Professional Documents

Culture Documents

The Ultimate Question

Uploaded by

Anonymous 8ooQmMoNs1Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Ultimate Question

Uploaded by

Anonymous 8ooQmMoNs1Copyright:

Available Formats

The Ultimate Question, by Fred Reichheld, 2006

Part One Why The Ultimate Question Works

Chapter 1 Bad Profits, Good Profits and the Ultimate Question

Chapter 2 The Measure of Success

Chapter 3 How the Net Promoter Score (NPS) Can Drive Growth

Part Two How To Measure Responses

Chapter 4 The Enterprise Story Measuring What Matters

Chapter 5 Why Satisfaction Surveys Fail

Chapter 6 The Rules Of Measurement

Part Three Becoming Good Enough To Grow

Chapter 7 Design Winning Customer Strategies

Chapter 8 Deliver Building An Organization That Creates PROMOTERS

Chapter 9 Develop A Community Of PROMOTERS By Listening

Chapter 10 One Goal, One Number

Appendix A The Linkage Between NPS And Growth

Appendix B Winners And Sinners For Selected US and UK Industries

The Ultimate Question Page 1 of 15 8/25/2006

Part One Why The Ultimate Question Works

Chapter 1 Bad Profits, Good Profits and the Ultimate Question

Bad profits are earnings that do not endure, earnings that are not based upon a

satisfied customer. Bad profits leave a customer feeling bad about their

experience with a company. Bad profits are earned at the expense of the

customer relationship. Bad profits are about extracting value from customers,

not creating value.

o Examples:

Phone companies that lock customers into long term contracts and

then dont give them a lower rate when the market changes for new

customers.

Drug companies paying doctors to push new drugs while

carefully quashing studies that might question the efficacy of

such drugs.

o The cost of bad profits is often carried like a virus by DETRACTORS,

the customers who feel so badly treated that they cut back on purchases,

switch to a competitor if they can and tell others about the companys bad

service.

o AOL is a company that has been hooked on bad profits. AOL grew

memberships after their IPO in 1992 by carpet-bombing the country with

free software diskettes. Their membership grew dramatically and their

network became overloaded, leading to several high profile blackouts in

1996. AOLs monthly customer loss rate rose to 6% and they turned to

advertising to boost current earnings. By 2002, 42% of the companys

customers were DETRACTORS.

True growth is hard to find: Bain & Company study found that only 22% of the

worlds major firms achieved real, sustainable growth of even 5% a year over the

ten-year period from 1994 to 2004.

Good profits are earned by the creation of value. (As Herbert Marcus of

Neimann Marcus once said, Its never a good sale for Neiman Marcus, unless

its a good buy for the customer.)

o Example companies: Amazon.com, Vanguard Group, Southwest Airlines,

Costco, Northwestern Mutual, eBay, The Four Seasons Hotels, Enterprise

Rent-A-Car, Intuit.

o When you earn good profits, your customers become PROMOTERS.

They sing your praises to their friends and colleagues.

o When you earn good profits, you can achieve true growth.

o At the heart of good profits, Reichheld believes you will find the Golden

Rule. There are no shortcuts to good profits. You must do things for your

customers, over the long-term, that you would want someone to do for

you.

o [TMP: Companys create value for their customer by delivering products

with value in excess of their price.]

The Ultimate Question Page 2 of 15 8/25/2006

Loyalty is the key to profitable growth.

A systematic feedback mechanism is required in order to turn a companys desire

to act in accordance with the Golden Rule into good profits and true growth.

One Bain study showed that a 5 percent increase in customer retention can yield

anywhere from a 25 percent to 100 percent improvement in profits.

Another Bain study showed that companies with the highest customer loyalty

(loyalty leaders) typically grew revenues at more than twice the rate of their

competitors.

If loyalty leads to good profits which leads to true growth, then what is needed is

a system to measure loyalty in a way that makes individuals accountable for

results.what gets measured creates accountability.

Reichheld is not a fan of traditional satisfaction surveys. He calls it a

pseudoscience; says it is stuck in the dark ages, managed by marketing and not

operationssurveys are generally too long and a waste of time.

Bain did research and experimentation to come up with a metric that helps

companies tell the difference between good profits and bad. It is simple, but is

only useful if it is implemented as part of larger system.

The Ultimate Question: How likely is it that you would recommend this

company to a friend or colleague?

The metric this question produces is called the Net Promoter Score (NPS).

Scores are on a 0 to 10 scale.

o PROMOTERS answer 9 or 10.

o Passives answer 7 or 8.

o DETRACTORS answer 0 through 6.

o NPS = PROMOTERS minus DETRACTORS

For the average firm, 66% or more of the customer are passives (bored) or

DETRACTORS (angry).

[TMP: One of my first questions was, what else are you going to ask the

customer, beside the would recommend question? The answer depends on

your situation, but it usually means one or a few follow-on questions. You might

ask, what was the most important reason for the score you gave? Reichheld

even spotlights Enterprise, who has a 1 to 5 scale system, to show their

commitment to a simple survey system. The point of the book is not a hard-

boiled formula, but that a company can find good profits and true growth by a)

simplifying their customer feedback process to a single question with a few

The Ultimate Question Page 3 of 15 8/25/2006

follow-on questions and b) asking these questions systematically and consistently

across all businesses and/or divisions.]

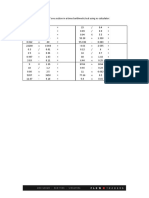

Company NPS*

USAA 82%

HomeBanc 81%

Harley-Davidson 81%

Costco 79%

Amazon.com 73%

Chick-fil-A 72%

eBay 71%

Vanguard 70%

SAS 66%

Apple 66%

Intuit (Turbo Tax) 58%

Cisco 57%

Fedex 56%

Southwest Airlines 51%

American Express 50%

Commerce Bank 50%

Dell 50%

Adobe 48%

Electronic Arts 48%

* Statistics based on Bain/Satmetrix studies

Chapter 2 The Measure of Success

Bain & Company and Reichheld have been studying loyalty for years.

When businesses were small, you knew exactly how your customers were

feeling. As businesses got larger, knowing your customers becomes harder. One

way to think about customers is to look at what products are selling and whether

you are making a profit on them. Another way is through market-research:

doing surveys to understand how customers are feeling.

However, market research is often left in the hands of marketing and not

operations. In addition, theres no guarantee of a correlation between satisfaction

rates and actual customer behaviors.

Bain did a study to understand which questions are most correlated to customer

loyalty. How likely are you to re-purchase? How would you rate the overall

quality? How strongly do you agree that company X deserves your loyalty?

They used a firm called Satmetrix Systems (www.satmetrix.com), on whose

board Reichheld sits. They hoped to find one question for each industry that

effectively predicted what customers would do and therefore helped predict a

companys growth.

What they found, however, was that one question worked best for most

industries. That question is the would recommend question.

The Ultimate Question Page 4 of 15 8/25/2006

Mapping responses to the ultimate question

How likely is it that you would recommend

Company X to a friend or colleague?

Extremely Not at

likely all likely

10 9 8 7 6 5 4 3 2 1 0

Promoter Passive Detractor

On reflection, Reichheld thinks that this question makes sense, because a

recommendation is the highest praise you can give to a company; youre

encouraging others you care about to share in the value you have received.

The would recommend question is not necessarily the best question for all

industries. Reichheld encourages companies to validate the link between survey

questions and answers and those customers behavior (buying patterns). In

business-to-business settings, an appropriate question might be: How likely is it

that you will continue to purchase products or services from Company X?

(Later, Reichheld addresses the issue of how to gather data when you sell to

retailers who then sell to customers.)

Intuit example of using NPS:

o Added NPS onto existing surveys

o Took away some of existing surveys

o Segmented recommendations by PROMOTERS, Passives,

DETRACTORS

o Found differing issues:

DETRACTORS wanted better tech support (not from India)

PROMOTERS wanted improved rebate process

o NPS provides actionable insights for Intuit and is now a part of every

strategic plan, every operating bonus, every executives bonus, every

monthly operating review.

Reichheld believes NPS should be reported to management as frequently as

management gets financial updates.

Chapter 3 How the Net Promoter Score (NPS) Can Drive Growth

In a company of our size and complexity, it becomes critically important to

simplify and focus on one number that is practical to measure. It is also vital

that this metric reliably link to profits and growth. Our experience with

satisfaction surveys has not been very good because they dont connect to

The Ultimate Question Page 5 of 15 8/25/2006

business economics. But as we saw at GE Healthcare, NPS links well to both

market share and profitability. Gary Reiner, Chief Information Officer, GE

There is strong evidence that NPS is correlated to growth.

o The graph below is one of six from the appendix of the book.

Internet Service Providers

Three-year growth (1999-2002)

40%

R2: 0.93

MSN

30

Earthlink

20

AOL

10

-20 -10 0 10 20

Net Promoters

Source: Satmetrix NPS survey (Q1-Q4, 2002); company annual report.

o Conceptually, Reichheld points out that businesses who get referrals have

an unpaid sales and marketing team working on their behalf. Referrals

come from PROMOTERS.

o Employees and, especially, managers of the NPS-leading companies in the

book earn salaries in excess of their competitors. This includes a)

HomeBanc, where mortgage originators earn as much as $1 million per

year, and b) Chick-fil-A, where restaurant managers, on average, earn

$170,000 per year.

Why NPS Works

o You need to understand the value of your customers.

The traditional approach is to calculate the lifetime net present

value of a customer.

The problem with this approach is that not all customers are the

same, especially in terms of their value.

Retention rate: DETRACTORS have a lower retention rate

and, therefore, a much lower overall value.

Margin: PROMOTERS are generally less price sensitive

and, therefore, have a higher overall value.

Annual spend: PROMOTERS tend to spend more and are

more receptive to cross-selling.

Cost efficiencies: DETRACTORS complain more and,

hence, cost more.

The Ultimate Question Page 6 of 15 8/25/2006

Word of mouth: PROMOTERS have higher value than the

average customer because of the additional business they

can bring to your organization. DETRACTORS work in

reverse. Bain studies have shown it takes three to ten

positive comments about a company to make up for one

negative comment.

The solution is to calculate the NPV of PROMOTERS and

DETRACTORS. Reichheld goes through a detailed analysis of

Dell customers to show how someone can go about this

calculation.

NPS and Market Share

o When a company focuses on market share, they often fall into the trap of

bad profits. When you dominate your market, you have little incentive to

think about good profits and bad profits. Instead, you are probably just

focused on growing earnings.

o The point is that when a company focuses on NPS, they are focused on

good and enduring profits.

Part Two How To Measure Responses

Chapter 4 The Enterprise Story Measuring What Matters

Enterprise grew from $2 billion in revenues in 1994 to $7 billion 2004. The

CEO largely credits this success to their customer feedback system.

ESQi stands for Enterprise Service Quality index and was created by Enterprise

in 1994. Previous Enterprise surveys suffered from question creep. ESQi was

a single page containing 9 questions, the most important of which was:

o Overall, how satisfied were you with your recent car rental from

Enterprise?

o Customers could check five boxes from completely satisfied to

completely dissatisfied.

o Survey methodology was attacked internally by low scorers.

o Initial results told them that high scorers were independent of branch size

or geographic region.

Enterprise made 3 important changes:

o Focused surveys on the appropriate granularity, which was each of the

several thousand branches, not the larger regions.

o Made survey results timely so that they could be acted upon by each

branch.

o Analyzed responses and correlated them to repurchases and referrals. The

were you completely satisfied question accounted for 86% of the

customers who did repurchase or refer.

Taking ESQi seriously.

o 1. Linked ESQi scores to corporate recognition.

o 2. Listed ESQi scores in every monthly operating report.

o 3. Constantly communicated the importance of the ESQi ratings.

Why ESQi works.

The Ultimate Question Page 7 of 15 8/25/2006

o Tight focus. When surveyor (3rd party) gets a dissatisfied response to the

completely satisfied question, he or she immediately asks if someone

could call them to talk about it. That someone is not in marketing, but

someone in operations who can do something about whatever is the

problem. ESQi is not a market-research program; it is an operating tool.

o Operational accountability. Responsibility for ESQi moved out of market

research and into operations.

o Timelinenss and high participation rates. Enterprise surveys customers

within days of their experience and, because their survey is so short, they

experience participation rates of 95% or more.

o The Closed Loop. Enterprise asked its survey vendor to NOT diagnose

the root cause of the customers score. Enterprise knew that doing the root

cause analysis would take four or five follow-up questions and require

knowledge that the survey vendor did not have.

o A link to the economics of the business. Enterprise has reduced

DETRACTORS from 12 to 5%, which improves word of mouth and

drives growth and reduces costs.

o Continuous evolution. Enterprise has continued to focus on improving the

ESQi system. To solve a seasonal drop in ESQi scores, they began

reporting ESQi on a weekly basis, thereby helping new seasonal hires

understand more quickly the importance of ESQi to the company.

How ESQi Drives Improvement

o Training. Enterprise develops training geared towards ESQi.

o On-the-spot fixes. Managers encouraged to not use survey language at

the branch, but to fix issues on the spot. Is there anything we can do to

serve you better? Managers know that company values making money

AND ESQi results.

o Experimentation. Managers and employees try things to improve their

scores. They figure out what customers want.

o Closing the loop even faster. Branches seek to get feedback and make

improvements daily.

o Learning from the best. Corporate executives understand that they should

be looking for ideas from the branches and from the branch managers who

have great ESQi scores.

o Pitfals/Prerequisites:

Honesty & Integrity. Falsifying their ESQi scores can have career-

ending consequences at Enterprise.

o Vote For Growth: One branch decided that each week each employee

would vote on the quality customer service of each of the other employees

over the previous week. Votes are tallied and posted.

Chapter 5 Why Satisfaction Surveys Fail

You cannot build an effective customer-feedback system on the shaky

foundation of current satisfaction-survey methods and practices.

Top 10 Reasons That Satisfaction Surveys Are A Joke:

o #10: Too many surveys, too many questions. Self-evident.

The Ultimate Question Page 8 of 15 8/25/2006

o #9: The wrong customers respond. Statistical sampling gets the people

who have time to fill out the surveys, not necessarily the PROMOTERS or

DETRACTORS.

o #8: Employees dont know how to take corrective action. Surveys dont

give employees the ability to close the loop with customers who make

suggestions or report their dissatisfaction.

o #7: Too many surveys are marketing campaigns in disguise.

o #6: Scores dont link to economics. You have to find a question that links

to the economics of your organization. Intent to repurchase is not a proxy

for loyalty; 60-80% of customer defectors (they later left) scored

themselves as satisfied or very satisfiedsatisfaction is too low of a

hurdle.

o #5: Plain vanilla solutions cant meet companys unique needs. Most are

not timely and not targeted and too complicated.

o #4: There are no generally accepted standards. Reichheld promotes the

idea of creating standards for customer surveying along the lines of GAAP

for accounting. One banks statisticians thought that satisfaction was

related to customer attrition, but operating managers pointed out that the

driver to growth and profits in credit cards was not customer retention but

instead customer usage. They were looking at the wrong measure.

o #3: Surveys confuse transactions with relationships. Companies need to

go beyond transactions and start focusing on relationships. Moreover,

even within relationships, the ultimate question has to get at the real

drivers of growth and profitability.

o #2: Satisfaction surveys dissatisfy customers. Surveys tend to piss people

off. Harley Davidson has recent retirees call and listen to customers.

o #1: Gaming and manipulation wreck the credibility of traditional surveys.

No survey will work if the intent is not honest.

Reichheld talks at multiple points about the Golden Rule.

Surveying must start with a companys intent to make an honest

profit.

All people at all levels of the organization must:

Have a good system to work with.

Behave honorably.

Gaming the system is sure-fire evidence that a companys

surveying system is not working.

Chapter 6 The Rules Of Measurement

Developing a measurement system, just like GAAP for accounting, takes time.

The following principles will help achieve the goal: to calculate your

customers promoter status in a fashion that is accurate, granular, timely and

credible. These principles will also drive accountability for good customer

relationships into your organization.

o Principle 1: Ask the Ultimate Question and Very Little Else.

o Principle 2: Choose a Scale That Works and Stick To It. Enterprise uses a

scale with five responses. Ebay has a 3 point scale. Reichheld likes the 0

The Ultimate Question Page 9 of 15 8/25/2006

to 10 because theres never any question about which end is the good end.

No one wants a zero.

o Principle 3: Aim for High Response Rates from the Right Customers.

Focus on your core customers.

If youre response rates are not 65%, youre not hearing from

enough customers.

In B-to-B situations, use a quarterback at the client to ensure that

you are getting the right mix of the various customer respondents.

Dont use gimmicks.

o Principle 4: Report Relationship Data as Frequently as Financial Data.

Publishing NPS with financial information enhances its importance.

o Principle 5: The More Granular the Data, the More Accountable the

Employees.

Police officers couldnt do their jobs if their radar machine tracked

average speed of all cars on the road.

Be attuned to distinguishing between a customers satisfaction with

a specific interaction and their loyalty to the overall relationship.

(Might ask two questions: Did we resolve all the problems you

called about? and Would you recommend us to a friend or

colleague?)

Be aware that teams frequently regroup and that customers often

interact with multiple departments, like a patient at a hospital.

Hockey teams monitor goals for and against while each player is

on the ice; hospitals could rank teams and individuals by the NPS

that is the average of all patients served.

o Principle 6: Audit to Ensure Accuracy and Freedom from Bias

Sources of Bias:

Fear of retributionwhen the surveyor (the vendor) has

power over customersmake sure the process is

confidential.

Briberywitnessed at car dealers, where employees bribe

customers to get good scoresagain, confidentiality is key,

as is education of employees.

Grade inflationcustomers might feel awkward giving bad

gradesuse 3rd party survey vendorskeep customer

names confidential, unless customer gives permission for

release.

Fighting Bias

Use email wherever feasible

Make team or individual scores transparent to enable

community policing

Use a 3rd party to collect feedback so customers can be

completely candid and the promise of confidentiality is

more credible

Educate employees and customers about the goals and

ethics of the feedback process

The Ultimate Question Page 10 of 15 8/25/2006

Develop audit procedures that will uncover gaming

Consistency for Accuracy. Be consistent in your approach. One

restaurant got very different results between surveying customers

as they were leaving the restaurant versus surveying by

emailthey were more honest by email.

o Principle 7: Validate That Scores Link to Behaviors

You must regularly validate the link between individual customer

scores and customer behavior over time.

Be on the look out for customer surveys saying our relationship is

great and then seeing customer defections. Means somethings

wrong with your questions and/or process.

o Footnotes to include in the presentation of information:

Response rates

Customer sample size and selection process

Inducement for participation, if any

Survey medium (face-to-face, telephone, email)

Degree of confidentiality

Granularity and frequency of reporting

Link to Employee Rewards

Gaming safeguards and sanctions

Audit procedures

Part Three Becoming Good Enough To Grow

Chapter 7 Design Winning Customer Strategies

Bain did a survey of 362 companies.

o 80% of senior executives said their company delivered a superior

experience to their customers. >>> Believers

Then Bain surveyed the customers of those same organizations.

o Only 8% of the companies received a superior experience rating. >>>

Achievers

Reichheld recommends that companies focus on three steps in becoming an NPS

achiever:

o 1. Design value propositions that focus on the right customers.

o 2. Deliver those propositions from end-to-end, across all departments.

o 3. Develop the capability to renew and reinvent the experience over time.

Defining the Reality of Your Customer Base

The Ultimate Question Page 11 of 15 8/25/2006

Separating good profits from bad with the customer grid

High

A B C

Profitability

Low F E D

Passive

Detractor Promoter

High

Low

NPS

Bad Profits Neutral Profits Good Profits

Understand the realities of your customer base. Circle size is for revenue.

Sector Strategy Priority

C 1

Reinvest for value-added products, especially if

youre earning excess profits

A 2 Talk to them change systems. Phone companies

have certain customers locked into contracts;

pissing off customers but making money.

F 3 Up or out

D 4 Talk to them be honest

B 5 Talk to them figure out how to change to C

E 6 Figure out what kind of customer

(Amex card holders who never spendlow profit

and passiveoffer different, more appropriate

products)

Designing Winning Propositions

o Best way to find winning value proposition is to a) think about the end-to-

end customer experience and b) focus on a profitable repeatable niche.

HomeBanc focused on home purchasers rather than refinancers.

Designing for Growth

o Dont hide behind the excuse that your business is a commodity business.

Look at what Enterprise has done in rent a cars and Southwest in airlines.

Chapter 8 Deliver Building An Organization That Creates PROMOTERS

Your employeesare they PROMOTERS? A Bain study of employees working

10 or more years for their company showed that only 19% were PROMOTERS.

The Ultimate Question Page 12 of 15 8/25/2006

the battle to convert customers into PROMOTERS can be won only if

frontline employees are PROMOTERS themselves.

Send the Right Messages

o If you tell your employees that all that counts is profits, they will rarely be

PROMOTERS.

o Dell has formed a Customer Experience Council

o Superquinn, Irish grocery chain with high NPS ratings, has all his

employees wearing boomerang pins, to remind them that customers come

back repeatedly. A new manager at a Superquinn store thought he could

cut costs by not baking bread as frequently and not having as much waste;

the result was a less appealing atmosphere and lower sales.

Hire (and Fire) to Inspire

o To build promoters from within, you have to start with your hiring

processes.

o John Young, in charge of HR for the Four Seasons, on building a service

culture, First, you must decide what you stand for, and then you must

align every one of your systems to reinforce it. You recruit for it, you

select for it, you orient for it, you train for it, you reward for it, you

promote for it, and you terminate those that dont have it.

o Reichheld says, Too many companies do kid themselves about their

commitment to the customer experience, let alone the Golden Rule. They

tolerate great salespeople or great engineers who dont embody the core

values the company nominally espouses. That practice alone tells

employees that the values are not the top priority.

Pay Well and Invest in Training So Employees Invest in Relationships

o Example of Four Seasons training where they roleplay situations:

Boss who realizes that its unfair to other employees and customers

to not terminate an employee who has received all the proper

training but still fails to deliver.

Coworkers who realize that complaining to other people causes

more problems versus simply speaking directly with the person

with whom you have a problem.

Does your main restaurant serve seafood? Question launches

training on how an employee can move beyond simply answering

the question to surprising and delighting customers.

Small Teams Enhance Accountability and Service.

o Loyalty leaders have found that making small teams, typically 5-15

people, greatly enhances service and accountability.

Link Measures and Rewards to Company Values

o Be careful what you measure and what you reward for, because youre

likely to find people gaming your system.

o Be careful of too many statistics and losing sight of the overall goal.

Putting It All Together: USAAs Call Centers.

o USAA is an insurer of military personnel. Recognized for service and

innovation.

USAA hires away from call-center experience.

The Ultimate Question Page 13 of 15 8/25/2006

Minimal scripts for call-center employees.

High training.

Encourage employees to resolve all issues on the first call.

Chapter 9 Develop A Community Of PROMOTERS By Listening

Hold Direct Conversations With Customers

o CEO of Vanguard Group mans the customer phone lines 4 hours per

month.

o CEO of Intuit participates in follow-me-homes, where Intuit employees

get permission to go to a customers home and observe them installing and

using the companys software.

o CEO of Superquinn holds seminars with his customerswithout his

managers in attendance.

Create Process for Systematic Listening by Frontline Employees.

o SAS Institute, a maker of analytical software, allows its Customer Service

Reps and customers to vote on where the companys development budget

will be spent.

o Because of technology, many companies are able to encourage others

(customers, developers) to improve their productLinux, Google,

Amazon.com.

Let Customers Guide Innovation

o Rapid Innovation at eBay.

Listen to customers and respond quickly.

Pink-liners, employees who facilitate exchange of messages on the

site, are a key source of feedback from customers.

Help Customers Delight One Another

o New Yorker magazine organized a homecoming event. Spent $1.5

million for artist showings, poetry readings, expert lectures, panel

discussions, author breakfasts. Great appeal for PROMOTERS, ie core

readers and staff members. (Reminded me of an event put on by Williams

College in San Francisco recently where Williams paid for professors to

come to a hotel and spend a day teaching alums.)

o Amazon.com nurtures its creative community, especially book reviewers.

o Adobe Studio Exchange, for key customers to exchange ideas.

o Harley-Davidson facilitates HOGs (Harley Owners Groups).

o The Lego Group facilitates new designs and product ideas from local

clubs and exhibitions.

Create an Inner Circle

o Look at the language you are using in your surveys very carefully.

PROMOTERS, passives and DETRACTORS should be asked tailored

questions.

o It is important to uncover the exact language that explains why a customer

appreciates and promotes a particular company.

o Intuit took its most unhappy customers and solicited their feedback.

Bringing Traditional Customers Into the Circle

The Ultimate Question Page 14 of 15 8/25/2006

o Communispace Corporation offers a web-based product that creates a

customer community for a companys end-users.

having a roomful of target customers camped out in the corner

conference room, always ready to comment on a new idea,

evaluate new pricing or contribute create ideas.

Companies become much more than vendors in the eyes of both

customers and employees. They become the hub of a network of

mutually beneficial relationships governed by a shared set of rules

and ideals that connect with the very identify of their members.

Chapter 10 One Goal, One Number

Growth: One Number for Better Customer Relationships

Talent: One Number for Better Employee Relationships

o Build from the Golden Rule; drive out cynicism

Financial Rewards: One Number for Better Investor Relationships

o Bain is now using NPS in the evaluation of acquisition targets

One Number, Many Foes

o NPS has its share of detractorsmany entrenched interests

The Accountability of a Community

o There is a great power when a community gets behind something. When

the community sees that rigorous oversight is a good thing, they will

participate and reinforce what the organization wants. Police departments

see this effect.

o Reichheld draws a correlation between the birth of democracy and the

power of a community to focus itself towards any greater goal.

Democracy encourages everyone to participate and, likewise, building a

real community means that members care about that community and they

participate in the rigorous oversight of the values and mission of that

community.

The Big Picture

o In an effort to keep this book short and focused, I have concentrated on

for-profit businesses. It doesnt require much imagination to see the

relevance of NPS to a much broader range of institutions. The best way

for any community to grow is to attract the right kind of new members

through word-of-mouth advertising, then ensure that members develop

mutually valuable relationships worthy of an ongoing investment of their

time and energy. This is the cycle that builds successful schools, charities,

hospitals, associations, and foundations.

Appendix A The Linkage Between NPS And Growth

Appendix B Winners And Sinners For Selected US and UK Industries

The Ultimate Question Page 15 of 15 8/25/2006

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Ginsborg History of ItalyDocument8 pagesGinsborg History of ItalyAnonymous 8ooQmMoNs10% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Weak & Strong FormsDocument77 pagesWeak & Strong FormsAnonymous 8ooQmMoNs1No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- L5 - OrganisingDocument13 pagesL5 - OrganisingAnonymous 8ooQmMoNs1No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- L7 - Managing DiversityDocument5 pagesL7 - Managing DiversityAnonymous 8ooQmMoNs1No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Harry HearderDocument15 pagesHarry HearderAnonymous 8ooQmMoNs1No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Jock Reynolds J LT RookiesDocument14 pagesJock Reynolds J LT RookiesAnonymous 8ooQmMoNs1No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Arithmetic Test Example PDFDocument1 pageArithmetic Test Example PDFAnonymous 8ooQmMoNs1No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Lectures 1-3 COLOURDocument45 pagesLectures 1-3 COLOURAnonymous 8ooQmMoNs1No ratings yet

- 07 AnsDocument5 pages07 AnsAnonymous 8ooQmMoNs10% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 08 AnsDocument13 pages08 AnsAnonymous 8ooQmMoNs1No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- 15-Compliance With Flexible Accounting StandardsDocument19 pages15-Compliance With Flexible Accounting StandardsAnonymous 8ooQmMoNs1No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Test Bank Questions Chapters 1 and 2Document3 pagesTest Bank Questions Chapters 1 and 2Anonymous 8ooQmMoNs150% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Test Bank Questions Chapter 5Document5 pagesTest Bank Questions Chapter 5Anonymous 8ooQmMoNs1No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Test Bank Questions Chapter 6Document3 pagesTest Bank Questions Chapter 6Anonymous 8ooQmMoNs1No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- 06 AnsDocument4 pages06 AnsAnonymous 8ooQmMoNs1No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Test Bank Questions Chapter 7Document3 pagesTest Bank Questions Chapter 7Anonymous 8ooQmMoNs10% (1)

- Test Bank Questions Chapters 8 and 9Document3 pagesTest Bank Questions Chapters 8 and 9Anonymous 8ooQmMoNs1No ratings yet

- 23 Things They Don't Tell You About Capit Alism: Department of International Development Public LectureDocument14 pages23 Things They Don't Tell You About Capit Alism: Department of International Development Public LectureAnonymous 8ooQmMoNs1No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Case Interview Marathon Workshop: Overhead Slides v1.0Document30 pagesCase Interview Marathon Workshop: Overhead Slides v1.0Anonymous 8ooQmMoNs1No ratings yet

- Pac All CAF Subject Referral Tests 1Document46 pagesPac All CAF Subject Referral Tests 1Shahid MahmudNo ratings yet

- LEBV4830Document371 pagesLEBV4830anton100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- An Overview of The Geostatistical Analyst Toolbar and ToolboxDocument1 pageAn Overview of The Geostatistical Analyst Toolbar and ToolboxSumit SumanNo ratings yet

- Caselet - LC: The Journey of The LCDocument5 pagesCaselet - LC: The Journey of The LCAbhi JainNo ratings yet

- Occupational Stress Questionnaire PDFDocument5 pagesOccupational Stress Questionnaire PDFabbaskhodaei666No ratings yet

- Nature Hill Middle School Wants To Raise Money For A NewDocument1 pageNature Hill Middle School Wants To Raise Money For A NewAmit PandeyNo ratings yet

- Lich King Chorus PDFDocument21 pagesLich King Chorus PDFMacgy YeungNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Details For Order #002 5434861 1225038: Not Yet ShippedDocument1 pageDetails For Order #002 5434861 1225038: Not Yet ShippedSarai NateraNo ratings yet

- List of Approved Journals For Promoting Purposes at The University of JordanDocument3 pagesList of Approved Journals For Promoting Purposes at The University of JordanZaid MarwanNo ratings yet

- Advanced Machining User Guide PDFDocument250 pagesAdvanced Machining User Guide PDFDaniel González JuárezNo ratings yet

- 1.1 Cruz v. DENR PDFDocument7 pages1.1 Cruz v. DENR PDFBenBulacNo ratings yet

- Baterías YuasaDocument122 pagesBaterías YuasaLuisNo ratings yet

- Introduction To Content AnalysisDocument10 pagesIntroduction To Content AnalysisfelixNo ratings yet

- Consolidated Companies ListDocument31 pagesConsolidated Companies ListSamir OberoiNo ratings yet

- Understanding FreeRTOS SVCDocument11 pagesUnderstanding FreeRTOS SVCshafi hasmani0% (1)

- Project Proposal - Articulation SessionsDocument8 pagesProject Proposal - Articulation SessionsJhay-are PogoyNo ratings yet

- Chapter 01Document26 pagesChapter 01zwright172No ratings yet

- 2008 Reverse Logistics Strategies For End-Of-life ProductsDocument22 pages2008 Reverse Logistics Strategies For End-Of-life ProductsValen Ramirez HNo ratings yet

- JQuery Interview Questions and AnswersDocument5 pagesJQuery Interview Questions and AnswersShailesh M SassNo ratings yet

- Art and Culture KSG IndiaDocument4 pagesArt and Culture KSG IndiaAbhishek SinghNo ratings yet

- News/procurement-News: WWW - Sbi.co - inDocument15 pagesNews/procurement-News: WWW - Sbi.co - inssat111No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Digirig Mobile 1 - 9 SchematicDocument1 pageDigirig Mobile 1 - 9 SchematicKiki SolihinNo ratings yet

- Choosing The Right HF Welding Process For Api Large Pipe MillsDocument5 pagesChoosing The Right HF Welding Process For Api Large Pipe MillsNia KurniaNo ratings yet

- Crystallization of Para-Xylene in Scraped-Surface CrystallizersDocument11 pagesCrystallization of Para-Xylene in Scraped-Surface Crystallizersanax22No ratings yet

- Columbia County Property Transfers March 29-April 4Document3 pagesColumbia County Property Transfers March 29-April 4augustapressNo ratings yet

- Question: To What Extent Do You Agree or Disagree?Document5 pagesQuestion: To What Extent Do You Agree or Disagree?tien buiNo ratings yet

- Fine Fragrances After Shave, Eau de Parfum, Eau de Cologne, Eau de Toilette, Parfume Products (9-08)Document6 pagesFine Fragrances After Shave, Eau de Parfum, Eau de Cologne, Eau de Toilette, Parfume Products (9-08)Mustafa BanafaNo ratings yet

- 9a Grundfos 50Hz Catalogue-1322Document48 pages9a Grundfos 50Hz Catalogue-1322ZainalNo ratings yet

- Teacher Planner 2023 PDFDocument52 pagesTeacher Planner 2023 PDFitaNo ratings yet

- Attachment 05 - BFD, ELD and P&I Diagrams-PearlDocument77 pagesAttachment 05 - BFD, ELD and P&I Diagrams-Pearlum er100% (1)