Professional Documents

Culture Documents

TATA Premium Receipt

Uploaded by

thetrilight2023Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TATA Premium Receipt

Uploaded by

thetrilight2023Copyright:

Available Formats

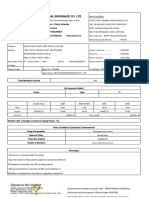

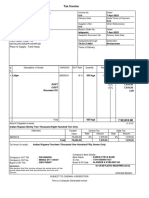

RENEWAL LIFE INSURANCE PREMIUM RECEIPT

Insured Name : KABUL DAS Policy No : U037463885

Policyowner : KABUL DAS Receipt Date : 2013/11/12

Agent/Broker Code : 004005113

Agent/Broker Name : Tata Aia

Siliguri

Payment Mode Payment Method Basic Plan Name Premium due Period

Annual Cash/Cheque Tata AIA Life InvestAssure Future (110L057V01) From 2013/11/11 to 2014/11/11

Modal Premium Service Tax* Amount Due Amount Received

` 15,000.00 ` 0.00 ` 15,000.00 ` 15,000.00

Temporary Receipt No Date Amount ₹

V0019612 2013/11/12 ` 15,000.00

Excess as on date (if any) : ` 0.00

Next Premium Due on : 2014/11/11

Upon issuance of this receipt, all previously issued temporary receipts, if any, related to this policy are considered null and void. Any excess

premium will be deposited in Future Policy Deposit Fund (FPDF). The amount lying in FPDF shall not bear any interest.

Tax benefits ** on Life Insurance Policies are available u/s 80C, on Pension u/s 80CCC & Health policies / Riders u/s 80D of Income tax

Act, 1961 Tax benefit u/s 80D is not available for premium payment in cash.

Tax benefits u/s 80CCC and 80D are not available for premium payment through automatic loans from Cash Value of the policy if any, as

per the policy provisions

This is a computer-generated receipt and does not require signature.

This receipt is null and void ab initio, if the cheque / any other valid negotiable instrument as per the Negotiable Instruments Act,1881, as receipted by the

Company vide this receipt , is reported as dishonoured by the Company bank or any other Financial Institution on which the Negotiable instrument is drawn

or is not acceptable to the Company due to any reason deemed fit by the company.

* Service tax is applicable as per governing laws and the same shall be borne by the policyholder. Tata AIA Life Insurance Company Limited reserves the right to recover from the

policyholder, any levies and duties (including service tax), as imposed by the government from time to time.

Service tax Registration Number: AABCT3784CST001

Category of Service: Life Insurance Service and / or Management of investment under ULIP Services

** Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. Tata AIA Life Insurance Company Ltd. does

not assume responsibility on tax implication mentioned anywhere in this document. Please consult your own tax consultant to know the tax benefits available to you.

Consolidated Revenue stamp duty paid: Notification No. Mudrank 2013/621/PR.KR.144/M-1-18/03/2013 vide receipt No. 37240 dated 02-Feb-2013

Tata AIA Life Insurance Company Ltd. (Reg. No. 110)

Registered & Corporate Office: 14th Floor, Tower A, Peninsula Business Park, Senapati Bapat Marg, Lower Parel, Mumbai

400013 For more Information, contact your advisor or call on our Helpline No's 1-800-267-9966 (toll free) or at 1-860-

266-9966

(local charges apply) or SMS “Service” to 58888 or e-mail us at customercare@tataaia.com. Version 3.0/FCI

U037463885 E/ROR/Other/147

You might also like

- C301149660-Renewal Premium ReceiptDocument1 pageC301149660-Renewal Premium ReceiptsaivenkateswarNo ratings yet

- TATA Premium ReceiptDocument1 pageTATA Premium ReceiptkabuldasNo ratings yet

- C320284551-Renewal Premium ReceiptDocument1 pageC320284551-Renewal Premium ReceiptThelu RajuNo ratings yet

- Tata Aia Life InsuranceDocument2 pagesTata Aia Life InsurancekotijbNo ratings yet

- Premium Receipt: Say Hi To Us On Our Whatsapp NoDocument1 pagePremium Receipt: Say Hi To Us On Our Whatsapp NodeepaksinghbishtNo ratings yet

- Prashant (1) CompletedDocument1 pagePrashant (1) CompletedAsifshaikh7566No ratings yet

- TQ0907728 Ack 20210531015407Document1 pageTQ0907728 Ack 20210531015407KumarNo ratings yet

- Payment SuccessDocument1 pagePayment SuccessJayant PrasadNo ratings yet

- Your Renewal Premium Receipt (Provisional) : Receipt Number: OT007932427 Date: 02-03-2019Document2 pagesYour Renewal Premium Receipt (Provisional) : Receipt Number: OT007932427 Date: 02-03-2019Ritik Goyal100% (1)

- Payment Receipt: 711166520 Mohd Khalid Sayeed Mohd Khalid Sayeed C-151 Suraj Kund, GorakhpurDocument1 pagePayment Receipt: 711166520 Mohd Khalid Sayeed Mohd Khalid Sayeed C-151 Suraj Kund, GorakhpurKhalid SayeedNo ratings yet

- Bajaj AL-Premium Receipts1Document1 pageBajaj AL-Premium Receipts1Anil KumarNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailschethanchethanmn8No ratings yet

- ULIP 50000 2022 MageshDocument1 pageULIP 50000 2022 Mageshmagi9999No ratings yet

- Policy 64ocuGvgdeT4YtTfyhuCFA 1900476226777Document1 pagePolicy 64ocuGvgdeT4YtTfyhuCFA 1900476226777kundan kumarNo ratings yet

- Bajaj AL-Premium Receipts2Document1 pageBajaj AL-Premium Receipts2Anil KumarNo ratings yet

- Welcome Kit Term Plan-PS - PDF2Document34 pagesWelcome Kit Term Plan-PS - PDF2Abhishek Sengupta0% (1)

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Medical Insurance Mother - Cleaned.cleanedDocument1 pageMedical Insurance Mother - Cleaned.cleanedAdil KhanNo ratings yet

- 0088470515-Premium Deposit Acknowledgement PDFDocument1 page0088470515-Premium Deposit Acknowledgement PDFjayanandaNo ratings yet

- GEMI Two Wheeler Enrolment Form - FinalDocument5 pagesGEMI Two Wheeler Enrolment Form - Finalasifan224No ratings yet

- Bajaj Allianz General Insurance Company Ltd. Bajaj Allianz House, Airport Road, Yerawada, Pune - 411006 Group Personal Accident Policy ScheduleDocument2 pagesBajaj Allianz General Insurance Company Ltd. Bajaj Allianz House, Airport Road, Yerawada, Pune - 411006 Group Personal Accident Policy Schedulehari bharadwajNo ratings yet

- Official Receipt 1676234862Document1 pageOfficial Receipt 1676234862vasim hatwadkarNo ratings yet

- Welcome Kit Term Plan-PS - PDFDocument35 pagesWelcome Kit Term Plan-PS - PDFAbhishek SenguptaNo ratings yet

- 20875366Document1 page20875366tahamasoodiNo ratings yet

- Renewal Premium Receipt: Invoice Number: A150048237100041Document1 pageRenewal Premium Receipt: Invoice Number: A150048237100041Aasiya shadab KhanNo ratings yet

- Pawan S PDF CompletedDocument1 pagePawan S PDF CompletedAsifshaikh7566No ratings yet

- PremiumRept FamilyDocument2 pagesPremiumRept Familynavengg521No ratings yet

- Payment Receipt: Service - Helpdesk@maxlifeinsuranceDocument1 pagePayment Receipt: Service - Helpdesk@maxlifeinsuranceSHIRIDI SAI INDUSTRIESNo ratings yet

- Premium Collection Receipt-DuplicateDocument1 pagePremium Collection Receipt-Duplicatesarabjitsingh123No ratings yet

- We Value Your Relationship With ICICI Lombard General Insurance Company Limited and Thank You For Choosing Us As Your Preferred Insurance ProviderDocument3 pagesWe Value Your Relationship With ICICI Lombard General Insurance Company Limited and Thank You For Choosing Us As Your Preferred Insurance ProviderSrajal Swayam TripathiNo ratings yet

- Life Insurance Corporation of India Detailed Policy Status ReportDocument1 pageLife Insurance Corporation of India Detailed Policy Status ReportRamNo ratings yet

- Ajax PDFDocument1 pageAjax PDFAshok PradhanNo ratings yet

- GPA PolicyDocument10 pagesGPA Policyparas INSURANCENo ratings yet

- Policy No. Plan Name Frequency Installment Premium: A Reliance Capital CompanyDocument1 pagePolicy No. Plan Name Frequency Installment Premium: A Reliance Capital CompanydeadlywaneNo ratings yet

- DocumentDocument1 pageDocumentPingala SoftNo ratings yet

- Renewal Premium Receipt - NON ULIP: Life Assured: Mr. PAWAN KUMAR Assignee: N.A. Policy DetailsDocument1 pageRenewal Premium Receipt - NON ULIP: Life Assured: Mr. PAWAN KUMAR Assignee: N.A. Policy DetailsPawan KumarNo ratings yet

- Renewal Notice: Policy No.P/151115/01/2018/008058Document1 pageRenewal Notice: Policy No.P/151115/01/2018/008058Khel Manoranjan Mitra MandalNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyNaga MurthyNo ratings yet

- 80C Relience InsuranceDocument1 page80C Relience Insuranceshailesh.kumarNo ratings yet

- PremiumRept MDS - RameshDocument2 pagesPremiumRept MDS - Rameshnavengg521No ratings yet

- Zprmrnot 23614257 14778150Document1 pageZprmrnot 23614257 14778150c97rvkkyfrNo ratings yet

- Consumer Credit Insurance: Proposal and Policy ScheduleDocument14 pagesConsumer Credit Insurance: Proposal and Policy ScheduleFaizan FarasatNo ratings yet

- Official Receipt 1676234863Document1 pageOfficial Receipt 1676234863vasim hatwadkarNo ratings yet

- Renewal ReceiptDocument1 pageRenewal ReceiptAnkit SinghNo ratings yet

- Tata Aig InsuranceDocument6 pagesTata Aig Insurancerajbrar98No ratings yet

- A-Star India CredentialDocument123 pagesA-Star India CredentialMecon LtdNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument5 pagesRenewal of Your Optima Restore Floater Insurance PolicydddddNo ratings yet

- Dear Rajendra Prasad Mishra,: Policy DetailsDocument5 pagesDear Rajendra Prasad Mishra,: Policy DetailsR P MishrsNo ratings yet

- Asf Shaikh TAX NEW2014Document1 pageAsf Shaikh TAX NEW2014Asifshaikh7566No ratings yet

- RecipientDocument2 pagesRecipientAmanSharmaNo ratings yet

- Bajaj Jun 23Document1 pageBajaj Jun 23MAYANK BASUNo ratings yet

- Zprmrnot - 22442221 - 9000233 2Document1 pageZprmrnot - 22442221 - 9000233 2Manju SinghalNo ratings yet

- ULIPRPR XXXXXXX8009 19022021 4680 UnlockedDocument1 pageULIPRPR XXXXXXX8009 19022021 4680 Unlockedmanish sharmaNo ratings yet

- Receipt OT012279515Document1 pageReceipt OT012279515amit kumarNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument5 pagesRenewal of Your Optima Restore Floater Insurance PolicyNeelez RaizNo ratings yet

- Policy Document BajajAllianz General InsuranceDocument5 pagesPolicy Document BajajAllianz General InsurancealirezadoctorNo ratings yet

- Agency Code Agency Contact No Agency Name Jasvir Singh 80107371 9888390609Document3 pagesAgency Code Agency Contact No Agency Name Jasvir Singh 80107371 9888390609ANVESH SHARVIRALANo ratings yet

- Premium Receipt: Say Hi To Us On Our Whatsapp NoDocument1 pagePremium Receipt: Say Hi To Us On Our Whatsapp NoAee Std sub div hgrNo ratings yet

- Dear Karthik P,: Policy DetailsDocument5 pagesDear Karthik P,: Policy DetailsKarthik PandianNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Employee Tax Declaration - FY 22-23-DBMPDocument3 pagesEmployee Tax Declaration - FY 22-23-DBMPthetrilight2023No ratings yet

- Site Visits History - Bhargav KumarDocument14 pagesSite Visits History - Bhargav Kumarthetrilight2023No ratings yet

- T2F2Document1 pageT2F2thetrilight2023No ratings yet

- Tax Decalaration 2023-24Document3 pagesTax Decalaration 2023-24thetrilight2023No ratings yet

- Medical BillDocument1 pageMedical Billthetrilight2023No ratings yet

- Usa - Bulk WaDocument3 pagesUsa - Bulk Wathetrilight2023No ratings yet

- P Bhargav Kumar Sep'23 PayslipDocument1 pageP Bhargav Kumar Sep'23 Payslipthetrilight2023No ratings yet

- Final Cost Sheet at The Time of BookingDocument5 pagesFinal Cost Sheet at The Time of Bookingthetrilight2023No ratings yet

- Diwali Gifts Handover ReportDocument4 pagesDiwali Gifts Handover Reportthetrilight2023No ratings yet

- Vidya SagarDocument4 pagesVidya Sagarthetrilight2023No ratings yet

- LICINSTAONLINEHGA4P13D280257938570Document1 pageLICINSTAONLINEHGA4P13D280257938570thetrilight2023No ratings yet

- Bucharest Academy of Economic Study Facutly of Accounting and Management SystemsDocument10 pagesBucharest Academy of Economic Study Facutly of Accounting and Management Systemsanon_671929315No ratings yet

- Central Recordkeeping AgencyDocument3 pagesCentral Recordkeeping AgencyAnuj SoniNo ratings yet

- History of BurgerDocument81 pagesHistory of BurgerbeverlyconcesaNo ratings yet

- Work in Progress SIP 5Document30 pagesWork in Progress SIP 5Yash GargNo ratings yet

- Filling, Penalties and RemediesDocument14 pagesFilling, Penalties and RemediesMichael Brian TorresNo ratings yet

- Peshawar Electric Supply Company: Say No To CorruptionDocument1 pagePeshawar Electric Supply Company: Say No To CorruptionFaheem UllahNo ratings yet

- Seminar XIIDocument67 pagesSeminar XIINeko IvanishviliNo ratings yet

- Gal EhrlichDocument8 pagesGal EhrlichiulicaNo ratings yet

- RDO No. 54B - Bacoor City, West CaviteDocument735 pagesRDO No. 54B - Bacoor City, West Cavitealperson peralta68% (38)

- 2week v4Document9 pages2week v4Sirius BlackNo ratings yet

- 2022 Nqesh April Edition 1Document9 pages2022 Nqesh April Edition 1ANTONETTE BALANSAG100% (1)

- CAS 3 OverheadsDocument12 pagesCAS 3 OverheadsVivekanandNo ratings yet

- Day AlanDocument1 pageDay AlanTechnetNo ratings yet

- Q2FY23Document12 pagesQ2FY23Err DatabaseNo ratings yet

- PO 46 4429 SITC Emergency Stop AmmendedDocument3 pagesPO 46 4429 SITC Emergency Stop AmmendedSraz MidniteNo ratings yet

- Certificate of TenancyDocument2 pagesCertificate of TenancyBenjie Moriño100% (9)

- Buy CA Vinod Gupta Books Online - Order VG Learning Books - VG Learning DestinationDocument5 pagesBuy CA Vinod Gupta Books Online - Order VG Learning Books - VG Learning DestinationAchilleas BGRNo ratings yet

- Commercial Proposal - Synzeal Research Pvt. Ltd. - v1.0Document25 pagesCommercial Proposal - Synzeal Research Pvt. Ltd. - v1.0HEMISHA LADNo ratings yet

- Unit 13 IeltsDocument15 pagesUnit 13 IeltsTrâm AnhNo ratings yet

- Lesson 1 Business EthicsDocument21 pagesLesson 1 Business EthicsRiel Marc AliñaboNo ratings yet

- Vishal Shimpi: Hotel Bandra MetroDocument3 pagesVishal Shimpi: Hotel Bandra MetroNikhil BaviskarNo ratings yet

- Cash Flow Statement PDFDocument48 pagesCash Flow Statement PDFsukriti dhauniNo ratings yet

- Rafael Arsenio S. Dizon, v. CTA and CIR G.R. No. 140944 April 30, 2008Document2 pagesRafael Arsenio S. Dizon, v. CTA and CIR G.R. No. 140944 April 30, 2008Jacinto Jr JameroNo ratings yet

- Koppel Vs Yatco G.R. No. 47673Document7 pagesKoppel Vs Yatco G.R. No. 47673JetJuárezNo ratings yet

- Estafa Through Falsification of Public Documents. in Particular, TheDocument27 pagesEstafa Through Falsification of Public Documents. in Particular, TheRochelle Ann ReyesNo ratings yet

- Fiscal Policy Vs Monetary PolicyDocument2 pagesFiscal Policy Vs Monetary PolicyAkash Ray100% (1)

- 40 Comparison of Vat WCT Rates For All StatesDocument130 pages40 Comparison of Vat WCT Rates For All StatesAbhishekVadadoriyaNo ratings yet

- GD TopicsDocument20 pagesGD Topicsapi-3832523100% (4)

- Chapter Five: Tax Avoidance and EvasionDocument14 pagesChapter Five: Tax Avoidance and Evasionembiale ayaluNo ratings yet

- SUMMER TRAINING REPORT - CameyDocument99 pagesSUMMER TRAINING REPORT - CameycameyNo ratings yet