Professional Documents

Culture Documents

Chapter 12 - Inclass Exercises

Chapter 12 - Inclass Exercises

Uploaded by

Summer0 ratings0% found this document useful (0 votes)

10 views6 pagesChapter 12 - Inclass Exercises

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentChapter 12 - Inclass Exercises

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views6 pagesChapter 12 - Inclass Exercises

Chapter 12 - Inclass Exercises

Uploaded by

SummerChapter 12 - Inclass Exercises

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

You are on page 1of 6

EXERCISE 12-1 Identifying Relevant Costs [LO12~1]

A number of costs are listed below that may be relevant in decisions faced

by the management of Svahn, AB, a Swedish manufacturer of sailing

yachts

Disposal vakie—Model B100 machin

Market vaiue—Model 8300 machine (cost) .

Fixed manufacturing overhead (general)... ..

Variable selling expense ..-.....60e0csee

Fixed selling expense ..... _

General administrative overhead .

crrrvessap re

Required:

Copy the information above onto your answer sheet and place an X in the

appropriate column to indicate whether each item is relevant or not relevant

in the following situations. Requirement 1 relates to Case 1 above, and

requitement 2 relates to Case 2.

1. The company chronically has no idle capacity and the old Model B100

machine is the company's constraint. Management is considering

purchasing a Model B300 machine to use in addition to the company’s

present Model B100 machine. The old Model B100 machine will

continue fo be used to capacity as before, with the new Model B300

machine being used to expand production. This will increase the

company's production and sales. The increase in volume will be large

enough to require increases in fixed selling expenses and in general

administrative overhead, but not in the fixed manufacturing overhead.

2. The old Model B100 machine is not the company's constraint, but

management is considering replacing it with a new Model B300

machine because of the potential savings in direct materials with the

new machine. The Model B100 machine would be sold. This change

will have no effect on production or sales, other than some savings in

direct materials costs due to less waste.

EXERCISE 12-2 Dropping or Rot:

Wl Guided Example 12-2

19 @ Segmont [LO12_2]

The Regal Cycle Company manufactures three types of bicycles—a dirt

bike, a mountain bike, and a racing bike. Data on sales and expenses for

the past quarter fellow:

Total

Sales... $00,000

Variable manufacturing

and seling expenses 120,000

CContibution margin 480,000

Fined experses:

Advertsing, traceable ......... 30,000

Depreciation of epecial

equioment . ..... 23,000

Salaries of product-line

managers... 35,000

Allocated common fixed

expenses". 60,000

“Total fixed expenses 7 148,000

Net operating income (loss) - $32,000,

*Allocated on the basis of sales dolar.

Management is concerned about the continued losses shown by the racing

bikes and wants a recommendation as to whether or not the ine should be

discontinued. The special equipment used to produce racing bikes has no

resale value and does not wear out

Required:

Dit

Bikes

$20,000

27,000

63,000

10,000

6,000

12,000

46,000

46,000

$17,000

Meuntain

Fikes

$180,000

60,000

80,000

14,000

9,000

73,000

20,000

66,000

$ 24,000

1. Should production and sale of the racing bikes be discontinued?

Explain. Showy computations to support your answer.

2. Recast the above data ina format that would be more usable to

management in assessing the long-run profitabilty of the various

productlines.

Racing

Bikes

$60,000

27,000

6000

8000

10.000

EXERCISE 12-3 Make or Buy a Component [012-3]

WM Guided Example 12.3

Troy Engines, Ltd, manufactures a variety of engines for use in heavy

equipment. The company has always produced all of the necessary parts

forts engines, including all of the carburetors, An outside supplier has

offered to sell one type of carburetor 1o Troy Engines, Ltd. for a cost of $35

per unit. To evaluate this offer, Troy Engines, Ltd., has gathered the

following information relating to its own cost of producing the carburetor

intemally:

Per 15,000 Unts

Unit per Year

Drect materials $210,000,

Drect labor 150,000

Variable manufacturing overhead 3 45,000

Fixed manufacturing overhead, traceable . 6 0,000

Fixed manufacturing overhead, allocated. 8 135,000

Total cost . $680,000,

“One-third supervisory salaries; two-thirds depraciation of special equipment

(ro resale value).

Required:

4. Assuming that the company has no alternative use for the facilities that

are now being used to produce the carburetors, should the outside

suppliers offer be accepted? Show all computations.

2. Suppose that if the carburetors were purchased, Troy Engines, Ltd,

could use the freed capacity to launch a new product. The segment

‘margin of the new product would be $150,000 per year. Should Troy

Engines, Ltd. accept the offer to buy the carburetors for $35 per unit?

Show all computations

EXERCISE 12-4 Evaluating a Spocial Ordor [L012],

Wl Guided Example 12-4

Imperial Jewelers is considering a special order for 20 handcrafted gold

bracolats to be given as gifs to members of a wedding party. Tho normal

selling price of a gold bracelet is $189.95 and its unit product cost is,

$149.00 as shown below:

Direct materials . $ 84.00

Direct labor sine 45.00

Manufacturing overhead . 20.00

Unit product cost .......

Most of the manufacturing overhead is fixed and unaffected by variations in

how much jewelry is produced in any civen period, However, $4.00 of the

overhead is variable with respect to the number of bracelets produced The

customer who is interested in the special bracelet order would like special

‘ligree applied to the bracelets. This filgree would require additional

materials costing $2.00 per bracelet and would also require acquisition of a

special tool costing $250 that would have no other use once the special

order is completed. This order would have no effect on the company's

regular sales and the order could be fufiled using the company’s existing

capacity without affecting any other order.

Required:

What effect would accepting this order have on the company’s net

operating income if a special price of $169.95 per braceletis offered for this,

‘order? Should the special order be accepted at this prica?

EXERCISE 12-7 Sell or Process Further [1012-7]

cai

Dorsey Company manufactures three products from a common input in a

joint processing operation. Joint processing costs up to the split-off point

total $350,000 per quarter. The company allocates these costs to the joint

products on the basis of their relative sales value at the spit-off point. Unit

selling prices and total output at the spit-off point are as follows:

sd Example 12-7

Quarterly.

Product Seling Price Output

$16 per pound 18,000 pounds

$8 perpound 20,000 pounds

$25 per gallon 4,000 gallons

oo>

Each product can be processed further after the splitoff point. Additional

processing requires no special facilties. The additional processing costs

(per quarter) and unit selling prices after further processing are given

below

‘Additionel Salling

Product Processing Costs Price

ee $63,000 $20 per pound

B $80,000 $13 per pound

c $36,000 {$32 per gallon

d

Required:

Which product or products should be cold at the split off point and which

product or products should be processed further? Show computations.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- State of The Industry Report EbookDocument34 pagesState of The Industry Report EbookSunil K.BNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ACCT 311 - Exam 2 Review and SolutionsDocument6 pagesACCT 311 - Exam 2 Review and SolutionsSummerNo ratings yet

- ACCT 311 - Exam 1 Review With SolutionsDocument6 pagesACCT 311 - Exam 1 Review With SolutionsSummerNo ratings yet

- OSIM ProductsDocument2 pagesOSIM Productsgbiyer12340% (1)

- Industry Overview - Davis IndustriesDocument7 pagesIndustry Overview - Davis IndustriesPranjalNaugariyaNo ratings yet

- ACCT 311 - Chapter 5 Notes - Part 1Document4 pagesACCT 311 - Chapter 5 Notes - Part 1SummerNo ratings yet

- ACCT 311 - Chapter 5 Notes - Part 2Document2 pagesACCT 311 - Chapter 5 Notes - Part 2SummerNo ratings yet

- Chapter 9 - Flexible Budgets and Performance AnalysisDocument3 pagesChapter 9 - Flexible Budgets and Performance AnalysisSummerNo ratings yet

- ACCT 311 - Chapter 6 NotesDocument4 pagesACCT 311 - Chapter 6 NotesSummerNo ratings yet

- ACCT 311 - Chapter 13 NotesDocument4 pagesACCT 311 - Chapter 13 NotesSummerNo ratings yet

- ACCT 311 - Exam 3 Review With SolutionsDocument7 pagesACCT 311 - Exam 3 Review With SolutionsSummerNo ratings yet

- Chapter 8 - Inclass ExercisesDocument8 pagesChapter 8 - Inclass ExercisesSummerNo ratings yet

- Chapter 13 Solutions - Inclass ExercisesDocument8 pagesChapter 13 Solutions - Inclass ExercisesSummerNo ratings yet

- Chapter 8 Solutions - Inclass ExercisesDocument8 pagesChapter 8 Solutions - Inclass ExercisesSummerNo ratings yet

- Chapter 1 NotesDocument3 pagesChapter 1 NotesSummerNo ratings yet

- Chapter 9 - Inclass ExercisesDocument5 pagesChapter 9 - Inclass ExercisesSummerNo ratings yet

- Chapter 10 Solutions - Inclass ExercisesDocument12 pagesChapter 10 Solutions - Inclass ExercisesSummerNo ratings yet

- 610 Exam 2 Spring 11 PracticeDocument8 pages610 Exam 2 Spring 11 PracticeSummerNo ratings yet

- 610 Midterm 3 A PracticeDocument12 pages610 Midterm 3 A PracticeSummerNo ratings yet

- Borang Ambulans CallDocument2 pagesBorang Ambulans Callleo89azman100% (1)

- Pas 9 2021-2022Document3 pagesPas 9 2021-2022Hilda HeldiyawatiNo ratings yet

- CritiCash LeafletDocument4 pagesCritiCash Leafletbalaji deshmukhNo ratings yet

- Yoga Myths and Facts - Fact CheckDocument14 pagesYoga Myths and Facts - Fact ChecklifelivabilityNo ratings yet

- Technical ReportDocument27 pagesTechnical ReportAgbama Christopher ErunsunraNo ratings yet

- Algoritma Neck PainDocument12 pagesAlgoritma Neck PainAri SudarsonoNo ratings yet

- Home Inspection Report TemplatesDocument3 pagesHome Inspection Report TemplatesMaurice EsoyNo ratings yet

- INBDE Test Specifications, by Clinical Component Section: Diagnosis and Treatment Planning Practice and ProfessionDocument3 pagesINBDE Test Specifications, by Clinical Component Section: Diagnosis and Treatment Planning Practice and ProfessionHanin AbukhiaraNo ratings yet

- Trifolio en Ingles Vida SaludableDocument2 pagesTrifolio en Ingles Vida SaludableSeminaristas 10 DNo ratings yet

- Test 2018 Questions and AnswersDocument23 pagesTest 2018 Questions and AnswersEun SaekNo ratings yet

- Endocrine Disorders Assessment Methods 2Document27 pagesEndocrine Disorders Assessment Methods 2May Chelle ErazoNo ratings yet

- ISICPMDocument1 pageISICPMAmit YadavNo ratings yet

- Seminar NTEP DR ParmeetDocument43 pagesSeminar NTEP DR ParmeetAdhya DubeyNo ratings yet

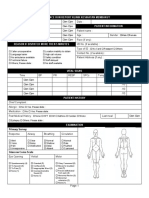

- Massage Intake Form Template 12Document2 pagesMassage Intake Form Template 12Hazel Roda EstorqueNo ratings yet

- Research ProposalDocument23 pagesResearch ProposalLeafriser Keigh Muron RamosNo ratings yet

- Blushing in Black Skin: F I D Konotey-AhuluDocument2 pagesBlushing in Black Skin: F I D Konotey-AhuluEllaNo ratings yet

- QUALISDocument31 pagesQUALISjopepinho5796No ratings yet

- UntitledDocument24 pagesUntitledRicardo silvestreNo ratings yet

- ArwilDocument14 pagesArwilJoshua Paul P. DauloNo ratings yet

- 9 G Mcgrath Anaesthetic Interview 2021 GM Final-2Document43 pages9 G Mcgrath Anaesthetic Interview 2021 GM Final-2susNo ratings yet

- Part - 1 Performance AppraisalDocument10 pagesPart - 1 Performance Appraisalpriya srmNo ratings yet

- RRL ResearchDocument3 pagesRRL ResearchJess Marie D. GodinNo ratings yet

- Uks2 Writing Persuasive Leaflet Knowledge Organiser - Ver - 2Document2 pagesUks2 Writing Persuasive Leaflet Knowledge Organiser - Ver - 2Ritah NantezaNo ratings yet

- Conflict and NegotiationDocument20 pagesConflict and NegotiationKunal ChaudhryNo ratings yet

- Normal Vo2 MaxDocument3 pagesNormal Vo2 Maxdr.chetan2385No ratings yet

- 2020.08 UN CRSV HandbookDocument170 pages2020.08 UN CRSV HandbookVolodymyr DOBROVOLSKYINo ratings yet

- Chua Resume EditedsszDocument3 pagesChua Resume Editedsszshyla chuaNo ratings yet