Professional Documents

Culture Documents

Accounting 1

Uploaded by

Amelia BaradasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting 1

Uploaded by

Amelia BaradasCopyright:

Available Formats

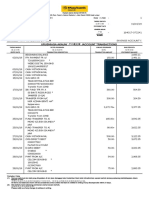

Bank Reconciliation= Reconciliation of Cash Balance

Internal Control for cash= a good control for cash should provide adequate procedure for

protecting both cash receipts and cash disbursements

Three Basic Principles

1.) There should be separation of duties so that the people responsible for handling cash for

its custody are not the same people who keep records.

2.) All cash receipts should be deposited in bank intact each day.

3.) All payments should be made by checks.

Bank Balance 4,608 Bank Balance 3,934

Add: Collection fee of note 300 Add: Deposit 1,500

Interest Earned 12 Bank 20

4,920 5,454

Deduct: Service Charge 16 Deduct: Outstanding 750

NSF Charge 200 Checks

Reconciled Balance 4704 Reconciled Balance 4704

Problem 2- The following information was available to reconcile

a.) After all posting was completed on July 31, the companys cash account had a $6,550 but

its bank statement showed $5,745 balance.

b.) Check No. 555 for $500, No. 444 $700 were outstanding on June bank statement. Check

No. 444 was returned with the July cancelled checks, but check No. 555 was not.

c.) In comparing the cancelled checks returned, it was found that check no. 400for the

purchase of equipment was correctly drawn for $1,216 but as entered in the accounting

records as though it were for $2,116. It was also found that check No. 535 for $5,775 and

check No. 537 for $850 were not among that cancelled checks returned with the

statements.

d.) A credit memorandum indicated that the bank had collected a $2,000 note, deducted a

$50 collection fee.

e.) A debit memorandum for $1,500 listed a $1,490 NSK check plus $10 NSF charge.

f.) Also among the cancelled checks was a $50 debit memorandum for bank services.

g.) The July cash receipts $9,230 were placed in the banks night depository after banking

hours and the amount did not appear on the bank statement.

Book Bank

Beginning Balance 6,550 Beginning Balance 5,745

Error 990 OC# 555 (500)

Notes Collected 2,000 OC# 535 (5,775)

Collection Fee (50) OC# 537 (850)

NSF Check (1,490) Unrecorded Deposit 9,230

Bank Charge (50)

7,850 7,850

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 227Document1 page227Yuuvraj SinghNo ratings yet

- UntitledDocument109 pagesUntitledRohit SharmaNo ratings yet

- Punjab National Bank - Wikipedia, The Free EncyclopediaDocument8 pagesPunjab National Bank - Wikipedia, The Free EncyclopediaPurushotam SharmaNo ratings yet

- Chapter 6 Practice Questions PDFDocument7 pagesChapter 6 Practice Questions PDFleili fallahNo ratings yet

- Multi-Purpose Loan (MPL) Application FormDocument16 pagesMulti-Purpose Loan (MPL) Application FormPablito BeringNo ratings yet

- Ca Doj - Registry - ListDocument9 pagesCa Doj - Registry - ListcircumventionNo ratings yet

- Polytechnic University of The Philippines: Financing CompaniesDocument48 pagesPolytechnic University of The Philippines: Financing CompaniesMomo MontefalcoNo ratings yet

- Presentation OnDocument90 pagesPresentation OnK V Sridharan General Secretary P3 NFPE100% (1)

- R MXrot LNXP 69 Ty 20Document5 pagesR MXrot LNXP 69 Ty 20Shankar kumar MahtoNo ratings yet

- List of Life Insurance PDFDocument51 pagesList of Life Insurance PDFChet KNo ratings yet

- Simple Interest & Simple DiscountDocument32 pagesSimple Interest & Simple DiscountHarold Kian50% (2)

- 2017 Key Routing TableDocument1 page2017 Key Routing Tablecamwills2No ratings yet

- Forensic Loan Audit Report - Sample Report 4-2009Document47 pagesForensic Loan Audit Report - Sample Report 4-2009boufninaNo ratings yet

- MDL ChallanDocument1 pageMDL ChallanPratik V PaliwalNo ratings yet

- Chapter 1 General BankingDocument223 pagesChapter 1 General BankingPushpa Kumari singhNo ratings yet

- How to Achieve Success Through Faith and Hard WorkDocument39 pagesHow to Achieve Success Through Faith and Hard WorkMian AdnanNo ratings yet

- Canarabank Request LatterDocument2 pagesCanarabank Request LatterKani SelvamNo ratings yet

- Murabaha - Application (Trade Finance)Document72 pagesMurabaha - Application (Trade Finance)Riz Khan100% (2)

- 164017-073241 20190331 PDFDocument5 pages164017-073241 20190331 PDFjalaluddinNo ratings yet

- Cheque Payment Voucher Format in ExcelDocument2 pagesCheque Payment Voucher Format in ExcelAhmed Farouk Al ShuwaikhNo ratings yet

- Functions of Central Bank in An EconomyDocument4 pagesFunctions of Central Bank in An EconomyShafiq MirdhaNo ratings yet

- Microfinancial Analysis of J&K Grameen Bank2Document99 pagesMicrofinancial Analysis of J&K Grameen Bank2Ayan NazirNo ratings yet

- Non Performing Assets in Allahabad Bank MBA Banking ProjectsDocument68 pagesNon Performing Assets in Allahabad Bank MBA Banking Projectsmallikarjun nayak50% (2)

- Time Value of Money NEW FINALDocument38 pagesTime Value of Money NEW FINALAwais A.No ratings yet

- Tata Motors Limited Issue of Commercial Paper (CP) Letter of OfferDocument2 pagesTata Motors Limited Issue of Commercial Paper (CP) Letter of OfferANAPARTI NaveenNo ratings yet

- 第四章 PDFDocument21 pages第四章 PDFMelva CynthiaNo ratings yet

- A Study On Attrition Rate in Standard Chartered Bank Jaat BudhiDocument78 pagesA Study On Attrition Rate in Standard Chartered Bank Jaat Budhikhrn_himanshuNo ratings yet

- Contoh Finance Report ShootingDocument14 pagesContoh Finance Report ShootingSyldaNo ratings yet

- Account Activity Generated Through HBL MobileDocument2 pagesAccount Activity Generated Through HBL MobileSaqib NawazNo ratings yet

- StudentDocument34 pagesStudentKevin CheNo ratings yet