Professional Documents

Culture Documents

2012-09-01 Brun ROV AUVtrends MarineTechnologyReporter PDF

Uploaded by

mohitbabuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2012-09-01 Brun ROV AUVtrends MarineTechnologyReporter PDF

Uploaded by

mohitbabuCopyright:

Available Formats

ROV/AUV Trends

Market and Technology

By Lukas Brun

The Duke University Center on Globalization, Governance and minerals extraction, particularly in the Arctic.

and Competitiveness (CGGC) recently completed a study The three market dynamics in the ROV market of particular

on ocean technologies, including remotely operated vehicles note are 1) the growing market for mini and small ROVs driv-

(ROVs) and autonomous underwater vehicles (AUVs), for a en, primarily, by their reduced cost and increased functional-

consortium led by Nova Scotias Department of Economic ity; 2) the increasing number of sensors and robotics capable

and Rural Development and Tourism (ERDT). Excerpts from of being placed on vehicles; and 3) the reduction in cost of the

the report on the market and technology trends in ROVs and platform relative to the cost of the instruments. The relative

AUVs are provided in this article. cost of instruments and platform is important to note because

it indicates the maturation of the ROV technology. ROVs, al-

ROV market and technology trends though they remain highly sophisticated technology packages,

Global ROV vehicle sales in 2010 totaled approximately have become adopted widely enough to expect continued cost

$850 million. In 2010, oil and gas purchased approximately reductions, or performance enhancements at the same cost.

50% of ROVs, while ROV sales for defense & security and Four technology trends in ROVs can be identified. The ROV

scientific research equaled 25% for each sector. industry is keenly aware of the need to simplify the interface

Market drivers for ROVs are offshore drilling, the security between the ROV operator and the vehicle. Most ROVs in use

environment, and the need for ocean data. The prospect for have multiple screens for monitoring the ROV vehicle status

offshore drilling varies by location, yet offshore exploration (health), feeds from onboard cameras and video, robotic arm

in Brazil, Nigeria, Indonesia, and the Gulf of Mexico are ex- manipulation, and receiving feedback from data collection

pected to be strong. In the security market, ROVs are rou- instruments. The trend is to simplify the interface by having

tinely used for forward observation, reconnaissance, and mine information provided on one screen. The integration of mul-

counter-measures by the military. ROVs will increasingly be tiple systems requires the development of software. ROV and

adopted by organizations charged with ocean rescue and port instrument manufacturers are working to improve the integra-

security seeking effective tools for scanning and observation, tion of systems developed independently. This after-market

including hull inspection. The need for data on the oceans is integration between the platform and instrumentation is sub-

driven by the need for creating detailed maps for navigation optimal. In the future, functional integration will be incorpo-

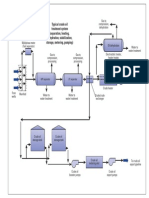

Remotely Operated Vehicles (ROVs) Autonomous Underwater Vehicles (AUVs)

Global Vehicle Sales (2010) ~ 850 million (US$) ~ 200 million (US$)

offshore oil need for ocean data and mapping

Demand Drivers security environment increased functionality of AUVs

need for ocean data offshore oil (reducing ROV costs)

market for mini and small ROVs increased comfort with autonomous

Market Dynamics increasing number of sensors and vehicles for monitoring and patrol

robotics on vehicles market for versatile products suit

reducing operational costs able for tough, physical environments

simplified user-interface increased functionality

Technology Trends high-definition (HD) camera & video longer mission life

reduced vehicle size reduced power requirements

tether-optional (hybrid) ROVs miniaturization

Source: Duke University Center on Globalization, Governance & Competitiveness (CGGC)

48 MTR September 2012

MTR #7 (34-49).indd 48 9/10/2012 10:01:06 AM

rated into the design of ROVs and on- compact buoyancy have also reduced

board systems. the weight and size requirements for

The availability of relatively inexpen- ROVs.

sive High Definition (HD) camera and Hybrid ROVs (HROVs) are an inter-

video has increased the demand for effi- esting trend in the ROV market. Hybrid

cient data transmission from the ROV to ROVs have tether-optional configura-

the operator station. High definition al- tions in which the vehicle can conduct

lows better inspection of the underwater programmed missions free from the

site due to improved quality of the im- tether. The benefit of hybrid systems is

age, better control of the vehicle, and al- increased maneuverability in locations

lows for easy switching between video where tethers would entangle or limit

formats found in different parts of the the ability to navigate around obstacles.

world. The consequence is that the cop- Woods Holes Nerus and Saabs Sea-

per video transmission system used in eye are examples of workclass HROVs.

most tethers must be replaced with fiber A number of manufacturers, including

optic cable to accommodate the greater Seabotix, are making mini and small

bandwidth required to transmit HD sig- production HROV models. Canadas

nals. Advances in fiber optic technology ISE has experimented with HROVs as a

allow ROVs to communicate with the way to reduce monitoring costs. Accord-

surface using millimeter-thin cables, al- ing to interviews conducted by CGGC,

lowing smaller diameters in the tether HROV configurations are expected to

and reduced drag. be an option increasingly offered by

The size of the average ROV is decreas- ROV manufacturers, particularly in the

ing due to technological developments mini and small ROV markets.

in instrumentation. Smaller ROVs are

preferred to large ROVs, keeping ev- AUV market and technology trends

erything else constant, because of better The AUV market is smaller than the

maneuverability and lower deployment ROV market. According to industry

costs. Small ROVs deployed by one or interviews conducted by CGGC, the

two-man crews are less expensive to op- global annual expenditure on AUVs

erate than vehicles deployed with large is roughly $200 million, dominated

landing and recovery systems (LARS) by U.S. manufacturers. Currently, the

requiring several operators. Mainte- military/security market makes up ap-

nance costs are also significant drivers proximately 50% of AUV sales. The

for reducing the size of ROVs, particu- scientific research market makes up ap-

larly in the scientific research market. proximately 30% of the AUV market.

In the past, large vehicles were needed The oil and gas market makes up ap-

to house the instruments needed to ac- proximately 20% of AUV sales.

complish the dive mission; however, as The market is expected to grow to $2.3

a result of the reduced size of onboard billion by 2019 (Westwood, 2010). Inter-

instruments, cameras and robotic arms views with leading AUV manufacturers

(often with improved performance) the consider the 30% compounded annual

size of the required vehicle has been growth rate implied by this forecast to be

reduced. The exception to this trend is optimistic. However, the growth poten-

in missions requiring the completion of tial of AUVs is clearly large. Military and

heavy intervention tasks, as in offshore scientific research markets are expected

construction, or in missions where pay- to make up more than 75% of projected

load capacity is critical. Another driver sales through 2019 (Westwood, 2010).

of reduced weight is the result of tech- AUVs increasingly will be used in the

nology improvements allowing greater oil and gas market, primarily due to

propulsion power through a given di- the cost of using ROVs. The increased

ameter of wire. This has allowed for re- functionality in AUVs and the demand

duced weight in the entire ROV deploy- for floating oil production systems and

ment system, including lighter landing remote fields also are drivers for adopt-

and recovery systems. Improvements in ing AUVs.

www.seadiscovery.com

MTR #7 (34-49).indd 49 9/10/2012 10:01:48 AM

The majority (~70%) of AUVs sold are rated

for water depths less than 200m, illustrating

the importance of small, light, shallow wa-

ter AUVs for various end-markets. Of these

shallow water AUVs, roughly 30% are rated

for depths less than 30m. Unit sales forecasts

through 2019 estimate that the majority of

sales will occur in small AUV sales. However,

large AUVs will dominate the projected $2.3

billion sales because of their high unit costs.

AUVs are still a relatively new ocean tech-

nology. The first recorded sale of an AUV oc-

curred in 1985; 75% of existing AUVs were

produced between 2001 and 2005. As newer

technologies, the platform costs are greater

than the instruments onboard. In contrast to

ROVs, the AUV vehicle makes up the major-

ity of the total cost of the vehicle. AUV plat-

forms make-up, on average,66-75% of the

cost (in comparison to 40% for ROVs), while

instruments make-up 25-33% of AUVs. This

of course depends on what instruments are

included in the AUV. Some instruments (e.g.,

spectrometers, dissolved gas and nutrient sen-

sors) are relatively expensive, while others

(e.g., altimeters and pressure gauges) are inex-

pensive. The platforms share of the total AUV

cost is expected to decrease as incremental in-

novations in the vehicle are implemented.

The technology trends in AUVs are increased

functionality, longer mission life, reduced

power requirements, and miniaturization.

The trend in AUV technology is to increase

their versatility from what essentially is an

oceanographic data collection system to per-

form a greater variety of missions. AUVs are

capable of mission lives up to a year, although

this varies on the type of vehicle and amount

of instrumentation onboard. Generally speak-

ing, the greater the number of instruments

onboard an AUV, the shorter its mission-life.

AUV surveys in deep water (>3000 meters)

are conducted two to three times faster than

in towed systems because AUVs have higher

cruising speeds, do not require repeated turns

and passes over the same locations, and pro-

vide higher data quality because of the stabil-

ity of the survey platform.

AUVs are currently being developed in the

military market for locating and disabling

mines. The University of Hawaii and the U.S.

Navys SAUVIM (Semi-Autonomous Under-

water Vehicle for Intervention Missions) per-

formed the first autonomous manipulation us-

ing feature based navigation in January, 2011

September 2012

MTR #7 (50-64).indd 50 9/10/2012 10:16:13 AM

(MASE, 2011). Scripps Oceanographic Institute, the University

of Washington, and the U.S. Navy developed the XRay Flying

Wing prototype to track submarines and conduct remote sensing

in shallow waters for up to 6 months.

A second trend is to increase the mission life of AUVs. Cur-

rent AUVs can be deployed up to a year, after which batteries

must be replaced and the vehicle reconditioned. The limitation

on mission life is largely a power imposed constraint the

vehicle simply runs out of power to conduct its mission. Three

developments have sought to address this limitation of AUVs.

The first is the development of compact battery technology

capable of storing more electricity. The second development

is instrumentation and communication devices requiring less

power. The third development is onboard power generation,

either through the use of solar arrays kept above the ocean

surface, or for gliders, through wave and bio-mimicking tech-

nology to power the vehicle.

A third trend is to reduce the power requirements for AUVs.

Two power requirements exist for an AUV: forward propul-

sion and power for onboard instrumentation, guidance, com-

puters, and communication devices. Forward propulsion for

most AUVs is generated from power stored in onboard batter-

ies. This limits the mission life of AUVs since physical limita-

tions on the number and size of batteries carried onboard exist.

The weight of batteries is a key drawback since they reduce

the payload available for other instrumentation. Gliders have

overcome some of these difficulties by using changes in the

vehicles buoyancy and onboard wings to propel the vehicle

forward. Advances in mechanical design, particularly bio-

mechanical engineering, may reduce or eliminate the need for

stored onboard power in gliders in the near future. Researchers

at the California Institute of Technology (US), Southampton

(UK), Tokai University (Shizuoka, Japan), and the Delft Uni-

versity of Technology (Netherlands) have recently presented

papers on biomechanical applications to AUVs. Most produc-

tion glider models require stored power to bring the vehicle up

at the end of its dive cycles. Onboard electronics are currently

powered with onboard batteries or solar arrays. The use of so-

lar arrays limits the depth the vehicle can dive; however.

The fourth major trend is miniaturization of onboard instru-

ments and vehicles. The application of nanotechnology to ro-

botics and electronic equipment holds tremendous potential

to develop small, highly sophisticated underwater vehicles.

While the promise of nanotechnology continues to develop,

AUVs have continued along the same path as ROVs to become

smaller while simultaneously adding capabilities.

About the Author

Lukas Brun is a senior research analyst at the Duke Uni-

versity Center on Globalization, Governance & Competi-

tiveness (CGGC), and author of the ROV chapter in the

Nova Scotia Ocean Technology report from which excerpts

were taken for this article. The full report is available free

of charge at http://www.cggc.duke.edu/pdfs/2012-03-

05_Nova%20Scotia%20OTReport.pdf

www.seadiscovery.com

MTR #7 (50-64).indd 51 9/10/2012 10:16:35 AM

You might also like

- Small Unmanned Aircraft: Theory and PracticeFrom EverandSmall Unmanned Aircraft: Theory and PracticeRating: 4.5 out of 5 stars4.5/5 (2)

- Chen 2014Document6 pagesChen 2014bassam abutraabNo ratings yet

- OTC 24461 Advances in Autonomous Deepwater InspectionDocument9 pagesOTC 24461 Advances in Autonomous Deepwater InspectionThomas ThomasNo ratings yet

- Cargo Transportation Market - Innovations & Competitive Analysis - Forecast - Facts and TrendsDocument2 pagesCargo Transportation Market - Innovations & Competitive Analysis - Forecast - Facts and Trendssurendra choudharyNo ratings yet

- On The Reliability of The Autosub Autonomous UnderDocument27 pagesOn The Reliability of The Autosub Autonomous Underjaiprakash nainNo ratings yet

- Main UAV Assessment Report OverviewDocument7 pagesMain UAV Assessment Report OverviewGor VardanyanNo ratings yet

- DP Integration On Workboats RevADocument13 pagesDP Integration On Workboats RevANhậtBùiNo ratings yet

- VSAT2 - 33441 IJAERok15503 15512new2Document11 pagesVSAT2 - 33441 IJAERok15503 15512new2David SiegfriedNo ratings yet

- Autonomous Underwater VehicleDocument9 pagesAutonomous Underwater VehicleManas BajpaiNo ratings yet

- Sensors 20 05476 v2Document35 pagesSensors 20 05476 v2SHARONNo ratings yet

- Fender Segmentation in Unmanned Aerial Vehi 2022 International Journal of NaDocument9 pagesFender Segmentation in Unmanned Aerial Vehi 2022 International Journal of NaNguyen Phuc LinhNo ratings yet

- Robotics: Robotic Development For The Nuclear Environment: Challenges and StrategyDocument16 pagesRobotics: Robotic Development For The Nuclear Environment: Challenges and StrategyAchal NimjeNo ratings yet

- Development in Underwater Robotic Vehicles-URVDocument9 pagesDevelopment in Underwater Robotic Vehicles-URVSMI2012No ratings yet

- Recent Developments in Remote Inspections of Ship StructuresDocument11 pagesRecent Developments in Remote Inspections of Ship StructuresSakib RafeeNo ratings yet

- HAI Advanced Air Mobility ReportDocument36 pagesHAI Advanced Air Mobility ReportL Dev100% (1)

- Recent Development of Digital Oil FieldDocument23 pagesRecent Development of Digital Oil FieldMohit AgarwalNo ratings yet

- 4373-Article Text-20623-3-10-20210907Document21 pages4373-Article Text-20623-3-10-20210907DyneNo ratings yet

- Market Overview of The Vertical Take-Off and Landing VehiclesDocument5 pagesMarket Overview of The Vertical Take-Off and Landing VehiclesEko Agus WinarsoNo ratings yet

- Floating Offshore Wind Market Technology ReviewDocument168 pagesFloating Offshore Wind Market Technology ReviewjobinhoeljovenNo ratings yet

- Tsac PenDocument28 pagesTsac PenGOUAL SaraNo ratings yet

- The Future of Advanced Aerial MobilityDocument54 pagesThe Future of Advanced Aerial MobilityShambhu Dewasi100% (2)

- 111759main DoD UAV Roadmap 2003Document209 pages111759main DoD UAV Roadmap 2003sharath_87No ratings yet

- Cost Metrics For Unmanned Aerial Vehicles: September 2005Document7 pagesCost Metrics For Unmanned Aerial Vehicles: September 2005Elias Jose Akle VillarealNo ratings yet

- Transportation Research Part D: Irina Panasiuk, Liudmila TurkinaDocument10 pagesTransportation Research Part D: Irina Panasiuk, Liudmila TurkinaJimmy IoannidisNo ratings yet

- FlatFish - A Compact Subsea-Resident Inspection AUVDocument9 pagesFlatFish - A Compact Subsea-Resident Inspection AUVAlberto RuizNo ratings yet

- A Review of Robotics in Onshore Oil-Gas Industry PDFDocument8 pagesA Review of Robotics in Onshore Oil-Gas Industry PDFAmit ShuklaNo ratings yet

- Keir Gravil: Autonomous Vessels - The Challenges and Opportunities in DesignDocument3 pagesKeir Gravil: Autonomous Vessels - The Challenges and Opportunities in DesignSat PartnerNo ratings yet

- Development of An Artificial Vision System For Underwater VehiclesDocument3 pagesDevelopment of An Artificial Vision System For Underwater Vehicleslox agencyNo ratings yet

- SSRN Id2178084Document11 pagesSSRN Id2178084Binit KumarNo ratings yet

- OTC-25134 Final - WatermarkDocument15 pagesOTC-25134 Final - WatermarkgenmikNo ratings yet

- Onair Issue 33Document4 pagesOnair Issue 33german682001No ratings yet

- Final Report of Robotic WeldingDocument8 pagesFinal Report of Robotic Weldingveereshkoutal100% (1)

- Detailed Survey of NGCDocument64 pagesDetailed Survey of NGCParkash SinghNo ratings yet

- Sensors: Design and Construction of An ROV For Underwater ExplorationDocument25 pagesSensors: Design and Construction of An ROV For Underwater ExplorationparthNo ratings yet

- Remotely Operated Vehicles Market ReportDocument23 pagesRemotely Operated Vehicles Market Reportlaleye_olumideNo ratings yet

- Underwater Rov ThesisDocument4 pagesUnderwater Rov Thesisafcmayfzq100% (1)

- Asset Management in A Low Price OilDocument17 pagesAsset Management in A Low Price OilArrif ImranNo ratings yet

- A Systems Engineering Approach To Unmanned AerialDocument23 pagesA Systems Engineering Approach To Unmanned AerialAriefa YusabihNo ratings yet

- Ao PPT Presentation Lecture 6 Fall 2021 Dated 09 Nov 2021Document44 pagesAo PPT Presentation Lecture 6 Fall 2021 Dated 09 Nov 2021Sameer Ul HaqNo ratings yet

- Robotics and Drones Use CasesDocument5 pagesRobotics and Drones Use CasespppooNo ratings yet

- Unmanned Aerial Vehicles: Emerging Policy and Regulatory Issues, George ChoDocument38 pagesUnmanned Aerial Vehicles: Emerging Policy and Regulatory Issues, George ChoJournal of Law, Information & ScienceNo ratings yet

- Emerging Capabilities For Autonomous Inspection Repair and MaintenanceDocument4 pagesEmerging Capabilities For Autonomous Inspection Repair and MaintenanceRachid RifaiNo ratings yet

- Microciencia y Su Relación Con Los DronesDocument7 pagesMicrociencia y Su Relación Con Los DronesJuan camilo Vargas perdonoNo ratings yet

- Thibbotuwawa - Problemas de Ruta de Vehículos Aéreos No Tripulados Una Revisión de La LiteraturaDocument20 pagesThibbotuwawa - Problemas de Ruta de Vehículos Aéreos No Tripulados Una Revisión de La LiteraturajuanjoNo ratings yet

- Sensors, Weapons and Systems For A 21st Century Counter-Air CampaignDocument0 pagesSensors, Weapons and Systems For A 21st Century Counter-Air CampaignHugo SanchezNo ratings yet

- The Future of Hydrographic Surveying - Balancing Automation and Human Expertise - Hydro InternationalDocument14 pagesThe Future of Hydrographic Surveying - Balancing Automation and Human Expertise - Hydro InternationalMuhamad AlfaniNo ratings yet

- Unmanned Aerial Vehicles Roadmap (2000-2025)Document130 pagesUnmanned Aerial Vehicles Roadmap (2000-2025)Neto Custodio0% (1)

- Cover Sheet: This Is The Author Version of Article Published AsDocument16 pagesCover Sheet: This Is The Author Version of Article Published AsVũ Huy MừngNo ratings yet

- Bristol MAV Ornithopter PaperDocument0 pagesBristol MAV Ornithopter PaperNurfarina HusseinNo ratings yet

- UAV1Document17 pagesUAV1TamerZakiFouadNo ratings yet

- Design and Development of The Hardware For Vision Based UAV AutopilotDocument6 pagesDesign and Development of The Hardware For Vision Based UAV AutopilotJoshua DanielNo ratings yet

- Impact of Flight Regulations On Effective Use of Unmanned Aircraft Systems For Natural Resources ApplicationsDocument13 pagesImpact of Flight Regulations On Effective Use of Unmanned Aircraft Systems For Natural Resources Applicationssanane_ulanNo ratings yet

- Morphing Wing Flaps For Large Civil AircraftDocument16 pagesMorphing Wing Flaps For Large Civil Aircraftshixian guoNo ratings yet

- Classification & Certification of OSVs at IDEC 2014 - May 2014Document34 pagesClassification & Certification of OSVs at IDEC 2014 - May 2014Ionut ArdeleanuNo ratings yet

- Managing The Evolving SkiesDocument16 pagesManaging The Evolving SkiesYasin KarabulakNo ratings yet

- Unmanned Aerial Vehicles in Agriculture A Review of Perspective of Platform, Control, and ApplicationsDocument16 pagesUnmanned Aerial Vehicles in Agriculture A Review of Perspective of Platform, Control, and Applicationsjulio A. Zorro PerezNo ratings yet

- Teamnet International About SWARMs ProjectsDocument14 pagesTeamnet International About SWARMs ProjectsTeamnet RomaniaNo ratings yet

- Yu 2019Document6 pagesYu 2019bassam abutraabNo ratings yet

- U Dai Fts T Unmanned Aircraft Systems January 9, 2009: Unmanned Warfare Ousd (At&L)Document32 pagesU Dai Fts T Unmanned Aircraft Systems January 9, 2009: Unmanned Warfare Ousd (At&L)wangxiaoming_0No ratings yet

- Position Description: (Financial, Operational, Etc)Document4 pagesPosition Description: (Financial, Operational, Etc)laleye_olumideNo ratings yet

- Offshore & Structural Plate SizeDocument4 pagesOffshore & Structural Plate Sizelaleye_olumideNo ratings yet

- AD2000 (31barg) CalculationDocument10 pagesAD2000 (31barg) CalculationMagdaline Matabang100% (1)

- RFQ Cs Fiittings2Document21 pagesRFQ Cs Fiittings2laleye_olumideNo ratings yet

- Pressure Vessel PresentationDocument18 pagesPressure Vessel Presentationlaleye_olumide0% (1)

- Separator Fundamentals - Process DesignDocument30 pagesSeparator Fundamentals - Process Designlaleye_olumide100% (3)

- SSETP 02 00 Agenda 5th EdDocument1 pageSSETP 02 00 Agenda 5th Edlaleye_olumideNo ratings yet

- Epf Crude Oil TreatmentDocument1 pageEpf Crude Oil Treatmentafroznishat100% (2)

- ThessaloniansDocument89 pagesThessalonianslaleye_olumideNo ratings yet

- Authorization Form For ApplicationsDocument1 pageAuthorization Form For Applicationslaleye_olumideNo ratings yet

- PV Elite 2008Document3 pagesPV Elite 2008laleye_olumideNo ratings yet

- Eni in NigeriaDocument4 pagesEni in Nigerialaleye_olumideNo ratings yet

- Remember To Leave Enough Time To Walk To Your Stop and To Your DestinationDocument2 pagesRemember To Leave Enough Time To Walk To Your Stop and To Your Destinationlaleye_olumideNo ratings yet

- Remotely Operated Vehicles Market ReportDocument23 pagesRemotely Operated Vehicles Market Reportlaleye_olumideNo ratings yet

- Hydrostatic Test ProcedureDocument7 pagesHydrostatic Test Procedurelaleye_olumideNo ratings yet

- Amount/Sq Metre (Dollars) @142naira Per UsdollarDocument6 pagesAmount/Sq Metre (Dollars) @142naira Per Usdollarlaleye_olumideNo ratings yet

- Total Cost Total Space Cost/sq MT Annual Cost/sq MTR $/SQ MTR Rent 395,799,446.00 4,099.00 96,560.00 24,140.00 178.81 Service ChargesDocument1 pageTotal Cost Total Space Cost/sq MT Annual Cost/sq MTR $/SQ MTR Rent 395,799,446.00 4,099.00 96,560.00 24,140.00 178.81 Service Chargeslaleye_olumideNo ratings yet

- Separator Design GuideDocument36 pagesSeparator Design Guidelaleye_olumide100% (16)