Professional Documents

Culture Documents

Mraj 3 Aa

Mraj 3 Aa

Uploaded by

Ahmad Rahhal100%(1)100% found this document useful (1 vote)

80 views2 pagesThis document contains 6 problems involving calculations of simple interest on loans. The problems include determining interest rates that will yield given maturity values, calculating maturity values for loans of different lengths at given interest rates, using the banker's rule to find interest on a loan over a period of time, determining payment amounts on a loan using different focal dates, using the merchant's rule to calculate a loan balance after partial payments, and calculating the amount received and effective interest rate on a discounted loan.

Original Description:

lll

Original Title

mraj3aa

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains 6 problems involving calculations of simple interest on loans. The problems include determining interest rates that will yield given maturity values, calculating maturity values for loans of different lengths at given interest rates, using the banker's rule to find interest on a loan over a period of time, determining payment amounts on a loan using different focal dates, using the merchant's rule to calculate a loan balance after partial payments, and calculating the amount received and effective interest rate on a discounted loan.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

80 views2 pagesMraj 3 Aa

Mraj 3 Aa

Uploaded by

Ahmad RahhalThis document contains 6 problems involving calculations of simple interest on loans. The problems include determining interest rates that will yield given maturity values, calculating maturity values for loans of different lengths at given interest rates, using the banker's rule to find interest on a loan over a period of time, determining payment amounts on a loan using different focal dates, using the merchant's rule to calculate a loan balance after partial payments, and calculating the amount received and effective interest rate on a discounted loan.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

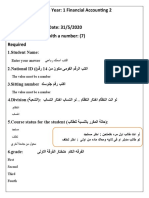

1- At what rate of simple interest will

a) $1000 accumulate to $1420 in 2.5 years,

b) money double itself in 7 years, and

c) $500 accumulate $10 interest in 2 months?

2-Determine the maturity value of

a) a $2500 loan for 4 months at 12% simple

interest,

b) a $1200 loan for 130 days at 8.5% ordinary

simple interest, and

c) a $13 000 loan for 64 days at 7% exact simple

interest.

3-using the bankers rule, find the amount of simple

interest on $200 from September 30, 1995, to july 7,

1997, at 18%.

4- ali borrows $800 at 16%. He agrees to

pay off the debt with payments of size $X, $2X,

and $4X in 3 months, 6 months, and 9 months

respectively. Determine X using all four

transaction dates as possible focal dates.

5-alex borrowed $1000, repayable in one

year, with interest at 9%. He pays $200 in

3 months and $400 in 7 months. Determine

the balance in one year using the Merchants Rule.

6. A 90-day note promises to pay Ms. Chiu $2000

plus simple interest at 13%. After 51 days it is

sold to a bank that discounts notes at a 12%

simple interest rate.

a) How much money does Ms. Chiu receive?

b) What rate of interest does Ms. Chiu realize

on her investment?

You might also like

- Practical Business Math Procedures 11th Edition Slater Test BankDocument31 pagesPractical Business Math Procedures 11th Edition Slater Test Bankhelgasophie7478k0100% (31)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Simple InterestDocument2 pagesSimple InterestNathan Dungog100% (2)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Simple Interest Word Problems: Grade 8Document1 pageSimple Interest Word Problems: Grade 8ClydeLisboaNo ratings yet

- TVM Practice Questions Fall 2018Document4 pagesTVM Practice Questions Fall 2018ZarakKhanNo ratings yet

- Time Value of Money ProblemsDocument24 pagesTime Value of Money ProblemsMahidhara Davangere100% (1)

- Overview of The Financial SystemDocument46 pagesOverview of The Financial SystemAhmad Rahhal100% (1)

- Time Value of MoneyDocument16 pagesTime Value of MoneyneerajgangaNo ratings yet

- Chapter 16Document13 pagesChapter 16Andi Luo100% (1)

- Test Bank 10Document6 pagesTest Bank 10Ahmad Rahhal100% (1)

- 4 Mathematics of InvestmentDocument1 page4 Mathematics of InvestmentJoy DacuanNo ratings yet

- Tutorial 5Document1 pageTutorial 5Rajneet ChandNo ratings yet

- Simple Discount ExercisesDocument1 pageSimple Discount ExercisesFaizal SyahrulNo ratings yet

- Cases For review-SIMPLE INTERESTDocument1 pageCases For review-SIMPLE INTERESTRogers BuzaileNo ratings yet

- 23 Q in Math 2 PDFDocument30 pages23 Q in Math 2 PDFobadfaisal24No ratings yet

- Simple Interest QuestionsDocument3 pagesSimple Interest Questionsk.angelacanqueNo ratings yet

- Compound Interest Concept Questions For Working FromDocument4 pagesCompound Interest Concept Questions For Working FromDony GregorNo ratings yet

- Business Mathematics 2nd Quarterly ExaminationDocument6 pagesBusiness Mathematics 2nd Quarterly ExaminationElbemar John B. BarairoNo ratings yet

- Tutorial 6 - QuestionsDocument1 pageTutorial 6 - QuestionsRajneet ChandNo ratings yet

- Simple and Compound InterestDocument2 pagesSimple and Compound Interestbigmike459No ratings yet

- HWChapter 5Document20 pagesHWChapter 5Yawar Abbas KhanNo ratings yet

- MODULE 4 - Consumer MathDocument10 pagesMODULE 4 - Consumer MathALMIRA LOUISE PALOMARIANo ratings yet

- solution of math first امتحانDocument8 pagessolution of math first امتحانMagdy KamelNo ratings yet

- Compound InterestDocument4 pagesCompound InterestNeha JainNo ratings yet

- Assignment No. 1Document2 pagesAssignment No. 1John Renz RetiroNo ratings yet

- Individual Assignment - TIME VALUE OF MONEYDocument5 pagesIndividual Assignment - TIME VALUE OF MONEYTherese Grace PostreroNo ratings yet

- Compilation For Final Exam 1 Converted 1Document7 pagesCompilation For Final Exam 1 Converted 1Trending News and TechnologyNo ratings yet

- TMU1053 Consumer Maths S2 16-17 v2Document4 pagesTMU1053 Consumer Maths S2 16-17 v2Iffah AnisahNo ratings yet

- EconomicsDocument1 pageEconomicsAlthea PeralesNo ratings yet

- Faculty of Commerce Year: 1 Financial Accounting 2 May 2020 Time: Three Hours - Date: 31/5/2020 The Questions Start With A Number: (7) RequiredDocument8 pagesFaculty of Commerce Year: 1 Financial Accounting 2 May 2020 Time: Three Hours - Date: 31/5/2020 The Questions Start With A Number: (7) Requiredmagdy kamelNo ratings yet

- S Announcement 31904 PDFDocument2 pagesS Announcement 31904 PDFNemo BaayNo ratings yet

- Csemar20 Numerical B KTCDocument4 pagesCsemar20 Numerical B KTCTin BulaoNo ratings yet

- Quiz 3Document2 pagesQuiz 3shaylieeeNo ratings yet

- Beirut Arab University Faculty of Engineering Department of Industrial Engineering and ManagementDocument2 pagesBeirut Arab University Faculty of Engineering Department of Industrial Engineering and ManagementGempf GisNo ratings yet

- Babe 1 Time Value QuestionsDocument9 pagesBabe 1 Time Value QuestionsCatherine LegaspiNo ratings yet

- Business Math Interest Sample ProblemsDocument1 pageBusiness Math Interest Sample ProblemsBear GummyNo ratings yet

- Exercises Chapter 2Document1 pageExercises Chapter 2ntxthuy04No ratings yet

- Screenshot 2023-12-08 at 11.56.27Document3 pagesScreenshot 2023-12-08 at 11.56.27alcantarakyara530No ratings yet

- QuestionnaireDocument6 pagesQuestionnaireKenshin SophisticNo ratings yet

- Name: - 5.1 Problem Set 115Document14 pagesName: - 5.1 Problem Set 115Clair BlushNo ratings yet

- Economics Sample ProblemDocument6 pagesEconomics Sample ProblemanthonyNo ratings yet

- Kaplan University MM 255 All QuizDocument9 pagesKaplan University MM 255 All QuizjustquestionanswerNo ratings yet

- td02 2019 2020 Composc3a9s CorrectionDocument2 pagestd02 2019 2020 Composc3a9s CorrectionMohamed EL AtassiNo ratings yet

- A.investment A Pays $250 at The Beginning of Every Year For The Next 10 Years (A Total of 10 Payments)Document4 pagesA.investment A Pays $250 at The Beginning of Every Year For The Next 10 Years (A Total of 10 Payments)EjkNo ratings yet

- Lat Soal Time Value of MoneyDocument3 pagesLat Soal Time Value of MoneyHendra G. AngjayaNo ratings yet

- 1 MultiDocument1 page1 MultiFaba, Froi Jastine T.No ratings yet

- QM Tutorial Simple and Compound InterestDocument6 pagesQM Tutorial Simple and Compound InterestLishalini GunasagaranNo ratings yet

- Worksheet No2Document2 pagesWorksheet No2juvaniecamerino462No ratings yet

- Time Payments Compilation - 13-14-43-00 PDFDocument1 pageTime Payments Compilation - 13-14-43-00 PDFgreycouncilNo ratings yet

- Assignment Time Value and MoneyDocument2 pagesAssignment Time Value and MoneySaqib Mirza0% (1)

- Objectivequestionanswersontvm 2944Document6 pagesObjectivequestionanswersontvm 2944AksNo ratings yet

- Practical Business Math Procedures 11Th Edition Slater Test Bank Full Chapter PDFDocument52 pagesPractical Business Math Procedures 11Th Edition Slater Test Bank Full Chapter PDFmichelleortizpxnzkycmbw100% (7)

- More About Percentages: Let 'S ReviewDocument23 pagesMore About Percentages: Let 'S ReviewJason Lam LamNo ratings yet

- Exercise InterestDocument1 pageExercise InterestimlanglavangNo ratings yet

- P 1Document27 pagesP 1Mark Lorenz SarionNo ratings yet

- MathDocument2 pagesMathJessel Ann MontecilloNo ratings yet

- PALOMARIA-MODULE 4 - Consumer MathDocument16 pagesPALOMARIA-MODULE 4 - Consumer MathALMIRA LOUISE PALOMARIANo ratings yet

- Class 5 Compound InterestDocument1 pageClass 5 Compound InterestvaleNo ratings yet

- BUS288 Test Practice QuestionsDocument9 pagesBUS288 Test Practice QuestionsJayden Vincent0% (1)

- Seatwork Activity: Engineering EconomyDocument12 pagesSeatwork Activity: Engineering EconomyMark Ian HernandezNo ratings yet

- Seatwork Activity: Engineering EconomyDocument12 pagesSeatwork Activity: Engineering EconomyMark Ian HernandezNo ratings yet

- Practice Problems - Simple Interest, Bank Discount, and Promissory NotesDocument1 pagePractice Problems - Simple Interest, Bank Discount, and Promissory Noteskillerair0% (2)

- Why Do Interest Rates Change?Document38 pagesWhy Do Interest Rates Change?Ahmad RahhalNo ratings yet

- Why Do Interest Rates Change?Document33 pagesWhy Do Interest Rates Change?Ahmad RahhalNo ratings yet

- Money & Banking: Week 3: The Behavior of Interest RatesDocument33 pagesMoney & Banking: Week 3: The Behavior of Interest RatesAhmad RahhalNo ratings yet

- The Behavior of Interest RatesDocument39 pagesThe Behavior of Interest RatesAhmad RahhalNo ratings yet

- Why Study Money, Banking, and Financial Markets?Document25 pagesWhy Study Money, Banking, and Financial Markets?Ahmad RahhalNo ratings yet

- Test BankDocument25 pagesTest BankAhmad RahhalNo ratings yet

- Why Study Financial Markets and InstitutionsDocument15 pagesWhy Study Financial Markets and InstitutionsAhmad RahhalNo ratings yet

- Test BankDocument25 pagesTest BankAhmad RahhalNo ratings yet

- Mohem AnnDocument74 pagesMohem AnnAhmad RahhalNo ratings yet

- Why Study Money, Banking, and Financial Markets?Document23 pagesWhy Study Money, Banking, and Financial Markets?Ahmad RahhalNo ratings yet

- Fe InvoiceDocument25 pagesFe InvoiceAhmad RahhalNo ratings yet

- DocDocument8 pagesDocAhmad RahhalNo ratings yet

- Chapter 13 - Weighing Net Present Value and Other Capital Budgeting Criteria QuestionsDocument21 pagesChapter 13 - Weighing Net Present Value and Other Capital Budgeting Criteria QuestionsAhmad RahhalNo ratings yet

- How Do Small Business Managers Influence Employee Satisfaction and Commitment?Document14 pagesHow Do Small Business Managers Influence Employee Satisfaction and Commitment?Ahmad RahhalNo ratings yet

- Gitman IM Ch08Document17 pagesGitman IM Ch08Ahmad RahhalNo ratings yet

- Transformational Leadership Principles Within Small BusinessesDocument133 pagesTransformational Leadership Principles Within Small BusinessesAhmad RahhalNo ratings yet

- Chapter 7: The Basics of Simple Interest (Time & Money) : Value (Or Equivalent Value)Document4 pagesChapter 7: The Basics of Simple Interest (Time & Money) : Value (Or Equivalent Value)Ahmad RahhalNo ratings yet