Professional Documents

Culture Documents

Source: Annual Report of Grasim (In Rs. Crores)

Uploaded by

oasis kumar0 ratings0% found this document useful (0 votes)

10 views1 pageratios of financial nature

Original Title

Ratios

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentratios of financial nature

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageSource: Annual Report of Grasim (In Rs. Crores)

Uploaded by

oasis kumarratios of financial nature

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

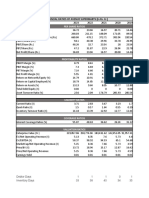

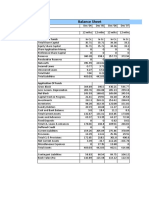

2014-15 2015-16

Net Income (PAT) 529.9 953.27

Revenue from Operations 6680.65 9261.37

Operating Income 1013.04 1860.47

Debt (LT+ST borrowings) 930.74 1615.18

Equity 11182.92 12370.51

Assets 14365.21 16982.58

EBIT 750.49 1413.33

Interest Expense 667.39 751.34

Current Assets 3715.12 4194.04

Current Liabilties 1622.63 2922.21

Inventory 1433.15 1609.41

Accounts Receivable 687.49 992.37

Accounts Payable 484.4 593.22

COGS 3622.33 4289.67

Price of Share (MPS) 933.13 as of 2/7/2016 1243.8 as of 2/7/2017

Dividend per share 18 22.5

EPS 57.69 102.13

Liquidity Ratios

Current Ratio 2.29 1.44

Quick Ratio 1.41 0.88

Efficiency Ratios

Receivables Turnover 9.72 9.33

Asset Turnover 0.47 0.55

Inventory Turnover 2.53 2.67

Profitability Ratios

Operating Profit Margin 15.16% 20.09%

Net Profit Margin 7.93% 10.29%

Solvency Ratios

EBIT/Interest 1.12 1.88

Debt/Assets 6.48% 9.51%

Debt/Equity 8.32% 13.06%

Market test Ratios

P/E Ratio 16.17 12.18

Dividend Payout 31.20% 22.03%

Dividend Yield 1.93% 1.81%

Source: Annual Report of Grasim (in Rs. crores)

You might also like

- Financial Modelling ExcelDocument6 pagesFinancial Modelling ExcelAanchal MahajanNo ratings yet

- Shinansh TiwariDocument11 pagesShinansh TiwariAnuj VermaNo ratings yet

- Annual Accounts 2021Document11 pagesAnnual Accounts 2021Shehzad QureshiNo ratings yet

- Profit and Loss Account of Akzo NobelDocument15 pagesProfit and Loss Account of Akzo NobelKaizad DadrewallaNo ratings yet

- Ashok Leyland Limited: RatiosDocument6 pagesAshok Leyland Limited: RatiosAbhishek BhattacharjeeNo ratings yet

- Financial HighlightsDocument4 pagesFinancial HighlightsmomNo ratings yet

- Particulars 2018-19 2017-18 Liquidity AnalysisDocument10 pagesParticulars 2018-19 2017-18 Liquidity AnalysisIvy MajiNo ratings yet

- Merged Income Statement and Balance Sheet of Pacific Grove Spice CompanyDocument9 pagesMerged Income Statement and Balance Sheet of Pacific Grove Spice CompanyArnab SarkarNo ratings yet

- Caterpillar IndicadoresDocument24 pagesCaterpillar IndicadoresChris Fernandes De Matos BarbosaNo ratings yet

- Financial Statements - TATA - MotorsDocument5 pagesFinancial Statements - TATA - MotorsKAVYA GOYAL PGP 2021-23 BatchNo ratings yet

- United Breweries Holdings LimitedDocument7 pagesUnited Breweries Holdings Limitedsalini sasiNo ratings yet

- Aditya nuVODocument12 pagesAditya nuVOPriyanshi yadavNo ratings yet

- Relaxo Footwear - Updated BSDocument54 pagesRelaxo Footwear - Updated BSRonakk MoondraNo ratings yet

- Balance Sheet (In Crores) - MSN LABORATARIESDocument3 pagesBalance Sheet (In Crores) - MSN LABORATARIESnawazNo ratings yet

- Particulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018Document6 pagesParticulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018MOHIT MARHATTANo ratings yet

- Hero MotoCorp LTDDocument10 pagesHero MotoCorp LTDpranav sarawagiNo ratings yet

- AnalysisDocument2 pagesAnalysisAzhari FauzanNo ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinDocument16 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Financial Statements - TATA - MotorsDocument6 pagesFinancial Statements - TATA - MotorsSANDHALI JOSHI PGP 2021-23 BatchNo ratings yet

- Financial AccountingDocument21 pagesFinancial AccountingMariam KupravaNo ratings yet

- Apollo TyresDocument4 pagesApollo TyresGokulKumarNo ratings yet

- Company 1 Yr1 Yr2 EPS 10 11 Price 100 110Document38 pagesCompany 1 Yr1 Yr2 EPS 10 11 Price 100 110Bhaskar RawatNo ratings yet

- Ajanta Pharma LTD.: LiquidityDocument4 pagesAjanta Pharma LTD.: LiquidityDeepak DashNo ratings yet

- Key Ratio Analysis: Profitability RatiosDocument27 pagesKey Ratio Analysis: Profitability RatioskritikaNo ratings yet

- Atlas Copco (India) LTD Balance Sheet: Sources of FundsDocument19 pagesAtlas Copco (India) LTD Balance Sheet: Sources of FundsnehaNo ratings yet

- Analysis of Working CapitalDocument7 pagesAnalysis of Working CapitalAzfar KawosaNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word Documentনীল আকাশNo ratings yet

- AMULDocument22 pagesAMULsurprise MFNo ratings yet

- Tvs Motor 2019 2018 2017 2016 2015Document108 pagesTvs Motor 2019 2018 2017 2016 2015Rima ParekhNo ratings yet

- Excel Workings ITE ValuationDocument19 pagesExcel Workings ITE Valuationalka murarka100% (1)

- Stock Cues: Amara Raja Batteries Ltd. Company Report Card-StandaloneDocument3 pagesStock Cues: Amara Raja Batteries Ltd. Company Report Card-StandalonekukkujiNo ratings yet

- MaricoDocument13 pagesMaricoRitesh KhobragadeNo ratings yet

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNo ratings yet

- CCS G4Document14 pagesCCS G4Harshit AroraNo ratings yet

- Revised - Ratio Analysis Based On Colgate Palmolive India LTDDocument7 pagesRevised - Ratio Analysis Based On Colgate Palmolive India LTDRaaj Nishanth SNo ratings yet

- Balance Sheet: Sources of FundsDocument7 pagesBalance Sheet: Sources of FundsAvanti GampaNo ratings yet

- Financial HighlightsDocument3 pagesFinancial HighlightsSalman SaeedNo ratings yet

- Ratio Analysis: Balance Sheet of HPCLDocument8 pagesRatio Analysis: Balance Sheet of HPCLrajat_singlaNo ratings yet

- Britannia Analysis 2018-19Document32 pagesBritannia Analysis 2018-19Hilal MohammedNo ratings yet

- BF1 Package Ratios ForecastingDocument16 pagesBF1 Package Ratios ForecastingBilal Javed JafraniNo ratings yet

- UltraTech Financial Statement - Ratio AnalysisDocument11 pagesUltraTech Financial Statement - Ratio AnalysisYen HoangNo ratings yet

- Bemd RatiosDocument12 pagesBemd RatiosPRADEEP CHAVANNo ratings yet

- 32 - Akshita - Sun Pharmaceuticals Industries.Document36 pages32 - Akshita - Sun Pharmaceuticals Industries.rajat_singlaNo ratings yet

- Book 1Document18 pagesBook 1Ankit PichholiyaNo ratings yet

- Hero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17Document25 pagesHero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17pranav sarawagiNo ratings yet

- India Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008Document6 pagesIndia Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008amitkr91No ratings yet

- Key Financial Ratios of NTPC: - in Rs. Cr.Document3 pagesKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalNo ratings yet

- FMUE Group Assignment - Group 4 - Section B2CDDocument42 pagesFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- Ratio CalculationDocument6 pagesRatio CalculationNuwani ManasingheNo ratings yet

- Business Finance PeTa Shell Vs Petron FinalDocument5 pagesBusiness Finance PeTa Shell Vs Petron FinalFRANCIS IMMANUEL TAYAGNo ratings yet

- Peer GRP Compsn BankingDocument2 pagesPeer GRP Compsn Bankinganupnayak123No ratings yet

- Ratio Analysis: Liquidity RatiosDocument2 pagesRatio Analysis: Liquidity RatiosSuryakantNo ratings yet

- FM WK 5 PmuDocument30 pagesFM WK 5 Pmupranjal92pandeyNo ratings yet

- Quiz 8 WorkingsDocument11 pagesQuiz 8 WorkingsGokul KulNo ratings yet

- Horizontal Vertical Ratio Analysis Problem Soln 16.04.2013Document15 pagesHorizontal Vertical Ratio Analysis Problem Soln 16.04.2013Ojas MaheshwaryNo ratings yet