Professional Documents

Culture Documents

Exam

Uploaded by

eyeash0 ratings0% found this document useful (0 votes)

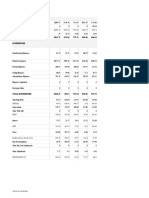

8 views2 pagesThis document shows various profitability metrics for years 2013 through 2015, including return on capital employed, operating margin, return on assets, and return on equity. It also includes metrics related to earnings capacity, operational gearing, break-even revenue, safety margin, gross margin, and contribution ratio. Finally, it lists capital adjustment rates such as fixed asset turnover, intangible fixed asset rate, tangible fixed asset rate, and stock turnover rate as well as days in stock.

Original Description:

fgfx vxf

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document shows various profitability metrics for years 2013 through 2015, including return on capital employed, operating margin, return on assets, and return on equity. It also includes metrics related to earnings capacity, operational gearing, break-even revenue, safety margin, gross margin, and contribution ratio. Finally, it lists capital adjustment rates such as fixed asset turnover, intangible fixed asset rate, tangible fixed asset rate, and stock turnover rate as well as days in stock.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesExam

Uploaded by

eyeashThis document shows various profitability metrics for years 2013 through 2015, including return on capital employed, operating margin, return on assets, and return on equity. It also includes metrics related to earnings capacity, operational gearing, break-even revenue, safety margin, gross margin, and contribution ratio. Finally, it lists capital adjustment rates such as fixed asset turnover, intangible fixed asset rate, tangible fixed asset rate, and stock turnover rate as well as days in stock.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

Profitability analysi 2013 2014 2015

ROCE 21.4 33.8 35.8

Operating margin 9.5 17.3 21.6

ROAT 2.3 2.0 1.7

ROE 31.0 48.3 35.8

Earning capacity

Operational gearing 21.6 17.1 15.1

Break-even revenue 9815.0 5926.6 6415.2

Safety margin 54.4 79.2 82.1

Gross margin 70.0 68.0 66.0

Contribution ratio 30.0 32.0 34.0

Capital adjustment

Rate of fixed asset tu 34 60 37

Rate of intangible fix 136.1 279.5 519.8

Rate of tangible fixed 46.0 75.6 40.4

Rate of stock turnover 5 8 2

Days in stock 73 45.6 182.5 days spent in stock

ays spent in stock

You might also like

- Marriott (2) ..Document13 pagesMarriott (2) ..veninsssssNo ratings yet

- Broadcom Financial AnalysisDocument68 pagesBroadcom Financial AnalysisKipley_Pereles_5949No ratings yet

- Financial Statement ANalysis of National Foods Limited Pakistan From 2005-2009Document97 pagesFinancial Statement ANalysis of National Foods Limited Pakistan From 2005-2009shahid Ali88% (8)

- Engineering and Commercial Functions in BusinessFrom EverandEngineering and Commercial Functions in BusinessRating: 5 out of 5 stars5/5 (1)

- Systems for Planning and Control in ManufacturingFrom EverandSystems for Planning and Control in ManufacturingRating: 3 out of 5 stars3/5 (1)

- I Am Sharing 'Cooper-Industries-Inc-Calculations' With YouDocument19 pagesI Am Sharing 'Cooper-Industries-Inc-Calculations' With YouChip choiNo ratings yet

- Case 11 Horniman Horticulture 20170504Document16 pagesCase 11 Horniman Horticulture 20170504Chittisa Charoenpanich100% (4)

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- Jinga Jinga Mihai Mihai: Experience ExperienceDocument2 pagesJinga Jinga Mihai Mihai: Experience ExperienceeyeashNo ratings yet

- 6 Holly Fashion Case StudyDocument3 pages6 Holly Fashion Case StudyCaramalau Mirela-Georgiana0% (1)

- Weekends TareaDocument9 pagesWeekends Tareasergio ramozNo ratings yet

- Review: Ten Year (Standalone)Document10 pagesReview: Ten Year (Standalone)maruthi631No ratings yet

- 6 Years at A Glance: 2015 Operating ResultsDocument2 pages6 Years at A Glance: 2015 Operating ResultsHassanNo ratings yet

- Tugas Pertemuan 10 - Sopianti (1730611006)Document12 pagesTugas Pertemuan 10 - Sopianti (1730611006)sopiantiNo ratings yet

- Also Annual Report Gb2022 enDocument198 pagesAlso Annual Report Gb2022 enmihirbhojani603No ratings yet

- Financial Statements-Kingsley AkinolaDocument4 pagesFinancial Statements-Kingsley AkinolaKingsley AkinolaNo ratings yet

- S9 - XLS069-XLS-ENG MarriottDocument12 pagesS9 - XLS069-XLS-ENG MarriottCarlosNo ratings yet

- BCTC Case 2Document10 pagesBCTC Case 2Trâm Nguyễn QuỳnhNo ratings yet

- AkzoNobel Last Five YearsDocument2 pagesAkzoNobel Last Five YearsNawair IshfaqNo ratings yet

- Kuhne NagelDocument133 pagesKuhne NagelKakoNo ratings yet

- Golden State Canning Company, Inc.: Selected Income Statement Items, Year Ending December 31Document1 pageGolden State Canning Company, Inc.: Selected Income Statement Items, Year Ending December 31dynaNo ratings yet

- Rosetta Stone IPODocument5 pagesRosetta Stone IPOFatima Ansari d/o Muhammad AshrafNo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- FCFF Vs Fcfe StudentDocument5 pagesFCFF Vs Fcfe StudentKanchan GuptaNo ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- Tarson Products (Woking Sheet - FRA)Document9 pagesTarson Products (Woking Sheet - FRA)RR AnalystNo ratings yet

- CH 32Document2 pagesCH 32Mukul KadyanNo ratings yet

- Key Ratio Analysis: Profitability RatiosDocument27 pagesKey Ratio Analysis: Profitability RatioskritikaNo ratings yet

- ANJ AR 2013 - English - Ykds3c20170321164338Document216 pagesANJ AR 2013 - English - Ykds3c20170321164338Ary PandeNo ratings yet

- DL 210222 q4 20 PDF GBDocument292 pagesDL 210222 q4 20 PDF GBTonyNo ratings yet

- Mehran Sugar Mills - Six Years Financial Review at A GlanceDocument3 pagesMehran Sugar Mills - Six Years Financial Review at A GlanceUmair ChandaNo ratings yet

- Fima Midterm ActsDocument4 pagesFima Midterm ActsKatrina PaquizNo ratings yet

- Altagas Green Exhibits With All InfoDocument4 pagesAltagas Green Exhibits With All InfoArjun NairNo ratings yet

- 06 Horniman Student F-1512xDocument5 pages06 Horniman Student F-1512xjohn galt0% (2)

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- Annual Accounts 2021Document11 pagesAnnual Accounts 2021Shehzad QureshiNo ratings yet

- News Release INDY Result 3M22Document7 pagesNews Release INDY Result 3M22M Rizky PermanaNo ratings yet

- Caterpillar IndicadoresDocument24 pagesCaterpillar IndicadoresChris Fernandes De Matos BarbosaNo ratings yet

- Working Excel - BASFDocument3 pagesWorking Excel - BASFVikin JainNo ratings yet

- Profit and Loss AccountDocument2 pagesProfit and Loss AccountNitish KanreshNo ratings yet

- News Release INDY Result 6M22Document7 pagesNews Release INDY Result 6M22Rama Usaha MandiriNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- Exhibit 1: Income Taxes 227.6 319.3 465.0 49.9Document11 pagesExhibit 1: Income Taxes 227.6 319.3 465.0 49.9rendy mangunsongNo ratings yet

- Ar 2014Document162 pagesAr 2014kokueiNo ratings yet

- 2012 2013 2014 2015 2016e Input Profit and Loss Statement: Cash Flow EstimatesDocument3 pages2012 2013 2014 2015 2016e Input Profit and Loss Statement: Cash Flow EstimatesBilal AhmedNo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Bhavak Dixit (PGFC2113) PI Industries PVT - LTDDocument45 pagesBhavak Dixit (PGFC2113) PI Industries PVT - LTDdixitBhavak DixitNo ratings yet

- XLS EngDocument26 pagesXLS EngcellgadizNo ratings yet

- Stryker Corporation: Capital BudgetingDocument8 pagesStryker Corporation: Capital Budgetinggaurav sahuNo ratings yet

- Verbio GB 2019 ENDocument132 pagesVerbio GB 2019 ENNitin KurupNo ratings yet

- Siddhi Chokhani - 65: Rahul Gupta - 31 Shyam Parasrampuria - 40 Reema Parkar - 54 Vidhi Gala - 57 Radhika Bajaj - 64Document31 pagesSiddhi Chokhani - 65: Rahul Gupta - 31 Shyam Parasrampuria - 40 Reema Parkar - 54 Vidhi Gala - 57 Radhika Bajaj - 64avinash singhNo ratings yet

- Sag Annual Report 2021 en DataDocument249 pagesSag Annual Report 2021 en DataAnthony JM CooperNo ratings yet

- Profitability Ratio: KPI'sDocument4 pagesProfitability Ratio: KPI'sdanyalNo ratings yet

- Andritz Financial Report 2017 - enDocument160 pagesAndritz Financial Report 2017 - enEssa QouraNo ratings yet

- Exhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Document2 pagesExhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Hằng Dương Thị MinhNo ratings yet

- Chapter 6Document35 pagesChapter 6Tanjila ShipaNo ratings yet

- Projection and Valuation Example - SolutionDocument13 pagesProjection and Valuation Example - SolutionPrince Akonor AsareNo ratings yet

- Exhibit 1: Gross Profit 3,597.1Document15 pagesExhibit 1: Gross Profit 3,597.1Rendy Setiadi MangunsongNo ratings yet

- Goglobal Show Your Face(s)Document2 pagesGoglobal Show Your Face(s)eyeashNo ratings yet

- Marketing PlanningDocument4 pagesMarketing PlanningeyeashNo ratings yet

- Fo 2Document6 pagesFo 2eyeashNo ratings yet

- Ap Degree MihaiDocument2 pagesAp Degree MihaieyeashNo ratings yet

- Jinga Jinga Mihai Mihai: Experience ExperienceDocument2 pagesJinga Jinga Mihai Mihai: Experience ExperienceeyeashNo ratings yet

- Mihai Jinga CVDocument4 pagesMihai Jinga CVeyeashNo ratings yet

- Job Application Cover LettersDocument2 pagesJob Application Cover LetterseyeashNo ratings yet

- Dok 02424231Document2 pagesDok 02424231eyeashNo ratings yet

- A Passionate, Experienced Marketing Expert, Extrovert, With A Genuine Love For Getting Projects Done and Seeing Resultsthrough Team Effots and CollabDocument1 pageA Passionate, Experienced Marketing Expert, Extrovert, With A Genuine Love For Getting Projects Done and Seeing Resultsthrough Team Effots and CollabeyeashNo ratings yet

- Ino Box Evolution + Cover LetterDocument7 pagesIno Box Evolution + Cover LettereyeashNo ratings yet

- 12 Powerful WordsDocument2 pages12 Powerful WordseyeashNo ratings yet

- Social Media Management Activity 3Document3 pagesSocial Media Management Activity 3eyeashNo ratings yet

- Speaking Useful Phrases: Opinion/start Speaking: Less Common VocabularyDocument2 pagesSpeaking Useful Phrases: Opinion/start Speaking: Less Common VocabularyeyeashNo ratings yet