0% found this document useful (0 votes)

574 views1 pageIncome Tax Flowchart

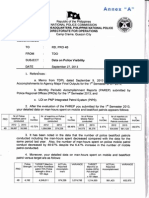

The document outlines the taxation rules for different types of taxpayers in the US, including resident citizens, non-resident citizens, resident aliens, non-resident aliens engaged or not engaged in trade or business, domestic corporations, resident foreign corporations, and non-resident foreign corporations. It shows whether each taxpayer type is taxed on worldwide income, capital gains, shares of stock sales, and at what tax rates for ordinary income, capital gains, and corporate income. It also indicates if final taxes apply to certain gains for some taxpayer types.

Uploaded by

bsulaw23Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

574 views1 pageIncome Tax Flowchart

The document outlines the taxation rules for different types of taxpayers in the US, including resident citizens, non-resident citizens, resident aliens, non-resident aliens engaged or not engaged in trade or business, domestic corporations, resident foreign corporations, and non-resident foreign corporations. It shows whether each taxpayer type is taxed on worldwide income, capital gains, shares of stock sales, and at what tax rates for ordinary income, capital gains, and corporate income. It also indicates if final taxes apply to certain gains for some taxpayer types.

Uploaded by

bsulaw23Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd