Professional Documents

Culture Documents

Executive Summary: Created By: Christopher B Taylor

Executive Summary: Created By: Christopher B Taylor

Uploaded by

nikhilroxOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Executive Summary: Created By: Christopher B Taylor

Executive Summary: Created By: Christopher B Taylor

Uploaded by

nikhilroxCopyright:

Available Formats

Executive Summary

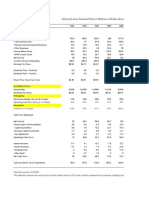

Entering the 4th quarter of Linear Technologys fiscal year 2003 the market continues to

show signs of improvement. The company has shown steady growth in the last year and revenues

are estimated to increase 19% over FY 2002. Based on this estimate, FY 2003 net income will hit

$222.7 million ($0.71 earnings per share); a 12.6% growth from the previous year. Operating

cash flow; while lower than 2000 and 2001 has shown a modest increase since 2002 and

continues to be positive due to the companys variable cost structure. This is in-part is due to

more efficient working capital investments and other adjustments to income, awarding the

company a 10% increase in net cash flow year-over-year. Linear Technology has increased its

cash holdings to excess of $1.5 billion through employing cost savings initiatives, though these

holdings have only shown investors modest returns in the neighborhood of 4.25% ($0.10

earnings per share). While modest, investors have come to expect this form of conservativeness

and there has been little outcry of agency issues. Looking ahead, based on an analog fabs life

expectancy of 10 plus years, capital investments, for a new fab, will be required in the next one

or two years in excess of $200 million; leaving more than sufficient cash holdings while

requiring no leveraging. Based on these financials, Linear Technology should look to increase

its dividend payout by $0.01 per share. This has become the expected trend over the last 3 plus

years and any adjustment to this could show signs of weakening in the businesses outlook. This

increase would raise dividend payouts to an estimated $66 million, a 22% increase from the FY

2002. An estimated 8.5% increase in the payout ratio, from 27.31% to estimated 29.64%; ranking

Linear Technology higher than any other company in the SOX for the dividend-to-earnings

payout ratio.

Created by: Christopher B Taylor Page 1

Potential Issues

Linear Technology is holding on to $1.5 billion in cash and short-term investments which

invests in low risk securities. This can be seen as an agency issue. By Linear Technology holding

onto all this cash and only placing it in short-term debt securities, they are only providing an

internal rate of return of 4.25% ($0.10 per share). See Exhibit 1. Investors may want to see some

of these current assets used to acquire other companies or invested in more R&D that would keep

the internal rate of return above the marginal cost of capital.

The company is faced with the option of keeping the quarterly dividend at $0.05 per

share or increasing the payout to $0.06 per share. If Linear Technology leaves the dividend

payout unchanged, investors could take this move as a sign of weakness. Acknowledging that in

January 2003 institutional holdings of the stock LLTC made up 84.93%; the companys move to

continue to be over-cautious with its current assets and not provide an increase in the dividend

payout may lead the investors to seek greater returns in other securities. By raising the dividend

payout, the company will be faced with a 29.64% payout ratio; the highest in the SOX. See

Exhibit 2. By spending an estimated 66 million on dividend payouts, the company will see a

percentage increase in operating cash flow payout of 26.13%, up from an operating cash flow

payout of 21%. See Exhibit 3.

Created by: Christopher B Taylor Page 2

Methodology

It is suggested that Linear Technology uses pro-forma statements, value of cash holdings

statements, and dividend payout charts to determine if an increase in dividend payouts will be of

value to the company. Secondly, an overview of the dividend payouts and ratios from previous

years can be used to approximate the clientele effect information effect on investors. Thirdly,

while a comparison of Linear Technology to the market and semiconductor industry will help

determine their position in various categories. Finally, an overview of economists and analysts

outlooks for the coming year in the analog market and semiconductor market can be helpful in

spotting future trends.

Data Requirements for Methodology

Initially Linear Technology will need to create a pro-forma statement for the 4th quarter

based on growth results over the last year. See Exhibit 4. In the exhibit provided, the pro-forma

statement for 2003 was developed based on a 19% increase in sales from the first half of 2003

verse 2002 ($287 million/$241 million = 19%) and adding an estimated growth of 19% to the

second half of FY 2002 figures ($271 million*1.19 = $323 million). The summation of these

figures gives us an estimated sales figure of $610 million ($287 million+$323 million). From this

we can create the pro-forma statements needed to determine net income and cash flows. This

allows the company to estimate dividend payout, dividend earnings, and earnings per share.

Created by: Christopher B Taylor Page 3

The valuation of cash holdings can be completed by using figures from the balance sheet,

income statement, and current money market rates. See Exhibit 1. Using the valuation of cash

holdings, Linear Technology can see that they are only providing a return of $0.11 on every

$3.56 of investments; a 3.1% return. See Exhibit 4. This formula is used to see how much value

is being added through current asset investments and can be compared with IRR of potential

other projects.

Another tool the company can use is a dividend payout chart that will show the after-tax

percent return to investors dependent on dividend payouts, repurchases and tax rates. See Exhibit

5. Due to the possible overhaul of the tax structure for capital gains and dividends for the 2003

tax year, this chart can be useful in understanding the investors attitude towards the companys

use of cash. By using scenario analysis the company can compare various situations they could

embark upon.

Key Assumptions

This analysis is drawn upon some assumptions made by the author. These assumptions

are as follows: The estimated end-of-year income statement is mostly based on a 19% sales

increase year-over-year; except for other expense based on a 4% increase year-over-year. It is

also assumed that investors are considered Bird in the Hand investors; that they prefer the

certainty of a cash dividend to that of the company placing their investments in uncertainties.

Asymmetry is assumed to be invalid due to the possibility of lower taxes on capital gains and

dividends, hence removing the theory based on investors preferred choice in relation to tax

percentages.

Created by: Christopher B Taylor Page 4

Analysis

The data shows that an increase of $0.01 in the dividend payout will put Linear

Technology at its highest payout ratio level ever, 29.64%. However, the company will be using

only 26.13% of operating cash flow, up 24.43% from the prior year. In many semiconductor

companies this may be seen as high, but Linear Technology has cash sitting in excess of $1.5

billion and will still be contributing estimates of $48 million to this at the end of FY 2003, even

after $66 million is paid out to investors. If we were to compare the payout ratios to other

technology firms it would suggest that Linear Technology is over paying on its dividend and

should not make an increase. In this case the payout ratio would begin to decline, though

investors would begin to doubt the growth of the company, causing a clientele effect.

It must be mentioned in the analysis that institutional holdings makes up 84.93% of

Linear Technologys stock as of January 2002. See Exhibit 5. This is much higher than the

semiconductor industrys average of 42.09% in 2002. Taking this into consideration, the

company may be able to hear insight from the top institutional holdings to determine their take

on the dividend policy. This was already announced by Blaine Rollins, Portfolio Manager of

Janus Capital, when he made it clear that he was comfortable with the current dividend approach

and ideally liked the strong cash flows and repurchases of stock.

Created by: Christopher B Taylor Page 5

Finally a look at the expected rate of return compared with the required rate of return for

Linear Technology tells us that by offering an increase in the dividend payout, the expected rate

of return comes in at 24.21%; much higher than the -0.45% required rate of return that the

company would see based on its correlation since the establishment of the SOX. See Exhibit 6.

By illustrating the various situations of dividend payouts, a payout that is based on no increase or

a decrease leaves the investor with a lower expected rate of return of 18.29% and 12.38%,

respectively. Meaning the company would be valued more highly by investors if it was to

increase the dividend.

Conclusion

It is recommended that Linear Technology increases their quarterly dividend up to $0.06

per share, from $0.05 per share. Current increased growth quarter-over-quarter in Linear

Technologys revenues and predicted growth in the world market for 2003 primarily China and

Taiwan provides a solid footing for the future ahead. In times of uncertainty, investors are

looking for companies that continue to show stability. By following the trend of the companys

historic dividend policy, Linear Technology is showing confidence in their outlook going into

Fiscal Year 2004.

Created by: Christopher B Taylor Page 6

Created by: Christopher B Taylor Page 7

Created by: Christopher B Taylor Page 8

Created by: Christopher B Taylor Page 9

You might also like

- Linear TechnologyDocument6 pagesLinear Technologyprashantkumarsinha007100% (1)

- Ethodology AND Ssumptions: B B × D EDocument7 pagesEthodology AND Ssumptions: B B × D ECami MorenoNo ratings yet

- Linear TechnologyDocument4 pagesLinear TechnologySatyajeet Sahoo100% (2)

- Dividend Policy at Linear TechnologyDocument9 pagesDividend Policy at Linear TechnologySAHILNo ratings yet

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- Focus Questions For Laura MartinDocument10 pagesFocus Questions For Laura MartinAgnik DuttaNo ratings yet

- Case 1 West Teleservice PDFDocument4 pagesCase 1 West Teleservice PDFKirill VasilyevNo ratings yet

- Commissioner v. Glenshaw Glass Co., 348 U.S. 426 (1955)Document6 pagesCommissioner v. Glenshaw Glass Co., 348 U.S. 426 (1955)Scribd Government DocsNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Mod 1Document41 pagesMod 1Raghav Mehra100% (2)

- VanessaFX Advanced SystemsDocument25 pagesVanessaFX Advanced SystemspetefaderNo ratings yet

- Session 19 - Dividend Policy at Linear TechDocument2 pagesSession 19 - Dividend Policy at Linear TechRichBrook7No ratings yet

- Kohler CompanyDocument3 pagesKohler CompanyDuncan BakerNo ratings yet

- 4TH GroupDocument5 pages4TH Groupmandeep_hs7698100% (1)

- 9-204-066 Dividend Policy - 204702-XLS-ENGDocument17 pages9-204-066 Dividend Policy - 204702-XLS-ENGValant Rivas DerteNo ratings yet

- Case StudyDocument10 pagesCase StudyEvelyn VillafrancaNo ratings yet

- Blaine Kitchenware Inc PDFDocument13 pagesBlaine Kitchenware Inc PDFpatriciolivares3009No ratings yet

- Linear Technology Payout Policy Case 3Document4 pagesLinear Technology Payout Policy Case 3Amrinder SinghNo ratings yet

- Rosario FinalDocument13 pagesRosario FinalDiksha_Singh_6639No ratings yet

- SeminarKohlerpaper PDFDocument35 pagesSeminarKohlerpaper PDFLLLLMEZNo ratings yet

- Linear Tech Dividend PolicyDocument25 pagesLinear Tech Dividend PolicyAdarsh Chhajed0% (2)

- 02 Eaton Questions PDFDocument1 page02 Eaton Questions PDFSulaiman AminNo ratings yet

- USTDocument4 pagesUSTJames JeffersonNo ratings yet

- Family BusinessDocument30 pagesFamily BusinessAdarsh KrishnaNo ratings yet

- 4th Edition Summary Valuation Measuring and Managing The ValueDocument17 pages4th Edition Summary Valuation Measuring and Managing The Valuekrb2709No ratings yet

- Firm ValuationDocument7 pagesFirm ValuationShahadat Hossain50% (2)

- Short Selling Around The 52-Week and Historical Highs: Eunju - Lee@uml - Edu Npiqueira@bauer - Uh.eduDocument32 pagesShort Selling Around The 52-Week and Historical Highs: Eunju - Lee@uml - Edu Npiqueira@bauer - Uh.eduBrock TernovNo ratings yet

- FIN4330 HirakiDocument7 pagesFIN4330 Hirakimsg-90No ratings yet

- Accounting For The IphoneDocument9 pagesAccounting For The IphoneFatihahZainalLim100% (1)

- M&A Case 1 - Group 7Document8 pagesM&A Case 1 - Group 7ndiazl100% (1)

- China Fire Case AssignmentDocument3 pagesChina Fire Case AssignmentTony LuNo ratings yet

- The RaceDocument183 pagesThe RaceJ.h. WangNo ratings yet

- M&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun KoDocument2 pagesM&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun Ko고지현100% (1)

- Pre-Study: Practice Exam Part IIDocument40 pagesPre-Study: Practice Exam Part IIRuby Sapphire0% (1)

- Linear Dividend PolicyDocument4 pagesLinear Dividend Policyhenry.alvarado.vargasNo ratings yet

- Corporation CaseDocument39 pagesCorporation Caseayane_sendoNo ratings yet

- Questions - Linear Technologies CaseDocument1 pageQuestions - Linear Technologies CaseNathan Toledano100% (1)

- Bed Bath Beyond (BBBY) Stock ReportDocument14 pagesBed Bath Beyond (BBBY) Stock Reportcollegeanalysts100% (2)

- Uttam Kumar Sec-A Dividend Policy Linear TechnologyDocument11 pagesUttam Kumar Sec-A Dividend Policy Linear TechnologyUttam Kumar100% (1)

- Coursehero 40252829Document2 pagesCoursehero 40252829Janice JingNo ratings yet

- Diageo Was Conglomerate Involved in Food and Beverage Industry in 1997Document6 pagesDiageo Was Conglomerate Involved in Food and Beverage Industry in 1997Prashant BezNo ratings yet

- Gainesboro Machine ToolsDocument2 pagesGainesboro Machine ToolsedselNo ratings yet

- Tool Kit Distributions To Shareholders: Dividends and RepurchasesDocument6 pagesTool Kit Distributions To Shareholders: Dividends and RepurchasesAdamNo ratings yet

- M&a Assignment - Syndicate C FINALDocument8 pagesM&a Assignment - Syndicate C FINALNikhil ReddyNo ratings yet

- XLS EngDocument19 pagesXLS EngCuong NguyenNo ratings yet

- Michael McClintock Case1Document2 pagesMichael McClintock Case1Mike MCNo ratings yet

- MarvelDocument14 pagesMarvelabhinav_gogia100% (1)

- Mellon Valuation AnalysisDocument7 pagesMellon Valuation AnalysisAmber Hill100% (1)

- Kohler Case StudyDocument13 pagesKohler Case StudySambashiva Srisailapathy50% (2)

- 83592481 (1)Document3 pages83592481 (1)MedhaNo ratings yet

- Facebook IPO SlidesDocument14 pagesFacebook IPO SlidesLof Kyra Nayyara100% (1)

- Case Analysis - Compania de Telefonos de ChileDocument4 pagesCase Analysis - Compania de Telefonos de ChileSubrata BasakNo ratings yet

- Teletech CorporationDocument7 pagesTeletech CorporationNeetha Mohan0% (1)

- Terminal ValueDocument2 pagesTerminal ValueOusmanNo ratings yet

- Finance KohlerDocument21 pagesFinance KohlerVinnie NardoneNo ratings yet

- MCI Case Questions PDFDocument1 pageMCI Case Questions PDFAlex Garma0% (1)

- Nu WareDocument22 pagesNu WaresslbsNo ratings yet

- RJR Nabisco - Case QuestionsDocument2 pagesRJR Nabisco - Case QuestionsJorge SmithNo ratings yet

- DollaramaDocument2 pagesDollaramaKenton ParrottNo ratings yet

- Description of Knoll:: Knoll Furniture: Going PublicDocument3 pagesDescription of Knoll:: Knoll Furniture: Going PublicIni EjideleNo ratings yet

- Deluxe Corporation Case StudyDocument3 pagesDeluxe Corporation Case StudyHEM BANSALNo ratings yet

- Gamification in Consumer Research A Clear and Concise ReferenceFrom EverandGamification in Consumer Research A Clear and Concise ReferenceNo ratings yet

- Ratio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesDocument3 pagesRatio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesSapcon ThePhoenixNo ratings yet

- Valuation Analysis and StructuredDocument19 pagesValuation Analysis and StructuredvasoskNo ratings yet

- P7int 2013 Jun A PDFDocument17 pagesP7int 2013 Jun A PDFhiruspoonNo ratings yet

- Business Finance Completed 3Document10 pagesBusiness Finance Completed 3mamaluicalinNo ratings yet

- Return On AssetsDocument9 pagesReturn On AssetsKirsten MontefalcoNo ratings yet

- ADL 03 Accounting For Managers V3final PDFDocument22 pagesADL 03 Accounting For Managers V3final PDFgouravNo ratings yet

- Ask For DowryDocument18 pagesAsk For DowryMuhammad AhmedNo ratings yet

- Miguel Oliveira DPDFADocument84 pagesMiguel Oliveira DPDFAHajar GhaitNo ratings yet

- BUILD AND SELL POLICY - PresentDocument11 pagesBUILD AND SELL POLICY - PresentZahin SamsudinNo ratings yet

- Lehman ResearchDocument7 pagesLehman ResearchFreya DaiNo ratings yet

- World Bank NotesDocument14 pagesWorld Bank Notes4df994v7zjNo ratings yet

- OutlineDocument6 pagesOutlineIce LeeNo ratings yet

- 10 BrazosDocument20 pages10 BrazosAlexander Jason LumantaoNo ratings yet

- Quantitative MethodsDocument9 pagesQuantitative MethodsYsmael Abad IINo ratings yet

- Chapter 3: Swot Analysis StrengthsDocument3 pagesChapter 3: Swot Analysis Strengthsamit_ruparelia28No ratings yet

- Asset and Liability Management: Interest Rate Risk ManagementDocument38 pagesAsset and Liability Management: Interest Rate Risk ManagementAbdullah Al FaisalNo ratings yet

- SVFC BS Accountancy - 1st Set Online Resources SY20-19 1st Semester PDFDocument28 pagesSVFC BS Accountancy - 1st Set Online Resources SY20-19 1st Semester PDFLorraine TomasNo ratings yet

- MOST 18 Brochure 2018Document16 pagesMOST 18 Brochure 2018Abu BindongNo ratings yet

- Running Head: Monetary Policy and Theory: A Study of 1724 France 1Document4 pagesRunning Head: Monetary Policy and Theory: A Study of 1724 France 1Jan RunasNo ratings yet

- Final Marketing Project On Colgate PalmoliveDocument33 pagesFinal Marketing Project On Colgate PalmoliveGimpi RawalNo ratings yet

- EMBA in Focus BrochureDocument8 pagesEMBA in Focus Brochureangel_anne78No ratings yet

- PPB - Complete PDFDocument185 pagesPPB - Complete PDFishantkathuriaNo ratings yet

- Business Finance I: Modular Learning MaterialDocument6 pagesBusiness Finance I: Modular Learning MaterialSrinivasan NarasimmanNo ratings yet

- Masters' Notes For Co-Op ManagementDocument47 pagesMasters' Notes For Co-Op Managementemerald computersNo ratings yet

- Product Plan (Am55)Document5 pagesProduct Plan (Am55)joanne riveraNo ratings yet

- Unit 2 Company Law - Part IIIDocument17 pagesUnit 2 Company Law - Part IIIDeborahNo ratings yet

- Project Financing - A Case Study On Coimbatore Bypass Road Project DR - Hiren ManiarDocument3 pagesProject Financing - A Case Study On Coimbatore Bypass Road Project DR - Hiren ManiarVignesh SridharanNo ratings yet

- Globalization in Indian EconomyDocument4 pagesGlobalization in Indian EconomyDigi StrengthNo ratings yet