Professional Documents

Culture Documents

Comm Bank Tips

Uploaded by

Venessa Yong0 ratings0% found this document useful (0 votes)

8 views1 pagedxxdv

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentdxxdv

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageComm Bank Tips

Uploaded by

Venessa Yongdxxdv

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

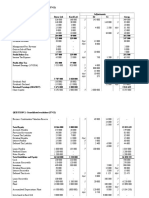

Comm bank tips

1. Week 3: NOT included

2. Regulation (Week 12) deposit insurance, compliance, source, std nt needed

3. Week 1: Financial institutions specialness important

Concepts : e.g. risk intermediation etc

4. Week 2: Risks (10 risks) Interest rate risks (repricing model, duration

model)- theory and mcq

5. Week 3 not coming out

6. Week 4: capital planning and why, 2 systems, AGM and ICGR

- Target model, dividends impact on this issue- capital planning

- Planning growth and risk management

7. Week 5: Capital adequacy- important

- Calculations, buffer, tut and tests

8. Week 6 Liquidity important

- Models to measure the risk

- Finance gap etc- simulation- deposit drain

- Liability management- not too important- just know how to choose liability

(in slide)

9. Week 7 and Week 8: Credit risk

- 2 parts: single loan, and portfolio

- Important

- RAROC

- Altman formula given etc

- Term structure: to do the pricing, how much interest rate must be when

comparing 1+k and 1+i

- Concentration risk- modern portfolio theory and kmo forget these,

dont forget the other models

- how to manage those risks- derivatives and options no need worry

about derivatives and options

- Option pricing dont worry

10.Week 9: Portfolio management-forward option yield curve policies controlling

stock with yield curve ladder split maturity riding the yield curve-

arbitraging: EVERYTHING

11.Week 10: ALL also related to price risk, market risk- direct

12.Week 11: Securitisation- risk important- modern banking- Week 11 tut 3a 3b

3c

How to deal with CMO etc formulas given

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MGW1010 AssignmentDocument4 pagesMGW1010 AssignmentVenessa YongNo ratings yet

- Investment Portfolio Management: A Brief History of Risk and ReturnDocument43 pagesInvestment Portfolio Management: A Brief History of Risk and ReturnVenessa Yong100% (1)

- Assignment QuestionDocument1 pageAssignment QuestionVenessa YongNo ratings yet

- No. Plant Name/Company Name Date Establishedsingle/Twin Plant Plant Capacity Available Trucks Customers RemarkDocument3 pagesNo. Plant Name/Company Name Date Establishedsingle/Twin Plant Plant Capacity Available Trucks Customers RemarkVenessa YongNo ratings yet

- ACW3431 Semester1 (S1-01) 2018Document21 pagesACW3431 Semester1 (S1-01) 2018Venessa YongNo ratings yet

- Financial Instruments Notes + TutorialDocument14 pagesFinancial Instruments Notes + TutorialVenessa YongNo ratings yet

- Chapter 20Document15 pagesChapter 20Venessa YongNo ratings yet

- Commercial Banking AnswersDocument74 pagesCommercial Banking AnswersVenessa YongNo ratings yet

- Business StatsDocument3 pagesBusiness StatsVenessa YongNo ratings yet

- Deegan 5e Ch20 - CFDocument23 pagesDeegan 5e Ch20 - CFVenessa YongNo ratings yet

- 5 MaggieDessertPlanningDocument3 pages5 MaggieDessertPlanningVenessa YongNo ratings yet

- Understanding Financial Accounting TutorialDocument76 pagesUnderstanding Financial Accounting TutorialVenessa YongNo ratings yet

- Accounting for Heritage and Biological AssetsDocument10 pagesAccounting for Heritage and Biological AssetsVenessa YongNo ratings yet

- Costing analysis helps electronics firm's "make or buyDocument8 pagesCosting analysis helps electronics firm's "make or buyVenessa YongNo ratings yet

- Marketing Notes: Customer-Driven StrategiesDocument76 pagesMarketing Notes: Customer-Driven StrategiesVenessa YongNo ratings yet

- Consolidation WorksheetDocument3 pagesConsolidation WorksheetVenessa YongNo ratings yet

- 3 - Acw2851 2014 Lec 3 IfvlookuppmtDocument55 pages3 - Acw2851 2014 Lec 3 IfvlookuppmtVenessa YongNo ratings yet

- Chemistry Form 5 Chapter 2 Carbon CompoundsDocument25 pagesChemistry Form 5 Chapter 2 Carbon CompoundsSharmini RajagopalNo ratings yet

- Chemistry Forn 5 Chapter 2 Carbon CompoundsDocument16 pagesChemistry Forn 5 Chapter 2 Carbon CompoundsVenessa Yong100% (1)