Professional Documents

Culture Documents

Particulars Note No

Uploaded by

Bishwaranjan Mishra0 ratings0% found this document useful (0 votes)

4 views2 pagesdoc 1

Original Title

Doc1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentdoc 1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesParticulars Note No

Uploaded by

Bishwaranjan Mishradoc 1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

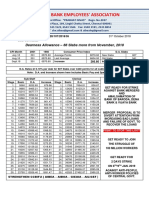

COMPARATIVE INCOME STATEMENT

FOR THE YEAR ENDING 2015 AND 2016

ABSOLUTE CHANGE IN

PARTICULARS NOTE NO 2015 2014 AMOUNT %CHANGE

REVENUE FROM OPERATIONS 2.22 17153.44 16497.37 656.07 3.976816

2.OTHER INCOME 2.21 1199.5 659.12 540.38 81.98507

GROSS PROFIT 15953.94 15838.25 115.69 0.730447

4.EXPENSES:

a.EMPLOYEE BENEFITS EXPENSES 2.23 5924.62 5123.95 800.67 15.62603

b.OPERATION AND OTHER EXPENSES 2.24 4071.69 3652.41 419.28 11.47954

c.FINANCE COSTS 2.13 60.64 81.65 -21.01 -25.7318

d.DEPRECIATION AND AMORTISATION

EXPENSES 2.25 299.92 490.7 -190.78 -38.8792

TOTAL EXPENSES 10356.87 9348.71 1008.16 10.78395

PROFIT BEFORE TAX 7696.54 8696.54 -1000 -11.4988

PROVISION FOR TAX

CURRENT TAX 1610.45 1555.74 54.71 3.516654

MAT CREDIT ENTITLEMENT -310.43 -115.91 194.52 -167.82

DEFERRED TAX CHARGE 52.57 -415.91 468.48 -112.64

TOTAL TAX EXPENSE 1352.59 1413.04 -60.45 -4.27801

PROFIT OF THE YEAR 6345.95 5984.52 361.43 6.039415

BALANCE SHEET:-

You might also like

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Assignment On Analysis of Annual Report ofDocument9 pagesAssignment On Analysis of Annual Report oflalagopgapangamdas100% (1)

- Heidelberg, Honeywell & EatonDocument18 pagesHeidelberg, Honeywell & EatonBishwaranjan MishraNo ratings yet

- A PROJECT REPORT On "Kotak Mahindra Mutul Fund"Document69 pagesA PROJECT REPORT On "Kotak Mahindra Mutul Fund"jai786063% (16)

- Financial Statement AnalysisDocument2 pagesFinancial Statement AnalysisBishwaranjan MishraNo ratings yet

- Comparative Income Statement and Balance Sheet Analysis 2014-2015Document3 pagesComparative Income Statement and Balance Sheet Analysis 2014-2015Bishwaranjan MishraNo ratings yet

- Century Textiles: A Leader in Cotton ProductionDocument25 pagesCentury Textiles: A Leader in Cotton ProductionAshish GaikwadNo ratings yet

- Indigo's Financial Performance from 2014-2019Document6 pagesIndigo's Financial Performance from 2014-2019Rehan TyagiNo ratings yet

- Balance Sheet and Income Statement AnalysisDocument19 pagesBalance Sheet and Income Statement AnalysisSaurabh NeveNo ratings yet

- Analysis of BhelDocument7 pagesAnalysis of BhelAmrita ParamanikNo ratings yet

- FSA GroupDocument87 pagesFSA GroupSanjib Kumar RamNo ratings yet

- 4-Year Balance Sheet and Income Statement AnalysisDocument42 pages4-Year Balance Sheet and Income Statement AnalysisSaurabh NeveNo ratings yet

- Prysor Co ExcelDocument4 pagesPrysor Co Excelsanjay gautamNo ratings yet

- Income StatementDocument6 pagesIncome StatementRajashree MuktiarNo ratings yet

- Financial Statement of Insurance Company 2021Document12 pagesFinancial Statement of Insurance Company 2021Nguyễn Trần Hải AnhNo ratings yet

- Balance Sheet of Colgate-Palmolive (India) Limited: Particulars 2021 2020Document42 pagesBalance Sheet of Colgate-Palmolive (India) Limited: Particulars 2021 2020ABHISHEK KHURANANo ratings yet

- FSA ASSIGNMENT-3 AnchalDocument4 pagesFSA ASSIGNMENT-3 AnchalAnchal ChokhaniNo ratings yet

- AccountsDocument15 pagesAccountsyogeshNo ratings yet

- M&M Standalone Profit & Loss and Balance Sheet AnalysisDocument9 pagesM&M Standalone Profit & Loss and Balance Sheet AnalysisAscharya DebasishNo ratings yet

- Trent Ltd. Balance Sheet and Profit & Loss AnalysisDocument6 pagesTrent Ltd. Balance Sheet and Profit & Loss AnalysisVandit BatlaNo ratings yet

- Institute Program Year Subject Project Name Company Competitor CompanyDocument37 pagesInstitute Program Year Subject Project Name Company Competitor CompanyEashaa SaraogiNo ratings yet

- Balance Sheet ACC LTDDocument5 pagesBalance Sheet ACC LTDVandita KhudiaNo ratings yet

- AccccDocument28 pagesAccccSumit WadhwaNo ratings yet

- Sree Lakshimi Organic Cotton Industry Balance Sheet Balance Sheet Particulars 2010-2011 2011-2012 2012-2013 2013-2014 2014-2015Document5 pagesSree Lakshimi Organic Cotton Industry Balance Sheet Balance Sheet Particulars 2010-2011 2011-2012 2012-2013 2013-2014 2014-2015ananthakumarNo ratings yet

- Ronak L & Yash FADocument9 pagesRonak L & Yash FAronakNo ratings yet

- Comparative Financial Analysis 2019 vs 2018Document16 pagesComparative Financial Analysis 2019 vs 2018Abimanyu ShenilNo ratings yet

- Accm507 Ca2 Nishtha ChhabraDocument12 pagesAccm507 Ca2 Nishtha ChhabraNishtha ChhabraNo ratings yet

- Asian Paints Balance Sheet and Profit & Loss Statement AnalysisDocument64 pagesAsian Paints Balance Sheet and Profit & Loss Statement Analysissanket patilNo ratings yet

- PG FS AnalysisDocument13 pagesPG FS AnalysisReina Nina CamanoNo ratings yet

- Comparative Analysis of DLF Ltd's FinancialsDocument6 pagesComparative Analysis of DLF Ltd's FinancialsAbimanyu ShenilNo ratings yet

- Balance Sheet (2009-2000) in US Format For Tata Motors: All Numbers Are in INR and in x10MDocument16 pagesBalance Sheet (2009-2000) in US Format For Tata Motors: All Numbers Are in INR and in x10MGirish RamachandraNo ratings yet

- ITC Annual Report Contents SummaryDocument10 pagesITC Annual Report Contents SummaryRohit singhNo ratings yet

- Comparative Balance SheetDocument14 pagesComparative Balance SheetsweetdipudeepmalaNo ratings yet

- Punjab National BankDocument7 pagesPunjab National BankSandeep PareekNo ratings yet

- DCF ValuationV!Document80 pagesDCF ValuationV!Sohini DeyNo ratings yet

- Bajaj Auto Financial StatementsDocument19 pagesBajaj Auto Financial StatementsSandeep Shirasangi 986No ratings yet

- Itc LTD: Balance Sheet FY17-18 FY16-17 FY15-16Document4 pagesItc LTD: Balance Sheet FY17-18 FY16-17 FY15-16gouri khanduallNo ratings yet

- Financials Projections and AssumptionsDocument4 pagesFinancials Projections and AssumptionsnishantNo ratings yet

- ITC Limited: Presented by - Manasi Behere P02 Shweta Manwadkar P30Document16 pagesITC Limited: Presented by - Manasi Behere P02 Shweta Manwadkar P30Shweta ManwadkarNo ratings yet

- 199.44 - 12.86462 Excluding Finance Cost 653.92 615.11Document2 pages199.44 - 12.86462 Excluding Finance Cost 653.92 615.11Nivedita YadavNo ratings yet

- Ten Years Performance at A GlanceDocument1 pageTen Years Performance at A GlancerahulNo ratings yet

- thu-BAV VNMDocument45 pagesthu-BAV VNMLan YenNo ratings yet

- All India Bank Employees' Association releases 66th DA slab hike detailsDocument2 pagesAll India Bank Employees' Association releases 66th DA slab hike detailsnellaimathivel4489No ratings yet

- Excel Bav Vinamilk C A 3 Chúng TaDocument47 pagesExcel Bav Vinamilk C A 3 Chúng TaThu ThuNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- HUL FinancialsDocument5 pagesHUL FinancialstheNo ratings yet

- Financial Performance 2019 vs 2018Document8 pagesFinancial Performance 2019 vs 2018Sruthi ChandrasekharanNo ratings yet

- Odyssey Corp CFO Report AnalysisDocument4 pagesOdyssey Corp CFO Report Analysisfelicia sunartaNo ratings yet

- Financial performance and ratios of manufacturing companyDocument6 pagesFinancial performance and ratios of manufacturing companyShubham RankaNo ratings yet

- Balance Sheet and Income Statement AnalysisDocument11 pagesBalance Sheet and Income Statement AnalysisLaksh SinghalNo ratings yet

- Accounts Case Study On Ratio AnalysisDocument6 pagesAccounts Case Study On Ratio AnalysisRADHIKA.J 19MCO033No ratings yet

- Gulf Oil Lubricant: Mar 21 Mar-20 (A) Opening Balance (B) ReceiptsDocument4 pagesGulf Oil Lubricant: Mar 21 Mar-20 (A) Opening Balance (B) ReceiptsKumar Risabh PriyeshNo ratings yet

- Last 5 Years Balance Sheet of Tata Steel Limited: Particulars Mar'19 Mar'18 Mar'17 Mar'16 Mar'15Document5 pagesLast 5 Years Balance Sheet of Tata Steel Limited: Particulars Mar'19 Mar'18 Mar'17 Mar'16 Mar'15Sai Jithin KalayanamNo ratings yet

- ITC LTDDocument27 pagesITC LTDSneha BhartiNo ratings yet

- Business Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BDocument7 pagesBusiness Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BShriyan GattaniNo ratings yet

- Part-2 Cash Flow Apex Footwear Limited Growth RateDocument11 pagesPart-2 Cash Flow Apex Footwear Limited Growth RateRizwanul Islam 1912111630No ratings yet

- All India Bank Employees' Association: Happy News AIBEA's Unit in Bank of BarodaDocument2 pagesAll India Bank Employees' Association: Happy News AIBEA's Unit in Bank of BarodaDevdutt MishraNo ratings yet

- Ratio Analysis TanyaDocument10 pagesRatio Analysis Tanyatanya chauhanNo ratings yet

- Analysis of 2005.08 HCL TechDocument10 pagesAnalysis of 2005.08 HCL TechsantoshviswaNo ratings yet

- Britannia Industries Vertical Income Statement AnalysisDocument4 pagesBritannia Industries Vertical Income Statement AnalysisMEENU MARY MATHEWS RCBSNo ratings yet

- Maruti Suzuki Balance SheetDocument6 pagesMaruti Suzuki Balance SheetMasoud AfzaliNo ratings yet

- Project Report On SimpleekareDocument62 pagesProject Report On SimpleekareBishwaranjan MishraNo ratings yet

- Project Report On SimpleekareDocument61 pagesProject Report On SimpleekareBishwaranjan MishraNo ratings yet

- IBCSDocument3 pagesIBCSBishwaranjan Mishra100% (1)

- The Indian Internet Banking JourneyDocument6 pagesThe Indian Internet Banking JourneyBishwaranjan MishraNo ratings yet