Professional Documents

Culture Documents

Tds Notes

Uploaded by

Hitanshi Takkar0 ratings0% found this document useful (0 votes)

6 views3 pagesNotes on tax deductible at source

Original Title

tds_notes

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNotes on tax deductible at source

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesTds Notes

Uploaded by

Hitanshi TakkarNotes on tax deductible at source

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

TAX DEDUCTED AT SOURCE

What is TDS?

Tax deduction at source or best known as TDS is one of the

modes of collecting income tax.

In simple terms, TDS is the tax getting deducted from the

person receiving the amount (employee/ deductee) by the

person paying such amount (employer/ deductor).

The tax so deducted at source by the payer, has to be

deposited in the Govt treasury to the credit of

Central Govt. within the specified time.

Presently this concept of TDS is also used as an instrument

in enlarging the tax base.

It is always considered as an advance tax which is paid to

the Govt.

Who shall deduct tax at source?

Every person responsible for making payment of nature

covered by TDS provisions of Income Tax Act shall be

responsible to deduct tax.

TAN (Tax Deduction Account No.): unique identification

number for person deducting the tax. 10 digit alpha numeric

character.

No TDS on any sum paid to:

1. The GOVT.

2. The RBI

3. Corporations established by or under a Central AcT which is

exempt from income tax.

4. Mutual fund specified under Sec 10(23D)

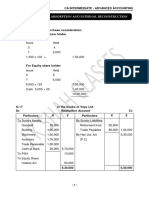

Nature of Payment Made To Thresho Individual Note:

Residents ld(Rs.) / HUF

TDS Rate

Salaries Slab Slab rate

rates applicable to

employees

Interest on securities 10

Dividends 10 No TDS on

dividend

exempt u/s

115-O

Interest other than interest on securities 5000 10

- Others (or Rs

10,000

in case

of

banks)

Winning from Lotteries 10000 30

Winnings from Horse Race 5000 30

Payment to Contractor - Single 30000 1 No TDS if

Transaction payment iS

Payment to Contractor - Annual 75000 1 for personal

Aggregate During the F.Y. purpose

Insurance Commission 20000 10

Commission - Lottery 1000 10

Commission / Brokerage 5000 10

Rent - Land and Building, 180000 10

Rent- plant & machinery 180000 2

Professional Fees, technical service or 30000 10

royalty

Immovable Property 1,00,000 10

Surcharge & Education cess:

In case of Resident Assessee

Payee Applicability of surcharge

Companies No surcharge or EDu Cess

Any other assessee No surcharge or EDu Cess. However Edu

Cess to be added to TDS on salary.

How this scheme practically works?

1. The person deducting tax shall furnish periodic

statement of TDS to IT Authority.

2. The above authority after verifying the details enter

the details of TDS on centralized computer system.

3. The AO shall send the details of TDS to the deductee.

4. The deductor is also required to send the certificate

to deductee.

5. The deductee shall claim credit of his return of TDS in

his return.

6. The AO after verifying the details shall give credit of

TDS

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Financial Management For Hospitality SectorDocument56 pagesFinancial Management For Hospitality SectorHitanshi Takkar100% (1)

- Literature Review Hitanshi Takkar 19 FCDocument4 pagesLiterature Review Hitanshi Takkar 19 FCHitanshi TakkarNo ratings yet

- Internship Project Report ITC HOTEL Done by RAVI KUMAR HS (MBA)Document64 pagesInternship Project Report ITC HOTEL Done by RAVI KUMAR HS (MBA)RaviSGowda75% (77)

- CSR ReportDocument38 pagesCSR ReportHitanshi TakkarNo ratings yet

- H3N0CV072698116Document2 pagesH3N0CV072698116Hitanshi TakkarNo ratings yet

- ReportDocument10 pagesReportHitanshi TakkarNo ratings yet

- Income Tax Unit 1Document44 pagesIncome Tax Unit 1Abhishek BhatiaNo ratings yet

- ReportDocument10 pagesReportHitanshi TakkarNo ratings yet

- Summer Internship Project HitanshiDocument58 pagesSummer Internship Project HitanshiHitanshi TakkarNo ratings yet

- I PhoneDocument12 pagesI PhoneHitanshi TakkarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Investment Policy StatementDocument8 pagesInvestment Policy StatementTomi Adeyemi100% (3)

- Atty. Dionisio Calibo, vs. CA (Cred Trans)Document2 pagesAtty. Dionisio Calibo, vs. CA (Cred Trans)JM CaupayanNo ratings yet

- Accounting I Assignment CH 3 and 4 - 2Document8 pagesAccounting I Assignment CH 3 and 4 - 2Mahmoud AminNo ratings yet

- Investment Analysis 1Document48 pagesInvestment Analysis 1yonasteweldebrhan87No ratings yet

- Introduction of Aditya Birla GroupDocument4 pagesIntroduction of Aditya Birla GroupdeshmonsterNo ratings yet

- 5 Amalgamation, Absorption and External Reconstruction - HomeworkDocument21 pages5 Amalgamation, Absorption and External Reconstruction - HomeworkYash ShewaleNo ratings yet

- Admission Capital AdjustmentsDocument6 pagesAdmission Capital AdjustmentsHamza MudassirNo ratings yet

- Amity Business School: MBA Legal Aspects of Business Ms. Shinu VigDocument20 pagesAmity Business School: MBA Legal Aspects of Business Ms. Shinu VigAamir MalikNo ratings yet

- Pyq - Mat112 - Jun 2019Document5 pagesPyq - Mat112 - Jun 2019isya.ceknua05No ratings yet

- Wise & Co. Vs TanglaoDocument5 pagesWise & Co. Vs Tanglaodominicci2026No ratings yet

- Financial Statement AnalysisDocument28 pagesFinancial Statement AnalysisbillyNo ratings yet

- NTPC ReportDocument15 pagesNTPC ReportKaushal Jaiswal100% (1)

- NpaDocument22 pagesNpaDeepika VermaNo ratings yet

- APC 2017 English Information On The DayDocument17 pagesAPC 2017 English Information On The DaySafwaan DanielsNo ratings yet

- This Study Resource Was: Running Head: CHAPTER 12 CASE STUDY 1Document4 pagesThis Study Resource Was: Running Head: CHAPTER 12 CASE STUDY 1Ruhul AminNo ratings yet

- Basel II PillarDocument123 pagesBasel II Pillarperera_kushan7365No ratings yet

- Syndicate Bank ProjectDocument86 pagesSyndicate Bank Projectmohammed saleem50% (4)

- Project Finance EMBA - NandakumarDocument63 pagesProject Finance EMBA - NandakumarKrishna SinghNo ratings yet

- The Finance ResourceDocument10 pagesThe Finance Resourceadedoyin123No ratings yet

- References DI MICELI ErmannoDocument1 pageReferences DI MICELI ErmannoIronmanoNo ratings yet

- Adinath InvoiceDocument9 pagesAdinath InvoiceArun AhirwarNo ratings yet

- Principles of Management Topic 7Document26 pagesPrinciples of Management Topic 7joebloggs1888No ratings yet

- Quiz 9Document3 pagesQuiz 9朱潇妤100% (1)

- Real Estate Principles Legal Equitable "Exclusive Equity"Document92 pagesReal Estate Principles Legal Equitable "Exclusive Equity"Ven Geancia100% (1)

- Life Insurance Advertising in India Analysis of Recen 337186587Document12 pagesLife Insurance Advertising in India Analysis of Recen 337186587Raghav DudejaNo ratings yet

- Kipley Pereles' Resume - ConcordiaDocument2 pagesKipley Pereles' Resume - ConcordiaKipley_Pereles_5949No ratings yet

- Wikborg Global Offshore Projects DEC15Document13 pagesWikborg Global Offshore Projects DEC15sam ignarskiNo ratings yet

- BLO Unit 1-1Document24 pagesBLO Unit 1-1Mohammad MAAZNo ratings yet

- Multiple Choice: Chapter 9: Responsibility Accounting and DecentralizationDocument43 pagesMultiple Choice: Chapter 9: Responsibility Accounting and Decentralizationquanghuymc100% (2)

- CHAPTER 1, 2, 3 and 4Document33 pagesCHAPTER 1, 2, 3 and 4Jobelle MalabananNo ratings yet