

in Balwant Rai V/S Nagrasna 1that an application for special leave petition may be summarily

rejected where the court is satisfied that no substantian injustice has been done. Similar judgment

1 AIR 1960 SC 1292

5

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

has been observed by the honble Supreme court even in the case of Pritam singh v/s state2. In

The present case both the district court and the Rajasthan High Court has dismissed since the

agreement to sale is unregistered and the remaining amt was not paid by the due date. Therefore

specific performance does not arise.

SUMMARY OF ARGUMENTS

1. WHETHER THE AGREEMENT OF SALE, GENERAL POWER OF ATTORNEY

AND THE WILL EXECUTED IN FAVOUR OF THE PLAINTIFF IS VALID?

The agreement of sale, general power of attorney and the will executed in favour of the

plaintiff is not valid for mainly two reasons- firstly the instruments ie agreement of sale,

general power of attorney and the will were not registered and secondly since there was

no transfer of absolute ownership that took place between the parties as such, therefore

the validity of the above said is nullified.

2 AIR 1950 SC 169

6

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

2. WHETHER WHEN SUM OF RS 45 LACS HAVING BEEN PAID OUT OF RS 50

LACS AND POSSESSION GIVEN UNDER SEC-53A OF THE TRANSFER OF

PROPERTY ACT, RAMANATH AND HIS FAMILY MEMBERS HAD NO

POWERS, COMPETENCE AND AUTHORITY TO EXECUTE SECOND

GENERAL POWER OF ATTORNEY IN FAVOUR OF MR, YADAV AND

CANCEL THE EARLIER GPA IN FAVOUR OF PLAINTIFF, IS VALID?

A power of attorney is not an instrument of transfer in regards to any right, title or interest

in an immovable property. So it does not convey ownership and also it is irrevocable or

terminable at any time unless under law. Therefore, Ramanath and his family member

had full authority to cancel the previous general power of attorney and execute a second

general power of attorney

3. WHETHER THE PLAINTIFF WAS READY, WILLING AND PREPARED AND

TENDERED RS 5 LACS AFTER 02.01.2014 AND REQUESTED RAMANATH

AND HIS FAMILY MEMBERS TO EXECUTE SALE DEED AND TO GET IT

REGISTERED. WHAT IS THE EFFECT OF NON-PAYMENT OF BALANCE

AMOUNT ON 02.01.2014?

JDC ltd had offered the amount immediately 5 days after the due date , this shows that

they enough resources to pay the amount even on the due date ie. 02.01.2014. This

subsequently implies that they were neither willing to get the sale deed executed nor to

get it registered.

4. WHETHER THE STAMP DUTY REGISTERING AUTHORITY WAS RIGHT IN

DEMANDING STAMP DUTY ON THE FAIR MARKET VALUE OF RS 1 CRORE

7

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

AND 50 LACS AS ON 01.08.2013 AND NOT AT RECORDED VALUE/FAIR

MARKET VALUE ON 01.08.2013 IE. RS 50 LACS? IF STAMP DUTY WOULD BE

PAYABLE ON ADDITIONAL 1 CRORE, WHO WOULD BEAR SUCH AMOUNT?

A proviso under Sec- 56(2) (vii) (b) (ii) of the Income Tax Act,1961 speaks that this section will

be applicable only if a part of the consideration is paid in mode other than cash. But the facts of

the case clearly show that Mr Yadav had paid the entire consideration of 50 lacs in cash.

Therefore the stamp duty registering authority was not right in demanding stamp duty on the fair

market value of rs 1 crore and 50 lacs as on 01.08.2013 and not at recorded value/fair market

value on 01.08.2013 ie. rs 50 lacs

ARGUMENTS ADVANCED

ISSUE-I

1. WHETHER THE AGREEMENT OF SALE, GENERAL POWER OF ATTORNEY

AND THE WILL EXECUTED IN FAVOUR OF THE PLAINTIFF IS VALID?

The respondent humbly submits to this Honorable Supreme Court that-there was prima facie

no registered documents of the transaction between Jdc Ltd And Ramanath and his family, so

there was so such sale that took place according to the provisions of transfer of property

act,1882.

1.1

We reproduce Section 54 of Transfer of property act,1882 as under

"Sale" defined

"Sale" is a transfer of ownership in exchange for a price paid or promised or part-paid and

part-promised.

8

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

Sale how made: Such transfer, in the case of tangible immovable property of the value of one

hundred rupees and upwards, or in the case of a reversion or other intangible thing, can be

made only by a registered instrument.

In the case of tangible immovable property of a value less than one hundred rupees, such

transfer may be made either by a registered instrument or by delivery of the property.

Delivery of tangible immovable property takes place when the seller places the buyer, or

such person as he directs, in possession of the property.

Contract for sale: A contract for the sale of immovable property is a contract that a sale of

such property shall take place on terms settled between the parties.

It does not, of itself, create any interest in or charge on such property.

As we can infer from the above mentioned section that for the application of Section 54 of

the transfer of property act,1882, there needs to be a registered document. An unregistered

instrument whether a

sale deed or a agreement of sale cannot be considered a valid

document under this section. In Vijaya Bank V/S Murudeswara Food and Export 3 , it was

held that an unregistered sale deed cannot be taken as a valid title deed. As sale is the transfer

of ownership from one party to another implying transfer of rights from the purchaser or the

seller to the buyer so an invalid agreement of sale would not confess any

rights upon the buyer as held in case of R. Rajagopala Ayyangar And Others V/S

Ranganatha Ayyanagar And Another4.

The plaintiff has been constantly been speaking on the validity of the agreement of sale. But they

need to get the facts clear that under Section 54 of the transfer of property act,1882, sale of

immovable property can only be done with a registered document which is completely absent in

3 (2003) BC 80

4 AIR 1933 MAD 181

9

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

this case. Even in the case of Alaka Raghunath Nandkarni, Mumbai V/S Assessee5, it was held

that a validity of a sale of immovable property can only be done with a registered document.

1.2

Furthermore, the plaintiff has also pleaded part performance under Sec-53A of

Transfer of Property Act, 1882.

We reproduce Section 53A of Transfer of property act,1882 as under

Part performance

Where any person contracts to transfer for consideration any immovable property by writing

signed by him or on his behalf from which the terms necessary to constitute the transfer can be

ascertained with reasonable certainty,

and the transferee has, in part performance of the contract, taken possession of the property or

any part thereof, or the transferee, being already in possession, continues in possession in part

performance of the contract and has done some act in furtherance of the contract,

and the transferee has performed or is willing to perform his part of the contract,

then, notwithstanding that the contract, though required to be registered, has not been registered,

or, where there is an instrument of transfer, that the transfer has not been completed in the

manner prescribed therefor by the law for the time being in force, the transferor or any person

claiming under him shall be debarred from enforcing against the transferee and persons claiming

under him any right in respect of the property of which the transferee has taken or continued in

possession, other than a right expressly provided by the terms of the contract:

PROVIDED that nothing in this section shall affect the rights of a transferee for consideration

who has no notice of the contract or of the part performance thereof.

Part performance under this section is applicable only if there is a valid contract. In other words a

prerequisite limb of Sec 53A is a valid contract as it was held in Sitaram V/S Corporation Of

5 ITA No. 4465/MUM./2009

10

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

Calcutta6that where a law provides that a contract with a corporation must be according to the

provision of law, but if it was not abide by, then the contract is not binding upon parties though

there was part- performance. Again in judgements given in Ama Sultan V/S Seydu Zohra

Beevi7and Nanjegowda V/S Gangamma8it was held that where the property was not proved to

be acquired under a contract, then the party cannot claim benefit under sec-53a of transfer of

property act,1882. Thus a valid contract is a must for this section.

Interpretation of this section by various precedents show that the section only gives the right to

holder of the property to only defend the property and not to carry out any legal action against

the property. But again this can be done only in case of a registered document. Thus the pleading

under the following section is completely forbidden. In the case of Gurbachanchan Singh V/S

Raghubir Singh9, it was held that suit for specific performance based upon an unregistered

agreement is not maintainable.

1.3

Registration

Even the amendment act (48 of 2011) which has amended sec-17 of the registration act speaks

that for the application of sec-53a of transfer of property act, 1882, the written document of the

said transfer must be registered. Since in this case, the document was not registered so the sale or

the agreement for sale was void-ab-initio.

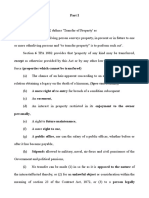

We reproduce Section 17 of the registration act as under:

Documents of which registration is compulsory

(1) The following documents shall be registered, if the property to which they relate is situate in

a district in which, and if they have been executed on or after the date on which, Act No. XVI of

6 AIR 1956 cal 18

7 Air 1990 Ker 187

8 Air 2011 Sc 3774

9 1980 AIR 1362

11

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

1864, or the Indian Registration Act, 1866, or the Indian Registration Act, 1871, or the Indian

Registration Act, 1877 or this Act came or comes into force, namely:(a) instruments of gift of immovable property;

(b) other non-testamentary instruments which purport or operate to create, declare, assign, limit

or extinguish, whether in present or in future, any right, title or interest, whether vested or

contingent, of the value of one hundred rupees, and upwards, to or in immovable property;

(c) non-testamentary instruments which acknowledge the receipt or payment of any

consideration on account of the creation, declaration, assignment, limitation or extinction of any

such right, title or interest; and

(d) leases of immovable property from year to year, or for any term exceeding one year, or

reserving a yearly rent;

12[(e) non-testamentary instruments transferring or assigning any decree or order of a court or

any award when such decree or order or award purports or operates to create, declare, assign,

limit or extinguish, whether in present or in future, any right, title or interest, whether vested or

contingent, of the value of one hundred rupees and upwards, to or in immovable property:]

PROVIDED that the State Government may, by order published in the Official Gazette, exempt

from the operation of this sub-section any leases executed in any district, or part of a district, the

terms granted by which do not exceed five years and the annual rent reserved by which do not

exceed fifty rupees.

(2) Nothing in clauses (b) and (c) of sub-section (1) applies to(i) any composition-deed; or

(ii) any instrument relating to shares in a joint Stock Company, notwithstanding that the assets of

such company consist in whole or in part of immovable property; or

12

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

(iii) any debenture issued by any such company and not creating, declaring, assigning, limiting

or extinguishing any right, title or interest, to or in immovable property except insofar as it

entitles the holder to the security afforded by a registered instrument whereby the company has

mortgaged, conveyed or otherwise transferred the whole or part of its immovable property or any

interest therein to trustees upon trust for the benefit of the holders of such debentures; or

(iv) any endorsement upon or transfer of any debenture issued by any such company; or

(v) any document not itself creating, declaring, assigning, limiting or extinguishing any right,

title or interest of the value of one hundred rupees and upwards to or in immovable property, but

merely creating a right to obtain another document which will, when executed, create, declare,

assign, limit or extinguish any such right, title or interest; or

(vi) any decree or order of a court 13[except a decree or order expressed to be made on a

compromise and comprising immovable property other than that which is the subject-matter of

the suit or proceeding;] or

(vii) any grant of immovable property by government; or

(viii) any instrument of partition made by a revenue-officer; or

(ix) any order granting a loan or instrument of collateral security granted under the Land

Improvement Act, 1871, or the Land Improvement Loans Act, 1883; or

(x) any order granting a loan under the Agriculturists Loans Act, 1884, or instrument for securing

the repayment of a loan made under that Act; or

14[(xa) any order made under the Charitable Endowments Act, 1890, (6 of 1890) vesting any

property in a Treasurer of Charitable Endowments or divesting any such treasurer of any

property; or]

13

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

(xi) any endorsement on a mortgage-deed acknowledging the payment of the whole or any part

of the mortgage-money, and any other receipt for payment of money due under a mortgage when

the receipt does not purport to extinguish the mortgage; or

(xii) any certificate of sale granted to the purchaser of any property sold by public auction by a

civil or revenue-officer.

15[Explanation: A document purporting or operating to effect a contract for the sale of

immovable property shall not be deemed to require or ever to have required registration by

reason only of the fact that such document contains a recital of the payment of any earnest

money or of the whole or any part of the purchase money.]

(3) Authorities to adopt a son, executed after the 1st day of January, 1872, and not conferred by a

will, shall also be registered.

In Stoneware Pipe And Sanitary V/S State Of Punjab 10, registration of document is necessary

under sec-17 of registration act for the enforcement of sale of property whose value is more than

rs 100. Even this section provides that registration is a must.

Registration is a process precisely in a designated place certain information in the public records

as is mandated by statute, it is a formal process.a non-registered document does not have any

legal bearing and any deal made on the basis of it is considered void. Even in Som Dev And Ors

V/S Rati Ram And Ans11, it was held that any document which purports to create, declare, assign

right title or interest in immovable property above rs 100 must be registered under sec-17 of

registration act.

Even the will that was executed was not valid. Reproducing sec- sec-2(h) of indian succession

act,1925 as under:

Will means the legal declaration of the intention of a testator with respect to his property which

he desires to be carried into effect after his death.

10 AIR 1972 RAJ 83

11 (2006) 142 PLR 609

14

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

Thus, a will can be executed only after the death of the testator who in this case is still alive thus

making the will absolutetly invalid. In other words, will cannot be used in cases where the

transfer is intervivos ie transfer between living persons.Even in the case R Vasanthi v/s Janaki

Devi and others12, the court held that a will is carried on only after the death of the testator and

its registration may not be required.

Thus to sum up, Agreement Of Sale, General Power Of Attorney And The Will executed in

favour of the plaintiff is totally null and void.

ISSUE-II

WHETHER WHEN SUM OF RS 45 LACS HAVING BEEN PAID OUT OF RS 50 LACS

AND POSSESSION GIVEN UNDER SEC-53A OF THE TRANSFER OF PROPERTY

12 2005 (1) CTC 11

15

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

ACT, RAMANATH AND HIS FAMILY MEMBERS HAD NO POWERS, COMPETENCE

AND AUTHORITY TO EXECUTE SECOND GENERAL POWER OF ATTORNEY IN

FAVOUR OF MR, YADAV AND CANCEL THE EARLIER GPA IN FAVOUR OF

PLAINTIFF, IS VALID?

That Sec 1A of the power of attorney act,1882 speaks that "Power-of-Attorney" includes any

instruments empowering a specified person to act for and in the name of the person executing it.

Thus it confers upon a principal- agency relation. Power of attorney are of two types-special

power of attorney and general power of attorney (GPA)

GPA authorizes the holder to do whatever is necessary. For example, in property 'sales'

using this instrument, the buyer gets a GPA from the seller not only for his own use of the

property, but for further 'sale' to someone else if he so desires. In 2004, the Delhi government

made it mandatory for GPAs to be registered at 90% of the stamp duty rate applicable to sale

deeds. It made it clear the GPAs that are not registered will have no legal validity. as there was

no registered instrument or document in the public office as the facts of the case suggests, so

there was no transfer of ownership as such my client could cancel the general power of attoney

and execute a fresh new general power of attorney.

In Satyawam Vs Govt Of Nct Of Delhi13, it was held that power of attorney needs to be

registered as an instrument

Again, there was no sale of property with jdc pvt ltd , therefore the canceling of the gpa should

not be a topic of any issue and the execution of it would come into place only if there was

transfer of ownership which in this case is not conducted. In the historical judgement of Suraj

Lamp And Industries Pvt. Ltd V/S State Of Haryana,14 honble supreme court of india has

declared that there cannot be transfer of title by gpa/sa/wills transactions. Only registered sale

deed /conveyance is a valid mode of transfer of title in immovable property. So the validity of the

GPA cannot be challenged by the plaintiff.

13 115 (2004) DLT 424

14 2009 (7) SCC 363

16

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

A power of attorney is not an instrument of transfer in regards to any right, title or interest in an

immovable property. So it does not convey ownership and also it is irrevocable or terminable at

any time unless under law. Therefore, my client had full authority to cancel the previous gpa and

execute a second GPA.

ISSUE III

III. WHETHER THE PLAINTIFF WAS READY, WILLING AND PREPARED AND

TENDERED RS 5 LACS AFTER 02.01.2014 AND REQUESTED RAMANATH AND HIS

FAMILY MEMBERS TO EXECUTE SALE DEED AND TO GET IT REGISTERED.

WHAT IS THE EFFECT OF NON-PAYMENT OF BALANCE AMOUNT ON 02.01.2014?

17

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

The issue as stated by the High Court of Rajasthan is quite academic. jdc ltd who was supposed

to pay the remaining amount of Rs 5 lacs before 02.01.2014 , offered to pay the amount on

10.01.2014. This proves that they were very casual towards the deal of property. This proves that

they were not willing to execute the sale deed and execute it.

The company had offered the amount immediately 5 days after the due date. This shows that they

enough resources to pay the amount. Subsequently implying that they were not bothered about

the registration as well as disinterested in paying the remaining amount.

The plaintiff has been constantly telling about breach of contract. But it has already been told

that there was no such contract or sale of property. Thus sec 73 of Indian contact act, 1872 will

not be applicable.

Thus reproducing sec-73 of Indian contract act of 1872,

73. Compensation of loss or damage caused by breach of contract

When a contract has been broken, the party who suffers by such breach is entitled to receive,

from the party who has broken the contract, compensation for any loss or damage caused to him

thereby, which naturally arose in the usual course of things from such breach, or which the

parties knew, when they made the contract, to be likely to result from the breach of it.

Such compensation is not to be given for any remote and indirect loss or damage sustained by

reason of the breach.

Compensation for failure to discharge obligation resembling those created by contract: When an

obligation resembling those created by contract has been incurred and has not been discharged,

any person injured by the failure to discharge it is entitled to receive the same compensation

from the party in default, as if such person had contracted to discharge it and had broken his

contract.

18

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

Explanation: In estimating the loss or damage arising from a breach of contract, the means

which existed of remedying the inconvenience caused by non-performance of the contract must

be taken into account.

Illustrations

(c) A contracts to buy of B, at a stated price, 50 maunds of rice, no time being fixed for delivery.

A afterwards informs B that he will not accept the rice if tendered to him. B is entitled to receive

from A, by way of compensation, the amount, if any, by which the contract price exceeds that

which B can obtain for the rice at the time when A informs B that he will not accept it.

(d) A contracts to buy B's ship for 60,000 rupees, but breaks the promise. A must pay to B, by

way of compensation, the excess, if any, of the contract price over the price which B can obtain

for the ship at the time of breach of promise.

(e) A, the owner of a boat, contracts with B to take a cargo of jute to Mirzapur, for sale at that

place, starting on a specified day. The boat, owing to some unavoidable cause, does not start at

the time appointed, whereby the arrival of the cargo at Mirzapur is delayed beyond the time

when it would have arrived if the boat had sailed according to the contract. After that date, and

before the arrival of the cargo, the price of jute falls. The measure of the compensation payable

to B by A is the difference between the price which B could have obtained for the cargo at

Mirzapur at the time when it would have arrived if forwarded in due course, and its market price

at the time when it actually arrived.

(f) A contracts to repair B's house in a certain manner, and receives payment in advance. A

repairs the house, but not according to contract. B is entitled to recover from A the cost of

making the repairs conforming to the contract.

(g) A contracts to let his ship to B for a year, from first of January, for a certain price. Freights

rise, and, on the first of January, the hire obtainable for the ship is higher than the contract price.

A breaks his promise. He must pay to B, by way of compensation, a sum equal to the difference

19

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

between the contract price and the price for which B could hire a similar ship for a year on and

from the first of January.

(l) A, a builder, contracts to erect and finish a house by the first of January, in order that B may

give possession of it at that time to C, to whom B has contracted to let it. A is informed of the

contract between B and C. A builds the house so badly that, before the first of January, it falls

down and has to be rebuilt by B, who in consequence, loses the rent which he was to have

received from C, and is obliged to make compensation to C for the breach of his contract. A must

make compensation to B for the cost of rebuilding of the house, for the rent lost, and for the

compensation made to C.

(m) A sells certain merchandise to B, warranting it to be of a particular quality, and B, in reliance

upon this warranty, sells it to C with a similar warranty. The goods prove to be not according to

the warranty, and B becomes liable to pay C a sum of money by way of compensation. B is

entitled to be reimbursed this sum by A.

(n) A contracts to pay a sum of money to B on a day specified. A does not pay the money on that

day. B, in consequence of not receiving the money on that day, is unable to pay his debts, and is

totally ruined. A is not liable to make good to B anything except the principal sum he contracted

to pay together with interest up to the day of payment.

(o) A contracts to deliver 50 maunds of saltpetre to B on the first of January, at a certain price. B,

afterwards, before the first of January, contracts to sell the saltpetre to C at a price higher than the

market price of the first of January. A breaks his promise. In estimating the compensation

payable by A to B, the market price of the first of January, and not the profit which would have

arisen to B from the sale to C, is to be taken into account.

(p) A contracts to sell and deliver 500 bales of cotton to B on a fixed day. A knows nothing of B's

mode of conducting his business. A breaks his promise, and B, having no cotton, is obliged to

close his mill. A is not responsible to B for the loss caused to B by closing of the mill.

20

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

(q) A contracts to sell and deliver to B, on the first of January, certain cloth which B intends to

manufacture into caps of a particular kind, for which there is no demand, except at that season.

The cloth is not delivered till after the appointed time, and too late to be used that year in making

caps. B is entitled to receive from A, by way of compensation, the difference between the

contract price of the cloth and its market price at the time of delivery, but not the profits which he

expected to obtain by making caps, nor the expenses which he has been put to in making

preparation for the manufacture.

Normally, a sale becomes effective on registration from the date of its execution. Execution

means signing of the deed of sale by the parties concerned and attested by witnesses. However,

mere registration of the document does not mean simultaneous transfer of ownership of the

property. Transfer of full ownership happens only after due compliance of all formalities and the

payment of price.

Unless and until the full sale price is paid and other legal formalities complied with, the sale is

ineffective, even though the deed of sale is registered before the registering authority concerned

and in presence of witnesses. If the price is not paid in full by the date stipulated, the seller is at

liberty to cancel the registered deed of sale. Thus, Ramanath could cancel the agreement at any

time.

ISSUE IV

21

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

1. WHETHER THE STAMP DUTY REGISTERING AUTHORITY WAS RIGHT IN

DEMANDING STAMP DUTY ON THE FAIR MARKET VALUE OF RS 1 CRORE

AND 50 LACS AS ON 01.08.2013 AND NOT AT RECORDED VALUE/FAIR

MARKET VALUE ON 01.08.2013 IE. RS 50 LACS? IF STAMP DUTY WOULD BE

PAYABLE ON ADDITIONAL 1 CRORE, WHO WOULD BEAR SUCH AMOUNT?

No, the Stamp Duty Registering authority was not right on demanding stamp duty on the fair

market value of 1crore and 50 lacs under Sec- 56(2) (vii) (b) (ii) of the Income Tax Act,1961

Reproducing Sec- Sec- 56(2) (vii) of the Income Tax Act,1961

(vii) where an individual or a Hindu undivided family receives, in any previous year, from

any person or persons on or after the 1st day of October, 2009,

(a) any sum of money, without consideration, the aggregate value of which exceeds fifty

thousand rupees, the whole of the aggregate value of such sum;

8

[(b) any immovable property,

(i) without consideration, the stamp duty value of which exceeds fifty thousand rupees, the

stamp duty value of such property;

(ii) for a consideration which is less than the stamp duty value of the property by an amount

exceeding fifty thousand rupees, the stamp duty value of such property as exceeds such

consideration:

Provided that where the date of the agreement fixing the amount of consideration for the

transfer of immovable property and the date of registration are not the same, the stamp duty

value on the date of the agreement may be taken for the purposes of this sub-clause:

Provided further that the said proviso shall apply only in a case where the amount of

consideration referred to therein, or a part thereof, has been paid by any mode other than

cash on or before the date of the agreement for the transfer of such immovable property;]

22

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

(c) any property, other than immovable property,

(i) without consideration, the aggregate fair market value of which exceeds fifty thousand

rupees, the whole of the aggregate fair market value of such property;

(ii) for a consideration which is less than the aggregate fair market value of the property by

an amount exceeding fifty thousand rupees, the aggregate fair market value of such property

as exceeds such consideration :

Provided that where the stamp duty value of immovable property as referred to in sub-clause

(b) is disputed by the assessee on grounds mentioned in sub-section (2) of section 50C, the

Assessing Officer may refer the valuation of such property to a Valuation Officer, and the

provisions of section 50C and sub-section (15) of section 155 shall, as far as may be, apply in

relation to the stamp duty value of such property for the purpose of sub-clause (b) as they

apply for valuation of capital asset under those sections :

Provided further that this clause shall not apply to any sum of money or any property

received

(a) from any relative; or

(b) on the occasion of the marriage of the individual; or

(c) under a will or by way of inheritance; or

(d) in contemplation of death of the payer or donor, as the case may be; or

(e) from any local authority as defined in the Explanation to clause (20) of section 10; or

(f) from any fund or foundation or university or other educational institution or hospital or

other medical institution or any trust or institution referred to in clause (23C) of section 10;

or

(g) from any trust or institution registered under section 12AA.

23

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

Explanation.For the purposes of this clause,

(a) assessable shall have the meaning assigned to it in the Explanation 2 to sub-section (2)

of section 50C;

(b) fair market value of a property, other than an immovable property, means the value

determined in accordance with the method as may be prescribed9;

(c) jewellery shall have the meaning assigned to it in the Explanation to sub-clause (ii) of

clause (14) of section 2;

(d) property 10[means the following capital asset of the assessee, namely:]

(i) immovable property being land or building or both;

(ii) shares and securities;

(iii) jewellery;

(iv) archaeological collections;

(v) drawings;

(vi) paintings;

(vii) sculptures; 11[***]

(viii) any work of art; 12[or]

12

[(ix) bullion;]

13

[(e) relative means,

(i) in case of an individual

24

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

(A) spouse of the individual;

(B) brother or sister of the individual;

(C) brother or sister of the spouse of the individual;

(D) brother or sister of either of the parents of the individual;

(E) any lineal ascendant or descendant of the individual;

(F) any lineal ascendant or descendant of the spouse of the individual;

(G) spouse of the person referred to in items (B) to (F); and

(ii) in case of a Hindu undivided family, any member thereof;]

(f) stamp duty value means the value adopted or assessed or assessable by any authority of

the Central Government or a State Government for the purpose of payment of stamp duty in

respect of an immovable property;]

14

[(viia) where a firm or a company not being a company in which the public are substantially

interested, receives, in any previous year, from any person or persons, on or after the 1st day

of June, 2010, any property, being shares of a company not being a company in which the

public are substantially interested,

(i) without consideration, the aggregate fair market value of which exceeds fifty thousand

rupees, the whole of the aggregate fair market value of such property;

(ii) for a consideration which is less than the aggregate fair market value of the property by

an amount exceeding fifty thousand rupees, the aggregate fair market value of such property

as exceeds such consideration :

25

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

Provided that this clause shall not apply to any such property received by way of a

transaction not regarded as transfer under clause (via) or clause (vic) or clause (vicb) or

clause (vid) or clause (vii) ofsection 47.

Explanation.For the purposes of this clause, fair market value of a property, being shares

of a company not being a company in which the public are substantially interested, shall have

the meaning assigned to it in the Explanation to clause (vii);]

15

[(viib) where a company, not being a company in which the public are substantially

interested, receives, in any previous year, from any person being a resident, any consideration

for issue of shares that exceeds the face value of such shares, the aggregate consideration

received for such shares as exceeds the fair market value of the shares:

Provided that this clause shall not apply where the consideration for issue of shares is

received

(i) by a venture capital undertaking from a venture capital company or a venture capital fund;

or

(ii) by a company from a class or classes of persons as may be notified by the Central

Government in this behalf.

Explanation.For the purposes of this clause,

(a) the fair market value of the shares shall be the value

(i) as may be determined in accordance with such method as may be prescribed16; or

(ii) as may be substantiated by the company to the satisfaction of the Assessing Officer, based

on the value, on the date of issue of shares, of its assets, including intangible assets being

goodwill, know-how, patents, copyrights, trademarks, licences, franchises or any other

business or commercial rights of similar nature,

26

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

whichever is higher;

(b) venture capital company, venture capital fund and venture capital undertaking shall

have the meanings respectively assigned to them in clause (a), clause (b) and clause (c)

of 17[Explanation] to clause (23FB) of section 10;]

A proviso under Sec- 56(2) (vii) (b) (ii) of the Income Tax Act,1961 speaks that this section

will be applicable only if a part of the consideration is paid in mode other than cash. But the

facts of the case clearly show that Mr Yadav had paid the entire consideration of 50 lacs in

cash. Thus this section will not at all be applicable.

Moreover, the fact sheet is completetly silent as to date when the

instrument was stamped. So under Sec-17 of the Rajasthan Stamp Act, 1998 and also under

sec-17 of the Indian Stamp Act,1899, the authorities cannot demand stamp duty on 1 crore

and 50 lacs.

Reproducing sec-17 of the Rajasthan Stamp Act, 1998

17 - Instruments executed in the State

All instruments chargeable with duty and executed by any person in the State shall be

stamped before or at the time of execution or immediately thereafter on the next working day

following the day of execution.

Reproducing sec-17 of the Indian Stamp Act,1899

All instruments chargeable with duty and executed by any person in India shall be stamped

before or at the time of execution.

The above two sections says that the instrument which are executed

should be stamped before or after the date of execution. But there is nowhere mentioned

when the documents were stamped. So no proof lies whether the documents were stamped or

not under sec-27 of Indian Stamp Act,1899

27

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

Sec 27 of Indian Stamp Act,1899 speaks

Facts affecting duty to be set forth in instrument

The consideration (if any) and all other facts and circumstances affecting the chargeability of any

instrument with duty, or the amount of the duty with which it is chargeable, shall be fully and

truly set forth therein.

Thus, the Stamp Duty Registering authority was not right on demanding stamp

duty on the fair market value of 1crore and 50 lacs.

Moreover, if the stamp duty is to be paid on the additional 1

crore, then it should be borne by the plaintiff because otherwise the seller would be required to

pay the additional capital gain tax for no fault on his part thus affecting the doctrine of Justice,

Equity and Good Conscience.

PRAYER

28

MEMORIAL ON BEHALF OF RESPONDENT

MANIPAL RANKA NATIONAL MOOT COURT COMPETITION, 2016

JDC LTD. Vs RAMNATH

In light of the issues raised, arguments advanced, cases cited in front of this Honorable Supreme

Court of India, the Respondents, on behalf of the Bar Association of India requests this

Honorable Court to summarily dismiss the case.

And may grant any other reliefs as Honble Court may deem fit in light of Justice, Equity and

Good Conscience.

For which the Counsels on behalf of the Respondents will be forever duty-bound and obliged.

29

MEMORIAL ON BEHALF OF RESPONDENT

You might also like

- Memorial For Respondent-NumberedDocument16 pagesMemorial For Respondent-NumberedKarthikJayakumar100% (1)

- Memorial For RespondentDocument17 pagesMemorial For RespondentSaba Mirza60% (5)

- Time Value of Money The Buy Versus Rent Decision Solution PDFDocument5 pagesTime Value of Money The Buy Versus Rent Decision Solution PDFMuhammad Ibtehash100% (1)

- LBMC09 Memorial of RespndentDocument19 pagesLBMC09 Memorial of RespndentSubhashreeNo ratings yet

- Petitioner MemoDocument16 pagesPetitioner MemoAbhishek singhNo ratings yet

- Asmitha Moot FinalDocument23 pagesAsmitha Moot Finalnilesh jainNo ratings yet

- Family Law Moot MemorialDocument22 pagesFamily Law Moot MemorialAakanksha KochharNo ratings yet

- Memorandum For Respondent Side For 2nd Manipal-Ranka National Moot Court Competition 2016Document40 pagesMemorandum For Respondent Side For 2nd Manipal-Ranka National Moot Court Competition 2016Varun Varma100% (4)

- Credit Card UnitDocument25 pagesCredit Card Unitali zafarNo ratings yet

- Sample Fraud Private BondDocument1 pageSample Fraud Private BondElisabeth Johnson100% (1)

- 1st Manipal Ranka National Moot Court Participation MemorialDocument23 pages1st Manipal Ranka National Moot Court Participation MemorialTrishna Devi50% (4)

- In The Hon'Ble Supreme Court of India: Manipal Ranka National Moot Court Competition, 2016 JDC Ltd. Vs RamnathDocument23 pagesIn The Hon'Ble Supreme Court of India: Manipal Ranka National Moot Court Competition, 2016 JDC Ltd. Vs RamnathAnonymous 1m3YOSIA3lNo ratings yet

- Moot Court Participation MemorialDocument23 pagesMoot Court Participation MemorialatipriyaNo ratings yet

- Winners ADocument28 pagesWinners ASanni KumarNo ratings yet

- 1st Manipal Ranka National Moot Court Competition 2Document27 pages1st Manipal Ranka National Moot Court Competition 2tusharNo ratings yet

- Moot MemorialDocument19 pagesMoot MemorialAkash A M100% (2)

- Memo AppellentDocument18 pagesMemo AppellentGurjinder Singh0% (1)

- R 12Document21 pagesR 12varun100% (1)

- Tc-Amcc 05: 2Nd Amity University Madhya Pradesh National Moot Court Competition, 2018Document32 pagesTc-Amcc 05: 2Nd Amity University Madhya Pradesh National Moot Court Competition, 2018Nandani AnandNo ratings yet

- Final Petitioner Memo DYPatil PDFDocument32 pagesFinal Petitioner Memo DYPatil PDFKetanSrivastava'mukul'100% (1)

- AppellantDocument40 pagesAppellantsagarNo ratings yet

- Issue-1 The Accused Are Guilty Under Section 498A, 304B of The Indian Penal Code, 1860 R/W Section 113B of Indian Evidence Act, 1872Document7 pagesIssue-1 The Accused Are Guilty Under Section 498A, 304B of The Indian Penal Code, 1860 R/W Section 113B of Indian Evidence Act, 1872Mandira PrakashNo ratings yet

- Santosh Moot Court 1 Final - RespondentDocument20 pagesSantosh Moot Court 1 Final - RespondentSantosh Chavan BhosariNo ratings yet

- Memorial On Behalf of PetitionersDocument45 pagesMemorial On Behalf of PetitionersNandini SharmaNo ratings yet

- I T M O P: Before The Hon'ble Supreme Court of ChakricaDocument25 pagesI T M O P: Before The Hon'ble Supreme Court of ChakricaSundram GauravNo ratings yet

- MootDocument15 pagesMootSuresjNo ratings yet

- Moot Memorial Rough On Medical Negligence and State Vicarious LiabilityDocument26 pagesMoot Memorial Rough On Medical Negligence and State Vicarious LiabilitySambhav PatelNo ratings yet

- Moot MemorialDocument27 pagesMoot MemorialSadiqNo ratings yet

- NMCC 2019-07-PDocument41 pagesNMCC 2019-07-PkritzrockxNo ratings yet

- Respondent MemoDocument29 pagesRespondent MemoKirithika Hariharan100% (1)

- Sample MemorialDocument26 pagesSample MemorialShr33% (3)

- CL09 (A)Document27 pagesCL09 (A)tanmaya_purohit100% (1)

- Wilfred Law College - AppellantDocument11 pagesWilfred Law College - AppellantJoyParimala100% (1)

- Problem 1 AppellantDocument29 pagesProblem 1 AppellantShreya Ghosh Dastidar100% (1)

- 4th National Moot Court Competition - AppelantDocument16 pages4th National Moot Court Competition - AppelantShivangi Gupta100% (1)

- 1St Surana & Surana & Kle Law College National Constitutional Law Moot Court Competition - 2017Document30 pages1St Surana & Surana & Kle Law College National Constitutional Law Moot Court Competition - 2017Prateek TanmayNo ratings yet

- Respondent Memorial DraftDocument21 pagesRespondent Memorial DraftNeelraj ShettyNo ratings yet

- Shivananda Moot Court FINALDocument13 pagesShivananda Moot Court FINALMästér LuckyNo ratings yet

- Team D Memorial of RespondentDocument26 pagesTeam D Memorial of RespondentdhavalNo ratings yet

- 16PDocument28 pages16PSanket Solanki0% (3)

- 7th Symbiosis B Krishna Memorial National Moot Court Competition 2015 MDocument29 pages7th Symbiosis B Krishna Memorial National Moot Court Competition 2015 MChirag AhluwaliaNo ratings yet

- Memorial On Behalf of RespondentDocument27 pagesMemorial On Behalf of Respondentgeethu sachithanandNo ratings yet

- MEMORIALDocument19 pagesMEMORIALJaideep Singh SalujaNo ratings yet

- Respondent MemoDocument32 pagesRespondent MemoPragya100% (1)

- Moot Court Memorial (Appellants)Document21 pagesMoot Court Memorial (Appellants)Meenu Pahal100% (1)

- Petitioner M 2Document17 pagesPetitioner M 2Harshit Mangal100% (3)

- Memorial - AppellantDocument37 pagesMemorial - AppellantAkash Warang0% (1)

- Moot Court MemorialDocument23 pagesMoot Court MemorialAnkit KumarNo ratings yet

- Criminal RespondentDocument33 pagesCriminal RespondentMukul1994No ratings yet

- Memorial Petitioner SideDocument25 pagesMemorial Petitioner Sidegeethu sachithanandNo ratings yet

- In The Hon'Ble Supreme Court of India: (Criminal Appellate Jurisdiction)Document18 pagesIn The Hon'Ble Supreme Court of India: (Criminal Appellate Jurisdiction)Sarah KosarNo ratings yet

- FinalpDocument32 pagesFinalpReview Rater100% (1)

- Second Internal Moot Court Balaji Law College, Pune: VersusDocument27 pagesSecond Internal Moot Court Balaji Law College, Pune: VersusDiksha MundhraNo ratings yet

- Civil Suit Under THE Section 20 OF THE Code OF Civil ProcedureDocument12 pagesCivil Suit Under THE Section 20 OF THE Code OF Civil ProcedureShubham YadavNo ratings yet

- Before The: Army Institute of Law Class MootDocument16 pagesBefore The: Army Institute of Law Class MootAbhidhaNo ratings yet

- Appellant MemorialDocument27 pagesAppellant MemorialsandeepkambozNo ratings yet

- Uday Moot RespondantDocument27 pagesUday Moot RespondantNEERAJ YADAV100% (1)

- The Moot CourtDocument24 pagesThe Moot CourtSpriha ShreyaNo ratings yet

- Memorial For The RespondentDocument25 pagesMemorial For The RespondentSoumiki Ghosh100% (2)

- Ranka Moot Problem PDFDocument4 pagesRanka Moot Problem PDFAnonymous 1m3YOSIA3lNo ratings yet

- Moot PropositionDocument3 pagesMoot PropositionAbhinavParashar100% (1)

- Property Law Moot1Document3 pagesProperty Law Moot1Naman MahajanNo ratings yet

- Prof Ethics T4 - 18010324103Document21 pagesProf Ethics T4 - 18010324103sashank varmaNo ratings yet

- Writ PetitionDocument22 pagesWrit PetitionShivesh Raj JaiswalNo ratings yet

- In The Hon'Ble Supreme Court of India: Manipal Ranka National Moot Court Competition, 2016 JDC Ltd. Vs RamnathDocument23 pagesIn The Hon'Ble Supreme Court of India: Manipal Ranka National Moot Court Competition, 2016 JDC Ltd. Vs RamnathAnonymous 1m3YOSIA3lNo ratings yet

- Ranka Moot Problem PDFDocument4 pagesRanka Moot Problem PDFAnonymous 1m3YOSIA3lNo ratings yet

- Ranka Moot Problem PDFDocument4 pagesRanka Moot Problem PDFAnonymous 1m3YOSIA3lNo ratings yet

- Memorial On Behalf of ProsecutorDocument38 pagesMemorial On Behalf of ProsecutorAnonymous 1m3YOSIA3l0% (1)

- Memorial On Behalf of Defendant - pdf-1Document33 pagesMemorial On Behalf of Defendant - pdf-1Anonymous 1m3YOSIA3lNo ratings yet

- Memorial On Behalf of Defendant - pdf-1Document33 pagesMemorial On Behalf of Defendant - pdf-1Anonymous 1m3YOSIA3lNo ratings yet

- BAB 3 - Marketing For Financial InstitutionsDocument47 pagesBAB 3 - Marketing For Financial InstitutionsSyai GenjNo ratings yet

- BPI vs. de RenyDocument1 pageBPI vs. de RenyVanya Klarika NuqueNo ratings yet

- Underwriting TreatmentDocument2 pagesUnderwriting TreatmentSangam NeupaneNo ratings yet

- Property ART. 415Document21 pagesProperty ART. 415CocoyPangilinanNo ratings yet

- What Is Rediscounting?: Rediscounting/Erediscounting System June 2020Document21 pagesWhat Is Rediscounting?: Rediscounting/Erediscounting System June 2020Eduardo SungaNo ratings yet

- Basel Requirement of Downturn LGD: Modeling and Estimating PD & LGD CorrelationsDocument32 pagesBasel Requirement of Downturn LGD: Modeling and Estimating PD & LGD CorrelationsleositorusNo ratings yet

- TPA NavDocument19 pagesTPA Navamit HCSNo ratings yet

- Financial Institutions in IndiaDocument4 pagesFinancial Institutions in Indiaabhishekaw02No ratings yet

- Answers To Exam-Style Questions: 1. The Nature of Business 1. ADocument23 pagesAnswers To Exam-Style Questions: 1. The Nature of Business 1. AKymani MccarthyNo ratings yet

- Credit Secrets: The Blueprint On How To Raise Your Credit Score To 100 PointsDocument76 pagesCredit Secrets: The Blueprint On How To Raise Your Credit Score To 100 PointsJakir0% (1)

- AirportDocument39 pagesAirportkalyan123456No ratings yet

- Resume SampleDocument3 pagesResume SampleLeonard Alfred BadongNo ratings yet

- Ba&a - MCQ4Document11 pagesBa&a - MCQ4Aniket PuriNo ratings yet

- Amicus Brief LevitinPorter1Document6 pagesAmicus Brief LevitinPorter1starhoneyNo ratings yet

- Public Information Request From TX OAGDocument20 pagesPublic Information Request From TX OAGKristina BrunnerNo ratings yet

- Rubric Functional Money Use ApplicationDocument3 pagesRubric Functional Money Use Applicationkristel linaNo ratings yet

- BSR CodesDocument60 pagesBSR CodesBoinzb TNo ratings yet

- Indian Overseas Bank - General AwarnessDocument7 pagesIndian Overseas Bank - General Awarnessshraddha_ghag3760No ratings yet

- ProbsetDocument1 pageProbsetJeff tvNo ratings yet

- E-Stamp: Government of RajasthanDocument11 pagesE-Stamp: Government of RajasthanAnil kumarNo ratings yet

- Financial ManagementDocument48 pagesFinancial Managementalokthakur100% (1)

- "My Project Proposal On Outsourcing Ict-Based Filipino Invention: Circuits To The FutureDocument13 pages"My Project Proposal On Outsourcing Ict-Based Filipino Invention: Circuits To The FutureDarna BalangNo ratings yet

- Rabin A Monetary Theory - 291 295Document5 pagesRabin A Monetary Theory - 291 295Anonymous T2LhplUNo ratings yet

- Profitabulity Analysis - PDF IntroductionDocument87 pagesProfitabulity Analysis - PDF IntroductionUsha Rani Vajroj100% (1)

- FIN203 Tutorial 2 QDocument6 pagesFIN203 Tutorial 2 Q黄于绮No ratings yet

- Simple and Compound InterestDocument8 pagesSimple and Compound InterestMari Carreon TulioNo ratings yet

- CibDocument6 pagesCibAriful Haque SajibNo ratings yet